Mexico Homeopathy Products Market

Market Size in USD Million

CAGR :

%

USD

162.29 Million

USD

400.53 Million

2024

2032

USD

162.29 Million

USD

400.53 Million

2024

2032

| 2025 –2032 | |

| USD 162.29 Million | |

| USD 400.53 Million | |

|

|

|

|

Homeopathy Products Market Size

- Mexico homeopathy products market was valued at USD 162.29 million in 2024 and is expected to reach USD 400.53 million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 12.0%, primarily driven by the increasing consumer awareness of natural health solutions

- This growth is driven by factors such as rising prevalence of chronic diseases. Additionally, affordability drives growing adoption of homeopathic remedies as a healthcare solution

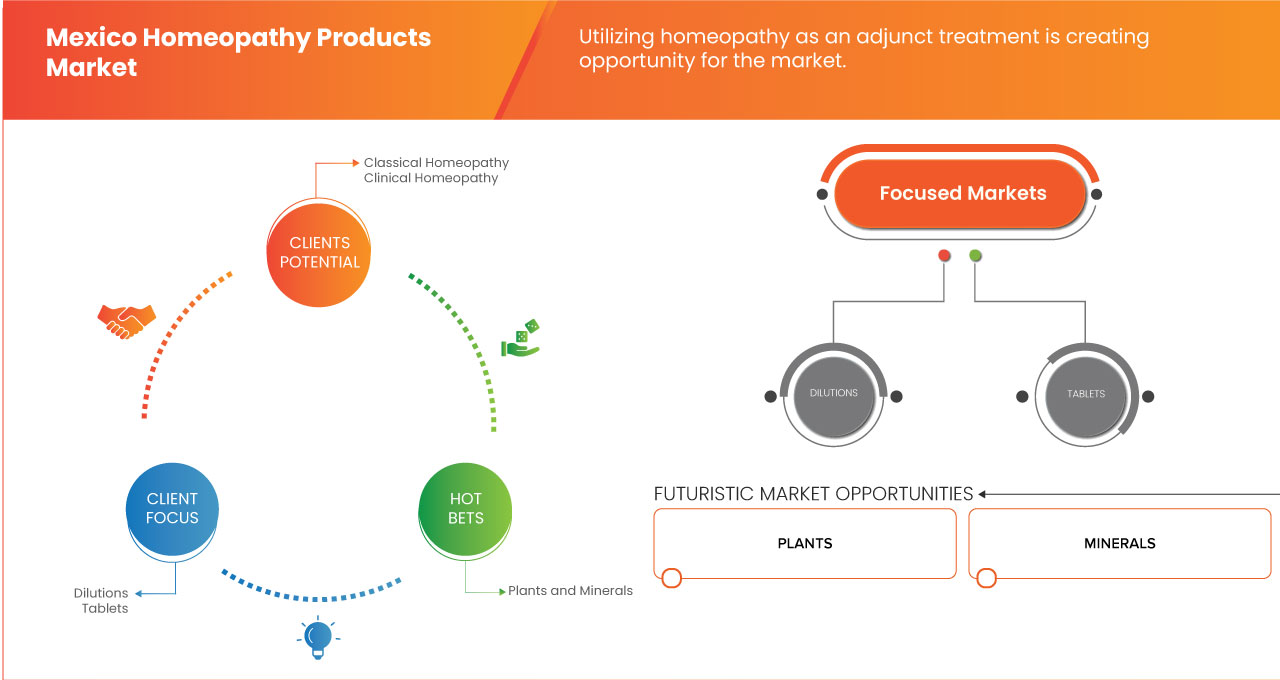

Homeopathy Products Market Analysis

- The homeopathy products market in Mexico is experiencing steady growth due to increasing consumer preference for natural and alternative medicine. Many individuals seek homeopathic remedies for chronic conditions, minor ailments, and overall wellness, driving demand for products from both local and international manufacturers. The growing awareness of holistic health approaches further fuels this trend.

- However, regulatory challenges present hurdles for market players. Homeopathic products in Mexico must comply with pharmaceutical regulations, requiring strict labeling, safety assessments, and approvals. This can create barriers to entry, particularly for foreign brands, delaying product launches and increasing compliance costs. Despite acceptance among consumers, regulatory scrutiny remains a key challenge.

- For instance, in 2022, Schwabe México, a subsidiary of Dr. Willmar Schwabe GmbH & Co. KG, faced delays in launching a new line of homeopathic remedies due to evolving regulatory requirements. The company had to revise its packaging and documentation to meet Mexico’s pharmaceutical compliance standards, resulting in postponed market entry and additional costs.

Report Scope and Homeopathy Products Market Segmentation

|

Attributes |

Homeopathy Products Key Market Insights |

|

Segments Covered |

|

|

Country Covered |

Mexico |

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Homeopathy Products Market Trends

“Increased Adoption of Digitalized Homeopathy Solutions”

- One prominent trend in the Mexico homeopathy products market is the growing adoption of digitalized homeopathy solutions

- These advanced platforms enhance treatment management by offering real-time tracking of symptoms, personalized remedy recommendations, and automated dosage adjustments, improving precision and overall health outcomes

- For instance, AI-driven homeopathy apps integrated with patient health data analyze symptoms and suggest tailored remedies, reducing the need for manual tracking and ensuring optimal treatment effectiveness.

