Global Wound Skin Substitutes Market

Market Size in USD Billion

CAGR :

%

USD

2.26 Billion

USD

4.11 Billion

2024

2032

USD

2.26 Billion

USD

4.11 Billion

2024

2032

| 2025 –2032 | |

| USD 2.26 Billion | |

| USD 4.11 Billion | |

|

|

|

|

Wound Skin Substitutes Market Size

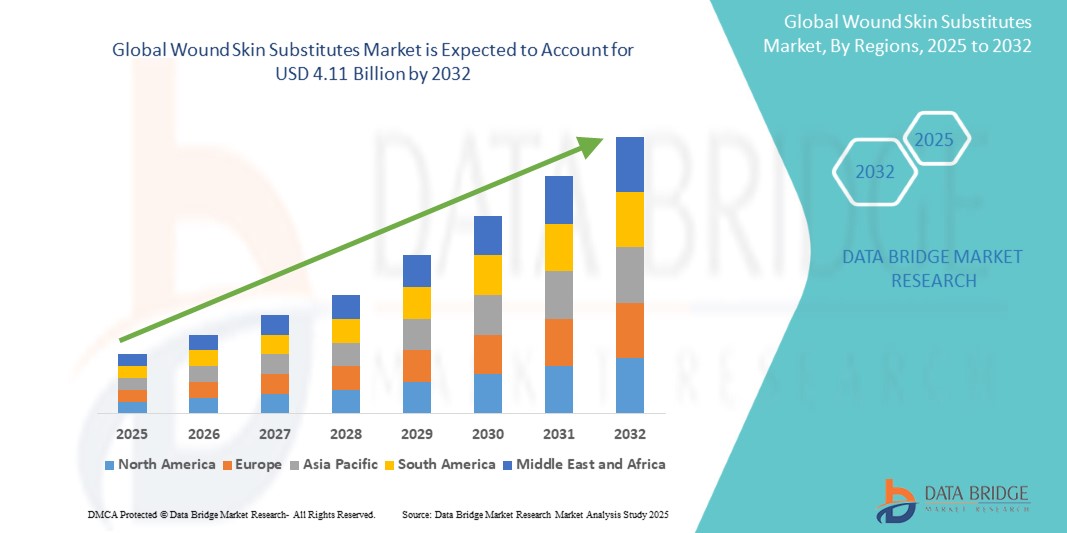

- The global wound skin substitutes market was valued at USD 2.26 billion in 2024 and is expected to reach USD 4.11 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 7.10% primarily driven by the increasing prevalence of chronic wounds and burn injuries

- This growth is driven by factors such advancements in wound care technologies and rising demand for effective skin replacement solutions

Wound Skin Substitutes Market Analysis

- The wound skin substitutes market is expanding due to the increasing incidence of chronic wounds, burn injuries, and diabetic ulcers

- For instance, according to the American Diabetes Association, over 34 million Americans have diabetes, many of whom suffer from chronic wounds that require advanced treatment

- Biological substitutes such as Dermagraft, made from human dermal fibroblasts, are growing in demand because they offer faster healing and better integration with the body, leading to improved outcomes in burn and diabetic wounds

- Synthetic substitutes such as Integra LifeSciences’ Integra Dermal Regeneration Template are being developed to provide cost-effective alternatives for wound care, addressing the growing need for affordable treatments in hospitals and clinics

- The increase in healthcare awareness has fueled demand for advanced wound care, as seen in Japan, where the government’s healthcare initiatives are promoting the use of advanced wound dressings and substitutes for elderly populations

- In 2023, AxioBiosolutions introduced a biocompatible hydrogel designed to accelerate wound healing, highlighting the continuous innovation in the field of skin substitutes

- Regenerative medicine is advancing, with companies such as StemBioSys focusing on stem cell-based wound treatments that could offer new options for complex wounds in the future

- The market is seeing more investment in personalized treatments, as evidenced by Mimetech, which has developed customized skin substitutes tailored to an individual’s genetic makeup to optimize healing processes

Report Scope and Wound Skin Substitutes Market Segmentation

|

Attributes |

Wound Skin Substitutes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Wound Skin Substitutes Market Trends

“Shift Towards Biological Skin Substitutes”

