Middle East and Africa Contract Manufacturing Market Analysis and Insights

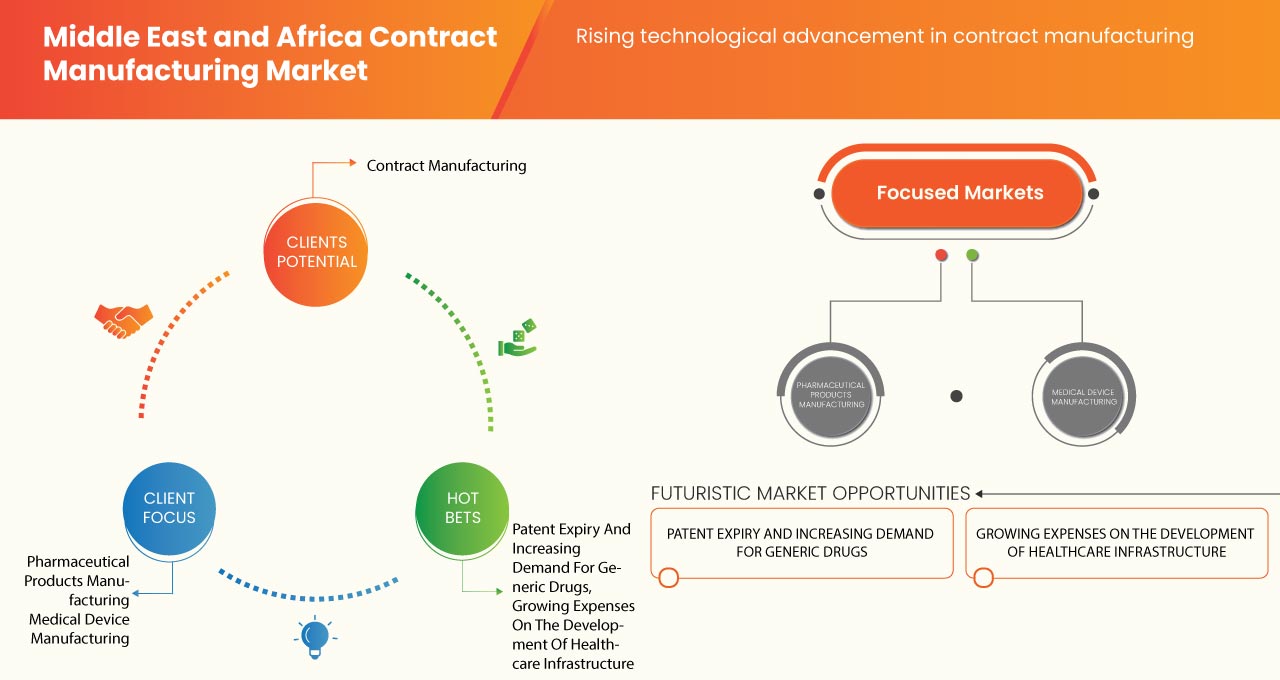

The Middle East and Africa contract manufacturing market is driven by the factors such as, rising technical advancements and cost effectiveness of pharmaceutical and pipeline products enhances its demand as well as rising investment in research and development leads to the market growth. Currently, healthcare expenditure has increased across developed and emerging countries that is expected to create a competitive advantage for manufacturers to develop new and innovative products.

Contract manufacturing is a contract between a company and a manufacturer to make a certain number of components or products for the company in a specified period of time. The goods created will be under the company’s label or brand. This is called private label manufacturing. This is often also called outsourcing if it is done across borders. Manufacturers provide their service based on their own designs, formulas, and specifications unless the customer provides its own. They will create these products to whomever they have contracted with, even competing firms.

One of the primary factors driving the growth of the contract manufacturing market is the rising demand in medical device & pharmaceutical sector globally. The continuing clinical trial research being conducted by several companies for better diagnosis leads to market expansion. The market is also influenced by the rising technological advancements and cost effectiveness. However, the risk of confidential information and stringent regulations may act as restraining factors for the Middle East and Africa Contract Manufacturing Market in the forecast period

On the other hand, patent expiry and increasing demand for generic drugs, growing expenses in healthcare infrastructure and strategic initiatives by key market players act as an opportunity for the growth of the market. However, the intellectual property risk and increasing number of pharmaceutical companies to set up their own manufacturing units may create challenges for the Middle East and Africa Contract Manufacturing Market.

