Middle East And Africa Industrial Valves Market

Market Size in USD Million

CAGR :

%

USD

77,081.35 Million

USD

124,722.69 Million

2022

2030

USD

77,081.35 Million

USD

124,722.69 Million

2022

2030

| 2023 –2030 | |

| USD 77,081.35 Million | |

| USD 124,722.69 Million | |

|

|

|

|

Middle East and Africa Industrial Valves Market Analysis and Size

Industrial valves are mechanical or electromechanical parts that regulate the flow of liquids, gases, slurries, and other substances through pipes and tubes in various industries. Pressure control, shut-on/off requirements, and other regulatory requirements are among the functions of different industrial valve types. Industrial valves come in various sizes and shapes, regulating, controlling, and turning on and off processes. In addition, industrial valves with high levels of automation and control operate more effectively in risky settings such as nuclear power plants, oil and gas fields, and chemical processing. The amount of liquid waste that passes through pipes and valves has decreased through automation technologies, which lowers costs.

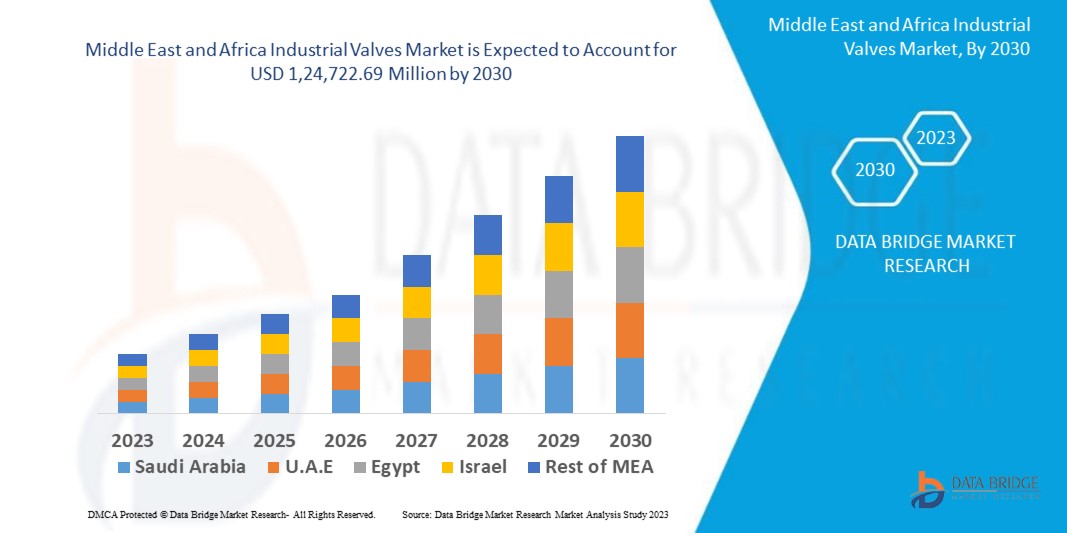

Data Bridge Market Research analyses that the industrial valves market, valued at USD 77,081.35 million in 2022, will reach USD 1,24,722.69 million by 2030, growing at a CAGR of 6.2% from 2023 to 2030. “Oil and gas” dominates in application segment due to increase in its usage in the region. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Middle East and Africa Industrial Valves Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Components (Actuators, Valve Body, Others), Type (Gate Valve, Globe Valve, Ball Valve, Butterfly Valve, Diaphragm Valve, Check Valve, Plug Valve, Pinch Valve, Needle Valve, Pressure Relief Valve, Safety Valve, Others), Function (On/Off, Control, Isolation, Regulation Safety Relief Valve, Special Purpose, Non-Return), Material (Iron, Carbon Steel, Alloy, Plastic, Brass, Bronze, Copper, Cryogenic, Aluminium, Others), Accessories (Hydraulic Filter, Power Cable, Mounting Screw and Bolts, Seal Kits, Dust Protection Cover, Others), Size (1 Inch to 6 Inch, 6 Inch to 12 Inch, 12 Inch to 24 Inch, 24 Inch to 48 Inch, Above 48 Inch), Application (Oil and Gas, Building and Construction, Semiconductors, Water and Waste Treatment, Chemical, Energy and Utilities, Food and Beverages, Pharmaceutical, Agriculture, Marine, Automotive, Metals and Mining, Pulp and Paper, Others) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

Emerson Electric Co. (U.S.), Flowserve Corporation (U.S.), Crane Company (U.S.), IMI (U.K.), Velan Inc. (Canada), KITZ Corporation (Japan), Neway valve (China), AVK Holding A/S (Denmark), Metso (Finland), Spirax Sarco Limited. (U.K.), Johnson Controls (Ireland), Powell Valves (U.S.), Curtiss-Wright. (U.S.), Mueller Co. LLC. (U.S.), Crane Co., CRANE ChemPharma & Energy Corp (U.S.), The Weir Group PLC (U.K.), Wärtsilä (Finland), Bray International (U.S.), Dwyer Instruments LTD (U.S.), Watts. (U.S.), Bonney Forge Corporation (U.S.), NIBCO Inc. (U.S.) |

|

Market Opportunities |

|

Market Definition

Mechanical industrial valves are used by businesses to control the flow of fluids through piping systems, including liquids, gases, and slurries. They can control the flow by enlarging, constricting, or partially obstructing the passage. They can also regulate backflow, pressure, and temperature. The various sizes and types of valves include gate valves, globe valves, ball valves, and butterfly valves, to name a few. They are essential in industries such as oil and gas, water treatment, power generation, and manufacturing, ensuring processes' safe and efficient operation by controlling fluid flow and maintaining system integrity.

