Middle East And Africa Excipients Market

Market Size in USD Million

CAGR :

%

USD

237.23 Million

USD

354.66 Million

2022

2030

USD

237.23 Million

USD

354.66 Million

2022

2030

| 2023 –2030 | |

| USD 237.23 Million | |

| USD 354.66 Million | |

|

|

|

Middle East and Africa Excipients Market Analysis and Size

The technological advancements in multifunctional excipients act as a driver for the excipients market growth in the forecast period. The long duration of the drug development process is expected to hinder the excipients market in the forecast period. The strategic initiatives by market players act as an opportunity for the growth of the excipients market. The safety consideration in storage and transportation acts as a challenge for the growth of the excipients market. However, cost and time-intensive drug development process is expected to hinder the growth of Middle East and Africa pharmaceutical excipients market. Moreover, safety consideration in storage & transportation will projected to become the biggest and foremost challenge for the growth of the market in the forecast period of 2023 to 2030.

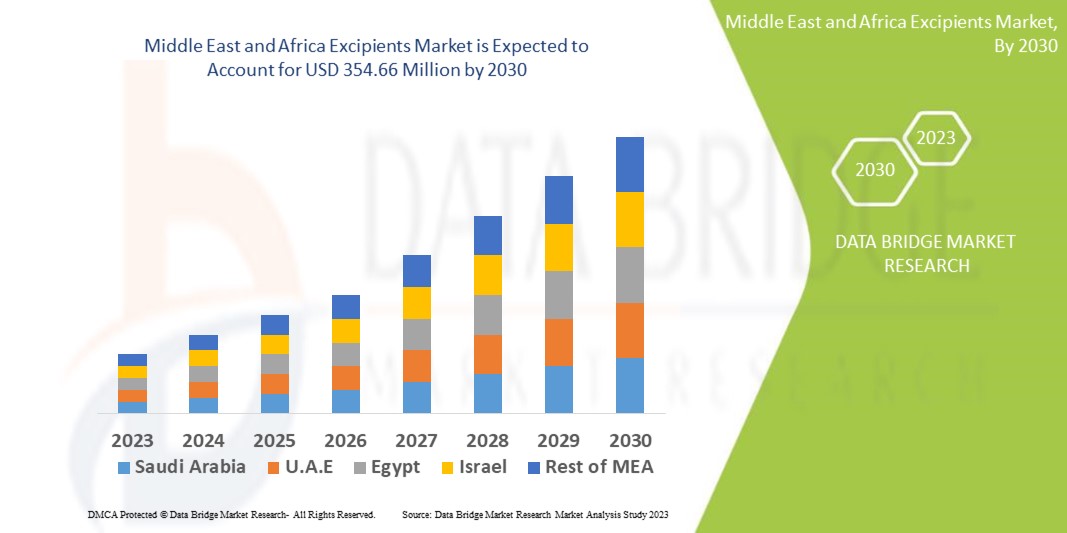

Data Bridge Market Research analyses that the excipients market which was USD 237.23 million in 2022, and would rocket up to USD 354.66 million by 2030, and is expected to undergo a CAGR of 5.2% during the forecast period. This indicates that the market value. “Direct Tender” dominates the distribution channel segment of the excipients market as it is the primary source of distribution of excipients. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Middle East and Africa Excipients Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Origin (Organic, Inorganic), Category (Primary Excipients, Secondary Excipients), Products (Polymers, Sugars, Alcohols, Minerals, Gelatin, Others), Chemistry Type (Plant, Animals, Synthetic, Minerals), Chemical Synthesis (Lactose Monohydrate, Sucralose, Polysorbate, Benzyl Alcohol, Cetosteary Alcohol, Soy Lecithin, Pregelatinized Starch, Others), Functionality (Binders and Adhesives, Disintegrants, Coating Material, Disintegrants, Solubilizers, Flavours, Sweetening Agents, Diluents, Lubricants, Buffers, Emulsifying Agents, Preservatives, Antioxidants, Sorbents, Solvents, Emollients, Glidients, Chelating Agents, Antifoaming Agents, Others), Dosage Form (Solid, Semi-Solid, Liquid), Route of Administration (Oral Excipients, Topical Excipients, Parenteral Excipients, Other Excipients), End-User (Pharmaceutical and Biopharmaceutical Companies, Contract Formulators, Research Organization and Academics, Others), Distribution Channel (Direct Tender, Retail Sales, Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Egypt, Israel, Rest of Africa and Rest of Middle East |

|

Market Players Covered |

Evonik Industries AG (Germany), Croda International Plc (U.K.), JRS Pharma (Germany), Colorcon (U.S.), Peter Greven GmbH & Co. KG (Germany), Omya AG (Switzerland), ADM (U.S.),MEGGLE Group Wasserburg (Germany),Kerry Group PLC (Ireland),Avantor, Inc (U.S.),among others |

|

Market Opportunities |

|

Market Definition

Excipients involve everything in a drug except that of the active pharmaceutical ingredients. These molecules don’t possess any medicinal property and are ultimately used for enhancing the physiological absorption of the drug. Excipients are inert in nature and it allows the drug molecule to apply to patients in the right form.

