Global Wraparound Case Packers Market

Market Size in USD Million

CAGR :

%

USD

877.63 Million

USD

1,420.07 Million

2024

2032

USD

877.63 Million

USD

1,420.07 Million

2024

2032

| 2025 –2032 | |

| USD 877.63 Million | |

| USD 1,420.07 Million | |

|

|

|

|

What is the Global Wraparound Case Packers Market Size and Growth Rate?

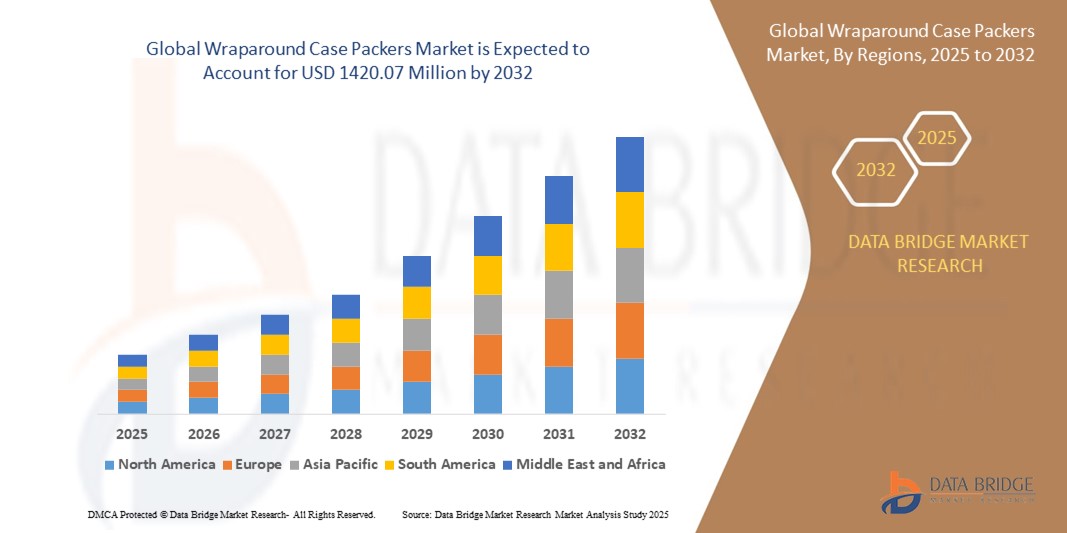

- The global wraparound case packers market size was valued at USD 877.63 million in 2024 and is expected to reach USD 1420.07 million by 2032, at a CAGR of 6.20% during the forecast period

- The wraparound case packers market is experiencing steady growth, driven by factors such as the increasing demand for automated packaging solutions, especially in industries such as food and beverage, pharmaceuticals, and consumer goods. These industries require efficient and reliable packaging equipment to meet the growing demand for their products

- In addition, the need for packaging equipment that can handle a variety of product sizes and configurations is driving the adoption of wraparound case packers. The market is also benefiting from advancements in technology, such as the integration of robotics and automation, which improve the efficiency and flexibility of wraparound case packers

What are the Major Takeaways of Wraparound Case Packers Market?

- The global trend towards urbanization, busy lifestyles, and convenience has significantly increased the consumption of packaged food and beverages. This surge in demand has created a need for efficient packaging solutions that can handle the diverse range of products in the market

- Wraparound case packers are ideal for this task, as they can accommodate various product sizes and configurations, ensuring that packaged food and beverages are securely packed for transportation and retail shelves. In addition, the flexibility and speed of wraparound case packers make them well-suited for the high-volume production requirements of the food and beverage industry, further driving their demand

- North America dominated the wraparound case packers market with the largest revenue share of 32.8% in 2024, supported by strong demand from food, beverage, and consumer goods industries

- Asia-Pacific region is expected to grow at the fastest CAGR of 11.02% from 2025 to 2032, driven by rapid urbanization, expanding manufacturing, and rising disposable incomes

- The horizontal segment dominated the market in 2024 with a revenue share of 58.6%, driven by its suitability for high-speed operations, flexibility in handling multiple carton sizes, and widespread adoption in the food and beverage industry

Report Scope and Wraparound Case Packers Market Segmentation

|

Attributes |

Wraparound Case Packers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Wraparound Case Packers Market?