Middle East and Africa Industrial Valves Market

Drivers

- Industry growth energizes the market

The development and growth of industries such as oil and gas, petrochemicals, power generation, water and wastewater treatment, and manufacturing fuel the demand for industrial valves. As these sectors expand their operations, so does the requirement for valves to control process parameters, regulate fluid flow, and guarantee efficient and secure operations. Valves are essential in these industries for starting, stopping, and modulating fluid flow, maintaining pressure and temperature levels, and preventing backflow or leakage. The development of infrastructure and the expansion of industrial activities in these sectors directly contribute to the rise in demand for industrial valves to support their expanding operations.

- The growth of the market is fueled by technological development

Technological advances in valve design, materials, and automation greatly impact the demand for industrial valves. These advancements bring new capabilities and features to valves, enhancing their performance, dependability, and control. Improved designs optimize fluid flow, which reduces energy consumption and increases effectiveness. Advanced materials offer enhanced toughness, corrosion resistance, and fluid compatibility. Automation technologies enable remote operation, monitoring, and integration with control systems, which improve process control and efficiency. Industries upgrade their existing valves or invest in new ones to benefit from these advancements to improve overall performance, reduce maintenance costs, and optimize their processes for greater productivity and operational excellence.

Opportunities

- Environmental issues are driving market expansion

The demand for industrial valves in green technologies has increased due to rising environmental consciousness and the focus on sustainability. These valves are essential for streamlining processes and reducing environmental impact in pollution prevention, wastewater treatment, and producing renewable energy. Valves control fluid flow in solar thermal systems, wind turbine cooling systems, and hydroelectric power plants. By regulating flow and treatment procedures, using valves in wastewater treatment enables effective and environmentally friendly treatment. In line with the growing emphasis on environmental sustainability, valves support pollution control efforts by regulating emissions, preventing leaks, and maintaining process efficiency.

- Globalization and international trade create market growth

Supply chains have grown, and demand for industrial valves has risen due to industry globalization and increased global trade. Valves are essential in the logistics and shipping industries, where goods are moved, stored, and processed. Valves effectively control fluid flow in tanks, containers, and pipelines, enabling the secure transportation of various goods. As the volume of international trade increases, so does the demand for valves in ports, terminals, warehouses, and transportation networks, which adds to the overall demand for industrial valves. These valves control and handle the movement of goods between various geographical areas.

Restraints/Challenges

- Technological obsolescence restricts the market growth

The industrial valve industry is constrained by technological obsolescence due to how quickly technology develops. As new technologies advance, older valve designs and features may become ineffective and incompatible with contemporary control systems. Industries need to stay on top of technological developments to ensure that their valves are effective, dependable, and flexible enough to adapt to changing industrial processes. Lack of technological adaptation may lead to decreased productivity, higher maintenance costs, and potential system failures. To reduce the risk of technological obsolescence and maintain market competitiveness, ongoing monitoring of technological advancement and proactive valve upgrade spending are required.

- High cost and need for regular maintenance limit the growth

On projects or industries with tight budgets, the price of industrial valves and related installation, maintenance, and repair costs can be a significant constraint. Industrial valves can be expensive up front, particularly those with larger or more specialized designs. Regular maintenance and sporadic repairs are also required to ensure the best valve performance. These processes frequently require downtime, which can impair operational efficiency and disrupt production, especially in sectors with continuous processes. For industries attempting to strike a balance between cost-effectiveness and uninterrupted operations, the expenses associated with valve maintenance and repair and the resulting downtime can present difficulties and financial constraints.

