Market Analysis and Insights

Brazing fillers for joining applications are essential for manufacturing and designing advanced materials. Several types of brazing fillers have been developed in recent decades to join similar or different engineering materials. Important parts of automotive and aircraft components, including steel, are often joined by brazing. In addition, ceramic components in microwave devices and circuits have been joined with a high level of integration in microelectronic devices.

Similarly, in the medical field, metallic implants have been brazed to ceramic dental crowns. These advances have made human life more convenient. However, in brazing, there are certain issues with intermetallic compound (IMC) formation and residual stresses in joints at high temperatures.

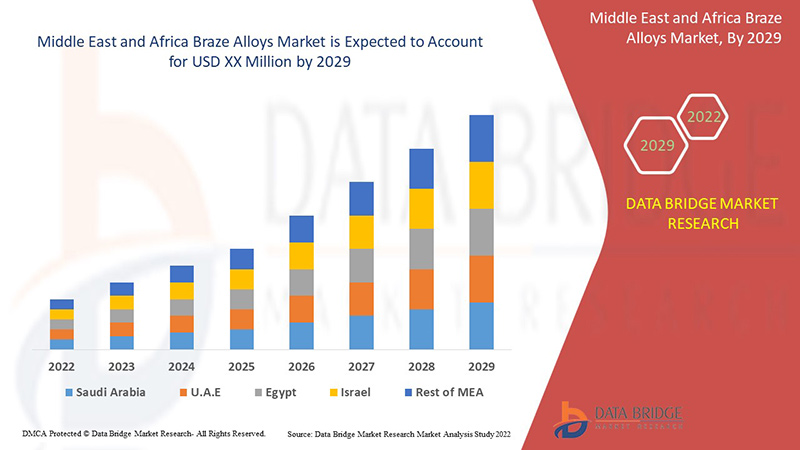

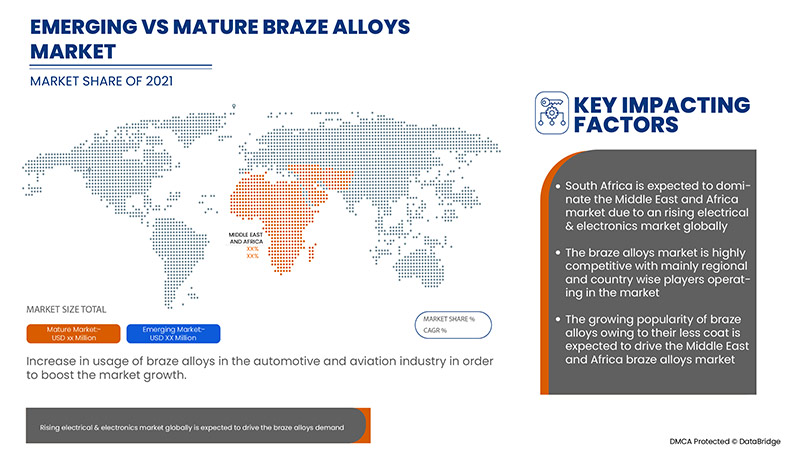

Increasing use of braze alloys coupled with growing application of braze alloys in automotive, aerospace and defense, electronics and electrical, building and construction has surged its demand. Data Bridge Market Research analyses that the Middle East Africa braze alloys market will grow at a CAGR of 4.0% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2020 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Tons, Pricing in USD |

