Global Workflow Management System Market

Market Size in USD Billion

CAGR :

%

USD

16.95 Billion

USD

168.97 Billion

2024

2032

USD

16.95 Billion

USD

168.97 Billion

2024

2032

| 2025 –2032 | |

| USD 16.95 Billion | |

| USD 168.97 Billion | |

|

|

|

|

Workflow Management System Market Size

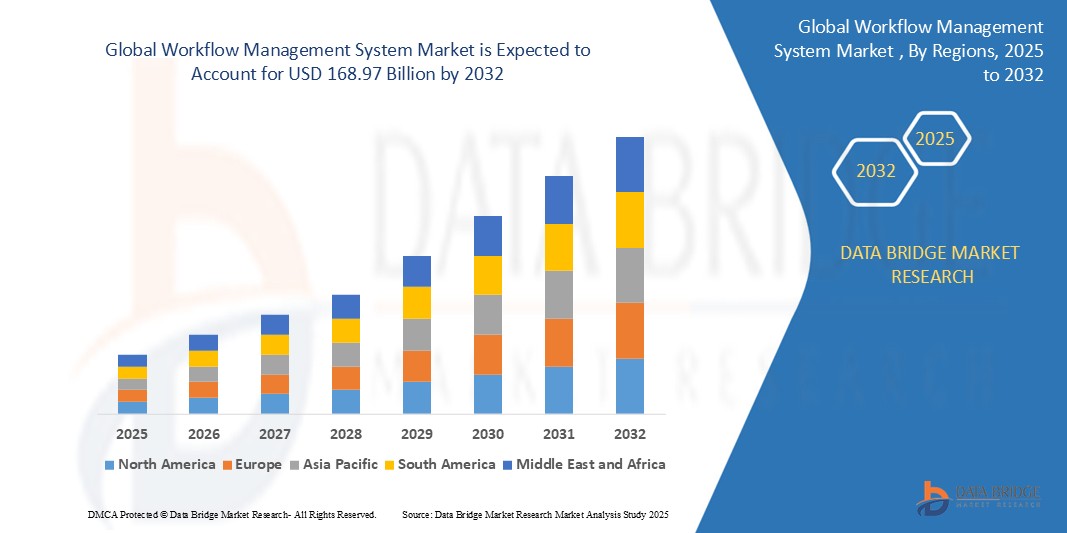

- The global workflow management system market size was valued at USD 16.95 billion in 2024 and is expected to reach USD 168.97 billion by 2032, at a CAGR of 33.30% during the forecast period

- This growth is driven by factors such as increased automation for productivity, cloud adoption for scalability, and integration with AI and IoT for smarter operations

Workflow Management System Market Analysis

- Workflow management systems involve the automation, monitoring, and optimization of business processes, allowing organizations to streamline operations, improve efficiency, and enhance collaboration. These systems enable task management, real-time tracking, and integration with other digital tools for seamless operations

- The WMS market is experiencing strong growth driven by the increasing need for automation, rising adoption of cloud-based solutions, advancements in AI and IoT integration for smarter decision-making, and the growing emphasis on operational efficiency

- North America is expected to dominate the workflow management system market with a share of with a share of 40.5%, due to the robust adoption of process management and automation solutions across the region

- Asia-Pacific is expected to be the fastest growing region in the workflow management system market with a share of during the forecast period due to surge in online transactions, increased demand for automating business processes, and rapid digitalization across the region

- Cloud segment is expected to dominate the market with a market share of 68.3% due to increasing adoption of cloud-based solutions for their scalability, cost-effectiveness, and remote accessibility. Cloud platforms offer businesses flexibility in managing workflows without the need for extensive infrastructure, driving the shift toward cloud-based systems across industries. In addition, the growing demand for real-time collaboration and seamless integration with other cloud services is further fueling this growth

Report Scope and Workflow Management System Market Segmentation

|

Attributes |

Workflow Management System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Workflow Management System Market Trends