Recent Developments

- In November 2022, the series of additively manufactured/3D printed diaphragm values made of unique alloy material was introduced by KSB SE & CO. KGaA. The pharmaceutical industry was the focus of the design of the new valve

- In March 2022, the valve and pulp businesses of Flowrox, a technology company with headquarters in Finland, were acquired by Neles, a leading provider of flow control solutions worldwide. Neles wants to increase its product offering and exposure to the mining and metals sector through this acquisition

Middle East and Africa Industrial Valves Market Scope

The industrial valves market is segmented based on component, type, function, material, accessories, size, and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Actuators

- Valve Body

- Others

- Positioners

- I/P Converters

Type

- Gate Valve

- Globe Valve

- Ball Valve

- Butterfly Valve

- Diaphragm Valve

- Check Valve

- Plug Valve

- Pinch Valve

- Needle Valve

- Pressure Relief Valve

- Safety Valve

- Others

Function

- On/Off

- Control

- Isolation

- Regulation

- Safety Relief Valve

- Special Purpose

- Non-Return

Material

- Iron

- Ductile

- Cast Iron

- Carbon Steel

- Alloy

- Plastic

- Brass

- Bronze

- Copper

- Cryogenic

- Aluminium

- Others

Accessories

- Hydraulic Filter

- Power Cable

- Mounting Screw and Bolts

- Seal Kits

- Dust Protection Cover

- Others

Size

- 1 Inch to 6 Inch

- 6 Inch to 12 Inch

- 12 Inch to 24 Inch

- 24 Inch to 48 Inch

- Above 48 Inch

Application

- Oil and Gas

- Building and Construction

- Semiconductors

- Water and Waste Treatment

- Chemical

- Energy and Utilities

- Food and Beverages

- Pharmaceutical

- Agriculture

- Marine

- Automotive

- Metals and Mining

- Paper and Pulp

- Others

- Textile

- Glass

Middle East and Africa Industrial Valves Market Regional Analysis/Insights

The industrial valves market is analysed and market size insights and trends are provided by country, component, type, function, material, accessories, size, and application, as referenced above.

The countries covered in the industrial valves market report are Saudi Arabia, U.A.E., South Africa, Egypt, Israel, and rest of Middle East and Africa.

Saudi Arabia dominates the market and will continue to flourish its trend of dominance during the forecast period. The major factors attributable to the region's dominance are increasing industrial activities and the growing no. of manufacturing plants for oil and gas, chemical, and water. This results in increasing the demand for industrial valves that have the capability of handling high pressure.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Ultra-Wideband Infrastructure Growth Installed Base and New Technology Penetration

The Middle East and Africa industrial valves market also provides you with detailed market analysis for every country growth in technology expenditure for capital equipment, installed base of different kind of products for Middle East and Africa industrial valves market, impact of technology using life line curves and changes in ultra-wideband regulatory scenarios and their impact on the Middle East and Africa Industrial Valves market. The data is available for historic period 2015-2020.

Competitive Landscape and Middle East and Africa Industrial Valves Market Share Analysis

The industrial valves market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to the market.

Some of the major players operating in the industrial valves market are:

- Emerson Electric Co. (U.S.)

- Flowserve Corporation (U.S.)

- Crane Company (U.S.)

- IMI (U.K.)

- Velan Inc. (Canada)

- KITZ Corporation (Japan)

- Neway valve (China)

- AVK Holding A/S (Denmark)

- Metso (Finland)

- Spirax Sarco Limited. (U.K.)

- Johnson Controls (Ireland)

- Powell Valves (U.S.)

- Curtiss-Wright. (U.S.)

- Mueller Co. LLC. (U.S.)

- Crane Co., CRANE ChemPharma & Energy Corp (U.S.)

- The Weir Group PLC (U.K.)

- Wärtsilä (Finland)

- Bray International (U.S.)

- Dwyer Instruments LTD (U.S.)

- Watts. (U.S.)

- Bonney Forge Corporation (U.S.)

- NIBCO Inc. (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.5 COMPANY COMPETITIVE ANALYSIS

5.5.1 STRATEGIC DEVELOPMENT

5.5.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.1. CHALLENGES

5.5.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.3 TECHNOLOGY SPEND OF COMPANY

