Middle East Africa Wound Care Biologics Market

Market Size in USD Million

CAGR :

%

USD

247.46 Million

USD

403.43 Million

2024

2032

USD

247.46 Million

USD

403.43 Million

2024

2032

| 2025 –2032 | |

| USD 247.46 Million | |

| USD 403.43 Million | |

|

|

|

|

Middle East and Africa Wound Care Biologics Market Size

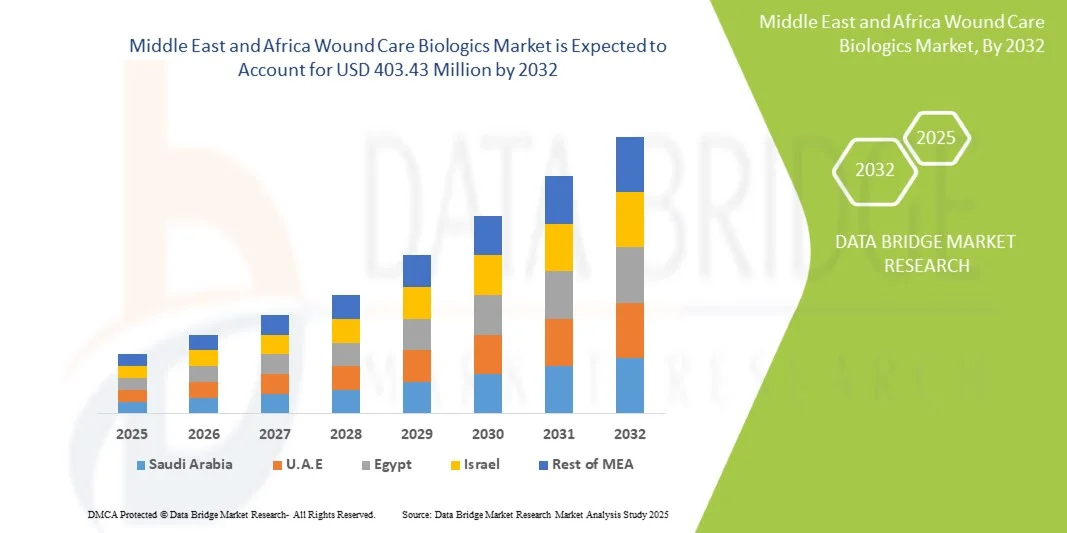

- The Middle East and Africa wound care biologics market size was valued at USD 247.46 million in 2024 and is expected to reach USD 403.43 million by 2032, at a CAGR of 6.3% during the forecast period

- The market growth in MEA is largely driven by rising prevalence of diabetes and chronic wounds, increasing surgical procedures and trauma cases, gradual improvements in healthcare infrastructure and growing availability of advanced wound-care products and distribution channels that enable biologics adoption.

- Furthermore, expanding awareness among clinicians about biologic therapies supportive reimbursement shifts in select countries, and targeted product launches by global players are steadily improving uptake these converging factors are accelerating adoption of wound-care biologics across the region

Middle East and Africa Wound Care Biologics Market Analysis

- Wound care biologics, including skin substitutes, growth factors, and cellular-based therapies, are gaining significant traction across hospitals and specialized wound care centers in the Middle East and Africa. Their superior healing efficacy, biocompatibility, and ability to treat chronic wounds such as diabetic foot ulcers and burns make them vital in advanced wound management protocols across the region

- The market growth is driven by the rising prevalence of diabetes and obesity, increased incidence of trauma and surgical wounds, and greater awareness of advanced treatment options among clinicians. Expanding healthcare infrastructure and government investments in modern medical technologies are further accelerating the adoption of biologic wound care products

- Saudi Arabia dominated the Middle East and Africa wound care biologics market in 2024, accounting for 35.4% of market share, supported by strong healthcare expenditure, advanced clinical infrastructure, and early adoption of regenerative wound care solutions. The country also benefits from the presence of global manufacturers and distributors improving product accessibility

- South Africa is projected to be the fastest-growing country in the region, during the forecast period, driven by a high burden of diabetic wounds, growing investments in healthcare facilities, and increasing acceptance of biologic-based wound therapies in both public and private healthcare systems

- The skin substitutes segment dominated the market with the largest market share of 42.8% in 2024, due to their clinical effectiveness in accelerating tissue regeneration, reducing infection risks, and minimizing hospital stays making them the most preferred biologic solution among surgeons and wound care specialists across Saudi Arabia and South Africa

Report Scope and Middle East and Africa Wound Care Biologics Market Segmentation

|

Attributes |

Middle East and Africa Wound Care Biologics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Wound Care Biologics Market Trends

