Ksa Aftermarket Spare Parts Market

Market Size in USD Thousand

CAGR :

%

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

USD

4.79 Thousand

USD

6.61 Thousand

2023

2029

| 2024 –2029 | |

| USD 4.79 Thousand | |

| USD 6.61 Thousand | |

|

|

|

KSA Aftermarket Spare Parts Market Analysis and Size

Aftermarket spare parts refer to components or parts that has manufactured by third-party companies and sold separately from the original equipment manufacturer (OEM). These parts has designed to replace or repair original parts in vehicles, machinery, or other equipment after the original parts have worn out or malfunctioned. Aftermarket spare parts has often produced to meet or exceed the specifications of the OEM parts and typically offered at competitive prices. They provide consumers with alternatives to OEM parts, offering a wider selection and often providing cost savings compared to purchasing directly from the original manufacturer.

Data Bridge Market Research analyses that KSA aftermarket spare parts market is expected to reach a value of USD 6.61 thousand by 2029 from 4.79 thousand in 2023, growing at a CAGR of 5.7% during the forecast period 2024 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2029 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Type (Replacement Parts and Accessories), Distribution Channel (Wholesalers & Distributors and Retails), Certification Outlook (Genuine Parts, Certified Parts, and Uncertified Parts), Service Channel (DIFM (Do It for Me), DIY (Do It Yourself), and OE (Delegating to OEM’S)), Vehicle Age (4 to 8 Years, 0 to 4 Years, and Above 8 Years), Vehicle Type (Passenger Cars, Commercial Vehicle, Utility Task Vehicle (UTV), Recreational Vehicle), Sales Channel (Offline and Online), Propulsion Type (Diesel/Petrol, CNG, and Electric) |

|

Countries Covered |

KSA |

|

Market Players Covered |

Michelin, The Goodyear Tire & Rubber Company, Continental AG, Aptiv, ZF Friedrichshafen AG, Robert Bosch GmbH, Knorr-Bremse AG, Yokohama Tire Corporation, Tenneco Inc, and DENSO CORPORATION, among others |

Market Definition

Aftermarket spare parts refer to components or parts that has manufactured by third-party companies and sold separately from the original equipment manufacturer (OEM). These parts has designed to replace or repair original parts in vehicles, machinery, or other equipment after the original parts have worn out or malfunctioned. Aftermarket spare parts has often produced to meet or exceed the specifications of the OEM parts and typically offered at competitive prices. They provide consumers with alternatives to OEM parts, offering a wider selection and often providing cost savings compared to purchasing directly from the original manufacturer.

KSA Aftermarket Spare Parts Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Increasing Demand for Automobile

The escalating demand for automobiles in Saudi Arabia acts as a pivotal driver propelling the aftermarket spare parts market forward. The nation's population steadily growing and urbanization trends on the rise, there is a corresponding surge in the need for personal transportation, be it for commuting or leisure purposes. This heightened demand establishes in increased vehicle sales across various segments, including passenger cars, commercial vehicles, and off-road vehicles, thereby reinforcing the overall size of the automotive fleet within the country.

- Surging Preference for Online Purchases of Auto Spare Parts

The surging preference for online purchases of auto spare parts represents a significant driver for the aftermarket spare parts market in Saudi Arabia. Digitalization and e-commerce continue to gain traction, consumers increasingly value the convenience, accessibility, and wide product selection offered by online platforms. The proliferation of e-commerce channels and dedicated auto parts websites, vehicle owners can easily browse, compare prices, and purchase spare parts from the comfort of their homes or workplaces.

Opportunities

- Collaboration and Partnerships Among Market Players

Collaboration and partnerships among market players present a significant opportunity for the KSA aftermarket spare parts market to enhance its competitiveness and efficiency. By forming strategic alliances, companies within the spare parts industry can leverage each other's strengths, resources, and expertise to drive innovation, expand market reach, and improve supply chain efficiencies. For instance, partnerships between spare parts manufacturers, distributors, and retailers can streamline distribution channels, reduce lead times, and optimize inventory management, ultimately benefiting end customers with faster access to quality spare parts.

