Middle East And Africa Aluminum Foil Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.76 Billion

2024

2032

USD

1.89 Billion

USD

2.76 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.76 Billion | |

|

|

|

Aluminum Foil Market Analysis

Aluminum foil is used in a wide range of products worldwide, due to a greater awareness of the pollution generated by plastics in the environment. Customers can use aluminum foil in both traditional and fan-assisted ovens, providing them the choice to utilize it in both. They also protect rock samples from organic solvents by forming a seal.

Aluminum Foil Market Size

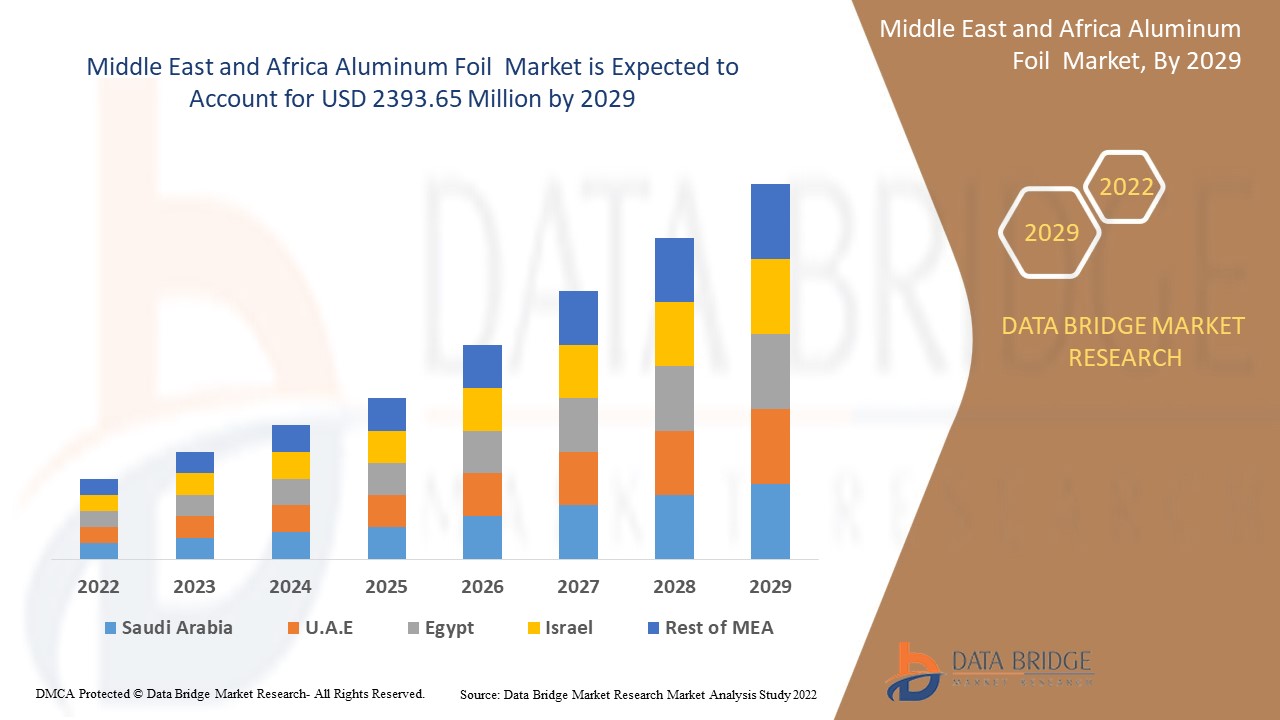

Middle East and Africa aluminum foil market size was valued at USD 1.89 billion in 2024 and is projected to reach USD 2.76 billion by 2032, with a CAGR of 4.84% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Aluminum Foil Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa. |