Automation and Digital Integration for Efficiency

- A significant trend in the wraparound case packers market is the rapid adoption of automation, robotics, and Industry 4.0 technologies, enabling higher productivity, reduced downtime, and better operational efficiency

- Case packers are increasingly integrated with IoT sensors, machine learning algorithms, and predictive maintenance systems, allowing manufacturers to minimize unplanned stoppages and improve overall equipment effectiveness (OEE)

- For instance, Tetra Pak (Switzerland) has been advancing its smart packaging equipment with digital connectivity solutions, enabling remote monitoring and real-time optimization in production lines

- The industry is shifting towards flexible, high-speed, and digitally connected machinery, creating smarter packaging lines and reshaping manufacturer expectations globally

What are the Key Drivers of Wraparound Case Packers Market?

- Rising demand for packaged food and beverages is driving adoption, as companies seek efficient and reliable secondary packaging solutions to handle high-volume production

- Growing emphasis on sustainability is pushing manufacturers to adopt eco-friendly packaging materials and machines designed for reduced waste and energy efficiency

- For instance, in March 2024, Cama Group (Italy) introduced advanced wraparound case packers with flexible changeover capabilities, catering to both traditional cartons and recyclable materials

- Increasing labor costs and workforce shortages are encouraging businesses to automate packaging operations, boosting demand for case packers

- Expansion in e-commerce and retail-ready packaging is further propelling market growth, as case packers ensure durability and optimized logistics handling

Which Factor is Challenging the Growth of the Wraparound Case Packers Market?

- High initial investment costs associated with advanced case packers remain a significant barrier, particularly for small and medium-sized manufacturers in emerging economies

- Integration challenges with legacy systems can slow down adoption, as many manufacturers still rely on older packaging equipment

- For instance, some mid-sized beverage companies in Asia-Pacific reported difficulties in integrating modern IoT-enabled case packers with their existing semi-automated lines

- Growing concerns around machine complexity and training requirements also hinder adoption, as operators need advanced skills to run and maintain digital case packers

- To overcome these challenges, companies are focusing on affordable, modular, and user-friendly solutions, along with after-sales support and training programs to ensure smooth adoption

How is the Wraparound Case Packers Market Segmented?

The market is segmented on the basis of machine orientation, machine type, packaging speed, and application.

- By Machine Orientation

On the basis of machine orientation, the wraparound case packers market is segmented into vertical wraparound case packers and horizontal wraparound case packers. The horizontal segment dominated the market in 2024 with a revenue share of 58.6%, driven by its suitability for high-speed operations, flexibility in handling multiple carton sizes, and widespread adoption in the food and beverage industry. Horizontal machines are preferred in large-scale packaging lines for their efficiency and reduced downtime.

The vertical segment is expected to witness the fastest CAGR of 9.8% from 2025 to 2032, supported by its space-saving design and growing demand in pharmaceutical and compact production facilities. Vertical machines are increasingly adopted by small to mid-sized manufacturers seeking automation in limited floor space environments. Their rising application in e-commerce and personal care packaging also strengthens future demand, positioning vertical machines as the fastest-growing category.

- By Machine Type

On the basis of machine type, the wraparound case packers market is segmented into automatic and semiautomatic machines. The automatic segment held the largest revenue share of 71.2% in 2024, as large-scale manufacturers prioritize high-speed, labor-efficient solutions. Automatic systems reduce dependency on manual intervention, improve throughput, and ensure consistent packaging quality, making them the preferred choice for industries such as food, beverage, and pharmaceuticals.

The semiautomatic segment is expected to register the fastest CAGR of 8.5% from 2025 to 2032, driven by adoption among SMEs (small and medium enterprises) with budget constraints and moderate production volumes. These machines offer a cost-effective balance between automation and manual control, providing flexibility in diverse packaging operations. The growing number of local and regional manufacturers, especially in emerging economies, is expected to accelerate demand for semiautomatic systems in the forecast period.

