Middle East And Africa Digital Diabetes Management Market

Market Size in USD Billion

CAGR :

%

USD

1.20 Billion

USD

4.26 Billion

2024

2032

USD

1.20 Billion

USD

4.26 Billion

2024

2032

| 2025 –2032 | |

| USD 1.20 Billion | |

| USD 4.26 Billion | |

|

|

|

|

Middle East and Africa Digital Diabetes Management Market Size

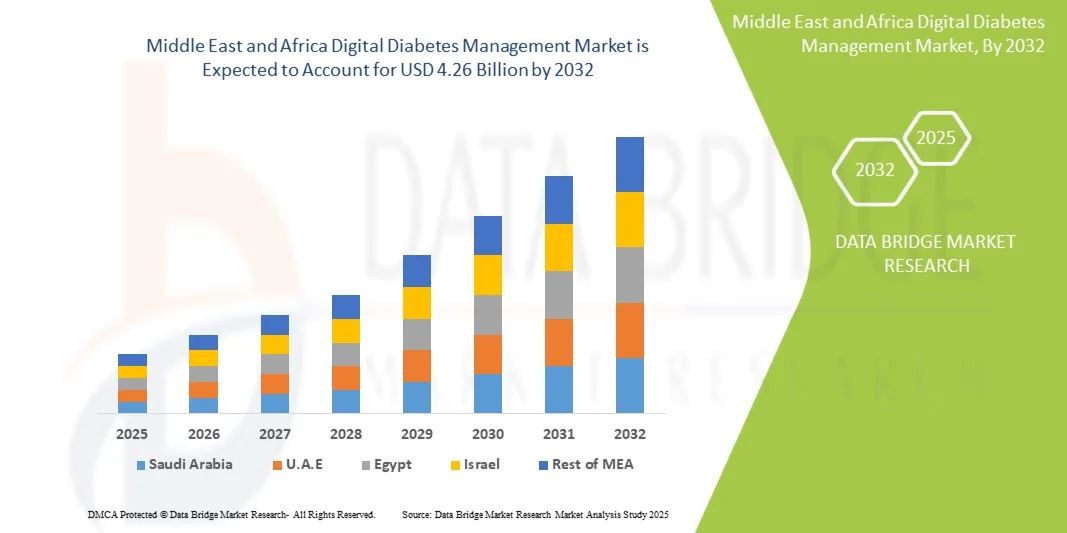

- The Middle East and Africa digital diabetes management market size was valued at USD 1.20 billion in 2024 and is expected to reach USD 4.26 billion by 2032, at a CAGR of 17.1% during the forecast period

- The market growth is largely fueled by the growing adoption of connected diabetes‑care devices and digital health platforms, leading to increased digitalization in both residential/home‑care and commercial/clinical settings

- Furthermore, rising consumer demand for secure, user‑friendly, and integrated diabetes‑management solutions, along with national healthcare initiatives and digital health transformation, is establishing digital diabetes management as the modern standard of care

Middle East and Africa Digital Diabetes Management Market Analysis

- Digital diabetes management solutions, encompassing devices, digital diabetes management apps, data management software and platforms, and services, are increasingly vital components of modern diabetes care in both residential and clinical settings due to their enhanced convenience, real-time monitoring capabilities, and seamless integration with digital health ecosystems

- The escalating demand for digital diabetes management is primarily fueled by the widespread adoption of connected health devices, growing prevalence of diabetes, and a rising preference for personalized, data-driven care

- Saudi Arabia dominated the Middle East & Africa market with the largest revenue share of 38.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and strong government support, with substantial growth in adoption of digital diabetes solutions driven by innovations from both established healthcare companies and health-tech startups focusing on AI-enabled analytics and remote monitoring features

- United Arab Emirates is expected to be the fastest-growing country in the Middle East & Africa digital diabetes management market during the forecast period due to increasing urbanization, rising healthcare awareness, and growing adoption of mobile health technologies

- Devices segment dominated the market with a market share of 44% in 2024, driven by its established reputation for reliability, ease of use in home care and clinical settings, and integration with digital diabetes management apps and data platforms

Report Scope and Middle East and Africa Digital Diabetes Management Market Segmentation

|

Attributes |

Middle East and Africa Digital Diabetes Management Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Digital Diabetes Management Market Trends

“Enhanced Convenience Through AI and Mobile Integration”

