Middle East And Africa Infection Surveillance Solution Systems Market

Market Size in USD Million

CAGR :

%

USD

500.50 Million

USD

1,257.03 Million

2025

2033

USD

500.50 Million

USD

1,257.03 Million

2025

2033

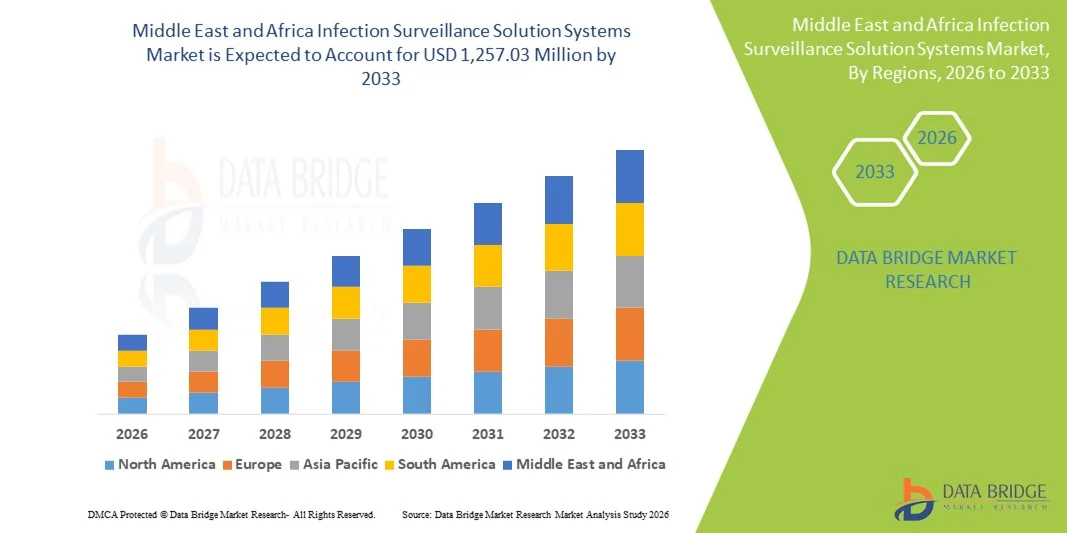

| 2026 –2033 | |

| USD 500.50 Million | |

| USD 1,257.03 Million | |

|

|

|

|

Middle East and Africa Infection Surveillance Solution Systems Market Size

- The Middle East and Africa infection surveillance solution systems market size was valued at USD 500.50 million in 2025 and is expected to reach USD 1,257.03 million by 2033, at a CAGR of 12.20% during the forecast period

- The market growth is largely fueled by rising healthcare-associated infection (HAI) rates, increased digitization of hospital workflows, and expanding implementation of real-time surveillance tools across public and private healthcare facilities

- Furthermore, the growing demand for automated, accurate, and integrated infection monitoring platforms is establishing surveillance systems as a critical component of modern healthcare infrastructure. These converging factors are accelerating the adoption of infection surveillance solutions across the region, thereby significantly boosting market growth

Middle East and Africa Infection Surveillance Solution Systems Market Analysis

- Infection surveillance solution systems, designed to digitally track, analyze, and manage healthcare-associated infections (HAIs), are becoming essential components of modern infection-control frameworks across Middle East and Africa as hospitals prioritize automated reporting, real-time monitoring, and improved patient-safety outcomes

- The rising adoption of infection-surveillance platforms is driven by increasing HAI incidence, national digital-health initiatives, and growing demand for accurate, automated infection-tracking capabilities across public, private, and specialty healthcare institutions

- Saudi Arabia dominated the Middle East and Africa market with a market share of 32.4% in 2025, supported by advanced healthcare infrastructure, strong national infection-control mandates, and accelerated digital-transformation initiatives under Vision 2030, resulting in higher deployment of automated surveillance solutions across major hospital network

