Middle East And Africa Molecular Diagnostics Services Market

Market Size in USD Million

CAGR :

%

USD

6.10 Million

USD

10.25 Million

2024

2032

USD

6.10 Million

USD

10.25 Million

2024

2032

| 2025 –2032 | |

| USD 6.10 Million | |

| USD 10.25 Million | |

|

|

|

|

Middle East and Africa Molecular Diagnostics Services Market Size

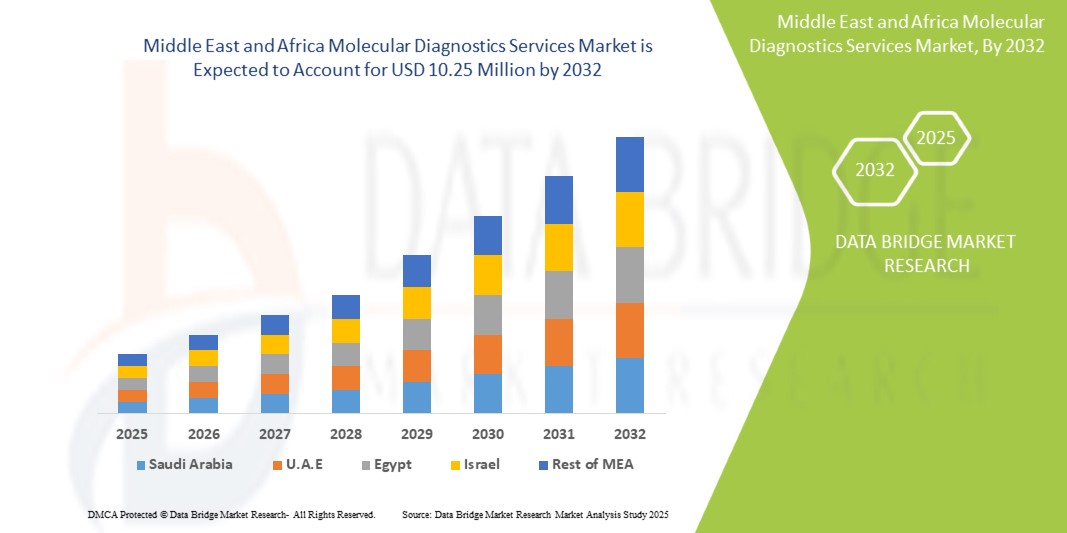

- The East and Africa molecular diagnostics services market size was valued at USD 6.10 million in 2024 and is expected to reach USD 10.25 million by 2032, at a CAGR of 6.70% during the forecast period

- The market growth is largely fueled by the increasing demand for rapid and accurate diagnostic solutions, advancements in molecular testing technologies, and rising investments in healthcare infrastructure across the region

- Furthermore, the adoption of molecular diagnostics services is expanding in hospitals, diagnostic centers, and research institutions, spurred by the need for personalized medicine and early disease detection. These converging factors are accelerating the uptake of molecular diagnostics services, thereby significantly boosting the industry's growth

Middle East and Africa Molecular Diagnostics Services Market Analysis

- Molecular diagnostics services, providing advanced testing for detecting genetic, infectious, and chronic diseases, are becoming essential components of modern healthcare infrastructure in both clinical and research settings due to their accuracy, speed, and ability to support personalized medicine

- The growing adoption of molecular diagnostics is primarily fueled by rising demand for early disease detection, increasing prevalence of infectious and genetic disorders, and expanding healthcare investments across the Middle East and Africa

- The United Arab Emirates (UAE) dominated the MEA molecular diagnostics services market with the largest revenue share of 28.9% in 2024, driven by well-established healthcare systems, high healthcare expenditure, and a strong presence of key diagnostic service providers, with substantial growth in molecular testing facilities in hospitals and specialized diagnostic centers, supported by government initiatives and public-private partnerships

- South Africa is expected to be the fastest-growing country in the MEA molecular diagnostics services market during the forecast period, due to increasing healthcare awareness, expansion of diagnostic laboratories, and rising investments in modern diagnostic technologies

- PCR segment dominated the MEA molecular diagnostics services market with a market share of 42% in 2024, driven by its high accuracy, rapid turnaround time, and widespread adoption for detecting infectious diseases and genetic conditions

