Middle East and Africa Coding and Marking Systems Market Analysis and Size

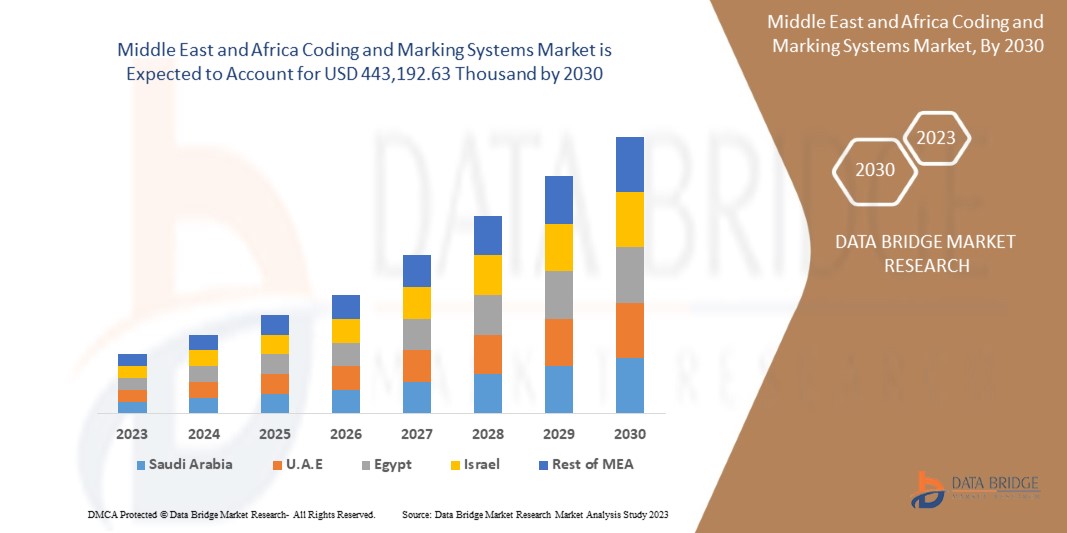

The Middle East and Africa coding and marking systems market is expected to grow significantly in the forecast period of 2023 to 2030. Data Bridge Market Research analyses that the market is growing with a CAGR of 5.2% in the forecast period of 2023 to 2030 and is expected to reach USD 443,192.63 thousand by 2030. The growing use of coding and marking systems in various industries has been the major driver for the Middle East and Africa coding and marking systems market.

The coding and marking systems market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Technology Type (Continuous Inkjet, Laser Coding, Thermal Inkjet, Piezo, Others), Type (Small Character Inkjet Printers, High-Resolution Inkjet Printers, Large Inkjet Printers, Laser Systems, and Spray Market Systems), Application (Secondary, Tertiary, Primary), Material (Plastics, Paper & Cardboard, Metal, Wood, Textiles (Excluding Carpet and Fleece), Foils, Organic Surfaces, Rubber, Carpet, Fleece, and Others), Number of Nozzles (Single Nozzle, Multiple Nozzles), End Use (Food & Beverage, Pharmaceuticals, Electrical & Electronics, Automotive & Aerospace, Personal Care, Construction, Chemical Manufacturing, and Others) |

|

Countries Covered |

South Africa, United Arab Emirates, Saudi Arabia, Oman, Qatar, Kuwait and Rest of Middle East and Africa |

|

Market Players Covered |

Danaher, Weber Marking Systems GmbH, Dover Corporation, REA Elektronik GmbH, Leibinger Group, Hitachi, Ltd., Illinois Tool Works Inc., Matthews International Corporation, Brother Industries, Ltd., and HSA Systems A/S among others |

Market Definition

Coding and marking systems are widely used in automotive coding. Coding and marking are used to print part numbers or anti-counterfeit labels on auto parts to prevent the sale of counterfeit parts. Encoding and marking devices are used to print specific product details onto the product case. This information is intended to provide end users and manufacturers with reliable information about their products. The coding includes, among other things, the printing of the date of manufacture, the expiry date, and the size of the packing lot. By printing codes or labels on products, manufacturers can reduce the risk of counterfeiting and protect the brand image of the end consumer.

