Global Yersinia Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

4.02 Billion

USD

5.88 Billion

2025

2033

USD

4.02 Billion

USD

5.88 Billion

2025

2033

| 2026 –2033 | |

| USD 4.02 Billion | |

| USD 5.88 Billion | |

|

|

|

|

Yersinia Diagnostics Market Size

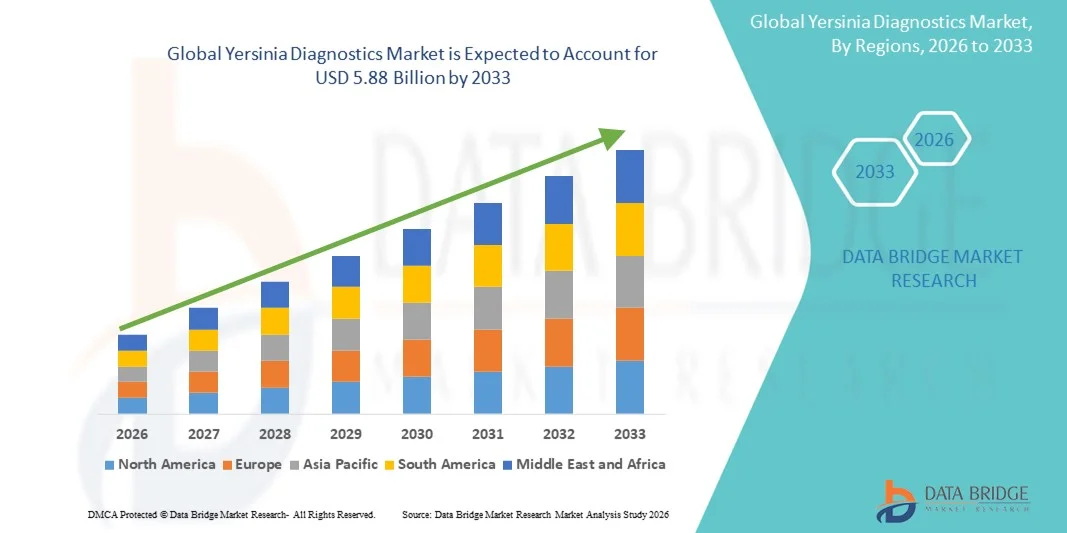

- The global Yersinia diagnostics market size was valued at USD 4.02 billion in 2025 and is expected to reach USD 5.88 billion by 2033, at a CAGR of 4.86% during the forecast period

- The market growth is largely fueled by the increasing incidence of Yersinia infections, rising awareness of food safety, and growing adoption of reliable diagnostic solutions in clinical and public-health settings

- Furthermore, technological advancements such as PCR-based molecular diagnostics, immunoassays, and automated testing platforms are enabling faster and more accurate detection of Yersinia species, driving the adoption of these solutions in hospitals, diagnostic labs, and public-health agencies

Yersinia Diagnostics Market Analysis

- Yersinia diagnostics, encompassing tests for detecting Yersinia species in clinical and food samples, are becoming increasingly critical in managing foodborne and zoonotic infections, supporting timely treatment, outbreak prevention, and public-health surveillance across hospitals, diagnostic laboratories, and regulatory agencies

- The rising demand for Yersinia diagnostics is primarily driven by increasing incidence of Yersinia infections, heightened awareness of food safety, and the need for rapid, accurate, and reliable detection methods to prevent outbreaks and ensure public-health safety

- North America dominated the Yersinia diagnostics market with the largest revenue share of 38.9% in 2025, owing to advanced healthcare infrastructure, high adoption of molecular and immunoassay-based diagnostic technologies, and strong presence of key industry players, with the U.S. witnessing significant growth in laboratory-based and point-of-care Yersinia testing

- Asia-Pacific is expected to be the fastest-growing region in the Yersinia diagnostics market during the forecast period due to rising foodborne infection cases, expanding healthcare access, and growing investments in diagnostic infrastructure in emerging economies such as China and India