Report Scope and Middle East and Africa Molecular Diagnostics Services Market Segmentation

|

Attributes |

Middle East and Africa Molecular Diagnostics Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Molecular Diagnostics Services Market Trends

Advancement Through AI-Enabled Diagnostics and Automation

- A significant and accelerating trend in the MEA molecular diagnostics services market is the integration of artificial intelligence (AI) and automated laboratory workflows, enhancing test accuracy, throughput, and data interpretation speed

- For instance, AI-powered platforms are being implemented in UAE diagnostic centers to streamline PCR testing and analyze large datasets for early disease detection

- AI-enabled diagnostics allow predictive insights, automated result interpretation, and optimization of laboratory processes, while reducing human errors and turnaround time

- Automation in molecular diagnostics facilitates centralized management of testing procedures, sample tracking, and result reporting, ensuring consistent quality across laboratories

- This trend toward smarter, data-driven, and automated diagnostic services is redefining healthcare delivery in the MEA, with companies such as G42 Healthcare deploying AI-assisted testing solutions to improve lab efficiency

- The demand for AI-integrated and automated molecular diagnostics is growing rapidly across hospitals, research institutions, and specialized labs as healthcare systems aim to enhance accuracy and efficiency

Middle East and Africa Molecular Diagnostics Services Market Dynamics

Driver

Rising Disease Burden and Growing Demand for Early Detection

- The increasing prevalence of infectious diseases, genetic disorders, and chronic conditions is a significant driver for molecular diagnostics adoption in the MEA region

- For instance, in 2024, a diagnostic center in Saudi Arabia implemented advanced PCR and NGS testing to address growing demand for rapid infectious disease detection

- Molecular diagnostics enable early disease detection, personalized treatment planning, and continuous patient monitoring, offering a clear advantage over conventional diagnostic methods

- Rising healthcare investments and expansion of diagnostic laboratories are making these services more accessible to hospitals, clinics, and research institutions

- The occurrence of chronic and infectious diseases is high and the number of molecular tests has also increased for diagnosis and treatment, the demand for products and services will rise eventually. Hence, the rising prevalence of chronic and infectious diseases is driving market growth across the globe

- The growing awareness among patients and healthcare providers regarding early disease intervention, combined with the need for precise and timely testing, is driving market growth across both public and private healthcare sectors

Restraint/Challenge

High Costs and Regulatory Compliance Hurdles

- The relatively high cost of molecular diagnostic tests compared to traditional laboratory testing remains a challenge for widespread adoption in certain MEA countries

- For instance, instance reports indicate that premium NGS or multiplex PCR panels in Nigeria and Kenya are often unaffordable for smaller clinics or low-income populations

- Stringent regulatory frameworks, varying across countries in the MEA, complicate market entry for new diagnostic service providers and can delay product approvals

- Addressing these challenges requires investment in local regulatory expertise, cost-effective testing solutions, and partnerships to expand accessibility

- The lack of skilled professionals causes inefficiency in operating specific types of equipment or machinery in laboratories which may lead to a costly safety hazard and directly lead to lower productivity and profitability. Hence, this will not only affect the quality of work but also lead to financial constraints. Thus, this will pose one of the major challenges to market growth

- Overcoming high costs and compliance hurdles through streamlined regulatory pathways, affordable test options, and capacity-building initiatives will be essential for sustained market growth in the region

Middle East and Africa Molecular Diagnostics Services Market Scope

The market is segmented on the basis of service type, technology, and end user.

- By Service Type

On the basis of service type, the Middle East and Africa molecular diagnostics services market is segmented into instrument repair services, training services, compliance services, calibration services, maintenance services, scalable automation services, turnkey services, instrument relocation services, hardware customization, performance assurance services, design and development services, supply chain solutions, new product introduction services, manufacturing services, environmental & regulatory services, medical management systems certification & auditing, clinical research services, consultative services, and other services. The maintenance services segment dominated the market with the largest revenue share of 26.8% in 2024, driven by the critical need to ensure uninterrupted operation of molecular diagnostic instruments across hospitals, diagnostic centers, and research institutions. Frequent maintenance reduces downtime, enhances test accuracy, and prolongs the lifespan of sophisticated instruments such as PCR and NGS platforms. Healthcare providers prioritize scheduled maintenance contracts to guarantee compliance with regulatory standards and to minimize operational disruptions. In addition, established service providers offering on-site and remote support further strengthen the dominance of maintenance services in the market.

