Global Woodworking Circular Saw Blades Market

Market Size in USD Million

CAGR :

%

USD

56.09 Million

USD

86.08 Million

2024

2032

USD

56.09 Million

USD

86.08 Million

2024

2032

| 2025 –2032 | |

| USD 56.09 Million | |

| USD 86.08 Million | |

|

|

|

|

What is the Global Woodworking Circular Saw Blades Market Size and Growth Rate?

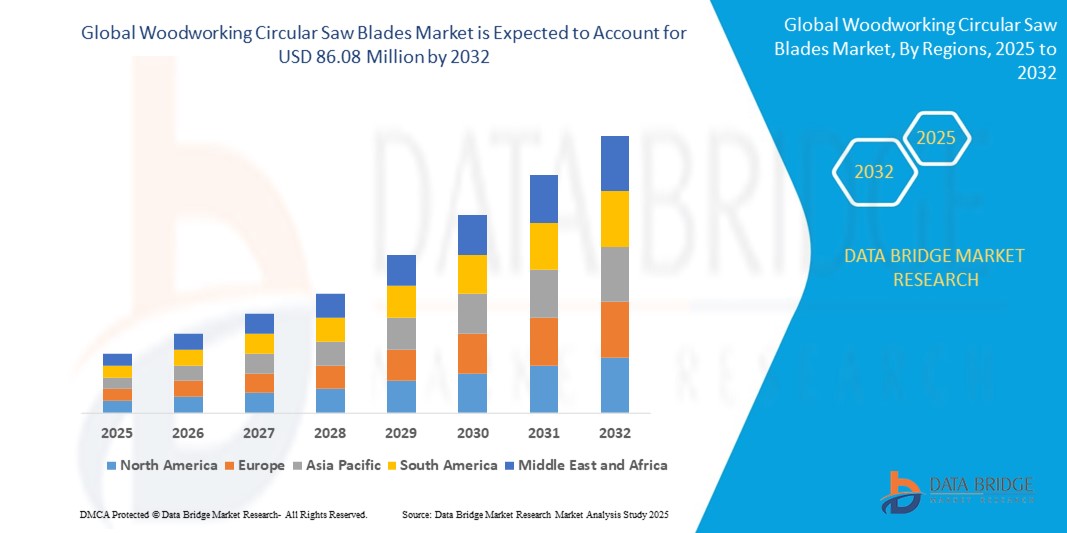

- The global woodworking circular saw blades market size was valued at USD 56.09 million in 2024 and is expected to reach USD 86.08 million by 2032, at a CAGR of 5.50% during the forecast period

- The woodworking circular saw blades market continues to advance with cutting-edge technologies enhancing precision and efficiency. Innovations such as carbide-tipped blades and laser-cut bodies optimize durability and performance

- Rising demand from the construction and furniture industries propels market growth, fostering the development of specialized blades for various applications. As the industry evolves, manufacturers focus on delivering high-quality, versatile tools to meet evolving user needs

What are the Major Takeaways of Woodworking Circular Saw Blades Market?

- The growth in the construction industry globally is a significant driver for the woodworking circular saw blades market. As construction activities increase, there is a rising demand for circular saw blades essential for cutting wood materials used in building construction

- For instance, in regions experiencing infrastructure development, such as Southeast Asia and parts of Africa, the demand for housing and commercial buildings fuels the need for efficient and reliable circular saw blades to meet construction deadlines and quality standards

- Asia-Pacific dominated the woodworking circular saw blades market with the largest revenue share of 42.8% in 2024, driven by strong growth in the construction, furniture, and woodworking industries across China, India, and Southeast Asia

- Europe is projected to be the fastest growing region in the woodworking circular saw blades market during 2025–2032, expected to grow at a CAGR of 11.6%, due to stringent product quality standards, eco-conscious manufacturing, and rising demand for custom furniture solutions

- The stationary machines segment dominated the market in 2024 with the largest revenue share of 56.3%, attributed to their high cutting precision, consistency, and suitability for industrial-scale operations such as furniture production and panel processing

Report Scope and Woodworking Circular Saw Blades Market Segmentation

|

Attributes |

Woodworking Circular Saw Blades Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Woodworking Circular Saw Blades Market?

