Middle East And Africa Mobile C Arm Equipment Market

Market Size in USD Million

CAGR :

%

USD

26.14 Million

USD

36.06 Million

2024

2032

USD

26.14 Million

USD

36.06 Million

2024

2032

| 2025 –2032 | |

| USD 26.14 Million | |

| USD 36.06 Million | |

|

|

|

|

Middle East and Africa Mobile C-Arm Equipment Market Size

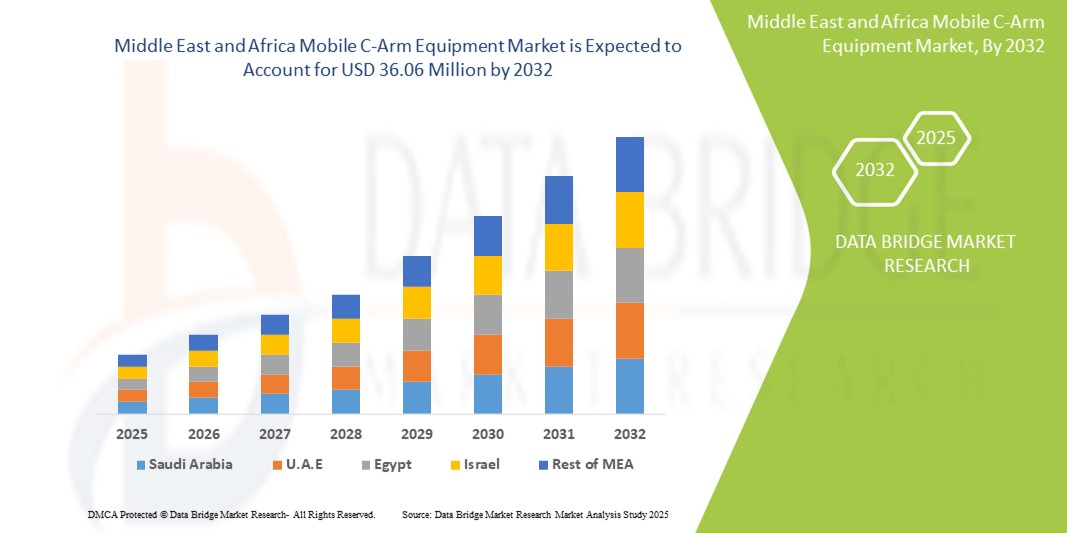

- The Middle East and Africa mobile C-Arm equipment market size was valued at USD 26.14 Million in 2024 and is expected to reach USD 36.06 Million by 2032, at a CAGR of 4.10% during the forecast period

- The market growth is largely fueled by the increasing prevalence of chronic diseases, rising surgical procedures, and growing adoption of minimally invasive surgeries across the Middle East and Africa region. These factors are driving the demand for real-time imaging solutions such as Mobile C-Arm Equipment in both public and private healthcare facilities

- Furthermore, government investments in healthcare infrastructure, the expansion of diagnostic imaging centers, and the need for advanced intraoperative imaging tools are establishing Mobile C-Arms as essential devices in surgical and orthopedic settings. These converging factors are accelerating the uptake of Mobile C-Arm Equipment across the region, thereby significantly boosting the industry's growth

Middle East and Africa Mobile C-Arm Equipment Market Analysis

- Mobile C-Arm systems, offering real-time X-ray imaging during surgeries and diagnostic procedures, are becoming increasingly vital components of modern healthcare infrastructure across both public and private hospitals in the Middle East and Africa. These devices are essential in orthopedic, cardiovascular, and trauma surgeries due to their flexibility, precision, and intraoperative imaging capabilities

- The escalating demand for mobile C-Arm equipment is primarily driven by the rising number of surgical procedures, the growing prevalence of chronic disorders, and increasing investments in medical imaging technologies by governments and private healthcare providers

- South Africa dominated the Middle East and Africa mobile C-Arm equipment market with a revenue share of 27.3% in 2024, owing to its robust network of public and private hospitals and increased investment in surgical imaging technologies. This growth is further bolstered by the rising burden of orthopedic and trauma cases in the country

- Saudi Arabia are expected to be the fastest-growing Middle East and Africa mobile C-Arm equipment market during the forecast period, with a projected CAGR of 7.9%, driven by government initiatives such as Vision 2030 and national health transformation programs that emphasize the adoption of modern diagnostic and surgical imaging tools