- The shift towards biological skin substitutes is becoming a prominent trend in the wound skin substitutes market due to their ability to closely mimic natural skin and promote faster healing

- Biological substitutes, such as Dermagraft and Apligraf, are derived from human or animal tissue and are gaining preference for their ability to integrate seamlessly with the patient's body, reducing the risk of rejection

- For instance, Integra LifeSciences offers the Integra Dermal Regeneration Template, a biological skin substitute used for burns and chronic wounds, which accelerates healing by encouraging tissue regeneration

- The adoption of biological substitutes is driven by their potential to reduce complications, enhance wound closure, and improve patient outcomes, making them more desirable compared to traditional dressings or synthetic options

- Hospitals and healthcare providers are increasingly turning to biological substitutes, particularly in advanced wound care, as they are seen to offer long-term benefits over cheaper synthetic alternatives

- Regenerative medicine advancements are pushing this shift forward, as biological skin substitutes integrate stem cells and growth factors to aid in faster and more efficient healing processes

- The trend is becoming more evident in markets such as North America, where high healthcare standards and focus on improved patient outcomes have led to a rising demand for these advanced, biological wound care solutions

Wound Skin Substitutes Market Dynamics

Driver

“Rising Prevalence of Chronic Wounds”

- Rising prevalence of chronic wounds such as diabetic ulcers, burns, and pressure ulcers is a key driver for the wound skin substitutes market

- For instance, American Diabetes Association reports that nearly 34 million people in the U.S. suffer from diabetes, and a large number experience chronic wounds requiring specialized care

- The growing global incidence of diabetes and the aging population is expected to increase the prevalence of chronic wounds, driving demand for advanced wound care products

- The aging process leads to weakened skin and poor circulation, making older adults more prone to slow-healing wounds, contributing to the increasing demand for wound substitutes in hospitals, clinics, and home healthcare settings

- The development of biological substitutes derived from human or animal tissues provides better healing and skin integration, making them highly preferred for treating complex wounds

- For instance, Integra LifeSciences offers the Integra Dermal Regeneration Template, which is a biological substitute widely used for chronic wound care

- The biological skin substitutes offer improved outcomes in treating severe wounds compared to traditional methods, driving their growing demand in both developed and developing regions

- As healthcare systems strive to improve the quality of care for patients with chronic wounds, the demand for advanced wound care products, particularly biological substitutes, is expected to continue to rise

- In response to this increasing demand, companies are expanding their portfolios to include biological and synthetic skin substitutes, ensuring better treatment options for complex wound care

Opportunity

“Personalized Wound Care Solutions”

- An emerging opportunity in the wound skin substitutes market is the growing focus on personalized wound care solutions

- Advances in 3D printing technology allow companies to create personalized skin substitutes that are tailored to an individual patient's unique tissue characteristics and wound type

- For instance, Mimetech has pioneered the use of 3D bioprinting to develop patient-specific wound care products, ensuring better tissue compatibility and more effective healing

- Companies are increasingly using stem cells and regenerative medicine to create biological substitutes that match the patient's skin cells, which minimizes the risk of rejection and accelerates the healing process

- The trend of creating customized skin substitutes for complex wounds is gaining momentum, driven by the desire to provide more effective and personalized treatment options

- Personalized treatments are increasingly seen as a way to meet the diverse needs of patients with chronic wounds, creating a growing demand for tailored wound care products

- The market for personalized wound care is expected to expand rapidly, as more research and development efforts are focused on creating wound substitutes that are specifically designed for each patient's needs

- The growing adoption of patient-specific wound substitutes is likely to result in improved patient outcomes, including faster healing and fewer complications

- With the integration of advanced technologies such as 3D bioprinting, the wound skin substitutes market is evolving to offer more effective, customized solutions for wound management

Restraint/Challenge

“High Cost Associated with Advanced Wound Care Products”

- One of the major challenges facing the wound skin substitutes market is the high cost associated with advanced wound care products, particularly biological substitutes

- Biological substitutes such as Dermagraft and Apligraf offer superior healing properties but come at a significantly higher price compared to traditional wound dressings, limiting their accessibility for patients and healthcare systems, especially in developing countries