The demand for contract manufacturing will increase globally due to an increasing inclination toward point-of-care diagnostics. Various companies are taking initiatives that gradually lead to the growth of the market.

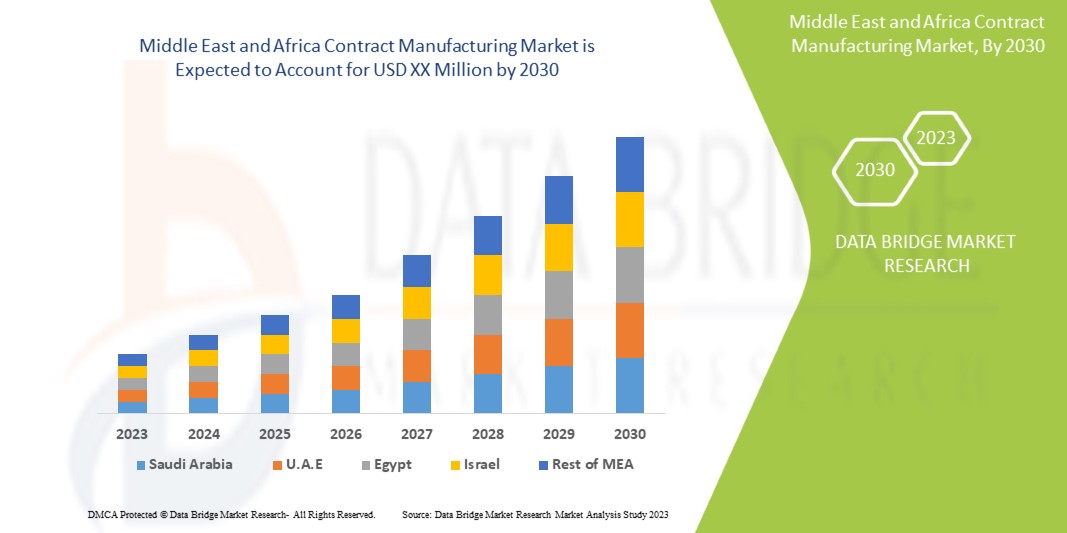

The Middle East and Africa contract manufacturing market is supportive and aims to reduce the manufacturing efforts of the healthcare organizations. Data Bridge Market Research analyses that Middle East and Africa Contract Manufacturing market will grow at a CAGR of 5.3% during the forecast period of 2023 to 2030.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015- 2020) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product (Pharmaceutical Products Manufacturing and Medical Device Manufacturing), By End User (Pharmaceutical Companies, Biotechnology Companies, Biopharma Companies, Medical Device Companies, Original Equipment Manufacturer, and Research Institutes), By Distribution Channel (Retail Sales, Direct Tender, and Others) |

|

Countries Covered |

Saudi Arabia, South Africa, U.A.E, Israel, Kuwait, Egypt, and the Rest of the Middle East and Africa |

|

Market Players Covered |

Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH., and Catalent, Inc among others |

Middle East and Africa Contract Manufacturing Dynamics

Market Definition

Contract manufacturing in international markets is used in situations when one company arranges for another company in a different country to manufacture its products; this is also known as international subcontracting or international outsourcing. The company provides the manufacturer with all the specifications, and, if applicable, also with the materials required for the production process. This type of contract sets out the requirements, which the manufacturer must meet concerning the quality of the products, certification, quantities, conditions and dates of delivery, etc. It also establishes guidelines for the inspection and testing of the products set forth by the company which contracts out the manufacture, or by its own clients. Furthermore, it also outlines modifications to orders, as well as guarantees and compensation in case of breach of contract. Since the process is essentially outsourcing production in foreign markets to a partner that privately brands the end product, there are a number of different companies and industries that can make use of this type of contract.

