Middle East And Africa Liposuction Devices Market

Market Size in USD Million

CAGR :

%

USD

261.62 Million

USD

473.59 Million

2024

2032

USD

261.62 Million

USD

473.59 Million

2024

2032

| 2025 –2032 | |

| USD 261.62 Million | |

| USD 473.59 Million | |

|

|

|

|

Middle East and Africa Liposuction Devices Market Size

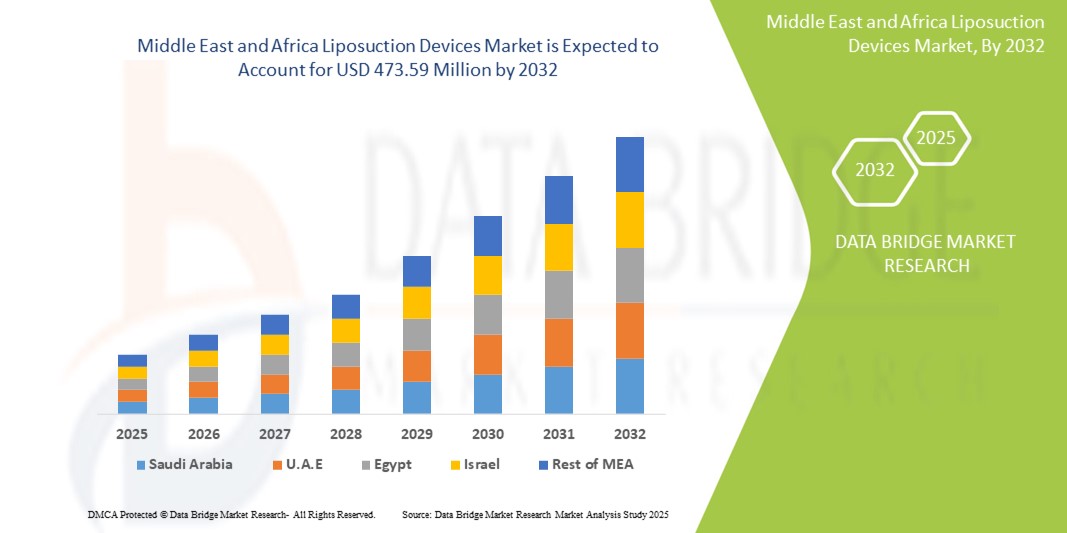

- The Middle East and Africa liposuction devices market size was valued at USD 261.62 million in 2024 and is expected to reach USD 473.59 million by 2032, at a CAGR of 7.70% during the forecast period

- The market growth is primarily driven by the increasing demand for body contouring procedures, rising aesthetic consciousness among consumers, and a growing presence of specialized cosmetic surgery clinics across the region

- In addition, advancements in minimally invasive liposuction technologies and rising disposable incomes in key countries such as the UAE and Saudi Arabia are contributing to greater adoption. These factors collectively support the expansion of the liposuction devices market across Middle Eastern and African nations

Middle East and Africa Liposuction Devices Market Analysis

- Liposuction devices, used in aesthetic procedures to remove excess body fat, are gaining traction across the Middle East and Africa due to rising interest in cosmetic enhancements and growing awareness of body contouring solutions among both male and female populations

- The surging demand in the region is primarily fueled by increasing disposable incomes, expanding medical tourism, and a cultural shift toward accepting cosmetic surgery as a lifestyle improvement tool

- The UAE dominated the Middle East and Africa liposuction devices market in 2024 with the largest revenue share, supported by advanced healthcare infrastructure, higher patient affordability, and the presence of globally accredited cosmetic clinics offering innovative, minimally invasive procedures

- Saudi Arabia is expected to be the fastest-growing country during the forecast period due to increasing aesthetic awareness, government investments in healthcare diversification, and rising demand for cosmetic procedures among its younger population

- Instruments segment dominated the Middle East and Africa liposuction devices market with a market share of 62.5% in 2024, driven by its essential role in various liposuction techniques and the consistent demand for reusable surgical tools such as cannulas and aspirators across aesthetic clinics and hospitals

