Global Wire And Cable Market

Market Size in USD Billion

CAGR :

%

USD

290.81 Billion

USD

497.81 Billion

2024

2032

USD

290.81 Billion

USD

497.81 Billion

2024

2032

| 2025 –2032 | |

| USD 290.81 Billion | |

| USD 497.81 Billion | |

|

|

|

Wire and Cable Market Analysis

The global wire and cable market is experiencing significant growth, driven by increasing demand across various industries such as energy and power, telecommunications, automotive, and construction. Rapid urbanization, infrastructure development, and the expansion of smart grids are further fueling market expansion. Advancements in fiber optic technology, high-performance cables, and eco-friendly wiring solutions are revolutionizing the industry, enhancing efficiency and sustainability. The integration of smart cables with real-time monitoring and fault detection capabilities is improving safety and reliability. In addition, the transition toward renewable energy sources is increasing the demand for specialized cables in solar and wind power projects. The adoption of high-voltage direct current (HVDC) transmission systems is optimizing power distribution across long distances with minimal losses. Moreover, innovations such as superconducting cables and lightweight aluminum alloys are improving performance while reducing costs. Key players in the market are investing in research and development to enhance cable durability, flexibility, and efficiency. With growing digitalization and electrification trends, the wire and cable industry is poised for continued expansion, shaping the future of energy transmission and connectivity worldwide.