Drivers

- Cost-effectiveness for the manufacturing companies

The time-consuming manufacturing and ineffective production for several things and management are major burdens for public and private sector organizations. They are also essential for addressing complex challenges because a single organization is less effective in driving the change and sometimes required outcomes. The contract manufacturing companies will act as rising opportunities for both governmental and private sectors

The rising demand for contract manufacturing with improved accuracy and less time constraint pushes the key players for strategic initiatives. Owning contract manufacturing frees up the overhead charges required to invest in machinery, material, and another workforce, simplifying the production process and streamlining the supply chain by reducing the overall cost.

However, major market players are investing heavy capital in manufacturing to reach the demands of their end users. The contract manufacturing players are involved in making the strategies and implementing them by reducing the cost of production of these players. Contract manufacturing services to other firms also ensure efficiency and optimum usage of resources by using effective workforce, strategic intelligence, or working resources required in the production cycle.

- Rise of technological advancements in contract manufacturing

Introducing a new drug in the market promptly requires considerable investments in manufacturing due to the escalated demand in the pharmaceutical industry. Advanced technologies and skills are mandatory as some drugs have complex formulas and require specific equipment and techniques when mass-produced.

The usage of innovative technologies such as machine learning, big data, and artificial intelligence to develop pharmaceutical drugs or manufacture medical devices are being considered for rapid and quick manufacturing. These technical advancements also help in mass production and scalability in a short span of time.

However, pharmaceutical firms conventionally audit or supervise their contract manufacturing organization's production and delivery processes to monitor the manufacturing process using real-time remote tracing.

Opportunities

- Growing expenses on the development of healthcare infrastructure

Infrastructure is a key pillar supporting the fundamental aim of promoting improved standards of care and well-being for all patients, together with a good healthcare system experience. In parallel, the healthcare system and staff must support effective health promotion, prevention, and self-care of the whole population. Infrastructure must integrate the hospital, as the center for acute and inpatient care, into the broader healthcare system and should facilitate the seven domains of quality patient experience, effectiveness, efficiency, timeliness, safety, equity, and sustainability. Infrastructure includes the built environment and supporting elements: equipment, access, information technology (IT), systems and processes, sustainability initiatives, and staff.

However, the growing expenses on the development of healthcare infrastructure are propelling the growth of the Middle East and Africa contract manufacturing market in the forecast period.

Restraints/Challenges

- Increase in the Number of Pharmaceutical Companies Set Up Their Manufacturing Sites

Most pharmaceutical companies are building manufacturing sites to produce pharmaceutical products to reduce costs. Manufacturers are more focused on introducing advanced technologies and the digitalization process. The Pharma industry also faces disruptions due to new business models and a more focused population on personalized medicines and treatments. Hence, the demand for personalized care is high. Occupational profiles are also changing: some jobs are disappearing due to automation while entirely new jobs are emerging.

Hence, the increasing number of pharmaceutical companies setting up their manufacturing units may challenge the growth of the Middle East and Africa contract manufacturing market in the forecast period.

Recent Developments

- In October 2021, Boehringer Ingelheim International gmbh., had inaugurated its state-of-the-art biopharmaceutical production facility Large Scale Cell Culture (LSCC) in Vienna, Austria, with an investment volume of more than 700 million EUR, which is the single largest investment in the company's history

- In March 2023, Evonik Industries AG has announced that it is opening a new GMP facility to manufacture lipids for advanced, pharmaceutical drug delivery applications. The lipid launch facility is located at the company’s site in Hanau, Germany and provides customers with quantities of lipids as needed for clinical and small-scale commercial manufacturing

