Middle East And Africa Fire Protection Materials Market

Market Size in USD million

CAGR :

%

USD

148.14 million

USD

193.58 million

2024

2032

USD

148.14 million

USD

193.58 million

2024

2032

| 2025 –2032 | |

| USD 148.14 million | |

| USD 193.58 million | |

|

|

|

|

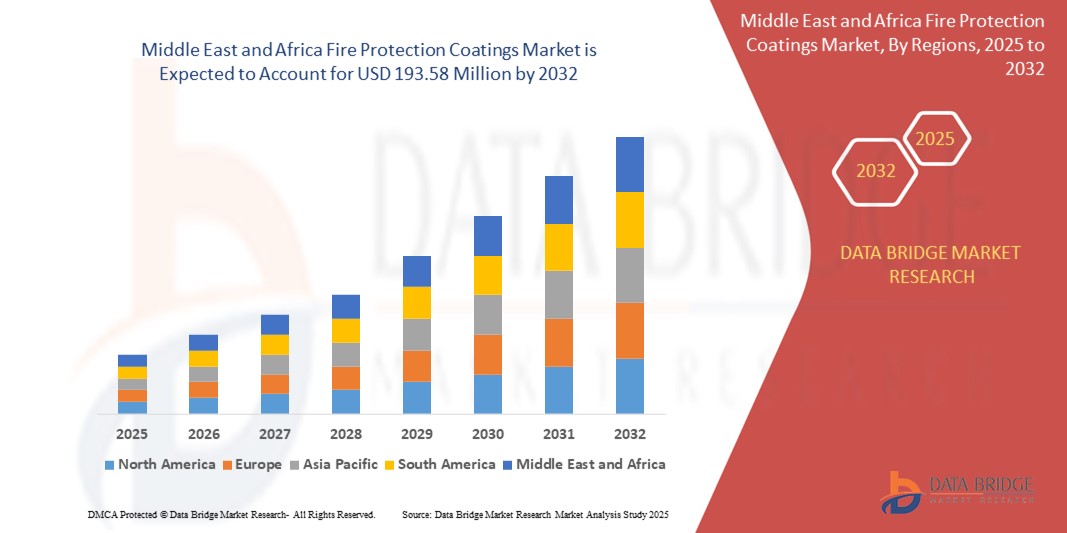

What is the Middle East and Africa Fire Protection Coatings Market Size and Growth Rate?

- The Middle East and Africa fire protection coatings market size was valued at USD 148.14 million in 2024 and is expected to reach USD 193.58 million by 2032, at a CAGR of3.40% during the forecast period

- The Middle East passive fire protection coatings market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief, our team will help you create a revenue impact solution to achieve your desired goal

What are the Major Takeaways of Fire Protection Coatings Market?

- Passive fire protection systems are composed of tools and other engineered solutions that reduce fire occurrence or delay their spread in a facility for a certain period. It reduces the extent of damage, risk to lives, and gives people more time to vacate the establishment and ample time for emergency services to respond and act

- Passive fire protection is commonly used in high rise buildings, houses, hotels, hospitals, industrial facilities, schools, warehouses, railways, car parks, railways, bridges, supermarkets, and on- and off-shore hydrocarbons. Passive fire protection coatings are increasingly important in the oil and gas industry

- Applied to industrial oil and gas installations, the coatings expand to form an insulating layer of carbon char when exposed to high temperatures. This enables the steel to maintain its load-bearing capacity for up to four hours longer during a fire, giving people valuable time to escape the building and for firefighters to put the fire out

- U.A.E. is projected to dominate the Middle East Passive fire protection coatings market with a revenue share of 41.87% in 2024, driven by booming commercial real estate, stringent fire safety regulations, and high investment in infrastructure projects like Expo City and Etihad Rail

- Saudi Arabia is expected to register the fastest CAGR of 7.24% from 2025 to 2032, backed by large-scale construction initiatives under Vision 2030 such as NEOM, Red Sea Project, and Qiddiya

- The Intumescent Coating segment dominated the market with the largest revenue share of 58.7% in 2024, driven by its superior aesthetic finish, lightweight formulation, and growing demand in architectural and industrial steel applications

Report Scope and Fire Protection Coatings Market Segmentation

|

Attributes |

Fire Protection Coatings Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Fire Protection Coatings Market?