Middle East and Africa Coding and Marking Systems Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Rising demand in the automotive industry

The rising demand for coding and marking systems in the automotive industry has increased due to the increased sales of counterfeit products. Therefore, manufacturers use coding and marking systems to decrease the usage of counterfeit products in the market and frequently use coding and marking systems to code part number labels on vehicle machinery. Coding and marking equipment must be able to comfortably meet the complex demands of automotive manufacturers in an industry that requires information to be printed onto individual components at various stages of the manufacturing process. Robust coders must provide trouble-free integration into existing processes and then operate consistently in demanding production environments. Manufacturers are seeking Middle East and Africa traceability and containment solutions, as well as the ability to print their logo, production date, expiry date, LOT number, part numbers, and other information on their products.

- Increasing use of coding and marking systems in various industries

Many industries are using coding and marking technologies, such as FMCG, food and beverages, electronic products, metals, rubber, textile, chemical and agrochemical, seeds, construction, healthcare, and pharmaceuticals. The increasing demand for packaged food, healthier packaged food, and increased urbanization are increasing the consumption of these products, which is further increasing the demand for coding and marking systems. The food and pharmaceutical industries are among the most regulated in terms of supply chain traceability. Coding and labeling products contribute to total traceability, protecting both consumers and businesses by using batch numbers, barcodes, and expiration dates. As coding technologies evolve with real-time reporting and analytics, consumers will be able to gain more transparent insights into the origins of the components that comprise a product.

Opportunities

- Stringent government rules for coding and marking systems

Governments across the globe have been implementing new packaging and labeling regulations. Many packaging companies are being forced to make significant investments in coding and marking equipment in order to comply with regulations and avoid penalties. Several companies are using advanced technologies such as Data Set to identify and track products in industries like food and beverage, healthcare, pharmaceutical, and others. Many governments around the world are imposing stringent packaging and labeling regulations. This regulation requires red color coding on the sides of the pack labels of packaged food products with high fat, high sugar, and high salt content levels. As a result, coding has become more popular all around the globe.