- The full-size C-Arms segment dominated the Middle East and Africa mobile C-Arm equipment market with a revenue share of 47.8% in 2024, driven by their broad application in orthopedic, cardiovascular, and gastrointestinal surgeries. Their ability to deliver high-resolution imaging and accommodate a wide range of procedures in advanced surgical environments makes them indispensable in large hospitals and specialty centers

Report Scope and Middle East and Africa Mobile C-Arm Equipment Market Segmentation

|

Attributes |

Middle East and Africa Mobile C-Arm Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Mobile C-Arm Equipment Market Trends

“Enhanced Diagnostic Efficiency Through AI Integration and Digital Advancements”

- A significant and accelerating trend in the Middle East and Africa mobile C-Arm equipment market is the increasing integration of artificial intelligence (AI) and advanced digital imaging technologies to enhance surgical precision, workflow efficiency, and diagnostic accuracy. This shift is transforming intraoperative imaging practices and driving demand for smart, connected C-arm systems

- For instance, newer mobile C-arm units from leading manufacturers now incorporate AI-powered image optimization, enabling real-time adjustments to contrast and clarity, which assists surgeons during complex procedures such as orthopedic and vascular surgeries

- AI integration in mobile C-arm systems supports features such as automated dose control, anomaly detection, and procedure-specific presets, allowing radiologists and surgeons to focus more on clinical decisions while minimizing radiation exposure and improving imaging outcomes

- Furthermore, the emergence of digital flat-panel detectors, 3D imaging capabilities, and remote access to imaging data is streamlining intraoperative workflows in both tertiary hospitals and outpatient surgery centers across the region. These digital enhancements also facilitate remote collaboration with specialists via teleradiology platforms

- This trend toward intelligent, software-enhanced imaging systems is reshaping the expectations of healthcare providers in the region, encouraging procurement of next-generation mobile C-arm equipment as part of broader operating room modernization efforts

- The demand for advanced mobile C-arm systems with AI-assisted imaging, data connectivity, and portable configurations is growing rapidly in both public and private healthcare sectors, especially in countries investing in surgical infrastructure such as the UAE, Saudi Arabia, South Africa, and Egypt

Middle East and Africa Mobile C-Arm Equipment Market Dynamics

Driver

“Growing Need Due to Rising Surgical Demand and Expanding Healthcare Infrastructure”

- The increasing burden of chronic diseases, orthopedic disorders, and traumatic injuries across the Middle East and Africa, coupled with a surge in surgical volumes, is a major driver for the rising demand for Mobile C-Arm Equipment. These devices enable real-time, high-resolution imaging, which is essential for intraoperative guidance during complex procedures

- For instance, in April 2024, the Ministry of Health in Saudi Arabia initiated a healthcare modernization project to equip public hospitals with advanced imaging and surgical tools, including mobile C-arms, to improve surgical outcomes. Such initiatives from regional governments are expected to significantly drive the Middle East and Africa Mobile C-Arm Equipment Market during the forecast period

- As hospitals and surgical centers across the region seek to improve patient outcomes and reduce intraoperative complications, mobile C-arms offer advanced capabilities such as digital imaging, fluoroscopy, and 3D visualization, making them an ideal upgrade over traditional fixed imaging systems

- Furthermore, the expansion of private healthcare facilities, growth in medical tourism, and the increasing availability of skilled professionals are making mobile C-arms a critical component of modern surgical infrastructure. Their flexibility and portability enhance workflow efficiency and reduce dependence on centralized radiology units

- The demand for compact, user-friendly, and high-resolution imaging systems in both urban and emerging healthcare settings is accelerating adoption across orthopedic, cardiovascular, and emergency surgery applications. Additionally, the availability of cost-effective mobile C-arm models tailored for low-resource environments is further contributing to market expansion

Restraint/Challenge

“High Initial Costs and Limited Technical Expertise”

- One of the key challenges hindering widespread adoption of mobile C-Arm equipment in the Middle East and Africa is the high initial investment cost, especially for advanced models with flat-panel detectors, 3D imaging, or AI-powered enhancements. Budget constraints in public hospitals and limited financial resources in lower-income nations restrict procurement