Shift Toward Eco-Friendly and Intumescent Technologies

- A defining trend in the fire protection coatings market is the growing adoption of water-based, low-VOC, and halogen-free formulations, driven by stricter environmental regulations and demand for sustainable construction materials. Manufacturers are investing in coatings that align with LEED certification and green building codes

- For instance, AkzoNobel (Netherlands) and PPG Industries (U.S.) have launched new-generation intumescent coatings using waterborne binders and advanced char-forming agents that deliver high fire resistance without compromising indoor air quality

- Innovations in nano-additive technologies and hybrid epoxy-silicone systems are enhancing thermal stability and fire endurance in steel structures while offering improved aesthetics, faster curing, and longer service life

- Fire protection coatings are also being customized for specific verticals offshore, petrochemical, and transport infrastructure with greater weatherability and corrosion resistance

- Companies such as Jotun (Norway) and Hempel A/S (Denmark) are focusing on low-temperature cure and solvent-free technologies to support cold-climate applications and reduce downtime during construction

- This trend is redefining fire coatings from passive safety barriers to smart, multi-functional materials, contributing to environmental sustainability, asset longevity, and fire compliance in both new construction and retrofitting projects

What are the Key Drivers of Fire Protection Coatings Market?

- The surge in infrastructure investment and stringent fire safety regulations is driving demand for fire protection coatings across commercial, industrial, and residential buildings. Governments are enforcing mandates such as NFPA, ASTM E119, and EN 13381 standards for steel structure protection

- For example, in October 2023, The Sherwin-Williams Company (U.S.) introduced FIRETEX® FX9502, a next-gen intumescent coating meeting UL263 standards for high-rise steel structures, responding to increasing urban safety requirement

- The expansion of the oil & gas and energy sectors, particularly in emerging economies, is fueling the use of epoxy-based intumescent coatings that resist hydrocarbon pool fires and jet fire conditions

- Rising construction in tunnel systems, power plants, and transport terminals further boosts market growth, where passive fire protection (PFP) is essential for evacuation time and structural integrity during fire outbreaks

- The retrofitting of aging infrastructure in developed regions and government investments in smart cities are creating long-term demand for coatings that combine fire resistance with aesthetic compatibility and low maintenance

- In addition, insurance mandates and ESG (Environmental, Social, Governance) reporting frameworks are pushing developers to adopt certified fire protection solutions as part of risk mitigation strategies

Which Factor is challenging the Growth of the Fire Protection Coatings Market?

- One major challenge is the high cost and complexity of testing and certifying fire protection coatings, which slows down product approvals and limits global scalability for small and mid-sized manufacturers

- For example, intumescent coatings must pass multi-hour fire resistance tests under ISO and EN standards, requiring costly simulation chambers and third-party validation, increasing time-to-market

- Limited awareness and non-uniform building codes across regions restrict widespread adoption, especially in price-sensitive markets where passive protection is not yet mandatory or enforced

- The volatile prices and limited availability of raw materials such as epoxy resins, ammonium polyphosphate, and flame-retardant additives impact production costs and lead times, particularly during supply chain disruptions

- Furthermore, application constraints such as ambient temperature, humidity sensitivity, and multiple coating layers add labor and maintenance costs, deterring adoption in fast-track construction

- Addressing these hurdles will require harmonized global fire safety standards, continued investment in low-cost, high-performance formulations, and training for applicators and engineers to ensure proper usage and lifecycle protection

How is the Fire Protection Coatings Market Segmented?

The market is segmented on the basis of product type, technology, and end-use industry.

- By Product Type

On the basis of product type, the market is segmented into Cementitious Material and Intumescent Coating. The Intumescent Coating segment dominated the market with the largest revenue share of 58.7% in 2024, driven by its superior aesthetic finish, lightweight formulation, and growing demand in architectural and industrial steel applications.

The Cementitious Material segment is expected to witness steady growth due to its cost-effectiveness and suitability for high-temperature industrial environments such as refineries and petrochemical plants.