|

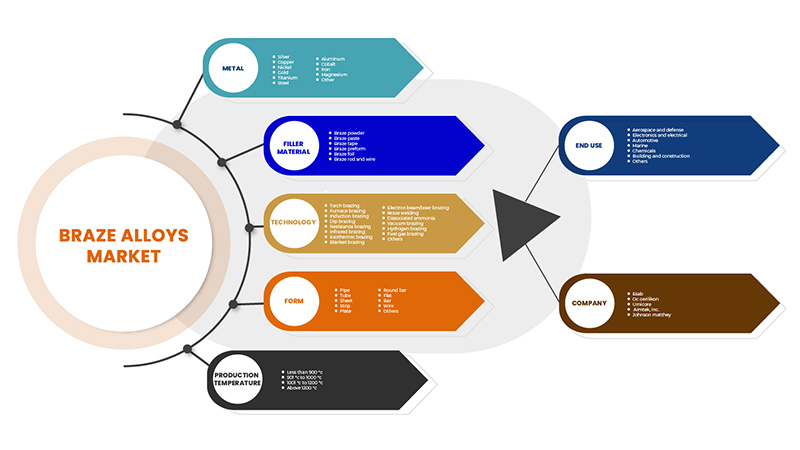

Segments Covered |

By Metal (Nickel, Cobalt, Silver, Gold, Aluminum, Copper, Steel, Iron, Magnesium, Titanium and Others), Filler Material (Braze Powder, Braze Paste, Braze Tape, Braze Preform, Braze Foil and Braze Rod and Wire), Technology (Torch Brazing, Furnace Brazing, Induction Brazing, Dip Brazing, Resistance Brazing, Infrared Brazing, Exothermic Brazing, Blanket Brazing, Electron Beam/Laser Brazing, Braze Welding, Dissociated Ammonia, Vacuum Brazing, Hydrogen Brazing, Fuel Gas Brazing and Others), Form (Pipe, Tube, Sheet, Strip, Plate, Round Bar, Flat, Bar, Wire and Others), Production Temperature (Less than 900 °C, 901 °C to 1000 °C, 1001 °C to 1200 °C and Above 1200 °C), End Use (Aerospace and Defense, Electronics and Electrical, Automotive, Marine, Chemicals, Building and Construction and Others) |

|

Countries Covered |

South Africa, Israel, Egypt, Saudi Arabia, U.A.E., and rest of Middle East and Africa. |

|

Market Players Covered |

Johnson Matthey, OC Oerlikon Management AG, Sulzer Ltd, Belmont Metals, Harris Products Group, Morgan Advanced Materials and its affiliates, Aimtek, Inc., Prince Izant Company, Lucas-Milhaupt, Inc., Esprix Technologies, Indium Corporation, AMETEK. Inc., TSI Technologies, ESAB and Umicore, Indian Solder and Brazing Alloys, SAXONIA Edelmetalle GmbH, Saru Silver Alloy Private Limited., Cupro Alloys Corporation., KRANTI METALLURGY PVT LTD., S. K. METAL among others. |

Middle East Africa Braze Alloys Market Dynamics

Drivers

- Increase in usage of braze alloys in the automotive and aviation industry

Braze alloys are witnessing significant demand from the automotive industry, where they are used condenser and evaporator connections for air-conditioning systems, fuel injection pipes, and brake linings. The automotive and aviation industry has been striving to develop lightweight automotive components.

- Increasing preference toward brazing process over soldering, and welding, among others

Brazing is a metal-joining process in which two or more metal items are joined together by melting and flowing a filler metal into the joint. It is widely used to join metal conductors in high through to low voltage electrical earthing systems. This process is currently used in the U.K., Ireland, and among other countries worldwide, to create a permanent joint of two conductive metals, usually copper or steel.

