Global Yoga Apparel Market

Market Size in USD Billion

CAGR :

%

USD

60.46 Billion

USD

96.37 Billion

2024

2032

USD

60.46 Billion

USD

96.37 Billion

2024

2032

| 2025 –2032 | |

| USD 60.46 Billion | |

| USD 96.37 Billion | |

|

|

|

Yoga Apparel Market Analysis

The yoga apparel market is experiencing significant growth due to the rising global adoption of yoga as part of a healthy lifestyle. Consumers are increasingly seeking comfortable, functional, and stylish activewear designed specifically for yoga practice. The demand for sustainable and eco-friendly fabrics, such as organic cotton, bamboo, and recycled polyester, has surged, as brands focus on environmentally responsible manufacturing practices. In addition, advancements in fabric technology, including moisture-wicking, stretchability, and odor-resistant properties, are enhancing the performance and appeal of yoga apparel.

The expansion of e-commerce and digital marketing has further fueled market growth, enabling brands to reach a wider audience. Companies are leveraging AI-driven personalization and augmented reality (AR) to offer virtual try-ons and customized recommendations, enhancing the online shopping experience. For instance, Lululemon and Adidas have introduced AI-powered fit guides to help customers find the perfect yoga wear. The market is also witnessing an increase in athleisure trends, where yoga apparel is worn for workouts and as everyday fashion. This shift has encouraged brands to introduce versatile and stylish designs suitable for both fitness and casual wear, driving further market expansion.

Yoga Apparel Market Size

The global yoga apparel market size was valued at USD 60.46 billion in 2024 and is projected to reach USD 96.37 billion by 2032, with a CAGR of6.00% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Yoga Apparel Market Trends

“Rising Demand for Sustainable and Eco-Friendly Yoga Wear”

One key trend shaping the yoga apparel market is the rising demand for sustainable and eco-friendly yoga wear, driven by increasing consumer awareness of environmental impact. Brands are focusing on organic, recycled, and biodegradable fabrics such as organic cotton, bamboo, and recycled polyester to create yoga clothing that is both functional and environmentally responsible. This trend is particularly evident in leading companies such as Lululemon and Adidas, which have launched sustainable yoga collections using eco-conscious materials and water-saving dyeing techniques. In addition, PUMA's recycled yoga wear line integrates polyester made from plastic waste, aligning with the shift toward ethical fashion and circular economy practices. As consumers prioritize sustainability, durability, and performance, brands are incorporating moisture-wicking, breathable, and stretchable fabric technologies to enhance comfort and longevity. The combination of sustainability, innovation, and functionality is redefining the yoga apparel industry, influencing both product design and consumer purchasing decisions.

Report Scope and Yoga Apparel Market Segmentation

|

Attributes |

Yoga Apparel Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Athleta LLC (U.S.), Nike, Inc. (U.S.), Adidas AG (Germany), PUMA SE (Germany), Under Armour, Inc. (U.S.), EVERLAST WORLDWIDE INC. (U.S.), Ralph Lauren Media LLC (U.S.), Umbro (U.K.), Fila Luxembourg, S.a.r.L. (Luxembourg), Blacks (U.K.), The Gap, Inc. (U.S.), Columbia Sportswear Company (U.S.), New Balance (U.S.), Jockey India (India), Lotto Spa (Italy), ASICS India Pvt. Ltd. (India), Billabong (Australia), Old Navy, LLC (U.S.), ALO, LLC. (U.S.), and Green Apple Active (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Yoga Apparel Market Definition

Yoga apparel refers to specialized clothing designed to provide comfort, flexibility, and breathability during yoga practice and other fitness activities. These garments, including yoga pants, leggings, tops, shorts, capris, and unitards, are made from stretchable, moisture-wicking, and breathable fabrics such as spandex, cotton, bamboo, and recycled materials to enhance performance and comfort.

Yoga Apparel Market Dynamics

Drivers

- Increasing Health Consciousness and Fitness Awareness

The global rise in health consciousness and fitness awareness has significantly impacted the yoga apparel market, as more individuals incorporate yoga and fitness routines into their daily lives. With increasing concerns about stress management, obesity, and mental well-being, consumers are actively seeking comfortable, breathable, and functional yoga wear that enhances their performance. The shift toward preventive healthcare has also encouraged people to embrace yoga as a holistic practice for physical and mental wellness, driving higher demand for moisture-wicking leggings, stretchable tops, and durable yoga pants. For instance, a study by the Yoga Journal and Yoga Alliance reported that the number of global yoga practitioners has risen exponentially, particularly in North America, Europe, and Asia-Pacific, leading to a surge in the adoption of premium yoga wear. This market expansion has pushed leading brands such as Athleta, Alo Yoga, and Lululemon to introduce high-performance yoga apparel tailored to both beginner and advanced practitioners.