“Advancement Through Biologics and Regenerative Therapies”

- A significant and accelerating trend in the MEA wound care biologics market is the increasing adoption of advanced biologics such as skin substitutes, growth-factor therapies, and cellular-based dressings, which enhance healing outcomes for chronic and complex wounds

- For instance, the use of Apligraf (a bilayered skin substitute) in Saudi Arabian hospitals has improved recovery times for diabetic foot ulcers, reducing hospitalization duration and improving patient quality of life

- The integration of regenerative medicine principles enables clinicians to employ personalized wound care strategies, optimizing healing based on patient-specific conditions, comorbidities, and wound types

- For instance, South African specialty clinics are combining platelet-rich plasma therapy with advanced skin substitutes to accelerate healing for chronic ulcers in diabetic patients

- This trend towards more biologically driven, clinically effective, and patient-specific wound therapies is reshaping expectations among healthcare providers, prompting local hospitals and private clinics to expand adoption of advanced biologic treatments

- The demand for wound care biologics that offer faster, safer, and more effective healing is growing rapidly across hospitals, specialty clinics, and long-term care facilities, as clinicians prioritize outcomes and reduced complication rates

Middle East and Africa Wound Care Biologics Market Dynamics

Driver

“Rising Prevalence of Chronic Wounds and Healthcare Investments”

- The increasing incidence of diabetes, obesity, and aging populations, coupled with expanding healthcare infrastructure in countries such as Saudi Arabia and UAE, is driving the demand for wound care biologics in the MEA region

- For instance, in 2024, the UAE Ministry of Health reported rising diabetic foot ulcer cases, leading hospitals to adopt biologics such as Dermagraft and EpiFix to improve clinical outcomes

- As awareness of advanced wound care grows, biologics offer effective solutions for difficult-to-heal wounds, reducing healing time, infection risk, and overall treatment costs

- For instance, in South Africa, private hospitals integrating skin substitutes into treatment protocols observed faster wound closure in patients with chronic ulcers compared to conventional dressings

- Saudi Arabia’s Vision 2030 healthcare initiatives are promoting modern wound care solutions, encouraging hospitals to implement advanced biologic therapies in standard wound management

- Growing government support, rising healthcare expenditure, and favorable reimbursement policies in GCC countries further strengthen biologics adoption and market expansion

Restraint/Challenge

“High Treatment Costs and Limited Accessibility”

- The relatively high cost of biologic wound care products compared to conventional dressings limits widespread adoption, especially in low-income MEA countries, affecting market penetration and overall growth

- For instance, the price of cellularized skin substitutes in Nigeria can be prohibitive for both hospitals and patients, restricting usage to private healthcare facilities

- Limited availability of biologics in rural or underdeveloped areas creates disparities in treatment access, slowing the adoption rate outside urban centers with advanced medical infrastructure

- For instance, in rural regions of South Africa, patients often rely on traditional dressings due to lack of supply chains and specialized wound care centers offering biologics

- Ensuring regulatory compliance, maintaining product quality, and addressing storage and handling challenges are additional hurdles for manufacturers seeking to expand in diverse MEA markets

- Strict import regulations in Saudi Arabia and the UAE require manufacturers to adhere to specific licensing and quality standards before biologics can be commercially distributed, delaying market entry

Middle East and Africa Wound Care Biologics Market Scope

The market is segmented on the basis of product, wound type, and end user.

- By Product

On the basis of product, the market is segmented into biologic skin substitutes, topical agents, synthetic skin grafts, growth factors, allografts, and xenografts. The biologic skin substitutes segment dominated the market in 2024, accounting for the largest revenue share of 42.8%. This dominance is driven by their proven clinical effectiveness in promoting tissue regeneration, accelerating healing, and reducing infection risks for chronic and complex wounds. Hospitals and specialty clinics across Saudi Arabia and UAE frequently adopt these products for diabetic foot ulcers and surgical wounds due to their superior outcomes compared to conventional dressings. Biologic skin substitutes also support reduced hospitalization duration, lowering overall treatment costs and improving patient quality of life. The availability of commercial products such as Apligraf and Dermagraft from leading global players further reinforces their market leadership. Clinicians prefer these substitutes for their versatility across multiple wound types, including burns and traumatic injuries. Their biocompatibility and ability to integrate with regenerative therapies continue to encourage higher adoption rates.

The topical agents segment is expected to witness the fastest growth, with a projected CAGR of 8% from 2025 to 2032, fueled by rising adoption in outpatient settings and wound clinics. These products, including growth-factor creams and antimicrobial gels, provide localized therapy, ease of application, and rapid symptom relief, making them suitable for both acute and chronic wounds. The low complexity of application and minimal training requirements make topical agents accessible in regions with limited specialist availability. Increasing awareness of early intervention for ulcers and burns is encouraging wider usage of topical biologics. Furthermore, manufacturers are innovating with combined formulations that accelerate healing and reduce complications, driving demand. Growing use in ambulatory surgical centers and home care settings also contributes to this segment’s rapid expansion.