Middle East and Africa Contract Manufacturing Market Segmentation

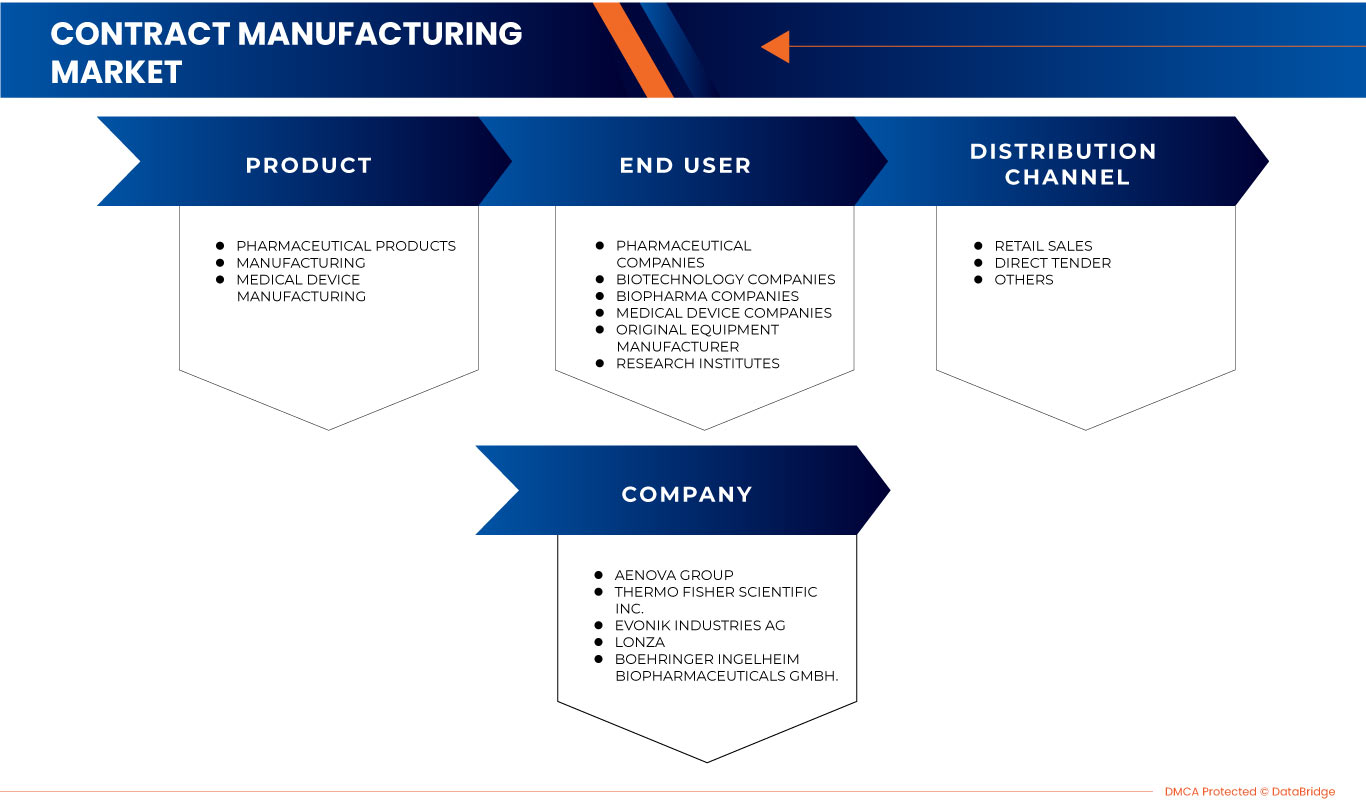

The Middle East and Africa contract manufacturing market is categorized into three notable segments based on product, end user and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

Product

- Medical Device Manufacturing

- Pharmaceutical Products Manufacturing

On the basis of product, the Middle East and Africa contract manufacturing market is segmented into medical device manufacturing and pharmaceutical products manufacturing.

End User

- Pharmaceutical Companies

- Biotechnology Companies

- Biopharma Companies

- Medical Device Companies

- Original Equipment Manufacturer

- Research Institutes

On the basis of end user, the Middle East and Africa contract manufacturing market is segmented into original equipment manufacturer, medical device companies, pharmaceutical companies, biotechnology companies, biopharma companies, and research institutes.

Distribution Channel

- Retail Sales

- Direct Tender

- Others

On the basis of distribution channel, the Middle East and Africa contract manufacturing market is segmented into direct tenders, retail sales, and others.

Middle East and Africa Contract Manufacturing Market Regional Analysis/Insights

The Middle East and Africa contract manufacturing market is analyzed, and market size insights and trends are provided by product, end user, and distribution channel as referenced above.