- South Africa is expected to be the fastest-growing country in 2025, driven by increasing investments in hospital modernization, expansion of infection-prevention programs, and rising adoption of cloud-based surveillance platforms across public and private healthcare systems

- The software segment dominated with the largest market share of 58.6% in 2025, fueled by rising demand for interoperable, cloud-enabled analytics platforms capable of integrating with electronic medical records and automated HAI detection workflows, enabling scalable and cost-efficient infection-control operations across the region

Report Scope and Middle East and Africa Infection Surveillance Solution Systems Market Segmentation

|

Attributes |

Middle East and Africa Infection Surveillance Solution Systems Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Infection Surveillance Solution Systems Market Trends

AI-Driven Automation and Advanced Analytics Integration

- A significant and accelerating trend in the Middle East and Africa infection surveillance solution systems market is the increasing integration of AI-driven analytics and intelligent automation into infection-control platforms, enabling hospitals to monitor HAIs more accurately and efficiently while enhancing clinical decision-making and patient-safety outcomes

- For instance, AI-enabled surveillance modules deployed in major hospitals in Saudi Arabia and the UAE can automatically analyze patient data, detect abnormal infection patterns, and generate real-time alerts to infection-control teams, helping reduce manual reporting errors and improving response times

- AI integration in infection surveillance systems enables capabilities such as predictive outbreak modeling, automated anomaly detection, and intelligent alert prioritization. For instance, platforms such as Baxter’s SurvellinX and VigiLanz deploy AI algorithms to refine alert accuracy and continuously learn from hospital data, helping infection-control teams focus on high-risk events and streamline HAI-related interventions

- The seamless integration of infection surveillance platforms with broader hospital information systems, electronic medical records, and laboratory information systems enables centralized monitoring of patient infections, antimicrobial usage, and hospital workflow efficiency, creating a connected infection-control ecosystem across facilities

- This trend towards more intelligent, automated, and interconnected surveillance technologies is reshaping expectations for infection-control standards in hospitals across MEA. Consequently, companies such as Wolters Kluwer and Premier, Inc. are developing AI-enabled modules capable of automated reporting, predictive alerts, and advanced clinical analytics tailored to improving infection-control outcomes

- The demand for AI-enhanced and interoperable infection surveillance systems is rapidly increasing across both public and private hospitals, as healthcare providers prioritize timely HAI detection, improved regulatory compliance, and stronger infection-prevention capabilities

Middle East and Africa Infection Surveillance Solution Systems Market Dynamics

Driver

Increasing Healthcare-Associated Infections (HAIs) and Digital Transformation in Hospitals

- The rising burden of healthcare-associated infections across Middle East and Africa, combined with accelerating adoption of digital-health technologies in hospitals, is a major driver for the growing need for automated infection surveillance systems

- For instance, in March 2025, large multi-specialty hospitals in Saudi Arabia and South Africa initiated digital transformation programs integrating AI-based infection-monitoring tools into national quality-improvement frameworks, signaling strong institutional demand for automated surveillance

- As HAIs continue to pose serious safety risks, hospitals are adopting systems offering capabilities such as real-time monitoring, antimicrobial-use tracking, and automated HAI alerts, allowing infection-control teams to react promptly and reduce infection-related morbidity

- Furthermore, the expansion of electronic health records, laboratory automation, and hospital information-system integration is making infection-surveillance platforms essential for improving regulatory compliance, strengthening infection-prevention practices, and enhancing overall patient outcomes

- The ability to automate HAI detection, streamline reporting workflows, and reduce manual surveillance efforts is a key factor accelerating the adoption of infection-surveillance systems in both large public hospitals and emerging private healthcare networks across MEA

- The rising emphasis on digital infrastructure upgrades, coupled with national health-quality mandates and supportive government initiatives, is further propelling the implementation of advanced surveillance solutions across the region

