Middle East And Africa Calcium Propionate Market

Market Size in USD Million

CAGR :

%

USD

24.48 Million

USD

34.29 Million

2024

2032

USD

24.48 Million

USD

34.29 Million

2024

2032

| 2025 –2032 | |

| USD 24.48 Million | |

| USD 34.29 Million | |

|

|

|

|

What is the Middle East and Africa Calcium Propionate Market Size and Growth Rate?

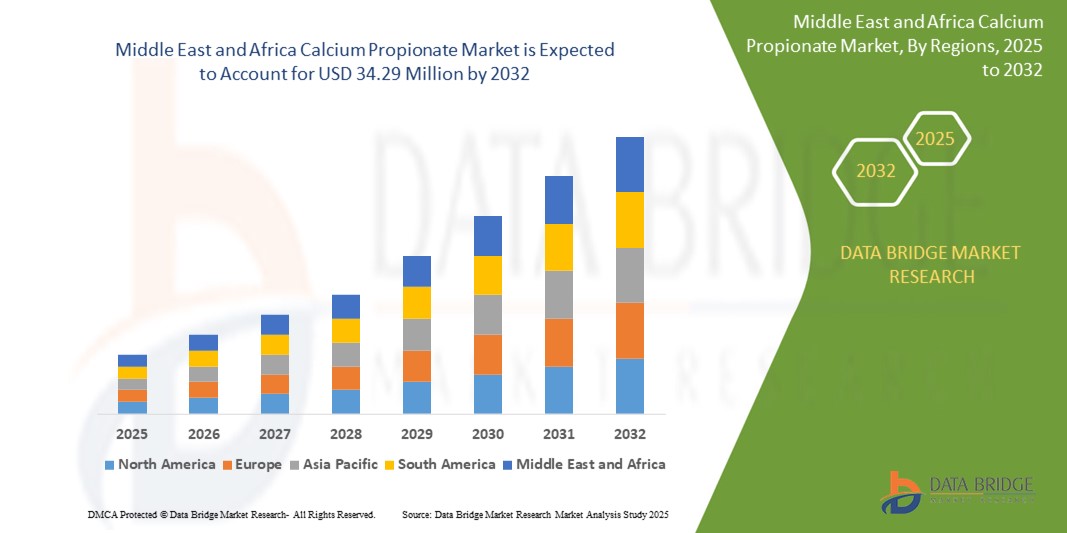

- The Middle East and Africa calcium propionate market size was valued at USD 24.48 million in 2024 and is expected to reach USD 34.29 million by 2032, at a CAGR of 4.30% during the forecast period

- Increasing demand of calcium propionate in food industry as preservatives to increase the shelf life of the food products. High demand of clean label food products among consumers as these food products provides high energy and lots of other health benefits to the consumer is a growing factor for the calcium propionate market growth

- Thus, numerous government regulations for the food safety and quality can be a restraining factor for the calcium propionate market growth. Thus the stringent government legalization can widely effect the company’s revenue cycle

What are the Major Takeaways of Calcium Propionate Market?

- High demand of aqua animals in the manufacturing of feed as well as food products can act as a new opportunity for the calcium propionate market growth as calcium propionates are used to reduce the possibility of mold and microbial contamination in the aquatic protein feed products which are widely used in the pets food products, farm animals and others

- The growing demand of these natural preservatives can decline the calcium propionate market growth for poultry meat products, therefore challenging the calcium propionate market

- U.A.E is expected to dominate the calcium propionate market with the largest market share of 25.36% within the MEA in 2024, fueled by its well-established food processing sector and increasing consumer demand for premium, health-conscious food products

- Saudi Arabia calcium propionate market is projected to grow at a fastest CAGR of 5.63% during the forecast period, supported by the Kingdom's Vision 2030 initiatives promoting food security, local manufacturing, and health-focused consumption patterns

- The Non-Encapsulated segment dominated the calcium propionate market with the largest market revenue share of 67.5% in 2024, attributed to its widespread use across bakery, dairy, and processed food industries due to easy blending and immediate preservative action

Report Scope and Calcium Propionate Market Segmentation

|

Attributes |

Calcium Propionate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Calcium Propionate Market?

“Growing Demand for Natural and Clean Label Ingredients”

- A significant and rapidly evolving trend in the calcium propionate market is the increasing demand for natural, clean-label preservative solutions, particularly in the bakery sector, driven by growing consumer concerns over artificial additives and food safety

- Consumers, especially across North America and Europe, are opting for bakery products such as bread, cakes, and pastries with minimal synthetic preservatives, encouraging manufacturers to adopt calcium propionate, which prevents mold and bacterial growth while aligning with clean-label demands

- For instance, in January 2024, Kerry Group introduced a new range of preservative solutions incorporating calcium propionate targeted at organic and clean-label baked goods, highlighting its role as a reliable anti-microbial agent

- Furthermore, innovations in production methods, such as plant-based or bio-fermentation-derived calcium propionate, are gaining traction, meeting both functional and sustainability expectations

- This trend is further reinforced by regulatory encouragement for safer, transparent food preservatives, positioning calcium propionate as an essential ingredient for extending shelf life in a natural, consumer-friendly manner across bakery and food applications

What are the Key Drivers of Calcium Propionate Market?