- By Technology

On the basis of technology, the market is segmented into Water-Based Protection Coating and Solvent-Based Protection Coating. The Water-Based Protection Coating segment held the highest share of 54.1% in 2024, supported by environmental regulations favoring low-VOC products and the rising preference for sustainable construction solutions.

Meanwhile, the Solvent-Based Protection Coating segment continues to find usage in offshore and high-humidity environments due to its strong adhesion and durability characteristics.

- By End-Use

On the basis of end-use, the market is segmented into Building and Construction, Oil & Gas, Automotive, Aerospace & Defense, Electrical and Electronics, Textile, Furniture, and Others. The Building and Construction segment accounted for the largest revenue share of 42.9% in 2024, owing to increasing fire safety mandates in urban infrastructure, rising real estate investments, and the growing emphasis on passive fire protection in commercial and residential spaces.

The Aerospace & Defense segment is projected to grow at the fastest CAGR between 2025 and 2032, driven by stringent fire safety protocols and the expanding defense manufacturing base globally.

Which Region Holds the Largest Share of the Fire Protection Coatings Market?

- U.A.E. is projected to dominate the Middle East Passive fire protection coatings market with a revenue share of 41.87% in 2024, driven by booming commercial real estate, stringent fire safety regulations, and high investment in infrastructure projects like Expo City and Etihad Rail

- The country’s emphasis on modern building codes and proactive fire risk mitigation across commercial and hospitality sectors has accelerated the adoption of intumescent and cementitious coatings

- Additionally, U.A.E.’s role as a logistical hub has attracted major coating manufacturers from Europe and Asia, boosting supply chain efficiency and regional distribution

Which Region is the Fastest Growing Region in the Fire Protection Coatings Market?

Saudi Arabia is expected to register the fastest CAGR of 7.24% from 2025 to 2032, backed by large-scale construction initiatives under Vision 2030 such as NEOM, Red Sea Project, and Qiddiya. Rising demand for passive fire safety in public infrastructure, coupled with regulatory mandates from the Saudi Civil Defense, is driving product uptake. Furthermore, domestic manufacturers are scaling up capacity, and international firms are partnering with local players to tap into the kingdom’s expanding industrial and urban development landscape.

Which are the Top Companies in Fire Protection Coatings Market?

The fire protection coatings industry is primarily led by well-established companies, including:

- 3M (U.S.)

- Hempel A/S (Denmark)

- The Sherwin-Williams Company (U.S.)

- Hilti (Liechtenstein)

- Carboline (U.S.)

- Akzo Nobel N.V. (Netherlands)

- PPG Industries, Inc. (U.S.)

- Kansai Paint Co., Ltd. (Japan)

- Etex Group (Belgium)

- Isolatek International (U.S.)

- GCP Applied Technologies Inc. (A Subsidiary of Saint-Gobain) (U.S./France)

- Jotun (Norway)

- Sika AG (Switzerland)

- Arabian Vermiculite Industries (Saudi Arabia)

- CHARCOAT Passive Fire Protection (Canada)

- Lanexis Enterprises (P) Ltd. (India)

What are the Recent Developments in Middle East and Africa Fire Protection Coatings Market?

- In February 2024, AkzoNobel concluded a significant capacity expansion at its Powder Coatings facility in Como, Italy. This expansion, involving a USD 21 million investment, is expected to enhance the company's ability to meet the growing demand for its products in Europe, the Middle East and Africa (EMEA). The completion of four new manufacturing lines, specifically two for automotive primers and two for architectural coatings, marks a substantial milestone in the project. Additionally, the incorporation of new bonding equipment lines further guarantees that the manufactured products not only meet but exceed industry standards, reinforcing AkzoNobel's commitment to delivering high-quality coatings to its customers in the EMEA region

- In December 2023, Hempel A/S announced the launch of HEET Dynamic, an innovative new coating software specially designed to make intumescent coating estimations on steel sections quicker, easier, and accurate for structural engineers and estimators. This will help the engineers to investigate the steel structures and other surfaces where fire-intumescent coatings are applied more accurately, making it a much-required tool. This will improve the company’s revenue eventually

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Fire Protection Materials Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Fire Protection Materials Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Fire Protection Materials Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.