Middle East And Africa Healthcare Analytics Market

Market Size in USD Million

CAGR :

%

USD

867.50 Million

USD

2,824.47 Million

2024

2032

USD

867.50 Million

USD

2,824.47 Million

2024

2032

| 2025 –2032 | |

| USD 867.50 Million | |

| USD 2,824.47 Million | |

|

|

|

|

Middle East and Africa Healthcare Analytics Market Size

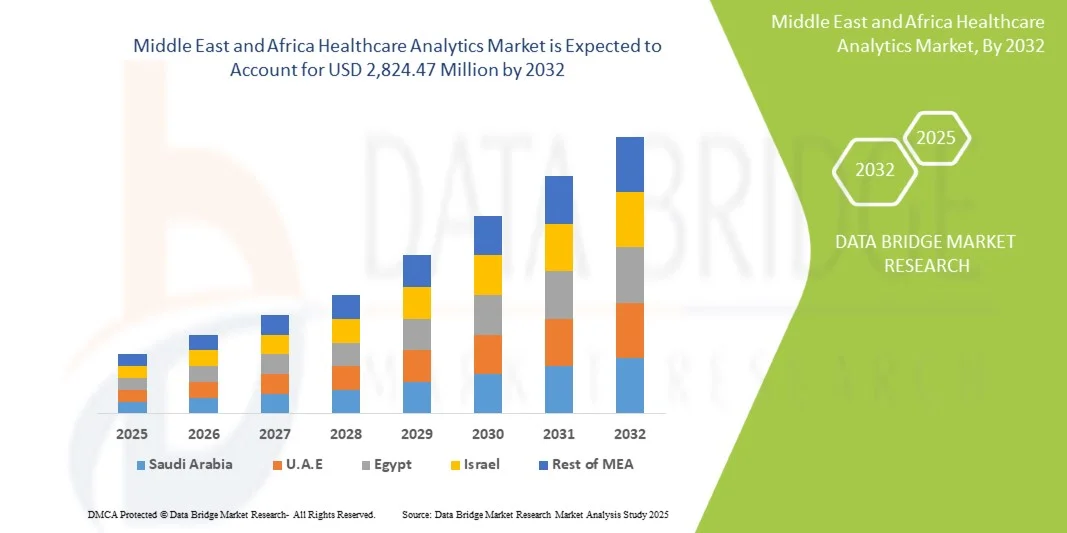

- The Middle East and Africa healthcare analytics market size was valued at USD 867.50 million in 2024 and is expected to reach USD 2,824.47 million by 2032, at a CAGR of 15.9% during the forecast period

- The market growth is largely fueled by the increasing adoption of electronic health records (EHRs), rising healthcare data volumes, and growing emphasis on data-driven decision-making to enhance patient outcomes and operational efficiency in hospitals and clinics

- Furthermore, the integration of advanced technologies such as artificial intelligence and machine learning, along with government initiatives to improve healthcare infrastructure, is driving demand for healthcare analytics solutions, thereby significantly boosting the industry's growth

Middle East and Africa Healthcare Analytics Market Analysis

- Healthcare analytics, providing data-driven insights for patient care, operational efficiency, and strategic decision-making, are becoming essential tools for hospitals, clinics, and other healthcare providers across the Middle East and Africa due to their ability to enhance patient outcomes, optimize resources, and streamline healthcare processes

- The growing demand for healthcare analytics is primarily driven by the increasing adoption of electronic health records (EHRs), rising healthcare data volumes, and the need for predictive analytics to improve clinical and financial decision-making

- Saudi Arabia dominated the MEA healthcare analytics market in 2024 with the largest revenue share of 32.5%, driven by significant investments in digital health infrastructure, national eHealth initiatives, and advanced IT solutions, particularly in hospitals and government healthcare programs

- The United Arab Emirates is expected to be the fastest-growing country in the MEA healthcare analytics market during the forecast period, driven by rising investments in healthcare IT, the adoption of cloud-based analytics solutions, and government support for smart hospital initiatives

- Predictive analytics segment dominated the MEA healthcare analytics market with a market share of 37.5% in 2024, fueled by its ability to forecast patient outcomes, reduce readmissions, and support proactive clinical interventions

Report Scope and Middle East and Africa Healthcare Analytics Market Segmentation

|

Attributes |

Middle East and Africa Healthcare Analytics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Healthcare Analytics Market Trends