Opportunities

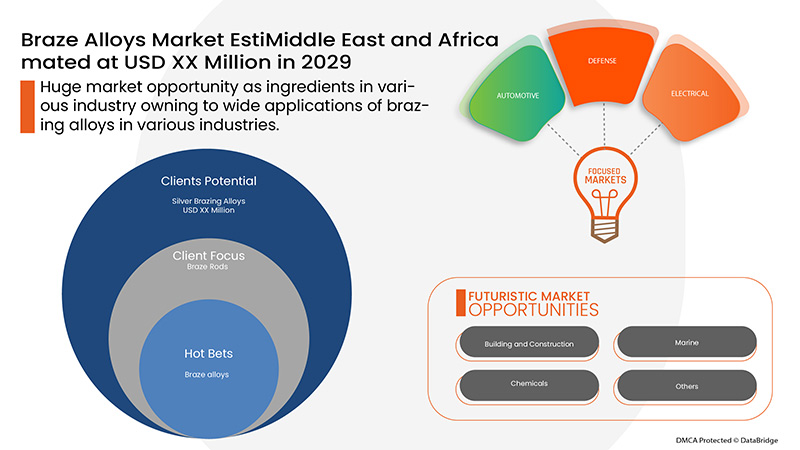

- Wide applications of brazing alloys in various industries

Brazing is a widely used joining process because it can join almost all metals except aluminum and magnesium. It is used for electrical components, pipe fittings among others. Metals having uneven thickness can be joined by brazing. Brazing is used to bond a variety of metals, dissimilar metals, and even non-metals. It produces clean joints which are cost-effective. In addition, brazing alloys are mostly corrosion-resistant and preserves metallurgical characteristics of the material as low temperatures of brazing alloys help to minimize thermal distortion. Furthermore, brazing alloys provide excellent sealing as compared to welding and other processes.

Restraints/Challenges

- Fluctuating prices of braze metals

The prices of raw materials are currently fluctuating at unprecedented levels both in the United States and elsewhere in the world. Since pricing is affected by the tightening of supply markets. Beyond supply and demand, the other factor has been influencing short-run fluctuations in the prices of raw materials. Investors can suddenly move away from what they perceive to be riskier bets, including stocks and commodities.

This braze alloys market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on braze alloys market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Post COVID-19 Impact on Middle East Africa Braze Alloys Market

The COVID-19 pandemic has highly disrupted the supply chain of raw materials used to manufacture braze alloys and the disturbance in the supply chain of end-user industries. It was attributed to the lack of resources and transportation, which led to lower access, delayed stock, and supplies of raw materials products. Additionally, many governments restricted the movement of goods across the countries, and the entire supply chain was distorted. Due to the disrupted supply chain, transportation of raw materials has been interrupted, stalling production. Similarly, inflated prices and halt on braze alloys production have resulted in unmet demands for braze alloys in various end-users such as constructions, electronics, aerospace and defense. COVID-19 pandemic also has adverse effects on end end-user industries of braze brazing alloys. It has negatively impacted the construction industry.

Recent Developments

- In August 2021, Indium Corporation launched New Versatile Solder Paste. Indium12.8HF is a versatile paste engineered to deliver exceptional jetting and micro dispensing performance on a variety of systems. This launch will help company increase customer base.

- In June 2021, OC Oerlikon Management AG acquired Coeurdor, a leading full-service provider of components for the fast-growing luxury goods industry. Coeurdor is a well-established brand and full-service provider for the design, manufacturing and coating of metallic components to world-leading luxury brands to offer a foothold in the luxury goods Thus, the acquisition will help to increase the revenue of the company.

- In April 2020, Johnson Matthey partnered with Stena Recycling Group for creating a sustainable, circular solution for lithium-ion battery recycling to develop an efficient value chain for recycling of lithium-ion batteries and cell manufacturing materials. This development will help the company to grow rapidly in the coming years.

Middle East Africa Braze Alloys Market Scope

The braze alloys market is segmented metal, filler material, technology, product form, production temperature and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Metal

- Silver

- Copper

- Nickel

- Gold

- Titanium

- Steel

- Aluminum

- Cobalt

- Iron

- Magnesium

- Other

On the basis of metal, the Middle East Africa braze alloys market is segmented into silver, copper, nickel, gold, titanium, steel, aluminum, cobalt, iron, magnesium and other.

Filler Material

- Braze Paste

- Braze Rod and Wire

- Braze Powder

- Braze Preform

- Braze Foil

- Braze Tape

On the basis of filler material, the Middle East Africa braze alloys market is segmented into braze paste, braze rod and wire, braze powder, braze preform, braze foil and braze tape.