- By Packaging Speed

On the basis of packaging speed, the wraparound case packers market is segmented into 10–15 cases per minute and 15–30 cases per minute. The 15–30 cases per minute segment dominated the market with a 62.4% share in 2024, owing to its adoption in large-scale production environments where high output and efficiency are critical. This speed range meets the needs of global FMCG companies and beverage manufacturers handling large volumes.

The 10–15 cases per minute segment is projected to grow at the fastest CAGR of 9.1% during 2025–2032, supported by demand from small and medium-sized enterprises that prioritize cost efficiency over maximum throughput. These machines are well-suited for specialized or low-volume packaging requirements, particularly in niche food products, regional beverage brands, and specialty pharmaceuticals. The increasing shift toward flexible and customized packaging solutions supports strong growth prospects for this segment.

- By Application

On the basis of application, the wraparound case packers market is segmented into food packaging, pharmaceutical packaging, and others. The food packaging segment dominated the market with a 54.7% share in 2024, driven by high-volume requirements from bakery, dairy, beverages, and frozen food sectors. The growth of convenience food consumption, coupled with rising automation adoption by global food manufacturers, continues to drive this dominance.

The pharmaceutical packaging segment is forecasted to record the fastest CAGR of 10.4% from 2025 to 2032, supported by rising global healthcare spending, stricter regulatory standards for drug safety, and the increasing demand for tamper-evident and durable packaging. The expansion of biopharmaceuticals and generics manufacturing facilities further boosts the need for efficient, precise case packers. While “others” (personal care, household goods) represent a steady segment, the pharmaceutical sector is set to drive future innovations and growth in case packaging technologies.

Which Region Holds the Largest Share of the Wraparound Case Packers Market?

- North America dominated the wraparound case packers market with the largest revenue share of 32.8% in 2024, supported by strong demand from food, beverage, and consumer goods industries

- The region’s packaging automation push, focus on labor cost reduction, and adoption of advanced case packing technologies are fueling market growth

- Established players and high capital investment capabilities strengthen adoption across industries

U.S. Wraparound Case Packers Market Insight

U.S. held the largest revenue share in 2024 within North America, supported by the country’s leadership in automated packaging machinery adoption. Growth is driven by demand for high-speed, flexible packaging solutions across food, beverage, and e-commerce sectors. Labor shortages and rising wages are encouraging manufacturers to adopt automation to improve productivity. The shift toward sustainable and eco-friendly packaging further boosts demand for wraparound case packers, especially in consumer goods and beverage packaging. Major manufacturers headquartered in the U.S., combined with strong technological innovation and investment, consolidate the country’s leadership in the global market.

Europe Wraparound Case Packers Market Insight

Europe is projected to register substantial growth, supported by stringent packaging and safety regulations and high demand for efficiency in production lines. Rising urbanization and growing packaged food consumption are key drivers. Companies are focusing on energy-efficient, compact, and sustainable case packers to comply with European Union environmental policies. Both residential and commercial packaging requirements, alongside expansion in pharmaceuticals and cosmetics, are spurring adoption. Automation in warehouses and manufacturing plants is also contributing. Germany, Italy, and France are major contributors, as the region is home to leading packaging equipment manufacturers that drive both local adoption and global exports.

U.K. Wraparound Case Packers Market Insight

U.K. market is expected to grow steadily due to rising demand for automation in the food & beverage, e-commerce, and retail sectors. Heightened concerns around sustainability and labor shortages are encouraging companies to adopt wraparound case packers to reduce costs and improve efficiency. Investments in smart packaging solutions are increasing, driven by e-commerce packaging needs and changing consumer preferences. In addition, U.K. manufacturing and logistics industries are emphasizing automation to boost productivity. Strong adoption in beverage packaging and increasing integration of robotics with case packers further strengthen the growth outlook for the U.K. market.