Restraint/Challenge

Data Integration Limitations and Compliance Challenges in Healthcare Systems

- Challenges related to inconsistent healthcare IT infrastructure, limited interoperability, and data-management complexities across hospitals in MEA pose significant barriers to widespread adoption of infection-surveillance systems

- For instance, several hospitals in Africa continue to face issues such as fragmented electronic medical record systems and incomplete digitization, making integration with advanced surveillance platforms difficult and slowing market penetration

- Addressing these infrastructural constraints through improved interoperability standards, upgraded hospital IT systems, and stronger data-governance frameworks is critical for enabling seamless surveillance workflows. Companies such as Wolters Kluwer and Cerner emphasize secure integration layers and compliant data-management protocols to support hospital adoption

- In addition, the high upfront cost of advanced surveillance software, coupled with the need for skilled personnel to manage and interpret data outputs, can be a barrier for resource-constrained hospitals, particularly in lower-income African regions where budget priorities remain focused on essential medical services

- While affordability is gradually improving, the perception of complex installation processes and ongoing maintenance requirements can hinder adoption in facilities with limited digital-health experience, reducing the pace of expansion in some markets

- Overcoming these challenges through capacity-building programs, improved funding support, and development of more cost-effective and simplified surveillance solutions will be essential for sustaining market growth across the MEA region

Middle East and Africa Infection Surveillance Solution Systems Market Scope

The market is segmented on the basis of products, infection type, and end user.

- By Products

On the basis of products, the market is segmented into software and services. The software segment dominated the market in 2025 with a market share of 58.6%, driven by the growing need for automated infection monitoring, real-time analytics, and seamless integration with hospital information systems. Hospitals across Saudi Arabia, UAE, and South Africa increasingly rely on advanced software platforms to detect trends, identify risks, and improve clinical decision-making. Cloud-based software solutions also provide scalability and remote accessibility, allowing infection control teams to monitor multiple units efficiently. The segment further benefits from regulatory pressures requiring digital reporting and standardized HAI documentation, reinforcing software as the foundation of infection surveillance modernization in MEA.

The services segment is expected to witness the fastest growth rate from 2026 to 2033, supported by rising demand for implementation support, system configuration, training, and maintenance across public and private hospitals. Many MEA healthcare facilities lack dedicated IT teams, making professional services essential for onboarding and optimizing surveillance systems. Cloud-based deployments further increase the need for managed services and continuous monitoring. Government-led digital transformation programs in Saudi Arabia, UAE, and South Africa are driving investments in long-term service support. As hospitals seek reliable system performance, tailored workflows, and regulatory compliance, service offerings become increasingly critical to successful surveillance adoption.

- By Infection Type

On the basis of infection type, the market is segmented into Surgical Site Infections (SSI), Blood Stream Infections (BSI), Urinary Tract Infections (UTI), Central Line-Associated Bloodstream Infections (CLABSI), Catheter-Associated Urinary Tract Infection (CAUTI), and Others. The Surgical Site Infections (SSI) segment dominated the market in 2025, owing to the high prevalence of post-operative infections and the heavy burden they place on hospitals across MEA. Facilities in Saudi Arabia, UAE, and South Africa with high surgical volumes prioritize SSI-focused surveillance tools to improve surgical outcomes and comply with evolving safety standards. SSI surveillance platforms integrate data from operating rooms, labs, and wards, allowing real-time alerts and efficient reporting. Increased surgical procedures and a strong regulatory emphasis on surgical safety continue to drive adoption of SSI monitoring tools across the region.

The Central Line-Associated Bloodstream Infections (CLABSI) segment is projected to grow at the fastest rate from 2026 to 2033, driven by increased use of invasive central-line procedures and the rising need for precise ICU infection monitoring. Hospitals are adopting automated CLABSI surveillance systems that integrate with EMRs to capture catheter days, analyze risk indicators, and support rapid intervention. National quality programs in MEA countries further reinforce the importance of CLABSI monitoring. The expansion of intensive care units and higher ICU admissions, combined with the need to reduce morbidity and mortality, make CLABSI surveillance a rapidly accelerating growth area.