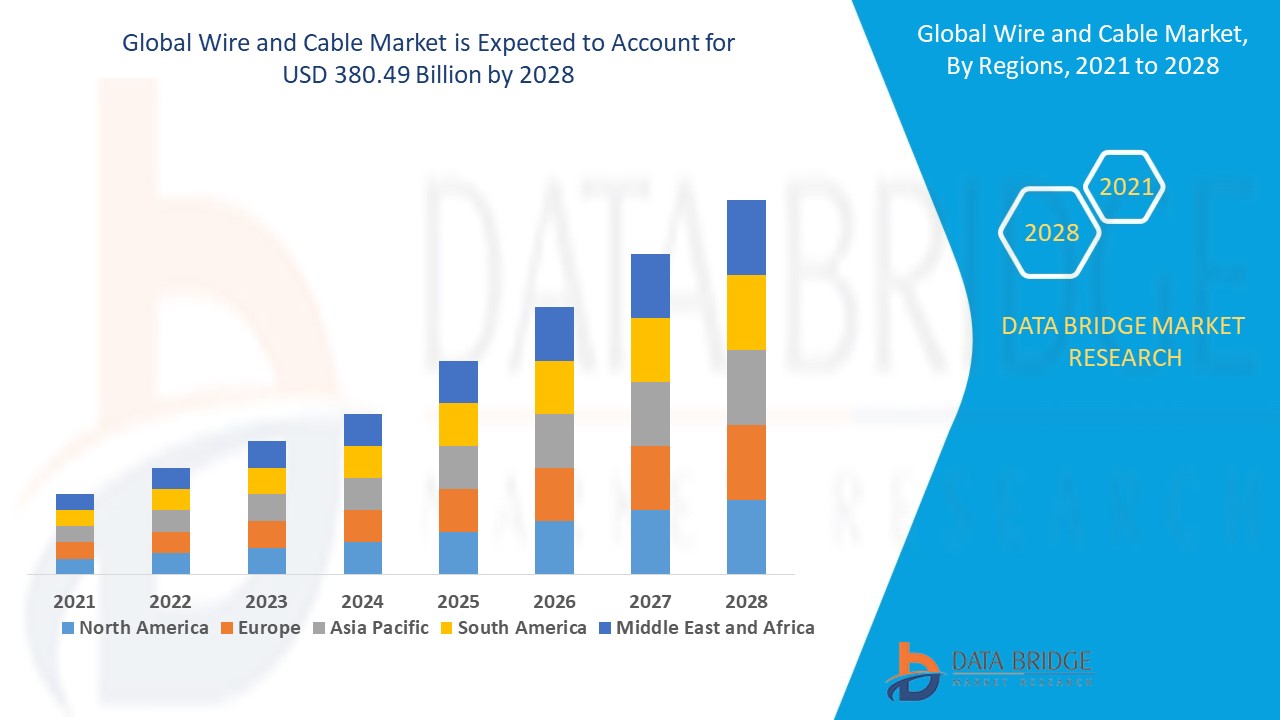

Wire and Cable Market Size

The global wire and cable market size was valued at USD 290.81 billion in 2024 and is projected to reach USD 497.81 billion by 2032, with a CAGR of 6.95% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Wire and Cable Market Trends

“Increasing Adoption of Smart Cables”

The wire and cable market is witnessing substantial growth, driven by rising electrification, infrastructure expansion, and advancements in fiber optic technology. A key trend shaping the industry is the increasing adoption of smart cables with real-time monitoring and fault detection capabilities, enhancing efficiency, safety, and reliability. These cables are critical in smart grids, renewable energy projects, and data centers. For instance, Prysmian Group has developed advanced high-voltage direct current (HVDC) cables, enabling efficient power transmission over long distances with minimal losses, crucial for connecting offshore wind farms to the mainland. In addition, self-healing cables, which use nanotechnology to repair minor damages, are emerging as a revolutionary innovation, reducing maintenance costs and downtime. With growing investments in 5G networks, electric vehicles (EVs), and renewable energy, the demand for high-performance cables is surging, positioning the wire and cable market for sustained expansion in the coming years.

Report Scope and Wire and Cable Market Segmentation

|

Attributes |

Wire and Cable Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Fujikura Ltd. (Japan), Corning Incorporated (U.S.), HENGTONG GROUP CO., LTD. (China), STL Tech (India), FURUKAWA ELECTRIC CO., LTD. (Japan), Prysmian Group (Italy), Copyright Coherent Corp (U.S.), Futong Group Import and Export Co., Ltd. (China), Folan (France), Sumitomo Electric Industries, Ltd. (Japan), Amphenol TPC (U.S.), Nexans (France), Southwire Company, LLC (U.S.), Finolex Cables (India), Smiths Interconnect Americas, Inc. (U.S.), LEONI AG (Germany), Tata Communications Limited (India), Belden Inc. (U.S.), and Marlin Steel Wire Products LLC (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Wire and Cable Market Definition

Wire and cable refer to electrical conductors used for transmitting power, signals, or data across various applications. A wire is a single electrical conductor, usually made of copper or aluminum, while a cable consists of multiple wires bundled together and insulated for protection.

Wire and Cable Market Dynamics

Drivers

- Rising Electrification & Infrastructure Development

The growing global demand for electricity, fueled by rapid urbanization and industrialization, is a major driver for the wire and cable market. Expanding residential, commercial, and industrial infrastructure requires advanced power transmission and distribution networks to ensure efficient electricity delivery. Governments worldwide are investing in smart grid technology to modernize aging power infrastructure, improve energy efficiency, and reduce transmission losses. In addition, the shift towards renewable energy sources, such as solar and wind power, has increased the need for specialized cables capable of withstanding extreme environmental conditions. For instance, Prysmian Group has developed high-performance submarine and underground cables for large-scale offshore wind farms, enabling efficient power transmission over long distances. With infrastructure expansion and electrification projects accelerating globally, the demand for durable, high-voltage, and low-loss cables continues to rise.

- Growing Telecommunications & 5G Deployment

The rapid expansion of 5G networks, increasing internet penetration, and the surge in data center construction are significantly boosting the demand for fiber optic cables. As the world becomes more digitally connected, the need for high-speed and low-latency communication infrastructure is at an all-time high. Telecom companies and governments are heavily investing in fiber-to-the-home (FTTH) and fiber-to-the-building (FTTB) projects to support ultra-fast broadband connections. For instance, Corning Incorporated, a leading manufacturer of optical fibers, has expanded its production capacity to meet the rising demand for 5G-compatible fiber cables. In addition, hyperscale data centers, essential for cloud computing and AI-driven applications, require high-bandwidth fiber optics to manage massive data loads efficiently. With continuous advancements in telecommunication infrastructure, the wire and cable market is poised for sustained growth, ensuring seamless connectivity in the digital age.

