Middle East And Africa Driving Footwear Market

Market Size in USD Billion

CAGR :

%

USD

0.82 Billion

USD

1.55 Billion

2024

2032

USD

0.82 Billion

USD

1.55 Billion

2024

2032

| 2025 –2032 | |

| USD 0.82 Billion | |

| USD 1.55 Billion | |

|

|

|

|

Driving Footwear Market Size

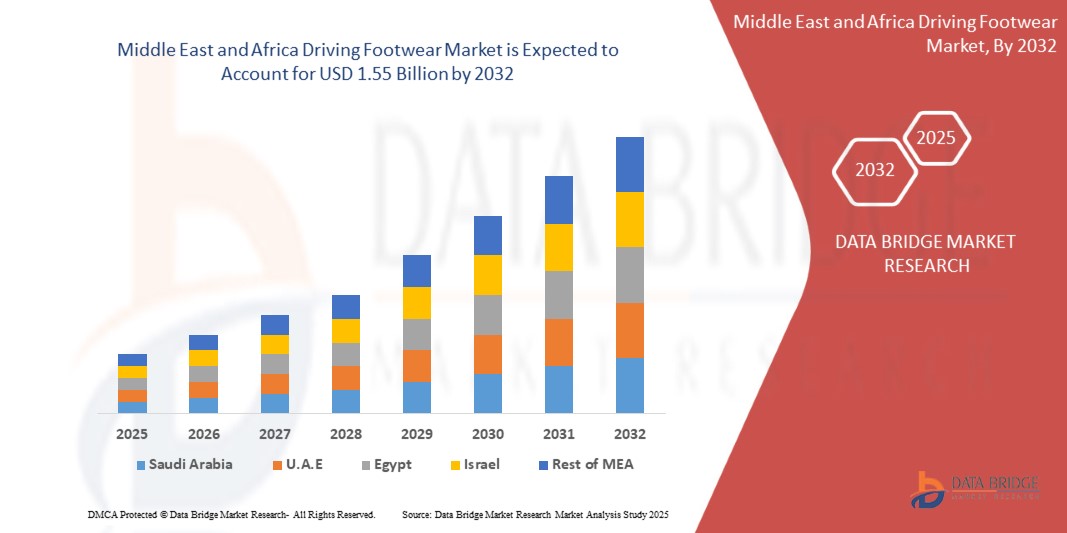

- The Middle East and Africa driving footwear market was valued at USD 0.82 billion in 2024 and is expected to reach USD 1.55 billion by 2032, growing at a CAGR of 8.12% during the forecast period.

- Growth is primarily driven by increasing demand for luxury vehicles, a rising car enthusiast culture particularly in GCC countries, and greater awareness of driving safety and comfort across urban centers.

Driving Footwear Market Analysis

- Driving footwear refers to specialized shoes designed to provide better control, comfort, and safety while driving. These include flexible soles, enhanced grip patterns, and lightweight construction aimed at performance and precision.

- The market is gaining traction due to an increasing population of affluent consumers, a growing motorsport culture, especially in the UAE and Saudi Arabia, and expanding automotive aftermarket trends.

- UAE is expected to dominate the driving footwear market in the region, with a market share of approximately 29.85%, attributed to its high luxury vehicle penetration, vibrant tourism-driven retail sector, and strong motorsport influence.

- Saudi Arabia is projected to be the fastest-growing country, supported by liberalization in female driving laws, growing interest in motorsports, and increasing disposable incomes leading to higher vehicle ownership.

- The leather material segment is likely to retain dominance due to the association with luxury, durability in hot climates, and preferences among premium vehicle owners.

- The men’s footwear segment currently dominates due to higher car ownership among male drivers, especially in the sports and luxury segments. However, the women’s segment is rapidly expanding, particularly in Saudi Arabia and the UAE, with broader female driving participation and rising fashion consciousness.

Report Scope and Driving Footwear Market Segmentation

|

Attributes |

Driving Footwear Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Driving Footwear Market Trends

“Growing Popularity of Casual-Luxury and Motorsport-Inspired Driving Shoes”

- One prominent trend in the Middle East and Africa driving footwear market is the increasing demand for casual-luxury and motorsport-inspired driving shoes that blend performance with style.

- This trend is fueled by evolving consumer preferences toward multifunctional footwear that serves both driving-specific and everyday fashion needs.

For instance, brands like PUMA (Germany) and Sparco (Italy) are developing footwear that features motorsport aesthetics, enhanced grip, and heel-to-toe comfort, making them popular among automotive enthusiasts and urban consumers.

- Driving footwear with sleek profiles, lightweight construction, and anti-slip soles are increasingly seen as lifestyle products, not just niche utility gear.

- As consumers prioritize both comfort and style, manufacturers are focusing on versatile designs that meet the dual demands of driving functionality and streetwear appeal, reinforcing this as a long-term trend in the market.