- By End User

On the basis of end user, the market is segmented into hospitals, long-term care facilities, clinics, ambulatory surgical centres, academic institutes, and others. The hospitals segment dominated the market in 2025, due to their large patient volumes, complex care environments, and greater exposure to HAIs. Hospitals across Saudi Arabia, UAE, and South Africa rely heavily on infection surveillance solutions to manage multi-departmental risks, monitor ICU infections, and comply with regulatory reporting requirements. Their advanced digital infrastructure and ongoing investments in health IT drive strong adoption of automated surveillance platforms. The need for integrated data across labs, EMRs, and pharmacy systems further supports the leading role of hospitals in this segment.

The ambulatory surgical centres (ASC) segment is expected to witness the fastest growth from 2026 to 2033, propelled by the region’s shift toward outpatient procedures and increasing emphasis on surgical safety. ASCs are adopting infection surveillance solutions to monitor post-procedure infections, comply with accreditation standards, and support safe, high-volume day-care surgeries. Cloud-based, cost-efficient surveillance tools are particularly well-suited to ASC workflows, enabling rapid deployments and easy integration. Rising investments in outpatient care facilities in Saudi Arabia and UAE further accelerate this segment’s growth trajectory.

Middle East and Africa Infection Surveillance Solution Systems Market Regional Analysis

- Saudi Arabia dominated the Middle East and Africa market with a market share of 32.4% in 2025, supported by advanced healthcare infrastructure, strong national infection-control mandates, and accelerated digital-transformation initiatives under Vision 2030, resulting in higher deployment of automated surveillance solutions across major hospital network

- Hospitals in Saudi Arabia prioritize infection surveillance solutions for their ability to streamline automated reporting, provide real-time infection-trend insights, and ensure compliance with the country’s increasingly stringent healthcare quality and infection-control regulations

- This widespread adoption is further supported by high healthcare expenditure, large tertiary care hospital networks, and national programs aimed at reducing hospital-acquired infections, positioning Saudi Arabia as the leading hub for infection surveillance technology deployment in MEA

The Saudi Arabia Infection Surveillance Solution Systems Market Insight

Saudi Arabia captured the largest revenue share in the MEA market in 2025, driven by robust investment in digital health infrastructure and national initiatives focused on minimizing hospital-acquired infections. The country’s leading hospitals are rapidly deploying automated infection surveillance platforms to support clinical decision-making, streamline reporting, and meet strict regulatory requirements set by health authorities. The expansion of advanced tertiary care facilities, combined with Saudi Arabia’s Vision 2030 digital transformation agenda, is significantly accelerating adoption. In addition, the increasing integration of infection-monitoring systems with hospital information systems and centralized health databases positions Saudi Arabia as the dominant force in the region’s surveillance technology landscape.

United Arab Emirates (UAE) Infection Surveillance Solution Systems Market Insight

The UAE infection surveillance solution systems market is projected to expand at a substantial CAGR throughout the forecast period, supported by the country’s highly modernized healthcare environment and strong emphasis on patient safety and infection-control protocols. Hospitals in the UAE are quick adopters of digital technologies, driving strong demand for automated surveillance tools capable of providing precise, real-time infection tracking. The growth is further bolstered by investments in smart hospital projects, rising medical tourism, and stringent accreditation requirements, which prioritize advanced IT-driven infection-prevention systems. As healthcare operators upgrade both inpatient and outpatient facilities, the UAE remains one of the region’s most technologically progressive adopters of surveillance solutions.