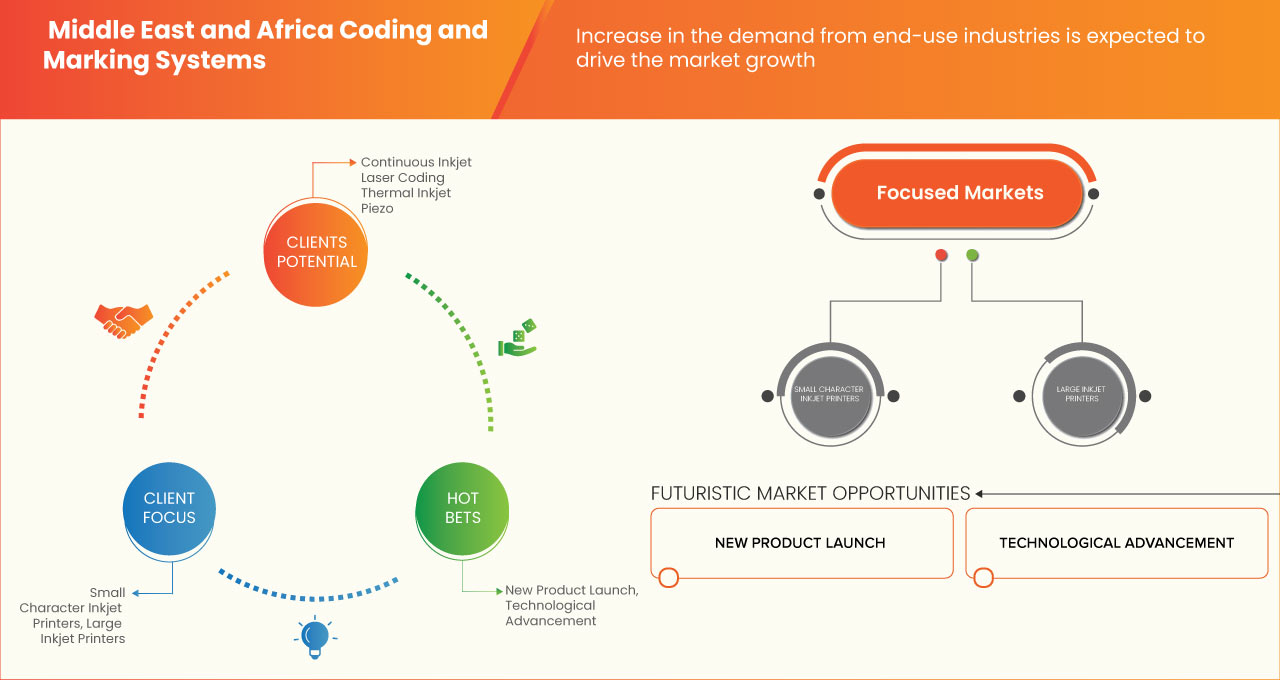

- Increasing use of laser coding

The demand for laser coding technology has increased significantly, mainly due to its characteristics and feasibility in various industrial applications by end users. For instance, laser coding solutions are gaining popularity in consumer goods such as cosmetics, personal care, food service, and automotive. Laser coding machines represent the latest advances in coding and marking technology and are used to print codes onto metal or metallic objects and other items. As customer demand for advanced technology increases, end-user manufacturers are turning to laser technology. Laser encoders offer high-speed continuous marking and the ability to deliver high-resolution codes or logos for brand protection. They provide sharp, detailed marking capabilities, which is useful in many end-use industries. Additionally, manufacturers of coding and marking systems are focusing on providing environmentally friendly solutions to meet the growing demand from various end-use sectors, such as food and packaging envelopes.

Restraint

- High cost of coding and marking equipment and improper printed codes

New equipment for industrial printing techniques, such as coding and marking, has emerged, promising to improve these processes' efficiency. However, the development and application of coding and marking equipment have evolved as a result of shifting packaging formats and design complexities. Barcodes that are not properly printed, trademarks that are damaged, and best-before information that is lost because printed ink fades can all lead to misunderstandings between businesses and customers. A lack of appropriate codes can cause products to lose popularity, and manufacturers may be plagued by ineffective traceability.

Challenge

- High installation cost and operational errors

Negligence and human error can often harm the interests of market makers and sellers. This is a major challenge in the end-use industry that manufacturers are constantly focusing on. In large manufacturing companies, workers typically work shifts, increasing human-machine interaction. This tends to increase the margin for error as the printing process takes longer to learn. Moreover, it takes away time and resources from businesses that could be used elsewhere.

Coding and marking equipment tend to be very expensive. Therefore, installing coding and marking systems is a challenge. All supply chain participants, especially smaller companies, may not have the financial resources to build the infrastructure needed to implement coding and marking systems. High operating costs will be a major challenge for the market during the forecast period.

Recent Developments

- In December 2021, Koenig & Bauer introduced a special packaging for premium tobacco leaves with laser marking. This task will be performed on-site in the future by the semi-automatic udaFORMAXX Offline coding system, which is equipped with a CO2 marking laser for permanent marking without smudging

- In June 2022, CONTROL PRINT LTD. launched a new product Pench, which is a continuous inkjet printer. It is mainly used for sectors like cable, wire, steel, and other ultra-fast high-speed applications, as it can print at a pace of up to 700-m/min. The product launch will help the company to expand its product portfolio and customer base in various end-use industries

Middle East and Africa Coding and Marking Systems Market Scope

The Middle East and Africa coding and marking systems market is categorized based on technology type, type, application, number of nozzles, material, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Technology Type

- Continuous Inkjet

- Laser Coding

- Thermal Coding

- Piezo

- Others

On the basis of technology type, the coding and marking systems market is segmented into continuous inkjet, laser coding, thermal inkjet, piezo, and others.

