Mexico Rfid And Electronic Article Surveillance Systems Market

Market Size in USD Million

CAGR :

%

USD

443.22 Million

USD

851.25 Million

2024

2032

USD

443.22 Million

USD

851.25 Million

2024

2032

| 2025 –2032 | |

| USD 443.22 Million | |

| USD 851.25 Million | |

|

|

|

|

What is the Mexico RFID and Electronic Article Surveillance Systems Market Size and Growth Rate?

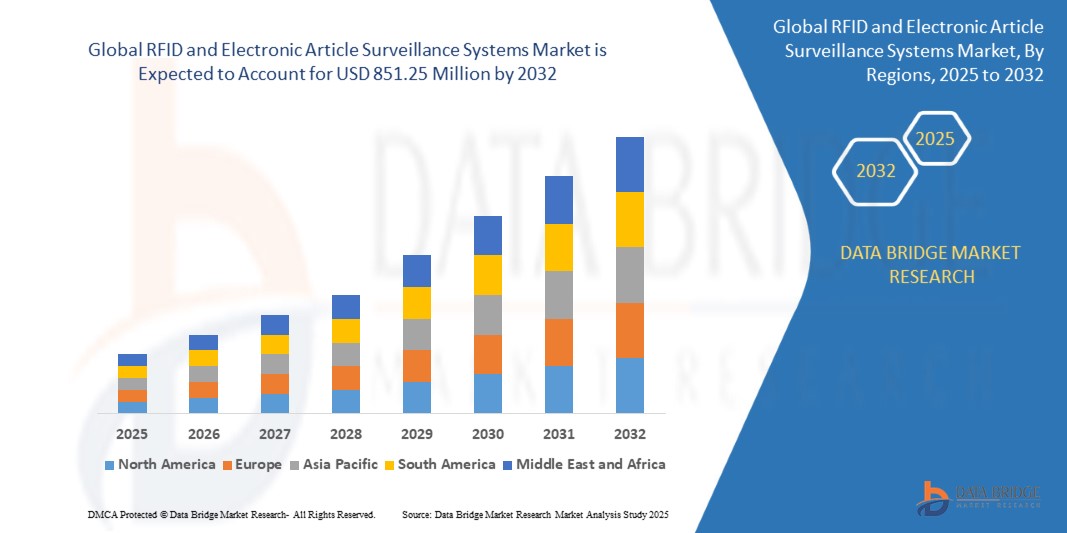

- The Mexico RFID and electronic article surveillance systems market size was valued at USD 443.22 million in 2024 and is expected to reach USD 851.25 million by 2032, at a CAGR of 8.50% during the forecast period

- The expansion of the retail sector underscores the crucial need for integrating radio-frequency identification (RFID) and electronic article surveillance (EAS) systems. Combining RFID, which facilitates real-time inventory management and enhances operational efficiency, with EAS, which provides anti-theft protection, ensures comprehensive asset tracking and security solutions

- This integration optimizes inventory visibility, reduces out-of-stock occurrences, minimizes theft losses, and streamlines checkout processes. By leveraging RFID for accurate inventory tracking and EAS for theft prevention, retailers can enhance customer satisfaction, increase sales, and maintain competitive advantage in the dynamic retail landscape

What are the Major Takeaways of RFID and Electronic Article Surveillance Systems Market?

- The rising demand for improved supply chain visibility is driving retailers to adopt advanced technologies such as RFID. Enhanced visibility enables real-time tracking of inventory, allowing for more precise logistics management and reducing operational costs. This granular insight into the movement of goods from source to sale helps identify inefficiencies and streamline processes, resulting in faster and more accurate fulfilment

- As a result, retailers can reduce excess stock, minimize waste, and improve overall supply chain responsiveness. The adoption of RFID technology thus enhances logistical efficiency and significantly lowers costs, contributing to better profitability and competitiveness in the market

- The hardware segment dominated the market in 2024 with the largest revenue share of 54.6%, attributed to the high demand for RFID tags, readers, antennas, and surveillance equipment in large-scale deployments across retail, logistics, and healthcare

Report Scope and RFID and Electronic Article Surveillance Systems Market Segmentation

|

Attributes |

RFID and Electronic Article Surveillance Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the RFID and Electronic Article Surveillance Systems Market?

“Enhanced Convenience Through AI and Voice Integration”

- A major and accelerating trend in the global RFID and electronic article surveillance systems market is the integration of artificial intelligence (AI) with popular voice-controlled platforms such as Amazon Alexa, Google Assistant, and Apple HomeKit, providing enhanced convenience and smarter operations

- For instance, Zebra Technologies has been embedding AI into RFID systems for intelligent inventory tracking, while Johnson Controls offers voice-enabled solutions that integrate seamlessly into broader security ecosystems

- AI-powered RFID and EAS systems are enabling predictive analytics, adaptive learning of access patterns, and more intelligent alerts, while voice control ensures hands-free management of security and access

- This integration allows RFID and EAS systems to act as part of a centralized smart infrastructure, combining asset tracking, surveillance, and access control with other IoT-enabled devices

- Companies such as Checkpoint Systems are developing advanced AI-driven EAS solutions that utilize RFID to reduce shrinkage, improve retail analytics, and support voice-enabled operations

- As a result, the market is shifting toward intelligent, intuitive, and interconnected solutions, raising user expectations across retail, logistics, and enterprise applications

What are the Key Drivers of RFID and Electronic Article Surveillance Systems Market?