- Innovative Distribution Models

Innovative distribution models present a significant opportunity for the Kingdom of Saudi Arabia (KSA) aftermarket spare parts market. The automotive industry in KSA witnessing rapid growth and technological advancements, traditional distribution channels has being challenged to adapt to changing consumer preferences and market dynamics. Innovative models such as e-commerce platforms, direct-to-consumer sales, and subscription-based services offer the potential to revolutionize the aftermarket spare parts market in KSA by providing greater convenience, accessibility, and efficiency for consumers.

Restraints/Challenges

- Regulatory Compliances Related to Auto Spare Parts

Regulatory compliance poses a significant restraint for the aftermarket spare parts market in Saudi Arabia. The stringent standards and regulations set by the Saudi Standards, Metrology and Quality Organization (SASO) require suppliers and distributors to adhere to specific quality and safety criteria for automotive spare parts. Ensuring compliance with SASO standards often entails rigorous certification processes, which can be time-consuming and costly for businesses operating in the aftermarket segment. Additionally, import regulations and customs duties further add to the complexity and cost of sourcing and distributing spare parts in the Saudi market. Consequently, these regulatory burdens may impede the entry of new players into the aftermarket sector and limit the availability of competitively priced spare parts, thereby hindering market growth and innovation.

- High Raw Material Price Fluctuations

The aftermarket spare parts market in Saudi Arabia faces a formidable restraint with the persistent fluctuations in raw material prices. These fluctuations ripple across the entire supply chain, affecting manufacturers, distributors, and ultimately, end consumers. Manufacturers, particularly small and medium-sized enterprises (SMEs), withstand the worst of these price swings, grappling with the unnerving task of managing operational costs within uncertainty. Forging partnerships with raw material suppliers becomes increasingly complex as negotiating stable pricing contracts becomes an elusive endeavour in the face of volatile markets.

Recent Developments

- In June 2023, According to an article published by Cotecna Inspection SA, Cotecna Worldwide announced a significant development concerning regulatory compliance in Saudi Arabia. The Saudi Standards, Metrology and Quality Organization (SASO) has approved amendments to the technical regulations and standard specifications for auto spare parts, reflecting their commitment to upholding product quality and safety standards in the Kingdom

- In June 2023, According to an article published by BRIDGESTONE MIDDLE EAST AND AFRICA, the scorching summers in the GCC region, with temperatures often exceeding 50°C, pose significant challenges for car tyres, making it crucial for vehicle owners to take preventive measures. As temperatures rise, tyre pressure increases due to the expansion of air molecules inside the tyres, leading to over-inflation and potential blowouts. Friction generated while driving further elevates tyre temperatures

- In June 2022, According to an article published by Industrial Centre of Saudi Arabia, the Automotive Cluster is dedicated to advancing the automotive industry in Saudi Arabia in line with the National Industry Strategy. Their goal is to have 3-4 OEMs producing over 400,000 passenger vehicles domestically by 2030, with a target of achieving a local gross value add (LGVA) of 40%. They aim to position Saudi Arabia as an export hub for high-value-added automotive products globally

- In February 2024, new east General Trading and Isuzu Motors forged partnership, culminating in the establishment of dealership in KSA, marking a significant milestone in automotive excellence. Positioned strategically in the heart of KSA, the dealership, spanning 8,060 square meters, epitomized the partners' commitment to innovation and service excellence, setting new industry standards

