Global Zero Friction Coatings Market

Market Size in USD Million

CAGR :

%

USD

915.00 Million

USD

1,470.00 Million

2024

2032

USD

915.00 Million

USD

1,470.00 Million

2024

2032

| 2025 –2032 | |

| USD 915.00 Million | |

| USD 1,470.00 Million | |

|

|

|

|

Zero-Friction Coatings Market Size

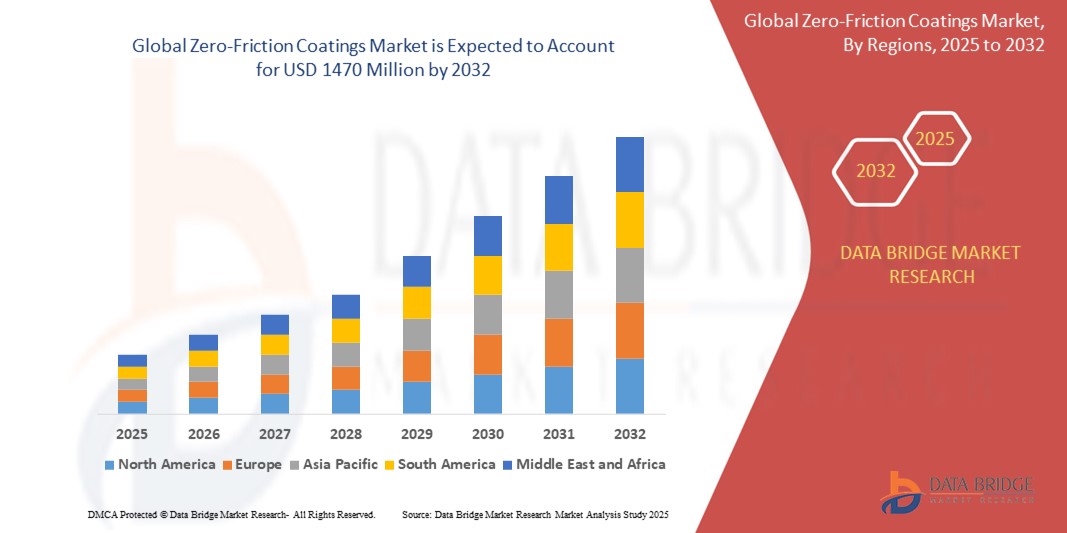

- The global Zero-Friction Coatings market size was valued at USD 915.6 Million in 2024 and is expected to reach USD 1470 Million by 2032, at a CAGR of 5.4% during the forecast period

- The market growth is largely fueled by increasing demand for energy-efficient solutions, rising automotive and aerospace production, advancements in low-friction coating technologies, stringent environmental regulations promoting eco-friendly materials, and expanding applications across industrial machinery, electronics, and renewable energy sectors globally.

- Furthermore, growing awareness of sustainability, government incentives for green technologies, and continuous innovation in coating materials enhance durability and performance, driving wider adoption of zero-friction coatings across diverse industries such as manufacturing, transportation, and electronics, accelerating overall market expansion.

Zero-Friction Coatings Market Analysis

- The Zero-Friction Coatings market is expanding rapidly due to increasing industrial automation, demand for enhanced equipment efficiency, and the need to reduce energy consumption. Advanced materials like PTFE and MoS₂ improve performance, durability, and environmental compliance across automotive, aerospace, and manufacturing sectors.

- Regional growth is driven by Asia-Pacific’s industrial boom and North America’s technological innovation. Stringent environmental regulations and sustainability goals push adoption of eco-friendly coatings. However, high production costs and raw material price volatility pose challenges, encouraging ongoing research to develop cost-effective, high-performance coating solutions.

- Asia-Pacific (APAC) dominates the Zero-Friction Coatings market with a 36% revenue share in 2025, driven by rapid industrialization, expanding automotive and aerospace sectors, increasing manufacturing activities, government initiatives supporting sustainable technologies, and growing demand for energy-efficient, high-performance coating solutions across key economies like China and India.

- Additionally, rising investments in research and development, adoption of advanced materials like PTFE and MoS₂, expansion of renewable energy projects, and increasing awareness of environmental regulations further boost the demand for zero-friction coatings in Asia-Pacific, reinforcing its leadership in the global market.

- The PTFE-Based Low Friction Coatings segment is expected to dominate the Zero-Friction Coatings market with a significant share of around 38% in 2025, driven by its excellent chemical resistance, low coefficient of friction, wide industrial applications, and growing demand for durable, energy-efficient coatings.