- PCR segment dominated the Yersinia diagnostics market with a market share of 42.3% in 2025, driven by its high sensitivity, specificity, and growing adoption in clinical and public-health laboratories for rapid detection and outbreak management

Report Scope and Yersinia Diagnostics Market Segmentation

|

Attributes |

Yersinia Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Yersinia Diagnostics Market Trends

Rapid and Point-of-Care Testing Adoption

- A significant and accelerating trend in the global Yersinia diagnostics market is the increasing adoption of rapid and point-of-care testing platforms that enable timely detection of infections in both clinical and field settings

- For instance, the BioFire FilmArray Gastrointestinal Panel allows healthcare providers to detect Yersinia species in under an hour, facilitating immediate clinical decisions

- Advances in molecular diagnostics, such as PCR and isothermal amplification methods, are enabling higher sensitivity and faster results, supporting early diagnosis and outbreak containment

- Point-of-care integration allows testing to be performed outside traditional laboratories, including in remote clinics and food safety inspection sites, increasing accessibility and reducing diagnostic delays

- This trend towards rapid, accurate, and portable Yersinia diagnostic solutions is reshaping expectations for infectious disease management and driving adoption across healthcare and public-health sectors

- The demand for user-friendly, field-deployable diagnostics is growing rapidly as healthcare providers and food-safety agencies prioritize timely interventions to prevent and control Yersinia outbreaks

- Increasing integration of Yersinia diagnostics with digital reporting and surveillance platforms enables real-time outbreak tracking and epidemiological analysis

- Partnerships between diagnostic companies and public-health organizations are expanding access to Yersinia testing in underserved and remote areas, further driving adoption

Yersinia Diagnostics Market Dynamics

Driver

Increasing Incidence of Foodborne and Zoonotic Infections

- The rising prevalence of Yersinia infections, particularly from contaminated food and water sources, is a significant driver of demand for reliable diagnostic solutions

- For instance, in March 2025, BioMerieux launched an expanded Yersinia testing kit targeting both clinical and food safety laboratories, highlighting the growing need for rapid detection solutions

- Early detection of infections allows timely clinical interventions, reduces complications, and minimizes public-health risks, encouraging healthcare providers to adopt advanced diagnostics

- Awareness campaigns on food safety and hygiene, coupled with government-led surveillance programs, are promoting the use of Yersinia diagnostics in both developed and emerging markets

- The need for accurate, high-throughput, and integrated testing solutions to monitor outbreaks and ensure food safety is further propelling market growth

- Technological innovations in multiplex panels that detect Yersinia alongside other pathogens are enhancing diagnostic efficiency and creating new growth opportunities

- Expansion of government-funded disease surveillance programs and mandatory testing regulations in the food industry is driving steady demand for Yersinia diagnostics

Restraint/Challenge

Regulatory Compliance and Infrastructure Limitations

- Compliance with stringent regulatory standards for diagnostic kits and laboratory testing poses a significant challenge for market expansion, particularly in emerging regions

- For instance, delays in obtaining FDA or CE approvals for new molecular Yersinia diagnostic assays can slow market entry and limit adoption by healthcare providers

- Limited laboratory infrastructure and shortage of trained personnel in certain regions hinder the widespread deployment of advanced diagnostics, affecting overall market penetration

- High costs associated with sophisticated molecular testing platforms, including PCR machines and automated immunoassay systems, can be a barrier for smaller clinics or public-health labs

- Addressing regulatory hurdles, enhancing laboratory capacity, and developing cost-effective diagnostic solutions will be critical for sustained market growth

- Companies focusing on streamlined regulatory approval, portable testing solutions, and training initiatives are better positioned to overcome these challenges and expand their market presence

- Variability in diagnostic accuracy and sensitivity across different Yersinia test platforms can affect clinician confidence and slow adoption

- Dependence on cold-chain logistics for certain reagents and kits limits accessibility in remote or resource-constrained regions, posing additional operational challenges

Yersinia Diagnostics Market Scope

The market is segmented on the basis of test type, technology, and end user.