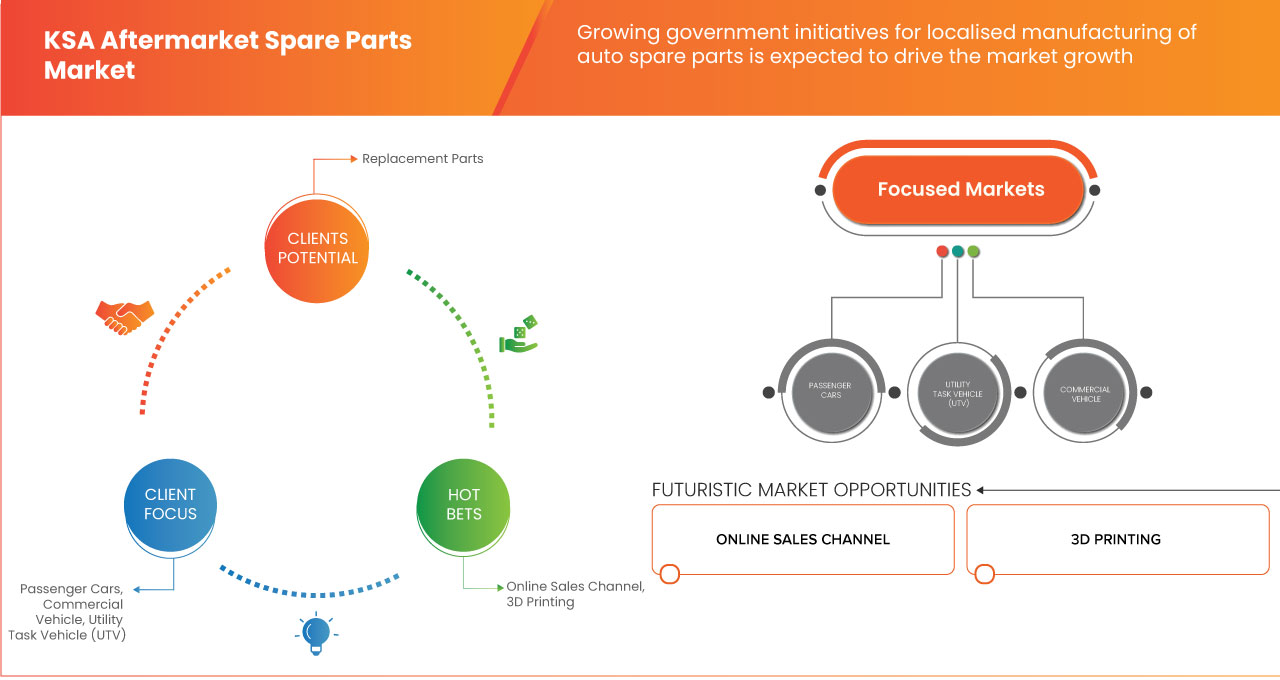

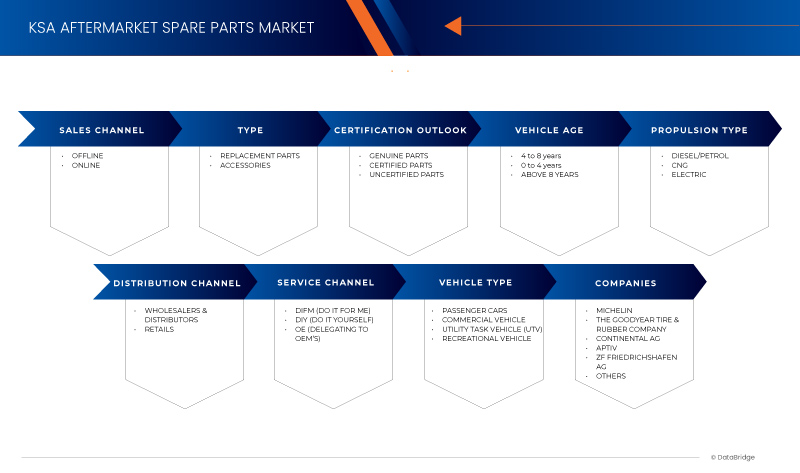

KSA Aftermarket Spare Parts Market Scope

KSA aftermarket spare parts market is segmented into eight notable segments based on type, distribution channel, certification outlook, propulsion type, service channel, vehicle age, vehicle type, and sales channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Type

- Replacement Parts

- Accessories

On the basis of type, the market is segmented into replacement parts and accessories.

Distribution Channel

- Wholesalers & Distributors

- Retails

On the basis of distribution channel, the market is segmented into wholesalers & distributors and retails.

Certification Outlook

- Genuine Parts

- Certified Parts

- Uncertified Parts

On the basis of certification outlook, the market is segmented into genuine parts, certified parts, and uncertified parts.

Service Channel

- DIFM (Do It for Me)

- DIY (Do it Yourself)

- OE (Delegating to OEM’S)

On the basis of service channel, the market is segmented into DIFM (Do it for Me), DIY (Do it yourself), and OE (delegating to OEM’S).

