Mea Cosmetic Pigments And Dyes Market

Market Size in USD Billion

CAGR :

%

USD

0.62 Billion

USD

0.81 Billion

2024

2032

USD

0.62 Billion

USD

0.81 Billion

2024

2032

| 2025 –2032 | |

| USD 0.62 Billion | |

| USD 0.81 Billion | |

|

|

|

|

Cosmetic Pigments and Dyes Market Size

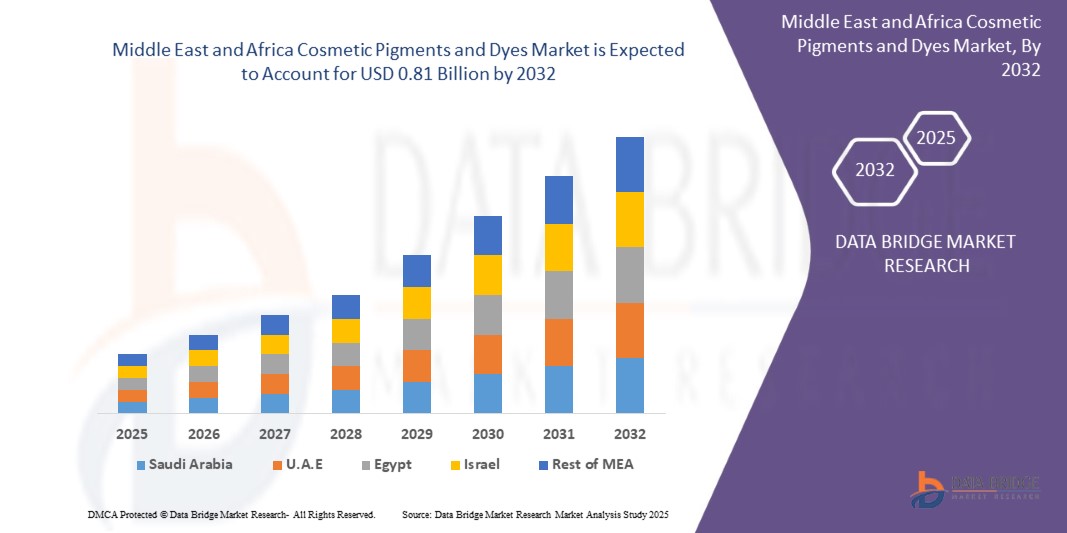

- The Middle East and Africa Cosmetic Pigments and Dyes market size was valued at USD 0.62 billion in 2024 and is projected to reach USD 0.81 billion by 2032, growing at a CAGR of 3.57% during the forecast period.

- This growth is primarily fueled by increasing consumer demand for innovative cosmetic products, the rising influence of social media and beauty influencers, and greater focus on self-care and aesthetic appeal post-pandemic. Additionally, urbanization, rising disposable incomes, and changing beauty standards across emerging markets are contributing to rapid market expansion

Cosmetic Pigments and Dyes Market Analysis

- Cosmetic pigments and dyes are the chemical additives that are added to the cosmetic products such as hair oil, lotions, lipsticks, nail enamels, soaps, and eye colors

- Rising modernization and globalization are the major factors fostering the growth of the market. Growing shift in consumer buying trends, rise in the research and development activities and surge in the usage of cosmetic dyes in toiletries, skin care, and hair care products across the globe are some other indirect market growth determinants

- Egypt dominates the Cosmetic Pigments and Dyes market, accounting for the largest regional share of approximately 31.8% in 2024, driven by the expanding personal care industry, growing consumer shift toward halal-certified and herbal cosmetics, and supportive government policies that promote local manufacturing and exports. The presence of regional manufacturing hubs and strong distribution networks enhances Egypt’s leadership in North Africa’s beauty segment

- The U.A.E is expected to witness the highest growth rate in the Cosmetic Pigments and Dyes market, projected to register a CAGR of 8.1% during the forecast period. This rapid growth is attributed to increasing consumer demand for luxury and organic beauty products, surging investment in beauty-tech and smart packaging, and the expansion of international cosmetic giants in cities like Dubai and Abu Dhabi, positioning the U.A.E as a premium cosmetics innovation and retail hub in the GCC region

- In 2025, the Inorganic Pigments segment is projected to dominate the Middle East and Africa Cosmetic Pigments and Dyes market with the largest share of 47.64% in the Elemental Composition segment. This dominance is driven by the widespread use of inorganic pigments like titanium dioxide, iron oxides, and zinc oxide, which offer superior color stability, opacity, and UV protection, making them ideal for use in a variety of cosmetic products

Report Scope and Cosmetic Pigments and Dyes Market Segmentation

|

Attributes |

Cosmetic Pigments and Dyes Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Cosmetic Pigments and Dyes Market Trends

“Increasing Demand for Sustainable and Eco-Friendly Pigments in the Cosmetic Industry”