- Moreover, shortages of trained radiology technicians and surgical imaging specialists in parts of Africa pose a barrier to the effective utilization of these devices, leading to underuse even in facilities that have acquired them

- To address this, healthcare providers and manufacturers must invest in technical training programs, offer after-sales support, and implement cost-efficient leasing or financing models. Companies such as Siemens Healthineers and GE HealthCare are already engaging in public-private partnerships to train local personnel and provide scalable imaging solutions

- Overcoming these challenges through regional collaborations, increased funding, and development of entry-level C-arm models tailored for emerging markets will be critical to unlocking the full growth potential of the Middle East and Africa Mobile C-Arm Equipment Market

Middle East and Africa Mobile C-Arm Equipment Market Scope

The market is segmented on the basis of product, technology, application, end user, and distribution channel.

• By Product

On the basis of product, the Middle East and Africa mobile C-Arm equipment market is segmented into Mini C-Arms, Full Size C-Arms, 2D Mobile C-Arms, and 3D Mobile C-Arms. The Full Size C-Arms segment dominated the market with a revenue share of 47.8% in 2024, driven by their broad application in orthopedic, cardiovascular, and gastrointestinal surgeries.

The 3D Mobile C-Arms segment is projected to grow at the fastest CAGR of 8.6% from 2025 to 2032, due to increasing demand for intraoperative 3D imaging and precision in complex surgeries.

• By Technology

On the basis of technology, the Middle East and Africa mobile C-Arm equipment market is segmented into image intensifiers and flat panel detectors. The image intensifiers segment held the largest share of 56.4% in 2024, owing to their affordability and widespread use in general imaging across hospitals in developing regions.

The flat panel detectors segment is expected to witness the fastest CAGR of 9.2% during the forecast period, due to superior image quality, lower radiation doses, and rising adoption in high-end medical facilities.

• By Application

On the basis of application, the Middle East and Africa mobile C-Arm equipment market is segmented into orthopaedic, trauma, cardiovascular surgeries, pain management, urology, gastroenterology, neurology, and others. The orthopaedic segment accounted for the largest share of 34.1% in 2024, primarily driven by the growing number of orthopedic procedures such as fracture repair and joint replacements.

The cardiovascular Surgeries segment is anticipated to register the fastest CAGR of 8.9% between 2025 and 2032, supported by increasing interventional procedures and need for real-time guidance.

• By End User

On the basis of end user, the Middle East and Africa mobile C-Arm equipment market is segmented into hospitals, specialty clinics, and ambulatory surgical centers. The hospitals segment dominated with a revenue share of 62.3% in 2024, as hospitals are the primary purchasers of full-sized C-arm systems and offer a wide range of surgical specialties.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR of 7.8% during the forecast period, owing to a shift toward outpatient surgeries and minimally invasive procedures.

• By Distribution Channel

On the basis of distribution channel, the Middle East and Africa mobile C-Arm equipment market is segmented into direct tender and retail sales. The direct tender segment captured the largest share of 68.7% in 2024, mainly driven by bulk procurement by public hospitals and government institutions.

The retail sales segment is projected to expand at a CAGR of 6.9% during the forecast period, propelled by the growing presence of private diagnostic chains and specialized clinics procuring through third-party distributors.

Middle East and Africa Mobile C-Arm Equipment Market Regional Analysis

- Middle East and Africa accounted for 6.3% of the global Mobile C-Arm Equipment Market in 2024, driven by rising demand for minimally invasive surgeries and expanding access to diagnostic imaging technologies across developing healthcare systems

- The market growth is further supported by government-led healthcare modernization efforts, a growing burden of orthopedic and trauma-related conditions.

- The increasing need for intraoperative imaging across both public and private facilities

Saudi Arabia Mobile C-Arm Equipment Market Insight

The Saudi Arabia mobile C-Arm equipment market held the largest revenue share of 24.7% in the Middle East and Africa region in 2024. The country’s Vision 2030 initiative is aggressively driving investments in tertiary care hospitals and advanced surgical infrastructure, leading to growing adoption of mobile imaging equipment. This market is projected to grow at a CAGR of 7.9% from 2025 to 2032, fueled by rising orthopedic procedures and a strong push for medical device digitization.