Report Scope and Middle East and Africa Liposuction Devices Market Segmentation

|

Attributes |

Middle East and Africa Liposuction Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Liposuction Devices Market Trends

“Technological Advancements Driving Demand for Minimally Invasive Procedures”

- A key and accelerating trend in the Middle East and Africa liposuction devices market is the growing adoption of minimally invasive and energy-assisted technologies such as laser-assisted, ultrasound-assisted, and radiofrequency-assisted liposuction. These innovations offer enhanced precision, reduced recovery time, and minimal scarring, significantly increasing patient satisfaction and clinic preference

- For instance, advanced liposuction systems such as SmartLipo and VASER Lipo are being rapidly integrated into aesthetic clinics in the UAE and Saudi Arabia, enabling targeted fat removal and simultaneous skin tightening. This has positioned these technologies as ideal solutions for time-conscious and appearance-focused patients

- Energy-based liposuction devices with intelligent thermal monitoring and enhanced cannula designs are enabling safer, more effective procedures, attracting both new and returning patients across urban medical centers

- Moreover, the rise of portable, compact liposuction systems is supporting the growth of outpatient treatments in specialty clinics and ambulatory surgical centers across cities such as Dubai, Riyadh, Cape Town, and Cairo

- This trend toward less invasive, tech-enabled fat removal is redefining consumer expectations for cosmetic procedures. In response, companies are launching advanced liposuction devices with smart energy control, real-time feedback, and improved ergonomics to meet the rising demand

- The increasing accessibility of these technologies, along with heightened aesthetic awareness, is expected to further accelerate the transition from traditional surgical methods to sophisticated, device-driven body contouring solutions in the coming years

Middle East and Africa Liposuction Devices Market Dynamics

Driver

“Growing Demand for Aesthetic Procedures and Expanding Medical Tourism”

- The increasing demand for cosmetic and body contouring procedures, driven by heightened aesthetic awareness and shifting beauty standards, is a major factor fueling the growth of the liposuction devices market in the Middle East and Africa

- For instance, the UAE and Saudi Arabia are leading the region with a surge in elective aesthetic treatments, supported by high disposable incomes, world-class medical infrastructure, and the influence of global fashion and social media trends

- Medical tourism is also expanding rapidly, especially in the UAE, where patients from Africa, Asia, and Europe seek affordable, high-quality cosmetic procedures in JCI-accredited facilities

- Increasing healthcare investments, favorable government policies promoting the private sector, and the entry of global cosmetic device manufacturers are further supporting the market’s expansion

- In addition, growing acceptance of aesthetic procedures among men and the rise of flexible payment and financing options are expanding the customer base and boosting demand for advanced liposuction technologies

Restraint/Challenge

“Limited Skilled Professionals and High Procedure Cost”

- A significant challenge in the Middle East and Africa liposuction devices market is the shortage of trained and certified aesthetic professionals, particularly in lower-income countries and rural areas

- While nations such as the UAE and South Africa have developed aesthetic sectors, several regions still face gaps in practitioner availability and procedural safety, which can limit the expansion of high-end liposuction services

- Moreover, the high cost associated with energy-assisted and minimally invasive liposuction procedures—especially those using advanced devices—acts as a barrier for middle-income and price-sensitive consumers across parts of Africa and less affluent regions of the Middle East

- As these procedures are typically not covered by insurance, out-of-pocket expenses remain high, limiting broader market access

- Though affordable device alternatives and installment-based procedure payments are emerging, the perception of liposuction as a luxury, non-essential service continues to constrain mass-market adoption in economically constrained areas

Middle East and Africa Liposuction Devices Market Scope

The market is segmented on the basis of product, type, gender, end user, and distribution channel.

- By Product

On the basis of product, the Middle East and Africa liposuction devices market is segmented into instruments and accessories. The instruments segment dominated the market with the largest revenue share of 62.5% in 2024, driven by the high usage frequency of reusable surgical tools such as cannulas, aspirators, and suction devices in nearly all types of liposuction procedures. These instruments are essential in ensuring procedural efficiency and safety, and their compatibility with various energy-assisted technologies makes them a preferred investment by clinics and hospitals.