“AI-Driven and Cloud-Enabled Analytics Adoption”

- A significant and accelerating trend in the MEA healthcare analytics market is the adoption of AI-driven analytics platforms combined with cloud-based solutions, enabling healthcare providers to derive actionable insights from large datasets in real time

- For instance, IBM Watson Health analytics solutions in the UAE allow hospitals to integrate AI models with patient data, helping clinicians predict disease risks and optimize treatment plans

- AI-enabled analytics platforms are increasingly used to identify patient readmission risks, optimize resource allocation, and provide predictive insights for preventive care, while cloud integration ensures scalability and accessibility across multiple facilities

- The integration of healthcare analytics with electronic health records (EHRs) and telemedicine platforms enables centralized monitoring of patient health, operational performance, and clinical outcomes through a unified interface, supporting data-driven decision-making

- This trend towards intelligent, interconnected, and scalable healthcare analytics solutions is reshaping healthcare delivery expectations, with companies such as Healthigo developing AI-powered dashboards and cloud-enabled predictive analytics for hospitals in Saudi Arabia and the UAE.

- The demand for AI and cloud-integrated healthcare analytics is growing rapidly across hospitals, clinics, and government health agencies as stakeholders increasingly prioritize patient-centric, data-driven healthcare management

Middle East and Africa Healthcare Analytics Market Dynamics

Driver

“Rising Demand Due to Digital Health Adoption and Data-Driven Care”

- The increasing adoption of electronic health records (EHRs) and telemedicine services, coupled with the growing emphasis on data-driven clinical decision-making, is a key driver for the rising demand for healthcare analytics

- For instance, in March 2024, the Saudi Ministry of Health launched initiatives to integrate predictive analytics into national hospitals for patient outcome optimization and resource management

- As healthcare providers aim to improve clinical outcomes, reduce costs, and enhance operational efficiency, healthcare analytics offers actionable insights for patient care management, financial planning, and performance monitoring

- Furthermore, the expansion of government-funded smart hospital programs and private sector digital health investments is driving adoption across the region, particularly in Saudi Arabia, the UAE, and Egypt

- The growing availability of cloud-based, user-friendly analytics solutions and AI-powered predictive tools allows smaller hospitals and clinics to leverage advanced analytics, accelerating adoption and integration across the MEA healthcare ecosystem

Restraint/Challenge

“Data Privacy Concerns and Implementation Complexity”

- Concerns surrounding patient data privacy, regulatory compliance, and secure handling of sensitive medical records pose significant challenges to the broader adoption of healthcare analytics

- For instance, reports of data breaches in UAE hospitals have made some healthcare providers cautious about fully deploying cloud-based analytics platforms

- Addressing these privacy concerns through compliance with regional healthcare regulations (such as the UAE Data Protection Law), robust encryption, and secure data storage protocols is critical for building trust among providers and patients

- In addition, the high initial investment for implementing advanced analytics infrastructure, integration complexity with legacy systems, and the shortage of skilled data professionals can hinder adoption in some hospitals and clinics

- While cloud-based and AI-enabled solutions are gradually becoming more accessible, perceived implementation challenges and concerns over regulatory compliance may slow widespread adoption, particularly among smaller healthcare facilities

- Overcoming these challenges through secure, compliant, and cost-effective analytics solutions, combined with training programs for healthcare professionals, will be essential for sustained growth in the MEA healthcare analytics market

Middle East and Africa Healthcare Analytics Market Scope

The market is segmented on the basis of type, component, delivery model, application, and end user.

- By Type

On the basis of type, the MEA healthcare analytics market is segmented into prescriptive analytics, predictive analytics, and descriptive analytics. The predictive analytics segment dominated the market with the largest market revenue share of 37.5% in 2024, driven by its ability to forecast patient outcomes, reduce readmissions, and optimize treatment plans. Hospitals and clinics in Saudi Arabia and the UAE increasingly rely on predictive analytics to manage patient populations efficiently and proactively intervene in high-risk cases. The adoption of AI-powered predictive platforms also enables better resource allocation and operational efficiency, further strengthening the market demand. Moreover, predictive analytics is integrated with EHRs and telemedicine platforms to provide actionable insights across multiple departments, making it a preferred choice for large healthcare providers. Government healthcare initiatives supporting smart hospitals and data-driven care are further boosting adoption of predictive analytics in the MEA region. Predictive analytics also helps optimize operational workflows and reduce healthcare costs, adding to its dominance.