- Growth of the Athleisure Trend

The athleisure trend, which combines athletic wear with casual fashion, has become a dominant force in the yoga apparel market, significantly boosting sales and product innovation. Consumers now prefer multifunctional, stylish, and high-performance clothing that transitions seamlessly from workout sessions to everyday wear, fueling the demand for fashionable yoga leggings, yoga tops, and breathable unitards. The growing preference for sustainable and eco-friendly activewear has also led to the introduction of organic cotton and recycled fabric-based yoga apparel, catering to environmentally conscious buyers. For instance, Lululemon, Nike, and Adidas have developed sweat-resistant, odor-neutralizing, and ultra-flexible yoga apparel that meets the needs of both fitness enthusiasts and lifestyle consumers. In addition, major retailers such as Target, Nordstrom, and Amazon have expanded their athleisure collections, reflecting the widespread adoption of yoga apparel beyond traditional fitness settings, making it a core part of modern fashion culture.

Opportunities

- Expansion of Sustainable and Eco-Friendly Yoga Apparel

The growing consumer preference for sustainable and eco-friendly clothing presents a significant opportunity for the yoga apparel market. With rising awareness of environmental conservation and ethical fashion, brands are focusing on organic, biodegradable, and recycled materials to create sustainable yoga wear. Companies such as Lululemon, Patagonia, and PrAna have introduced yoga apparel made from organic cotton, bamboo fibers, and recycled polyester, reducing their carbon footprint while appealing to environmentally conscious buyers. This trend is further supported by government regulations promoting sustainable textile production, creating a favorable market environment for green yoga apparel brands.

- Rising Demand for Customization and Smart Fabrics

The increasing demand for customized and tech-integrated yoga apparel offers a lucrative market opportunity. Consumers are seeking personalized fits, unique designs, and performance-enhancing features, leading brands to offer custom yoga leggings, tops, and unitards with moisture-wicking, UV protection, and anti-microbial properties. Moreover, advancements in smart textiles have enabled the development of yoga clothing with embedded sensors that monitor posture, body temperature, and hydration levels, enhancing the overall yoga experience. For instance, companies such as Wearable X and Nadi X have launched smart yoga pants with built-in haptic feedback to guide users in achieving the correct yoga poses, catering to both beginners and experienced practitioners.

Restraints/Challenges

- Increasing Presence of Counterfeit and Low-Cost Yoga Apparel

The increasing presence of counterfeit and low-cost yoga apparel in the market, especially on e-commerce platforms, poses a significant challenge to established brands. Many unregulated manufacturers produce low-quality replicas of premium brands, often using substandard fabrics and poor stitching, leading to discomfort, durability issues, and potential health risks such as skin irritation. This influx of counterfeit products dilutes brand value and erodes consumer trust, as unsuspecting buyers may associate negative experiences with the authentic brand. For instance, brands such as Lululemon and Alo Yoga have reported issues with fake products appearing on third-party online marketplaces, forcing them to take legal action and invest in anti-counterfeiting measures. As online shopping continues to grow, ensuring product authenticity through verified sellers, blockchain-based tracking, and brand protection initiatives remains a crucial market challenge for premium yoga apparel manufacturers.

- High Competition and Market Saturation

The yoga apparel market is highly competitive, with numerous global and regional players offering similar product lines. Industry leaders such as Lululemon, Nike, and Adidas dominate with their strong brand identity, innovative fabric technologies, and extensive distribution networks, making it difficult for emerging brands to gain traction. Established brands also have the advantage of loyal customer bases and high marketing budgets, enabling them to stay ahead in terms of product development and brand visibility. In addition, the rise of direct-to-consumer (DTC) brands and fast fashion retailers entering the athleisure space has intensified competition, reducing profit margins for smaller businesses. For instance, brands such as Outdoor Voices and Vuori have struggled to maintain market share against dominant players despite offering premium quality products. To survive in this saturated market, new entrants must differentiate themselves through sustainability, unique designs, influencer marketing, and technological advancements in fabric innovation all of which require substantial investment, making it a key market challenge.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Yoga Apparel Market Scope

The market is segmented on the basis of type, application, and distribution channel. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Yoga Shorts