Technology

- Torch Brazing

- Furnace Brazing

- Resistance Brazing

- Induction Brazing

- Dip Brazing

- Infrared Brazing

- Vacuum Brazing

- Electron Beam/Laser Brazing

- Exothermic Brazing

- Braze Welding

- Hydrogen Brazing

- Blanket Brazing

- Dissociated Ammonia

- Fuel Gas Brazing

- Others

On the basis of technology, the Middle East Africa braze alloys market is segmented into torch brazing, furnace brazing, resistance brazing, induction brazing, dip brazing, infrared brazing, vacuum brazing, electron beam/laser brazing, exothermic brazing, braze welding, hydrogen brazing, blanket brazing, dissociated ammonia, fuel gas brazing and others.

Form

- Wire

- Strip

- Bar

- Pipe

- Tube

- Flat

- Sheet

- Plate

- Round Bar

- Others

On the basis of form, the Middle East Africa braze alloys market is segmented into wire, strip, bar, pipe, tube, flat, sheet, plate, round bar and others.

Production Temperature

- 1001 °C to 1200 °C

- Less Than 900 °C

- 901 °C to 1000 °C

- Above 1200 °C

On the basis of production temperature, the Middle East Africa braze alloys market is segmented into 1001°C to 1200°C, less than 900°C, 901°C to 1000°C and above 1200°C.

End Use

- Automotive

- Aerospace and Defense

- Electronics and Electrical

- Building and Construction

- Chemicals

- Marine

- Others

On the basis of end use, the Middle East Africa braze alloy market is segmented into automotive, aerospace and defense, electronics and electrical, building and construction, chemicals, marine and others.

Middle East Africa Braze Alloys Market Regional Analysis/Insights

The braze alloys market is analysed and market size insights and trends are provided by country, metal, filler material, technology, product form, production temperature and end use.

The countries covered in the Middle East Africa braze alloys market report are South Africa, Saudi Arabia, Israel, Egypt, U.AE. and rest of Middle East and Africa.

South Africa is dominating the braze Middle East Africa alloys market during the forecast period due to increase in use of braze alloys in automatic sector.

The country section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Middle East Africa brands and their challenges faced due to high competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Braze Alloys Market Share Analysis

The braze Middle East Africa alloys market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, GCC presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on braze alloys market.

Some of the major players operating in the braze alloys market are Johnson Matthey, OC Oerlikon Management AG, Sulzer Ltd, Belmont Metals, Harris Products Group, Morgan Advanced Materials and its affiliates, Aimtek, Inc., Prince Izant Company, Lucas-Milhaupt, Inc., Esprix Technologies, Indium Corporation, AMETEK. Inc., TSI Technologies, ESAB and Umicore, Indian Solder and Brazing Alloys, SAXONIA Edelmetalle GmbH, Saru Silver Alloy Private Limited., Cupro Alloys Corporation., KRANTI METALLURGY PVT LTD., S. K. METAL among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, MEA Vs Regional and Vendor Share Analysis. Please request analyst call in case of further inquiry.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 METAL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET- VENDOR SELECTION CRITERIA

4.2 TECHNOLOGICAL ADVANCEMENT IN BRAZE ALLOYS MARKET

4.3 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: SUPPLY CHAIN ANALYSIS

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 MANUFACTURING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: REGULATIONS

4.4.1 REGULATIONS BY U.K. GOVERNMENT

4.4.2 FDA REGULATIONS

4.4.3 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS

4.4.4 ISO STANDARDS

4.5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET-RAW MATERIAL PRODUCTION COVERAGE

4.6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, PORTER’S FIVE FORCES ANALYSIS