The prescriptive analytics segment is anticipated to witness the fastest growth rate of 19.5% from 2025 to 2033, fueled by rising adoption among hospitals and healthcare systems aiming to recommend optimal treatment plans. Prescriptive solutions go beyond prediction to suggest actionable interventions, helping healthcare providers improve patient outcomes and reduce operational costs. The increasing focus on personalized medicine and value-based care is driving the integration of prescriptive analytics into hospital workflows. Cloud-based prescriptive platforms offer scalability and easy deployment across multiple facilities, accelerating adoption among mid-sized and large healthcare organizations. The trend towards combining predictive and prescriptive analytics is also contributing to faster market growth in this subsegment. Prescriptive analytics further enables scenario simulation and “what-if” analysis, assisting in strategic planning and resource optimization.

- By Component

On the basis of component, the MEA healthcare analytics market is segmented into software, services, and hardware. The software segment dominated the market with the largest revenue share of 42.1% in 2024, owing to the growing deployment of AI-powered analytics platforms, cloud-based dashboards, and integrated EHR solutions. Software platforms enable hospitals to analyze large volumes of patient and operational data efficiently while supporting real-time decision-making. The adoption of healthcare analytics software is particularly strong in government hospitals and large private healthcare chains in Saudi Arabia and the UAE. Software solutions also provide predictive and prescriptive analytics capabilities, population health monitoring, and financial analytics integration, enhancing their overall value. Continuous innovation, updates, and integration capabilities further reinforce the dominance of software solutions in the MEA market. Hospitals increasingly rely on software to centralize reporting and compliance tracking, making it an essential component of analytics adoption.

The services segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2033, driven by growing demand for managed analytics services, consulting, and data management support. Many healthcare organizations in the region lack in-house expertise for deploying advanced analytics, prompting reliance on external service providers. Services include implementation, training, data migration, and analytics support, which help hospitals and clinics optimize their analytics investments. Increasing collaborations between analytics service providers and government healthcare initiatives are further fueling growth in this segment. Service providers also offer ongoing monitoring and optimization, ensuring that analytics tools deliver maximum value. The growth of outsourced healthcare IT services across MEA is also enhancing adoption of analytics services.

- By Delivery Model

On the basis of delivery model, the MEA healthcare analytics market is segmented into on-demand (cloud-based) and on-premise. The on-demand segment dominated the market with the largest revenue share of 39.5% in 2024, due to the flexibility, scalability, and cost-efficiency offered by cloud-based solutions. Cloud delivery allows hospitals and clinics to access advanced analytics without investing heavily in IT infrastructure, making it ideal for both urban and semi-urban healthcare facilities. On-demand platforms also enable real-time data sharing across multiple locations, supporting centralized management and collaborative decision-making. The increasing penetration of reliable internet connectivity and government initiatives promoting digital health solutions are further reinforcing the growth of cloud-based analytics in the MEA region. On-demand solutions support multi-facility deployments, enabling health systems to standardize analytics processes across regions. They also reduce IT maintenance costs and allow rapid updates, contributing to their dominance.

The on-premise segment is expected to witness the fastest CAGR of 18.9% from 2025 to 2033, driven by demand from large hospitals and healthcare systems requiring local data storage for compliance with regional data privacy laws. On-premise solutions offer enhanced control over sensitive patient information and can be customized for complex hospital workflows. Adoption is also supported by hybrid deployment models, where core analytics is managed on-premise while additional modules are cloud-enabled. Hospitals with stringent compliance requirements often prefer on-premise deployment. The rising trend of hybrid models allows organizations to leverage cloud benefits while maintaining data security, fueling growth. On-premise solutions are particularly relevant for government-run facilities handling sensitive public health data.

