Middle East And Africa Autonomous Robot Market

Market Size in USD Million

CAGR :

%

USD

424.72 Million

USD

1,213.58 Million

2024

2032

USD

424.72 Million

USD

1,213.58 Million

2024

2032

| 2025 –2032 | |

| USD 424.72 Million | |

| USD 1,213.58 Million | |

|

|

|

Middle East and Africa Autonomous Robot Market Analysis

The autonomous robot market is experiencing significant growth, driven by advancements in artificial intelligence, machine learning, and sensor technologies. These robots are increasingly adopted across industries such as logistics, manufacturing, healthcare, agriculture, and defense, addressing demands for automation, operational efficiency, and safety. The rise of e-commerce, coupled with labor shortages and the need for faster and more accurate operations, has particularly boosted the use of autonomous mobile robots in warehouses and fulfillment centers. In addition, government investments in robotics research and the expansion of smart technologies are propelling the market further. However, high initial costs and integration challenges remain key barriers. The market's future is poised for strong expansion as industries continue embracing automation to meet evolving operational needs.

Autonomous Robot Market Size

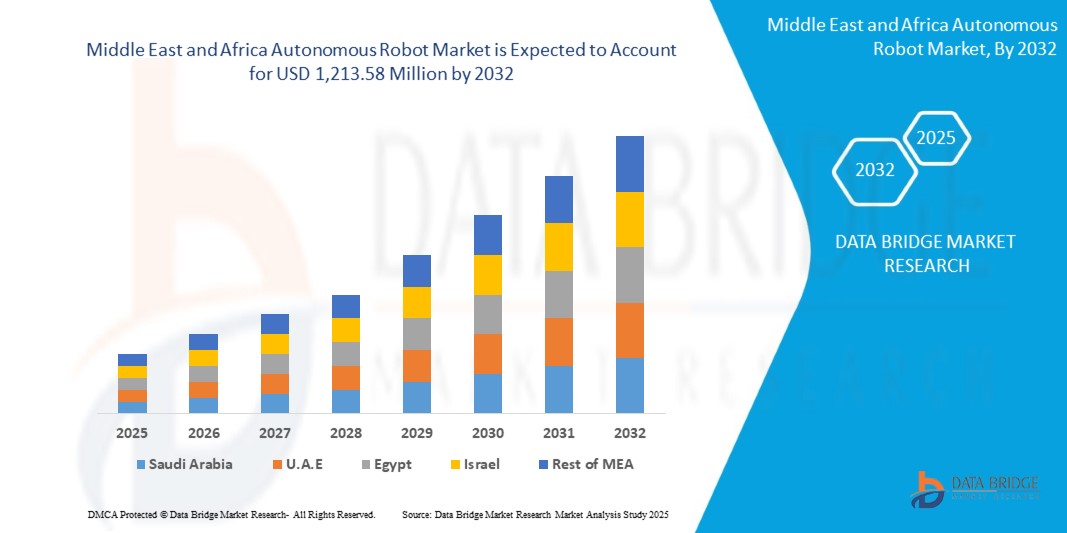

Middle East and Africa autonomous robot market size was valued at USD 424.72 million in 2024 and is projected to reach USD 1,213.58 million by 2032, with a CAGR of 14.1% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Autonomous Robot Market Trends

“Growing Adoption of Smart Manufacturing”

The growing adoption of smart manufacturing is significantly driving the expansion of the autonomous robot market. As industries seek to enhance operational efficiency, reduce costs, and improve product quality, autonomous robots are increasingly being integrated into production lines for tasks such as material handling, assembly, and inspection. These robots, equipped with advanced AI and machine learning algorithms, offer real-time data processing, adaptability, and precision, making them essential in modern manufacturing environments, this aligning with broader trends in the autonomous robot market. The demand for automation, coupled with technological advancements in robotics, is accelerating the deployment of autonomous robots, helping manufacturers meet the rising expectations for faster, more flexible, and cost-effective production processes.