|

Key Market Players |

Amcor PLC (Switzerland), Constantia Flexibles (Austria), Novelis Aluminum (US), Raviraj Foils Ltd (India), Novelis Aluminum (US), Ampco metal (Switzerland), All hilal group (Saudi Arabia), Caterpack (South Africa), Alcon (Switzerland), Huyi Aluminum Co, Ltd (UAE), Cosmoplast (UAE), Symetal (US), Aluminum Foil Converters (South Africa), UNIPACK (US), Express Group (UAE), ERAMCO (Saudi Arabia) |

|

Market Opportunities |

|

Aluminum Foil Market Definition

Aluminum foil is a key component of laminates and is commonly found in food packaging. It offers a higher barrier function against moisture, oxygen, and other gases, as well as volatile smell and light, than any plastic laminate material. Aluminum foil is also used to make sterilized packaging. Aluminum foils deliver many advantages to the packaging and food industries and the consumer, including consumer-friendliness & recyclability.

Aluminum Foil Market Dynamics

Drivers

- Rising government initiatives for spreading consumer awareness

The market is being pushed by growing demand for aluminium foil from end-users such as food, pharmaceuticals, and cosmetics as a result of increased government actions to promote awareness about food safety.

- Stringent rules and regulations toward food safety

Government rules prevailing food safety and quality standards have fueled the rise of the domestic aluminium foil business, encouraging producers to develop effective packaging solutions that avoid food contamination.

- Increase the demand of E-retailing

Changing retail industry dynamics are likely to boost the demand for different retail products, therefore positively propelling the growth of the ready-to-use packaging products. Furthermore, the development of the e-retailing segment has moved consumers to online stores from retail stores. The online food industry will likely remain a key consumer market for aluminum foil products.

- Increasing demand of biologics

Development in biotechnology and the increasing demand for biologics are expected to drive the demand for aluminum foil in goods, such as powders, liquids, and tablets.

Opportunities

- Rise in product innovations

The rising number of product developments will improve the industry's growth rate by creating new market opportunities. Aluminum is recyclable material that represents a lucrative opportunity for manufacturers as rising collection and recovery rates for the product mean less production price and improved profitability.

- Demand for producing lightweight packages

Use of aluminum foil accompanied by flexible films to produce lightweight packages increasing at a reasonable pace. This is probable to offer new opportunities for the market sellers over the short term. These packages can be used in food, coffee, and fish packaging.

Restraints/ Challenges

The global market is growing enormously. However, there are some difficulties in the paths of growth. These hindrances include a lack of proper packaging techniques. Some countries are still stuck to traditional methods. Due to the changing lifestyle of people, there is still a significant part of the world that does not have enough money to buy packaged food. These are the major market restraints that will obstruct the market's growth rate.

This aluminum foil market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the aluminum foil market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Aluminum Foil Market Scope

The aluminum foil market is segmented on the basis of products, types, thickness and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Products

- Foil Wrappers

- Pouches

- Blister Packs

- Collapsible Tubes

- Trays/Containers

- Capsules

- Laminated Lids

- Foil Lined Bags

- Chocolate Foils

- Foil Round Seals

- Others

Type

- Printed

- Unprinted

Thickness

- 0.07 MM

- 0.09 MM

- 0.2 MM

- 0.4 MM

End-User

- Food

- Pharmaceuticals

- Cosmetics

- Insulation

- Electronics

- Geochemical Sampling

- Automotive Components

- Others

Aluminum Foil Market Regional Analysis

The aluminum foil market is analyzed and market size insights and trends are provided by country, products, types, thickness and end-user as referenced above.

The countries covered in the aluminum foil market report are United Arab Emirate, Saudi Arabia, Egypt, Israel, South Africa, Rest of Middle East and Africa.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aluminum Foil Market Share

The aluminum foil market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to aluminum foil market.