The training services segment is anticipated to witness the fastest growth rate of 12.3% from 2025 to 2032, fueled by the growing adoption of advanced molecular diagnostic technologies in the MEA region. As laboratories increasingly deploy PCR, real-time PCR, and next-generation sequencing platforms, there is a rising demand for skilled personnel who can operate these instruments efficiently. Training services help bridge the skills gap, ensure quality testing, and enhance laboratory efficiency. Continuous professional development programs, workshops, and virtual training solutions are contributing to the rapid uptake of training services across hospitals and research centers.

- By Technology

On the basis of technology, the Middle East and Africa molecular diagnostics services market is segmented into PCR, real-time PCR, next-generation sequencing (NGS), and other technologies. The PCR segment dominated the market with a market share of 42% in 2024, driven by its widespread adoption for infectious disease detection, genetic testing, and routine laboratory diagnostics. PCR-based testing offers high sensitivity, rapid results, and cost-effective operations, making it a preferred choice across hospitals and diagnostic centers in the UAE, Saudi Arabia, and South Africa. The segment benefits from continuous technological improvements, such as multiplex PCR panels, which allow simultaneous detection of multiple pathogens. Moreover, PCR remains the backbone for both routine testing and outbreak management, consolidating its dominant position in the market.

The next-generation sequencing (NGS) segment is expected to witness the fastest CAGR of 14.2% from 2025 to 2032, due to increasing demand for personalized medicine and advanced genetic research in the MEA region. NGS provides comprehensive genomic insights for oncology, inherited disorders, and infectious disease studies, which is driving its adoption in academic and research institutions. Rising investments in high-throughput sequencing infrastructure, coupled with collaborations between diagnostic service providers and global technology vendors, are accelerating the growth of NGS-based molecular diagnostics services.

- By End User

On the basis of end user, the Middle East and Africa molecular diagnostics services market is segmented into hospitals, diagnostic centers, academic & research institutions, and others. The hospitals segment dominated the market with a revenue share of 38.7% in 2024, attributed to the increasing implementation of molecular diagnostic services for patient care, early disease detection, and infectious disease management. Hospitals in the UAE and Saudi Arabia are leading in integrating PCR and real-time PCR services within clinical workflows, supported by government initiatives to improve healthcare standards. Hospitals also prioritize service contracts, instrument maintenance, and technical support, which reinforces their dominant market position.

The academic & research institutions segment is expected to witness the fastest growth rate of 11.8% from 2025 to 2032, driven by the expansion of genomics research and the adoption of cutting-edge molecular diagnostic technologies. Institutions in South Africa and Egypt are increasingly investing in NGS and automated PCR platforms for research applications, including cancer genomics, infectious disease surveillance, and population genetics. Access to skilled personnel and technology-driven training programs is further accelerating the adoption of molecular diagnostics services in these research-focused environments.

Middle East and Africa Molecular Diagnostics Services Market Regional Analysis

- The United Arab Emirates (UAE) dominated the Middle East and Africa molecular diagnostics services market with the largest revenue share of 28.9% in 2024, driven by well-established healthcare systems, high healthcare expenditure, and a strong presence of key diagnostic service providers

- Healthcare providers in the UAE prioritize molecular diagnostic services for early disease detection, infectious disease management, and personalized treatment, supported by state-of-the-art laboratories and skilled personnel

- This widespread adoption is further reinforced by government initiatives to enhance healthcare quality, rising patient awareness about molecular diagnostics, and strategic collaborations with global diagnostic service providers, establishing these services as a preferred choice across hospitals, diagnostic centers, and research institutions in the UAE

The UAE Molecular Diagnostics Services Market Insight

The UAE molecular diagnostics services market captured the largest revenue share of 28.9% in 2024 within the MEA region, fueled by substantial healthcare investments, advanced medical infrastructure, and growing demand for rapid and accurate diagnostic solutions. Healthcare providers are increasingly prioritizing molecular diagnostics for early disease detection, infectious disease management, and personalized treatment. The rising adoption of advanced technologies such as PCR, real-time PCR, and next-generation sequencing, coupled with skilled personnel and state-of-the-art laboratories, further propels market growth. Government initiatives to enhance healthcare quality and collaborations with global diagnostic service providers are significantly contributing to the expansion of the UAE market.

