Middle East And Africa Nutraceutical Excipients Market

Market Size in USD Million

CAGR :

%

USD

56.97 Million

USD

78.57 Million

2024

2032

USD

56.97 Million

USD

78.57 Million

2024

2032

| 2025 –2032 | |

| USD 56.97 Million | |

| USD 78.57 Million | |

|

|

|

|

Middle East and Africa Nutraceutical Excipients Market Size

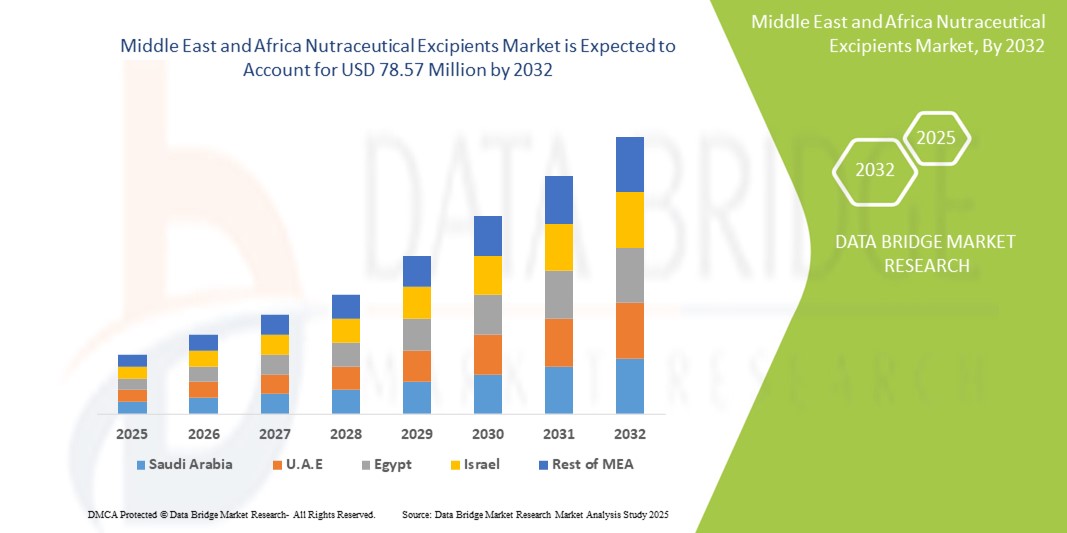

- The Middle East and Africa nutraceutical excipients market size was valued at USD 56.97 million in 2024 and is expected to reach USD 78.57 million by 2032, at a CAGR of 4.1% during the forecast period

- The market growth is largely fueled by the expanding nutraceutical industry across the region, driven by rising health awareness, preventive healthcare trends, and the increasing consumption of dietary supplements and functional foods

- Furthermore, growing demand for high-quality, multifunctional excipients that enhance product stability, bioavailability, and shelf-life is positioning excipients as a critical component in nutraceutical manufacturing. These converging factors are accelerating the uptake of advanced excipient solutions, thereby significantly boosting the industry’s growth

Middle East and Africa Nutraceutical Excipients Market Analysis

- Nutraceutical excipients, functioning as critical formulation ingredients in dietary supplements and functional foods, are increasingly vital to ensuring stability, bioavailability, palatability, and dosage consistency, thereby becoming indispensable in the region’s rapidly developing nutraceutical sector

- The escalating demand for nutraceutical excipients is primarily fueled by rising consumer focus on preventive healthcare, growing adoption of dietary supplements, and the expanding consumption of fortified and functional foods across Middle Eastern and African countries

- South Africa dominated the nutraceutical excipients market with the largest revenue share of 32.9% in 2024, supported by its advanced pharmaceutical industry, nutraceutical production facilities, and high consumer expenditure on wellness-focused products

- Saudi Arabia is expected to be the fastest growing country in the nutraceutical excipients market during the forecast period, driven by strong demand for functional food supplements, high purchasing power, and increasing prevalence of lifestyle-related health conditions

- The synthetic excipients segment dominated the nutraceutical excipients market with a market share of 58.7% in 2024, attributed to their cost-effectiveness, consistent quality, and suitability for large-scale nutraceutical manufacturing compared to natural alternatives

Report Scope and Middle East and Africa Nutraceutical Excipients Market Segmentation

|

Attributes |

Middle East and Africa Nutraceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Nutraceutical Excipients Market Trends

Shift Toward Clean-Label and Natural Excipients

- A significant and accelerating trend in the Middle East and Africa nutraceutical excipients market is the increasing preference for clean-label, plant-based, and naturally sourced excipients, as consumers demand transparency, safety, and sustainability in health-related products

