Middle East And Africa Industrial Machine Vision Market

Market Size in USD Billion

CAGR :

%

USD

4.92 Billion

USD

1.83 Billion

2024

2032

USD

4.92 Billion

USD

1.83 Billion

2024

2032

| 2025 –2032 | |

| USD 4.92 Billion | |

| USD 1.83 Billion | |

|

|

|

|

Middle East and Africa Industrial Machine Vision Market Size

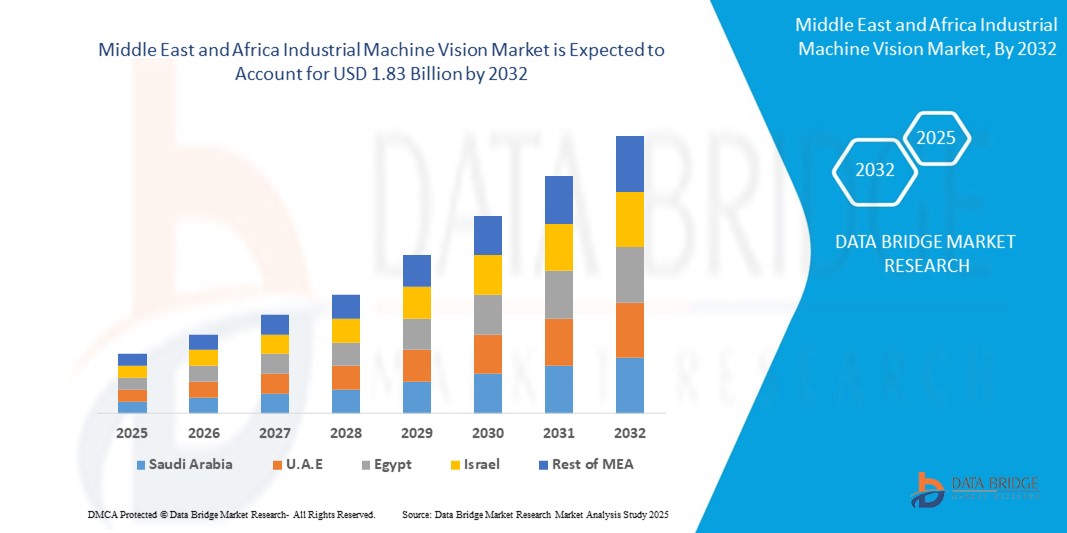

- The Middle East and Africa industrial machine vision market size was valued at USD 4.92 billion in 2024 and is expected to reach USD 1.83 billion by 2032, at a CAGR of 6.83% during the forecast period

- The growing focus on quality control and inspection is a significant driver of the industrial machine vision market, playing a crucial role in its expansion. As industries across various sectors strive to meet stringent quality standards and maintain competitive advantage, the demand for advanced machine vision systems has surged. These systems are essential in automating the inspection process, ensuring consistency, accuracy, and efficiency in quality control, which ultimately drives market growth

Middle East and Africa Industrial Machine Vision Market Analysis

- The growing focus on quality control and inspection is a significant driver of the industrial machine vision market, playing a crucial role in its expansion. As industries across various sectors strive to meet stringent quality standards and maintain competitive advantage, the demand for advanced machine vision systems has surged. These systems are essential in automating the inspection process, ensuring consistency, accuracy, and efficiency in quality control, which ultimately drives market growth

- The U.A.E. industrial machine vision market is expected to dominate with the largest market share of 53.12% the supported by the country’s strong emphasis on smart manufacturing, infrastructure development, and innovation-driven industries

- Saudi Arabia industrial machine vision market is anticipated to grow at a fastest CAGR of 13.67% during the forecast period, propelled by the country’s Vision 2030 initiative, which prioritizes industrial diversification and smart technology adoption

- The hardware segment dominated the market with the largest revenue share of 67.4% in 2024, driven by strong demand for cameras, sensors, lenses, and lighting systems that serve as the foundation of vision systems

Report Scope and Middle East and Africa Industrial Machine Vision Market Segmentation

|

Attributes |

Middle East and Africa Industrial Machine Vision Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Industrial Machine Vision Market Trends

Rising Adoption of AI-Driven Quality Inspection and Automation

- A key and accelerating trend in the Middle East and Africa (MEA) industrial machine vision market is the growing adoption of AI-powered vision systems for automated inspection, quality control, and predictive maintenance. The integration of artificial intelligence with machine vision enhances accuracy, reduces human error, and enables real-time decision-making in manufacturing and logistics

- For instance, companies across the region are deploying machine vision systems equipped with AI algorithms to detect defects on production lines, ensuring higher product consistency and reduced wastage. This is particularly evident in industries such as automotive and food & beverage processing

- The use of AI-driven machine vision also supports predictive maintenance by analyzing visual data from equipment to identify early signs of wear or potential failures, minimizing downtime

- Furthermore, automation initiatives supported by government-led industrial digitalization programs in the U.A.E. and Saudi Arabia are encouraging businesses to adopt smarter inspection and monitoring systems

- Companies such as OMRON and Cognex are expanding their presence in the MEA region, offering AI-enabled industrial machine vision systems tailored to local manufacturing and logistics needs