“Increasing Advancements in Cloud Technology”

- One prominent trend in the global workflow management system market is the increasing advancements in cloud technology

- This trend is driven by the growing demand for flexible, scalable, and cost-effective deployment options that support remote access, real-time collaboration, and rapid system updates

- For instance, major WMS providers such as IBM, Microsoft, and Monday.com are expanding their cloud-based offerings to deliver enhanced scalability, faster implementation, and seamless integration with other enterprise tools

- The adoption of cloud-based WMS is gaining traction across both large enterprises and SMEs, particularly in regions embracing digital transformation and hybrid work models

- As businesses prioritize agility, security, and operational efficiency, cloud technology is expected to remain a key driver of innovation and long-term growth in the workflow management system market

Workflow Management System Market Dynamics

Driver

“Increasing Digital Transformation Initiatives”

- The surge in digital transformation initiatives is a major driver of growth in the workflow management system market, as organizations increasingly prioritize automation, operational efficiency, and data-driven decision-making

- This shift is especially prominent among enterprises undergoing cloud migrations and adopting hybrid work models that demand streamlined, real-time collaboration tools

- As businesses modernize their IT infrastructure, there is rising demand for workflow systems that integrate seamlessly with ERP, CRM, and other enterprise platforms to enhance productivity and transparency

- Companies are responding by offering AI-powered workflow solutions that automate repetitive tasks, improve resource allocation, and support agile project execution across departments

- The emphasis on digital transformation is further accelerating adoption across sectors such as healthcare, BFSI, manufacturing, and government, where compliance, scalability, and performance optimization are critical

For instance,

- Firms such as Kissflow and Nintex are launching low-code and no-code platforms to empower non-technical users to design and deploy automated workflows quickly

- Tech giants and startups alike are integrating advanced analytics, machine learning, and cloud-native architectures to offer scalable, intelligent workflow ecosystems

- As digital transformation remains a strategic priority for global enterprises, this driver is expected to significantly influence the future trajectory and innovation pace of the workflow management system market

Opportunity

“Development of AI-Driven Features”

- The development of AI-driven features presents a significant opportunity for the workflow management system market, enabling smarter, more adaptive, and predictive automation across business processes

- Solution providers are increasingly incorporating machine learning, natural language processing, and intelligent analytics to enhance workflow customization, decision support, and anomaly detection

- This opportunity aligns with the growing demand for intelligent automation, real-time insights, and personalized user experiences in dynamic enterprise environments

For instance,

- Companies such as Pipefy and Zoho are integrating AI-powered assistants that suggest workflow optimizations, automate routine approvals, and provide contextual recommendations based on user behavior

- Vendors are embedding AI capabilities such as document recognition, sentiment analysis, and process mining to streamline operations and improve compliance across industries

- As AI technologies mature, the workflow management system market is well-positioned to capitalize on this opportunity through enhanced efficiency, reduced manual intervention, and broader adoption across data-intensive sectors such as finance, healthcare, and logistics

Restraint/Challenge

“High Initial Implementation Costs”

- High initial implementation costs pose a significant challenge for the workflow management system market, as expenses related to software licensing, infrastructure upgrades, and integration services create substantial entry barriers

- These upfront costs are particularly restrictive for small and medium-sized enterprises (SMEs) and organizations with constrained IT budgets, limiting their ability to adopt advanced workflow automation tools

- The challenge is further compounded by the need for employee training, customization, and compatibility with legacy systems, all of which add to the total cost of ownership

For instance,

- Enterprise-level workflow platforms such as ServiceNow or IBM BPM often require significant financial and technical resources for deployment, customization, and ongoing support

- Without more cost-effective, scalable solutions or simplified onboarding processes, high implementation costs may slow down adoption, especially in emerging markets and among resource-limited businesses

Workflow Management System Market Scope

The market is segmented on the basis of component, deployment type, and industry vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Type |

|

|

By Industry Vertical |

|

In 2025, the cloud is projected to dominate the market with a largest share in deployment type segment

The cloud segment is expected to dominate the workflow management system market with the largest share of 68.3% in 2025 due to increasing adoption of cloud-based solutions for their scalability, cost-effectiveness, and remote accessibility. Cloud platforms offer businesses flexibility in managing workflows without the need for extensive infrastructure, driving the shift toward cloud-based systems across industries. In addition, the growing demand for real-time collaboration and seamless integration with other cloud services is further fueling this growth.