- For instance, DuPont and Roquette are introducing plant-derived excipient solutions tailored for nutraceuticals, catering to consumers seeking natural ingredients in supplements and fortified foods

- Natural excipients offer benefits such as improved digestibility, reduced allergen risks, and alignment with regional preferences for organic and halal-certified products. For instance, acacia gum from African regions is being utilized as a multifunctional binder and stabilizer in nutraceutical formulations

- The shift is also supported by regulatory encouragement for safer, consumer-friendly excipient use, prompting manufacturers to innovate natural alternatives that can match the performance of synthetics. For instance, firms in South Africa and GCC countries are increasingly investing in R&D to develop clean-label excipients for vitamin and mineral supplements

- This trend is reshaping product development strategies, with companies adapting portfolios to emphasize sustainability and consumer trust. For instance, multinational players such as BASF and Ingredion are highlighting natural, eco-friendly excipients as part of their Middle East and Africa product offerings

- The demand for clean-label nutraceutical excipients is growing rapidly across both dietary supplement and functional food categories, as consumers increasingly prioritize wellness, safety, and natural product integrity

Middle East and Africa Nutraceutical Excipients Market Dynamics

Driver

Growing Nutraceutical Consumption and Preventive Healthcare Focus

- The rising adoption of nutraceuticals across the Middle East and Africa, fueled by consumer interest in preventive healthcare and immunity-boosting products, is a significant driver for the growing demand for nutraceutical excipients

- For instance, in March 2024, DSM-Firmenich expanded its excipient offerings in South Africa to support the production of high-quality nutraceutical supplements, enhancing stability and absorption

- As consumers become more health-conscious and seek alternatives to pharmaceuticals, excipients play a key role in improving supplement quality, bioavailability, and shelf-life, making them essential to product effectiveness

- Furthermore, supportive government policies promoting functional foods and dietary supplements are creating favorable market conditions, encouraging manufacturers to scale up excipient-based formulations

- The growing diversity of nutraceutical products, from vitamins to omega-3 supplements, further expands the need for specialized excipients. The availability of retail and e-commerce channels across the region also strengthens distribution and access for consumers

Restraint/Challenge

Regulatory Complexity and High Cost Barriers

- Regulatory frameworks governing excipients in nutraceuticals vary across Middle Eastern and African countries, posing challenges for manufacturers in terms of compliance, product approvals, and labeling standards

- For instance, delays in regulatory harmonization have slowed the launch of certain excipient types, requiring companies to invest additional time and resources to meet diverse country-specific requirements

- The relatively high cost of advanced excipients, particularly naturally sourced or multifunctional ones, can limit adoption among nutraceutical producers operating in cost-sensitive markets across Africa

- For instance, smaller manufacturers in regions such as Nigeria and Kenya face challenges in integrating premium excipients due to limited budgets and higher import dependency

- While local sourcing of natural excipients such as acacia gum is improving availability, production costs and limited scalability still hinder broader adoption. For instance, global suppliers highlight that natural excipient extraction and purification processes require significant investment

- Overcoming these challenges through regional regulatory alignment, investment in cost-efficient excipient production, and increased consumer education on product value will be crucial for sustained market growth

Middle East and Africa Nutraceutical Excipients Market Scope

The market is segmented on the basis of type, end product, form, excipient source, and distribution channel.

- By Type

On the basis of type, the nutraceutical excipients market is segmented into flavoring agents, coloring agents, sweeteners, coating agent, buffers, solvents, carriers, antifoams, gliding agents, wetting agents, thickeners/gelling agents, preservatives, binders, disintegrates, lubricants, fillers and diluents, and others. The synthetic binders segment dominated the market in 2024 with the largest revenue share, driven by their essential role in ensuring product stability, compressibility, and dosage uniformity in tablets and capsules. These excipients are critical in meeting pharmaceutical-grade standards and are widely adopted by nutraceutical manufacturers across South Africa and GCC countries. Their consistent performance and scalability make them indispensable for large-scale supplement production, while their cost-effectiveness ensures broad usage across product categories.

The coating agents segment is expected to witness the fastest growth from 2025 to 2032, fueled by rising demand for visually appealing, easy-to-swallow, and taste-masked nutraceutical formulations. As consumers increasingly prefer coated tablets and capsules that improve palatability and product aesthetics, manufacturers are investing in advanced coating technologies. Coating agents also help in controlled release and extended shelf-life, making them highly attractive in premium nutraceutical offerings. Growth in the functional food and fortified supplement segments is further boosting demand for innovative coating excipients in the region.

