Middle East Africa Ventilator Market

Market Size in USD Million

CAGR :

%

USD

266.50 Million

USD

444.38 Million

2024

2032

USD

266.50 Million

USD

444.38 Million

2024

2032

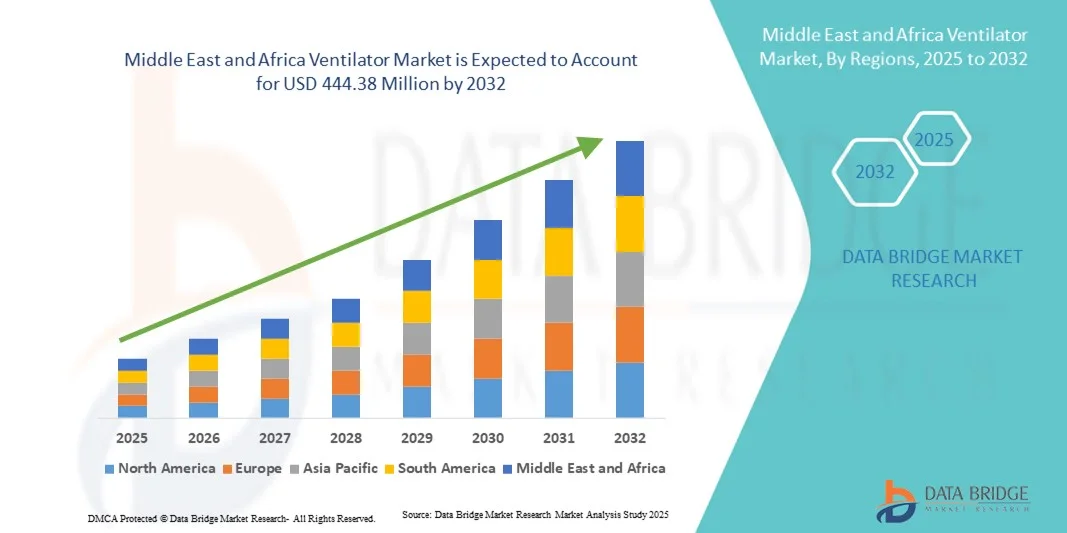

| 2025 –2032 | |

| USD 266.50 Million | |

| USD 444.38 Million | |

|

|

|

|

Middle East and Africa Ventilator Market Size

- The Middle East and Africa ventilator market size was valued at USD 266.50 million in 2024 and is expected to reach USD 444.38 million by 2032, at a CAGR of 6.60% during the forecast period

- The market growth is largely fueled by increasing healthcare infrastructure investments, rising incidences of respiratory diseases, and advancements in ventilator technology, leading to enhanced patient care across hospitals and clinics

- Furthermore, government initiatives to improve healthcare access and the growing demand for advanced respiratory care solutions are establishing ventilators as essential medical devices, thereby significantly boosting the industry's growth

Middle East and Africa Ventilator Market Analysis

- Ventilators, providing mechanical respiratory support for patients with breathing difficulties, are increasingly vital components of modern healthcare infrastructure in both hospitals and critical care settings due to their life-saving capabilities, advanced monitoring features, and integration with patient management systems

- The escalating demand for ventilators is primarily fueled by the rising prevalence of respiratory diseases, increasing patient awareness, and the need for advanced critical care solutions across both public and private healthcare facilities

- Saudi Arabia dominated the Middle East and Africa ventilator market with the largest revenue share of 38.8% in 2024, characterized by substantial healthcare investments, government initiatives to enhance critical care capacity, and a strong presence of key medical device suppliers

- South Africa is expected to be the fastest-growing country in the Middle East and Africa ventilator market during the forecast period, due to expanding hospital infrastructure, rising healthcare spending, and increasing access to advanced medical technologies

- Invasive ventilators dominated the Middle East and Africa ventilator market with a market share of 52.5% in 2024, driven by their critical role in intensive care settings and compatibility with a wide range of patient conditions requiring mechanical respiratory support

Report Scope and Middle East and Africa Ventilator Market Segmentation

|

Attributes |

Middle East and Africa Ventilator Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Ventilator Market Trends