- By Test Type

On the basis of test type, the Yersinia diagnostics market is segmented into stool culture, ELISA, radioimmunoassay, tube agglutination, CT scan, ultrasonography, and colonoscopy. The stool culture segment dominated the market in 2025, owing to its status as the gold standard for detecting Yersinia species in clinical samples. Stool culture provides accurate identification of bacterial strains, allowing targeted treatment and effective outbreak management. Healthcare providers prefer this method for its reliability, cost-effectiveness, and ease of implementation in routine laboratory workflows. In addition, stool culture supports antibiotic susceptibility testing, which is crucial in clinical decision-making and reducing antimicrobial resistance risks. Its wide acceptance among hospitals and public-health laboratories further reinforces its dominance. The increasing incidence of foodborne infections globally sustains steady demand for stool culture diagnostics.

The ELISA segment is expected to witness the fastest growth from 2026 to 2033 due to its high sensitivity, specificity, and suitability for large-scale screening in both clinical and food-safety laboratories. ELISA-based tests allow rapid detection of Yersinia antigens or antibodies, facilitating early diagnosis and outbreak control. The method’s automation potential and compatibility with high-throughput platforms make it attractive for commercial laboratories and public-health agencies. Growing awareness about foodborne pathogens and demand for faster diagnostic turnaround times also contribute to ELISA’s rising adoption. Furthermore, ongoing technological improvements are enhancing assay accuracy and reducing processing time, reinforcing its growth potential. ELISA’s cost-effectiveness in large-scale testing scenarios supports its forecasted market expansion.

- By Technology

On the basis of technology, the market is segmented into DNA probes, immunoassay, monoclonal antibodies, and PCR. The PCR segment dominated the market in 2025 with a market share of 42.3% due to its high sensitivity, specificity, and rapid detection capabilities. PCR-based diagnostics allow precise identification of Yersinia species even in low bacterial load samples, enabling early intervention and outbreak containment. Clinical laboratories prefer PCR for its reproducibility and ability to provide quantitative results. Its adoption is driven by the increasing focus on molecular diagnostics and technological advances in automated PCR platforms. PCR also facilitates multiplex testing, allowing simultaneous detection of multiple pathogens, which enhances laboratory efficiency and reduces turnaround times. The rising demand for quick, accurate, and reliable diagnostics in hospitals and public-health surveillance continues to fuel PCR adoption.

The immunoassay segment is expected to witness the fastest growth from 2026 to 2033, supported by advancements in enzyme-linked immunosorbent assays (ELISA) and lateral-flow immunoassays for point-of-care applications. Immunoassays offer rapid, sensitive, and user-friendly detection of Yersinia antigens or antibodies, making them suitable for clinical, food safety, and field testing. Increasing investments in portable and high-throughput immunoassay platforms are accelerating adoption in emerging markets. The ability to integrate immunoassays with automated reporting systems and digital surveillance networks further enhances their growth prospects. Rising awareness about foodborne infections and the need for preventive diagnostics are key factors driving the segment’s rapid expansion.

- By End User

On the basis of end user, the market is segmented into hospital laboratories, public-health laboratories, and commercial laboratories. The hospital laboratories segment dominated the market in 2025, driven by the growing demand for accurate and rapid diagnostics for patient care. Hospitals prioritize reliable detection methods, including PCR and stool culture, to enable timely treatment and prevent complications. The presence of advanced diagnostic infrastructure, skilled personnel, and high patient inflow supports hospital laboratories’ dominance in the market. In addition, integration with electronic health record systems allows efficient management of test results and epidemiological data, enhancing hospital laboratories’ role in disease monitoring. Increasing incidence of gastrointestinal and zoonotic infections continues to boost testing volumes in hospital settings.