Report Scope and Autonomous Robot Market Segmentation

|

Attributes |

Autonomous Robot Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Oman, Bahrain, Kuwait, Qatar, and rest of Middle East and Africa |

|

Key Market Players |

KUKA AG (Germany), ABB (Switzerland), OMRON Corporation (Japan), Geekplus Technology Co., Ltd (China), Multiway Robotics (Shenzhen) Co., Ltd. (China), and Zebra Technologies Corp. (U.S.) among others |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Autonomous Robot Market Definition

An autonomous robot is a type of robot that operates independently, performing tasks without human intervention by utilizing sensors, algorithms, and artificial intelligence to navigate and make decisions based on its environment. These robots are equipped with capabilities such as self-navigation, task execution, and learning from experiences, allowing them to adapt to new situations. Autonomous robots are used in various industries, including manufacturing for assembly lines, logistics for warehouse automation, healthcare for assisting patients, agriculture for crop monitoring, and in hazardous environments such as mining or disaster response, where human presence may be limited or unsafe.

Autonomous Robot Market Dynamics

Drivers

- Enhanced Sensor Technologies and Computer Vision

Enhanced sensor technologies and computer vision are pivotal in driving the growth of the autonomous robot market. These advancements enable robots to perceive and interact with their environments more accurately and efficiently, improving tasks such as navigation, object recognition, and obstacle avoidance. By integrating high-resolution cameras, LIDAR, infrared sensors, and advanced algorithms, autonomous robots can operate autonomously in complex, dynamic environments across various industries. As sensor and vision systems become more sophisticated, they enhance the precision and reliability of robots, leading to broader adoption in manufacturing, logistics, healthcare, and other sectors, thus expanding the market potential.

For instance,

In September 2024, Luxolis, a South Korea-based company, introduced advanced 3D vision and data tools designed to enhance the precision of industrial and collaborative robots in electronics manufacturing. Luxolis’ technologies, including the 3D Capture system with Sony’s IMX566PLR Time-of-Flight (ToF) sensor, enable sub-millimeter precision for real-time depth imaging. These innovations allow robots to perform complex tasks such as quality control and Electrostatic Discharge (ESD) testing with high accuracy and efficiency. The integration of AI with Luxolis’ 3D vision systems enhances the ability of robots to autonomously detect edges and boundaries, reducing labor costs and improving operational efficiency. These developments in enhanced sensor technologies and computer vision are pivotal in driving the growth of the autonomous robot market, as they enable robots to operate more effectively in dynamic and complex environments across industries.

- Improvements in AI and Machine Learning Capabilities

Advancements in AI and machine learning are playing a crucial role in the evolution of autonomous robots, enabling them to learn, adapt, and make decisions in real-time. These technologies allow robots to process vast amounts of data, recognize patterns, and continuously improve their performance without human intervention. With enhanced capabilities in perception, decision-making, and task execution, autonomous robots are becoming increasingly efficient and capable of handling more complex and dynamic environments. As a result, industries such as manufacturing, logistics, and healthcare are witnessing faster and more intelligent automation, driving the growth of the autonomous robot market.

For instance,

In November 2024, according to the news published by Business Standards, robotics startup Addverb announced plans to launch its next-generation humanoid robot in 2025. The robot will leverage advanced AI and machine learning algorithms to process multi-modal data from vision, audio, and touch inputs, enabling it to navigate complex environments and perform intricate tasks. Powered by self-learning algorithms, the humanoid will adapt to diverse workflows in industries such as warehouses, defense, and healthcare, while executing tasks like parcel handling, quality inspection, and disaster relief. This advancement in AI and machine learning further enhances autonomous robots’ ability to make real-time decisions and autonomously adapt to dynamic environments, driving growth in the autonomous robot market.