Advancements in Smart and Portable Ventilator Technology

- A significant and accelerating trend in the Middle East and Africa ventilator market is the integration of advanced monitoring systems and portable ventilator solutions, enabling enhanced patient care both in hospitals and home settings. This fusion of technologies is improving real-time patient monitoring, data collection, and critical care management

- For instance, the Hamilton-C6 ventilator supports transport and ICU care with automated lung protection strategies, allowing clinicians to optimize ventilation parameters efficiently. Similarly, the Philips Respironics E30 provides portable respiratory support with user-friendly interfaces for diverse clinical environments

- AI-enabled ventilators enhance features such as adaptive ventilation modes that learn patient breathing patterns and provide more personalized respiratory support. For instance, Dräger Evita V800 uses AI algorithms to adjust ventilation dynamically based on patient conditions, reducing complications and improving outcomes

- The seamless integration of ventilators with hospital information systems and remote monitoring platforms allows centralized management of patient respiratory data, enabling clinicians to track multiple patients and intervene promptly when necessary

- This trend toward smarter, portable, and interconnected ventilator systems is reshaping expectations in critical care, prompting manufacturers such as Medtronic to develop devices with automated weaning protocols and real-time monitoring dashboards for improved ICU efficiency

- The demand for ventilators that provide intelligent support and portability is increasing rapidly across both hospital and home care sectors, as healthcare providers aim to improve patient outcomes and operational efficiency

Middle East and Africa Ventilator Market Dynamics

Driver

Increasing Demand Driven by Rising Respiratory Disease Prevalence and Healthcare Investments

- The growing incidence of respiratory disorders, including COPD, COVID-19, and pneumonia, combined with rising healthcare infrastructure investments, is a significant driver for ventilator adoption across the Middle East and Africa

- For instance, in March 2024, GE Healthcare launched portable ventilators in Saudi Arabia to support emergency and ICU care in response to increased respiratory illness cases. Such initiatives by key players are expected to accelerate ventilator market growth during the forecast period

- As hospitals and clinics expand their critical care capacity, ventilators provide life-saving support for patients in ICUs and emergency settings, offering advanced monitoring, adaptive ventilation, and safety alarms that surpass basic respiratory devices

- Furthermore, government initiatives to enhance healthcare access, coupled with rising awareness among medical professionals, are driving demand for sophisticated ventilators capable of supporting diverse patient populations

- The need for rapid response during respiratory emergencies, coupled with the growing adoption of portable and smart ventilators, is propelling market expansion in both established and emerging healthcare facilities

- Increased focus on home healthcare services is driving demand for compact, easy-to-use ventilators suitable for patient use outside hospital settings. Collaboration between ventilator manufacturers and local distributors is improving market reach and accessibility, particularly in remote or underserved areas

Restraint/Challenge

High Costs and Maintenance Requirements Limit Wider Adoption

- The high cost of advanced ventilators, along with complex maintenance and operational requirements, poses a significant challenge to market penetration, particularly in lower-income countries within the region

- For instance, procurement and maintenance of invasive ventilators such as the Maquet Servo-i can be cost-prohibitive for smaller hospitals or clinics, limiting access to state-of-the-art respiratory care

- Addressing these challenges requires training healthcare personnel, investing in maintenance infrastructure, and offering cost-effective ventilator options suitable for varying healthcare facility scales

- Furthermore, the need for regular calibration, software updates, and spare parts can increase operational costs, discouraging adoption in resource-constrained environments

- Overcoming these restraints through affordable portable ventilator models, leasing programs, and technical support initiatives is essential for ensuring broader accessibility and sustained market growth

- Limited availability of skilled respiratory therapists and biomedical engineers in some countries hinders optimal ventilator usage and adoption. Dependence on imported ventilator devices can lead to supply chain disruptions, particularly during global health crises, affecting timely deployment and scalability

Middle East and Africa Ventilator Market Scope

The market is segmented on the basis of mobility, interface, type, oxygen delivery into the lungs, mode, and end user.

