Middle East And Africa Corneal Transplant Market

Market Size in USD Million

CAGR :

%

USD

22.87 Million

USD

32.76 Million

2024

2032

USD

22.87 Million

USD

32.76 Million

2024

2032

| 2025 –2032 | |

| USD 22.87 Million | |

| USD 32.76 Million | |

|

|

|

|

Middle East and Africa Corneal Transplant Market Size

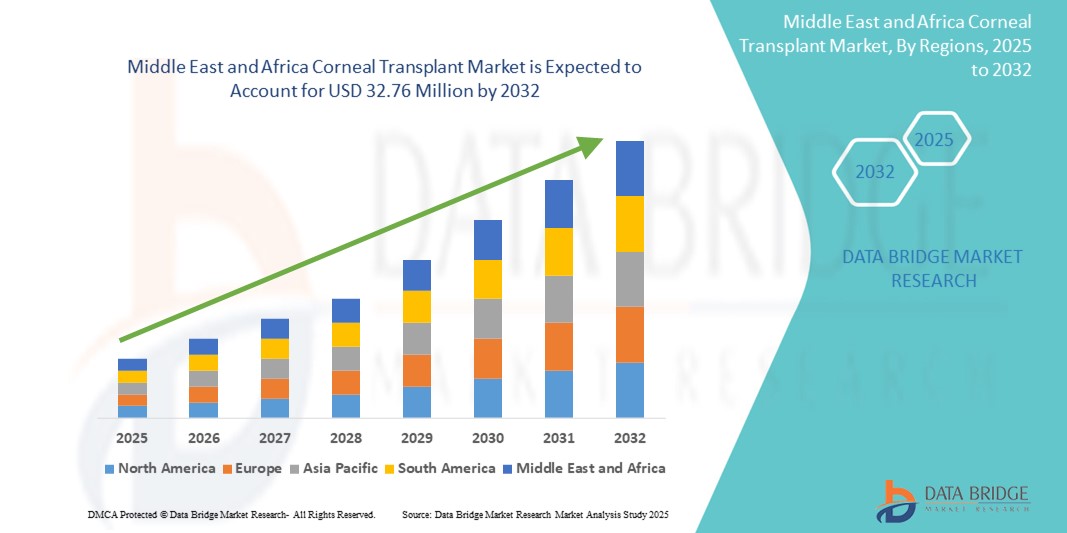

- The Middle East and Africa corneal transplant market size was valued at USD 22.87 million in 2024 and is expected to reach USD 32.76 million by 2032, at a CAGR of 4.60% during the forecast period

- The market expansion is driven by increasing prevalence of corneal blindness, coupled with rising awareness and improving accessibility to advanced ophthalmic care and surgical interventions across the region

- In addition, growing governmental and non-governmental initiatives to establish eye banks and strengthen transplant infrastructure are catalyzing demand. These collective efforts are fostering wider adoption of corneal transplantation, thereby advancing market growth across MEA

Middle East and Africa Corneal Transplant Market Analysis

- Corneal transplants, involving the replacement of damaged or diseased corneal tissue with donor corneas, are becoming increasingly vital procedures across the Middle East and Africa due to the rising burden of corneal blindness, trauma, and infectious eye diseases in the region

- The growing demand is largely fueled by increasing healthcare investments, heightened awareness about treatable causes of visual impairment, and the development of specialized ophthalmic centers across countries such as South Africa, Saudi Arabia, and the UAE

- South Africa dominated the corneal transplant market in the Middle East and Africa with the largest revenue share of 32.5% in 2024, supported by stronger surgical infrastructure, expanding donor cornea availability, and public-private initiatives to combat corneal blindness

- United Arab Emirates is expected to be the fastest growing country in the corneal transplant market during the forecast period, driven by advanced healthcare modernization programs, increasing medical tourism, and expanding adoption of innovative corneal treatment technologies

- Penetrating keratoplasty segment dominated the corneal transplant market with a market share of 49.2% in 2024, attributed to its established success rate and suitability for a wide range of corneal conditions commonly treated in the region

Report Scope and Middle East and Africa Corneal Transplant Market Segmentation

|

Attributes |

Middle East and Africa Corneal Transplant Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Corneal Transplant Market Trends

“Advancing Eye Banking and Surgical Infrastructure”

- A notable trend shaping the Middle East and Africa corneal transplant market is the ongoing development of regional eye banks and enhanced access to advanced ophthalmic surgical infrastructure. These efforts are crucial in addressing the high burden of corneal blindness and improving transplant availability

- For instance, in 2024, the South African National Eye Bank expanded its donor network and cornea preservation capacity, significantly boosting corneal graft availability. Similarly, Saudi Arabia is investing in state-of-the-art ophthalmic surgical centers as part of its Vision 2030 healthcare goals