South Africa Infection Surveillance Solution Systems Market Insight

South Africa is anticipated to grow at a noteworthy CAGR during the forecast period, driven by heightened awareness of infection prevention and the increasing burden of HAIs across public and private healthcare facilities. Hospitals and clinics are rapidly transitioning toward digital surveillance tools to strengthen reporting accuracy and meet evolving compliance standards. The expansion of EHR systems, combined with national efforts to modernize healthcare IT infrastructure, is pushing adoption of integrated infection-monitoring platforms. In addition, the country’s need to manage infectious disease challenges across diverse healthcare settings is reinforcing the demand for scalable and automated infection-surveillance technologies.

Egypt Infection Surveillance Solution Systems Market Insight

The Egypt infection surveillance solution systems market is expected to expand at a considerable CAGR, fueled by growing investment in healthcare modernization and a rising focus on reducing infection-related morbidity. With expanding hospital networks and an increasing number of tertiary care institutions, Egypt is prioritizing the integration of digital infection-control tools to support clinical accuracy and operational efficiency. The country’s emphasis on improving healthcare quality indicators and its adoption of EHR platforms are enabling faster deployment of surveillance solutions. This trend, supported by both public-sector programs and private-sector hospital modernization, is strengthening Egypt’s position as an emerging growth market for infection surveillance technologies.

Middle East and Africa Infection Surveillance Solution Systems Market Share

The Middle East and Africa Infection Surveillance Solution Systems industry is primarily led by well-established companies, including:

- BD (U.S.)

- Premier Inc., (U.S.)

- Wolters Kluwer N.V. (Netherlands)

- Baxter (U.S.)

- Cerner Corporation (U.S.)

- GOJO Industries, Inc., (U.S.)

- RLDatix (U.K.)

- Vecna Technologies, Inc., (U.S.)

- VigiLanz Corporation, (U.S.)

- BIOMÉRIEUX (France)

- Clinisys Group Ltd (U.K.)

- Deb Group Ltd (U.K.)

- Merative, (U.S.)

- PeraHealth Inc. (U.S.)

- CenTrak, Inc. (U.S.)

- Ecolab Inc. (U.S.)

- Medexter Healthcare GmbH (Austria)

- STANLEY Healthcare Solutions (U.S.)

- Vitalacy Inc. (U.S.)

- VIZZIA Technologies LLC (U.S.)

What are the Recent Developments in Middle East and Africa Infection Surveillance Solution Systems Market?

- In November 2025, the World Health Organization Regional Office for the Eastern Mediterranean (WHO/EMRO) convened a high‑level “Integrated Disease Surveillance (IDS) Partners’ Meeting” in Cairo bringing together technical experts and international partners to advance coordination and rollout of interoperable disease‑surveillance systems across the region

- In April 2025, the Saudi Medical Journal published a comprehensive review evaluating the role of artificial intelligence in infection control and surveillance. The review highlighted how machine-learning models, automated detection systems, and predictive risk scoring can assist hospitals in identifying infection outbreaks earlier and optimizing intervention workflows. The findings signal growing clinical and academic support in the Middle East for AI-integrated infection-surveillance solutions

- In January 2025, Emirates Health Services (EHS) unveiled five new smart healthcare solutions at Arab Health 2025, aimed at improving hospital operational efficiency and strengthening clinical decision-making across UAE facilities. These solutions integrate AI-enabled analytics, automated monitoring dashboards, and real-time performance tracking, supporting faster identification of potential infection risks

- In December 2024, Saudi Arabia reported a 48.8% reduction in CLABSI (central line-associated bloodstream infections) in its ICUs between 2021 and 2024, according to an analysis published by the Saudi Gazette. This improvement stems from nationwide infection-control initiatives launched by the Ministry of Health, including data-driven surveillance programs, standardized reporting systems, and strengthened hospital compliance protocols

- In September 2023, Emirates Health Services (EHS) signed a strategic MoU with Care.AI to implement a generative-AI-powered intelligent patient room solution across multiple UAE healthcare facilities. The system uses continuous environmental and patient-behavior monitoring to alert clinicians in real time, helping to reduce hospital-acquired infection risks, support staff workflows, and enhance emergency and ICU surveillance

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.