The public-health laboratories segment is expected to witness the fastest growth from 2026 to 2033 due to expanding government surveillance programs and mandatory foodborne pathogen testing initiatives. Public-health labs increasingly adopt advanced diagnostics, including PCR and immunoassays, to monitor Yersinia outbreaks and ensure community safety. The growth is further supported by funding from governmental and international health agencies to enhance laboratory capacity and testing coverage. These labs also serve as reference centers for commercial and smaller clinical laboratories, driving adoption of standardized diagnostic protocols. Rising awareness of foodborne diseases and regulatory mandates for pathogen monitoring are key factors fueling growth in the public-health laboratory segment.

Yersinia Diagnostics Market Regional Analysis

- North America dominated the Yersinia diagnostics market with the largest revenue share of 38.9% in 2025, owing to advanced healthcare infrastructure, high adoption of molecular and immunoassay-based diagnostic technologies, and strong presence of key industry players, with the U.S. witnessing significant growth in laboratory-based and point-of-care Yersinia testing

- Healthcare providers and public-health agencies in the region highly prioritize rapid, accurate, and reliable diagnostic solutions to detect Yersinia species, supporting timely treatment, outbreak prevention, and public-health monitoring

- This widespread adoption is further reinforced by high healthcare spending, availability of advanced laboratory facilities, and strong presence of key diagnostic companies, establishing North America as the leading market for Yersinia diagnostics in both clinical and food safety applications

U.S. Yersinia Diagnostics Market Insight

The U.S. Yersinia diagnostics market captured the largest revenue share of 79% in 2025 within North America, driven by the high prevalence of foodborne infections and well-established healthcare infrastructure. Clinical laboratories and public-health agencies prioritize rapid, accurate, and sensitive detection methods, including PCR and ELISA, to manage outbreaks effectively. The growing emphasis on food safety, coupled with strong government surveillance programs and mandatory reporting of zoonotic infections, further propels market adoption. Moreover, integration of diagnostics with digital reporting systems and epidemiological tracking enhances efficiency, supporting sustained market growth.

Europe Yersinia Diagnostics Market Insight

The Europe Yersinia diagnostics market is projected to expand at a substantial CAGR throughout the forecast period, largely due to stringent food safety regulations and increasing awareness of public-health risks. Rising urbanization and the growing adoption of advanced diagnostic technologies are encouraging the use of rapid testing solutions in hospitals, food inspection agencies, and public-health laboratories. European healthcare providers value highly sensitive and reliable detection methods for Yersinia species, with adoption spanning both clinical and commercial laboratory applications. The trend toward integrated surveillance systems further supports market growth.

U.K. Yersinia Diagnostics Market Insight

The U.K. Yersinia diagnostics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by government-mandated foodborne pathogen testing and rising incidence of gastrointestinal infections. Public-health initiatives, combined with the country’s strong healthcare infrastructure, are encouraging widespread adoption of PCR and immunoassay-based Yersinia diagnostics. In addition, the U.K.’s focus on outbreak prevention and digital reporting for epidemiological monitoring is expected to stimulate market expansion. Commercial laboratories are increasingly investing in high-throughput diagnostic solutions to meet both clinical and food-safety testing demands.

Germany Yersinia Diagnostics Market Insight

The Germany Yersinia diagnostics market is expected to expand at a considerable CAGR during the forecast period, fueled by strong regulatory frameworks and high awareness of foodborne diseases. Germany’s emphasis on technological innovation and precision diagnostics drives the adoption of molecular and immunoassay-based testing solutions. Hospitals and public-health laboratories are increasingly implementing advanced diagnostic platforms for rapid detection of Yersinia species. Integration of diagnostics with digital reporting systems and food-safety monitoring networks enhances outbreak preparedness, supporting steady market growth.

Asia Pacific Yersinia Diagnostics Market Insight

The Asia-Pacific Yersinia diagnostics market is poised to grow at the fastest CAGR of 22% during the forecast period, driven by rising incidence of foodborne infections, growing urban populations, and improving healthcare infrastructure in countries such as China, India, and Japan. Government initiatives promoting food safety and infectious disease monitoring are accelerating the adoption of advanced diagnostics. Furthermore, increasing investments in laboratory infrastructure and rising awareness about gastrointestinal and zoonotic infections are expanding the market. Emerging economies are also witnessing growth in point-of-care testing and rapid diagnostic solutions, making detection more accessible and timely.