- By Mobility

On the basis of mobility, the Middle East and Africa ventilator market is segmented into intensive care ventilators and portable/transportable ventilators. The intensive care ventilators segment dominated the market with the largest revenue share of 58% in 2024, driven by their critical role in hospital ICUs and emergency units. These ventilators are preferred for their advanced features, including multi-mode ventilation, real-time monitoring, and compatibility with hospital information systems. Hospitals in Saudi Arabia and UAE prioritize intensive care ventilators due to their ability to manage severely ill patients with complex respiratory conditions. The segment also benefits from government healthcare investments and adoption in high-dependency units across the region. Intensive care ventilators are increasingly integrated with AI-assisted technologies to optimize patient outcomes and reduce ICU workload.

The portable/transportable ventilators segment is anticipated to witness the fastest CAGR of 15% from 2025 to 2032, fueled by the growing demand for home healthcare and emergency transport solutions. These ventilators provide flexibility for patient mobility, rapid deployment in ambulances, and remote monitoring. Countries such as South Africa and Egypt are witnessing increasing adoption due to expanding home care services and emergency medical services. The convenience of lightweight, battery-operated ventilators allows healthcare providers to deliver continuous respiratory support outside traditional ICU settings. Rising telemedicine adoption further enhances the relevance of portable ventilators for patient care in remote or underserved areas.

- By Interface

On the basis of interface, the market is segmented into invasive ventilation and non-invasive ventilation. The invasive ventilation segment dominated the market with a share of 52.5% in 2024, owing to its essential application in critical care, particularly for patients unable to maintain adequate spontaneous breathing. Invasive ventilators provide precise control over oxygen delivery, ventilation modes, and airway pressures, making them indispensable in ICU and surgical settings. Hospitals in Saudi Arabia, UAE, and Nigeria rely heavily on invasive ventilation to manage severe respiratory illnesses and emergencies. These ventilators are increasingly integrated with AI and patient monitoring systems to optimize treatment efficiency and outcomes. The segment also benefits from extensive clinical familiarity and established protocols for invasive respiratory support.

The non-invasive ventilation segment is expected to record the fastest growth rate of 16% during 2025–2032, driven by increasing awareness and adoption for moderate respiratory distress and home care. Non-invasive ventilators are less intrusive, reduce infection risks, and are suitable for chronic conditions such as COPD. Rising demand in countries such as Egypt, Kenya, and South Africa for home-based respiratory support fuels market growth. The ease of use and minimal training requirements make non-invasive ventilators attractive for outpatient care and emergency transport. Government initiatives promoting early respiratory intervention further accelerate adoption in this segment.

- By Type

On the basis of type, the market is segmented into adult/pediatric ventilators and infant/neonatal ventilators. The adult/pediatric ventilators segment dominated the market with a share of 65% in 2024 due to the high prevalence of respiratory illnesses in adult populations and widespread ICU usage. Hospitals prefer these ventilators for their versatility across age groups, advanced monitoring features, and compatibility with multiple ventilation modes. Countries such as Saudi Arabia, UAE, and South Africa invest heavily in adult/pediatric ventilators to improve critical care outcomes. The segment benefits from continuous technological upgrades and integration with digital healthcare platforms. Strong demand from surgical, emergency, and ICU departments further strengthens its dominance.

The infant/neonatal ventilators segment is projected to witness the fastest CAGR of 14% from 2025 to 2032, fueled by rising neonatal mortality awareness and increasing premature births. Specialized ventilators for neonatal care are in high demand in Egypt, Nigeria, and Kenya due to expanding neonatal intensive care units (NICUs). These ventilators provide delicate respiratory support and precise oxygen control essential for newborns. Integration with advanced monitoring and alarm systems enhances safety and clinical effectiveness. Government health programs targeting maternal and infant care are driving adoption across the region.

- By Oxygen Delivery into the Lungs

On the basis of oxygen delivery, the market is segmented into positive pressure mechanical ventilators and negative pressure mechanical ventilators. The positive pressure ventilators segment dominated the market with a share of 70% in 2024, as they are widely used in hospitals for critically ill patients requiring controlled ventilation. Positive pressure systems allow precise delivery of oxygen and ventilation support across invasive and non-invasive applications. Adoption is high in Saudi Arabia, UAE, and South Africa due to the increasing number of ICUs and emergency care facilities. These ventilators are compatible with advanced monitoring systems and provide safety features to reduce patient complications. Rising cases of COVID-19 and other respiratory disorders have further strengthened demand.