Opportunities

- Investment in Robotics Supported by Government Initiatives

Government initiatives supporting robotics investments are creating significant opportunities for the autonomous robot market. Many governments are offering funding, tax incentives, and grants to encourage the development and deployment of robotic technologies across industries such as manufacturing, healthcare, and logistics. These initiatives not only lower the financial barriers to adoption but also foster innovation, collaboration, and growth in the robotics sector, accelerating the widespread integration of autonomous robots in various markets. As a result, businesses can benefit from improved efficiency and cost reduction, while governments can strengthen their technological leadership and industrial competitiveness.

For instance,

In January 2023, according to the International Federation of Robotics, several government-backed initiatives globally are significantly advancing the robotics sector, creating key opportunities for the autonomous robot market. In China, the “14th Five-Year Plan” and the “Intelligent Robots” program, with a funding of USD 43.5 million, aim to make the country a leader in robot technology. Japan’s “New Robot Strategy” allocated over USD 930 million in 2022, with a focus on diverse sectors such as manufacturing, healthcare, and agriculture, positioning the country as a robotics innovation hub. South Korea’s investment of USD 172.2 million in robotics, combined with its high robot density, showcases its commitment to developing robotics as a core industry. The EU’s Horizon Europe program, with a budget of USD 94.3 billion for 2021-2027, further boosts the region’s robotics development. Germany’s High-Tech Strategy 2025 and the U.S. National Robotics Initiative (NRI-3.0), which has a funding of USD 14 million, also contribute to the growth and innovation in the robotics sector. These initiatives present substantial growth opportunities for the autonomous robot market, driving technological advancements and widespread adoption across industries.

- Deployment in Recycling, Energy Optimization, and Precision Agriculture

The deployment of autonomous robots in recycling, energy optimization, and precision agriculture presents significant opportunities for the autonomous robot market. These applications address critical challenges such as waste management, resource efficiency, and sustainable food production, driving demand for advanced robotic solutions. As industries prioritize automation to enhance productivity and meet environmental goals, the integration of robotics in these areas is expected to fuel market growth, creating avenues for innovation and expansion across diverse sectors.

For instance,

In June 2024, Glacier, a San Francisco-based company, showcased AI-enabled robots designed to enhance recycling efficiency by automating waste sorting. These robots use computer vision and analytics to identify and sort recyclable materials with high precision, preventing over 10 million items annually from ending up in landfills. Such advancements highlight the transformative role of autonomous robots in recycling, energy optimization, and precision agriculture, underscoring their potential to drive sustainability and create significant growth opportunities in the autonomous robot market.

Restraints/Challenges

- Shortage of Qualified Robotics Engineers

The autonomous robot market faces a significant challenge due to the shortage of qualified robotics engineers. As the demand for advanced robotic solutions in various industries grows, the limited availability of skilled professionals hampers the development and deployment of cutting-edge technologies. This gap in expertise can delay project timelines, limit innovation, and hinder the broader adoption of autonomous robots across sectors. Addressing this shortage is crucial for unlocking the full potential of the market and meeting the increasing demand for autonomous

For instance,

In May 2023, according to the article published by the Mark Allen Group, the shortage of qualified robotics engineers has significantly impacted the autonomous robot market, hindering the pace of innovation and deployment. As industries face a scarcity of skilled professionals, the development and integration of autonomous robots have slowed, especially in sectors such as manufacturing and healthcare where the need for expertise is crucial. This talent gap has led to delays in robot programming, maintenance, and system optimization, ultimately limiting the full potential of autonomous robotics. However, efforts to address this challenge, including upskilling programs and partnerships with educational institutions, are helping to alleviate the strain and support market growth in the long run.

- Compatibility with Human Interaction

Compatibility with human interaction presents a significant challenge for the autonomous robot market. While robots are increasingly integrated into various sectors, their ability to work alongside humans seamlessly and safely remains a key hurdle. Ensuring that robots can understand and respond to human actions, emotions, and decisions in real-time without causing accidents or discomfort requires sophisticated AI, sensors, and intuitive interfaces. As robots become more involved in sensitive environments, such as healthcare or customer service, the complexity of these human-robot interactions increases, demanding further advancements in robot design and programming to ensure compatibility and efficiency in real-world applications.