- Rising security concerns across retail, enterprises, and logistics, combined with rapid smart technology adoption, are fueling RFID and EAS system demand

- For instance, in May 2024, Avery Dennison Corporation expanded its RFID inlay portfolio to meet the growing demand for supply chain transparency and loss prevention in global retail

- RFID and EAS systems provide real-time tracking, remote monitoring, and tamper alerts, offering clear advantages over traditional systems

- Increasing deployment in smart retail environments, where inventory accuracy and theft prevention are critical, is making RFID an essential part of digital store transformation

- Growing consumer preference for seamless, contactless, and automated access solutions is accelerating adoption across commercial, logistics, and healthcare sectors

- The convenience of automated inventory management, faster checkout systems, and smart integration with IoT platforms is further propelling market growth

Which Factor is Challenging the Growth of the RFID and Electronic Article Surveillance Systems Market?

- Cybersecurity vulnerabilities and risks of data breaches remain key barriers to adoption, as RFID and connected surveillance devices are increasingly targeted by hackers

- For instance, incidents of RFID cloning and IoT system breaches have raised concerns for retailers and enterprises relying heavily on connected security solutions

- Addressing these risks requires robust encryption, secure authentication, and frequent software updates to maintain trust and reliability

- Companies such as Honeywell International Inc. are focusing on advanced encryption technologies to reassure customers of system safety and compliance with data security standards

- In addition, high initial deployment costs of RFID and advanced EAS solutions can deter adoption, especially in cost-sensitive markets within MEA and Asia-Pacific

- Overcoming these issues through affordable AI-driven solutions, enhanced cybersecurity frameworks, and user education will be crucial to unlocking sustained market expansion

How is the RFID and Electronic Article Surveillance Systems Market Segmented?

The market is segmented on the basis of offering, type, organization size, application, end users, and sales channel.

• By Offering

On the basis of offering, the RFID and Electronic Article Surveillance (EAS) Systems market is segmented into hardware, software, and services. The hardware segment dominated the market in 2024 with the largest revenue share of 54.6%, attributed to the high demand for RFID tags, readers, antennas, and surveillance equipment in large-scale deployments across retail, logistics, and healthcare. Hardware is the backbone of RFID and EAS solutions, ensuring seamless data capture and physical monitoring, which continues to drive significant investment.

The software segment is projected to grow at the fastest CAGR from 2025 to 2032, fueled by the rising adoption of cloud-based platforms, AI-driven analytics, and integration with enterprise resource planning (ERP) and customer relationship management (CRM) systems. The growing need for real-time monitoring, predictive insights, and automation is accelerating software investments, making it the key growth driver within offerings.

• By Type

The market is segmented into RFID systems and electronic article surveillance (EAS) systems. The RFID segment accounted for the largest revenue share of 62.1% in 2024, driven by its widespread application in asset tracking, supply chain management, and inventory monitoring. RFID technology offers versatility, scalability, and efficiency, making it the preferred solution in industries such as retail, logistics, and automotive.

Meanwhile, the EAS segment is expected to witness the fastest growth from 2025 to 2032, propelled by the retail sector’s emphasis on theft prevention, loss reduction, and real-time item-level visibility. With increasing pressure on retailers to protect margins and improve store efficiency, EAS adoption is rising in apparel, electronics, and high-value merchandise stores. The synergy between RFID and EAS in integrated solutions is further expanding opportunities for end users across both segments.

• By Organization Size

Based on organization size, the market is segmented into large enterprises and small & medium-sized enterprises (SMEs). The large enterprise segment dominated the market in 2024 with 58.4% revenue share, owing to their higher purchasing power, large-scale deployments, and growing need for advanced asset management and access control solutions. Large organizations often prioritize sophisticated RFID and EAS systems to secure operations and streamline global supply chains.

However, the SMEs segment is projected to record the fastest CAGR from 2025 to 2032, driven by increasing awareness of cost savings, inventory accuracy, and operational efficiency. Affordable cloud-based RFID solutions and scalable EAS offerings are making it easier for SMEs to adopt these technologies without heavy capital expenditure. Growing digitalization initiatives in emerging economies are further supporting adoption among smaller organizations.

• By Application

The RFID and EAS market is segmented into access control, asset tracking, personnel tracking, jewelry management, and others. The asset tracking segment dominated the market in 2024 with 40.9% revenue share, supported by the critical need for inventory management, theft prevention, and real-time location visibility in logistics, healthcare, and retail sectors. Businesses increasingly rely on RFID-enabled asset tracking for accuracy, cost reduction, and process optimization.