- Yoga Pants

- Yoga Unitards

- Yoga Tops

- Yoga Capris

- Others

Application

- Men

- Women

- Kids

Distribution Channel

- Offline

- Online

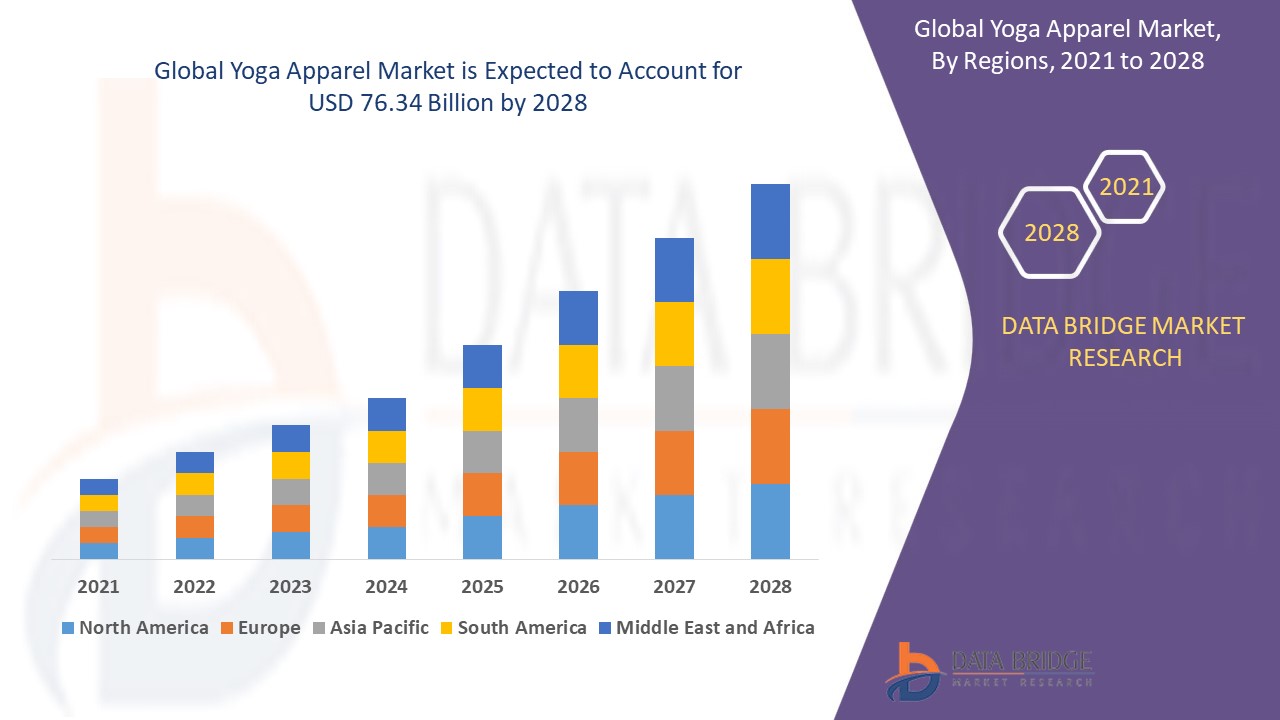

Yoga Apparel Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, type, application, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America holds a dominant position in the yoga apparel market, driven by the strong presence of leading yoga apparel manufacturers, particularly in the U.S. The growing popularity of yoga as a fitness and wellness activity has led to a surge in the number of yoga studios across the region. In addition, an increasing number of individuals are embracing yoga due to its numerous health benefits, including stress reduction, flexibility improvement, and overall well-being. This rising awareness, coupled with a preference for comfortable and stylish activewear, continues to fuel the demand for yoga apparel in North America.

Asia-Pacific is expected to experience the highest CAGR from 2025 to 2032, driven by a growing shift toward healthier and more active lifestyles, particularly among working professionals and students. The demand for yoga clothing continues to rise as manufacturers focus on designing apparel that prioritizes functionality and wearer comfort, making it highly appealing to consumers. In addition, countries such as China, India, and Japan have introduced various initiatives promoting yoga and fitness activities to enhance public health. These efforts have led to the establishment of numerous yoga centers and studios across the region, witnessing strong participation and creating significant growth opportunities for yoga apparel manufacturers.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Yoga Apparel Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Yoga Apparel Market Leaders Operating in the Market Are:

- Athleta LLC (U.S.)

- Nike, Inc. (U.S.)

- Adidas AG (Germany)

- PUMA SE (Germany)

- Under Armour, Inc. (U.S.)

- EVERLAST WORLDWIDE INC. (U.S.)

- Ralph Lauren Media LLC (U.S.)

- Umbro (U.K.)

- Fila Luxembourg, S.a.r.L. (Luxembourg)

- Blacks (U.K.)

- The Gap, Inc. (U.S.)

- Columbia Sportswear Company (U.S.)

- New Balance (U.S.)

- Jockey India (India)

- Lotto Spa (Italy)

- ASICS India Pvt. Ltd. (India)

- Billabong (Australia)

- Old Navy, LLC (U.S.)

- ALO, LLC. (U.S.)

- Green Apple Active (U.S.)

Latest Developments in Yoga Apparel Market

- In September 2022, Spanx introduced a new collection of activewear, featuring track pants, yoga pants, and tennis skirts with pockets, while also expanding its existing product portfolio

- In September 2022, Puma unveiled a sustainable yoga wear collection, including jackets, tops, and tights, crafted from recycled materials such as certified polyester and cotton

- In July 2022, Follett Higher Education, North America’s largest campus retailer, announced a partnership with Beyond Yoga, providing campus members and students access to premium branded yoga apparel

- In March 2022, Reebok launched its spring activewear collection, designed for women, featuring yoga bras, leggings, and hoodies tailored for comfort and performance

- In July 2021, Lululemon, a Canada-based activewear retailer, collaborated with Bolt Threads to develop eco-friendly yoga apparel made from mushroom mycelium leather, promoting sustainable fashion

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.