- By Wound Type

On the basis of wound type, the market is segmented into ulcers, surgical and traumatic wounds, and burns. The ulcers segment dominated the MEA market in 2024, contributing the largest share of roughly 40%, primarily due to the rising prevalence of diabetic foot ulcers and pressure ulcers in Saudi Arabia, UAE, and South Africa. Chronic ulcer management requires advanced biologic therapies to prevent complications, reduce infection risks, and improve healing outcomes, making it a priority for hospitals and specialty clinics. Long-term patient management and the high cost of traditional treatments reinforce the preference for biologic substitutes and growth-factor therapies. Clinicians also favor products that minimize hospital stays while offering predictable clinical results. Ongoing awareness campaigns and public health initiatives targeting diabetic populations are further sustaining demand. Moreover, the segment benefits from the established presence of multinational biologics manufacturers supplying the region.

Surgical and traumatic wounds are expected to register the fastest growth during the forecast period, with a CAGR of 7%, driven by increased elective and emergency surgeries, trauma cases, and rising hospital admissions across GCC countries and South Africa. Biologic solutions help accelerate post-surgical healing, reduce scarring, and lower the risk of infection, which is particularly important in high-volume surgical centers. For instance, the integration of allografts and growth-factor therapies in post-trauma care has demonstrated improved recovery times. The increasing number of trauma centers and specialized hospitals adopting advanced wound care protocols is further accelerating segment growth. Rising awareness among surgeons and wound care specialists about the efficacy of biologics is also boosting adoption.

- By End User

On the basis of end user, the market is segmented into hospitals, ambulatory surgical centers, burn centers, wound clinics, and others. The hospitals segment dominated the MEA wound care biologics market in 2024, accounting for the largest revenue share of 50%, due to the availability of advanced infrastructure, specialized staff, and higher treatment volumes. Hospitals in Saudi Arabia, UAE, and South Africa lead in implementing biologic therapies for chronic wounds, burns, and post-surgical recovery. The presence of well-established procurement systems and partnerships with global suppliers ensures consistent access to high-quality products. Hospitals also benefit from regulatory approvals and insurance reimbursements that support the adoption of costly biologics. Moreover, hospitals act as key centers for training and demonstrating the clinical efficacy of biologics, further reinforcing their market dominance. High patient inflow for chronic wound management drives consistent demand in this segment.

Wound clinics are expected to witness the fastest growth, with a projected CAGR of 8% from 2025 to 2032, fueled by the rising prevalence of chronic wounds, diabetes, and geriatric patients requiring outpatient care. These specialized clinics provide focused wound management, adopt advanced biologic treatments, and offer more personalized care than general hospitals. For instance, clinics in South Africa and UAE are increasingly integrating topical agents, growth factors, and skin substitutes to reduce healing times and improve patient satisfaction. The convenience, lower cost, and accessibility of wound clinics compared to hospitals make them an attractive option for patients. Expansion of private and franchise-based wound clinics is also contributing to segment growth. Training programs for clinicians on biologic use further support faster adoption in these outpatient centers.

Middle East and Africa Wound Care Biologics Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa wound care biologics market in 2024, accounting for 35.4% of market share, supported by strong healthcare expenditure, advanced clinical infrastructure, and early adoption of regenerative wound care solutions. The country also benefits from the presence of global manufacturers and distributors improving product accessibility

- Patients and clinicians in the region increasingly value the clinical efficacy, faster healing times, and reduced infection risks offered by biologic wound care products, making them preferred solutions in hospitals, burn centers, and specialty clinics

- This widespread adoption is further supported by government initiatives to improve healthcare services, investments in modern medical technologies, and collaboration with global manufacturers, establishing biologic wound care as the standard for advanced wound management in the country

The Saudi Arabia Wound Care Biologics Market Insight

The Saudi Arabia wound care biologics market captured the largest revenue share of 35.4% in 2024 within the Middle East and Africa region, fueled by rising prevalence of diabetes, chronic wounds, and advanced hospital infrastructure. Patients and healthcare providers increasingly prioritize biologic therapies for faster healing, reduced infection risk, and improved clinical outcomes. The growing adoption of regenerative therapies and skin substitutes, coupled with government initiatives under Vision 2030 to enhance healthcare quality, further propels market growth. In addition, partnerships with multinational biologics manufacturers ensure consistent product availability and innovation. Hospitals, burn centers, and specialty clinics remain the primary end users, supporting widespread utilization.