- By Application

On the basis of application, the MEA healthcare analytics market is segmented into clinical analytics, population health analytics, operational and administrative analytics, and financial analytics. The clinical analytics segment dominated the market with a share of 35.6% in 2024, driven by hospitals and specialty clinics using data to enhance patient care, optimize treatment protocols, and reduce medical errors. Clinical analytics tools integrate with EHRs to provide predictive and prescriptive insights, enabling proactive interventions. The adoption of clinical analytics is particularly strong in Saudi Arabia and the UAE, where hospitals are modernizing infrastructure and implementing smart hospital programs. Integration with AI-powered diagnostic tools and telemedicine platforms further strengthens the value of clinical analytics. Hospitals use clinical analytics to monitor outcomes, improve care coordination, and support evidence-based medicine. Clinical analytics also helps in benchmarking performance across departments, enhancing operational efficiency.

The population health analytics segment is expected to witness the fastest growth rate of 21.2% from 2025 to 2033, fueled by government initiatives to monitor and improve public health outcomes. Analytics platforms help track disease trends, manage chronic conditions, and plan preventive healthcare programs across regions. Cloud-based and AI-enabled solutions allow health authorities to analyze large-scale population data efficiently. Increasing focus on preventive care, value-based healthcare, and national eHealth strategies in countries such as Saudi Arabia, UAE, and Egypt is driving the adoption of population health analytics. Population health analytics supports vaccination planning, epidemic management, and resource allocation. The growing emphasis on preventive care and chronic disease management contributes to faster adoption.

- By End User

On the basis of end user, the MEA healthcare analytics market is segmented into healthcare payers, healthcare providers and Accountable Care Organizations (ACOs), Health Information Exchanges (HIEs), Managed Care Organizations (MCOs), and Third-Party Administrators (TPAs). The healthcare providers and ACOs segment dominated the market with a revenue share of 41.3% in 2024, owing to large hospitals and clinics leveraging analytics for patient care optimization, resource allocation, and operational efficiency. Adoption is particularly high among hospitals in Saudi Arabia, the UAE, and Egypt, supported by government programs promoting smart healthcare and integrated data management systems. Analytics tools help providers monitor patient outcomes, reduce readmissions, and implement value-based care strategies. Providers also utilize analytics for staff management, workflow optimization, and strategic planning. Integration with telemedicine and EHR platforms enhances clinical decision-making, reinforcing dominance. Large hospital networks increasingly rely on analytics to standardize care protocols and improve patient satisfaction.

The healthcare payers segment is expected to witness the fastest CAGR of 19.8% from 2025 to 2033, driven by insurers and TPAs using analytics to assess risk, detect fraud, manage claims, and improve cost efficiency. Advanced predictive and prescriptive analytics enable payers to forecast claims trends, optimize reimbursement models, and enhance member management. Increasing partnerships between payers and government healthcare programs in the MEA region are further accelerating adoption. Payers leverage analytics to identify high-risk patients and design preventive care programs. Cloud-based solutions allow payers to scale analytics across multiple regions efficiently. Adoption is further supported by regulatory encouragement for transparent and efficient claims management.

Middle East and Africa Healthcare Analytics Market Regional Analysis

- Saudi Arabia dominated the MEA healthcare analytics market in 2024 with the largest revenue share of 32.5%, driven by significant investments in digital health infrastructure, national eHealth initiatives, and advanced IT solutions, particularly in hospitals and government healthcare programs

- Healthcare providers and government health agencies in Saudi Arabia highly value the ability of analytics solutions to improve patient outcomes, optimize resource allocation, and support data-driven decision-making for both clinical and operational purposes

- This widespread adoption is further supported by strong government support, public-private partnerships, and ongoing initiatives to implement AI and cloud-based analytics platforms, establishing healthcare analytics as a critical tool for healthcare modernization in the country

The Saudi Arabia Healthcare Analytics Market Insight

The Saudi Arabia healthcare analytics market captured the largest revenue share of 32.5% in 2024 within the MEA region, fueled by substantial investments in digital health infrastructure, national eHealth initiatives, and smart hospital projects. Healthcare providers are increasingly prioritizing data-driven decision-making to enhance patient outcomes, optimize resource allocation, and improve operational efficiency. The growing adoption of AI-powered predictive and prescriptive analytics platforms further supports market expansion. Moreover, government policies promoting healthcare modernization, combined with strong public-private partnerships, are significantly contributing to the growth of healthcare analytics in the country.