Germany Wraparound Case Packers Market Insight

Germany is set to witness significant growth, driven by its well-developed industrial base, focus on automation, and strong demand from FMCG and beverage sectors. German manufacturers emphasize sustainable and eco-friendly packaging machinery, aligning with the country’s strict environmental standards. Increasing integration of robotics and AI in packaging systems ensures higher efficiency, precision, and flexibility. The demand for automated case packers in food processing, beer, and pharmaceutical industries is particularly strong. Germany’s reputation as a hub for advanced packaging equipment manufacturers allows it to play a leading role in Europe’s overall market growth and technology exports worldwide.

Which Region is the Fastest Growing in the Wraparound Case Packers Market?

Asia-Pacific region is expected to grow at the fastest CAGR of 11.02% from 2025 to 2032, driven by rapid urbanization, expanding manufacturing, and rising disposable incomes. Countries such as China, Japan, and India are fueling demand, supported by government-led digitalization and automation initiatives. The presence of low-cost manufacturers makes equipment more affordable, increasing adoption across food, beverage, and e-commerce packaging industries. Rising exports and local demand for packaged products are key growth factors. APAC’s position as a manufacturing hub ensures both domestic consumption and international supply of wraparound case packing machinery.

Japan Wraparound Case Packers Market Insight

Japan is witnessing steady growth, with demand driven by its advanced automation culture and strong food & beverage industry. The country prioritizes compact, efficient, and high-tech packaging machinery to meet consumer expectations for quality and convenience. Integration of wraparound case packers with IoT and robotics is becoming standard, allowing manufacturers to improve productivity and precision. An aging workforce further increases reliance on automated packaging solutions. Demand from convenience foods, beverages, and pharmaceuticals is particularly high. Japan’s manufacturing sector emphasizes efficiency and space-saving designs, making wraparound case packers an ideal solution for its industrial requirements.

China Wraparound Case Packers Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, fueled by its expanding middle class, rapid urbanization, and strong demand for packaged products. The government’s smart manufacturing and Industry 4.0 policies are boosting automation adoption. China is also a major producer of wraparound case packers, supported by domestic manufacturers offering cost-effective solutions. Growth is strong across food, beverage, personal care, and e-commerce industries. The rise of smart cities and the expansion of large-scale manufacturing facilities contribute to high demand. Affordable pricing and increasing exports position China as a key growth driver globally.

Which are the Top Companies in Wraparound Case Packers Market?

The wraparound case packers industry is primarily led by well-established companies, including:

- Tetra Pak (Switzerland)

- Cama Group (Italy)

- Pro Mach, Inc. (U.S.)

- KHS GmbH (Germany)

- SOMIC GmbH (Germany)

- A-B-C Packaging Machine Corporation (U.S.)

- Brenton Engineering (U.S.)

- Cermex Group (France)

- Econocorp Inc. (U.S.)

- OCME S.r.l. (Italy)

- Schneider Packaging Equipment Co. (U.S.)

- ECONO-PAK GmbH (Germany)

- Adpak Machinery Systems Ltd. (U.K.)

- ARPAC LLC (U.S.)

- Wexxar Bel (Canada)

- Z Automation Company (U.S.)

- Bradman Lake Group Ltd. (U.K.)

- Brentwood Packaging Systems Ltd. (U.K.)

- Brentorma (China)

- Harpak-ULMA Packaging, LLC (U.S.)

What are the Recent Developments in Global Wraparound Case Packers Market?

- In April 2024, Orlandi launched EcoPro Paper-Wrap, a sustainable packaging solution meeting eco-friendly demands. The product, offering high-barrier, recyclable material, replaces plastic film or foil pouches at lower costs. Versatile for various packaging needs, EcoPro ensures freshness and containment of products, maintaining brands' visual identity with exceptional printing capabilities. Orlandi's commitment to innovation and sustainability in packaging is further solidified with EcoPro

- In April 2024, Cox & Co introduced its first paper flow wrap chocolate packaging, offering a 12-month shelf life and enabling the brand to eliminate plastics for kerbside recyclable wrapping. The company highlighted consumer demand for sustainability and easy recyclability. The new packaging reduced packaging costs by 35%, allowing the brand to maintain competitive pricing while reducing environmental impact

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wraparound Case Packers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wraparound Case Packers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wraparound Case Packers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.