Report Scope and Zero-Friction Coatings Market Segmentation

|

Attributes |

Zero-Friction Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Zero-Friction Coatings Market Trends

“Icreasing adoption of sustainable, low-friction coatings in automotive and industrial applications”

- Growing environmental regulations are pushing automotive manufacturers to use sustainable low-friction coatings, improving fuel efficiency and reducing emissions while meeting strict global standards for eco-friendly vehicle production.

- Industrial sectors are adopting low-friction coatings to enhance machinery lifespan, reduce maintenance costs, and improve operational efficiency, contributing to sustainability goals by minimizing energy consumption and resource wastage.

- Advances in coating technologies enable development of bio-based and waterborne low-friction coatings, attracting industries aiming to reduce their carbon footprint and comply with increasing environmental compliance requirements worldwide.

- Automotive and aerospace industries prefer low-friction coatings for critical components to reduce wear and friction, resulting in improved performance, lower energy consumption, and extended equipment life, supporting long-term sustainability.

- Increasing awareness among manufacturers about the benefits of low-friction coatings, such as reduced downtime and improved equipment reliability, drives higher adoption rates in industrial applications seeking sustainable and cost-effective solutions.

Zero-Friction Coatings Market Dynamics

Driver

“Rising automotive production increases demand for sustainable friction-reducing coatings”

- Rapid growth in global automotive manufacturing drives the need for advanced low-friction coatings that improve fuel efficiency, reduce emissions, and meet stringent environmental regulations, promoting widespread adoption of sustainable coating solutions in vehicle components.

- Increasing production of electric vehicles (EVs) emphasizes the use of friction-reducing coatings to enhance battery performance, extend component life, and optimize energy efficiency, accelerating demand for sustainable coatings in the automotive sector.

- Automotive OEMs focus on lightweight materials and advanced surface treatments, including sustainable friction-reducing coatings, to improve overall vehicle performance, durability, and compliance with global emission standards, stimulating market growth.

- Expansion of automotive supply chains in emerging economies boosts demand for cost-effective, eco-friendly coatings that support local manufacturers’ sustainability goals and meet international quality benchmarks.

- Rising consumer preference for environmentally responsible vehicles encourages manufacturers to integrate sustainable coatings that reduce energy loss and wear, aligning product development with global sustainability trends and regulatory frameworks.

Restraint/Challenge

“High production costs limit widespread adoption of zero-friction coatings”

- Expensive raw materials and complex manufacturing processes increase overall costs, making zero-friction coatings less affordable for small and medium-sized enterprises, limiting their market penetration and adoption across various industries.

- High production expenses discourage price-sensitive customers from switching to zero-friction coatings, especially in cost-competitive sectors where cheaper alternatives may be preferred despite lower performance benefits

- The need for specialized equipment and skilled labor to apply advanced coatings adds to operational costs, posing a barrier to large-scale implementation in emerging markets and developing economies.

- Research and development investments required to improve coating formulations and reduce costs can be substantial, limiting the pace of innovation and the availability of cost-effective zero-friction coating options.

- Price volatility of key raw materials such as PTFE and MoS₂ further escalates production costs, making it challenging for manufacturers to maintain stable pricing and profitability in a competitive market environment.

Zero-Friction Coatings Market Scope

The market is segmented on the basis of type and end-user.

- By Type

On the basis of type, the Zero-Friction Coatings market is segmented into PTFE-Based Low Friction Coatings and MOS2 Based Low Friction Coatings. The PTFE-Based Low Friction Coatings segment dominates the largest market revenue share of approximately 38% in 2025, driven by its excellent chemical resistance, low friction properties, wide industrial applications, durability under extreme conditions, and growing demand from automotive, aerospace, and manufacturing sectors globally.

The PTFE-Based Low Friction Coatings segment is anticipated to witness the fastest growth rate of around 6.5% CAGR from 2025 to 2032, fueled by increasing adoption in automotive and aerospace industries, superior performance in reducing wear, and rising demand for energy-efficient, sustainable coating solutions.

- By End-User

On the basis of end-user, the Zero-Friction Coatings market is segmented in to automobile and transportation industry, aerospace industry, general engineering, food and healthcare, energy, oil and gas, power and others. The automobile and transportation industry segment drives the Zero-Friction Coatings market due to increasing demand for fuel-efficient vehicles, stringent emission regulations, need for lightweight components, and growing adoption of electric vehicles, which require advanced low-friction coatings to enhance performance and reduce energy consumption.