Some countries covered in the contract manufacturing report are Saudi Arabia, South Africa, U.A.E, Israel, Kuwait, Egypt, and the Rest of the Middle East and Africa.

South Africa is expected to dominate due to increasing technological advancement in developing areas.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and African brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Middle East and Africa Contract Manufacturing Market Share Analysis

Middle East and Africa contract manufacturing market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on Middle East and Africa contract manufacturing market.

Some players in the market are Aenova Group, Thermo Fisher Scientific Inc., EVONIK INDUSTRIES AG, Lonza, Boehringer Ingelheim Biopharmaceuticals GmbH. and Catalent, Inc among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 MARKET END USER COVERAGE GRID

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

4.3 STRATEGIC INITIATIVES:

5 REGULATORY FRAMEWORK

5.1 REGULATORY SCENARIO BY FDA

5.2 REGULATORY SCENARIO IN AUSTRALIA

5.3 REGULATORY SCENARIO IN EUROPE FOR MEDICINES

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 COST-EFFECTIVENESS FOR THE MANUFACTURING COMPANIES

6.1.2 RISE OF TECHNOLOGICAL ADVANCEMENTS IN CONTRACT MANUFACTURING

6.1.3 MIDDLE EAST & AFRICA PRESENCE AND CONNECTED NETWORK

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATIONS AMONG VARIOUS JURISDICTIONS

6.2.2 RISK OF CONFIDENTIAL INFORMATION

6.3 OPPORTUNITIES

6.3.1 PATENT EXPIRY AND INCREASING DEMAND FOR GENERIC DRUGS

6.3.2 GROWING EXPENSES ON THE DEVELOPMENT OF HEALTHCARE INFRASTRUCTURE

6.3.3 INCREASE IN NUMBER OF STRATEGIC INITIATIVES BY KEY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 INTELLECTUAL PROPERTY RISKS