The accessories segment is expected to witness the fastest growth from 2025 to 2032, supported by rising procedure volumes and the need for disposable or consumable items such as tubing, infiltration systems, and safety components that require regular replacement across different clinical settings.

- By Type

On the basis of type, the Middle East and Africa liposuction devices market is segmented into suction-assisted liposuction, power-assisted liposuction, water jet-assisted liposuction devices, twin cannula-assisted liposuction, radio frequency-assisted liposuction devices, laser-assisted liposuction devices, ultrasound-assisted liposuction devices, and others. The tumescent (suction-assisted) liposuction segment held the largest market share in 2024, owing to its established safety, affordability, and widespread use across both public and private healthcare facilities. The technique’s ability to reduce bleeding and improve fat removal precision contributes to its dominance.

The laser-assisted liposuction segment is anticipated to witness the fastest growth during the forecast period, driven by its dual benefits of fat removal and skin tightening, shorter recovery times, and growing preference among image-conscious patients in urban centers.

- By Gender

On the basis of gender, the Middle East and Africa liposuction devices market is bifurcated into male and female. The female segment dominated the market with a share of 78% in 2024, as women remain the primary demographic for aesthetic procedures related to body contouring, abdominal sculpting, and thigh reduction. Increased social acceptance and the influence of beauty trends further fuel demand in this segment.

The male segment s anticipated to witness the fastest growth during the forecast period, supported by rising awareness, greater focus on physical appearance, and increasing adoption of male-targeted cosmetic procedures such as gynecomastia correction and abdominal etching.

- By End User

On the basis of end user, the Middle East and Africa liposuction devices market is segmented into hospitals, specialty clinics, dermatology centers, ambulatory surgical centers, and others. Specialty clinics held the largest market share of 41% in 2024, driven by a growing number of private aesthetic centers that offer advanced liposuction technologies, personalized care, and flexible payment models. These clinics are particularly prominent in major cities such as Dubai, Riyadh, and Cape Town.

The ambulatory surgical centers segment is expected to experience the fastest growth during forecast period, due to the rising popularity of outpatient procedures that allow patients to return home the same day, supported by minimally invasive techniques and shorter recovery periods.

- By End User

On the basis of distribution channel, the Middle East and Africa liposuction devices market is segmented into direct tender, retail sales, and third-party distributors. The direct tender segment dominated the market with a revenue share of 47% in 2024, as hospitals and high-volume clinics prefer direct procurement from manufacturers for cost savings, product customization, and comprehensive after-sales support.

The third-party distributor segment is projected to witness fastest growth during forecast period, driven by its ability to reach smaller clinics and dermatology centers in emerging markets and rural areas across Africa, where direct manufacturer presence is limited.

Middle East and Africa Liposuction Devices Market Regional Analysis

- The UAE dominated the Middle East and Africa liposuction devices market with the largest revenue share in 2024, supported by a well-developed healthcare infrastructure, a strong presence of internationally accredited cosmetic clinics, and a growing influx of medical tourists seeking advanced, minimally invasive procedures

- Consumers across major urban centers such as Dubai, Riyadh, and Cape Town are increasingly opting for body contouring treatments due to lifestyle changes, higher aesthetic awareness, and accessibility to state-of-the-art technology

- The region’s market expansion is further fueled by government initiatives to strengthen the private healthcare sector and the entry of global aesthetic device manufacturers, creating favorable conditions for the adoption of innovative liposuction technologies across both public and private healthcare facilities

U.A.E Middle East and Africa Liposuction Devices Market Insight

The UAE liposuction devices market captured the largest revenue share in the Middle East in 2024, supported by its advanced healthcare infrastructure, strong medical tourism sector, and high-income population. The growing demand for minimally invasive aesthetic procedures, availability of cutting-edge technologies, and presence of internationally accredited cosmetic clinics are major contributors to market growth. Urban centers such as Dubai and Abu Dhabi lead in the adoption of advanced liposuction systems due to increasing lifestyle-related body concerns and a strong emphasis on appearance.