Driving Footwear Market Dynamics

Driver

“Rise in Car Ownership and Performance-Oriented Driving Culture”

- The rise in car ownership and the growing interest in performance-oriented driving across the Middle East and Africa is a significant driver for the driving footwear market.

- This driver is particularly strong in countries with rich automotive cultures such as the United Arab Emirates, South Africa, and Saudi Arabia, where car enthusiasts seek footwear that enhances pedal feel, grip, and driving safety.

- Consumers are becoming more aware of the benefits of using purpose-built driving shoes, including better foot control, reduced fatigue, and enhanced responsiveness while driving.

For instance, Piloti (Italy) has launched driving shoes with ergonomic heel counters and reinforced soles that cater to motorsport and everyday users alike.

- With the increasing appeal of motorsports, classic car rallies, and leisure driving activities, the demand for specialized driving footwear is expected to grow steadily.

Restraint/Challenge

“High Product Cost and Limited Awareness in General Population”

- The relatively high cost of driving footwear compared to regular shoes presents a challenge for widespread market adoption, particularly among the price-sensitive demographic.

- Additionally, limited consumer awareness about the specific benefits of driving footwear – especially in non-enthusiast segments – restrains growth potential.

- While high-income consumers and automotive enthusiasts value these features, the general population may not see enough utility to justify the premium pricing.

For instance, premium brands such as Car Shoe (Italy) and Piloti (Italy) offer products priced significantly above average footwear, limiting mass-market reach.

- As the market continues to grow, brands may need to invest in awareness campaigns and affordable product lines to overcome this restraint and expand their customer base.

Driving Footwear Market Scope

The market is segmented on the basis of product type, material type, vehicle type, and end user.

- By Product Type

On the basis of product type, the Middle East and Africa driving footwear market is segmented into Boots, Loafers, Driving Shoes, and Others. The Driving Shoes segment dominates the largest market revenue share of 39.6% in 2025, owing to their optimized design for pedal control, lightweight construction, and growing popularity among daily commuters and automotive enthusiasts. These shoes provide enhanced grip, flexibility, and heel-to-toe transition, making them highly functional for both casual and performance driving.

However, the Boots segment is expected to grow with the highest CAGR of 7.35% during the forecast period of 2025–2032. This anticipated growth is driven by increasing consumer interest in rugged, all-weather driving footwear with high ankle support and durability—especially appealing to off-road drivers and motorsport segments.

- By Material Type

On the basis of material type, the market is segmented into Leather, Synthetic, and Others. The Leather segment held the largest market share of 43.8% in 2025, driven by its premium look, breathability, comfort, and traditional association with luxury and performance footwear. Leather remains the material of choice for high-end and enthusiast-grade driving shoes.

Meanwhile, the Synthetic segment is projected to register the fastest CAGR of 7.21% during the forecast period. This growth is fueled by rising demand for lightweight, cost-effective, and weather-resistant alternatives to natural leather, particularly among price-conscious consumers and sustainable product lines.

- By Vehicle Type

On the basis of vehicle type, the market is segmented into Luxury, Economy, and Sports Cars. The Luxury segment accounted for the largest market share of 38.9% in 2025, as consumers purchasing high-end cars are more inclined to invest in premium accessories, including specialized driving footwear that complements their vehicle’s performance and aesthetics.

However, the Sports Cars segment is projected to witness the highest CAGR of 7.48% during the forecast period. This surge is attributed to the growing motorsport culture and increasing participation in track events and car enthusiast activities, where performance-oriented driving shoes are preferred for their enhanced control and safety.

- By End User

Based on end user, the Middle East and Africa driving footwear market is segmented into Men, Women, and Unisex. The Men segment held the highest revenue share of 51.4% in 2025, largely due to a higher proportion of male automotive enthusiasts and consumers in the motorsports and luxury vehicle ownership segments.

Nevertheless, the Women segment is expected to register the fastest CAGR of 7.22% during 2025–2032. The projected growth is supported by the rise in female car ownership, expanding fashion-forward automotive accessories market, and increasing participation of women in motorsport and performance driving activities across the Middle East and Africa.

Middle East and Africa Driving Footwear Market Regional Analysis

The Middle East and Africa (MEA) driving footwear market is projected to witness steady growth, supported by rising automobile ownership, a growing culture of motorsports and luxury vehicles, and increasing consumer interest in premium and functional automotive accessories. Urbanization, an expanding affluent middle class, and higher disposable incomes are boosting demand for performance-enhancing and stylish driving shoes. Additionally, cultural preferences for premium and branded goods—particularly in the Gulf Cooperation Council (GCC) countries—are shaping product development and brand strategies in the region.