For instance,

In November 2024, according to an article published by Loyola Marymount University, Professor Xiangyi Cheng’s research focuses on enhancing human-robot interaction through robotics, augmented reality, and AI technologies, particularly in healthcare and education. Cheng aims to develop solutions that improve these sectors by leveraging technologies such as computer vision and machine learning. Her work highlights the challenges of achieving seamless compatibility between robots and human interaction, an area crucial for the growth of the autonomous robot market. As robots become more integrated into daily life, ensuring they can effectively communicate and collaborate with humans remains a significant hurdle for widespread adoption and market expansion.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Autonomous Robot Market Scope

The market is segmented on the basis of type, mode of operations, offering, application, and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Goods-to-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

Mode of Operations

- Semi-Autonomous

- Fully-Autonomous

Offering

- Hardware

- Type

- Sensor

- Actuator

- Power Supply

- Control System

- Others

- Type

- Software

- Services

Application

- Warehouse Fleet Management

- Sorting

- Pick And Place

- Tugging

- Others

End User

- Industrial & Manufacturing

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- Warehousing & Logistics

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- E-Commerce

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- Healthcare

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- Agriculture

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- Military & Defense

- Type

- Goods-To-Person Picking Robots

- Self-Driving Forklifts

- Unmanned Aerial Vehicle

- Autonomous Inventory Robots

- Type

- Others

Autonomous Robot Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, type, mode of operations, offering, application and end user as referenced above.

The countries covered in the market are U.A.E., Saudi Arabia, South Africa, Egypt, Israel, Oman, Bahrain, Kuwait, Qatar, and rest of Middle East and Africa.

Saudi Arabia is anticipated to lead the Middle East and Africa autonomous robot market. This growth can be attributed to several factors, including rapid industrialization, increasing adoption of automation across various sectors, and a rising emphasis on workplace safety.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Autonomous Robot Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Autonomous Robot Market Leaders Operating in the Market Are:

- KUKA AG (Germany)

- ABB (Switzerland)

- OMRON Corporation (Japan)

- Geekplus Technology Co., Ltd (China)

- Multiway Robotics (Shenzhen) Co., Ltd. (China)

- Zebra Technologies Corp. (U.S.)

Latest Developments in Autonomous Robot Market

- In March 2020, KUKA secured a major contract to plan and supply a fully automated battery pack production line. The line, set to manufacture battery systems for premium electric vehicles starting in 2021, incorporates over fifty KUKA industrial robots for various tasks, from assembly to quality control. This acquisition strengthens KUKA’s position in the electro-mobility sector, showcasing its expertise in battery production automation. It will also support growth in KUKA’s robotics sector by enhancing capabilities in high-demand, precision manufacturing and digital factory technologies

- In April 2024, OMRON Corporation, Neura Robotics and Safety Technologies Inc. have formed a strategic partnership to advance cognitive robotics in manufacturing. This collaboration integrates Neura’s AI-driven cognitive robotics with OMRON’s global automation expertise to enhance efficiency, flexibility, and safety in factory automation. Together, they aim to revolutionize the industry by enabling robots to adapt, learn, and perform complex tasks, setting new standards in industrial automation

- In October 2024, ABB has partnered with US start-up Molg to create robotic micro factories for automated disassembly and recycling of data center e-waste. This collaboration addresses rising e-waste challenges by enabling responsible disposal, recovery of rare materials, and circularity in the electronics sector. ABB's robotics division supports innovation by advancing automation solutions that enhance efficiency, sustainability, and worker safety in industrial processes

- In November 2024, Geekplus Technology Co., Ltd. and Intel unveiled the Vision Only Robot Solution, the first-ever vision-only autonomous mobile robot (AMR) powered by Intel's Visual Navigation Modules to advance smart logistics. This innovation strengthens Geekplus's leadership in vision-based AMR technology, improving navigation, obstacle avoidance, and adaptability in complex settings, while enhancing efficiency and accuracy in autonomous warehouse and logistics processes