4.6.1 BUYER POWER

4.6.2 SUPPLIER POWER

4.6.3 THE THREAT OF NEW ENTRANTS

4.6.4 THREAT OF SUBSTITUTES

4.6.5 RIVALRY AMONG EXISTING COMPETITORS

4.7 PESTEL ANALYSIS: MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

4.7.1 POLITICS:

4.7.2 ECONOMY:

4.7.3 SOCIAL:

4.7.4 TECHNOLOGY:

4.7.5 ENVIRONMENTAL:

4.7.6 LEGAL:

4.8 CLIMATE CHANGE-

4.9 ALLOY PRICES AFFECT MARKET GROWTH BY REGIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION INDUSTRY

5.1.2 INCREASING PREFERENCE TOWARD BRAZING PROCESS OVER SOLDERING, AND WELDING, AMONG OTHERS

5.1.3 INCREASING DEMAND FOR COPPER & ALUMINUM BRAZES ALLOYS

5.1.4 RISING ELECTRICAL & ELECTRONICS MARKET MIDDLE EAST & AFRICALY

5.2 RESTRAINTS

5.2.1 FLUCTUATING PRICES OF BRAZE METALS

5.2.2 COMPLEXITIES IN THE MANUFACTURING PROCESS OF BRAZE ALLOYS

5.2.3 AVAILABILITY OF SUBSTITUTES FOR BRAZE ALLOYS

5.3 OPPORTUNITIES

5.3.1 WIDE APPLICATIONS OF BRAZING ALLOYS IN VARIOUS INDUSTRIES

5.3.2 COST-EFFECTIVENESS OF BRAZE ALLOYS

5.3.3 RISING NUMBER OF INNOVATIONS IN THE BRAZING INDUSTRY

5.3.4 STRATEGIC DECISIONS BY KEY PLAYERS

5.4 CHALLENGES

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO COVID -19

5.4.2 ADVERSE EFFECT OF BRAZING ON THE ENVIRONMENT

6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL

6.1 OVERVIEW

6.2 SILVER

6.3 COPPER

6.4 NICKEL

6.5 GOLD

6.6 TITANIUM

6.7 STEEL

6.7.1 STAINLESS STEEL

6.7.2 CARBON STEEL

6.7.3 LOW ALLOY STEEL

6.7.4 OTHERS

6.8 ALUMINUM

6.9 COBALT

6.1 IRON

6.11 MAGNESIUM

6.12 OTHERS

7 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL

7.1 OVERVIEW

7.2 BRAZE PASTE

7.3 BRAZE ROD AND WIRE

7.4 BRAZE POWDER

7.5 BRAZE PREFORM

7.6 BRAZE FOIL

7.7 BRAZE TAPE

8 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY

8.1 OVERVIEW

8.2 TORCH BRAZING

8.3 FURNACE BRAZING

8.4 RESISTANCE BRAZING

8.5 INDUCTION BRAZING

8.6 DIP BRAZING

8.7 INFRARED BRAZING

8.8 VACUUM BRAZING

8.9 ELECTRON BEAM/LASER BRAZING

8.1 EXOTHERMIC BRAZING

8.11 BRAZE WELDING

8.12 HYDROGEN BRAZING

8.13 BLANKET BRAZING

8.14 DISSOCIATED AMMONIA

8.15 FUEL GAS BRAZING

8.16 OTHERS

9 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FORM

9.1 OVERVIEW

9.2 WIRE

9.3 STRIP

9.4 BAR

9.5 PIPE

9.6 TUBE

9.7 FLAT

9.8 SHEET

9.9 PLATE

9.1 ROUND BAR

9.11 OTHERS

10 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE

10.1 OVERVIEW

10.2 1001 °C TO 1200 °C

10.3 LESS THAN 900 °C

10.4 901 °C TO 1000 °C

10.5 ABOVE 1200 °C

11 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY END USER

11.1 OVERVIEW

11.2 AUTOMOTIVE

11.2.1 SILVER

11.2.2 COPPER

11.2.3 NICKEL

11.2.4 GOLD

11.2.5 TITANIUM

11.2.6 STEEL

11.2.7 ALUMINUM

11.2.8 COBALT

11.2.9 IRON

11.2.10 MAGNESIUM

11.2.11 OTHERS

11.3 AEROSPACE AND DEFENSE

11.3.1 SILVER

11.3.2 COPPER

11.3.3 NICKEL

11.3.4 GOLD

11.3.5 TITANIUM

11.3.6 STEEL

11.3.7 ALUMINUM

11.3.8 COBALT

11.3.9 IRON

11.3.10 MAGNESIUM

11.3.11 OTHERS

11.4 ELECTRONICS AND ELECTRICAL

11.4.1 SILVER

11.4.2 COPPER

11.4.3 NICKEL

11.4.4 GOLD

11.4.5 TITANIUM

11.4.6 STEEL

11.4.7 ALUMINUM