Vehicle Age

- 4 to 8 Years

- 0 to 4 Years

- Above 8 Years

On the basis of vehicle age, the market is segmented into 4 to 8 years, 0 to 4 years, and above 8 years.

Vehicle Type

- Passenger Cars

- Commercial Vehicle

- Utility Task Vehicle (UTV)

- Recreational Vehicle

On the basis of vehicle type, the market is segmented into passenger cars, commercial vehicle, Utility Task Vehicle (UTV), and recreational vehicle.

Sales Channel

- Offline

- Online

On the basis of sales channel, the market is segmented into online and offline.

Propulsion Type

- Diesel/Petrol

- CNG

- Electric

On the basis of propulsion type, the market is segmented into diesel/petrol, CNG, and electric.

Competitive Landscape and KSA Aftermarket Spare Parts Market Share Analysis

KSA aftermarket spare parts market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global industrial automation market.

Some of the major players operating in the KSA aftermarket spare parts market are Michelin, The Goodyear Tire & Rubber Company, Continental AG, Aptiv, ZF Friedrichshafen AG, Robert Bosch GmbH, Knorr-Bremse AG, Yokohama Tire Corporation, Tenneco Inc, and DENSO CORPORATION among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF KSA AFTERMARKET SPARE PARTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 TYPE TIMELINE CURVE

2.9 VEHICLE TYPE COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY STANDARDS

4.3 TECHNOLOGICAL TRENDS

4.4 TOP 50 SPARE PARTS PRICES

4.5 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

4.6 MARKET SIZE TOP 5 BRANDS IN KSA

4.7 TOP EXPORTING COUNTRIES TO KSA

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR AUTOMOBILE

5.1.2 SURGING PREFERENCE FOR ONLINE PURCHASES OF AUTO SPARE PARTS

5.1.3 EXTREME WEATHER CONDITIONS IN SAUDI ARABIA

5.1.4 GROWING GOVERNMENT INITIATIVES FOR LOCALISED MANUFACTURING OF AUTO SPARE PARTS

5.2 RESTRAINTS

5.2.1 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

5.2.2 HIGH RAW MATERIAL PRICE FLUCTUATIONS

5.3 OPPORTUNITIES

5.3.1 COLLABORATION AND PARTNERSHIPS AMONG MARKET PLAYERS

5.3.2 INNOVATIVE DISTRIBUTION MODELS

5.3.3 TECHNOLOGICAL ADVANCEMENTS RELATED TO AUTO SPARE PARTS

5.4 CHALLENGES

5.4.1 HIGH PRODUCT VARIABILITY

5.5 PREVALENCE OF COUNTERFEIT SPARE PARTS

6 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE

6.1 OVERVIEW

6.2 REPLACEMENT PART

6.2.1 TIRE AND WHEELS

6.2.2 BATTERY

6.2.3 ENGINE AND TRANSMISSION PART

6.2.4 BRAKES AND BRAKE PARTS

6.2.5 BODY PARTS

6.2.6 ELECTRONIC COMPONENTS

6.2.6.1 LIGHTS

6.2.6.2 ALTERNATORS

6.2.6.3 STARTERS

6.2.6.4 SENSOR

6.2.7 COOLING SYSTEMS

6.2.7.1 WATER PUMPS

6.2.7.2 RADIATORS

6.2.7.3 INTERCOOLER

6.2.7.4 OTHERS

6.2.8 BELTS AND HOSES

6.2.9 FUEL INTAKE AND IGNITION PARTS

6.2.9.1 FUEL PUMP

6.2.9.2 FUEL INJECTOR

6.2.9.3 SPARK PLUG

6.2.9.4 FUEL FILTER

6.2.9.5 OTHERS

6.2.10 EXHAUST COMPONENTS

6.2.10.1 MUFFLERS

6.2.10.2 PIPES

6.2.11 IGNITION COILS AND DISTRIBUTORS

6.2.12 A/C PARTS

6.2.13 OTHERS

6.3 ACCESSORIES

6.3.1 CAR EXTERIORS

6.3.2 CAR INTERIORS

7 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE

7.1 OVERVIEW

7.2 DIESEL/PETROL

7.3 CNG

7.4 ELECTRIC

8 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL

8.1 OVERVIEW

8.2 DIFM (DO IT FOR ME)

8.2.1 AUTO PARTS STORES

8.2.2 DISCOUNT DEPARTMENT STORES

8.3 DIY (DO IT YOURSELF)

8.4 OE (DELEGATING TO OEM’S)

9 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 WHOLESALERS & DISTRIBUTORS