6.4.2 INCREASE IN NUMBER OF PHARMACEUTICAL COMPANIES TO SET UP THEIR MANUFACTURING SITES

7 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY PRODUCT

7.1 OVERVIEW

7.2 PHARMACEUTICAL PRODUCTS MANUFACTURING

7.2.1 TYPES OF PRODUCTS

7.2.1.1 TABLETS

7.2.1.2 CAPSULES

7.2.1.3 BIOLOGICS

7.2.1.4 SMALL MOLECULE

7.2.1.5 CELL & GENES MANUFACTURING

7.2.1.6 NUTRACEUTICALS

7.2.1.7 OTHERS

7.2.2 TYPE OF SERVICES

7.2.2.1 DRUG DEVELOPMENT SERVICES

7.2.2.2 TABLET MANUFACTURING SERVICES

7.2.2.3 BIOLOGICS API MANUFACTURING

7.2.2.4 BIOLOGICS FDF MANUFACTURING SERVICES

7.2.2.5 OTHERS

7.2.3 BY DOSAGE FORM

7.2.3.1 SOLID FORMULATIONS

7.2.3.2 LIQUID FORMULATIONS

7.2.3.2.1 INJECTABLE

7.2.3.2.2 SYRUPS

7.2.3.3 SEMI-SOLID FORMULATIONS

7.2.3.4 TOPICAL DRUG FORMULATIONS

7.2.3.5 OTHERS

7.3 MEDICAL DEVICE MANUFACTURING

7.3.1 TYPE OF DEVICES

7.3.1.1 SYRINGES AND NEEDLES

7.3.1.2 INFUSION DEVICES & ADMINISTRATION SETS

7.3.1.3 MEDICAL ACCESSORIES, COMPONENTS & CONSUMABLES

7.3.1.4 DISPOSABLES

7.3.1.5 IVD DEVICES

7.3.1.6 CARDIOVASCULAR DEVICES

7.3.1.7 DIABETES CARE DEVICES

7.3.1.8 GENERAL SURGERY DEVICES

7.3.1.9 ORTHOPEDIC DEVICES

7.3.1.10 RESPIRATORY DEVICES

7.3.1.11 OPHTHALMIC DEVICES

7.3.1.12 DENTAL DEVICES

7.3.1.13 GYNECOLOGY/UROLOGY DEVICES

7.3.1.14 LABORATORY EQUIPMENT

7.3.2 TYPE OF SERVICES

7.3.2.1 MEDICAL DEVICE DESIGN AND DEVELOPMENT

7.3.2.2 DEVICE ASSEMBLY

7.3.2.3 REGULATORY ASSISTANCE

7.3.2.4 PACKAGING & LABELLING

7.3.2.5 STERILIZATION SERVICES

7.3.2.6 TRAINING AND VALIDATION

7.3.2.7 QUALITY ASSURANCE

7.3.2.8 OTHERS

7.3.3 BY DEVICE CLASS

7.3.3.1 CLASS I MEDICAL DEVICES

7.3.3.2 CLASS IIA MEDICAL DEVICES

7.3.3.3 CLASS IIB MEDICAL DEVICES

7.3.3.4 CLASS III MEDICAL DEVICES

8 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY END USER

8.1 OVERVIEW

8.2 PHARMACEUTICAL COMPANIES

8.3 BIOTECHNOLOGY COMPANIES

8.4 BIOPHARMA COMPANIES

8.5 MEDICAL DEVICES COMPANIES

8.6 ORIGINAL EQUIPMENT MANUFACTURER

8.7 RESEARCH INSTITUTES

9 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL SALES

9.3 DIRECT TENDER

9.4 OTHERS

10 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 U.A.E.

10.1.4 EGYPT

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 AENOVA GROUP

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 THERMO FISHER SCIENTIFIC INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 EVONIK INDUSTRIES AG

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 LONZA

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 BOEHRINGER INGELHEIM INTERNATIONAL GMBH.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 ABBVIE INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 ALMAC GROUP

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 AVID BIOSERVICES, INC.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENT

13.9 BAXTER

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.1 CATALENT, INC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 FAMAR HEALTH CARE SERVICES

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 JUBILANT PHARMA LIMITED

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 KIMBALL INTERNATIONAL

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 MERCK KGAA

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 NIPR0

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENT

13.16 PFIZER INC

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 RECIPHARM AB.

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENT

13.18 SIEGFRIED HOLDING AG

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SUN PHARMACEUTICAL INDUSTRIES LTD

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENT

13.2 TE CONNECTIVITY

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

13.21 VETTER PHARMA-FERTIGUNG GMBH & CO. KG

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 MIDDLE EAST & AFRICA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA TYPES OF PRODUCTS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 5 MIDDLE EAST & AFRICA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 8 MIDDLE EAST & AFRICA MEDICAL DEVICE MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CONSUMABLES AND ACCESSORIES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 10 MIDDLE EAST & AFRICA TYPE OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 12 MIDDLE EAST & AFRICA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 14 MIDDLE EAST & AFRICA PHARMACEUTICAL COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA BIOTECHNOLOGY COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 MIDDLE EAST & AFRICA BIOPHARMA COMPANIES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA AMBULATORY SURGICAL CENTERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 MIDDLE EAST & AFRICA ORIGINAL EQUIPMENT MANUFACTURER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA RESEARCH INSTITUTES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA RETAIL SALES IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 MIDDLE EAST & AFRICA DIRECT TENDER IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA OTHERS IN CONTRACT MANUFACTURING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 25 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 26 MIDDLE EAST AND AFRICA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 27 MIDDLE EAST AND AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 28 MIDDLE EAST AND AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, 2021-2030, 2021-2030 (UNIT)