- Digital platforms also facilitate seamless data sharing, enabling patients and practitioners to monitor progress, refine treatments, and prevent complications

- This trend is transforming homeopathic care, improving patient compliance and outcomes, and driving the demand for innovative homeopathy solutions in the market

Homeopathy Products Market Dynamics

Driver

“Increasing Consumer Awareness of Natural Health Solutions”

- With an increasing number of consumers seeking alternatives to conventional pharmaceutical treatments, the demand for homeopathic remedies has risen

- This shift is driven by rising healthcare costs, concerns about the side effects of pharmaceutical drugs, and a broader cultural interest in holistic wellness

- As consumers become more educated about the benefits of natural treatments, including homeopathic medicines, they are increasingly opting for solutions that are perceived as safer and more sustainable for long-term health management

- In addition, the internet and social media play a key role in raising awareness and providing easier access to information about the benefits and availability of homeopathy products

For instance,

- In January 2024, as per the article published by Universidad Autónoma de Baja California (UABC), The article discusses the integration of traditional medicine, including homeopathy, into the Mexican healthcare system. It highlights the cultural relevance and growing acceptance of alternative therapies in Mexico, driven by consumer demand for holistic, accessible treatments, despite ongoing debates over their scientific validation and effectiveness in mainstream medicine.

- The market is benefiting from an uptick in consumer awareness regarding natural health alternatives. This trend, combined with the rising costs of traditional healthcare, is leading to greater adoption of homeopathic remedies. However, challenges such as scientific scepticism and regulatory issues still exist. If these barriers are addressed through education and improved standardization, the homeopathy market in Mexico could experience significant growth, driven by an increasingly health-conscious and informed consumer base seeking safer, affordable alternatives to traditional medical treatments.

Opportunity

“Advocacy by Government for Homeopathy”

- In Mexico, increased recognition and regulation of homeopathic practices by the government lead to a more structured environment for practitioners and manufacturers, fostering greater consumer trust

- As awareness of homeopathy grows, more individuals are seeking alternative therapies for health and wellness, which drives demand for homeopathic remedies

- Educational initiatives can help disseminate information about the benefits and uses of these products, contributing to a broader acceptance among the general population

For instance,

- In March 2024, according to an article published by the Homeopathic Wellness Clinic, in Mexico, the government supports homeopathic medicine and has University level degree programs in homeopathic medicine. This educational framework enhances the credibility of homeopathy as a legitimate medical practice and contributes to the advancement of research and development, ensuring that homeopathic treatments are both safe and effective for the population

- In February 2022, according to an article published by the Prensa Latina, the National Polytechnic Institute (IPN) and the National Autonomous University of Mexico (UNAM) supported the use of homeopathic medicine as an individualized treatment against Covid-19.

- Government initiatives that promote research and development within the homeopathy sector can enhance product quality and innovation. By providing funding and resources, the government can support local production and distribution, making homeopathic products more accessible to consumers. This approach positions Mexico to benefit both locally and globally, tapping into the rising interest in holistic and natural health solutions while potentially opening avenues for export to international markets.

Restraint/Challenge

“Lack of Scientific Evidence”

- Unlike conventional medicine, which is based on rigorous clinical trials and empirical data, homeopathy often lacks consistent scientific validation. Many studies that support homeopathy face criticism for methodological flaws, such as small sample sizes and insufficient controls. In addition, the lack of standardization in formulations means that different practitioners may prescribe varying dosages or substances, leading to inconsistencies in outcomes. This absence of scientific rigor and standardized practices undermines the credibility of homeopathy as a legitimate healthcare solution.

For instance,

- In June 2021, according to the article published by AME Publishing Company., the article reviews homeopathy's historical use and ongoing debates regarding its efficacy. In Mexico, the growing interest in homeopathy as an alternative treatment reflects a broader trend of seeking natural remedies. However, without strong clinical evidence, its widespread acceptance faces challenges, influencing both consumer trust and regulatory scrutiny

- In July 2023 an article by NCBI highlighted the scientific evidence surrounding homeopathy, particularly its use in treating chronic diseases and conditions. It discusses the challenges of proving homeopathic efficacy through conventional clinical trials, addressing both positive findings and skepticism. The review calls for more high-quality, large-scale studies to better assess homeopathy’s potential as a legitimate treatment option

- In May 2024, NCBI reported that the article reinforces that high-level scientific evidence supports the cost-effectiveness of homeopathy. This finding emphasizes the need for further research and standardization, offering a foundation to address concerns about the scientific evidence and consistency in homeopathic practices.

- The lack of scientific evidence and standardization remains a significant barrier to the broader adoption of homeopathic remedies. Without robust research and standardized practices, homeopathy continues to face scepticism within the medical community and challenges in gaining widespread acceptance. To overcome this, more rigorous, large-scale studies and clear regulatory frameworks are needed to ensure that homeopathic treatments are both safe and effective.