Aluminum Foil Market Leaders Operating in the Market Are:

- Amcor PLC (Switzerland)

- Constantia Flexibles (Austria)

- Novelis Aluminum (US)

- Raviraj Foils Ltd (India)

- Novelis Aluminum (US)

- Ampco metal (Switzerland)

- All hilal group (Saudi Arabia)

- Caterpack (South Africa)

- Alcon (Switzerland)

- Huyi Aluminum Co, Ltd (UAE)

- Cosmoplast (UAE)

- Symetal (US)

- Aluminum Foil Converters (South Africa)

- UNIPACK (US)

- Express Group (UAE)

- ERAMCO (Saudi Arabia)

Latest Developments in Aluminum Foil Market

- In November 2021, ProAmpac declared that their parent company, IFP Investments Limited had developed Irish Flexible Packaging and Fispak. These are Ireland based producers and suppliers of sustainable, flexible packaging serving the fish, dairy, bakery, meat and cheese markets in Ireland and globally

- In September 2021, Flex Films, the film manufacturing arm of flexible packaging company Uflex, launched its BOPET high barrier film F-UHB-M. The film is planned to replace aluminum foil in flexible packaging applications to resolve the tasks of the Industry that have weak integrity, material availability, high material price amongst others. Due to these alternatives in the market which can lead food production to substitute aluminum foil for packaging the products which is expected to challenge the market growth

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO (BY COUNTRY)

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICING ANALYSIS

7 SUPPLY CHAIN ANALYSIS

7.1 OVERVIEW

7.2 LOGISTIC COST SCENARIO

7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

8 CLIMATE CHANGE SCENARIO

8.1 ENVIRONMENTAL CONCERNS

8.2 INDUSTRY RESPONSE

8.3 GOVERNMENT’S ROLE

8.4 ANALYST RECOMMENDATIONS

9 PRODUCTION CAPACITY OUTLOOK

10 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY PRODUCT TYPE, 2018-2032 (USD MILLION)

10.1 OVERVIEW

10.2 FOIL WRAPPERS

10.2.1 FOOD PACKAGING

10.2.2 PHARMACEUTICAL PACKAGING

10.2.3 COSMETIC PACKAGING

10.3 POUCHES

10.3.1 STAND-UP POUCHES

10.3.2 FLAT POUCHES

10.3.3 OTHERS

10.4 BLISTER PACKS

10.4.1 PHARMACEUTICAL BLISTERS

10.4.1.1. TABLET BLISTERS

10.4.1.2. CAPSULE BLISTERS

10.4.1.3. MEDICINE STRIPS

10.4.1.4. OTHERS

10.4.2 CONSUMER GOODS BLISTERS

10.4.3 OTHERS

10.5 COLLAPSIBLE TUBES

10.5.1 COSMETIC TUBES

10.5.2 PHARMACEUTICAL TUBES

10.5.3 FOOD TUBES

10.5.4 OTHERS

10.6 TRAYS/CONTAINERS

10.6.1 FOOD TRAYS

10.6.2 MEDICAL TRAYS

10.6.3 OTHERS

10.7 CAPSULES

10.7.1 PHARMACEUTICAL CAPSULES

10.7.2 NUTRACEUTICAL CAPSULES

10.7.3 OTHERS

10.8 LAMINATED LIDS

10.8.1 FOOD LIDS

10.8.2 PHARMACEUTICAL LIDS

10.8.3 OTHERS

10.9 FOIL LINED BAGS

10.9.1 FOOD BAGS

10.9.2 ELECTRONICS BAGS

10.9.3 OTHERS

10.1 CHOCOLATE FOILS

10.10.1 WRAPPED CHOCOLATES

10.10.2 CONFECTIONERY PACKAGING

10.10.3 OTHERS

10.11 FOIL ROUND SEALS

10.11.1 FOOD SEALS

10.11.2 PHARMACEUTICAL SEALS

10.12 OTHERS

11 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY TYPE, 2018-2032 (USD MILLION)

11.1 OVERVIEW

11.2 PRINTED ALUMINUM FOIL

11.3 UNPRINTED ALUMINUM FOIL

12 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY THICKNESS, 2018-2032 (USD MILLION)