- A significant and accelerating trend in the Middle East & Africa digital diabetes management market is the integration of artificial intelligence (AI) with mobile apps and cloud-based platforms, significantly enhancing patient convenience and remote monitoring capabilities

- For instance, the GlucoTrack mobile app integrates AI-based predictive analytics to provide personalized insulin and diet recommendations, allowing users to manage blood glucose levels more effectively

- AI integration in digital diabetes management enables features such as analyzing patient glucose patterns to suggest lifestyle adjustments and providing intelligent alerts for abnormal readings. For instance, DarioHealth’s platform uses AI to detect anomalies and provide actionable insights for patients and clinicians

- Mobile app integration with wearable devices facilitates centralized monitoring of blood glucose, insulin administration, and other health metrics, enabling real-time data sharing with healthcare providers and family members

- This trend towards more intelligent, intuitive, and interconnected diabetes management systems is reshaping patient expectations for care. Consequently, companies such as Glooko are developing AI-enabled solutions with features such as predictive alerts and automated integration with wearable glucose monitors

- The demand for digital diabetes management solutions offering seamless AI and mobile integration is growing rapidly across home care and clinical settings, as patients increasingly prioritize convenience and personalized care

Middle East and Africa Digital Diabetes Management Market Dynamics

Driver

“Growing Need Due to Rising Diabetes Prevalence and Mobile Health Adoption”

- The increasing prevalence of diabetes in Middle East & Africa, coupled with the accelerating adoption of mobile health and digital health platforms, is a significant driver for heightened demand for digital diabetes management solutions

- For instance, in March 2024, LifeScan Middle East launched a cloud-based glucose monitoring program aimed at integrating real-time patient data across clinics and home care settings to improve disease management outcomes

- As patients and caregivers become more aware of the importance of continuous monitoring, digital diabetes solutions offer advanced features such as real-time glucose tracking, predictive alerts, and remote clinician access, providing a compelling upgrade over traditional methods

- Furthermore, the growing popularity of wearable health devices and digital platforms for chronic disease management is making digital diabetes management solutions an integral part of healthcare delivery, enabling personalized care and proactive intervention

- The convenience of remote monitoring, real-time analytics, and smartphone-based management for patients and caregivers are key factors propelling adoption. The trend towards telehealth integration and availability of user-friendly platforms further contributes to market growth

Restraint/Challenge

“Data Privacy Issues and Regulatory Compliance Hurdle”

- Concerns surrounding the security and privacy of patient health data in digital diabetes management solutions pose a significant challenge to broader market penetration. As these platforms rely on network connectivity and cloud storage, they are susceptible to data breaches and unauthorized access, raising anxieties among patients and healthcare providers

- For instance, high-profile reports of vulnerabilities in cloud health platforms have made some patients hesitant to adopt digital diabetes management solutions, including mobile apps and wearable devices

- Addressing these data privacy concerns through secure encryption, compliance with healthcare regulations (such as GDPR and HIPAA), and regular software updates is crucial for building trust. Companies such as Glooko and DarioHealth emphasize their data protection and regulatory compliance in marketing to reassure users

- In addition, the relatively high cost of advanced digital diabetes management platforms compared to traditional glucose monitoring methods can be a barrier to adoption for price-sensitive patients, particularly in developing countries. While basic apps and devices have become more affordable, premium features such as AI analytics or integration with multiple health devices often come with higher costs

- Overcoming these challenges through enhanced cybersecurity, patient education on data protection, and development of more affordable solutions will be vital for sustained market growth

Middle East and Africa Digital Diabetes Management Market Scope

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product and Services

On the basis of product and services, the market is segmented into devices, digital diabetes management apps, data management software and platforms, and services. The Devices segment dominated the market with the largest market revenue share of 44% in 2024, driven by their essential role in diabetes monitoring and management. Devices such as wearable continuous glucose monitors (CGM) and handheld glucometers provide real-time and accurate readings, forming the backbone of digital diabetes care. Their integration with mobile apps and cloud platforms allows seamless monitoring and remote clinician access, enhancing patient compliance. Hospitals, diabetes clinics, and home care settings prefer devices for their reliability, ease of use, and compatibility with existing healthcare infrastructure. Moreover, increasing awareness among patients about proactive glucose monitoring has reinforced devices as a critical segment in the digital diabetes ecosystem.