- The rising demand for bakery and convenience food products, coupled with increasing food safety awareness, is a primary driver fueling the growth of the calcium propionate market

- For instance, in April 2024, Niacet, a Kerry Group company, announced expanded production capacity for food-grade Calcium Propionate, citing strong growth in bakery consumption and the need for effective mold inhibition

- In addition, the surge in urbanization and changing dietary habits is driving demand for packaged foods with extended shelf life, positioning calcium propionate as a widely used preservative in bread, cakes, tortillas, and dairy products

- The growing regulatory emphasis on reducing food waste further amplifies the use of calcium propionate to ensure product freshness during transport and storage, especially in emerging markets with developing cold chain infrastructures

- Furthermore, increased awareness of food spoilage risks due to mold and bacterial contamination supports broader adoption of calcium propionate in bakery, dairy, and animal feed sectors, ensuring product stability and safety

Which Factor is challenging the Growth of the Calcium Propionate Market?

- Regulatory restrictions and evolving consumer skepticism regarding the use of preservatives, even naturally derived ones such as calcium propionate, present significant challenges to market expansion

- For instance, stricter labeling laws in the European Union, which require transparent disclosure of all food additives, have prompted some consumers to avoid bakery products containing any form of preservatives, impacting demand

- In addition, fluctuations in raw material prices, particularly for calcium compounds, can increase production costs, creating pricing pressures for manufacturers and affecting market competitiveness

- Some technical limitations, such as calcium propionate's reduced efficacy in high-pH bakery products or its potential to impart a slight off-taste when not formulated properly, further challenge its widespread adoption

- Overcoming these obstacles through advanced formulation technologies, consumer education campaigns on food safety benefits, and innovations in natural preservative alternatives will be vital for sustaining market growth, particularly in health-conscious and premium product categories

How is the Calcium Propionate Market Segmented?

The market is segmented on the basis of type, source, form, grade and application.

- By Type

On the basis of type, the calcium propionate market is segmented into Encapsulated and Non-Encapsulated. The Non-Encapsulated segment dominated the calcium propionate market with the largest market revenue share of 67.5% in 2024, attributed to its widespread use across bakery, dairy, and processed food industries due to easy blending and immediate preservative action. The simplicity of incorporating non-encapsulated calcium propionate into existing food formulations makes it a preferred option among manufacturers.

The Encapsulated segment is projected to witness the fastest CAGR from 2025 to 2032, driven by increasing demand for controlled-release preservatives in baked goods and meat products. Encapsulation extends shelf life and enhances flavor stability, making it ideal for premium and specialty food applications.

- By Source

On the basis of source, the calcium propionate market is segmented into Natural and Synthetic. The Synthetic segment held the largest market revenue share of 59.3% in 2024, supported by its consistent quality, cost-effectiveness, and extensive use in industrial-scale food production where affordability and standardized performance are critical.

The Natural segment is anticipated to record the fastest CAGR from 2025 to 2032, fueled by rising consumer demand for clean-label, plant-based preservatives and growing preference for minimally processed, health-focused food products. The shift toward organic and sustainable ingredients continues to accelerate natural calcium propionate adoption across food, beverage, and pharmaceutical industries.

- By Form

On the basis of form, the calcium propionate market is segmented into Powdered and Liquid. The Powdered segment dominated the market with the largest revenue share of 64.8% in 2024, driven by its extended shelf life, ease of storage, and compatibility with dry food mixes, bakery products, and animal feed formulations. Its stability under varying environmental conditions makes it a widely preferred form across industries.

The Liquid segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to its superior solubility and efficient dispersion in dairy, sauces, and beverage products. Liquid forms offer convenience for manufacturers looking for quick integration into liquid food processing lines.

- By Grade

On the basis of grade, the calcium propionate market is segmented into Food Grade, Feed Grade, Pharma Grade, and Industrial Grade/Technical Grade. The Food Grade segment dominated the market with the largest revenue share of 71.2% in 2024, attributed to the extensive use of food-grade calcium propionate in bakery, confectionery, dairy, and ready-to-eat meals for mold prevention and shelf-life extension.

The Pharma Grade segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by the increasing incorporation of calcium propionate in pharmaceutical formulations such as medicinal syrups, oral care products, and dietary supplements, where preservative efficiency and flavor masking are essential.