- UAE Driving Footwear Market Insight

The UAE holds the largest market share of 29.67% in the Middle East and Africa driving footwear market, driven by a strong luxury car market, high-income consumers, and a fashion-conscious population. The presence of international motorsport events, such as Formula 1 in Abu Dhabi, has elevated consumer interest in racing-inspired apparel and footwear. High awareness of global brands, coupled with widespread availability in premium retail outlets, continues to support market growth.

- South Africa Driving Footwear Market Insight

South Africa commands a significant share in the MEA market, driven by a mix of automotive enthusiasm and practical footwear needs for daily commuting. The country is projected to register the fastest CAGR of 6.92% during the forecast period. The rising trend of lifestyle-oriented accessories, increased availability of mid-range and premium brands, and a growing interest in motorsport events are accelerating product penetration, especially among urban youth.

Driving Footwear Market Share

The Driving Footwear industry is primarily led by well-established companies, including:

- Puma SE (Germany)

- Geox S.p.A. (Italy)

- Sparco S.p.A. (Italy)

- Piloti Inc. (U.S.)

- Tod’s S.p.A. (Italy)

- Recaro Automotive GmbH (Germany)

- Bally Schuhfabriken AG (Switzerland)

- Car Shoe S.r.l. (Italy)

- Apex Middle East and Africa Brands Inc. – Owner of Hi-Tec (U.S.)

- Baer Schuhe GmbH & Co. KG (Germany)

- Alpinestars S.p.A. (Italy)

- Nike Inc. (U.S.)

- Timberland LLC (U.S.)

Latest Developments in Middle East and Africa Driving Footwear Market

- In May 2025, PUMA launched a special edition of its “SpeedCat Evo” line in the UAE and Saudi Arabia, tailored for luxury car owners and motorsport enthusiasts. The shoes feature enhanced heel support and lightweight materials, catering to hot weather and high-performance driving conditions typical of the Gulf region.

- In February 2025, Piloti expanded into key African markets such as Kenya and Nigeria by introducing its “Shift Eco” collection. Featuring sustainable materials like recycled leather and eco-rubber soles, the line targets environmentally aware consumers and urban professionals seeking premium yet eco-friendly gear.

- In November 2024, Geox debuted its “DriveTech” line in South Africa, designed for urban drivers and long-distance commuters. The product includes breathable soles and anti-slip technology, addressing local needs for comfort and functionality in varying terrains and weather conditions.

- In October 2024, Sparco and Tod’s unveiled their limited-edition driving loafers in the Middle East at Dubai Design District (d3). The collection, blending motorsport heritage with Italian luxury design, was well-received by affluent car collectors and fashion-forward customers.

- In July 2024, Alpinestars launched the “Urban Motion” series in North African countries like Egypt and Morocco. Priced affordably and styled for versatility, this range appeals to young, budget-conscious consumers looking for practical driving footwear suitable for daily and casual use.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT/EXPORT DATA

2.15 SECONDARY SOURCES

2.16 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET: RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 PRICE TREND ANALYSIS

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 REGULATION COVERAGE

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 LOAFERS

7.3 BOOTS

7.4 OTHERS

8 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 SYNTHETIC

8.3 LEATHER

8.4 NATURAL FIBERS

9 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY VEHICLE TYPE

9.1 OVERVIEW

9.2 TWO WHEELERS

9.3 FOUR WHEELERS

9.4 OTHERS

10 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY SOLE TYPE

10.1 OVERVIEW

10.2 EXTENDED SOLE

10.3 SPLIT SOLE

11 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET,BY DISTRIBUTION CHANNEL

11.1 OVERVIEW

11.2 OFFLINE

11.3 ONLINE

12 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY END-USER

12.1 OVERVIEW

12.2 MEN

12.3 WOMEN

13 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, BY GEOGRAPHY

Middle East and Africa Driving Footwear market, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.1 SOUTH AFRICA

13.2 EGYPT

13.3 ISRAEL

13.4 UNITED ARAB EMIRATES

13.5 SAUDI ARABIA

13.6 REST OF MIDDLE EAST & AFRICA

14 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

14.2 MERGERS AND ACQUISITIONS

14.3 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.4 EXPANSIONS

14.5 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 SWOT AND DATA BRIDGE MARKET RESEARCH ANALYSIS

16 MIDDLE EAST AND AFRICA DRIVING FOOTWEAR MARKET- COMPANY PROFILE

16.1 PUMA SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT UPDATES

16.2 NIKE INC.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT UPDATES

16.3 GUCCI

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATES

16.4 ADIDAS AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 HUSH PUPPIES

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SAUDI LEATHER INDUSTRIES COMPANY

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 CONHPOL

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT UPDATES

16.8 STEVE MADDEN

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT UPDATES

16.9 SKECHERS

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATES

16.1 SCOTT SPORTS SA

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

17 RELATED REPORTS

18 QUESTIONNAIRE

19 CONCLUSION

Middle East And Africa Driving Footwear Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Driving Footwear Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Driving Footwear Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.