9.3 RETAILS

9.3.1 OEM

9.3.2 REPAIR SHOPS

10 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK

10.1 OVERVIEW

10.2 GENUINE PARTS

10.3 CERTIFIED PARTS

10.4 UNCERTIFIED PARTS

11 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE

11.1 OVERVIEW

11.2 4 TO 8 YEARS

11.3 0 TO 4 YEARS

11.4 ABOVE 8 YEARS

12 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL

12.1 OVERVIEW

12.2 OFFLINE

12.3 ONLINE

12.4 E-COMMERCE

12.5 COMPANY WEBSITE

13 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE

13.1 OVERVIEW

13.2 PASSENGER CARS

13.2.1 SUV

13.2.2 SEDAN

13.2.3 HATCHBACK

13.2.4 CROSSOVER

13.2.5 COUPE

13.2.6 CONVERTIBLE

13.2.7 OTHERS

13.3 COMMERCIAL VEHICLE

13.3.1 LIGHT COMMERCIAL VEHICLE

13.3.1.1 PICK UP TRUCKS

13.3.1.2 VANS

13.3.1.3 MINI BUS

13.3.1.4 OTHERS

13.3.2 MEDIUM COMMERCIAL VEHICLE

13.3.3 HEAVY COMMERCIAL VEHICLE

13.3.3.1 TRUCK

13.3.3.1.1 TANKER TRUCKS

13.3.3.1.2 DUMP TRUCK

13.3.3.1.3 CEMENT TRUCK

13.3.3.1.4 REFRIGERATED TRUCKS

13.3.3.1.5 TOW TRUCK

13.3.3.1.6 FIRE TRUCK

13.3.3.2 BUSES

13.3.3.3 OTHERS

13.4 UTILITY TASK VEHICLE (UTV)

13.4.1 SPORTS UTVS

13.4.2 LOAD CARRIER UTVS

13.4.3 MULTIPURPOSE UTVS

13.5 RECREATIONAL VEHICLE

14 KSA FREIGHT FORWARDING MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: KSA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 MICHELIN

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 THE GOODYEAR TIRE & RUBBER COMPANY

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 CONTINENTAL AG

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 APTIV PLC

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 ZF FRIEDRICHSHAFEN AG

16.5.1 COMPANY SNAPSHOT

16.5.2 PRODUCT PORTFOLIO

16.5.3 RECENT DEVELOPMENTS

16.6 DENSO CORPORATION

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 KNORR-BREMSE AG

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 ROBERT BOSCH GMBH

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 TENNECO INC.

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 YOKOHAMA TIRE CORPORATION

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

List of Table

TABLE 1 REGULATORY STANDARDS FOR KSA AFTERMARKET SPARE PARTS MARKET

TABLE 2 TOP 50 SPARE PARTS PRICES

TABLE 3 MOST SELLING SPARE PARTS FOR TOP 15 BRANDS IN KSA

TABLE 4 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 5 KSA AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 6 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 7 KSA REPLACEMENT PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 8 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 9 KSA ELECTRONIC COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 10 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 11 KSA COOLING SYSTEMS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 12 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 13 KSA FUEL INTAKE AND IGNITION PARTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 14 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 15 KSA EXHAUST COMPONENTS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 16 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 17 KSA ACCESSORIES IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (THOUSAND UNITS)

TABLE 18 KSA AFTERMARKET SPARE PARTS MARKET, BY PROPULSION TYPE, 2018-2029 (USD MILLION)

TABLE 19 KSA AFTERMARKET SPARE PARTS MARKET, BY SERVICE CHANNEL, 2018-2029 (USD MILLION)

TABLE 20 KSA DIFM (DO IT FOR ME) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 21 KSA AFTERMARKET SPARE PARTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2029 (USD MILLION)