12.1 OVERVIEW

12.2 0.07 MM

12.3 0.09 MM

12.4 0.2 MM

12.5 0.4 MM

12.6 OTHERS

13 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY APPLICATION, 2018-2032 (USD MILLION)

13.1 OVERVIEW

13.2 PACKAGING

13.2.1 PACKAGING, BY CATEGORY

13.2.1.1. INDUSTRIAL

13.2.1.2. CONSUMER

13.2.2 PACKAGING, BY VERTICAL

13.2.2.1. FOOD PACKAGING

13.2.2.1.1. READY-TO-EAT MEALS

13.2.2.1.2. SNACK PACKAGING

13.2.2.1.2.1 CHIPS

13.2.2.1.2.2 POPCORN

13.2.2.1.2.3 OTHERS

13.2.2.1.3. CONFECTIONERY PACKAGING

13.2.2.1.3.1 CHOCOLATES

13.2.2.1.3.2 CANDIES

13.2.2.1.3.3 OTHERS

13.2.2.1.4. BAKERY PACKAGING

13.2.2.1.4.1 CAKES

13.2.2.1.4.2 PASTRIES

13.2.2.1.4.3 TARTS

13.2.2.1.4.4 OTHERS

13.2.2.1.5. FRESH PRODUCE PACKAGING

13.2.2.1.5.1 FRUITS

13.2.2.1.5.2 VEGETABLES

13.2.2.1.5.3 SEA FOOD

13.2.2.1.5.4 OTHERS

13.2.2.1.6. FROZEN FOOD PACKAGING

13.2.2.1.7. PROCESSED FOOD PACKAGING

13.2.2.1.8. OTHERS

13.2.2.2. PHARMACEUTICAL PACKAGING

13.2.2.2.1. BLISTER PACKS FOR TABLETS & CAPSULES

13.2.2.2.2. LIQUID MEDICINE PACKAGING (SYRUPS)

13.2.2.2.3. SACHETS FOR SINGLE-DOSE MEDICATIONS

13.2.2.2.4. OINTMENT AND CREAM TUBES

13.2.2.2.5. OTHERS

13.2.2.3. COSMETICS AND PERSONAL CARE

13.2.2.3.1. SKINCARE TUBES AND JARS

13.2.2.3.2. HAIRCARE PACKAGING

13.2.2.3.3. COSMETIC SAMPLE PACKAGING

13.2.2.3.4. TOOTHPASTE PACKAGING

13.2.2.3.5. DEODORANT STICK PACKAGING

13.2.2.3.6. OTHERS

13.2.2.4. BEVERAGE PACKAGING

13.2.2.4.1. BEVERAGE CANS

13.2.2.4.2. DRINK POUCHES

13.2.2.4.3. OTHERS

13.2.2.5. AGRICULTURAL PACKAGING

13.2.2.5.1. SEED PACKAGING

13.2.2.5.2. FERTILIZER BAGS

13.2.2.5.3. ORGANIC PRODUCT PACKAGING

13.2.2.5.4. OTHERS

13.2.2.6. ELECTRONICS PACKAGING

13.2.2.6.1. ANTISTATIC BAGS FOR COMPONENTS

13.2.2.6.2. PROTECTIVE ALUMINUM FOIL WRAPPING

13.2.2.6.3. OTHERS

13.2.2.7. AUTOMOTIVE PACKAGING

13.2.2.7.1. HEAT SHIELDS FOR ENGINES

13.2.2.7.2. SOUNDPROOFING PANELS FOR VEHICLES

13.2.2.7.3. OTHERS

13.2.2.8. OTHERS

13.3 INSULATION

13.3.1 THERMAL INSULATION

13.3.1.1. BUILDING INSULATION

13.3.1.1.1. WALLS

13.3.1.1.2. ROOFS

13.3.1.1.3. OTHERS

13.3.1.2. INDUSTRIAL INSULATION

13.3.1.2.1. PIPES

13.3.1.2.2. BOILERS

13.3.1.2.3. OTHERS

13.3.1.3. AUTOMOTIVE THERMAL INSULATION

13.3.1.4. OTHERS

13.3.2 ACOUSTIC INSULATION

13.3.2.1. SOUNDPROOFING FOR BUILDINGS

13.3.2.2. AUTOMOTIVE SOUND INSULATION

13.3.2.3. OTHERS

13.4 ELECTRONICS AND ELECTRICAL APPLICATIONS

13.4.1 ELECTRONICS INSULATION

13.4.1.1. CIRCUIT BOARDS PROTECTION

13.4.1.2. POWER CABLES INSULATION

13.4.1.3. OTHERS

13.4.2 ELECTRICAL SHIELDING

13.4.2.1. ELECTROMAGNETIC INTERFERENCE (EMI) SHIELDING

13.4.2.2. ELECTRICAL WIRING INSULATION