11.4.8 COBALT

11.4.9 IRON

11.4.10 MAGNESIUM

11.4.11 OTHERS

11.5 BUILDING AND CONSTRUCTION

11.5.1 SILVER

11.5.2 COPPER

11.5.3 NICKEL

11.5.4 GOLD

11.5.5 TITANIUM

11.5.6 STEEL

11.5.7 ALUMINUM

11.5.8 COBALT

11.5.9 IRON

11.5.10 MAGNESIUM

11.5.11 OTHERS

11.6 CHEMICALS

11.6.1 SILVER

11.6.2 COPPER

11.6.3 NICKEL

11.6.4 GOLD

11.6.5 TITANIUM

11.6.6 STEEL

11.6.7 ALUMINUM

11.6.8 COBALT

11.6.9 IRON

11.6.10 MAGNESIUM

11.6.11 OTHERS

11.7 MARINE

11.7.1 SILVER

11.7.2 COPPER

11.7.3 NICKEL

11.7.4 GOLD

11.7.5 TITANIUM

11.7.6 STEEL

11.7.7 ALUMINUM

11.7.8 COBALT

11.7.9 IRON

11.7.10 MAGNESIUM

11.7.11 OTHERS

11.8 OTHERS

11.8.1 SILVER

11.8.2 COPPER

11.8.3 NICKEL

11.8.4 GOLD

11.8.5 TITANIUM

11.8.6 STEEL

11.8.7 ALUMINUM

11.8.8 COBALT

11.8.9 IRON

11.8.10 MAGNESIUM

11.8.11 OTHERS

12 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY REGION

12.1 MIDDLE EAST AND AFRICA

12.1.1 SOUTH AFRICA

12.1.2 U.A.E.

12.1.3 SAUDI ARABIA

12.1.4 EGYPT

12.1.5 ISRAEL

12.1.6 REST OF MIDDLE EAST AND AFRICA

13 COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 ESAB

15.1.1 COMPANY SANPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSYS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 OC OERLIKON MANAGEMENT AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 UMICORE

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENT

15.4 AMETEK.INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 JOHNSON MATTHEY

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSI

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 AIMTEK

15.6.1 COMPANY SANPSHOT

15.6.2 COMPANY SHARE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 BELMONT METALS

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 CUPRO ALLOYS CORPORATION.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ESPRIX TECHNOLOGIES

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HARRIS PRODUCTS GROUP.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 INDIAN SOLDER AND BRAZING ALLOYS

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 INDIUM CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 KRANTI METALLURGY PVT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 LUCAS-MILHAUPT, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 MORGAN ADVANCED MATERIALS

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 PRINCE IZANT COMPANY.

15.16.1 COMPANY SANPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SARU SILVER ALLOY PRIV ATE LIMITED.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SAXONIA EDELMETALLE GMBH

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 S. K. METAL

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SULZER LTD

15.20.1 COMPANY SNAPSHOT

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 RECENT DEVELOPMENTS

15.21 TSI TECHNOLOGIES

15.21.1 COMPANY SANPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 CHINA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 2 INDIA'S AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 3 U.S. AVERAGE PRICE FOR BRAZING ALLOYS TYPES