TABLE 22 KSA RETAILS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 23 KSA AFTERMARKET SPARE PARTS MARKET, BY CERTIFICATION OUTLOOK, 2018-2029 (USD MILLION)

TABLE 24 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE AGE, 2018-2029 (USD MILLION)

TABLE 25 KSA AFTERMARKET SPARE PARTS MARKET, BY SALES CHANNEL, 2018-2029 (USD MILLION)

TABLE 26 KSA ONLINE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 27 KSA AFTERMARKET SPARE PARTS MARKET, BY VEHICLE TYPE, 2018-2029 (USD MILLION)

TABLE 28 KSA PASSENGER CARS IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 29 KSA COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 30 KSA LIGHT COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 31 KSA HEAVY COMMERCIAL VEHICLE IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 32 KSA TRUCK IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

TABLE 33 KSA UTILITY TASK VEHICLE (UTV) IN AFTERMARKET SPARE PARTS MARKET, BY TYPE, 2018-2029 (USD MILLION)

List of Figure

FIGURE 1 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 2 KSA AFTERMARKET SPARE PARTS MARKET: DATA TRIANGULATION

FIGURE 3 KSA AFTERMARKET SPARE PARTS MARKET : DROC ANALYSIS

FIGURE 4 KSA AFTERMARKET SPARE PARTS MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 KSA AFTERMARKET SPARE PARTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 KSA AFTERMARKET SPARE PARTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 KSA AFTERMARKET SPARE PARTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 KSA AFTERMARKET SPARE PARTS MARKET: MULTIVARIATE MODELING

FIGURE 9 KSA AFTERMARKET SPARE PARTS MARKET: TYPE TIMELINE CURVE

FIGURE 10 KSA AFTERMARKET SPARE PARTS MARKET: VEHICLE TYPE COVERAGE GRID

FIGURE 11 KSA AFTERMARKET SPARE PARTS MARKET: SEGMENTATION

FIGURE 12 INCREASING DEMAND FOR AUTOMOBILE IS EXPECTED TO DRIVE THE MARKET GROWTH IN THE FORECAST PERIOD 2024-2029

FIGURE 13 REPLACEMENT PARTS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE KSA AFTERMARKET SPARE PARTS MARKET IN 2024 & 2029

FIGURE 14 PORTER FIVE FORCES ANALYSIS

FIGURE 15 MARKET SIZE TOP 5 BRANDS IN KSA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE KSA AFTERMARKET SPARE PART MARKET

FIGURE 17 VEHICLE SOLD IN 2022, 2023, AND 2032 (FORECASTED) IN THOUSAND UNITS

FIGURE 18 FACTORS INFLUENCING THE AUTOMOBILE DEMAND IN KSA

FIGURE 19 HIGH TEMPERATURE AFFECTS AUTO SPARE PARTS

FIGURE 20 VARIOUS GOVERNMENT INITIATIVES FOR AUTO SPARE PARTS

FIGURE 21 REGULATORY COMPLIANCES RELATED TO AUTO SPARE PARTS

FIGURE 22 STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

FIGURE 23 INNOVATIONS IN WHOLESALE AUTO PARTS DISTROBUTION

FIGURE 24 TECHNOLOGICAL ADVANCEMENT IN AUTO SPARE PARTS

FIGURE 25 KSA AFTERMARKET SPARE PARTS MARKET: BY TYPE, 2023

FIGURE 26 KSA AFTERMARKET SPARE PARTS MARKET: BY PROPULSION TYPE, 2023

FIGURE 27 KSA AFTERMARKET SPARE PARTS MARKET: BY SERVICE CHANNEL, 2023

FIGURE 28 KSA AFTERMARKET SPARE PARTS MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 29 KSA AFTERMARKET SPARE PARTS MARKET: BY CERTIFICATION OUTLOOK, 2023

FIGURE 30 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE AGE, 2023

FIGURE 31 KSA AFTERMARKET SPARE PARTS MARKET: BY SALES CHANNEL, 2023

FIGURE 32 KSA AFTERMARKET SPARE PARTS MARKET: BY VEHICLE TYPE, 2023

FIGURE 33 KSA FREIGHT FORWARDING MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.