- By Application

On the basis of application, the calcium propionate market is segmented into Food & Beverages, Feed, Pharmaceuticals, and Others. The Food & Beverages segment accounted for the largest market revenue share of 76.5% in 2024, driven by its widespread use as a preservative to inhibit mold and bacterial growth in baked goods, dairy, confectionery, and processed foods. The consumer trend toward fresh, high-quality, and long-lasting food products continues to support segment dominance.

The Pharmaceuticals segment is expected to grow at the fastest CAGR from 2025 to 2032, owing to the rising adoption of calcium propionate in health supplements, wellness products, and medicinal formulations, where preservation of product integrity and sensory quality is crucial for consumer acceptance.

Which Region Holds the Largest Share of the Calcium Propionate Market?

- U.A.E is expected to dominate the calcium propionate market with the largest market share of 25.36% within the MEA in 2024, fueled by its well-established food processing sector and increasing consumer demand for premium, health-conscious food products

- The country's focus on diversifying food production, along with high per capita income and growing expatriate population, drives the use of calcium propionates across bakery, confectionery, and functional beverage segments. U.A.E consumers' preference for natural, clean-label ingredients continues to strengthen the market's growth trajectory

Saudi Arabia Calcium Propionate Market Insight

Saudi Arabia calcium propionate market is projected to grow at a fastest CAGR of 5.63% during the forecast period, supported by the Kingdom's Vision 2030 initiatives promoting food security, local manufacturing, and health-focused consumption patterns. The increasing adoption of calcium propionates in bakery, dairy, and ready-to-eat products, alongside the demand for shelf-life extension and flavor enhancement, is driving growth. Saudi Arabia's emphasis on reducing food waste and encouraging local production further fuels calcium propionate adoption across food categories.

South Africa Calcium Propionate Market Insight

South Africa calcium propionate market is projected to witness substantial growth throughout the forecast period, driven by rising urbanization, growing demand for affordable packaged food, and increasing awareness of food preservation. The expanding middle-class population and shift towards convenient, long-lasting food options create favorable conditions for calcium propionate usage in bakery, snacks, and dairy products. In addition, South Africa's growing retail network and investments in food production infrastructure contribute to sustained market development.

Egypt Calcium Propionate Market Insight

Egypt calcium propionate market is anticipated to grow steadily during the forecast period, supported by the country's expanding food and beverage sector, rising population, and growing demand for affordable, shelf-stable food products. The use of calcium propionates in bread, bakery, and dairy products is increasing due to heightened awareness around food quality, spoilage prevention, and consumer preference for fresher, longer-lasting items. Egypt's strategic location as a gateway to both African and Middle Eastern markets further enhances its role in the region's calcium propionate market growth.

Which are the Top Companies in Calcium Propionate Market?

The calcium propionate industry is primarily led by well-established companies, including:

- Impextraco NV (Belgium)

- Shandong Tong Tai Wei Run Chemical Co., Ltd (China)

- Fine Organics (India)

- Perstorp (Sweden)

- Kemin Industries, Inc. (U.S.)

- Kemira (Finland)

- Saf Sulphur Company (Saudi Arabia)

What are the Recent Developments in Middle East and Africa Calcium Propionate Market?

- In May 2025, Creative Enzymes introduced its Fermented Calcium Propionate, produced through submerged fermentation, positioned as a natural and sustainable preservative alternative. This product launch highlights the company's focus on delivering eco-friendly solutions to meet the rising demand for clean-label food preservation

- In November 2024, Health Canada reaffirmed the approval of Calcium Propionate as a food additive and provided updated usage guidelines for its application across various food categories in the revised List of Permitted Preservatives. This regulatory support is expected to strengthen consumer confidence and drive market adoption of Calcium Propionate in Canada

- In September 2023, Kemin Industries launched Shield V Plus Dry, a novel preservative designed as an alternative to potassium sorbate, specifically targeting the bread and bakery industry. This innovation expands Kemin's offerings for the bakery sector and aligns with industry demands for advanced, effective preservation solutions

- In February 2023, Niacet Corp. announced its plan to invest USD 121 million to expand and modernize select operations within its 19-acre facility located at 400 47th Street. This strategic investment reflects the company’s commitment to enhancing production capabilities and meeting the growing demand for food preservation ingredients, including Calcium Propionate

- In July 2020, Kemin Industries Inc. completed the acquisition of a U.S. patent application for an advanced solution to combat African Swine Fever Virus in feed and feed ingredients through the use of Sal CURB Liquid Antimicrobial. This acquisition strengthens the company's animal nutrition portfolio and reinforces its leadership in biosecurity solutions for the feed industry

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Calcium Propionate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Calcium Propionate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Calcium Propionate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.