TABLE 29 MIDDLE EAST AND AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP

TABLE 30 MIDDLE EAST AND AFRICA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 31 MIDDLE EAST AND AFRICA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 32 MIDDLE EAST AND AFRICA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 33 MIDDLE EAST AND AFRICA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 34 MIDDLE EAST AND AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 35 MIDDLE EAST AND AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 36 MIDDLE EAST AND AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 37 MIDDLE EAST AND AFRICA TYPE OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 38 MIDDLE EAST AND AFRICA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 39 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 40 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 SOUTH AFRICA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 42 SOUTH AFRICA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 43 SOUTH AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 44 SOUTH AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 45 SOUTH AFRICA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 46 SOUTH AFRICA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 47 SOUTH AFRICA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 48 SOUTH AFRICA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 49 SOUTH AFRICA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 50 SOUTH AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 51 SOUTH AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 52 SOUTH AFRICA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 53 SOUTH AFRICA TYPES OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 54 SOUTH AFRICA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 55 SOUTH AFRICA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 56 SOUTH AFRICA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 57 SAUDI ARABIA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 58 SAUDI ARABIA PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 59 SAUDI ARABIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 60 SAUDI ARABIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 61 SAUDI ARABIA TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 62 SAUDI ARABIA BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 63 SAUDI ARABIA BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 64 SAUDI ARABIA LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 65 SAUDI ARABIA MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 66 SAUDI ARABIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 67 SAUDI ARABIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 68 SAUDI ARABIA TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 69 SAUDI ARABIA TYPES OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 70 SAUDI ARABIA BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 71 SAUDI ARABIA CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 72 SAUDI ARABIA CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 73 UA.E. CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 74 UA.E. PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 75 UA.E. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 76 UA.E. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 77 UA.E. TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 78 UA.E. BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 79 UA.E. BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 80 UA.E. LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 81 UA.E. MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 82 UA.E. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 83 UA.E. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 84 UA.E. TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 85 UA.E. TYPES OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 86 UA.E. BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 87 UA.E. CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 88 UA.E. CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 89 EGYPT CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 90 EGYPT PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 91 EGYPT TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 92 EGYPT TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 93 EGYPT TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 94 EGYPT BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 95 EGYPT BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 96 EGYPT LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 97 EGYPT MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 98 EGYPT TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 99 EGYPT TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 100 EGYPT TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 101 EGYPT TYPES OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 102 EGYPT BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 103 EGYPT CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 104 EGYPT CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 105 ISRAEL CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 106 ISRAEL PHARMACEUTICAL PRODUCTS MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 107 ISRAEL TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 108 ISRAEL TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 109 ISRAEL TYPES OF PRODUCT IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 110 ISRAEL BY SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 111 ISRAEL BY DOSAGE FORM IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 112 ISRAEL LIQUID FORMULATIONS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 113 ISRAEL MEDICAL DEVICES MANUFACTURING IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 114 ISRAEL TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 115 ISRAEL TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (UNIT)

TABLE 116 ISRAEL TYPES OF DEVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (ASP)

TABLE 117 ISRAEL TYPES OF SERVICES IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 118 ISRAEL BY DEVICE CLASS IN CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

TABLE 119 ISRAEL CONTRACT MANUFACTURING MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 120 ISRAEL CONTRACT MANUFACTURING MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 121 REST OF MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET, BY PRODUCT, 2021-2030 (USD MILLION)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: SEGMENTATION

FIGURE 11 RISING TECHNOLOGICAL ADVANCEMENTS AND COST-EFFECTIVENESS OF PHARMACEUTICAL AND MEDICAL PRODUCTS ARE EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET

FIGURE 12 THE PHARMACEUTICAL PRODUCTS MANUFACTURING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET IN 2023 & 2030

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD

FIGURE 14 NORTH AMERICA IS THE FASTEST-GROWING MARKET FOR CONTRACT MANUFACTURING MARKET MANUFACTURERS IN THE FORECAST PERIOD

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET

FIGURE 16 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2022

FIGURE 17 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY PRODUCT, 2023-2030 (USD MILLION)

FIGURE 18 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY PRODUCT, CAGR (2023-2030)

FIGURE 19 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY END USER, 2022

FIGURE 21 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 22 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY END USER, CAGR (2023-2030)

FIGURE 23 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY END USER, LIFELINE CURVE

FIGURE 24 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 26 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 27 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET: SNAPSHOT (2022)

FIGURE 29 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022)

FIGURE 30 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 MIDDLE EAST AND AFRICA CONTRACT MANUFACTURING MARKET: BY PRODUCT (2023-2030)

FIGURE 33 MIDDLE EAST & AFRICA CONTRACT MANUFACTURING MARKET: COMPANY SHARE 2022 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.