5.5.4 CUSTOMER BASE

5.5.5 SERVICE POSITIONING

5.6 USED CASES & ITS ANALYSIS

6 INDUSTRY INSIGHTS

7 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY TYPE

7.1 OVERVIEW

7.1.1 GATE VALVE

7.1.1.1. STANDARD PLATE GATE VALVES

7.1.1.2. WEDGE GATE VALVES

7.1.1.3. KNIFE GATE VALVES

7.1.2 DIAPHRAGM (SAUNDERS) VALVES

7.1.2.1. WEIR TYPE

7.1.2.2. STRAIGHT THROUGH TYPE

7.1.3 GLOBE VALVE

7.1.4 CHECK VALVE

7.1.4.1. SWING CHECK VALVES

7.1.4.2. PISTON CHECK VALVES

7.1.4.3. BALL CHECK VALVES

7.1.4.4. TITLTING DISC CHECK VALVES

7.1.5 PLUG VALVE

7.1.6 BALL VALVE

7.1.7 BUTTERFLY VALVE

7.1.7.1. LINED TYPE

7.1.7.2. DOUBLE OFFSET

7.1.7.3. TRIPLE OFFSET

7.1.7.4. NEEDLE VALVE

7.1.7.5. PINCH VALVE

7.1.7.6. PRESSURE RELIEF VALVE

7.1.7.7. OTHERS

7.2 INDUSTRIAL ACTUATOR

7.2.1.1. BY TYPE

7.2.1.2. LINEAR

7.2.1.3. ROTARY

7.2.2 BY TECHNOLOGY

7.2.2.1. MECHANICAL

7.2.2.2. ELECTRIC

7.2.2.3. PNEUMATIC

7.2.2.4. HYDRAULLIC

8 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY FUNCTION

8.1 OVERVIEW

8.2 ISOLATION

8.3 REGULATION

8.4 SAFETY RELIEF VALVE

8.5 NON RETURN

8.6 SPECIAL PURPOSE

9 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY ACCESSORIES

9.1 OVERVIEW

9.2 SEAL KITS

9.3 HYDRAULLIC FILTERS

9.4 MOUNTING SCREWS AND BOLTS

9.5 POWER CABLES

9.6 DUST PROTECTION COVER

9.7 OTHERS

10 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 PLASTIC

10.2.1 POLYVINYL CHLORIDE (PVC)

10.2.2 CHLORINATED POLYVINYL CHLORIDE (CPVC)

10.2.3 SPOLYPROPYLENE (PP), AND POLYVINYLIDENE FLUORIDE (PVDF)

10.2.4 PVC

10.2.5 CPVC VALVES

10.2.6 OTHERS

10.3 ALUMINUM

10.4 COPPER

10.5 BRONZE

10.6 BRASS

10.7 GREY IRON

10.8 CARBON STEEL

10.9 OTHERS

11 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY SIZE

11.1 OVERVIEW

11.2 BELOW 1”

11.3 1” TO 6”

11.4 6” TO 12”

11.5 12” TO 24”

11.6 24” TO 48”