Opportunities

- Increasing Technological Advancements

Rapid advancements in fiber optic cables, high-voltage direct current (HVDC) systems, and smart cables are significantly transforming the wire and cable market. Fiber optic cables are now essential for high-speed data transmission, particularly in 5G networks, cloud computing, and IoT applications, fueling demand across the telecommunications and IT sectors. Meanwhile, HVDC transmission systems are revolutionizing long-distance power transmission by reducing energy losses and enhancing grid stability. Companies such as Siemens Energy and Nexans are developing next-generation HVDC cables to support large-scale renewable energy projects, such as offshore wind farms. In addition, smart cables with real-time monitoring capabilities are improving grid reliability by detecting faults, optimizing energy flow, and reducing downtime. As industries demand greater efficiency and safety, these technological innovations present a lucrative market opportunity for wire and cable manufacturers, driving investment in advanced materials, AI-driven monitoring systems, and next-gen power grids.

- Increasing Electric Vehicle (EV) Adoption

The surging adoption of electric vehicles (EVs) worldwide is creating a significant demand for high-performance automotive wires and charging cables. EVs require specialized high-voltage cables to efficiently transmit power between batteries, motors, and charging stations, ensuring optimal performance and safety. With governments pushing for sustainable transportation and major automakers such as Tesla, Ford, and Volkswagen ramping up EV production, the demand for advanced charging infrastructure is rising exponentially. For instance, Southwire Company has developed fast-charging cables that enable ultra-fast charging for EVs, addressing one of the industry's biggest challenges charging speed. Moreover, wireless charging technologies and lightweight aluminum wiring solutions are gaining traction, offering additional market opportunities. As the global shift toward electrification of transport accelerates, wire and cable manufacturers that innovate in EV cabling solutions stand to benefit from this rapidly expanding sector.

Restraints/Challenges

- Stringent Regulatory Standards and Compliance

Governments and industry bodies worldwide enforce strict safety, environmental, and quality regulations on wire and cable manufacturing to ensure product reliability and consumer safety. These regulations, such as RoHS (Restriction of Hazardous Substances), REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals), and fire safety standards, limit the use of hazardous materials and require manufacturers to meet stringent environmental norms. Compliance with these evolving standards necessitates continuous innovation, material substitutions, and advanced manufacturing processes, all of which drive up production costs. For instance, European Union regulations mandate the reduction of lead, cadmium, and phthalates in electrical cables, forcing manufacturers to develop alternative materials that comply without compromising performance. In addition, failure to meet these regulations can result in significant financial penalties, product recalls, and reputational damage, making it a major market challenge. Companies must invest in research and development (R&D) to keep up with changing requirements while balancing profitability and compliance costs.

- Intensified Competition from Low-Cost Manufacturers

The wire and cable market is becoming increasingly competitive, particularly with the rise of low-cost manufacturers in emerging economies such as China, India, and Vietnam. These manufacturers leverage lower labor costs, government incentives, and large-scale production capabilities to offer cost-effective wire and cable solutions, significantly undercutting established brands in North America and Europe. As a result, well-known manufacturers face pricing pressure, forcing them to either reduce prices to stay competitive or shift their focus towards premium, high-performance products with enhanced safety, durability, and efficiency. For instance, Chinese manufacturers dominate the fiber optic cable industry, supplying cost-effective alternatives that challenge traditional European and U.S. players. This price war poses a challenge for established companies that must differentiate through quality, branding, and technological innovation while ensuring their products remain cost-effective. In addition, tariffs and trade restrictions imposed by Western countries to curb cheap imports further complicate market dynamics, making it harder for legacy players to maintain their competitive edge.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Wire and Cable Market Scope