The negative pressure mechanical ventilators segment is expected to record the fastest growth rate of 13% during 2025–2032, driven by growing interest in non-invasive respiratory support and home healthcare applications. Negative pressure ventilators are less intrusive and preferred for long-term care of patients with chronic respiratory diseases. Increasing investments in rehabilitation centers and home care services in Egypt and Kenya support market expansion. Their non-invasive nature reduces infection risk and enhances patient comfort, contributing to rising adoption.

- By Mode

On the basis of mode, the market is segmented into combined-mode ventilation, volume-mode ventilation, pressure-mode ventilation, and others. The combined-mode ventilation segment dominated the market with a share of 45% in 2024, due to its flexibility in adjusting ventilation strategies based on patient conditions. Hospitals in Saudi Arabia and UAE prefer combined-mode ventilators for ICU and emergency care applications. These ventilators improve patient outcomes by automatically switching between pressure and volume modes as needed. Integration with AI and patient monitoring systems enhances accuracy and reduces clinician workload. The segment’s adoption is driven by the need for versatile solutions that can cater to diverse patient populations.

The pressure-mode ventilation segment is expected to witness the fastest CAGR of 17% from 2025 to 2032, driven by its ability to deliver precise airway pressures and reduce lung injury in critical patients. Pressure-mode ventilators are increasingly used in adult and neonatal ICUs across South Africa, Egypt, and Nigeria. Rising demand for lung-protective ventilation strategies in hospitals and emergency units is fueling growth. Technological advancements such as adaptive pressure algorithms and real-time monitoring enhance safety and efficacy, making this segment highly attractive.

- By End User

On the basis of end user, the market is segmented into hospitals and clinics, home care, ambulatory care centers, and emergency medical services. The hospitals and clinics segment dominated the market with a share of 75% in 2024, as these facilities are the primary adopters of ventilators for ICU, emergency, and surgical care. Adoption is strongest in Saudi Arabia, UAE, and South Africa due to large-scale healthcare infrastructure and government funding. Hospitals prefer advanced ventilators with multiple modes, AI integration, and real-time monitoring capabilities. Increasing respiratory disease burden and critical care requirements reinforce the dominance of this segment.

The home care segment is expected to witness the fastest growth rate of 16% from 2025 to 2032, driven by rising awareness of home healthcare solutions and the need for portable ventilators for chronic respiratory patients. South Africa, Egypt, and Kenya are experiencing rapid adoption of home ventilators due to increasing telemedicine services and healthcare accessibility programs. The convenience, patient comfort, and reduced hospitalization costs associated with home care ventilators are boosting their demand. Government initiatives supporting home-based respiratory care further accelerate growth in this segment.

Middle East and Africa Ventilator Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa ventilator market with the largest revenue share of 38.8% in 2024, characterized by substantial healthcare investments, government initiatives to enhance critical care capacity, and a strong presence of key medical device suppliers

- Healthcare providers in the region highly prioritize advanced ventilators for ICU, emergency, and surgical care, valuing features such as AI-assisted monitoring, adaptive ventilation modes, and compatibility with hospital information systems

- This widespread adoption is further supported by growing hospital networks, rising healthcare spending, and a strong presence of key medical device suppliers, establishing ventilators as essential equipment for both public and private healthcare facilities

The Saudi Arabia Ventilator Market Insight

The Saudi Arabia ventilator market captured the largest revenue share of 38.8% in 2024 within the Middle East and Africa, fueled by significant investments in healthcare infrastructure and rising prevalence of respiratory diseases. Hospitals and clinics are increasingly prioritizing advanced ICU ventilators equipped with AI-assisted monitoring and adaptive ventilation modes. The growing emphasis on emergency preparedness and government initiatives to expand critical care capacity further propels the ventilator industry. Moreover, the integration of smart ventilator technologies, including remote monitoring and data analytics, is significantly contributing to market expansion.