“Advancements in Material Science and Tooth Geometry”

- A defining trend shaping the global woodworking circular saw blades market is the rapid evolution in materials and tooth designs to enhance performance, precision, and durability

- Manufacturers are increasingly investing in high-performance alloys, carbide-tipped blades, and coatings such as titanium nitride or non-stick Teflon to reduce friction, heat buildup, and blade wear. These innovations extend blade life and improve cutting speed and accuracy, particularly for high-volume woodworking operations

- Tooth geometries such as alternate top bevel (ATB), triple chip grind (TCG), and high alternate top bevel (Hi-ATB) are being optimized for different wood types and applications—from fine cabinetry to heavy-duty lumber processing. For instance, Freud America has introduced blades with Perma-SHIELD non-stick coating and laser-cut stabilizer vents to ensure clean cuts with minimal vibration

- Similarly, Amana Tool Corporation leverages advanced carbide grades for longer tool life and superior performance across hardwood and engineered wood panels. These enhancements allow end users in furniture, construction, and flooring industries to achieve greater output efficiency and surface quality

- The growing demand for premium saw blades with tailored specifications is accelerating R&D investments, driving the market toward increasingly application-specific solutions that cater to both industrial and artisanal woodworkers

What are the Key Drivers of Woodworking Circular Saw Blades Market?

- The global woodworking circular saw blades market is being significantly driven by the expanding furniture, construction, and home renovation sectors, which continue to demand efficient and durable cutting tools

- As residential and commercial infrastructure development accelerates—particularly in emerging economies there is rising demand for high-performance tools that can handle diverse materials, including hardwood, plywood, MDF, and laminated panels

- In addition, the trend toward automation in woodworking processes has heightened the need for precision saw blades that can seamlessly integrate with CNC machines and automated cutting systems

- For instance, HOMAG Group has reported increased adoption of their automated panel saws equipped with advanced circular blades designed for smooth, chip-free cuts

- Moreover, the rising popularity of DIY woodworking among hobbyists and small workshop owners has created a new wave of demand for easy-to-use, high-quality blades that deliver professional results

- Consumer preferences for aesthetic wood finishes and complex joinery further fuel demand for blades that provide clean, accurate cuts with minimal tear-out. Sustainability trends are also pushing the market toward longer-lasting blades that reduce waste and resource consumption

- Collectively, these factors are contributing to steady growth in both the professional and consumer-grade segments of the woodworking circular saw blades market

Which Factor is challenging the Growth of the Woodworking Circular Saw Blades Market?

- Despite robust growth drivers, the woodworking circular saw blades market faces challenges that could hinder its expansion, particularly the high cost of premium blades and the technical expertise required for proper selection and usage

- Advanced saw blades, such as those with specialized coatings or geometries, can carry significantly higher price points than conventional options, which may deter small workshops and price-sensitive buyers

- In addition, users often struggle to select the correct blade for specific materials and machines, resulting in suboptimal performance or premature wear. For instance, blades designed for crosscutting may perform poorly when used for ripping, and improper usage can lead to material damage, reduced productivity, or safety hazards

- Moreover, blade maintenance such as regular sharpening and proper alignment—can be time-consuming and requires access to professional services or tools, which are not always available in developing markets

- Environmental regulations on industrial emissions and workplace safety standards can also increase operational costs for manufacturers, particularly in regions with stringent compliance requirements

- To mitigate these challenges, manufacturers are focusing on user education, providing comprehensive product guides, and developing multi-purpose blades that offer versatility across a broader range of applications. Balancing performance, affordability, and ease of use will be critical for ensuring long-term growth in this competitive market

How is the Woodworking Circular Saw Blades Market Segmented?

The market is segmented on the basis of mode of operation, blade type, diameter, distribution channel, and end-use industry.

- By Mode of Operation

On the basis of mode of operation, the market is segmented into stationary machines and hand machines. The stationary machines segment dominated the market in 2024 with the largest revenue share of 56.3%, attributed to their high cutting precision, consistency, and suitability for industrial-scale operations such as furniture production and panel processing. These machines are commonly used in large-scale manufacturing units for their efficiency and ability to handle heavy-duty workloads.

The hand machines segment is expected to witness the fastest CAGR from 2025 to 2032, owing to increasing adoption among DIY users, contractors, and small workshops seeking portable and versatile cutting tools for onsite and flexible applications.