Type

- Small Character Inkjet Printers

- High Resolution Inkjet Printers

- Large Inkjet Printers

- Laser System and Spray Market Systems

On the basis of type, the coding and marking systems market is segmented into small character inkjet printers, high resolution inkjet printers, large inkjet printers, and laser system and spray market systems.

Application

- Primary

- Secondary

- Tertiary

On the basis of application, the coding and marking systems market is segmented into primary, secondary, and tertiary.

Number of Nozzles

- Single Nozzle

- Multiple Nozzles

On the basis of number of nozzles, the coding and marking systems market is segmented into single nozzle and multiple nozzles.

Material

- Plastics

- Paper & Cardboard

- Metal

- Wood

- Textiles (Excluding Carpet and Fleece)

- Foils

- Organic Surfaces

- Rubber

- Carpet

- Fleece

- Others

On the basis of material, the coding and marking systems market is segmented into plastics, paper & cardboard, metal, wood, textiles (excluding carpet and fleece), foils, organic surfaces, rubber, carpet, fleece, and others.

End-Use

- Food & beverage

- Pharmaceuticals

- Electrical & electronics

- Automotive & aerospace

- Personal care

- Construction

- Chemical manufacturing

- Others

On the basis of end-use, the coding and marking systems market is segmented into food & beverage, pharmaceuticals, electrical & electronics, automotive & aerospace, personal care, construction, chemical manufacturing, and others.

Middle East and Africa Coding and Marking Systems Market Regional Analysis/Insights

The Middle East and Africa coding and marking systems market is segmented on the basis of technology type, type, application, number of nozzles, material, and end use.

The countries in the coding and marking systems market are South Africa, United Arab Emirates, Saudi Arabia, Oman, Qatar, Kuwait and rest of Middle East and Africa.

South Africa is expected to dominate the Middle East and Africa coding and marking systems market due to the growing demand for laser coding and marking systems in various industries.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Coding and Marking Systems Market Share Analysis

The Middle East and Africa coding and marking systems market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies' focus related to the Middle East and Africa coding and marking systems market.

Some of the major market players operating in the Middle East and Africa market are Danaher, Weber Marking Systems GmbH, Dover Corporation, REA Elektronik GmbH, Leibinger Group, Hitachi, Ltd., Illinois Tool Works Inc., Matthews International Corporation, Brother Industries, Ltd., and HSA Systems A/S among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 TECHNOLOGY TYPE LIFELINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER'S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 CLIMATE CHANGE SCENARIO

4.3.1 ENVIRONMENTAL CONCERNS

4.3.2 INDUSTRY RESPONSE

4.3.3 GOVERNMENT’S ROLE

4.3.4 ANALYST RECOMMENDATION

4.4 OVERVIEW ON NEW MACHINES V/S CONSUMBALES SOLD

4.4.1 END USER INDUSTRIES

4.4.2 PRODUCT AND BATCH SIZE

4.4.3 TYPE OF PRINTING

4.4.4 TECHNOLOGICAL ADVANCEMENTS

4.5 LIST OF KEY BUYERS

4.6 PRODUCTION CONSUMPTION ANALYSIS

4.7 SUPPLY CHAIN ANALYSIS

4.7.1 OVERVIEW

4.7.2 LOGISTIC COST SCENARIO

4.7.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.8 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.9 VENDOR SELECTION CRITERIA

4.1 RAW MATERIAL PRODUCTION COVERAGE

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING DEMAND IN THE AUTOMOTIVE INDUSTRY