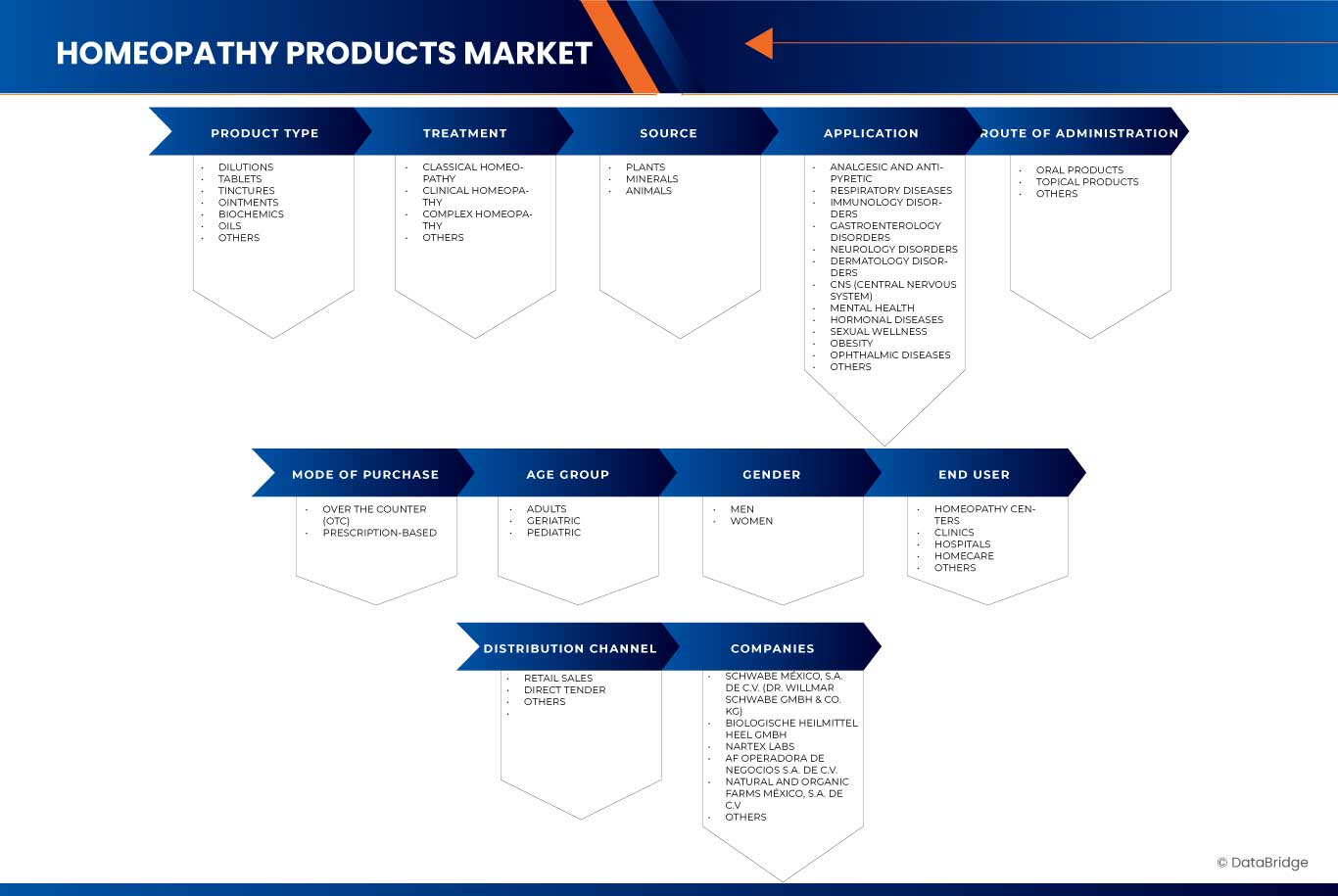

Homeopathy Products Market Scope

The market is segmented on the basis of type, treatment, source, application, route of administration, mode of purchase, age group, gender, end user, and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Treatment |

|

|

By Source |

|

|

By Application |

|

|

By Route of Administration |

|

|

By Mode of Purchase |

|

|

By Age Group

|

|

|

By Gender |

|

|

By End User |

|

|

By Distribution Channel |

|

Homeopathy Products Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, country presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Schwabe México, S.A. de C.V. (Dr. Willmar Schwabe GmbH & Co. KG) (Germany)

- Biologische Heilmittel Heel GmbH (Germany)

- NARTEX Labs (Mexico)

- AF Operadora de Negocios S.A. de C.V. (Mexico)

- Natural and Organic Farms México, S.A. de C.V. (Mexico)

- Similia (Mexico)

- Sinergia Farmacéutica SAPI de CV (Biofarma Natural CMD SA de CV) (Mexico)

- Häsler Homeopathic Laboratories (Mexico)

- Botanic Healthcare (India)

Latest Developments in Mexico Homeopathy Products Market

- In March 2025, Schwabe Group acquired a majority stake in Braineffect, strengthening its position in the functional food and supplement market. CEO Olaf Schwabe highlights the brand’s innovation and alignment with Schwabe’s mission for healthier living. Founder Fabian Foelsch remains onboard. This strategic move aims to redefine health in the digital age, expanding Schwabe’s reach and impact

- In April 2024, a clinical trial confirms the efficacy of Silexan, a proprietary lavender oil preparation, in treating mild to moderate depression. In an 8-week study with 498 patients, Silexan showed significant antidepressant effects, comparable to sertraline. These results highlight its potential as a natural treatment option

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MEXICO HOMEOPATHY PRODUCTS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 DBMR TRIPOD DATA VALIDATION MODEL

2.4 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.5 MEXICO HOMEOPATHY PRODUCTS MARKET: MULTIVARIATE MODELLING

2.6 DBMR MARKET POSITION GRID

2.7 MARKET END USER COVERAGE GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 CUSTOMER BEHAVIOR ANALYSIS: MEXICO HOMEOPATHY PRODUCTS MARKET