- This trend reflects the growing shift toward Industry 4.0 practices across the MEA market, as enterprises increasingly prioritize efficiency, safety, and operational intelligence

Middle East and Africa Industrial Machine Vision Market Dynamics

Driver

Increasing Industrial Automation and Smart Manufacturing Initiatives

- The rapid expansion of industrial automation, supported by national transformation strategies such as Saudi Vision 2030 and U.A.E. Industry 4.0 initiatives, is a major driver for the adoption of machine vision systems in the region

- For instance, in May 2024, Cognex Corporation partnered with regional distributors to deliver machine vision solutions across the Middle East, enabling manufacturers to achieve greater productivity and precision

- Machine vision systems are being deployed across automotive, packaging, and pharmaceuticals sectors to enhance quality assurance, streamline operations, and reduce reliance on manual inspection

- The increasing demand for reliable quality control, traceability, and compliance with global manufacturing standards is accelerating market growth

- In addition, the need for digital transformation and competitiveness in global supply chains is motivating MEA manufacturers to adopt advanced automation technologies, making industrial machine vision a core enabler

Restraint/Challenge

High Deployment Costs and Limited Technical Expertise

- Despite growing interest, the MEA market faces challenges due to the high upfront investment required for machine vision systems, including cameras, sensors, and AI-driven software. For many small and medium enterprises (SMEs), these costs act as a barrier to adoption

- For instance, several local manufacturers in Africa remain reliant on manual inspection processes due to budget constraints, limiting the penetration of advanced machine vision solutions

- Another key restraint is the shortage of skilled professionals capable of integrating and maintaining machine vision systems. The lack of in-house technical expertise increases reliance on external vendors, adding to operational costs

- Cybersecurity concerns related to cloud-connected vision systems further discourage adoption in certain industries where data sensitivity is high

- Companies such as OMRON and SICK AG are addressing these challenges by offering modular, cost-effective solutions and training programs to build local expertise. However, affordability and technical readiness remain hurdles

- Overcoming these challenges through regional partnerships, government incentives, and workforce training will be critical for sustained adoption of machine vision technologies across the Middle East and Africa

Middle East and Africa Industrial Machine Vision Market Scope

The market is segmented on the basis of component, product, type, deployment, applications, and end user.

- By Component

On the basis of component, the industrial machine vision market is segmented into hardware and software. The hardware segment dominated the market with the largest revenue share of 67.4% in 2024, driven by strong demand for cameras, sensors, lenses, and lighting systems that serve as the foundation of vision systems. The need for high-performance image acquisition devices in automotive, electronics, and packaging industries continues to fuel hardware adoption. In addition, advancements in CMOS sensors and high-resolution cameras are strengthening this dominance.

The software segment is expected to witness the fastest CAGR of 21.2% from 2025 to 2032, propelled by growing demand for AI-powered image processing, deep learning algorithms, and data analytics to improve detection accuracy and automation. The rising shift towards intelligent, adaptive vision systems that require less human intervention highlights software as the critical driver of future market expansion.

- By Product

On the basis of product, the industrial machine vision market is segmented into smart camera/smart sensor vision system, hybrid smart camera vision system, and PC-based systems. The PC-based segment accounted for the largest revenue share of 52.8% in 2024, supported by its superior processing power, flexibility, and suitability for complex inspection tasks across automotive, semiconductor, and aerospace industries. Its ability to handle multi-camera setups and advanced software applications drives its continued preference.

Meanwhile, the smart camera/smart sensor vision system segment is projected to register the fastest CAGR of 22.6% from 2025 to 2032, owing to increasing demand for compact, cost-effective, and user-friendly solutions. Smart cameras reduce wiring, require less maintenance, and integrate AI-driven features, making them highly attractive for small to mid-sized manufacturers in food, packaging, and electronics industries.

- By Type

On the basis of type, the industrial machine vision market is segmented into 1D vision systems, 2D vision systems, and 3D vision systems. The 2D vision systems segment dominated with the largest revenue share of 61.3% in 2024, driven by its wide application in defect detection, barcode reading, packaging inspection, and assembly verification. Cost efficiency, ease of installation, and established reliability support its leading position across diverse industries.

The 3D vision systems segment is expected to grow at the fastest CAGR of 23.4% from 2025 to 2032, fueled by increasing adoption in robotics, automotive, and electronics industries. 3D systems offer depth perception, accurate spatial measurement, and advanced pattern recognition capabilities, making them essential for applications such as bin picking, robotic guidance, and complex assembly inspection.

- By Deployment

On the basis of deployment, the industrial machine vision market is segmented into robotic cell and general. The general deployment segment held the largest market revenue share of 68.9% in 2024, supported by widespread use in standalone inspection stations, quality control, and packaging lines. Its flexibility and cost-effectiveness make it highly adopted across SMEs and large enterprises in food, printing, and consumer goods industries.

The robotic cell segment is anticipated to record the fastest CAGR of 20.8% from 2025 to 2032, as the integration of machine vision with industrial robots accelerates. Robotic cells enable real-time guidance, precise assembly, and automated defect detection, aligning with Industry 4.0 and smart manufacturing initiatives. Rising labor costs and the demand for automation in automotive and electronics sectors are further boosting this trend.