The Digital Diabetes Management Apps segment is anticipated to witness the fastest growth during the forecast period due to rising smartphone penetration and growing adoption of mobile health solutions. Apps enable patients to track glucose levels, diet, exercise, and medication adherence in one platform. They often integrate with wearable devices and cloud platforms, providing predictive analytics, personalized recommendations, and automated alerts for abnormal readings. In addition, apps support telemedicine consultations, data sharing with healthcare providers, and remote patient management, which is especially valuable in the geographically dispersed regions of Middle East and Africa. The convenience, affordability, and accessibility of apps make them increasingly preferred by patients, home care providers, and clinics aiming for a connected, data-driven approach to diabetes care.

- By Type

On the basis of type, the market is segmented into wearable devices and handheld devices. The Wearable Devices segment dominated the market in 2024, accounting for 55% of the revenue share, due to their continuous monitoring capabilities and real-time data collection. Wearables, including CGM systems and smart insulin pumps, allow patients and healthcare providers to track glucose fluctuations continuously, supporting proactive interventions. These devices are highly favored in both home care and clinical settings for their comfort, ease of integration with apps, and ability to improve treatment adherence. The increasing trend toward personalized healthcare and data-driven disease management further strengthens the dominance of wearable devices.

The Handheld Devices segment is expected to witness the fastest growth from 2025 to 2032, driven by their affordability, portability, and ease of use in home and clinic settings. Handheld glucometers and portable insulin delivery devices are especially preferred in regions with limited healthcare access, offering reliable readings without requiring constant connectivity. Their low cost and user-friendly design make them attractive for first-time users and rural populations. Moreover, many handheld devices now offer app connectivity and cloud integration, bridging the gap between traditional monitoring methods and modern digital diabetes management solutions.

- By End User

On the basis of end user, the market is segmented into home care settings, diabetes clinics, academic and research institutes, and others. The Home Care Settings segment dominated the market in 2024, with a revenue share of 48%, reflecting the increasing preference for self-management of diabetes. Patients and caregivers are adopting digital diabetes solutions for continuous monitoring, personalized insights, and remote consultations. The convenience of monitoring glucose levels at home, coupled with telemedicine integration, has accelerated adoption, particularly in urban areas with high smartphone penetration. Home care solutions also reduce the dependency on frequent hospital visits, supporting better patient compliance and improved quality of life.

The Diabetes Clinics segment is anticipated to witness the fastest growth during the forecast period due to rising patient inflow and the adoption of digital platforms to enhance clinical efficiency. Clinics are leveraging devices, apps, and data platforms to monitor large patient populations efficiently, provide personalized treatment plans, and ensure adherence to therapy. The integration of data management software facilitates streamlined record keeping, analytics, and predictive care, improving outcomes for patients with chronic diabetes. Government initiatives promoting digital health adoption and increasing funding for diabetes care infrastructure further propel growth in clinic-based solutions.

Middle East and Africa Digital Diabetes Management Market Regional Analysis

- Saudi Arabia dominated the Middle East & Africa market with the largest revenue share of 38.5% in 2024, characterized by advanced healthcare infrastructure, high healthcare spending, and strong government support, with substantial growth in adoption of digital diabetes solutions driven by innovations from both established healthcare companies and health-tech startups focusing on AI-enabled analytics and remote monitoring features

- Patients and healthcare providers in the country highly value the convenience, real-time monitoring, and personalized insights offered by digital diabetes management solutions, including devices, apps, and data platforms, which help improve treatment adherence and patient outcomes

- This widespread adoption is further supported by advanced healthcare infrastructure, high healthcare spending, and a tech-savvy population, establishing digital diabetes management solutions as a preferred choice for both home care settings and diabetes clinics across the country

The Saudi Arabia Digital Diabetes Management Market Insight

The Saudi Arabia digital diabetes management market captured the largest revenue share of 38.5% in 2024 within the Middle East & Africa, fueled by the swift adoption of connected health devices and the expanding trend of digital healthcare solutions. Patients and caregivers are increasingly prioritizing the enhancement of diabetes care through AI-enabled monitoring systems, mobile apps, and wearable devices. The growing preference for home-based monitoring, combined with robust demand for cloud-based data platforms and telemedicine integration, further propels the market. Moreover, government initiatives promoting digital health, strong healthcare infrastructure, and high healthcare spending are significantly contributing to market expansion.