11.7 ABOVE 48 ”

12 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 OIL AND GAS

12.2.1 GATE VALVE

12.2.1.1. STANDARD PLATE GATE VALVES

12.2.1.2. WEDGE GATE VALVES

12.2.1.3. KNIFE GATE VALVES

12.2.2 DIAPHRAGM (SAUNDERS) VALVES

12.2.2.1. WEIR TYPE

12.2.2.2. STRAIGHT THROUGH TYPE

12.2.3 GLOBE VALVE

12.2.4 CHECK VALVE

12.2.4.1. SWING CHECK VALVES

12.2.4.2. PISTON CHECK VALVES

12.2.4.3. BALL CHECK VALVES

12.2.4.4. TITLTING DISC CHECK VALVES

12.2.5 PLUG VALVE

12.2.6 BALL VALVE

12.2.7 BUTTERFLY VALVE

12.2.7.1. LINED TYPE

12.2.7.2. DOUBLE OFFSET

12.2.7.3. TRIPLE OFFSET

12.2.7.4. NEEDLE VALVE

12.2.7.5. PINCH VALVE

12.2.7.6. PRESSURE RELIEF VALVE

12.2.7.7. OTHERS

12.3 INDUSTRIAL ACTUATOR

12.3.1 BY TYPE

12.3.1.1. LINEAR

12.3.1.2. ROTARY

12.3.2 BY TECHNOLOGY

12.3.2.1. MECHANICAL

12.3.2.2. ELECTRIC

12.3.2.3. PNEUMATIC

12.3.2.4. HYDRAULLIC

12.4 CHEMICALS

12.4.1 GATE VALVE

12.4.1.1. STANDARD PLATE GATE VALVES

12.4.1.2. WEDGE GATE VALVES

12.4.1.3. KNIFE GATE VALVES

12.4.2 DIAPHRAGM (SAUNDERS) VALVES

12.4.2.1. WEIR TYPE

12.4.2.2. STRAIGHT THROUGH TYPE

12.4.3 GLOBE VALVE

12.4.4 CHECK VALVE

12.4.4.1. SWING CHECK VALVES

12.4.4.2. PISTON CHECK VALVES

12.4.4.3. BALL CHECK VALVES

12.4.4.4. TITLTING DISC CHECK VALVES

12.4.5 PLUG VALVE

12.4.6 BALL VALVE

12.4.7 BUTTERFLY VALVE

12.4.7.1. LINED TYPE

12.4.7.2. DOUBLE OFFSET

12.4.7.3. TRIPLE OFFSET

12.4.7.4. NEEDLE VALVE

12.4.7.5. PINCH VALVE

12.4.7.6. PRESSURE RELIEF VALVE

12.4.7.7. OTHERS

12.5 INDUSTRIAL ACTUATOR

12.5.1 BY TYPE

12.5.1.1. LINEAR

12.5.1.2. ROTARY

12.5.2 BY TECHNOLOGY

12.5.2.1. MECHANICAL

12.5.2.2. ELECTRIC

12.5.2.3. PNEUMATIC

12.5.2.4. HYDRAULLIC

12.6 FOOD & BEVERAGES

12.6.1 GATE VALVE

12.6.1.1. STANDARD PLATE GATE VALVES

12.6.1.2. WEDGE GATE VALVES

12.6.1.3. KNIFE GATE VALVES

12.6.2 DIAPHRAGM (SAUNDERS) VALVES

12.6.2.1. WEIR TYPE

12.6.2.2. STRAIGHT THROUGH TYPE

12.6.3 GLOBE VALVE

12.6.4 CHECK VALVE

12.6.4.1. SWING CHECK VALVES

12.6.4.2. PISTON CHECK VALVES

12.6.4.3. BALL CHECK VALVES

12.6.4.4. TITLTING DISC CHECK VALVES

12.6.5 PLUG VALVE

12.6.6 BALL VALVE

12.6.7 BUTTERFLY VALVE

12.6.7.1. LINED TYPE

12.6.7.2. DOUBLE OFFSET

12.6.7.3. TRIPLE OFFSET

12.6.7.4. NEEDLE VALVE

12.6.7.5. PINCH VALVE

12.6.7.6. PRESSURE RELIEF VALVE

12.6.7.7. OTHERS

12.7 INDUSTRIAL ACTUATOR

12.7.1 BY TYPE

12.7.1.1. LINEAR

12.7.1.2. ROTARY

12.7.2 BY TECHNOLOGY

12.7.2.1. MECHANICAL

12.7.2.2. ELECTRIC

12.7.2.3. PNEUMATIC

12.7.2.4. HYDRAULLIC

12.8 PHARMACEUTICALS

12.8.1 GATE VALVE

12.8.1.1. STANDARD PLATE GATE VALVES

12.8.1.2. WEDGE GATE VALVES

12.8.1.3. KNIFE GATE VALVES

12.8.2 DIAPHRAGM (SAUNDERS) VALVES

12.8.2.1. WEIR TYPE

12.8.2.2. STRAIGHT THROUGH TYPE

12.8.3 GLOBE VALVE

12.8.4 CHECK VALVE

12.8.4.1. SWING CHECK VALVES

12.8.4.2. PISTON CHECK VALVES

12.8.4.3. BALL CHECK VALVES

12.8.4.4. TITLTING DISC CHECK VALVES

12.8.5 PLUG VALVE

12.8.6 BALL VALVE

12.8.7 BUTTERFLY VALVE

12.8.7.1. LINED TYPE

12.8.7.2. DOUBLE OFFSET

12.8.7.3. TRIPLE OFFSET

12.8.7.4. NEEDLE VALVE

12.8.7.5. PINCH VALVE

12.8.7.6. PRESSURE RELIEF VALVE

12.8.7.7. OTHERS

12.9 INDUSTRIAL ACTUATOR

12.9.1 BY TYPE

12.9.1.1. LINEAR

12.9.1.2. ROTARY

12.9.2 BY TECHNOLOGY

12.9.2.1. MECHANICAL

12.9.2.2. ELECTRIC

12.9.2.3. PNEUMATIC

12.9.2.4. HYDRAULLIC

12.1 WIND INDUSTRY

12.10.1 GATE VALVE

12.10.1.1. STANDARD PLATE GATE VALVES

12.10.1.2. WEDGE GATE VALVES

12.10.1.3. KNIFE GATE VALVES

12.10.2 DIAPHRAGM (SAUNDERS) VALVES

12.10.2.1. WEIR TYPE

12.10.2.2. STRAIGHT THROUGH TYPE