4.4 EPIDEMIOLOGY: MEXICO HOMEOPATHY PRODUCTS MARKET

4.5 HOMEOPATHY ADOPTION IN MEXICO

4.6 DRUG TREATMENT RATE BY MATURED MARKETS: MEXICO HOMEOPATHY PRODUCTS MARKET

4.7 KEY PRICING STRATEGIES: MEXICO HOMEOPATHY PRODUCTS MARKET

4.8 TOP 10 BEST-SELLING HOMEOPATHY PRODUCTS IN THE MEXICO MARKET

5 MEXICO HOMEOPATHY PRODUCTS MARKET, REGULATORY FRAMEWORK

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING CONSUMER AWARENESS OF NATURAL HEALTH SOLUTIONS

6.1.2 RISING PREVALENCE OF CHRONIC DISEASES

6.1.3 AFFORDABILITY DRIVES GROWING ADOPTION OF HOMEOPATHIC REMEDIES AS A HEALTHCARE SOLUTION

6.2 RESTRAINTS

6.2.1 LACK OF SCIENTIFIC EVIDENCE

6.2.2 INEFFECTIVENESS IN TREATING LIFE-THREATENING INFECTIONS

6.3 OPPORTUNITIES

6.3.1 ADVOCACY BY GOVERNMENT FOR HOMEOPATHY

6.3.2 AVAILABILITY OF HOMEOPATHY MEDICINES IN E-COMMERCE

6.3.3 UTILIZING HOMEOPATHY AS AN ADJUNCT TREATMENT

6.4 CHALLENGES

6.4.1 DELAYED THERAPEUTIC RESPONSE OF HOMEOPATHIC MEDICINES

6.4.2 REGULATORY AND LEGAL ISSUES

7 MEXICO HOMEOPATHY PRODUCTS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 DILUTIONS

7.2.1 BY POTENCY

7.2.1.1 HIGH POTENCY

7.2.1.1.1 50M

7.2.1.1.2 CM (CENTESIMAL)

7.2.1.2 MEDIUM POTENCY

7.2.1.2.1 10M

7.2.1.2.2 1M

7.2.1.2.3 200C

7.2.1.2.4 30C

7.2.1.3 LOW POTENCY

7.2.1.3.1 LM (50 MILLESIMAL)

7.2.1.3.2 30X

7.2.1.3.3 12X

7.2.1.3.4 6X

7.2.2 BY SOURCE

7.2.2.1 PLANTS

7.2.2.1.1 HERBS

7.2.2.1.2 FLOWERS

7.2.2.1.3 TREES

7.2.2.2 MINERALS

7.2.2.2.1 NON-METALLIC MINERALS

7.2.2.2.1.1 CALCAREA CARBONICA (CALCIUM CARBONATE)

7.2.2.2.1.2 SILICEA (SILICA)

7.2.2.2.1.3 OTHERS

7.2.2.2.2 METALLIC MINERALS

7.2.2.2.2.1 AURUM METALLICUM (GOLD)

7.2.2.2.2.2 FERRUM METALLICUM (IRON)

7.2.2.2.2.3 OTHERS

7.2.2.3 ANIMALS

7.2.2.3.1 APIS MELLIFICA (HONEYBEE)

7.2.2.3.2 LACHESIS MUTA (BUSHMASTER SNAKE)

7.2.2.3.3 OTHERS

7.3 TABLETS

7.3.1 SUGAR-BASED TABLETS

7.3.2 PILLULES AND PELLETS

7.3.3 LACTOSE-FREE TABLETS

7.3.4 ORALLY DISINTEGRATING TABLETS (ODTS)

7.3.5 OTHERS

7.4 TINCTURE

7.4.1 BY PRODUCT TYPE

7.4.1.1 ARNICA

7.4.1.2 ECHINACEA

7.4.1.3 TURMERIC

7.4.1.4 ELDERBERRY

7.4.1.5 PROPOLIS

7.4.1.6 HYPERICUM PERFORATUM

7.4.1.7 ACONITUM

7.4.1.8 HEPAR SULPHURIS CALCAREUM

7.4.1.9 STAPHYSAGRIA

7.4.1.10 BENZOIN

7.4.1.11 IODINE

7.4.1.12 CANNABIS

7.4.1.13 OTHERS

7.4.2 BY TYPE,

7.4.2.1 ROOTS

7.4.2.2 LEAF

7.4.2.3 FLOWER

7.4.2.4 OTHERS

7.4.3 BY SOURCE

7.4.3.1 PLANTS

7.4.3.1.1 CANNABIS

7.4.3.1.2 CHAMOMILE

7.4.3.1.3 GINGKO

7.4.3.1.4 GINGER

7.4.3.1.5 VALERIAN

7.4.3.1.6 GARLIC

7.4.3.1.7 FEVERFEW

7.4.3.1.8 MILK THISTLE

7.4.3.1.9 GINSENG

7.4.3.1.10 SAW PALMETTO

7.4.3.1.11 OTHERS

7.4.3.2 MINERALS

7.4.3.3 ANIMALS

7.5 OINTMENTS

7.5.1 BY SIZE

7.5.1.1 30 GM

7.5.1.2 60 GM

7.5.1.3 25 GM

7.5.1.4 75 GM

7.5.1.5 OTHERS

7.5.2 BY USAGE

7.5.2.1 TOPICAL PAIN RELIEF

7.5.2.1.1 MUSCLE PAIN

7.5.2.1.2 ARTHRITIS

7.5.2.1.3 JOINT PAIN

7.5.2.1.4 PILES & FISSURES

7.5.2.1.5 INSECT BITES & HIVES

7.5.2.1.6 OTHERS

7.5.2.2 SKIN CONDITIONS

7.5.2.2.1 PSORIASIS

7.5.2.2.2 ECZEMA

7.5.2.2.3 ACNE

7.5.2.2.4 OTHERS

7.5.2.3 SCAR HEALING