Japan Yersinia Diagnostics Market Insight

The Japan Yersinia diagnostics market is gaining momentum due to high awareness of food safety, strong healthcare infrastructure, and increasing use of molecular diagnostics in clinical and food-testing laboratories. Rapid urbanization and adoption of smart laboratory technologies are further fueling market growth. Integration of diagnostics with automated reporting systems for epidemiological monitoring enhances operational efficiency. Moreover, the aging population and growing focus on preventive healthcare are expected to increase demand for accurate and rapid Yersinia testing across hospitals and public-health facilities.

India Yersinia Diagnostics Market Insight

The India Yersinia diagnostics market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to rising foodborne disease incidence, expanding healthcare infrastructure, and increased public awareness of food safety. Rapid urbanization, government initiatives for disease surveillance, and increasing adoption of molecular and immunoassay diagnostics are driving growth. Hospitals, commercial laboratories, and public-health agencies are increasingly investing in rapid and high-throughput testing solutions. In addition, affordable diagnostic platforms and partnerships with domestic and international manufacturers are supporting wider market penetration in India.

Yersinia Diagnostics Market Share

The Yersinia Diagnostics industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific Inc (U.S.)

- Merck KGaA (Germany)

- Bio-Rad Laboratories, Inc (U.S.)

- ELITechGroup Inc (U.S.)

- GSK plc (U.K.)

- Lonza Ltd (Switzerland)

- PerkinElmer (U.S.)

- QIAGEN (Netherlands)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Siemens Healthcare AG (Germany)

- SeraCare Life Sciences Inc (U.S.)

- Abbott (U.S.)

- BD (U.S.)

- BIOMÉRIEUX (France)

- Surmodics IVD, Inc (U.S.)

- Mikrogen GmbH (Germany)

- CerTest Biotec (Spain)

- Labcorp (U.S.)

- Hologic, Inc (U.S.)

- Pfizer Inc (U.S.)

What are the Recent Developments in Global Yersinia Diagnostics Market?

- In October 2025, Hologic, Inc. received 510(k) clearance from the U.S. Food and Drug Administration (FDA) and CE‑mark approval for its Panther Fusion GI Expanded Bacterial Assay, a fully automated multiplex real-time PCR test that includes detection of Yersinia enterocolitica enabling faster, high-throughput diagnosis of gastroenteritis pathogens including Yersinia

- In February 2025, a major genomic‑surveillance publication from Centers for Disease Control and Prevention (CDC) reported genomic characterization of 78 Y. enterocolitica isolates from Costa Rica, revealing persistent circulation between animal reservoirs and humans plus unusual antimicrobial resistance levels a finding that emphasizes the need for robust diagnostics and continuous surveillance globally

- In April 2024, public‑health surveillance in Finland reported a marked rise in Yersinia enterocolitica infection cases compared to previous year, with 168 cases reported to the national Infectious Disease Register underlining growing demand for effective diagnostic testing and outbreak detection capacity

- In January 2024, ELITechGroup launched its “GI Bacterial PLUS ELITe MGB® Kit”, a CE‑IVDR certified in‑vitro diagnostic assay that includes detection of Yersinia enterocolitica among other gastrointestinal bacterial pathogens expanding molecular diagnostic options for stool‑based detection

- In April 2023, a study titled “Public health implications of Yersinia enterocolitica investigation: an ecological modeling and molecular epidemiology study” was published. The research characterized Y. enterocolitica isolates from animals, food, and human clinical samples in Ningxia, China showing that over half of isolates were pathogenic, and using genomic & ecological modelling to highlight risk zones, underscoring the importance of surveillance and diagnostics in zoonotic and foodborne contexts

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.