6.1.2 INCREASING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES

6.2 RESTRAINT

6.2.1 HIGH COST OF CODING AND MARKING EQUIPMENT AND IMPROPER PRINTED CODES

6.3 OPPORTUNITIES

6.3.1 STRINGENT GOVERNMENT RULES FOR CODING AND MARKING SYSTEMS

6.3.2 INCREASING USE OF LASER CODING

6.4 CHALLENGES

6.4.1 HIGH INSTALLATION COST AND OPERATIONAL ERRORS

7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE

7.1 OVERVIEW

7.2 CONTINUOUS INKJET

7.3 LASER CODING

7.4 THERMAL INKJET

7.5 PIEZO

7.6 OTHERS

8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE

8.1 OVERVIEW

8.2 SMALL CHARACTER INKJET PRINTERS

8.3 HIGH RESOLUTION INKJET PRINTERS

8.4 LARGE INKJET PRINTERS

8.5 LASER SYSTEMS AND SPRAY MARKET SYSTEMS

9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 SECONDARY

9.3 TERTIARY

9.4 PRIMARY

10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PLASTICS

10.3 PAPER & CARDBOARD

10.4 METAL

10.5 WOOD

10.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

10.7 FOILS

10.8 ORGANIC SURFACES

10.9 RUBBER

10.1 CARPET

10.11 FLEECE

10.12 OTHERS

11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES

11.1 OVERVIEW

11.2 SINGLE NOZZLE

11.3 MULTIPLE NOZZLES

12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE

12.1 OVERVIEW

12.2 FOOD & BEVERAGE

12.2.1 FOOD & BEVERAGE, BY TYPE

12.2.1.1 PACKAGED FOOD

12.2.1.2 DAIRY PRODUCTS

12.2.1.3 MEAT & POULTRY

12.2.1.4 FRUITS & VEGETABLES

12.2.1.5 PET FOOD & ANIMAL FEED

12.2.1.6 OTHERS

12.2.2 FOOD & BEVERAGE, BY TECHNOLOGY TYPE

12.2.2.1 THERMAL INKJET

12.2.2.2 CONTINUOUS INKJET

12.2.2.3 LASER CODING

12.2.2.4 PIEZO

12.2.2.5 OTHERS

12.2.3 FOOD & BEVERAGE, BY MATERIAL

12.2.3.1 PLASTICS

12.2.3.2 FOILS

12.2.3.3 PAPER & CARDBOARD

12.2.3.4 METAL

12.2.3.5 WOOD

12.2.3.6 RUBBER

12.2.3.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.2.3.8 ORGANIC SURFACES