The software is expected to account for the largest share during the forecast period in Component market

In 2025, the software segment is expected to dominate the market with the largest market share of 66.8% due to increasing demand for automation, enhanced efficiency, and customization in workflow management. Software solutions provide businesses with advanced features such as real-time tracking, task prioritization, and analytics, which are critical for optimizing operations. The growing focus on streamlining processes and improving productivity across various industries, along with the rise of AI-driven solutions, is also contributing to the strong demand for software-based workflow management systems.

Workflow Management System Market Regional Analysis

“North America Holds the Largest Share in the Workflow management system Market”

- North America dominates the workflow management system market with a share of 40.5%, driven by the robust adoption of process management and automation solutions across the region

- U.S. holds a significant share due to its advanced technological infrastructure, high levels of digital transformation, and widespread adoption of cloud-based WMS solutions across industries

- Regional dominance is further reinforced by major investments in WMS solutions by both large enterprises and small businesses seeking to improve operational efficiency, streamline workflows, and enhance business performance

- With continuous advancements in automation technologies and strong government support for digital innovation, North America is expected to maintain its leading position in the WMS market through 2032

“Asia-Pacific is Projected to Register the Highest CAGR in the Workflow management system Market”

- Asia-Pacific is expected to witness the highest growth rate in the workflow management system market, driven by surge in online transactions, increased demand for automating business processes, and rapid digitalization across the region

- China holds a significant share due to its rapid adoption of digital technologies, government-backed initiatives to modernize industries, and the expanding demand for process automation in key sectors such as manufacturing, logistics, and finance

- The region’s momentum is further supported by the increasing growth of e-commerce, rising business investments in automation, and a booming middle-class population seeking cost-effective and efficient workflow solutions

- With expanding applications across various industries, including retail, logistics, and financial services, Asia-Pacific is poised to become the fastest-growing region in the global WMS market through 2032

Workflow Management System Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Xerox Corporation (U.S.)

- IBM (U.S.)

- Oracle (U.S.)

- Software AG (Germany)

- SourceCode Technology Holdings, Inc. (U.S.)

- Pegasystems Inc. (U.S.)

- Nintex UK Ltd (U.K.)

- Bizagi (U.K.)

- Appian (U.S.)

- Newgen Software Technologies Limited (India)

- FUJITSU (Japan)

- TIBCO Software Inc. (U.S.)

- Microsoft (U.S.)

- SAP SE (Germany)

- monday.com (Israel)

- Wrike, Inc. (U.S.)

- Kissflow Inc. (U.S.)

- ProjectManager (U.S.)

- Pelago (U.S.)

Latest Developments in Global Workflow Management System Market

- In October 2022, Workflow Labs launched the first phase of its HelpDesk software—an eCommerce workflow management tool designed to streamline operations for businesses on the Amazon platform. By automating repetitive tasks through an intuitive dashboard, HelpDesk empowers eCommerce sellers to improve efficiency and redirect focus toward strategic growth, positioning Workflow Labs to strengthen its foothold in the growing market for specialized workflow automation solutions

- In May 2022, Personio, an HR software company headquartered in Dublin, acquired back, an employee experience platform, to broaden its software offerings and establish two new offices in Barcelona and Berlin. Based in Berlin, Black enhances key personnel processes through its employee platform. This acquisition bolstered Personio's expansion in the people workflow automation software sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.