Global Xylitol Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

1.51 Billion

2024

2032

USD

1.06 Billion

USD

1.51 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 1.51 Billion | |

|

|

|

|

Xylitol Market Size

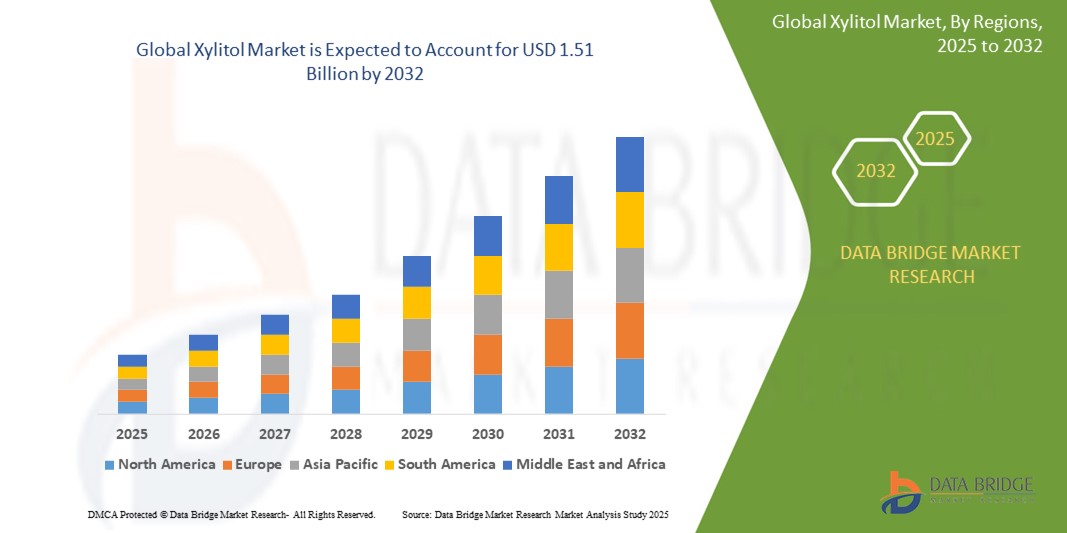

- The global xylitol market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 1.51 billion by 2032, at a CAGR of 4.56% during the forecast period

- The market growth is primarily driven by increasing consumer awareness of low-calorie and sugar-free alternatives, rising demand for natural sweeteners in food and beverage products, and growing applications in pharmaceutical and personal care industries

- The shift toward healthier lifestyles and the rising prevalence of diabetes and obesity are boosting the adoption of xylitol as a sugar substitute, significantly contributing to market expansion

Xylitol Market Analysis

- Xylitol, a naturally occurring sugar alcohol used as a sweetener, is gaining popularity due to its low glycemic index, dental health benefits, and suitability for diabetic-friendly products

- The demand for xylitol is fueled by its increasing use in chewing gums, confectionery, and oral care products, alongside growing applications in pharmaceuticals for drug formulations and personal care products such as toothpaste and mouthwash

- North America dominated the xylitol market with the largest revenue market share of 38.5% in 2024, driven by high consumer awareness of health-conscious diets, strong demand for sugar-free products, and the presence of major manufacturers. The U.S. is a key market, with significant growth in the use of xylitol in functional foods and oral care

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, propelled by rising disposable incomes, increasing urbanization, and growing demand for sugar-free and natural products in countries such as China and India

- The solid segment dominates the largest market revenue share of 91.2% in 2024, driven by its versatility, ease of handling, and widespread use in food manufacturing, particularly in confectionery and chewing gum.

Report Scope and Xylitol Market Segmentation

|

Attributes |

Xylitol Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Xylitol Market Trends

“Rising Preference for Plant-Based and Sustainable Xylitol Sources”

- Plant-based xylitol, particularly derived from corn husk and sugarcane bagasse, is gaining traction due to its eco-friendly production and sustainability credentials

- These sources provide high purity and consistent quality, making them ideal for use in premium products such as chewing gum and confectioner

- In regions with abundant agricultural resources, such as Brazil and India, sugarcane bagasse-derived xylitol is favored for its cost-effectiveness and local availability

- Health-conscious consumers and premium brands prefer xylitol for its natural, non-GMO properties and dental health benefits

- For instance, brands such as Spry offer xylitol-based chewing gums marketed for oral health, appealing to wellness-focused consumers

- Manufacturers are increasingly integrating plant-based xylitol into product lines to meet the growing demand for clean-label and sustainable ingredients

Xylitol Market Dynamics

Driver

“Rising Demand for Sugar-Free and Health-Oriented Products”

- Growing consumer awareness about the adverse effects of sugar consumption, such as diabetes and obesity, is driving demand for xylitol as a natural, low-calorie sweetener

- Xylitol’s ability to prevent tooth decay and maintain oral health is increasing its adoption in chewing gum, confectionery, and pharmaceutical product

- These properties enhance product appeal in health-focused markets, particularly in North America and Europe, where dental care awareness is high

- Manufacturers are responding by incorporating xylitol into sugar-free product lines or partnering with oral care brands to promote its benefits