The personnel tracking segment is expected to witness the fastest growth from 2025 to 2032, as organizations place greater emphasis on workforce safety, productivity monitoring, and compliance. Industries such as healthcare, IT, and defense are deploying RFID badges and wearable devices for secure access and real-time monitoring of employees and contractors. Jewelry management is also gaining traction in luxury retail due to rising concerns over shrinkage and fraud.

• By End Users

The market is categorized into retail/commercial, logistics & transportation, automotive, industrial, healthcare, aerospace, IT, defense, education, livestock, sports, wildlife, and others. The retail/commercial segment dominated with a 36.7% revenue share in 2024, driven by growing demand for theft prevention, real-time inventory visibility, and improved customer shopping experiences. RFID and EAS solutions are critical in apparel, electronics, and luxury goods retail for reducing shrinkage and improving operational efficiency.

The logistics & transportation segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by booming e-commerce, global trade, and rising demand for visibility across supply chains. RFID systems are increasingly deployed in warehouses, ports, and distribution centers to streamline asset tracking and automate inventory management. Adoption in healthcare and defense is also accelerating, with strong focus on compliance and security.

• By Sales Channel

The sales channel is divided into direct and indirect. The indirect sales channel held the largest revenue share of 61.3% in 2024, owing to the extensive network of distributors, resellers, and system integrators providing tailored RFID and EAS solutions to diverse industries. Indirect channels enable companies to reach a wider audience and ensure local support, making them a dominant mode of sales.

In contrast, the direct sales channel is forecasted to grow at the fastest CAGR from 2025 to 2032, as leading providers increasingly focus on building direct relationships with clients for customized deployments, technical support, and long-term service contracts. Large organizations prefer direct partnerships for large-scale, mission-critical deployments requiring advanced integration and real-time support, fueling growth in this segment.

Which are the Top Companies in RFID and Electronic Article Surveillance Systems Market?

The RFID and electronic article surveillance systems industry is primarily led by well-established companies, including:

- Checkpoint Systems, Inc. (U.S.)

- Avery Dennison Corporation (U.S.)

- Johnson Controls (Ireland)

- Zebra Technologies Corp. (U.S.)

- HID Global Corporation (part of ASSA ABLOY) (U.S.)

- Honeywell International Inc. (U.S.)

- Dahua Technology (China)

- Amersec s.r.o (Czech Republic)

- Datalogic S.p.A (Italy)

- Gunnebo AB (Sweden)

What are the Recent Developments in Mexico RFID and Electronic Article Surveillance Systems Market?

- In April 2023, Checkpoint Systems, Inc. has teamed up with Partner Tech Europe to create a next-generation RFID-based Self-Service Checkout (SCO) solution aimed at improving customer convenience and in-store security. This collaboration bolsters Checkpoint Systems, Inc.'s presence in the RFID market by embedding their technology into advanced SCO systems. The new solution enhances customer experience, increases loss prevention, and delivers precise purchase data, thereby boosting sales and operational efficiency for retailers

- In February 2024, Zebra Technologies debuted "The Modern Store" at NRF'24 Retail's Big Show, introducing a groundbreaking retail approach with RFID technology. This innovation boosts inventory management, personalizes customer interactions, and streamlines store operations with features such as self-checkout and personalized user profiles. By embedding RFID into retail settings, Zebra solidifies its reputation for delivering advanced solutions that enhance operational efficiency, accuracy, and customer experience. The success of "The Modern Store" strengthens Zebra's market position and broadens its impact in the retail technology industry

- In January 2022, Johnson Controls’ Sensormatic Solutions released its 2021 Sustainability Story white paper, detailing its commitment to sustainability through innovative RFID technology. Their Electronic Article Surveillance (EAS) systems now consume 50% less power, and the Inventory Intelligence solution, leveraging RFID, reduces waste and carbon emissions in the supply chain. This focus on sustainability benefits both retailers and shoppers, ensuring efficient operations, reduced energy use, and seamless shopping experiences

- In February 2023, HID Global Corporation has expanded its healthcare offering with the acquisition of GuardRFID, a real-time location services company. This move enhances HID's presence in the active RFID and RTLS space, allowing them to offer innovative solutions for infant security, staff duress, asset tracking, and wandering patients. The acquisition strengthens HID's ability to protect patients and staff in healthcare facilities, positioning them as a leader in the industry

- In August 2020, Datalogic S.p.A has unveiled the 2128P UHF RFID Reader, tailored for the Memor 10 PDA, to bolster inventory accuracy with rapid and precise RFID tag scanning. This advancement amplifies Datalogic SPA's RFID capabilities, enabling superior performance in tag reading. With the introduction of the 2128P UHF RFID Reader, Datalogic elevates inventory accuracy and efficiency for its clientele. Key features such as maximum output power, extended read range, and tag de-duplication software streamline inventory management processes, positioning Datalogic as a leading provider of cutting-edge RFID solutions across industries including retail, transportation and logistics, manufacturing, and healthcare

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.