TABLE 4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 6 MIDDLE EAST & AFRICA SILVER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA COPPER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA NICKEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA GOLD IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA TITANIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA STEEL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA ALUMINUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA COBALT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA IRON IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA MAGNESIUM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA BRAZE PASTE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA BRAZE ROD AND WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA BRAZE POWDER IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA BRAZE PREFORM IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA BRAZE FOIL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 24 MIDDLE EAST & AFRICA BRAZE TAPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA TORCH BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA FURNACE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 28 MIDDLE EAST & AFRICA RESISTANCE BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA INDUCTION BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 30 MIDDLE EAST & AFRICA DIP BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA INFRARED BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 32 MIDDLE EAST & AFRICA VACUUM BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ELECTRON BEAM/LASER BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 34 MIDDLE EAST & AFRICA EXOTHERMIC BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA BRAZE WELDING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 36 MIDDLE EAST & AFRICA HYDROGEN BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA BLANKET BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 38 MIDDLE EAST & AFRICA DISSOCIATED AMMONIA IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA FUEL GAS BRAZING IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 41 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY FORM, 2014-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA WIRE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA STRIP IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 44 MIDDLE EAST & AFRICA BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA PIPE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 46 MIDDLE EAST & AFRICA TUBE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 47 MIDDLE EAST & AFRICA FLAT IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 48 MIDDLE EAST & AFRICA SHEET IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 49 MIDDLE EAST & AFRICA PLATE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 50 MIDDLE EAST & AFRICA ROUND BAR IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 51 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 52 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 53 MIDDLE EAST & AFRICA 1001 °C TO 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 54 MIDDLE EAST & AFRICA LESS THAN 900 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 55 MIDDLE EAST & AFRICA 901 °C TO 1000 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 56 MIDDLE EAST & AFRICA ABOVE 1200 °C IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 57 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET, BY END-USER, 2014-2029 (USD MILLION)

TABLE 58 MIDDLE EAST & AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 59 MIDDLE EAST & AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 60 MIDDLE EAST & AFRICA AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 61 MIDDLE EAST & AFRICA AEROSPACE AND DEFENSE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 62 MIDDLE EAST & AFRICA ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 63 MIDDLE EAST & AFRICA ELECTRONICS AND ELECTRICAL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 64 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 65 MIDDLE EAST & AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 66 MIDDLE EAST & AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 67 MIDDLE EAST & AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 68 MIDDLE EAST & AFRICA MARINE IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 69 MIDDLE EAST & AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 70 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY REGION, 2014-2029 (USD MILLION)

TABLE 71 MIDDLE EAST & AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 72 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (USD MILLION)

TABLE 73 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY COUNTRY, 2014-2029 (TONS)

TABLE 74 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 75 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 76 MIDDLE EAST AND AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 84 MIDDLE EAST AND AFRICA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 85 MIDDLE EAST AND AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 86 MIDDLE EAST AND AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 87 MIDDLE EAST AND AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 88 MIDDLE EAST AND AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 89 SOUTH AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 90 SOUTH AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 91 SOUTH AFRICA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 92 SOUTH AFRICA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 93 SOUTH AFRICA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 94 SOUTH AFRICA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 95 SOUTH AFRICA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 96 SOUTH AFRICA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 97 SOUTH AFRICA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 98 SOUTH AFRICA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 99 SOUTH AFRICA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 100 SOUTH AFRICA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 101 SOUTH AFRICA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 102 SOUTH AFRICA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 103 SOUTH AFRICA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 104 U.A.E. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 105 U.A.E. BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 106 U.A.E. STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 107 U.A.E. BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 108 U.A.E. BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 109 U.A.E. BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 110 U.A.E. BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 111 U.A.E. BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 112 U.A.E. AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 113 U.A.E. AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 114 U.A.E. ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 115 U.A.E. BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 116 U.A.E. CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 117 U.A.E. MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 118 U.A.E. OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 119 SAUDI ARABIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 120 SAUDI ARABIA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 121 SAUDI ARABIA STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 122 SAUDI ARABIA BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 123 SAUDI ARABIA BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 124 SAUDI ARABIA BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 125 SAUDI ARABIA BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 126 SAUDI ARABIA BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 127 SAUDI ARABIA AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 128 SAUDI ARABIA AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 129 SAUDI ARABIA ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 130 SAUDI ARABIA BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 131 SAUDI ARABIA CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 132 SAUDI ARABIA MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 133 SAUDI ARABIA OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 134 EGYPT BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 135 EGYPT BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 136 EGYPT STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 137 EGYPT BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 138 EGYPT BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 139 EGYPT BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 140 EGYPT BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 141 EGYPT BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 142 EGYPT AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 143 EGYPT AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 144 EGYPT ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 145 EGYPT BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 146 EGYPT CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 147 EGYPT MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 148 EGYPT OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 149 ISRAEL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 150 ISRAEL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