- For instance, in countries with underdeveloped healthcare systems, the cost of biological skin substitutes is a significant barrier, often restricting their use to only severe or complex wounds

- This pricing issue creates a treatment gap for less severe cases, where traditional wound dressings might still be the only affordable option

- Reimbursement policies in certain regions do not fully cover the cost of advanced wound care products, further limiting their accessibility and adoption

- For instance, the complexity of manufacturing biological substitutes involves strict quality control and regulatory approvals, contributing to high production costs

- The slow production and distribution times for biological substitutes, coupled with the need for specialized storage and handling, further increase costs, making them less affordable

- While there are efforts to develop more cost-effective solutions, the high price point of advanced wound substitutes remains a significant restraint in price-sensitive markets, preventing wider adoption of these products

Wound Skin Substitutes Market Scope

The market is segmented on the basis of type, application, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Application |

|

|

By End-User |

|

Wound Skin Substitutes Market Regional Analysis

“North America is the Dominant Region in the Wound Skin Substitutes Market”

- North America dominates the global wound skin substitutes market due to its established healthcare infrastructure, high awareness of advanced wound care, and increasing chronic wound prevalence

- U.S. holds the largest market share, driven by the rising incidence of chronic diseases such as diabetes, which leads to conditions such as diabetic foot ulcers requiring specialized treatment

- The well-developed U.S. healthcare system offers extensive access to cutting-edge medical treatments, including biological substitutes such as Dermagraft and Apligraf, used in severe burns, diabetic ulcers, and other complex wounds

- High levels of investment in research and development of advanced wound care products by key manufacturers such as Mölnlycke Health Care and Smith & Nephew further drive market growth

- The strong healthcare infrastructure, rising chronic disease rates, and the availability of advanced treatments ensure that North America maintains its dominant position in the wound skin substitutes market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is the fastest-growing market for wound skin substitutes, driven by the increasing prevalence of chronic wounds, urbanization, and improvements in healthcare infrastructure

- Countries such as China, India, and Japan are experiencing significant healthcare challenges due to an aging population and increasing rates of chronic diseases such as diabetes and pressure ulcers

- The aging population in Japan, with about 28% over the age of 65, is contributing to a higher incidence of wounds, further driving the demand for advanced wound care solutions

- Rapid urbanization in India and China is leading to more cases of trauma and burn injuries, fueling the need for biological skin substitutes

- Increased healthcare investments by governments, such as China’s National Health Commission, improving healthcare access, along with higher awareness and affordable wound substitutes, are contributing to the region's rapid growth in the wound skin substitutes market

Wound Skin Substitutes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Organogenesis Inc (U.S.)

- INTEGRA LIFESCIENCES (U.S.)

- Smith+Nephew (U.K.)

- MIMEDX Group, Inc. (U.S.)

- Essity Aktiebolag (publ) (Sweden)

- Stryker (U.S.)

- Vericel Corporation (U.S.)

- 3M (U.S.)

- BioTissue (U.S.)

- MTF Biologics (U.S.)

- AVITA Medical, Inc. (U.S.)

- Bioventus (U.S.)

- Mallinckrodt company (Ireland)

Latest Developments in Global Wound Skin Substitutes Market

- In October 2023, IP Group PLC announced a strategic development regarding their portfolio company, Celltech Biologics. The company revealed that Celltech Biologics has made significant progress in its advanced wound care treatments using biological materials. This development will enhance the production of skin substitutes derived from human tissues, helping to treat chronic and complex wounds more effectively. The partnership and technological advancements are expected to drive growth in the wound skin substitutes market by offering innovative solutions for patients with severe wounds. It will benefit the market by improving healing rates, lowering the cost of treatments, and expanding product accessibility

- In May 2023, BioTissue announced a new partnership with Dakota Lions Sight & Health to expand their birth tissue donation program. This collaboration aims to increase the availability of birth tissue for use in various medical treatments, particularly in wound care, by promoting awareness and facilitating easier donation processes. The development is expected to enhance the supply of biological materials, which are used in advanced wound care products such as skin substitutes. This partnership will positively impact the wound skin substitutes market by improving product accessibility, reducing costs, and supporting faster healing processes for patients with chronic wounds

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.