UAE Wound Care Biologics Market Insight

The UAE wound care biologics market is expected to expand at a substantial CAGR during the forecast period, primarily driven by high healthcare expenditure, increasing incidence of diabetes-related ulcers, and growing awareness of advanced wound care solutions. The demand for biologics is further supported by modern medical facilities and regulatory support for innovative treatments. Clinics and hospitals are incorporating skin substitutes, growth factors, and allografts into treatment protocols for chronic and surgical wounds. The UAE’s strategic position as a regional healthcare hub encourages both local adoption and distribution of advanced wound care products. Wound care biologics are increasingly used across private and public healthcare sectors to improve patient outcomes.

South Africa Wound Care Biologics Market Insight

The South Africa wound care biologics market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising diabetes prevalence, chronic wound cases, and increasing investments in healthcare infrastructure. Awareness among clinicians regarding advanced biologic therapies, including skin substitutes and growth factors, is accelerating adoption in hospitals and wound clinics. For instance, private hospitals are increasingly integrating allografts and topical biologics into chronic ulcer treatment protocols. Expanding public–private partnerships and improved access to imported biologic products further support market growth. Burn centers and specialized clinics are also contributing to rising usage of biologic therapies.

Egypt Wound Care Biologics Market Insight

The Egypt wound care biologics market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing incidence of traumatic wounds, surgical cases, and chronic ulcers. Hospitals and specialty clinics are adopting biologics for faster recovery, reduced infection rates, and improved patient care. Government support for modern medical technologies, along with collaborations with multinational suppliers, facilitates access to advanced wound care products. Growing awareness campaigns targeting diabetic patients and healthcare providers are further encouraging biologics adoption. Egypt’s large population base presents significant growth potential for wound care biologics.

Middle East and Africa Wound Care Biologics Market Share

The Middle East and Africa Wound Care Biologics industry is primarily led by well-established companies, including:

- Mölnlycke AB (Sweden)

- Urgo Medical (France)

- MediWound (Israel)

- Al-Rajhi Pharma (Saudi Arabia)

- AMS BioteQ (Taiwan)

- Hidramed Solutions. (U.K.)

- MLM Biologics Inc (U.S.)

- Solventum (U.S.)

- Afrigen Biologics and Vaccines (South Africa)

- AVITA Medical, Inc. (Australia)

- Dawa Life Sciences (Kenya)

- Fine Hygienic Holding (UAE)

- PAUL HARTMANN AG (Germany)

- ConvaTec Group PLC (U.K.)

- Baxter. (U.S.)

- Coloplast (Denmark)

- Cardinal Health (U.S.)

- Lohmann & Rauscher GmbH & Co. KG (Germany)

- Medtronic (Ireland)

- Zimmer Biomet. (U.S.)

What are the Recent Developments in Middle East and Africa Wound Care Biologics Market?

- In June 2025, researchers from Tel Aviv University and Sheba Tel Hashomer Medical Center developed an innovative bioengineered skin equivalent for grafting in burn victims, produced from the patient's own cells, offering more stability, robustness, and flexibility than current treatments

- In November 2022, Magle Group's proprietary product AXXO® Woundgel (also marketed as SmartGEL®), a hydrogel based on their Degradable Starch Microsphere (DSM®) polymer technology with incorporated antimicrobials, received regulatory approval in Kuwait. The product is intended for the prevention and treatment of wound infections, and the first commercial batch was delivered to its distribution partner ahead of the product launch. The approval was cited as an important step in establishing the product in the Middle East

- In June 2022, Mölnlycke Health Care AB launched its single-patient-use Negative Pressure Wound Therapy (NPWT) device, Avance Solo, in the Middle East. Although NPWT is a device, it is a key component of the advanced wound care ecosystem and is often used in conjunction with biologics to manage complex and chronic wounds, including diabetic foot ulcers. The launch increases the availability of advanced therapeutic options in the region

- In May 2022, RLS Global announced a new distribution partnership for its debriding agent, ChloraSolv, in key Middle East countries, including Qatar, Saudi Arabia, Egypt, and Oman. While ChloraSolv is a chemical-mechanical debrider and not strictly a biologic, its distribution network expansion represents an important development for advanced wound care products in the region

- In January 2022, a press release highlighted that scientists from the University of Nizwa, Oman, developed a novel bioactive wound dressing based on chitosan and alginate. This development, mentioned in the Times of Oman, focuses on creating a local, technologically advanced wound care solution claimed to improve wound healing time significantly. This represents a significant domestic scientific development within the MEA region aimed at creating bioactive products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.