7.5.2.4 BURN AND WOUND CARE

7.5.2.5 OTHERS

7.6 BIOCHEMICS

7.6.1 PLANTS

7.6.2 MINERALS

7.6.3 ANIMALS

7.7 OILS

7.7.1 ARNICA OIL

7.7.2 CALENDULA OIL

7.7.3 HYPERICUM OIL

7.7.4 RHUS TOXICODENDRON OIL

7.7.5 BELLADONNA OIL

7.7.6 LAVENDER OIL

7.7.7 CHAMOMILE OIL

7.7.8 MENTHOLATED OIL

7.7.9 EUCALYPTUS OIL

7.7.10 OTHERS

7.8 OTHERS

8 MEXICO HOMEOPATHY PRODUCTS MARKET, BY AGE GROUP

8.1 OVERVIEW

8.2 ADULTS

8.3 GERIATRIC

8.4 PEDIATRIC

9 MEXICO HOMEOPATHY PRODUCTS MARKET, BY GENDER

9.1 OVERVIEW

9.2 MEN

9.3 WOMEN

10 MEXICO HOMEOPATHY PRODUCTS MARKET, BY TREATMENT

10.1 OVERVIEW

10.2 CLASSICAL HOMEOPATHY

10.3 CLINICAL HOMEOPATHY

10.4 COMPLEX HOMEOPATHY

10.5 OTHERS

11 MEXICO HOMEOPATHY PRODUCTS MARKET, BY SOURCE

11.1 OVERVIEW

11.2 PLANTS

11.2.1 CANNABIS

11.2.2 CHAMOMILE

11.2.3 GINGKO

11.2.4 GINGER

11.2.5 VALERIAN

11.2.6 GARLIC

11.2.7 FEVERFEW

11.2.8 MILK THISTLE

11.2.9 GINSENG

11.2.10 SAW PALMETTO

11.2.11 OTHERS

11.3 MINERALS

11.3.1 NON-METALLIC MINERALS

11.3.1.1 CALCAREA CARBONICA (CALCIUM CARBONATE)

11.3.1.2 SILICEA(SILICA)

11.3.1.3 OTHERS

11.3.2 METALLIC MINERALS

11.3.2.1 AURUM METALLICUM(GOLD)

11.3.2.2 FERRUM METALLICUM(IRON)

11.3.2.3 OTHERS

11.4 ANIMALS

11.4.1 APIS MELLIFICA (HONEYBEE)

11.4.2 LACHESIS MUTA (BUSHMASTER SNAKE)

11.4.3 OTHERS

12 MEXICO HOMEOPATHY PRODUCTS MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 ANALGESIC AND ANTIPYRETIC

12.2.1 MUSCLES AND JOINT PAIN

12.2.2 SWELLING AND BRUISING

12.2.3 POST-SURGICAL PAIN

12.2.4 SPRAINS, STRAINS, AND MINOR TRAUMAS

12.2.5 OTHERS

12.3 RESPIRATORY DISEASES

12.3.1 UPPER RESPIRATORY TRACT INFECTIONS (URTIS)

12.3.2 ALLERGIC RHINITIS

12.3.3 ASTHMA

12.3.4 BRONCHITIS

12.3.5 SINUSITIS

12.3.6 COUGHS

12.3.7 OTHERS

12.4 IMMUNOLOGY DISORDERS

12.5 GASTROENTEROLOGY DISORDERS

12.5.1 DIGESTIVE DISCOMFORTS

12.5.2 DYSPEPSIA

12.5.3 BLOATING

12.5.4 CONSTIPATION

12.5.5 DIARRHEA

12.5.6 OTHERS

12.6 NEUROLOGY DISORDERS

12.6.1 MIGRAINES AND HEADACHES

12.6.2 NEUROPATHIC PAIN

12.6.3 RESTLESS LEG SYNDROME (RLS)

12.6.4 EPILEPSY

12.6.5 PARKINSON’S DISEASE

12.6.6 OTHERS

12.7 DERMATOLOGY DISORDERS

12.7.1 MINOR SKIN IRRITATIONS

12.7.2 INSECT BITES

12.7.3 MINOR SUNBURN

12.7.4 OTHERS

12.8 CNS (CENTRAL NERVOUS SYSTEM)

12.9 MENTAL HEALTH

12.9.1 ANXIETY

12.9.2 STRESS

12.9.3 INSOMNIA

12.9.4 DEPRESSION

12.9.5 OBSESSIVE-COMPULSIVE DISORDER (OCD)

12.9.6 ATTENTION DEFICIT HYPERACTIVITY DISORDER (ADHD)

12.9.7 OTHERS

12.1 HORMONAL DISEASES

12.10.1 PREMENSTRUAL SYNDROME

12.10.2 MENOPAUSAL VASOMOTOR SYMPTOMS

12.10.3 THYROID DISORDERS

12.10.4 OTHERS

12.11 SEXUAL WELLNESS

12.11.1 ERECTILE DYSFUNCTION (ED)

12.11.2 FEMALE SEXUAL DYSFUNCTION

12.11.3 3 INFERTILITY

12.11.4 OTHERS

12.12 OBESITY

12.13 OPHTHALMIC DISEASES

12.13.1 CONJUNCTIVITIS

12.13.2 DRY EYES

12.13.3 RED EYES

12.13.4 EYESTRAIN

12.13.5 UVEITIS

12.13.6 RETINAL DISORDERS

12.13.7 CORNEAL DISEASES

12.13.8 CROSS EYES (STRABISMUS)

12.13.9 NYSTAGMUS

12.13.10 OTHERS

12.14 OTHERS

13 MEXICO HOMEOPATHY PRODUCTS MARKET, BY MODE OF PURCHASE

13.1 OVERVIEW

13.2 OVER THE COUNTER (OTC)