12.10.3 GLOBE VALVE

12.10.4 CHECK VALVE

12.10.4.1. SWING CHECK VALVES

12.10.4.2. PISTON CHECK VALVES

12.10.4.3. BALL CHECK VALVES

12.10.4.4. TITLTING DISC CHECK VALVES

12.10.5 PLUG VALVE

12.10.6 BALL VALVE

12.10.7 BUTTERFLY VALVE

12.10.7.1. LINED TYPE

12.10.7.2. DOUBLE OFFSET

12.10.7.3. TRIPLE OFFSET

12.10.7.4. NEEDLE VALVE

12.10.7.5. PINCH VALVE

12.10.7.6. PRESSURE RELIEF VALVE

12.10.7.7. OTHERS

12.11 INDUSTRIAL ACTUATOR

12.11.1.1. BY TYPE

12.11.1.2. LINEAR

12.11.1.3. ROTARY

12.11.2 BY TECHNOLOGY

12.11.2.1. MECHANICAL

12.11.2.2. ELECTRIC

12.11.2.3. PNEUMATIC

12.11.2.4. HYDRAULLIC

12.12 MARINE

12.12.1 GATE VALVE

12.12.1.1. STANDARD PLATE GATE VALVES

12.12.1.2. WEDGE GATE VALVES

12.12.1.3. KNIFE GATE VALVES

12.12.2 DIAPHRAGM (SAUNDERS) VALVES

12.12.2.1. WEIR TYPE

12.12.2.2. STRAIGHT THROUGH TYPE

12.12.3 GLOBE VALVE

12.12.4 CHECK VALVE

12.12.4.1. SWING CHECK VALVES

12.12.4.2. PISTON CHECK VALVES

12.12.4.3. BALL CHECK VALVES

12.12.4.4. TITLTING DISC CHECK VALVES

12.12.5 PLUG VALVE

12.12.6 BALL VALVE

12.12.7 BUTTERFLY VALVE

12.12.7.1. LINED TYPE

12.12.7.2. DOUBLE OFFSET

12.12.7.3. TRIPLE OFFSET

12.12.7.4. NEEDLE VALVE

12.12.7.5. PINCH VALVE

12.12.7.6. PRESSURE RELIEF VALVE

12.12.7.7. OTHERS

12.13 INDUSTRIAL ACTUATOR

12.13.1.1. BY TYPE

12.13.1.2. LINEAR

12.13.1.3. ROTARY

12.13.2 BY TECHNOLOGY

12.13.2.1. MECHANICAL

12.13.2.2. ELECTRIC

12.13.2.3. PNEUMATIC

12.13.2.4. HYDRAULLIC

12.14 AUTOMOTIVE

12.14.1 GATE VALVE

12.14.1.1. STANDARD PLATE GATE VALVES

12.14.1.2. WEDGE GATE VALVES

12.14.1.3. KNIFE GATE VALVES

12.14.2 DIAPHRAGM (SAUNDERS) VALVES

12.14.2.1. WEIR TYPE

12.14.2.2. STRAIGHT THROUGH TYPE

12.14.3 GLOBE VALVE

12.14.4 CHECK VALVE

12.14.4.1. SWING CHECK VALVES

12.14.4.2. PISTON CHECK VALVES

12.14.4.3. BALL CHECK VALVES

12.14.4.4. TITLTING DISC CHECK VALVES

12.14.5 PLUG VALVE

12.14.6 BALL VALVE

12.14.7 BUTTERFLY VALVE

12.14.7.1. LINED TYPE

12.14.7.2. DOUBLE OFFSET

12.14.7.3. TRIPLE OFFSET

12.14.7.4. NEEDLE VALVE

12.14.7.5. PINCH VALVE

12.14.7.6. PRESSURE RELIEF VALVE

12.14.7.7. OTHERS

12.15 INDUSTRIAL ACTUATOR

12.15.1.1. BY TYPE

12.15.1.2. LINEAR

12.15.1.3. ROTARY

12.15.2 BY TECHNOLOGY

12.15.2.1. MECHANICAL

12.15.2.2. ELECTRIC

12.15.2.3. PNEUMATIC

12.15.2.4. HYDRAULLIC

12.16 STEEL INDUSTRY

12.16.1 GATE VALVE

12.16.1.1. STANDARD PLATE GATE VALVES

12.16.1.2. WEDGE GATE VALVES

12.16.1.3. KNIFE GATE VALVES

12.16.2 DIAPHRAGM (SAUNDERS) VALVES

12.16.2.1. WEIR TYPE

12.16.2.2. STRAIGHT THROUGH TYPE

12.16.3 GLOBE VALVE

12.16.4 CHECK VALVE

12.16.4.1. SWING CHECK VALVES

12.16.4.2. PISTON CHECK VALVES

12.16.4.3. BALL CHECK VALVES

12.16.4.4. TITLTING DISC CHECK VALVES

12.16.5 PLUG VALVE

12.16.6 BALL VALVE

12.16.7 BUTTERFLY VALVE

12.16.7.1. LINED TYPE

12.16.7.2. DOUBLE OFFSET

12.16.7.3. TRIPLE OFFSET

12.16.7.4. NEEDLE VALVE

12.16.7.5. PINCH VALVE

12.16.7.6. PRESSURE RELIEF VALVE

12.16.7.7. OTHERS

12.17 INDUSTRIAL ACTUATOR

12.17.1.1. BY TYPE

12.17.1.2. LINEAR

12.17.1.3. ROTARY

12.17.2 BY TECHNOLOGY

12.17.2.1. MECHANICAL

12.17.2.2. ELECTRIC

12.17.2.3. PNEUMATIC

12.17.2.4. HYDRAULLIC

12.18 POWER PLANTS

12.18.1 GATE VALVE

12.18.1.1. STANDARD PLATE GATE VALVES

12.18.1.2. WEDGE GATE VALVES

12.18.1.3. KNIFE GATE VALVES

12.18.2 DIAPHRAGM (SAUNDERS) VALVES

12.18.2.1. WEIR TYPE

12.18.2.2. STRAIGHT THROUGH TYPE

12.18.3 GLOBE VALVE

12.18.4 CHECK VALVE

12.18.4.1. SWING CHECK VALVES

12.18.4.2. PISTON CHECK VALVES

12.18.4.3. BALL CHECK VALVES