12.2.3.9 CARPET

12.2.3.10 FLEECE

12.2.3.11 OTHERS

12.3 PHARMACEUTICALS

12.3.1 PHARMACEUTICALS, BY TECHNOLOGY TYPE

12.3.1.1 THERMAL INKJET

12.3.1.2 CONTINUOUS INKJET

12.3.1.3 LASER CODING

12.3.1.4 PIEZO

12.3.1.5 OTHERS

12.3.2 PHARMACEUTICALS, BY MATERIAL

12.3.2.1 PAPER & CARDBOARD

12.3.2.2 PLASTICS

12.3.2.3 FOILS

12.3.2.4 METAL

12.3.2.5 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.3.2.6 RUBBER

12.3.2.7 WOOD

12.3.2.8 ORGANIC SURFACES

12.3.2.9 CARPET

12.3.2.10 FLEECE

12.3.2.11 OTHERS

12.4 ELECTRICAL & ELECTRONICS

12.4.1 ELECTRICAL & ELECTRONICS, BY TECHNOLOGY TYPE

12.4.1.1 CONTINUOUS INKJET

12.4.1.2 THERMAL INKJET

12.4.1.3 LASER CODING

12.4.1.4 PIEZO

12.4.1.5 OTHERS

12.4.2 ELECTRICAL & ELECTRONICS, BY MATERIAL

12.4.2.1 PLASTICS

12.4.2.2 METAL

12.4.2.3 RUBBER

12.4.2.4 FOILS

12.4.2.5 WOOD

12.4.2.6 PAPER & CARDBOARD

12.4.2.7 ORGANIC SURFACES

12.4.2.8 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.4.2.9 CARPET

12.4.2.10 FLEECE

12.4.2.11 OTHERS

12.5 AUTOMOTIVE & AEROSPACE

12.5.1 AUTOMOTIVE & AEROSPACE, BY TECHNOLOGY TYPE

12.5.1.1 CONTINUOUS INKJET

12.5.1.2 LASER CODING

12.5.1.3 THERMAL INKJET

12.5.1.4 PIEZO

12.5.1.5 OTHERS

12.5.2 AUTOMOTIVE & AEROSPACE, BY MATERIAL

12.5.2.1 RUBBER

12.5.2.2 METAL

12.5.2.3 PLASTICS

12.5.2.4 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.5.2.5 CARPET

12.5.2.6 FLEECE

12.5.2.7 FOILS

12.5.2.8 PAPER & CARDBOARD

12.5.2.9 WOOD

12.5.2.10 ORGANIC SURFACES

12.5.2.11 OTHERS

12.6 PERSONAL CARE

12.6.1 PERSONAL CARE, BY TECHNOLOGY TYPE

12.6.1.1 CONTINUOUS INKJET

12.6.1.2 THERMAL INKJET

12.6.1.3 LASER CODING

12.6.1.4 PIEZO

12.6.1.5 OTHERS

12.6.2 PERSONAL CARE, BY MATERIAL

12.6.2.1 PLASTICS

12.6.2.2 PAPER & CARDBOARD

12.6.2.3 FOILS

12.6.2.4 METAL

12.6.2.5 RUBBER

12.6.2.6 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.6.2.7 ORGANIC SURFACES