South Africa Ventilator Market Insight

The South Africa ventilator market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by increasing healthcare spending and the rising incidence of respiratory disorders. Expansion of hospital networks, home care services, and emergency medical services is fostering the adoption of both portable and intensive care ventilators. Healthcare providers in South Africa are also drawn to the convenience, efficiency, and improved patient outcomes offered by technologically advanced ventilators. The region is experiencing significant growth across public and private hospitals, with ventilators being incorporated into both new hospital setups and critical care expansions.

United Arab Emirates Ventilator Market Insight

The UAE ventilator market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the country’s focus on healthcare modernization and advanced critical care facilities. In addition, rising prevalence of chronic respiratory diseases and increasing government healthcare initiatives are encouraging hospitals to upgrade to high-performance ventilators. The UAE’s adoption of connected ventilator systems, along with integration into hospital monitoring networks, is expected to continue stimulating market growth. Furthermore, the country’s investments in smart hospitals and AI-enabled healthcare technologies enhance the appeal of modern ventilator solutions.

Egypt Ventilator Market Insight

The Egypt ventilator market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of respiratory health and rising demand for ICU and emergency care support. Egypt’s expanding healthcare infrastructure, coupled with government programs to improve access to critical care equipment, promotes ventilator adoption, particularly in urban hospitals. Integration of ventilators with digital patient management systems and remote monitoring capabilities is becoming increasingly prevalent, supporting enhanced treatment efficiency. Hospitals are placing strong emphasis on reliable and cost-effective ventilator solutions to manage both acute and chronic respiratory conditions.

Middle East and Africa Ventilator Market Share

The Middle East and Africa Ventilator industry is primarily led by well-established companies, including:

- Koninklijke Philips N.V. (Netherlands)

- ResMed (Australia)

- Medtronic (Ireland)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

- Fisher & Paykel Healthcare Limited (New Zealand)

- Vyaire (U.S.)

- General Electric Company (U.S.)

- GE HealthCare (U.S.)

- Air Liquide (France)

- Drägerwerk AG & Co. KGaA (Germany)

- NIHON KOHDEN CORPORATION (Japan)

- Asahi Kasei Corporation (Japan)

- Allied Healthcare Products, Inc. (U.S.)

- Avasarala Technologies Limited (India)

- ebm-papst (Germany)

- Zitrón (Spain)

- Tornado Roof Ventilator (UAE)

- Maico Gulf L.L.C (Germany)

What are the Recent Developments in Middle East and Africa Ventilator Market?

- In October 2025, the Saudi Arabian government announced an accelerated expansion of its critical care infrastructure under the Vision 2030 initiative. This expansion includes the establishment of new hospitals and the enhancement of existing medical facilities, with a focus on increasing the number of intensive care unit (ICU) beds and upgrading medical equipment, including ventilators

- In June 2025, Iranian company Ehya Darman Pishrafteh was recognized as one of the world's top six ventilator manufacturers. The company showcased its advanced medical equipment, including ventilators, at the Iran Health Exhibition, highlighting its significant role in the global medical device industry

- In February 2025, Dräger showcased the new functions of its MEDUVENT Standard turbine ventilator at Arab Health 2025. The company highlighted its innovations in ventilation during emergencies and intensive care, emphasizing the importance of advanced ventilator technologies in improving patient care in the region

- In January 2025, Hamilton Medical introduced the HAMILTON-HF90 at the Arab Health exhibition in Dubai. This high-flow oxygen therapy device combines ventilation, monitoring, and infusion capabilities into a single unit, enhancing mobility and efficiency in critical care settings. Its design aims to support medical teams in delivering high-flow oxygen therapy whenever required, setting a new standard in respiratory care

- In January 2025, Air Liquide Medical Systems showcased the Monnal™ TEO, a new ICU ventilator, at Arab Health 2025. This device is designed to provide advanced ventilation support, aiming to improve patient outcomes in intensive care units. Its introduction underscores the company's commitment to enhancing respiratory care technologies in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.