- By Application

On the basis of application, the industrial machine vision market is segmented into defect detection, product inspection, surface inspection, packaging inspection, identification, OCR/OCV, pattern recognition, gauging, guidance and part tracking, web inspection, and others. The product inspection segment dominated with a revenue share of 26.5% in 2024, as quality assurance remains a critical factor in automotive, electronics, and pharmaceutical manufacturing. Its ability to reduce recalls and enhance compliance strengthens demand.

The guidance and part tracking segment is projected to grow at the fastest CAGR of 24.1% from 2025 to 2032, as manufacturers increasingly adopt robotic vision systems for assembly, bin picking, and material handling. The rise of autonomous and collaborative robots in manufacturing further fuels demand for accurate part tracking and navigation.

- By End-User

On the basis of end-user, the industrial machine vision market is segmented into automotive, consumer electronics, food and packaging, pharmaceuticals, metals, printing, aerospace, glass, rubber and plastics, mining, textiles, wood and paper, machinery, solar panel manufacturing, and others. The automotive segment dominated with the largest revenue share of 31.7% in 2024, driven by rising automation in assembly lines, demand for precision inspection, and quality assurance requirements. Vision systems are essential for defect detection, robotic guidance, and part verification in automotive manufacturing.

The pharmaceuticals segment is expected to witness the fastest CAGR of 22.9% from 2025 to 2032, fueled by strict regulatory standards, demand for serialization, and the need for accurate inspection in drug packaging and labeling. The increasing adoption of machine vision to ensure compliance, reduce errors, and maintain product safety positions this segment as the most dynamic growth area.

Industrial Machine Vision Market Regional Analysis

- The U.A.E. industrial machine vision market is expected to dominate with the largest market share of 53.12% the supported by the country’s strong emphasis on smart manufacturing, infrastructure development, and innovation-driven industries

- Industrial Vision solutions are being integrated into logistics, packaging, and automotive assembly lines, reflecting the U.A.E.’s drive towards automation and advanced quality assurance. Dubai and Abu Dhabi are leading with investments in digital transformation and AI-powered technologies, further enhancing the market’s growth prospects

- In addition, the U.A.E.’s role as a regional trade hub fuels demand for reliable inspection systems to support exports and regulatory compliance

Saudi Arabia Industrial Machine Vision Market Insight

Saudi Arabia industrial machine vision market is anticipated to grow at a fastest CAGR of 13.67% during the forecast period, propelled by the country’s Vision 2030 initiative, which prioritizes industrial diversification and smart technology adoption. The manufacturing sector is increasingly integrating advanced inspection systems to meet global quality standards, particularly in automotive, food and beverage, and pharmaceuticals. Rapid urbanization and infrastructure development projects are also fueling demand for machine vision solutions in packaging, identification, and safety inspections. Strong government-backed digital transformation programs and foreign investment in smart industries are further accelerating adoption.

South Africa Industrial Machine Vision Market Insight

South Africa industrial machine vision market is poised for steady growth, driven by rising automation needs in mining, automotive, and food processing sectors. Local industries are embracing vision-based systems to enhance operational efficiency, reduce errors, and ensure compliance with international quality standards. The growing demand for packaging inspection, defect detection, and guidance systems is particularly strong in consumer goods and export-oriented industries. Furthermore, the government’s push to modernize industrial operations and the rising adoption of robotics and smart manufacturing practices are boosting the demand for machine vision solutions across the country.

Middle East and Africa Industrial Machine Vision Market Share

The industrial machine vision industry is primarily led by well-established companies, including:

- OMRON Corporation (Japan)

- Sony Semiconductor Solutions Corporation (Japan)

- Cognex Corporation (U.S.)

- SICK AG (U.S.)

- Teledyne FLIR LLC (U.S.)

- NATIONAL INSTRUMENTS CORP. (U.S.)

- Intel Corporation (U.S.)

- Cadence Design Systems, Inc. (U.S.)

What are the Recent Developments in Middle East and Africa Industrial Machine Vision Market?

- In March 2024, Cognex launched the DataMan 8700 Series, a next-generation handheld barcode scanner built on an entirely new platform. The device offers advanced performance, ease of use, and requires no prior adjustments or operator training. This release reinforces Cognex’s focus on simplifying operations while delivering high-performance scanning solutions to industries

- In February 2024, OMRON Automation introduced the TM S Series Collaborative Robots in India, equipped with faster joints and enhanced safety features. These innovations significantly improve factory efficiency in shared workspaces. The launch highlights OMRON’s commitment to advancing safe and productive collaborative robotics for industrial automation

- In March 2023, KEYENCE CORPORATION unveiled its VS Series Vision System, designed to enhance industrial automation through advanced image processing, high-speed inspection, and user-friendly operation. The system is particularly suited for improving quality control and manufacturing efficiency. This introduction demonstrates Keyence’s dedication to delivering state-of-the-art vision technology for a wide range of industrial applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Industrial Machine Vision Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Industrial Machine Vision Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Industrial Machine Vision Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.