Middle East and Africa Excipients Market Dynamics

Drivers

- Increase in Use of Nanotechnology for Development of Nano-Excipients and in Pharmaceutical Drug Production

Nano-delivery systems and nanomedicine are new and rapidly growing fields where nanoscale materials are used to deliver therapeutic agents to targeted sites or as diagnostic tools. Nanotechnology provides several advantages in treating chronic human diseases through site-specific and selective delivery of accurate medicines. During the manufacturing of NADDS, the process has the potential to convert the excipients into nano-excipients. Nano-excipients have enhanced properties compared to excipients. Nano-excipients are easily transported through biological membranes. Also, they can easily get absorbed into the blood and delivered to the targeted tissue and cell. Nano-excipients stay in the circulatory system for a prolonged period and release the amalgamated drugs as per the specified dose. The efficient production of NADDS includes a detailed understanding of the physicochemical properties and functionality of the excipients. Thus, nanotechnology excipients would witness intensive scientific investigations in the coming years, as they can contribute unique functionality to drug products. This increase in use of nanotechnology for development of nano-excipients and in pharmaceutical drug production which will further act as driver that will lead to the growth of the excipients market in the above mentioned projected timeframe

- Rise in Technological Advancements in Multifunctional Excipients

Multifunctional excipients can be obtained by developing a new excipient (such as cross-linked polymers) or by developing new grades of existing excipients; modification in the processing leads to changes in the particle size distribution, particle shape and morphology and porosity. This increase in the technological advancements is expected to accelerate the market growth. Furthermore, most of the excipients are used in pharmaceutical and biopharmaceutical companies because these companies are responsible for the production of medicines in all dosage forms such as solid, semi-solid and liquid

- Rising Pharmaceutical Industry

Expanding pharmaceutical industry due to disruptive technologies and emerging trends such as robotics, artificial intelligence, 3d printing, precision medicine or patient design will impact the manufacturing and distribution of pharmaceuticals. In order to prepare successfully for a better future of healthcare, the pharma industry has to embrace new technologies and put a greater focus on prevention and digital health, which can foster the demand for the excipients in the market

Opportunity

- Rising Strategic Initiatives by Market Players

Furthermore, key product launches, high concentration of market players or manufacturer's presence, and acquisition and partnerships among major players will extend profitable opportunities for the market players in the forecast period of 2023 to 2030. In addition, the rising demand for drugs has significantly heightened the need for new drug development via extensive clinical trials. Manufacturers are now focusing on remodelling their drug development processes in an attempt to cater to patient needs. Increasing advancement in technology and rising number of innovations along with rising product approvals which will further contribute by generating immense opportunities that will further expand the market's growth rate in the future

Restraint/Challenge

- Higher Cost and Time Intensive Drug Development Process

On the other hand, cost and time-intensive drug development process is expected to hinder the growth of Middle East and Africa pharmaceutical excipients market. The safety consideration in storage and transportation restraint the market. Moreover, cost of these developments will projected to become the biggest and foremost challenge for the growth of the market in the forecast period of 2023 to 2030

This excipients market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the excipients market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth

Recent Development

- In 2020, Evonik launched RESOMER Precise platform of custom functional excipients to precisely control the release profile of parenteral drug products

Middle East and Africa Excipients Market Scope

The excipients market is segmented on the basis of origin, category, products, chemistry type, chemical synthesis, functionality, dosage forms, and route of administration, end-user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Origin

- Organic

- Inorganic

Category

- Primary Excipients

- Secondary Excipients

Products

- Polymers

- Sugars

- Alcohols

- Minerals

- Gelatin

- Others

Chemistry Type

- Plant

- Animals

- Synthetic

- Minerals

Chemical Synthesis

- Lactose Monohydrate

- Sucralose

- Polysorbate

- Benzyl Alcohol

- Cetosteary Alcohol

- Soy Lecithin

- Pregelatinized Starch

- Others

Functionality

- Binders and Adhesives

- Disintegrants

- Coating Material

- Disintegrants, Solubilizers

- Flavours

- Sweetening Agents

- Diluents

- Lubricants

- Buffers

- Emulsifying Agents

- Preservatives

- Antioxidants

- Sorbents

- Solvents

- Emollients

- Glidients

- Chelating Agents

- Antifoaming Agents

- Others

Dosage Form

- Solid

- Semi-Solid

- Liquid

Route of Administration

- Oral Excipients

- Topical Excipients

- Parenteral Excipients

- Other Excipients

End-User

- Pharmaceutical and Biopharmaceutical Companies

- Contract Formulators

- Research Organization and Academics

- Others

Distribution Channel

- Direct Tender

- Retail Sales

- Others

Middle East and Africa Excipients Market Regional Analysis/Insights

The excipients market is analysed and market size insights and trends are provided by origin, category, products, chemistry type, chemical synthesis, functionality, dosage forms, and route of administration, end-user and distribution channel.

The countries covered in the excipients market report are South Africa, Saudi Arabia, U.A.E., Israel, Kuwait, Egypt, and Rest of Middle East and Africa.

South Africa dominates the excipients market and is expected to grow at the highest growth rate during the forecast period of 2023 to 2030 due to innovations in biopharmaceuticals, rising focus on orphan drugs and technological advancements in multifunctional excipients.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and up-stream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed Base and New Technology Penetration

The excipients market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for handheld ultrasound imaging devices market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the handheld ultrasound imaging devices market. The data is available for historic period 2010 to 2020.

Competitive Landscape and Excipients market Share Analysis

The excipients market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the company’s focus related to handheld ultrasound imaging devices market.

Some of the major players operating in the excipients market are:

- Evonik Industries AG (Germany)

- Croda International Plc (U.K.)

- JRS Pharma (Germany)

- Colorcon (U.S.)

- Peter Greven GmbH & Co. KG (Germany)

- Omya AG (Switzerland)

- ADM (U.S.)

- MEGGLE Group Wasserburg (Germany)

- Kerry Group PLC (Ireland)

- Avantor, Inc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.