- In March 2024, Teradyne Inc. has teamed up with NVIDIA to incorporate AI technology into its robots, including Universal Robots' cobots and the MiR1200 Pallet Jack. This partnership boosts the robots' capabilities with accelerated computing, enhancing path planning efficiency and enabling autonomous pallet handling in complex environments. By leveraging NVIDIA's advanced AI solutions, Teradyne Robotics improves the performance and autonomy of its robots, opening up new application possibilities, particularly in automation and material handling. This collaboration strengthens Teradyne's position as a leader in the AI-driven robotics sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 USE CASE ANALYSIS

4.1.1 INDUSTRIAL & MANUFACTURING

4.1.2 E-COMMERCE

4.1.3 MILITARY & DEFENSE

4.1.4 WAREHOUSING & LOGISTICS

4.1.5 HEALTHCARE

4.1.6 AGRICULTURE

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGY TREND

4.3.1 AI AND MACHINE LEARNING INTEGRATION

4.3.2 ADVANCED SENSOR TECHNOLOGY

4.3.3 BATTERY AND POWER INNOVATIONS

4.4 INVESTMENT VS ADOPTION MODEL

4.5 PORTERS FIVE FORCES

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF SMART MANUFACTURING

5.1.2 ENHANCED SENSOR TECHNOLOGIES AND COMPUTER VISION

5.1.3 IMPROVEMENTS IN AI AND MACHINE LEARNING CAPABILITIES

5.1.4 REDUCTION IN HUMAN ERROR-RELATED COSTS

5.2 RESTRAINTS

5.2.1 SIGNIFICANT UPFRONT COSTS AND ROBOT DEPLOYMENT

5.2.2 DATA PRIVACY AND SECURITY CONCERNS

5.3 OPPORTUNITIES

5.3.1 INVESTMENT IN ROBOTICS SUPPORTED BY GOVERNMENT INITIATIVES

5.3.2 DEPLOYMENT IN RECYCLING, ENERGY OPTIMIZATION, AND PRECISION AGRICULTURE

5.4 CHALLENGES

5.4.1 SHORTAGE OF QUALIFIED ROBOTICS ENGINEERS

5.4.2 COMPATIBILITY WITH HUMAN INTERACTION

6 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE

6.1 OVERVIEW

6.2 GOODS-TO-PERSON PICKING ROBOTS

6.3 SELF-DRIVING FORKLIFTS

6.4 UNMANNED AERIAL VEHICLE

6.5 AUTONOMOUS INVENTORY ROBOTS

7 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS

7.1 OVERVIEW

7.2 SEMI-AUTONOMOUS

7.3 FULLY-AUTONOMOUS

8 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY OFFERING

8.1 OVERVIEW

8.2 HARDWARE

8.2.1 HARDWARE, BY TYPE

8.2.1.1 SENSOR

8.2.1.2 ACTUATOR

8.2.1.3 POWER SUPPLY

8.2.1.4 CONTROL SYSTEM

8.2.1.5 OTHER

8.3 SOFTWARE

8.4 SERVICE

9 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 WAREHOUSE FLEET MANAGEMENT