12.6.2.8 WOOD

12.6.2.9 CARPET

12.6.2.10 FLEECE

12.6.2.11 OTHERS

12.7 CONSTRUCTION

12.7.1 CONSTRUCTION, BY TECHNOLOGY TYPE

12.7.1.1 CONTINUOUS INKJET

12.7.1.2 LASER CODING

12.7.1.3 PIEZO

12.7.1.4 THERMAL INKJET

12.7.1.5 OTHERS

12.7.2 CONSTRUCTION, BY MATERIAL

12.7.2.1 METAL

12.7.2.2 WOOD

12.7.2.3 CARPET

12.7.2.4 PLASTICS

12.7.2.5 PAPER & CARDBOARD

12.7.2.6 RUBBER

12.7.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.7.2.8 FOILS

12.7.2.9 FLEECE

12.7.2.10 ORGANIC SURFACES

12.7.2.11 OTHERS

12.8 CHEMICAL MANUFACTURING

12.8.1 CHEMICAL MANUFACTURING, BY TECHNOLOGY TYPE

12.8.1.1 CONTINUOUS INKJET

12.8.1.2 LASER CODING

12.8.1.3 THERMAL INKJET

12.8.1.4 PIEZO

12.8.1.5 OTHERS

12.8.2 CHEMICAL MANUFACTURING, BY MATERIAL

12.8.2.1 PLASTICS

12.8.2.2 RUBBER

12.8.2.3 METAL

12.8.2.4 PAPER & CARDBOARD

12.8.2.5 WOOD

12.8.2.6 FOILS

12.8.2.7 TEXTILES (EXCLUDING CARPET AND FLEECE)

12.8.2.8 ORGANIC SURFACES

12.8.2.9 CARPET

12.8.2.10 FLEECE

12.8.2.11 OTHERS

12.9 OTHERS

13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY REGION

13.1 MIDDLE EAST & AFRICA

13.1.1 SOUTH AFRICA

13.1.2 SAUDI ARABIA

13.1.3 UNITED ARAB EMIRATES

13.1.4 QATAR

13.1.5 KUWAIT

13.1.6 OMAN

13.1.7 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 ACQUISITION

14.3 PRODUCT LAUNCH

14.4 CERTIFICATION

15 COMPANY PROFILES

15.1 ILLINOIS TOOL WORKS INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 SWOT ANALYSIS

15.1.5 PRODUCT PORTFOLIO

15.1.6 RECENT DEVELOPMENTS

15.2 HITACHI, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 SWOT ANALYSIS

15.2.5 PRODUCT PORTFOLIO

15.2.6 RECENT DEVELOPMENTS

15.3 DANAHER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SWOT ANALYSIS

15.3.5 PRODUCT PORTFOLIO

15.3.6 RECENT DEVELOPMENTS

15.4 BROTHER INDUSTRIES, LTD.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SWOT ANALYSIS

15.4.5 PRODUCT PORTFOLIO

15.4.6 RECENT DEVELOPMENTS

15.5 DOVER CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 SWOT ANALYSIS

15.5.5 PRODUCT PORTFOLIO

15.5.6 RECENT DEVELOPMENTS

15.6 ATD UK

15.6.1 COMPANY SNAPSHOT

15.6.2 SWOT ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 CODELINE AUTOMATION

15.7.1 COMPANY SNAPSHOT

15.7.2 SWOT ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 CONTROL PRINT LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SWOT ANALYSIS

15.8.4 PRODUCT PORTFOLIO

15.8.5 RECENT DEVELOPMENTS

15.9 HSA SYSTEMS A/S

15.9.1 COMPANY SNAPSHOT

15.9.2 SWOT ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 LEIBINGER GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 SWOT ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 MATTHEWS INTERNATIONAL CORPORATION

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SWOT ANALYSIS

15.11.4 PRODUCT PORTFOLIO

15.11.5 RECENT DEVELOPMENTS

15.12 NOVANTA INC.

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 SWOT ANALYSIS

15.12.4 PRODUCT PORTFOLIO

15.12.5 RECENT DEVELOPMENTS

15.13 OVERPRINT LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 SWOT ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 PAK-TEC

15.14.1 COMPANY SNAPSHOT

15.14.2 SWOT ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT DEVELOPMENTS

15.15 PROMACH INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 SWOT ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENTS

15.16 REA ELEKTRONIK GMBH.

15.16.1 COMPANY SNAPSHOT

15.16.2 SWOT ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 WEBER MARKING SYSTEMS GMBH

15.17.1 COMPANY SNAPSHOT

15.17.2 SWOT ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 3 MIDDLE EAST & AFRICA CONTINUOUS INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST & AFRICA LASER CODING IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 MIDDLE EAST & AFRICA THERMAL INKJET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST & AFRICA PIEZO IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 MIDDLE EAST & AFRICA SMALL CHARACTER INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST & AFRICA HIGH RESOLUTION INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 MIDDLE EAST & AFRICA LARGE INKJET PRINTERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST & AFRICA LASER SYSTEMS AND SPRAY MARKET SYSTEMS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST & AFRICA SECONDARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 MIDDLE EAST & AFRICA TERTIARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST & AFRICA PRIMARY IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST & AFRICA PLASTICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 19 MIDDLE EAST & AFRICA PAPER & CARDBOARD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST & AFRICA METAL IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 MIDDLE EAST & AFRICA WOOD IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST & AFRICA TEXTILES (EXCLUDING CARPET AND FLEECE) CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 MIDDLE EAST & AFRICA FOILS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 MIDDLE EAST & AFRICA ORGANIC SURFACES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 MIDDLE EAST & AFRICA RUBBER IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 MIDDLE EAST & AFRICA CARPET IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 MIDDLE EAST & AFRICA FLEECE IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 30 MIDDLE EAST & AFRICA SINGLE NOZZLE IN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 31 MIDDLE EAST & AFRICA MULTIPLE NOZZLES IN CODING AND MARKING SYSTEMS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 33 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 36 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 37 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 40 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 43 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 46 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 49 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 52 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 53 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 55 MIDDLE EAST & AFRICA OTHERS IN CODING AND MARKING SYSTEMS, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 60 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 61 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 62 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 63 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST & AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 66 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 MIDDLE EAST & AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 68 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 MIDDLE EAST & AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 70 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 MIDDLE EAST & AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 72 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 MIDDLE EAST & AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 74 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 MIDDLE EAST & AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 76 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 MIDDLE EAST & AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 78 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 81 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 82 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 83 SOUTH AFRICA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 84 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 SOUTH AFRICA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 87 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 88 SOUTH AFRICA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 89 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 SOUTH AFRICA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 91 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 SOUTH AFRICA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 93 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 SOUTH AFRICA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 95 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 SOUTH AFRICA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 97 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 98 SOUTH AFRICA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 99 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 102 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 103 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 104 SAUDI ARABIA CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 105 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 SAUDI ARABIA FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 108 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 SAUDI ARABIA PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 110 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 SAUDI ARABIA ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 112 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 SAUDI ARABIA AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 114 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 SAUDI ARABIA PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 116 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 SAUDI ARABIA CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 118 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 SAUDI ARABIA CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 120 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 123 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 124 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 125 UNITED EMIRATES ARAB CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 126 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 127 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 128 UNITED EMIRATES ARAB FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 129 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 130 UNITED EMIRATES ARAB PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 131 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 132 UNITED EMIRATES ARAB ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 133 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 134 UNITED EMIRATES ARAB AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 135 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 136 UNITED EMIRATES ARAB PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 137 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 138 UNITED EMIRATES ARAB CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 139 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 140 UNITED EMIRATES ARAB CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 141 QATAR CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 142 QATAR CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 143 QATAR CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 144 QATAR CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 145 QATAR CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 146 QATAR CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 147 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 148 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 149 QATAR FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 150 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 151 QATAR PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 152 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 153 QATAR ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 154 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 155 QATAR AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 156 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 157 QATAR PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 158 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 159 QATAR CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 160 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 161 QATAR CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 162 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 163 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 164 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 165 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 166 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 167 KUWAIT CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 168 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 169 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 170 KUWAIT FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 171 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 172 KUWAIT PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 173 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 174 KUWAIT ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 175 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 176 KUWAIT AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 177 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 178 KUWAIT PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 179 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 180 KUWAIT CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 181 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 182 KUWAIT CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 183 OMAN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 184 OMAN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 185 OMAN CODING AND MARKING SYSTEMS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 186 OMAN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 187 OMAN CODING AND MARKING SYSTEMS MARKET, BY NUMBER OF NOZZLES, 2021-2030 (USD THOUSAND)