13.5 INDUSTRIAL APPLICATIONS

13.5.1 FOIL FOR INDUSTRIAL USES

13.5.1.1. RAW MATERIAL PACKAGING

13.5.1.2. BULK PRODUCT PACKAGING

13.5.1.3. PROTECTIVE FILM FOR MANUFACTURING

13.5.1.4. OTHERS

13.5.2 AUTOMOTIVE COMPONENTS

13.5.2.1. HEAT SHIELDS FOR EXHAUST SYSTEMS

13.5.2.2. SOUND INSULATION FOR VEHICLE INTERIORS

13.5.2.3. OTHERS

13.6 OTHERS

14 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, BY GEOGRAPHY, 2018-2032 (USD MILLION) (MILLION UNITS)

14.1 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.2 MIDDLE EAST AND AFRICA

14.2.1 SOUTH AFRICA

14.2.2 EGYPT

14.2.3 SAUDI ARABIA

14.2.4 UNITED ARAB EMIRATES

14.2.5 ISRAEL

14.2.6 QATAR

14.2.7 OMAN

14.2.8 KUWAIT

14.2.9 BAHRAIN

14.2.10 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

15.2 MERGERS AND ACQUISITIONS

15.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.4 EXPANSIONS

15.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - SWOT ANALYSIS

17 MIDDLE EAST AND AFRICA ALUMINUM FOIL MARKET - COMPANY PROFILES

17.1 AMCOR PLC

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 REVENUE ANALYSIS

17.1.4 RECENT UPDATES

17.2 CONSTANTIA FLEXIBLES

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 REVENUE ANALYSIS

17.2.4 RECENT UPDATES

17.3 ERAMCO

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 REVENUE ANALYSIS

17.3.4 RECENT UPDATES

17.4 RAVIRAJ FOILS LIMITED

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 REVENUE ANALYSIS

17.4.4 RECENT UPDATES

17.5 CATERPACK

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 REVENUE ANALYSIS

17.5.4 RECENT UPDATES

17.6 ALUMINIUM FOIL CONVERTERS (PTY) LTD

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 REVENUE ANALYSIS

17.6.4 RECENT UPDATES

17.7 SYMETAL

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 REVENUE ANALYSIS

17.7.4 RECENT UPDATES

17.8 COSMOPLAST UAE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 REVENUE ANALYSIS

17.8.4 RECENT UPDATES

17.9 EXPRESS GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 REVENUE ANALYSIS

17.9.4 RECENT UPDATES

17.1 UACJ CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 REVENUE ANALYSIS

17.10.4 RECENT UPDATES

17.11 ZHENGZHOU EMING ALUMINIUM INDUSTRY CO., LTD.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 REVENUE ANALYSIS

17.11.4 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

18 RELATED REPORTS

19 QUESTIONNAIRE

20 CONCLUSION

21 ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Aluminum Foil Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Aluminum Foil Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Aluminum Foil Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.