12.18.4.4. TITLTING DISC CHECK VALVES

12.18.5 PLUG VALVE

12.18.6 BALL VALVE

12.18.7 BUTTERFLY VALVE

12.18.7.1. LINED TYPE

12.18.7.2. DOUBLE OFFSET

12.18.7.3. TRIPLE OFFSET

12.18.7.4. NEEDLE VALVE

12.18.7.5. PINCH VALVE

12.18.7.6. PRESSURE RELIEF VALVE

12.18.7.7. OTHERS

12.19 INDUSTRIAL ACTUATOR

12.19.1.1. BY TYPE

12.19.1.2. LINEAR

12.19.1.3. ROTARY

12.19.2 BY TECHNOLOGY

12.19.2.1. MECHANICAL

12.19.2.2. ELECTRIC

12.19.2.3. PNEUMATIC

12.19.2.4. HYDRAULLIC

12.2 MINING

12.20.1 GATE VALVE

12.20.1.1. STANDARD PLATE GATE VALVES

12.20.1.2. WEDGE GATE VALVES

12.20.1.3. KNIFE GATE VALVES

12.20.2 DIAPHRAGM (SAUNDERS) VALVES

12.20.2.1. WEIR TYPE

12.20.2.2. STRAIGHT THROUGH TYPE

12.20.3 GLOBE VALVE

12.20.4 CHECK VALVE

12.20.4.1. SWING CHECK VALVES

12.20.4.2. PISTON CHECK VALVES

12.20.4.3. BALL CHECK VALVES

12.20.4.4. TITLTING DISC CHECK VALVES

12.20.5 PLUG VALVE

12.20.6 BALL VALVE

12.20.7 BUTTERFLY VALVE

12.20.7.1. LINED TYPE

12.20.7.2. DOUBLE OFFSET

12.20.7.3. TRIPLE OFFSET

12.20.7.4. NEEDLE VALVE

12.20.7.5. PINCH VALVE

12.20.7.6. PRESSURE RELIEF VALVE

12.20.7.7. OTHERS

12.21 INDUSTRIAL ACTUATOR

12.21.1 BY TYPE

12.21.1.1. LINEAR

12.21.1.2. ROTARY

12.21.2 BY TECHNOLOGY

12.21.2.1. MECHANICAL

12.21.2.2. ELECTRIC

12.21.2.3. PNEUMATIC

12.21.2.4. HYDRAULLIC

12.22 PAPER INDUSTRY

12.22.1 GATE VALVE

12.22.1.1. STANDARD PLATE GATE VALVES

12.22.1.2. WEDGE GATE VALVES

12.22.1.3. KNIFE GATE VALVES

12.22.2 DIAPHRAGM (SAUNDERS) VALVES

12.22.2.1. WEIR TYPE

12.22.2.2. STRAIGHT THROUGH TYPE

12.22.3 GLOBE VALVE

12.22.4 CHECK VALVE

12.22.4.1. SWING CHECK VALVES

12.22.4.2. PISTON CHECK VALVES

12.22.4.3. BALL CHECK VALVES

12.22.4.4. TITLTING DISC CHECK VALVES

12.22.5 PLUG VALVE

12.22.6 BALL VALVE

12.22.7 BUTTERFLY VALVE

12.22.7.1. LINED TYPE

12.22.7.2. DOUBLE OFFSET

12.22.7.3. TRIPLE OFFSET

12.22.7.4. NEEDLE VALVE

12.22.7.5. PINCH VALVE

12.22.7.6. PRESSURE RELIEF VALVE

12.22.7.7. OTHERS

12.23 INDUSTRIAL ACTUATOR

12.23.1 BY TYPE

12.23.1.1. LINEAR

12.23.1.2. ROTARY

12.23.2 BY TECHNOLOGY

12.23.2.1. MECHANICAL

12.23.2.2. ELECTRIC

12.23.2.3. PNEUMATIC

12.23.2.4. HYDRAULLIC

12.24 AGRICULTURE

12.24.1 GATE VALVE

12.24.1.1. STANDARD PLATE GATE VALVES

12.24.1.2. WEDGE GATE VALVES

12.24.1.3. KNIFE GATE VALVES

12.24.2 DIAPHRAGM (SAUNDERS) VALVES

12.24.2.1. WEIR TYPE

12.24.2.2. STRAIGHT THROUGH TYPE

12.24.3 GLOBE VALVE

12.24.4 CHECK VALVE

12.24.4.1. SWING CHECK VALVES

12.24.4.2. PISTON CHECK VALVES

12.24.4.3. BALL CHECK VALVES

12.24.4.4. TITLTING DISC CHECK VALVES

12.24.5 PLUG VALVE

12.24.6 BALL VALVE

12.24.7 BUTTERFLY VALVE

12.24.7.1. LINED TYPE

12.24.7.2. DOUBLE OFFSET

12.24.7.3. TRIPLE OFFSET

12.24.7.4. NEEDLE VALVE

12.24.7.5. PINCH VALVE

12.24.7.6. PRESSURE RELIEF VALVE

12.24.7.7. OTHERS

12.25 INDUSTRIAL ACTUATOR

12.25.1.1. BY TYPE

12.25.1.2. LINEAR

12.25.1.3. ROTARY

12.25.2 BY TECHNOLOGY

12.25.2.1. MECHANICAL

12.25.2.2. ELECTRIC

12.25.2.3. PNEUMATIC

12.25.2.4. HYDRAULLIC

12.26 WATER & WASTEWATER TREATMENT

12.27 OTHERS

13 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: MIDDLE-EAST & AFRICA

13.2 MERGERS & ACQUISITIONS

13.3 NEW PRODUCT DEVELOPMENT & APPROVALS

13.4 EXPANSIONS

13.5 REGULATORY CHANGES

13.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

14 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, SWOT & DBMR ANALYSIS

15 MIDDLE-EAST & AFRICA INDUSTRIAL VALVES MARKET, COMPANY PROFILE

15.1 MAYUR (VALVES) SYSTEM PRIVATE LIMITED

15.1.1 COMPANY OVERVIEW