13.3 PRESCRIPTION-BASED

14 MEXICO HOMEOPATHY PRODUCTS MARKET, BY ROUTE OF ADMINISTRATION

14.1 OVERVIEW

14.2 ORAL PRODUCTS

14.2.1 BY SOURCE

14.2.1.1 PLANTS

14.2.1.1.1 CANNABIS

14.2.1.1.2 CHAMOMILE

14.2.1.1.3 GINGKO

14.2.1.1.4 GINGER

14.2.1.1.5 VALERIAN

14.2.1.1.6 GARLIC

14.2.1.1.7 FEVERFEW

14.2.1.1.8 MILK THISTLE

14.2.1.1.9 GINSENG

14.2.1.1.10 SAW PALMETTO

14.2.1.1.11 OTHERS

14.2.1.2 MINERALS

14.2.1.2.1 NON-METALLIC MINERALS

14.2.1.2.1.1 CALCAREA CARBONICA (CALCIUM CARBONATE)

14.2.1.2.1.2 SILICEA(SILICA)

14.2.1.2.1.3 OTHERS

14.2.1.2.2 METALLIC MINERALS

14.2.1.2.2.1 AURUM METALLICUM (GOLD)

14.2.1.2.2.2 FERRUM METALLICUM (IRON)

14.2.1.2.2.3 OTHERS

14.2.1.3 ANIMALS

14.2.1.3.1 APIS MELLIFICA (HONEYBEE)

14.2.1.3.2 LACHESIS MUTA (BUSHMASTER SNAKE)

14.2.1.3.3 OTHERS

14.3 TOPICAL PRODUCTS

14.3.1 BY SOURCE

14.3.1.1 PLANTS

14.3.1.1.1 CANNABIS

14.3.1.1.2 CHAMOMILE

14.3.1.1.3 GINGKO

14.3.1.1.4 GINGER

14.3.1.1.5 VALERIAN

14.3.1.1.6 GARLIC

14.3.1.1.7 FEVERFEW

14.3.1.1.8 MILK THISTLE

14.3.1.1.9 GINSENG

14.3.1.1.10 SAW PALMETTO

14.3.1.1.11 OTHERS

14.3.1.2 MINERALS

14.3.1.2.1 NON-METALLIC MINERALS

14.3.1.2.1.1 CALCAREA CARBONICA (CALCIUM CARBONATE)

14.3.1.2.1.2 SILICEA (SILICA)

14.3.1.2.1.3 OTHERS

14.3.1.2.2 METALLIC MINERALS

14.3.1.2.2.1 AURUM METALLICUM (GOLD)

14.3.1.2.2.2 FERRUM METALLICUM (IRON)

14.3.1.2.2.3 OTHERS

14.3.1.3 ANIMALS

14.3.1.3.1 APIS MELLIFICA (HONEYBEE)

14.3.1.3.2 LACHESIS MUTA (BUSHMASTER SNAKE)

14.3.1.3.3 OTHERS

14.4 OTHERS

15 MEXICO HOMEOPATHY PRODUCTS MARKET, BY END USER

15.1 OVERVIEW

15.2 HOMEOPATHY CENTERS

15.3 CLINICS

15.4 HOSPITAL

15.4.1 PUBLIC HOSPITALS

15.4.2 PRIVATE HOSPITALS

15.5 HOMECARE

15.6 OTHERS

16 MEXICO HOMEOPATHY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 RETAIL SALES

16.2.1 RETAIL PHARMACY

16.2.2 ONLINE PHARMACY

16.2.3 HOSPITAL PHARMACY

16.3 DIRECT TENDER

16.4 OTHERS

17 MEXICO HOMEOPATHY PRODUCTS MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: MEXICO

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 SCHWABE MÉXICO, S.A. DE C.V. (DR. WILLMAR SCHWABE GMBH & CO. KG)

19.1.1 COMPANY SNAPSHOT

19.1.2 PRODUCT PORTFOLIO

19.1.3 RECENT DEVELOPMENTS

19.2 BIOLOGISCHE HEILMITTEL HEEL GMBH

19.2.1 COMPANY SNAPSHOT

19.2.2 PRODUCT PORTFOLIO

19.2.3 RECENT DEVELOPMENT

19.3 NARTEX LABS

19.3.1 COMPANY SNAPSHOT

19.3.2 PRODUCT PORTFOLIO

19.3.3 RECENT DEVELOPMENT

19.4 AF OPERADORA DE NEGOCIOS S.A. DE C.V.

19.4.1 COMPANY SNAPSHOT

19.4.2 PRODUCT PORTFOLIO

19.4.3 RECENT DEVELOPMENT

19.5 NATURAL AND ORGANIC FARMS MÉXICO, S.A. DE C.V.

19.5.1 COMPANY SNAPSHOT

19.5.2 PRODUCT PORTFOLIO

19.5.3 RECENT DEVELOPMENT

19.6 BOTANIC HEALTHCARE.

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT DEVELOPMENT

19.7 DR. RECKEWEG & CO. GMBH

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENT

19.8 HÄSLER HOMEOPATHIC LABORATORIES

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENT

19.9 SIMILIA

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 SINERGIA FARMACÉUTICA SAPI DE CV (BIOFARMA NATURAL CMD SA DE CV)