9.3 SORTING

9.4 PICK AND PLACE

9.5 TUGGING

9.6 OTHER

10 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY END-USER

10.1 OVERVIEW

10.2 INDUSTRIAL & MANUFACTURING

10.2.1 GOODS-TO-PERSON PICKING ROBOTS

10.2.2 SELF-DRIVING FORKLIFTS

10.2.3 UNMANNED AERIAL VEHICLE

10.2.4 AUTONOMOUS INVENTORY ROBOTS

10.3 WAREHOUSING & LOGISTICS

10.3.1 GOODS-TO-PERSON PICKING ROBOTS

10.3.2 SELF-DRIVING FORKLIFTS

10.3.3 UNMANNED AERIAL VEHICLE

10.3.4 AUTONOMOUS INVENTORY ROBOTS

10.4 E-COMMERCE

10.4.1 GOODS-TO-PERSON PICKING ROBOTS

10.4.2 SELF-DRIVING FORKLIFTS

10.4.3 UNMANNED AERIAL VEHICLE

10.4.4 AUTONOMOUS INVENTORY ROBOTS

10.5 HEALTHCARE

10.5.1 GOODS-TO-PERSON PICKING ROBOTS

10.5.2 SELF-DRIVING FORKLIFTS

10.5.3 UNMANNED AERIAL VEHICLE

10.5.4 AUTONOMOUS INVENTORY ROBOTS

10.6 AGRICULTURE

10.6.1 GOODS-TO-PERSON PICKING ROBOTS

10.6.2 SELF-DRIVING FORKLIFTS

10.6.3 UNMANNED AERIAL VEHICLE

10.6.4 AUTONOMOUS INVENTORY ROBOTS

10.7 MILITARY & DEFENSE

10.7.1 GOODS-TO-PERSON PICKING ROBOTS

10.7.2 SELF-DRIVING FORKLIFTS

10.7.3 UNMANNED AERIAL VEHICLE

10.7.4 AUTONOMOUS INVENTORY ROBOTS

10.8 OTHER

11 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY REGION

11.1 MIDDLE EAST AND AFRICA

11.1.1 SAUDI ARABIA

11.1.2 U.A.E.

11.1.3 SOUTH AFRICA

11.1.4 EGYPT

11.1.5 ISRAEL

11.1.6 OMAN

11.1.7 BAHRAIN

11.1.8 KUWAIT

11.1.9 QATAR

11.1.10 REST OF MIDDLE EAST AND AFRICA

12 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 KUKA AG

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 OMRON CORPORATION

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 ABB

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 GEEKPLUS TECHNOLOGY CO., LTD.

14.4.1 COMPANY SNAPSHOT

14.4.2 COMPANY SHARE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENTS

14.5 TERADYNE INC.

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 AETHON, INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 CLEARPATH ROBOTICS, INC. (A ROCKWELL AUTOMATION COMPANY)

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 FETCH ROBOTICS, INC (ZEBRA TECHNOLOGIES CORP.)

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 GREYORANGE INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 HARVEST AUTOMATION

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 LOCUS ROBOTICS

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 MULTIWAY ROBOTICS (SHENZHEN) CO., LTD.