United Arab Emirates Healthcare Analytics Market Insight

The UAE healthcare analytics market is anticipated to grow at a significant CAGR during the forecast period, driven by the nation’s focus on smart hospitals, digital transformation, and advanced healthcare IT infrastructure. Rising adoption of cloud-based analytics solutions and AI integration enables healthcare providers to improve clinical and operational decision-making. In addition, the increasing demand for patient-centric care and real-time monitoring supports market growth. Government-backed initiatives and collaborations with global technology providers are further strengthening the UAE market. The region is experiencing strong adoption across hospitals, clinics, and government health agencies.

Egypt Healthcare Analytics Market Insight

The Egypt healthcare analytics market is poised to expand at a considerable CAGR, fueled by rising investments in healthcare IT, the modernization of hospitals, and increased focus on population health management. Healthcare providers are leveraging analytics platforms to monitor patient outcomes, optimize resource utilization, and support preventive care initiatives. Cloud-based and AI-enabled solutions are becoming increasingly popular, offering scalable and cost-efficient options for public and private hospitals. Government initiatives promoting digital health and eHealth strategies are accelerating adoption. Egypt’s growing healthcare infrastructure and increasing data digitization are key growth drivers.

South Africa Healthcare Analytics Market Insight

The South Africa healthcare analytics market is expected to witness steady growth during the forecast period, driven by the growing emphasis on data-driven healthcare management and operational efficiency in hospitals and clinics. Analytics solutions are being adopted to reduce medical errors, enhance patient care, and improve administrative workflows. The integration of predictive and prescriptive analytics with electronic health records is further strengthening the market. Public and private healthcare providers are increasingly focusing on cost optimization and quality care, boosting analytics adoption. Government support and rising awareness of digital health tools are also contributing to market expansion.

Middle East and Africa Healthcare Analytics Market Share

The Middle East and Africa Healthcare Analytics industry is primarily led by well-established companies, including:

- IQVIA (U.S.)

- SAS Institute Inc. (U.S.)

- Optum Inc. (U.S.)

- IBM (U.S.)

- McKesson Corporation (U.S.)

- Allscripts Healthcare Solutions Inc. (U.S.)

- Oracle (U.S.)

- MedeAnalytics Inc. (U.S.)

- Inovalon (U.S.)

- Health Catalyst (U.S.)

- Milliman Inc. (U.S.)

- PwC (U.K.)

- AlTibbi (Jordan)

- TA Telecom (Egypt)

- Zamakan Agency (Saudi Arabia)

- Al Khayyat Investments LLC (UAE)

- Qure.ai (India)

- Practo (India)

- Opontia (UAE)

What are the Recent Developments in Middle East and Africa Healthcare Analytics Market?

- In October 2025, Abu Dhabi introduced advanced artificial intelligence (AI) tools aimed at the early detection of chronic diseases such as diabetes and cancer. These initiatives were showcased at GITEX Global 2025 by the Department of Health – Abu Dhabi (DoH). A key component of this strategy is the development of "Malaffi," a next-generation healthcare ecosystem designed to enhance patient data sharing and coordination among medical professionals

- In October 2025, Kuwait and Bahrain signed a Memorandum of Understanding (MoU) aimed at strengthening collaboration in the healthcare sector. This agreement focuses on improving medical training, developing healthcare infrastructure, and fostering the exchange of medical expertise between the two countries

- In August 2025, researchers from United Arab Emirates University (UAEU) and the Indian Institute of Technology Madras' Zanzibar campus introduced an advanced artificial intelligence-based system designed to model and forecast malaria outbreaks. This collaboration integrates AI with dynamic mathematical modeling to accurately predict malaria transmission patterns, enabling early health interventions and improved disease control strategies in malaria-prone regions

- In July 2025, Nordic Capital acquired Arcadia Solutions, a healthcare analytics company, as part of its strategy to enhance healthcare delivery and cost-efficiency using artificial intelligence (AI). Arcadia specializes in consolidating and analyzing health data from various sources to identify care gaps and improve outcomes. The acquisition marks an exit for investors including Peloton Equity, Merck’s digital-health venture arm, and Vista Credit Partners

- In October 2024, the Global Health Network Middle East and North Africa (TGHN MENA) was officially launched, representing a pivotal step in advancing healthcare research and collaboration across the MENA region. This initiative aims to enhance the quality and accessibility of healthcare by fostering partnerships, sharing knowledge, and promoting best practices among healthcare professionals and institutions in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.