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

List of Table

TABLE 1 MEXICO HOMEOPATHY PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 MEXICO DILUTIONS IN HOMEOPATHY PRODUCTS MARKET, BY POTENCY, 2018-2032 (USD THOUSAND)

TABLE 3 MEXICO HIGH POTENCY IN HOMEOPATHY PRODUCTS MARKET, BY POTENCY, 2018-2032 (USD THOUSAND)

TABLE 4 MEXICO MEDIUM POTENCY IN HOMEOPATHY PRODUCTS MARKET, BY POTENCY, 2018-2032 (USD THOUSAND)

TABLE 5 MEXICO LOW POTENCY IN HOMEOPATHY PRODUCTS MARKET, BY POTENCY, 2018-2032 (USD THOUSAND)

TABLE 6 MEXICO DILUTIONS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 7 MEXICO PLANTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 8 MEXICO MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 9 MEXICO NON-METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 10 MEXICO METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 11 MEXICO ANIMALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 12 MEXICO TABLETS IN HOMEOPATHY PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 MEXICO TINCTURE IN HOMEOPATHY PRODUCTS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 MEXICO TINCTURE IN HOMEOPATHY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 MEXICO TINCTURE IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 16 MEXICO PLANTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 17 MEXICO OINTMENTS IN HOMEOPATHY PRODUCTS MARKET, BY SIZE, 2018-2032 (USD THOUSAND)

TABLE 18 MEXICO OINTMENTS IN HOMEOPATHY PRODUCTS MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 19 MEXICO TOPICAL PAIN RELIEF IN HOMEOPATHY PRODUCTS MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 20 MEXICO SKIN CONDITIONS IN HOMEOPATHY PRODUCTS MARKET, BY USAGE, 2018-2032 (USD THOUSAND)

TABLE 21 MEXICO BIOCHEMICS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 22 MEXICO OILS IN HOMEOPATHY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 23 MEXICO HOMEOPATHY PRODUCTS MARKET, BY AGE GROUP, 2018-2032 (USD THOUSAND)

TABLE 24 MEXICO HOMEOPATHY PRODUCTS MARKET, BY GENDER, 2018-2032 (USD THOUSAND)

TABLE 25 MEXICO HOMEOPATHY PRODUCTS MARKET, BY TREATMENT, 2018-2032 (USD THOUSAND)

TABLE 26 MEXICO HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 27 MEXICO PLANTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 28 MEXICO MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 29 MEXICO NON-METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 30 MEXICO METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 31 MEXICO ANIMALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 32 MEXICO HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 33 MEXICO ANALGESIC AND ANTIPYRETIC IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 34 MEXICO RESPIRATORY DISEASES IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 35 MEXICO GASTROENTEROLOGY DISORDERS IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 36 MEXICO NEUROLOGY DISORDERS IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 37 MEXICO DERMATOLOGY DISORDERS IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 38 MEXICO MENTAL HEALTH IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 39 MEXICO HORMONAL DISEASES IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 40 MEXICO SEXUAL WELLNESS IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 41 MEXICO OPHTHALMIC DISEASES IN HOMEOPATHY PRODUCTS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 42 MEXICO HOMEOPATHY PRODUCTS MARKET, BY MODE OF PURCHASE, 2018-2032 (USD THOUSAND)

TABLE 43 MEXICO HOMEOPATHY PRODUCTS MARKET, BY ROUTE OF ADMINISTRATION, 2018-2032 (USD THOUSAND)

TABLE 44 MEXICO ORAL PRODUCTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 45 MEXICO PLANTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 46 MEXICO MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 47 MEXICO NON-METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 48 MEXICO METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 49 MEXICO ANIMALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 50 MEXICO TOPICAL PRODUCTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 51 MEXICO PLANTS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 52 MEXICO MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 53 MEXICO NON-METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 54 MEXICO METALLIC MINERALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 55 MEXICO ANIMALS IN HOMEOPATHY PRODUCTS MARKET, BY SOURCE, 2018-2032 (USD THOUSAND)

TABLE 56 MEXICO HOMEOPATHY PRODUCTS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 57 MEXICO HOSPITAL IN HOMEOPATHY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 MEXICO HOMEOPATHY PRODUCTS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 59 MEXICO RETAIL SALES IN HOMEOPATHY PRODUCTS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MEXICO HOMEOPATHY PRODUCTS MARKET: SEGMENTATION

FIGURE 2 MEXICO HOMEOPATHY PRODUCTS MARKET: DATA TRIANGULATION

FIGURE 3 MEXICO HOMEOPATHY PRODUCTS MARKET: DROC ANALYSIS

FIGURE 4 MEXICO HOMEOPATHY PRODUCTS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 MEXICO HOMEOPATHY PRODUCTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MEXICO HOMEOPATHY PRODUCTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MEXICO HOMEOPATHY PRODUCTS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MEXICO HOMEOPATHY PRODUCTS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 MEXICO HOMEOPATHY PRODUCTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MEXICO HOMEOPATHY PRODUCTS MARKET: SEGMENTATION

FIGURE 11 MEXICO HOMEOPATHY PRODUCTS MARKET: EXECUTIVE SUMMARY

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 SEVEN SEGMENTS COMPRISE THE MEXICO HOMEOPATHY PRODUCTS MARKET, BY PRODUCT TYPE (2024)