- A prominent trend in the Middle East and Africa Cosmetic Pigments and Dyes market is the rising consumer and industry demand for sustainable, eco-friendly pigments. As consumers become more environmentally conscious, there is an increased preference for pigments that are derived from natural sources or produced using environmentally friendly methods, avoiding toxic chemicals and heavy metals

- Manufacturers are responding by focusing on sustainable sourcing, green chemistry, and biodegradable pigments, aligning with the growing demand for clean, green, and ethical beauty products

- For instance, in February 2025, Alhaddad Industrial Group in Saudi Arabia announced plans to expand its range of halal-certified cosmetic pigments, aiming to meet the rising demand for ethical and culturally appropriate beauty products in the region

- This trend not only promotes environmental responsibility but also opens up new market opportunities for brands to enhance their sustainability credentials, tapping into a growing segment of eco-conscious consumers while complying with stricter regulations around cosmetic ingredients and environmental impact

Cosmetic Pigments and Dyes Market Dynamics

Driver

“Growing Consumer Demand for Clean and Natural Beauty Products”

- A major driver in the Middle East and Africa Cosmetic Pigments and Dyes market is the increasing consumer demand for clean, natural, and non-toxic beauty products. Consumers are becoming more aware of the harmful effects of synthetic chemicals and artificial pigments in cosmetic products, leading to a shift toward natural alternatives

- This awareness is especially prominent among eco-conscious and health-focused consumers who prefer beauty products with transparent ingredient lists, free from harsh chemicals, parabens, and artificial dyes

- As a result, cosmetic brands are increasingly opting for natural, mineral-based pigments and dyes that are safe, sustainable, and effective, meeting the growing demand for non-toxic and ethically produced products

For instance,

- in April 2025, Chromaflo Technologies South Africa announced the expansion of its product line to include customizable pigment solutions, allowing brands to create tailored cosmetic products that resonate with local consumers.

- This trend not only drives growth in the market but also creates opportunities for innovation in product formulations, offering brands a chance to align with consumer preferences for safe, clean, and sustainable beauty products

Opportunity

“Rising Demand for Eco-Friendly and Sustainable Cosmetic Solutions”

- A key opportunity in the Cosmetic Pigments and Dyes market is the increasing consumer demand for eco-friendly, sustainable, and cruelty-free beauty products. As consumers become more environmentally conscious, there is a growing preference for products made with natural, renewable ingredients and those that minimize environmental impact, including biodegradable packaging and ethically sourced pigments

- This demand is influencing the beauty industry to shift towards plant-based, mineral, and organic cosmetic pigments that not only align with sustainability goals but also cater to health-conscious consumers seeking non-toxic options

For instance,

- In May 2025, BASF SE introduced a new line of biodegradable cosmetic pigments derived from renewable sources, designed to reduce the environmental footprint of beauty products while maintaining high color performance

- This trend presents an opportunity for manufacturers to innovate in creating eco-friendly and sustainable cosmetic offerings, which can lead to increased brand loyalty and market penetration as more consumers seek out environmentally responsible beauty solutions

Restraint/Challenge

“Regulatory Challenges and Consumer Skepticism Over Artificial Sweeteners”

- The Cosmetic Pigments and Dyes market faces a significant challenge due to regulatory scrutiny and consumer skepticism regarding the long-term health and environmental impacts of synthetic pigments and dyes. Regulatory agencies in various regions, such as the European Chemicals Agency (ECHA) and the U.S. Food and Drug Administration (FDA), continue to evaluate the safety of certain synthetic pigments, leading to increased regulations and bans in some markets

- Additionally, consumers are becoming more cautious about the potential adverse effects of synthetic chemicals in cosmetics, including allergies, skin irritation, and environmental damage, which can hinder the widespread adoption of products containing these pigments and dyes

For instance,

in March 2025, Egypt's regulatory authorities implemented stricter guidelines for cosmetic products, requiring comprehensive testing and certification processes to ensure product safety and efficacy.

- This challenge emphasizes the need for manufacturers to focus on natural, sustainable, and safe alternatives for cosmetic pigments and dyes to align with consumer preferences and regulatory requirements, thus maintaining market competitiveness and trust

Cosmetic Pigments and Dyes Market Scope

The market is segmented on the basis of elemental composition, type, technology and application

|

Segmentation |

Sub-Segmentation |

|

By Elemental Composition |

|

|

By type |

|

|

By Technology |

|

|

By Application |

|

In 2025, the Inorganic Pigments segment is projected to dominate the market with a largest share in Elemental Composition segment

In 2025, the Inorganic Pigments segment is projected to dominate the Elemental Composition segment of the Middle East and Africa Cosmetic Pigments and Dyes market with the largest share of 45.6%. This dominance is driven by the increasing demand for highly stable and skin-safe pigments, such as titanium dioxide and iron oxide, which are favored for their opacity, UV protection, and long-lasting effects in cosmetic products. These pigments are extensively used in facial makeup (foundations, concealers) and eye makeup due to their reliable performance and safe application