TABLE 188 OMAN CODING AND MARKING SYSTEMS MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 189 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 190 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 191 OMAN FOOD & BEVERAGE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 192 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 193 OMAN PHARMACEUTICALS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 194 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 195 OMAN ELECTRICAL & ELECTRONICS IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 196 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 197 OMAN AUTOMOTIVE & AEROSPACE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 198 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 199 OMAN PERSONAL CARE IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 200 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 201 OMAN CONSTRUCTION IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 202 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

TABLE 203 OMAN CHEMICAL MANUFACTURING IN CODING AND MARKING SYSTEMS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 204 REST OF MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TECHNOLOGY TYPE, 2021-2030 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 2 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE TECHNOLOGY TYPE LIFE LINE CURVE

FIGURE 7 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MULTIVARIATE MODELLING

FIGURE 8 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: MARKET END – USE COVERAGE GRID

FIGURE 11 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SEGMENTATION

FIGURE 14 THE GROWING USE OF CODING AND MARKING SYSTEMS IN VARIOUS INDUSTRIES IS ONE OF THE DRIVING FACTORS FOR THR MARKET GROWTH

FIGURE 15 CONTINUOUS INKJET IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET IN 2023 & 2030

FIGURE 16 VENDOR SELECTION CRITERIA

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET

FIGURE 18 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE, 2022

FIGURE 19 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET, BY TYPE, 2022

FIGURE 20 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY APPLICATION, 2022

FIGURE 21 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY MATERIAL, 2022

FIGURE 22 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY NUMBER OF NOZZLES, 2022

FIGURE 23 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY END USE, 2022

FIGURE 24 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: SNAPSHOT (2022)

FIGURE 25 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022)

FIGURE 26 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: BY TECHNOLOGY TYPE (2023-2030)

FIGURE 29 MIDDLE EAST & AFRICA CODING AND MARKING SYSTEMS MARKET: COMPANY SHARE 2022 (%)

Middle East And Africa Coding And Marking Systems Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Coding And Marking Systems Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Coding And Marking Systems Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.