FIGURE 14 INCREASING CONSUMER AWARENESS OF NATURAL HEALTH SOLUTIONS IS EXPECTED TO DRIVE THE MEXICO HOMEOPATHY PRODUCTS MARKET FROM 2025 TO 2032

FIGURE 15 THE DILUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MEXICO HOMEOPATHY PRODUCTS MARKET IN 2025 AND 2032

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MEXICO HOMEOPATHY PRODUCTS MARKET

FIGURE 17 MEXICO HOMEOPATHY PRODUCTS MARKET: BY PRODUCT TYPE, 2024

FIGURE 18 MEXICO HOMEOPATHY PRODUCTS MARKET: BY PRODUCT TYPE, 2025 TO 2032 (USD THOUSAND)

FIGURE 19 MEXICO HOMEOPATHY PRODUCTS MARKET: BY PRODUCT TYPE, CAGR (2025-2032)

FIGURE 20 MEXICO HOMEOPATHY PRODUCTS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 21 MEXICO HOMEOPATHY PRODUCTS MARKET: BY AGE GROUP, 2024

FIGURE 22 MEXICO HOMEOPATHY PRODUCTS MARKET: BY AGE GROUP, 2025 TO 2032 (USD THOUSAND)

FIGURE 23 MEXICO HOMEOPATHY PRODUCTS MARKET: BY AGE GROUP, CAGR (2025-2032)

FIGURE 24 MEXICO HOMEOPATHY PRODUCTS MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 25 MEXICO HOMEOPATHY PRODUCTS MARKET: BY GENDER, 2024

FIGURE 26 MEXICO HOMEOPATHY PRODUCTS MARKET: BY GENDER, 2025 TO 2032 (USD THOUSAND)

FIGURE 27 MEXICO HOMEOPATHY PRODUCTS MARKET: BY GENDER, CAGR (2025-2032)

FIGURE 28 MEXICO HOMEOPATHY PRODUCTS MARKET: BY GENDER, LIFELINE CURVE

FIGURE 29 MEXICO HOMEOPATHY PRODUCTS MARKET: BY TREATMENT, 2024

FIGURE 30 MEXICO HOMEOPATHY PRODUCTS MARKET: BY TREATMENT, 2025 TO 2032 (USD THOUSAND)

FIGURE 31 MEXICO HOMEOPATHY PRODUCTS MARKET: BY TREATMENT, CAGR (2025-2032)

FIGURE 32 MEXICO HOMEOPATHY PRODUCTS MARKET: BY TREATMENT, LIFELINE CURVE

FIGURE 33 MEXICO HOMEOPATHY PRODUCTS MARKET: BY SOURCE, 2024

FIGURE 34 MEXICO HOMEOPATHY PRODUCTS MARKET: BY SOURCE, 2025 TO 2032 (USD THOUSAND)

FIGURE 35 MEXICO HOMEOPATHY PRODUCTS MARKET: BY SOURCE, CAGR (2025-2032)

FIGURE 36 MEXICO HOMEOPATHY PRODUCTS MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 37 MEXICO HOMEOPATHY PRODUCTS MARKET: BY APPLICATION, 2024

FIGURE 38 MEXICO HOMEOPATHY PRODUCTS MARKET: BY APPLICATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 39 MEXICO HOMEOPATHY PRODUCTS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 40 MEXICO HOMEOPATHY PRODUCTS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 41 MEXICO HOMEOPATHY PRODUCTS MARKET: BY MODE OF PURCHASE, 2024

FIGURE 42 MEXICO HOMEOPATHY PRODUCTS MARKET: BY MODE OF PURCHASE, 2025 TO 2032 (USD THOUSAND)

FIGURE 43 MEXICO HOMEOPATHY PRODUCTS MARKET: BY MODE OF PURCHASE, CAGR (2025-2032)

FIGURE 44 MEXICO HOMEOPATHY PRODUCTS MARKET: BY MODE OF PURCHASE, LIFELINE CURVE

FIGURE 45 MEXICO HOMEOPATHY PRODUCTS MARKET: BY ROUTE OF ADMINISTRATION, 2024

FIGURE 46 MEXICO HOMEOPATHY PRODUCTS MARKET: BY ROUTE OF ADMINISTRATION, 2025 TO 2032 (USD THOUSAND)

FIGURE 47 MEXICO HOMEOPATHY PRODUCTS MARKET: BY ROUTE OF ADMINISTRATION, CAGR (2025-2032)

FIGURE 48 MEXICO HOMEOPATHY PRODUCTS MARKET: BY ROUTE OF ADMINISTRATION, LIFELINE CURVE

FIGURE 49 MEXICO HOMEOPATHY PRODUCTS MARKET: BY END USER, 2024

FIGURE 50 MEXICO HOMEOPATHY PRODUCTS MARKET: BY END USER, 2025 TO 2032 (USD THOUSAND)

FIGURE 51 MEXICO HOMEOPATHY PRODUCTS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 52 MEXICO HOMEOPATHY PRODUCTS MARKET: BY END USER, LIFELINE CURVE

FIGURE 53 MEXICO HOMEOPATHY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 54 MEXICO HOMEOPATHY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, 2025 TO 2032 (USD THOUSAND)

FIGURE 55 MEXICO HOMEOPATHY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 56 MEXICO HOMEOPATHY PRODUCTS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 57 MEXICO HOMEOPATHY PRODUCTS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.