- By Blade Type

On the basis of blade type, the market is segmented into framing blades, rip-cut blades, crosscut blades, and plywood cut blades. In 2024, the crosscut blades segment held the dominant market share of 38.7%, due to their widespread usage in furniture and cabinetry applications requiring clean, smooth cuts across wood grain. Crosscut blades are favored for their fine finish and versatility across different wood types

The framing blades segment is anticipated to register the highest growth during the forecast period, driven by increased construction activities and the demand for fast, rough cuts in framing lumber and structural woodwork.

- By Diameter

On the basis of diameter, the Woodworking Circular Saw Blades market is segmented into less than 100 mm, 100–200 mm, 200–300 mm, and more than 300 mm. The 100–200 mm segment dominated the market with a revenue share of 41.4% in 2024, attributed to its extensive application in both portable and benchtop saws used across woodworking shops and job sites. This diameter range balances cutting capacity and control, making it a popular choice for a variety of woodworking tasks

The more than 300 mm segment is expected to grow at the highest CAGR from 2025 to 2032, driven by its usage in heavy-duty saw machines for processing large wood panels and beams in industrial settings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into online and offline platforms. The offline channel accounted for the largest share of 64.5% in 2024, as professional woodworkers and industrial buyers prefer physical evaluation and direct consultation before purchasing precision tools such as saw blades. Hardware stores, specialty tool retailers, and distributors play a significant role in this segment.

The online segment is projected to expand at the fastest CAGR between 2025 and 2032, owing to the convenience of comparing brands, accessing product reviews, and growing availability of e-commerce platforms offering woodworking tools with doorstep delivery.

- By End-Use Industry

On the basis of end-use industry, the market is segmented into furniture manufacturing, construction, cabinetry, flooring, and DIY. The furniture manufacturing segment led the market in 2024 with a revenue share of 35.1%, driven by the consistent demand for precision cutting tools used in processing hardwood, softwood, and engineered wood for furniture assembly. The construction segment is projected to record the highest growth rate during the forecast period, propelled by booming infrastructure and housing projects globally, which demand fast, durable blades for framing, roofing, and structural woodwork.

The DIY segment is also witnessing notable growth, fueled by increased interest in home improvement and small-scale woodworking hobbies.

Which Region Holds the Largest Share of the Woodworking Circular Saw Blades Market?

- Asia-Pacific dominated the woodworking circular saw blades market with the largest revenue share of 42.8% in 2024, driven by strong growth in the construction, furniture, and woodworking industries across China, India, and Southeast Asia

- The region's rapid urbanization, rising disposable income, and expansion of residential and commercial infrastructure are key factors supporting market growth

- In addition, the availability of cost-effective manufacturing capabilities and a booming furniture export industry are contributing to the increased adoption of circular saw blades for wood processing applications. Governments in the region are also investing in infrastructure and affordable housing, boosting demand for precision woodworking tools

China Woodworking Circular Saw Blades Market Insight

The China woodworking circular saw blades market captured the largest share in the Asia-Pacific region in 2024, attributed to the country’s dominant position in global furniture manufacturing and export. China is home to a vast number of woodworking factories and OEM manufacturers, which rely heavily on industrial-grade saw blades for efficient cutting and shaping processes. In addition, the rise of customized furniture and interior décor trends is further fueling demand for versatile and high-precision circular saw blades. With the presence of key domestic manufacturers and government support for smart manufacturing, China continues to be a strong contributor to regional market expansion.

India Woodworking Circular Saw Blades Market Insight

The India market is expected to grow at a remarkable CAGR during the forecast period, supported by a burgeoning construction sector and rising popularity of modular furniture. Increased urban housing demand and a growing middle-class population are creating new opportunities for woodworking shops and small-scale manufacturers, which are investing in quality cutting tools. Moreover, the "Make in India" initiative is fostering local production of furniture and related components, accelerating the demand for reliable circular saw blades. The DIY culture is also gradually picking up in metro areas, further diversifying the consumer base for woodworking tools in the country.

Japan Woodworking Circular Saw Blades Market Insight

The Japan woodworking circular saw blades market is steadily advancing due to a combination of precision engineering, high-quality furniture production, and automation in manufacturing processes. Japanese consumers and industries value durable, high-performance blades that offer clean, accurate cuts for both residential and commercial applications. In addition, the aging population is driving demand for ergonomic and efficient woodworking tools in small-scale, easy-to-use formats. Innovations in blade coating technologies and noise reduction are well-received in Japan’s highly regulated and safety-conscious market. These factors collectively position Japan as a key contributor to the Asia-Pacific woodworking blades segment.