- The expansion of eye banking facilities is improving the quality and safety of transplantable tissue, enabling more efficient cornea distribution, and reducing transplant wait times. In addition, the incorporation of advanced diagnostic and surgical technologies, including femtosecond lasers and endothelial keratoplasty techniques, is elevating surgical outcomes across the region

- Emerging public-private partnerships are supporting awareness campaigns, donor recruitment initiatives, and skill-building programs for ophthalmic surgeons. These efforts are gradually aligning the region with global corneal transplant standards

- This trend toward building a sustainable transplant ecosystem is reshaping regional eye care systems and enhancing access to vision-restoring procedures. Consequently, countries such as the UAE and Egypt are becoming regional hubs for ophthalmic care, supported by rising medical tourism and growing investments in specialty eye hospitals

- The emphasis on expanding corneal donor pools, refining surgical precision, and training skilled professionals is accelerating the pace of corneal transplantation across the Middle East and Africa, improving long-term market viability

Middle East and Africa Corneal Transplant Market Dynamics

Driver

“Increasing Corneal Blindness and Government Eye Health Initiatives”

- The rising incidence of corneal blindness due to trauma, infections, and degenerative disorders is a major driver of growth in the corneal transplant market across the Middle East and Africa. This growing need for vision restoration is driving demand for surgical solutions

- For instance, in 2024, the UAE Ministry of Health launched a national corneal donation registry and transplant coordination system to streamline access and reduce dependency on imported donor tissue. Similar initiatives in Kenya and Egypt are targeting preventable blindness through surgical interventions and improved accessibility

- Governments and health organizations are increasingly prioritizing eye care within national health strategies, with a focus on capacity building, patient education, and infrastructure development. These policy-level commitments are expected to boost transplant volumes in the coming years

- Corneal transplants are gaining importance as cost-effective solutions for restoring sight and improving quality of life, especially in underserved populations. Donor awareness campaigns and the adoption of mobile eye care services are also supporting broader access in rural areas

- The integration of donor tracking systems, enhanced preservation methods, and specialized training programs for corneal surgeons are further reinforcing the regional transplant landscape, making it more responsive to growing demand

Restraint/Challenge

“Limited Donor Cornea Availability and High Treatment Costs”

- A critical challenge in the Middle East and Africa corneal transplant market is the persistent shortage of donor corneas, which limits the number of viable surgeries that can be performed. This scarcity is particularly acute in low-resource countries with underdeveloped donation systems

- For instance, many sub-Saharan nations rely heavily on imported donor tissue due to inadequate local eye banking infrastructure, leading to delays and increased procedural costs

- High treatment expenses, particularly for advanced transplant procedures such as DMEK or DSAEK, present another barrier in cost-sensitive markets. Out-of-pocket expenses often deter patients from seeking surgical care, especially in rural and underserved regions

- Regulatory gaps, inconsistent donation laws, and cultural resistance to eye donation also hinder donor pool expansion in several countries. Moreover, a lack of trained ophthalmic surgeons and modern surgical tools in some areas reduces procedural success rates and limits scalability

- Addressing these challenges through targeted government funding, cross-border collaboration in eye banking, public education, and international partnerships will be essential to broaden access and improve affordability across the region

Middle East and Africa Corneal Transplant Market Scope

The market is segmented on the basis of procedure type, type, donor type, graft type, surgery type, indication, gender, age group, and end user.

- By Procedure Type

On the basis of procedure type, the Middle East and Africa corneal transplant market is segmented into endothelial keratoplasty, penetrating keratoplasty, Anterior Lamellar Keratoplasty (ALK), corneal limbal stem cell transplant, artificial cornea transplant, and others. The penetrating keratoplasty segment dominated the market with the largest market revenue share of 49.2% in 2024, attributed to its broad applicability in treating full-thickness corneal diseases, especially in regions with limited access to advanced surgical tools. Hospitals and eye centers across South Africa and Nigeria continue to rely on this traditional procedure due to its effectiveness and surgical familiarity.

The endothelial keratoplasty segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by its minimally invasive nature, faster visual recovery, and increasing availability of skilled ophthalmic surgeons, especially in the UAE and Saudi Arabia. The rise of DMEK and DSAEK techniques is contributing to the segment’s expansion.

- By Type

On the basis of type, the Middle East and Africa corneal transplant market is segmented into human cornea and synthetic. The human cornea segment held the largest market revenue share in 2024, driven by continued preference for donor-derived tissues and the growing establishment of eye banks in countries such as South Africa, Egypt, and Kenya. The natural compatibility and high transplant success rates support its dominance.

The synthetic segment is expected to grow steadily during forecast period, due to technological advancements in keratoprosthesis and increasing use in cases of multiple graft failures or when human donor tissue is unavailable.