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 ROBOTNIK

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 SEEGRID

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 SESTO ROBOTICS

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 REGULATORY FRAMEWORKS

TABLE 2 OBSTACLES AND DISINCENTIVES TO ROBOTICS TECHNOLOGIES ADOPTION

TABLE 3 ROBOTS PRICE BREAKDOWN FOR DEVELOPMENT 2024

TABLE 4 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 MIDDLE EAST AND AFRICA GOODS-TO-PERSON PICKING ROBOTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA SELF-DRIVING FORKLIFTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA UNMANNED AERIAL VEHICLE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA AUTONOMOUS INVENTORY ROBOTS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA SEMI-AUTONOMOUS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA FULLY-AUTONOMOUS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032, (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY, 2018-2032, (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA SOFTWARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA SERVICE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA WAREHOUSE FLEET MANAGEMENT IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SORTING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PICK AND PLACE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA TUGGING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA OTHERS FLEET MANAGEMENT IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 MIDDLE EAST AND AFRICA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA OTHERS IN AUTONOMOUS ROBOT MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 MIDDLE EAST AND AFRICA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 MIDDLE EAST AND AFRICA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 SAUDI ARABIA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 SAUDI ARABIA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 52 SAUDI ARABIA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 53 SAUDI ARABIA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 SAUDI ARABIA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 55 SAUDI ARABIA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 56 SAUDI ARABIA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 SAUDI ARABIA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 SAUDI ARABIA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 SAUDI ARABIA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 SAUDI ARABIA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 SAUDI ARABIA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 U.A.E. AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 U.A.E. AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 64 U.A.E. AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 65 U.A.E. HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 U.A.E. AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 U.A.E. AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 68 U.A.E. INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 U.A.E. WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 U.A.E. E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 U.A.E. HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 U.A.E. AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.A.E. MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 SOUTH AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 SOUTH AFRICA AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 76 SOUTH AFRICA AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 77 SOUTH AFRICA HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 SOUTH AFRICA AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 79 SOUTH AFRICA AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 SOUTH AFRICA INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 81 SOUTH AFRICA WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 SOUTH AFRICA E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 SOUTH AFRICA HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 SOUTH AFRICA AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 SOUTH AFRICA MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 EGYPT AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 EGYPT AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 88 EGYPT AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 89 EGYPT HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 EGYPT AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 91 EGYPT AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 92 EGYPT INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 EGYPT WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 EGYPT E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 EGYPT HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 EGYPT AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 EGYPT MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 ISRAEL AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 ISRAEL AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 100 ISRAEL AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 101 ISRAEL HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 ISRAEL AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 103 ISRAEL AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 104 ISRAEL INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 ISRAEL WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 ISRAEL E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 ISRAEL HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 ISRAEL AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 ISRAEL MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 OMAN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 OMAN AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 112 OMAN AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 113 OMAN HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 OMAN AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 115 OMAN AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 116 OMAN INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 OMAN WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 OMAN E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 OMAN HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 OMAN AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 OMAN MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 BAHRAIN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 BAHRAIN AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 124 BAHRAIN AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 125 BAHRAIN HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 BAHRAIN AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 127 BAHRAIN AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 128 BAHRAIN INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 BAHRAIN WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 BAHRAIN E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 BAHRAIN HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 BAHRAIN AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 BAHRAIN MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 KUWAIT AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 KUWAIT AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 136 KUWAIT AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 137 KUWAIT HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 KUWAIT AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 139 KUWAIT AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 140 KUWAIT INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 KUWAIT WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 KUWAIT E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 KUWAIT HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 KUWAIT AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 KUWAIT MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 QATAR AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 QATAR AUTONOMOUS ROBOT MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 148 QATAR AUTONOMOUS ROBOT MARKET, BY OFFERING, 2018-2032 (USD THOUSAND)

TABLE 149 QATAR HARDWARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 QATAR AUTONOMOUS ROBOT MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 151 QATAR AUTONOMOUS ROBOT MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 152 QATAR INDUSTRIAL & MANUFACTURING IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 QATAR WAREHOUSING & LOGISTICS IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 QATAR E-COMMERCE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 155 QATAR HEALTHCARE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 156 QATAR AGRICULTURE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 157 QATAR MILITARY & DEFENSE IN AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 REST OF MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: MULTIVARIATE MODELING

FIGURE 10 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: TYPE TIMELINE CURVE

FIGURE 11 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: MARKET END USER COVERAGE GRID

FIGURE 12 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: SEGMENTATION

FIGURE 13 FOUR SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET, BY TYPE (2024)

FIGURE 14 EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWING ADOPTION OF SMART MANUFACTURING IS EXPECTED TO DRIVE THE MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 GOODS-TO-PERSON PICKING ROBOTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET IN 2025 & 2032

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET

FIGURE 19 ADOPTION OF ROBOTICS IN ACROSS SECTORS IN (%)

FIGURE 20 ROBOTICS R&D PROGRAMS OFFICIALLY DRIVEN BY GOVERNMENTS IN MILLIONS

FIGURE 21 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: BY TYPE, 2024

FIGURE 22 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: BY MODE OF OPERATIONS, 2024

FIGURE 23 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: BY OFFERING, 2024

FIGURE 24 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: BY APPLICATION, 2024

FIGURE 25 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: BY END-USER, 2024

FIGURE 26 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: SNAPSHOT (2024)

FIGURE 27 MIDDLE EAST AND AFRICA AUTONOMOUS ROBOT MARKET: COMPANY SHARE 2024 (%)

Middle East And Africa Autonomous Robot Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Autonomous Robot Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Autonomous Robot Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.