- For instance, Colgate offers xylitol-infused dental products as a premium oral health solution

- The rise of diabetic-friendly and low-glycemic-index diets is further fueling the adoption of xylitol in food and beverage applications, improving consumer health and product marketability

Restraint/Challenge

“Regulatory Restrictions and Production Costs”

- Regulatory restrictions on xylitol use in certain food and pharmaceutical applications limit market growth and product innovation

- Different countries have varying standards for xylitol purity and acceptable daily intake, complicating global standardization for manufacturers and distributors

- High production costs, particularly for xylitol derived from berries or oats, pose challenges due to limited raw material availability and complex extraction processes

- For instance, in some regions, regulatory bodies such as the FDA and EFSA require stringent safety assessments for xylitol in pharmaceutical applications, increasing compliance costs

- These challenges discourage smaller manufacturers from entering the market and may limit the availability of cost-competitive xylitol products, hindering market expansion

Xylitol Market Scope

The market is segmented on the basis of form, raw materials, and application.

- By Form

On the basis of form, the xylitol market is segmented into solid and liquid. The solid segment dominates the largest market revenue share of 91.2% in 2024, driven by its versatility, ease of handling, and widespread use in food manufacturing, particularly in confectionery and chewing gum. Solid xylitol, often in powder or granulated form, is favored for its stability, long shelf life, and ability to blend seamlessly with other ingredients without altering taste or texture. Its compatibility with various production processes and cost-effectiveness further bolsters its dominance.

The liquid segment is anticipated to witness the fastest growth rate of 6.8% from 2025 to 2032, fueled by its increasing use in beverages, syrups, and pharmaceutical applications. Liquid xylitol is valued for its solubility and ability to integrate into liquid-based products, offering a cost-effective solution for manufacturers seeking low-calorie sweeteners for health-conscious consumers.

- By Raw Materials

On the basis of raw materials, the xylitol market is segmented into corn husk, berries, sugarcane bagasse, mushrooms, and oats. The corn husk segment held the largest market revenue share in 2024, driven by its abundance as an agricultural byproduct and cost-effective extraction processes. Corn husks are rich in xylan, making them a sustainable and scalable source for industrial xylitol production, particularly in regions such as Asia-Pacific where corn production is high.

The sugarcane bagasse segment is expected to witness the fastest CAGR from 2025 to 2032, driven by innovative biotechnological advancements, such as the novel fermentation method developed by I.I.T. Guwahati in August 2022, which enhances yield and reduces production time. Sugarcane bagasse, a by-product of sugar processing, supports sustainable production practices and aligns with the growing demand for eco-friendly raw materials.

- By Application

On the basis of application, the xylitol market is segmented into chewing gum, confectionery, pharmaceutical and personal care, and others. The chewing gum segment accounted for the largest market revenue share of 68% in 2024, driven by the rising demand for sugar-free chewing gums due to their dental health benefits, such as reducing cavity-forming bacteria and promoting saliva production. Xylitol’s anti-cariogenic properties and similarity to sugar in taste and texture make it a preferred sweetener in this segment.

The pharmaceutical and personal care segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by xylitol’s low glycemic index and its use in sugar-free medicinal syrups, chewable tablets, toothpaste, and mouthwash. The increasing prevalence of diabetes and consumer preference for health-conscious products drive demand, with xylitol’s moisturizing properties also boosting its use in cosmetics such as skin creams.

Xylitol Market Regional Analysis

- North America dominated the xylitol market with the largest revenue market share of 38.5% in 2024, driven by high consumer awareness of health-conscious diets, strong demand for sugar-free products, and the presence of major manufacturers. The U.S. is a key market, with significant growth in the use of xylitol in functional foods and oral care

- Asia-Pacific is projected to be the fastest-growing region during the forecast period, propelled by rising disposable incomes, increasing urbanization, and growing demand for sugar-free and natural products in countries such as China and India

U.S. Xylitol Market Insight

The U.S. xylitol market held the largest revenue share of 78% in North America in 2024, driven by increasing consumer awareness of sugar-free and low-calorie sweeteners. The growing demand for natural sweeteners in food and beverage products, coupled with rising health consciousness, is fueling market growth. The prevalence of diabetes and obesity has further accelerated the adoption of xylitol in chewing gums, confectionery, and oral care products. In addition, the integration of xylitol in pharmaceutical applications and its promotion as a dental health-friendly sweetener are key growth drivers.

Europe Xylitol Market Insight

The Europe xylitol market is projected to grow at a significant CAGR during the forecast period, propelled by stringent regulations on sugar consumption and increasing demand for natural sweeteners in food and beverage industries. Rising health awareness, particularly in countries such as Germany and France, is driving the adoption of xylitol in sugar-free products. The region's focus on sustainable and eco-friendly ingredients, along with growing applications in cosmetics and pharmaceuticals, supports market expansion across residential and commercial sectors.

U.K. Xylitol Market Insight

The U.K. xylitol market is expected to expand at a notable CAGR during the forecast period, fueled by the growing trend of health-conscious diets and demand for sugar substitutes. Concerns about obesity and dental health are encouraging consumers and manufacturers to opt for xylitol-based products, particularly in confectionery and oral care. The U.K.'s robust retail and e-commerce infrastructure, combined with increasing consumer preference for natural and sustainable ingredients, is anticipated to drive market growth.