- By Donor Type

On the basis of donor type, the Middle East and Africa corneal transplant market is segmented into autograft and allograft. The allograft segment dominated the market with the highest revenue share in 2024, primarily due to the common practice of using donor corneas from deceased individuals and the growing donor awareness programs. Efforts by regional health ministries and NGOs are enhancing the donor registry base in nations such as Egypt and Kenya.

The autograft segment is expected to witness fastest growth during the forecast period, mostly restricted to corneal limbal stem cell transplant procedures, and is typically used in highly specialized cases.

- By Graft Type

On the basis of graft type, the Middle East and Africa corneal transplant market is segmented into partial thickness grafts (lamellar) and full thickness grafts (penetrating). The full thickness grafts (penetrating) segment held the largest market revenue share in 2024, driven by its established use in both public and private hospitals and its ability to treat advanced and complex corneal conditions across MEA.

The partial thickness grafts (lamellar) segment is projected to grow at a higher pace during the forecast period due to fewer postoperative complications, quicker healing time, and increasing adoption in technologically advanced eye centers.

- By Surgery Type

On the basis of surgery type, the Middle East and Africa corneal transplant market is segmented into conventional surgery and laser-assisted surgery. The conventional surgery segment dominated the market in 2024, due to the widespread use of traditional manual techniques in corneal transplant operations, particularly in lower- and middle-income countries with limited access to advanced surgical systems.

The laser-assisted surgery segment is expected to grow rapidly from 2025 to 2032, driven by rising demand for precision, reduced healing time, and growing use of femtosecond laser systems in the UAE and Saudi Arabia.

- By Indication

On the basis of indication, the Middle East and Africa corneal transplant market is segmented into fuch's endothelial dystrophy, infectious keratitis, bullous keratopathy, keratoconus, regraft procedures, corneal scarring, corneal ulcers, and others. The keratoconus segment held the largest market revenue share in 2024, owing to high regional prevalence, particularly among young adults in Middle Eastern countries such as Saudi Arabia and the UAE. Early diagnosis and availability of advanced surgical options are key factors.

The Fuch’s endothelial dystrophy segment is anticipated to witness the fastest growth during forecast period, supported by increasing geriatric population, rising awareness, and access to endothelial keratoplasty procedures across urban healthcare settings.

- By Gender

On the basis of gender, the Middle East and Africa corneal transplant market is segmented into female and male. The male segment accounted for the largest market share in 2024, mainly due to higher exposure to occupational eye injuries and greater prevalence of corneal trauma cases in men, especially in industrial zones across South Africa and Nigeria.

The female segment is expected to show fastest growth during forecast period, aided by increasing female healthcare access, rising awareness campaigns, and a focus on gender equality in regional health initiatives.

- By Age Group

On the basis of age group, the Middle East and Africa corneal transplant market is segmented into geriatric, adult, and pediatric. The adult segment dominated the market with the highest revenue share in 2024, driven by the high incidence of conditions such as keratoconus and infectious keratitis in working-age populations.

The geriatric segment is projected to grow at the fastest rate during the forecast period due to an aging population and increasing cases of endothelial dysfunction and bullous keratopathy among elderly individuals in the UAE and Egypt.

- By End User

On the basis of end user, the Middle East and Africa corneal transplant market is segmented into hospitals, eye clinics, ambulatory surgical centers, academic & research institutes, and others. The hospitals segment led the market in 2024, supported by advanced infrastructure, integrated surgical capabilities, and the presence of skilled ophthalmologists in leading medical facilities across South Africa, Egypt, and the UAE.

The eye clinics segment is expected to witness the fastest growth from 2025 to 2032, driven by the expansion of specialized eye care networks and increased accessibility in urban and suburban areas.

Middle East and Africa Corneal Transplant Market Regional Analysis

- South Africa dominated the corneal transplant market in the Middle East and Africa with the largest revenue share of 32.5% in 2024, supported by stronger surgical infrastructure, expanding donor cornea availability, and public-private initiatives to combat corneal blindness

- Patients in the country benefit from increasing awareness of treatable visual impairments, access to trained ophthalmic professionals, and government-led programs aimed at reducing the burden of corneal blindness

- The region’s leadership in transplant procedures is further reinforced by advancements in eye banking, improved access to surgical technologies, and ongoing collaborations with international organizations, positioning South Africa as a key hub for corneal care in the Middle East and Africa

The South Africa Corneal Transplant Market Insight

The South Africa corneal transplant market captured the largest revenue share of 32.5% in 2024 across the region, driven by its advanced eye care facilities and growing network of donor cornea programs. Public-private partnerships and increased training for ophthalmic surgeons have significantly improved procedural access and outcomes. The country continues to lead regional adoption due to strong governmental support, expanding transplant registries, and collaborations with international eye health organizations, positioning it as a key hub for corneal care.