Which Region is the Fastest Growing Region in the Woodworking Circular Saw Blades Market?

Europe is projected to be the fastest growing region in the woodworking circular saw blades market during 2025–2032, expected to grow at a CAGR of 11.6%, due to stringent product quality standards, eco-conscious manufacturing, and rising demand for custom furniture solutions. Countries across Europe are witnessing strong renovation and retrofitting trends in both residential and commercial spaces, which boosts the need for precision-cutting tools. The shift toward sustainable and engineered wood products further enhances blade replacement cycles, pushing market growth. European woodworking professionals also prioritize energy-efficient and long-lasting saw blades, driving innovation and product development.

Germany Woodworking Circular Saw Blades Market Insight

Germany holds a dominant position in the European woodworking circular saw blades market, fueled by its advanced woodworking machinery industry and strong presence of premium furniture manufacturers. The country emphasizes sustainable building practices and high product standards, which translate into consistent demand for long-lasting, precision blades. Integration of automated machinery with CNC-compatible blades is also widespread in Germany, enhancing production efficiency. As a key exporter of wood products and tools, Germany serves both domestic and international demand, with local companies investing in R&D for carbide-tipped and diamond-coated blade technologies.

U.K. Woodworking Circular Saw Blades Market Insight

The U.K. market is growing steadily, supported by increasing interest in home improvement, modular furniture, and heritage property renovations. Demand is rising for high-performance blades that cater to both traditional wood types and modern engineered panels. The growing popularity of DIY woodworking projects and small-scale custom furniture businesses further contributes to the market's diversity. In addition, post-Brexit emphasis on local manufacturing and job creation is incentivizing investment in small woodworking operations, boosting sales of circular saw blades suited for handheld and benchtop machines.

France Woodworking Circular Saw Blades Market Insight

The France market is experiencing growth as consumers and professionals asuch as invest in advanced woodworking equipment for remodeling, interior design, and artisanal furniture production. Circular saw blades with noise-reduction features and fine-tooth configurations are gaining popularity for their ability to provide smooth finishes. Moreover, France’s commitment to eco-friendly construction and sustainable forestry aligns with the use of high-quality, durable blades. The market also benefits from increased import and export activity within the EU, ensuring widespread availability of premium and mid-range products catering to varied woodworking needs.

Which are the Top Companies in Woodworking Circular Saw Blades Market?

The woodworking circular saw blades industry is primarily led by well-established companies, including:

- Amana Tool Corporation (U.S.)

- Stanley Black & Decker, Inc. (U.S.)

- HOMAG Group (Germany)

- Karnasch Professional Tools GmbH (Germany)

- DEWALT (U.S.)

- BLECHER (Germany)

- Robert Bosch GmbH (Germany)

- Koki Holdings Co., Ltd. (Japan)

- TENRYU SAW MFG. CO., LTD. (Japan)

- AKE Knebel GmbH & Co. KG (Germany)

- Ledermann GmbH & Co. KG (Germany)

- Freud America, Inc. (Italy)

- PILANA a.s (Czech Republic)

- Kinkelder B.V. (Netherlands)

- M.K. Morse Company (U.S.)

- DoAll Saws (U.S.)

- Simonds International, LLC (U.S.)

- AMADA CO., LTD. (Japan)

What are the Recent Developments in Global Woodworking Circular Saw Blades Market?

- In May 2023, Makita U.S.A. Inc. introduced bi-metal band saw blades optimized for both wireless and corded band saws. Available in packs of three, these blades offer various Tooth Per Inch (TPI) options to cater to diverse cutting needs, enhancing cutting possibilities for professional users

- In September 2022, The M. K. Morse Company unveiled its fourth-generation Metal Devil circular saw blades, setting a new industry benchmark for cutting performance. Designed for cutting metal, stainless steel, titanium, and aluminum/non-ferrous materials, these blades excel in longevity, efficient and cool cutting, and superior surface finishing

- In September 2021, Crescent, a leading brand under Apex Tool Group, launched a new series of circular saw blades designed for durability and speed across rigorous applications. The NailSlicer Framing Blades, FineCut Finishing Blades, and SteelSlicer Metal Blades were specifically engineered to deliver enhanced cutting speed and prolonged operational lifespan

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Woodworking Circular Saw Blades Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Woodworking Circular Saw Blades Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Woodworking Circular Saw Blades Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.