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 GEOGRAPHIC PRESENCE

15.1.5 RECENT DEVELOPMENTS

15.2 INBAL SA

15.2.1 COMPANY OVERVIEW

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 GEOGRAPHIC PRESENCE

15.2.5 RECENT DEVELOPMENTS

15.3 AVK VALVES SOUTHERN AFRICA

15.3.1 COMPANY OVERVIEW

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 GEOGRAPHIC PRESENCE

15.3.5 RECENT DEVELOPMENTS

15.4 LVSA GROUP

15.4.1 COMPANY OVERVIEW

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 GEOGRAPHIC PRESENCE

15.4.5 RECENT DEVELOPMENTS

15.5 ITHUBA VALVES

15.5.1 COMPANY OVERVIEW

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 GEOGRAPHIC PRESENCE

15.5.5 RECENT DEVELOPMENTS

15.6 AVK VALVES

15.6.1 COMPANY OVERVIEW

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 GEOGRAPHIC PRESENCE

15.6.5 RECENT DEVELOPMENTS

15.7 RHINO VALVES

15.7.1 COMPANY OVERVIEW

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 GEOGRAPHIC PRESENCE

15.7.5 RECENT DEVELOPMENTS

15.8 VALCO GROUP

15.8.1 COMPANY OVERVIEW

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 GEOGRAPHIC PRESENCE

15.8.5 RECENT DEVELOPMENTS

15.9 PENTAIR LTD.

15.9.1 COMPANY OVERVIEW

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 GEOGRAPHIC PRESENCE

15.9.5 RECENT DEVELOPMENTS

15.1 RGT TECHNOLOGIES

15.10.1 COMPANY OVERVIEW

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 GEOGRAPHIC PRESENCE

15.10.5 RECENT DEVELOPMENTS

15.11 AVK VALVES SOUTHERN MIDDLE-EAST & AFRICA

15.11.1 COMPANY OVERVIEW

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 GEOGRAPHIC PRESENCE

15.11.5 RECENT DEVELOPMENTS

15.12 EMERSON ELECTRIC CO.

15.12.1 COMPANY OVERVIEW

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 GEOGRAPHIC PRESENCE

15.12.5 RECENT DEVELOPMENTS

15.13 THE WEIR GROUP PLC

15.13.1 COMPANY OVERVIEW

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 GEOGRAPHIC PRESENCE

15.13.5 RECENT DEVELOPMENTS

15.14 FLOWSERVE CORPORATION

15.14.1 COMPANY OVERVIEW

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 GEOGRAPHIC PRESENCE

15.14.5 RECENT DEVELOPMENTS

15.15 SCHLUMBERGER LIMITED.

15.15.1 COMPANY OVERVIEW

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 GEOGRAPHIC PRESENCE

15.15.5 RECENT DEVELOPMENTS

15.16 SPIRAX-SARCO ENGINEERING PLC

15.16.1 COMPANY OVERVIEW

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 GEOGRAPHIC PRESENCE

15.16.5 RECENT DEVELOPMENTS

15.17 IMI PLC

15.17.1 COMPANY OVERVIEW

15.17.2 REVENUE ANALYSIS

15.17.3 PRODUCT PORTFOLIO

15.17.4 GEOGRAPHIC PRESENCE

15.17.5 RECENT DEVELOPMENTS

15.18 CRANE CO.

15.18.1 COMPANY OVERVIEW

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 GEOGRAPHIC PRESENCE

15.18.5 RECENT DEVELOPMENTS

15.19 KITZ CORPORATION

15.19.1 COMPANY OVERVIEW

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 GEOGRAPHIC PRESENCE

15.19.5 RECENT DEVELOPMENTS

15.2 METSO CORPORATION

15.20.1 COMPANY OVERVIEW

15.20.2 REVENUE ANALYSIS

15.20.3 PRODUCT PORTFOLIO

15.20.4 GEOGRAPHIC PRESENCE

15.20.5 RECENT DEVELOPMENTS

15.21 NEWAY VALVE.

15.21.1 COMPANY OVERVIEW

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 GEOGRAPHIC PRESENCE

15.21.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

16 RELATED REPORTS

17 CONCLUSION

18 QUESTIONNAIRE

19 ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Industrial Valves Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Industrial Valves Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Industrial Valves Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.