U.A.E. Mobile C-Arm Equipment Market Insight

The U.A.E. mobile C-Arm equipment market accounted for 20.5% of the regional market share in 2024, driven by a well-developed healthcare infrastructure and a rising demand for outpatient surgical imaging. Increasing integration of C-arms in private surgical centers and the emergence of same-day surgery models are bolstering market expansion. The U.A.E. market is anticipated to grow at a CAGR of 7.5% during the forecast period, supported by demand for flat-panel detector technology and improved image quality.

South Africa Mobile C-Arm Equipment Market Insight

The South Africa mobile C-Arm equipment market captured 27.3% of the Middle East and Africa mobile C-Arm equipment market share in 2024. Growth is being driven by a rising incidence of trauma and orthopedic injuries, particularly in urban centers. Public hospitals are gradually adopting mobile C-arm technology to enhance intraoperative imaging capabilities. The market is projected to expand at a CAGR of 6.2% between 2025 and 2032.

Israel Mobile C-Arm Equipment Market Insight

The Israel mobile C-Arm equipment market accounted for 9.6% of the regional market in 2024, bolstered by its technologically advanced healthcare system and strong R&D capabilities. The country is at the forefront of adopting digital mobile C-arms for neurosurgical and minimally invasive applications. Market expansion is supported by growing interest in AI-assisted imaging and integration with robotic surgery systems. The Israel market is projected to expand at a CAGR of 6.5% through 2032.

Middle East and Africa Mobile C-Arm Equipment Market Share

The Middle East and Africa Mobile C-Arm Equipment Market industry is primarily led by well-established companies, including:

- GE HealthCare (India)

- Hologic, Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers AG (Germany)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- NOVAmedtek (Turkey)

- EcoRay (South Korea)

- Assing S.p.A. (Italy)

- BMI Biomedical International s.r.l. (Italy)

- Eurocolumbus srl. (Italy)

- ITALRAY (Italy)

- MS Westfalia GmbH (Germany)

- Shimadzu Corporation (Japan)

- GENORAY CO. LTD (South Korea)

- Villa Sistemi Medicali Spa (Italy)

- Ziehm Imaging GmbH (Germany)

- INTERMEDICAL S.r.l IMD Group (Italy)

Latest Developments in Middle East and Africa Mobile C-Arm Equipment Market

- In April 2023, Siemens Healthineers announced the launch of its next-generation mobile C-arm system in the Middle East and Africa region, featuring advanced 3D imaging and enhanced workflow capabilities tailored to complex surgical environments. This strategic introduction aims to strengthen the company's footprint in high-growth markets such as the U.A.E. and Saudi Arabia, where the demand for cutting-edge surgical imaging technologies is rapidly increasing. The move underscores Siemens’ commitment to improving intraoperative imaging precision and supporting value-based healthcare initiatives in the region

- In March 2023, GE HealthCare entered into a partnership with a leading private healthcare network in South Africa to deploy its latest OEC 3D mobile C-arm units across multiple hospitals. This collaboration is intended to boost surgical efficiency and diagnostic accuracy, especially in orthopedics and trauma cases. The initiative marks a significant milestone in GE’s efforts to expand its presence in emerging markets and offer scalable imaging solutions aligned with regional healthcare demands

- In February 2023, Philips Healthcare introduced an AI-powered image optimization feature for its Zenition series mobile C-arms, targeting adoption in high-volume surgical centers across the Middle East and Africa. This innovation is designed to assist clinicians in acquiring real-time, high-quality imaging with reduced radiation exposure, supporting both patient safety and improved procedural outcomes. The enhancement demonstrates Philips’ focus on integrating artificial intelligence into medical imaging systems

- In January 2023, Ziehm Imaging GmbH expanded its distribution network in North and Sub-Saharan Africa by signing new reseller agreements with regional partners. The company aims to capitalize on the growing demand for mobile surgical imaging equipment in secondary and tertiary healthcare institutions. Ziehm’s focus remains on delivering flexible, high-performance C-arm systems that cater to budget-sensitive markets without compromising on image quality or versatility

- In December 2022, Shimadzu Corporation showcased its latest mobile C-arm technology at Arab Health 2023 in Dubai, featuring compact designs, low-dose imaging, and user-friendly interfaces. With a spotlight on fluoroscopy-guided procedures, the company highlighted its intention to serve developing markets in the region, particularly in outpatient surgical units and diagnostic imaging centers where space and budget constraints are key considerations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.