Saudi Arabia Molecular Diagnostics Services Market Insight

The Saudi Arabia molecular diagnostics services market is expected to grow at a notable CAGR during the forecast period, driven by increasing prevalence of chronic and infectious diseases and rising healthcare expenditure. Hospitals and diagnostic centers are adopting advanced molecular testing solutions to improve patient outcomes and support personalized medicine. Strategic partnerships with international diagnostic companies, along with government programs aimed at improving laboratory capabilities, are facilitating the expansion of molecular diagnostics across the country. The rising awareness of early disease detection and growing investments in modern diagnostic technologies are also contributing to market growth.

South Africa Molecular Diagnostics Services Market Insight

The South Africa molecular diagnostics services market is anticipated to expand at the fastest CAGR in the MEA region during the forecast period, driven by rising healthcare awareness, growing adoption of molecular diagnostic technologies, and increasing investments in laboratory infrastructure. Academic and research institutions, along with private diagnostic centers, are deploying advanced PCR and NGS platforms to support infectious disease surveillance, cancer genomics, and population health studies. Government initiatives and funding programs aimed at enhancing healthcare access and research capabilities further boost the market. The increasing demand for early disease detection and personalized medicine is shaping the growth trajectory in South Africa.

Nigeria Molecular Diagnostics Services Market Insight

The Nigeria molecular diagnostics services market is expected to expand steadily during the forecast period, driven by increasing awareness of early disease detection and rising healthcare expenditure. Hospitals and research institutions are gradually adopting advanced molecular testing solutions, including PCR and real-time PCR platforms, to enhance diagnostic capabilities. Strategic collaborations with international service providers and investments in laboratory infrastructure are facilitating market growth. The growing prevalence of infectious and genetic diseases, coupled with government and NGO initiatives to improve healthcare access, further contributes to market development.

Middle East and Africa Molecular Diagnostics Services Market Share

The Middle East and Africa Molecular Diagnostics Services industry is primarily led by well-established companies, including:

- GE HealthCare (U.S.)

- Jiangsu BioPerfectus Technologies Co., Ltd (China)

- F. Hoffmann-La Roche Ltd (Switzerland)

- EUROIMMUN Medizinische Labordiagnostika AG (Germany)

- Seegene Inc. (South Korea)

- Cepheid (U.S.)

- Molbio Diagnostics Pvt. Ltd. (India)

- Dawa Life Sciences Ltd. (Kenya)

- Lancet Laboratories (Pty) Ltd. (South Africa)

- Afrigen Biologics and Vaccines (Pty) Ltd. (South Africa)

- Metropolis Healthcare Ltd. (India)

- Astragene (U.A.E.)

- AstraZeneca (U.K.)

- QIAGEN (Netherlands)

- Danaher (U.S.)

- Abbott (U.S.)

- Agilent Technologies, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- BIOMÉRIEUX (France)

What are the Recent Developments in Middle East and Africa Molecular Diagnostics Services Market?

- In December 2024, Moroccan startup Moldiag became the first African company to produce mpox (monkeypox) diagnostic tests. Priced at USD 5 each, these tests aim to address the continent's reliance on imported medical supplies. Orders have been received from countries including Burundi, Uganda, Congo, Senegal, and Nigeria

- In November 2024, Moldiag received approval from the Africa Centres for Disease Control and Prevention (Africa CDC) to distribute its mpox tests. This approval supports the company's efforts to provide affordable and accessible diagnostics within Africa, addressing the continent's healthcare disparities

- In September 2024, FIND, a global non-profit organization focused on diagnostic infrastructure, highlighted a significant shortage of diagnostic tests for infectious diseases in Africa. The report emphasized the urgent need for investment in research and development to address gaps in diagnostic capabilities for pathogens such as Ebola, cholera, and salmonella

- In May 2024, Biocartis and Merck expanded their collaboration to improve patient access to RAS biomarker testing in the Middle East and North Africa (MEA) region. The partnership aims to enhance personalized medicine by providing rapid and accessible molecular diagnostics for colorectal cancer patients

- In January 2024, QIAGEN opened its regional headquarters in Riyadh, Saudi Arabia, to strengthen its presence in the Middle East. The company also signed a memorandum of understanding with the Ministry of Health of Saudi Arabia to support public health initiatives, including tuberculosis screening program

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.