The automobile and transportation industry segment is expected to witness the fastest CAGR from 2025 to 2032, driven by rising electric vehicle production, stringent emission norms, demand for improved fuel efficiency, and increasing use of lightweight materials requiring advanced zero-friction coatings.

Zero-Friction Coatings Market Regional Analysis

- Asia-Pacific (APAC) dominates the Zero-Friction Coatings market with a 36% revenue share in 2025, driven by rapid industrialization, expanding automotive and aerospace sectors, increasing manufacturing activities, government initiatives supporting sustainable technologies, and growing demand for energy-efficient, high-performance coating solutions across key economies like China and India.

- Strong government support for sustainable technologies and environmental regulations, coupled with rising demand for energy-efficient and durable coating solutions, further accelerate market expansion across Asia-Pacific, making it the fastest-growing region for zero-friction coatings globally.

- Increasing investments in research and development within Asia-Pacific are driving innovation in zero-friction coatings, enabling the creation of cost-effective, eco-friendly, and high-performance products that meet stringent environmental standards, further strengthening the region’s dominance and fueling robust market growth through 2025 and beyond.

China Zero-Friction Coatings Market Insight

The China Zero-Friction Coatings market captured the largest revenue share of approximately 42% within Asia-Pacific (APAC) in 2025, driven by its extensive manufacturing base, strong automotive and industrial machinery sectors, and growing demand for high-performance coatings to reduce energy losses and enhance equipment durability.

North America Zero-Friction Coatings Market Insight

The North America market is projected to expand at a substantial CAGR due to increasing demand from the automotive and aerospace sectors, rising focus on energy efficiency, technological advancements in coating materials, and growing investments in research and development for durable, high-performance surface solutions.

U.S. Zero-Friction Coatings Market Insight

The U.S. market is driven by robust industrial infrastructure, high demand from automotive and aerospace sectors, advancements in coating technologies, stringent environmental regulations promoting low-friction solutions, and increased investment in R&D. These factors collectively support the growing adoption of zero-friction coatings across various applications.

Zero-Friction Coatings Market Share

The Zero-Friction Coatings industry is primarily led by well-established companies, including:

- AkzoNobel N.V. (Netherlands)

- The Chemours Company (United States)

- Solvay S.A. (Belgium)

- PPG Industries, Inc. (United States)

- BASF SE (Germany)

- Mankiewicz Gebr. & Co. GmbH (Germany)

- Henkel AG & Co. KGaA (Germany)

- RPM International Inc. (United States)

- Saint-Gobain (France)

- CIE Automotive (Spain)

- Zhejiang Jiashan Coating Co., Ltd. (China)

- Jiangsu Yoke Industrial Co., Ltd. (China)

- Coventya GmbH (Germany)

- NanoTech Coatings (United Kingdom)

- Süd-Chemie AG (Germany)

Latest Developments in Global Zero-Friction Coatings Market

- In September 2024, DuPont launched an advanced zero-friction coating designed for extreme industrial conditions. This product significantly increases component lifespan and efficiency in high-stress environments, such as automotive and aerospace applications. It aligns with growing industry demand for energy-saving, wear-resistant coating technologies.

- In April 2022, PPG Industries acquired Arsonsisi's powder coatings division to enhance its zero-friction coating portfolio. The acquisition strengthens PPG’s market presence across Europe and supports innovation in sustainable, low-emission coating solutions tailored for automotive, electronics, and heavy machinery sectors seeking performance and regulatory compliance.

- In June 2022, The FUCHS Group expanded its lubricant and coating offerings by acquiring Gleitmo Technik AB's business in Sweden. This move bolsters FUCHS’ position in the European market, providing access to advanced zero-friction coating technologies aimed at improving machinery performance and reducing energy consumption.

- In 2023, 3M introduced a new series of zero-friction coatings specifically designed for the automotive sector. These coatings help reduce mechanical energy loss, enhance fuel efficiency, and support emission reduction goals, catering to the growing global focus on sustainability and high-performance vehicle engineering.

- In 2023, DuPont unveiled a new generation of low-friction coatings engineered to offer longer durability and lower environmental impact. Designed for industrial and transportation applications, these coatings address increasing demand for eco-friendly materials while maintaining performance under extreme operational conditions such as heat and pressure.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Zero Friction Coatings Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Zero Friction Coatings Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Zero Friction Coatings Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.