The market is segmented on the basis of installation, voltage, material, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Installation

- Overhead

- Underground

Voltage

- Low Voltage

- Medium Voltage

- High Voltage

- Extra High Voltage

Material

- Copper

- Aluminum

- Glass

End User

- Aerospace and Defense

- Automotive

- Building and Construction

- Oil and Gas

- Energy and Power

- IT and Telecommunication

- Others

Wire and Cable Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, installation, voltage, material, and end user as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific dominates the wire and cable market, driven by rapid industrialization, urbanization, and increasing energy demand across the region. Governments are heavily investing in modernizing power transmission and distribution networks, ensuring reliable and efficient electricity supply. In addition, the expansion of smart grids, renewable energy projects, and high-speed telecommunication networks is further propelling market growth. With rising infrastructure development and advancements in electrification and connectivity, the region continues to be a key contributor to the global wire and cable industry.

North America is projected to grow at a fastest rate from 2025 to 2032, driven by increasing disposable income, rising electricity demand, and strong government initiatives supporting infrastructure modernization. Significant private investments and federal funding are being directed toward the development and expansion of electrical power grids, enhancing energy distribution efficiency. In addition, the adoption of smart grid technology, renewable energy integration, and advancements in power transmission systems are fueling market growth. With continuous efforts to upgrade and expand the region’s energy infrastructure, North America remains a key player in the wire and cable industry.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Wire and Cable Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Wire and Cable Market Leaders Operating in the Market Are:

- Fujikura Ltd. (Japan)

- Corning Incorporated (U.S.)

- HENGTONG GROUP CO., LTD. (China)

- STL Tech (India)

- FURUKAWA ELECTRIC CO., LTD. (Japan)

- Prysmian Group (Italy)

- Copyright Coherent Corp (U.S.)

- Futong Group Import and Export Co., Ltd. (China)

- Folan (France)

- Sumitomo Electric Industries, Ltd. (Japan)

- Amphenol TPC (U.S.)

- Nexans (France)

- Southwire Company, LLC (U.S.)

- Finolex Cables (India)

- Smiths Interconnect Americas, Inc. (U.S.)

- LEONI AG (Germany)

- Tata Communications Limited (India)

- Belden Inc. (U.S.)

- Marlin Steel Wire Products LLC (U.S.)

Latest Developments in Wire and Cable Market

- In June 2024, French subsea power cable manufacturer Nexans successfully completed the acquisition of La Triveneta Cavi S.p.A., an Italian company specializing in medium and low-voltage cables. This acquisition represents a significant step in Nexans’ strategic expansion to strengthen its position as a leading player in the electrification sector

- In April 2024, Finolex Cables launched a new range of eco-friendly wires under the FinoGreen brand, which is expected to contribute approximately 5% to the company’s wire business. The FinoGreen series features flame-retardant and halogen-free industrial cables, designed to enhance electrical safety and minimize fire hazards in industrial and residential installations

- In April 2024, Amphenol TPC, a leading manufacturer of high-performance cables, connectors, and assemblies for industrial applications, introduced ATPC Medium Voltage Cables. This new product line expands the company’s medium voltage cable portfolio, offering enhanced options for insulation, conductor, and jacket materials to meet the demands of harsh operating environments

- In September 2023, Southwire Company LLC announced the acquisition of Genesis Wire & Cable from Resideo Technologies, Inc. This acquisition strengthens Southwire’s foothold in the low-voltage wires and cables market, supporting its commitment to innovation and market expansion within the industry

- In April 2023, Nexans acquired Reka Cables, a Finnish company specializing in high, medium, and low-voltage cables used in building applications, power distribution networks, and onshore wind projects. This acquisition brings together the expertise of both companies, reinforcing innovation and sustainability while delivering reliable and energy-efficient cable solutions across the Nordic region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wire And Cable Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wire And Cable Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wire And Cable Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.