Germany Xylitol Market Insight

The Germany xylitol market is poised to grow at a substantial CAGR during the forecast period, driven by heightened awareness of health and wellness and demand for eco-conscious, low-calorie sweeteners. Germany’s advanced food processing industry and emphasis on innovation promote the adoption of xylitol in functional foods, beverages, and oral care products. The integration of xylitol in pharmaceutical formulations and its alignment with consumer preferences for sustainable, health-focused products further boosts market growth.

Asia-Pacific Xylitol Market Insight

The Asia-Pacific xylitol market is expected to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by rising disposable incomes, increasing urbanization, and growing health awareness in countries such as China, Japan, and India. Government initiatives promoting healthier lifestyles and the expanding food and beverage industry are accelerating the adoption of xylitol. The region’s emergence as a manufacturing hub for xylitol-based products enhances affordability and accessibility, further propelling market growth.

Japan Xylitol Market Insight

The Japan xylitol market is gaining traction due to the country’s health-conscious culture, rapid urbanization, and demand for natural sweeteners. The adoption of xylitol is driven by its widespread use in oral care products, confectionery, and functional foods, supported by Japan’s focus on preventive healthcare. The integration of xylitol in innovative food and beverage formulations, along with its appeal to an aging population seeking health-friendly products, is fueling market growth in both residential and commercial sectors.

China Xylitol Market Insight

The China xylitol market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s expanding middle class, rapid urbanization, and increasing adoption of sugar-free products. China is a leading market for xylitol in food, beverage, and oral care applications, particularly in urban areas and among health-conscious consumers. The push toward healthier lifestyles, coupled with strong domestic manufacturing and affordable xylitol-based products, are key factors driving market expansion.

Xylitol Market Share

The xylitol industry is primarily led by well-established companies, including:

- Cargill, Incorporated (U.S.)

- DuPont (U.S.)

- Novagreen Mechanical, Inc. (Canada)

- Shandong Futaste Co. (China)

- ZuChem, Inc. (U.S.)

- Zhejiang Huakang Pharmaceutical Co., Ltd. (China)

- Roquette Frères (France)

- Merck KGaA (Germany)

- AVANSCHEM (India)

- Foodchem International Corporation (China)

- Ingredion (U.S.)

- DFI Corporation (U.S.)

- Yusweet Xylitol Technology Co., Ltd. (China)

- Fengchen Group Co., Ltd. (China)

What are the Recent Developments in Global Xylitol Market?

- In August 2022, IIT Guwahati researchers developed an ultrasound-assisted fermentation method to produce xylitol from sugarcane bagasse, significantly improving efficiency and sustainability. This breakthrough reduces fermentation time by 15 hours and boosts product yield by nearly 20%, overcoming challenges in traditional chemical synthesis. The innovation supports cost-effective xylitol production, benefiting food and pharmaceutical applications. The research, led by Prof. V.S. Moholkar, was published in Bioresource Technology and Ultrasonics Sonochemistry

- In August 2022, IFF launched its Nourish Innovation Lab at its Union Beach, New Jersey R&D center, reinforcing its commitment to food and beverage innovation. This state-of-the-art facility enables co-creation with customers, offering proteins, flavor modulators, sweeteners, seasonings, functional ingredients, cultures, and enzymes. The lab integrates cutting-edge sensory and consumer insights technology, advancing sustainability and circular economy initiatives. Scientists collaborate to enhance taste, nutrition, and functionality, accelerating product development

- In July 2022, BURST Oral Care launched its Teeth Whitening Trays, designed for professional-grade brightening results. These custom-fit trays combine 12.5% hydrogen peroxide, potassium hydroxide, and xylitol, ensuring effective whitening while supporting dental health. The formula is vegan, cruelty-free, and free from parabens, phthalates, sulfates, allergens, artificial sweeteners, flavors, or colors. The trays provide hassle-free whitening in 15 minutes, delivering noticeably brighter teeth after one use and dramatically whiter results after a full 7-day course

- In April 2022, Fazer Group launched the world’s first oat-derived xylitol at its new factory in Lahti, Finland. This sustainable sweetener is produced using patented technology, transforming upcycled oat hulls into high-quality xylitol. The innovation supports the circular economy, repurposing oat milling sidestreams for food, cosmetic, and pharmaceutical applications. Fazer’s xylitol offers moisturizing and dental health benefits, reinforcing its commitment to sustainable production. The factory’s low-carbon footprint further enhances its eco-friendly credentials

- In February 2021, International Flavors & Fragrances Inc. (IFF) completed its merger with DuPont’s Nutrition & Biosciences (N&B) business, creating a global leader in ingredients and solutions for food, beverage, health, and wellness markets. The merger integrates DuPont’s expertise in sweetener production, including xylitol, expanding IFF’s portfolio and global reach in natural sweeteners. The combined company continues to operate under the IFF name, reinforcing its market position

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Xylitol Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Xylitol Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Xylitol Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.