TABLE 151 ISRAEL STEEL IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 152 ISRAEL BRAZE ALLOYS MARKET, BY FILLER MATERIAL, 2014-2029 (USD MILLION)

TABLE 153 ISRAEL BRAZE ALLOYS MARKET, BY TECHNOLOGY, 2014-2029 (USD MILLION)

TABLE 154 ISRAEL BRAZE ALLOYS MARKET, BY FORM , 2014-2029 (USD MILLION)

TABLE 155 ISRAEL BRAZE ALLOYS MARKET, BY PRODUCTION TEMPERATURE, 2014-2029 (USD MILLION)

TABLE 156 ISRAEL BRAZE ALLOYS MARKET, BY END USE, 2014-2029 (USD MILLION)

TABLE 157 ISRAEL AUTOMOTIVE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 158 ISRAEL AEROSPACE AND DEFENCE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 159 ISRAEL ELECTRONICS AND ELECTRICAL BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 160 ISRAEL BUILDING AND CONSTRUCTION IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 161 ISRAEL CHEMICALS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 162 ISRAEL MARINE IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 163 ISRAEL OTHERS IN BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (USD MILLION)

TABLE 165 REST OF MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET, BY METAL, 2014-2029 (TONS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA BRAZE ALLOY MARKET: SEGMENTATION

FIGURE 10 ASIA-PACIFIC IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA CONDENSING UNIT MARKET AND GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 INCREASE IN USAGE OF BRAZE ALLOYS IN THE AUTOMOTIVE AND AVIATION IS A MAJOR DRIVER FOR THE GROWTH OF MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET IN THE FORECAST PERIOD OF 2022-2029

FIGURE 12 METAL IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET IN 2021 AND 2029

FIGURE 13 VENDOR SELECTION CRITERIA:

FIGURE 14 SUPPLY CHAIN OF MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

FIGURE 15 VARIOUS CLASSES OF BRAZING FILLERS ACCORDING TO ISO 17672:2016

FIGURE 16 THE FOLLOWING GRAPH SHOWCASES THE DIFFERENT PRICES RANGE IN DIFFERENT REGIONS IN USD MILLION PER TON.

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET

FIGURE 18 PRICE GRAPH OF SOME OF THE METALS USED IN BRAZE ALLOYS

FIGURE 19 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY METAL, 2021

FIGURE 20 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY FILLER MATERIAL, 2021

FIGURE 21 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY TECHNOLOGY, 2021

FIGURE 22 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY FORM, 2021

FIGURE 23 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY PRODUCTION TEMPERATURE, 2021

FIGURE 24 MIDDLE EAST & AFRICA BRAZE ALLOYS MARKET: BY END USER, 2021

FIGURE 25 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: SNAPSHOT (2021)

FIGURE 26 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2021)

FIGURE 27 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 28 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 29 MIDDLE EAST AND AFRICA BRAZE ALLOYS MARKET: BY METAL (2022 & 2029)

FIGURE 30 MIDDLE EAST & AFRICA BRAZE ALLOY MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Braze Alloys Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Braze Alloys Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Braze Alloys Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.