The Facial Makeup is expected to account for the largest share during the forecast period in Application market

In 2025, the Facial Makeup segment is projected to dominate the Middle East and Africa Cosmetic Pigments and Dyes market in the Application segment with the largest share of 42.3%. This growth is fueled by the rising demand for innovative, skin-safe formulations in makeup products like foundations, blushes, and highlighters. The increasing focus on personal grooming, inclusive shade ranges, and natural, long-lasting makeup solutions is expected to drive the segment's dominance and significant market growth during the forecast period

Cosmetic Pigments and Dyes Market Regional Analysis

“Egypt Holds the Largest Share in the Cosmetic Pigments and Dyes Market”

- Egypt is projected to dominate the Middle East and Africa Cosmetic Pigments and Dyes market in 2025, holding the largest regional share of 31.8%. This dominance is driven by the country's established cosmetics industry, a rapidly growing consumer base, and increasing demand for high-quality and sustainable beauty products

- Key factors contributing to Egypt's leadership in the market include the availability of local manufacturing capabilities, a mature consumer base that prioritizes quality and safety, and a high rate of adoption of clean beauty trends, such as natural, organic, and mineral-based pigments

- Egypt's major urban centers, such as Cairo and Alexandria, are also seeing a surge in cosmetic consumption, particularly in the premium and luxury segments, which is further fueling demand for innovative and eco-friendly cosmetic pigments and dyes

- Additionally, the shift toward sustainable and cruelty-free products, along with consumer awareness regarding animal testing and environmental impacts, is boosting the adoption of vegan-certified pigments and dyes, which are becoming increasingly popular in Egypt’s growing beauty market

“U.A.E is Projected to Register the Highest CAGR in the Cosmetic Pigments and Dyes Market”

- The U.A.E. is expected to witness the highest growth rate in the Middle East and Africa Cosmetic Pigments and Dyes market, with a projected CAGR of 8.1%. This growth is largely driven by a rising demand for premium beauty products, an increasingly affluent consumer base, and the widespread popularity of international beauty trends in the region

- The U.A.E. is emerging as a major beauty hub in the region, with an increasing interest in K-beauty and J-beauty innovations, which are influencing local product formulations and spurring demand for multifunctional, long-lasting cosmetic products

- Dubai and Abu Dhabi, as regional beauty and fashion capitals, play a significant role in driving demand for advanced pigments and dyes, as both local brands and international beauty giants invest heavily in the region to cater to the diverse needs of consumers

- With growing awareness of environmental sustainability and personal well-being, consumers in the U.A.E. are also increasingly seeking out organic, vegan, and cruelty-free pigments, which is pushing local brands to invest in cleaner and safer alternatives in their product lines

Cosmetic Pigments and Dyes Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- LANXESS (Germany)

- BASF SE (Germany)

- Clariant (Switzerland)

- Dayglo Color Corp (U.S.)

- ECKART GmbH (Germany)

- Sun Chemical (U.S.)

- Sandream Specialties (U.S.)

- Rakuten Kobo Inc. (Japan)

- LI PIGMENTS (U.S.)

- Merck KGaA (Germany)

- Miyoshi Kasei, Inc. (Japan)

- Toyal Europe (France)

Latest Developments in Middle East and Africa Cosmetic Pigments and Dyes Market

- In March 2024, Nykaa, a prominent Indian beauty retailer, debuted its first beauty retail outlet, Nysaa, in Dubai. This significant move was made possible through a strategic partnership with the renowned Apparel Group, a leading Gulf Cooperation Council (GCC) retail giant. Nykaa has ambitious plans, eyeing 70 stores in the GCC over the next five years, with a target of securing a 7% share in the GCC's prestigious beauty market

- In July 2024, Henkel inaugurated a state-of-the-art beauty care production facility in Riyadh, Saudi Arabia. This facility manufactures a diverse array of products under the Pert brand, such as shampoos and conditioners, catering to the rising demand for premium personal care products in the Middle East.

- In September 2024, the Middle East and Africa (MEA) regions emerged as hotspots for local beauty and personal care product innovation. Brands in these regions are focusing on catering to the specific needs of local consumers by leveraging local ingredients, traditions, and climate conditions. Notable innovations include Asteri Beauty's 45 Degree Blush, designed for the Saudi Arabian climate, and UAE-based Peacefull's South Korean skincare range tailored for the Middle East.

- In March 2024, Nykaa, a prominent Indian beauty retailer, debuted its first beauty retail outlet, Nysaa, in Dubai. This significant move was made possible through a strategic partnership with the renowned Apparel Group, a leading Gulf Cooperation Council (GCC) retail giant. Nykaa has ambitious plans, eyeing 70 stores in the GCC over the next five years, with a target of securing a 7% share in the GCC's prestigious beauty market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.