United Arab Emirates Corneal Transplant Market Insight

The UAE corneal transplant market is anticipated to grow at a robust CAGR during the forecast period, supported by cutting-edge healthcare infrastructure and rising medical tourism. The government's focus on digital health, innovation, and specialty care has led to increased availability of laser-assisted transplant procedures. Growing awareness, coupled with national donor programs and integration of global surgical standards, is fostering strong adoption in both private and public hospitals.

Saudi Arabia Corneal Transplant Market Insight

The Saudi Arabia corneal transplant market is expected to expand steadily due to the country’s Vision 2030 healthcare reforms and rising prevalence of corneal diseases. Investments in ophthalmic centers and initiatives to increase donor awareness are helping close the supply-demand gap for transplantable corneas. Technological advancements and improved access to training are supporting the growth of advanced surgical techniques such as endothelial keratoplasty across leading hospitals in Riyadh and Jeddah.

Egypt Corneal Transplant Market Insight

The Egypt corneal transplant market is witnessing increased momentum, driven by the growing burden of infectious eye diseases and trauma-related corneal damage. Expanding public eye care services and foreign collaborations with eye banks are helping improve cornea availability. The market is expected to benefit from a strong patient base, government-led awareness campaigns, and international partnerships focusing on reducing corneal blindness in underserved regions.

Kenya Corneal Transplant Market Insight

The Kenya corneal transplant market is projected to grow gradually, supported by the expansion of non-profit eye care initiatives and mobile surgical units. As access to specialized ophthalmic care improves in rural areas, the demand for affordable and effective corneal transplant procedures is increasing. Initiatives by global health organizations and improvements in public sector hospitals are expected to enhance donor cornea access and surgical outcomes over the forecast period.

Middle East and Africa Corneal Transplant Market Share

The Middle East and Africa Corneal Transplant industry is primarily led by well-established companies, including:

- CorneaGen, Inc. (U.S.)

- KeraLink International (U.S.)

- Aurolab (India)

- AJL Ophthalmic S.A. (Spain)

- DIOPTEX GmbH (Austria)

- Presbia PLC (Ireland)

- Florida Lions Eye Bank (U.S.)

- San Diego Eye Bank (U.S.)

- TissueTech, Inc. (U.S.)

- Eversight (U.S.)

- Alcon Inc. (Switzerland)

- Bausch + Lomb Incorporated (U.S.)

- Ziemer Ophthalmic Systems AG (Switzerland)

- Gebauer Medizintechnik GmbH (Germany)

- MEDIPHACOS Ltda. (Brazil)

- Ophtec BV (Netherlands)

- Surgical Specialties Corporation (U.S.)

- EyeYon Medical Ltd. (Israel)

- Miracles Optical (India)

- Keramed, Inc. (U.S.)

What are the Recent Developments in Middle East and Africa Corneal Transplant Market?

- In May 2024, the South African National Eye Bank announced a major expansion initiative to enhance donor cornea collection and preservation capacity. This development is aimed at addressing the growing demand for corneal transplants in the region by increasing the availability of high-quality grafts. The initiative underscores the organization’s commitment to reducing corneal blindness through strengthened eye banking infrastructure, improved tissue handling protocols, and broader donor outreach programs across South Africa

- In April 2024, Moorfields Eye Hospital Dubai, a leading ophthalmic care center in the UAE, launched an advanced corneal transplant program integrating femtosecond laser technology. This program is designed to deliver precision-based surgical outcomes for conditions such as Fuch’s dystrophy and keratoconus. By adopting state-of-the-art equipment and international surgical standards, Moorfields is reinforcing its role as a regional leader in corneal care and supporting the UAE’s goal of becoming a hub for medical excellence

- In March 2024, the King Khaled Eye Specialist Hospital in Saudi Arabia signed a collaborative agreement with global nonprofit Orbis International to expand training programs for corneal surgeons. The partnership focuses on capacity building, including live surgical training, workshops, and telemedicine support to enhance transplant capabilities across the Kingdom. This initiative highlights the importance of international partnerships in improving ophthalmic care quality and accessibility in Saudi Arabia

- In February 2024, the Ministry of Health in Kenya launched a public eye donation awareness campaign in collaboration with regional NGOs and international eye banks. The campaign aims to increase local donor registration and reduce the country’s reliance on imported corneal tissue. This development reflects growing governmental focus on addressing preventable blindness through local donor mobilization and improved transplant infrastructure

- In January 2024, Magrabi Hospitals & Centers in Egypt introduced a centralized corneal transplant registry to streamline patient management and optimize donor tissue allocation. The system supports transparent tracking of surgical outcomes, donor-recipient matching, and post-operative care. This initiative reflects a data-driven approach to enhancing transplant efficiency, positioning Egypt as an emerging player in ophthalmic surgical innovation within the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.