Saudi Arabia Middle East and Africa Liposuction Devices Market Insight

The Saudi Arabia liposuction devices market is anticipated to grow at a notable CAGR during the forecast period, driven by growing consumer interest in aesthetic procedures and an evolving beauty culture. Rising healthcare investments, government-backed initiatives to diversify the healthcare sector, and increasing adoption of energy-assisted liposuction methods are contributing to rapid market development. The youth demographic and rising social media influence are also shaping demand for cosmetic enhancements.

South Africa Middle East and Africa Liposuction Devices Market Insight

The South Africa Middle East and Africa liposuction devices market represents the largest market in Africa in 2024, fueled by a well-established private healthcare sector and a growing number of cosmetic surgery clinics. The rising popularity of body sculpting among both men and women, coupled with the availability of skilled practitioners, supports strong demand for advanced liposuction technologies. Increasing urbanization and cultural shifts toward body aesthetics are also boosting the market.

Middle East and Africa Liposuction Devices Market Share

The Middle East and Africa liposuction devices industry is primarily led by well-established companies, including:

- Dubai Cosmetic Surgery Clinic (UAE)

- American Academy of Cosmetic Surgery Hospital (UAE)

- Novomed Centers (UAE)

- CosmeSurge (UAE)

- Saudi German Hospital Group (Saudi Arabia)

- Riyadh Aesthetic Hospital (Saudi Arabia)

- Derma Clinic (Saudi Arabia)

- Dr. Sulaiman Al Habib Medical Group (Saudi Arabia)

- Life Healthcare Group (South Africa)

- Netcare LTD. (South Africa)

- Mediclinic Southern Africa (South Africa)

- Cape Aesthetics (South Africa)

- Cairo Aesthetic Center (Egypt)

- Dar Al Fouad Hospital (Egypt)

- As-Salam International Hospital (Egypt)

- Lagos Aesthetic Institute (Nigeria)

- Clinique Bensouda (Morocco)

- AlSalam Hospital (Kuwait)

What are the Recent Developments in Middle East and Africa Liposuction Devices Market?

- In April 2024, Dubai Cosmetic Surgery Clinic, one of the leading aesthetic service providers in the UAE, introduced a new line of laser-assisted liposuction procedures using advanced SmartLipo technology. This upgrade is part of the clinic’s commitment to offering minimally invasive, high-precision body contouring services with faster recovery times. The adoption of next-generation laser devices reflects the growing demand for aesthetic innovations among the region's high-income and image-conscious clientele

- In March 2024, Riyadh Aesthetic Hospital in Saudi Arabia partnered with a European medical device company to integrate ultrasound-assisted liposuction systems (UAL) into its body sculpting portfolio. The collaboration brings globally certified technology into the local market, enhancing the hospital’s capabilities in delivering efficient fat removal treatments with improved safety and cosmetic outcomes. This strategic move highlights Saudi Arabia's growing investment in modernizing its aesthetic healthcare sector

- In February 2024, Groote Schuur Hospital in South Africa launched a specialized training initiative for tumescent liposuction techniques in collaboration with the South African Society for Dermatologic Surgery (SASDS). The program aims to build clinical capacity and procedural expertise in energy-assisted liposuction among local practitioners, addressing the skill gap and supporting safer, more standardized aesthetic procedures across public and private sectors

- In January 2024, Cairo Aesthetic Center, a leading cosmetic clinic in Egypt, introduced radiofrequency-assisted liposuction (RFAL) services using the BodyTite platform. This launch caters to the increasing demand for skin-tightening and contouring procedures among Egypt’s urban population. The integration of RFAL technology signifies a shift toward multifunctional aesthetic solutions and highlights Egypt’s rising role in regional cosmetic tourism

- In December 2023, Lagos Aesthetic Institute in Nigeria announced its investment in power-assisted liposuction (PAL) devices aimed at offering affordable yet effective fat reduction options to Nigeria’s growing middle class. The move aligns with the institute’s mission to democratize access to modern aesthetic care, tapping into the rising demand among younger populations influenced by global beauty standards and social media trends.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.