United Arab Emirates Digital Diabetes Management Market Insight

The UAE digital diabetes management market is anticipated to grow at a substantial CAGR during the forecast period, primarily driven by increasing healthcare awareness and the rising prevalence of diabetes. Urbanization, high smartphone penetration, and demand for mobile health solutions are fostering adoption across home care and clinical settings. UAE consumers are drawn to the convenience, real-time insights, and personalized recommendations offered by digital diabetes management solutions. The market is experiencing significant growth in both new healthcare setups and modernization of existing clinics, supported by innovative health-tech startups and strong government backing.

Egypt Digital Diabetes Management Market Insight

The Egypt digital diabetes management market is expected to expand at a noteworthy CAGR during the forecast period, driven by growing adoption of digital health platforms and mobile-based diabetes solutions. Concerns regarding diabetes prevalence and a desire for effective disease management are encouraging patients and clinics to adopt wearable devices, apps, and connected data platforms. Egypt’s increasing urbanization, rising middle-class population, and improved healthcare accessibility continue to stimulate market growth, with clinics and home care settings seeking convenient, connected solutions.

South Africa Digital Diabetes Management Market Insight

The South Africa digital diabetes management market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of diabetes management and technological adoption in healthcare. South Africa’s developing infrastructure, combined with government programs promoting digital health and remote monitoring, supports the adoption of wearable devices and mobile apps. Integration with telemedicine services and data platforms is becoming increasingly prevalent, with patients and healthcare providers favoring secure, privacy-focused, and efficient solutions aligned with local healthcare expectations.

Middle East and Africa Digital Diabetes Management Market Share

The Middle East and Africa Digital Diabetes Management industry is primarily led by well-established companies, including:

- Glooko, Inc. (U.S.)

- Abbott (U.S.)

- Dexcom, Inc. (U.S.)

- Medtronic (Ireland)

- F. Hoffmann La Roche Ltd. (Switzerland)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- B. Braun SE (Germany)

- Sanofi (France)

- Insulet Corporation (U.S.)

- Novo Nordisk A/S (Denmark)

- Bayer AG (Germany)

- LifeScan, Inc. (U.S.)

- Tandem Diabetes Care, Inc. (U.S.)

- Ypsomed AG (Switzerland)

- Welldoc, Inc. (U.S.)

- Omada Health Inc (U.S.)

- Noom, Inc. (U.S.)

- Lark Technologies, Inc. (U.S.)

- Vida Health, Inc (U.S.)

- DarioHealth Corp. (U.S.)

What are the Recent Developments in Middle East and Africa Digital Diabetes Management Market?

- In October 2025, Saudi Arabia inaugurated the world’s first “Diabetes Command & Control Centre” a national‑level digital hub for real‑time monitoring of diabetic patients across the Kingdom, enabling continuous tracking of vital signs, linking patients and clinicians via cloud platforms, and embedding into the preventive‑care model. The launch was covered by multiple outlets

- In February 2025, the UAE’s MoHAP launched “Biosigns” an AI‑powered system that uses a mobile camera to estimate biomarkers including glycated haemoglobin (HbA1c), cholesterol and glucose via image analysis and sensor data. This mobile‑based innovation is poised to shift diabetes monitoring towards non‑invasive, frequent, remote methods

- In July 2024, Fitverse.ai launched its diabetes‑reversal programme in Dubai, UAE the first of its kind in the UAE and MENA region. The programme offers personalized, holistic management of Type 2 diabetes and pre‑diabetes using AI‑based nutrition, exercise, and mental‑health support. It is positioned as a lifestyle‑and‑technology hybrid solution aimed at reducing medication dependency and improving patient engagement. Published by Khaleej Times

- In January 2024, Ministry of Health and Prevention (UAE) (MoHAP) announced a nationwide screening campaign in which over 12,000 people were tested within 100 days and more than 1,000 were found to have pre‑diabetes or diabetes. AI was then deployed to analyze the data and direct high‑risk individuals into early‑intervention pathways. This marked a shift towards proactive digital diabetes care in UAE

- In August 2023, Sanofi and the Ministry of Health Ghana launched the “Access to Diabetes Care” programme in Accra, Ghana, which includes deployment of digital diabetes‑management solutions at diabetes centres and training of more than 170 healthcare professionals via an online course for diabetes educators

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.