- By End Product

On the basis of end product, the Middle East and Africa nutraceutical excipients market is segmented into prebiotics, probiotics, protein and amino acid supplements, mineral supplements, vitamin supplements, omega-3 supplements, and other supplements. The vitamin supplements segment dominated the market with the largest share in 2024, as consumers across Middle East and Africa increasingly rely on multivitamins for preventive healthcare, immunity strengthening, and overall wellness. Governments and healthcare organizations have also emphasized micronutrient supplementation to address regional deficiencies, particularly in countries such as South Africa and Nigeria. The wide consumer acceptance of vitamins in multiple dosage forms such as tablets, gummies, and capsules strengthens the role of excipients in improving stability and taste.

The probiotics segment is anticipated to witness the fastest growth during the forecast period, driven by rising consumer interest in gut health, digestion, and immunity. Increasing awareness of the microbiome’s role in overall health is fueling demand for probiotic supplements, which require specialized excipients for stability and survivability of live microorganisms. Excipients such as protective carriers and stabilizers are in high demand to maintain probiotic efficacy under regional climatic conditions. The growth of probiotic-enriched functional foods in GCC countries further enhances opportunities for excipient innovation.

- By Form

On the basis of form, the Middle East and Africa nutraceutical excipients market is segmented into dry and liquid. The dry form segment dominated the market in 2024 with the largest revenue share, as it is widely used in the production of tablets, capsules, and powdered supplements. Dry excipients are favored due to their extended shelf-life, ease of handling and transportation, and cost-effectiveness in bulk manufacturing. Manufacturers prefer dry excipients for their compatibility with multiple nutraceutical dosage forms and their ability to ensure dosage accuracy. Consumer demand for powdered proteins, amino acids, and multivitamins in convenient sachets or jars further boosts this segment.

The liquid form segment is expected to record the fastest growth from 2025 to 2032, supported by the rising popularity of syrups, suspensions, and liquid-filled capsules in nutraceutical formulations. Liquids are increasingly favored by pediatric and geriatric populations due to ease of consumption and faster absorption rates. The shift towards personalized nutrition and fortified beverages in urban markets across GCC countries is also driving demand for liquid excipient formulations. Companies are innovating in liquid excipient stability and solubility to cater to this growing demand.

- By Excipient Source

On the basis of source, the Middle East and Africa nutraceutical excipients market is segmented into natural and synthetic. The synthetic excipients segment dominated the market in 2024 with the largest share of 58.7%, owing to their consistent quality, scalability, and cost efficiency. Synthetic excipients are highly preferred in standardized nutraceutical manufacturing processes, ensuring uniformity and compliance with regulatory requirements. Their stability and multifunctional applications make them a dependable choice for mass-market nutraceuticals, particularly in South Africa and Saudi Arabia. Manufacturers continue to rely on synthetic sources for critical roles such as binding, coating, and disintegration.

The natural excipients segment is projected to grow at the fastest rate during the forecast period, driven by consumer demand for clean-label, plant-based, and eco-friendly supplements. With rising interest in organic and halal-certified products, natural excipients derived from acacia gum, starches, and cellulose are gaining traction in both supplements and functional foods. Consumers perceive natural excipients as safer, healthier, and more sustainable, creating new opportunities for suppliers in GCC and African countries. The trend toward transparency and sustainability further accelerates this shift.

- By Distribution Channel

On the basis of distribution channel, the Middle East and Africa nutraceutical excipients market is segmented into direct tender, retail sales, and others. The retail sales segment dominated the market in 2024 with the largest share of 46.8%, supported by the growing availability of nutraceutical supplements through pharmacies, supermarkets, specialty health stores, and e-commerce platforms. Rising consumer preference for self-care and the convenience of purchasing nutraceuticals directly has accelerated retail expansion across South Africa, UAE, and Nigeria. The surge of online pharmacies and digital wellness platforms further boosts retail distribution of excipient-based products.

The direct tender segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing adoption of nutraceutical supplements in hospitals, clinics, and government healthcare programs. Procurement through tenders is becoming more common for institutional supply of fortified supplements addressing regional nutritional deficiencies. Countries such as Saudi Arabia and South Africa are investing in healthcare infrastructure and wellness initiatives, which include bulk purchasing of nutraceuticals through tender-based systems. This channel ensures large-scale, cost-efficient distribution, supporting wider adoption of excipients in institutional markets.

Middle East and Africa Nutraceutical Excipients Market Regional Analysis

- South Africa dominated the nutraceutical excipients market with the largest revenue share of 32.9% in 2024, supported by its advanced pharmaceutical industry, nutraceutical production facilities, and high consumer expenditure on wellness-focused products

- Consumers in the country increasingly value high-quality supplements formulated with excipients that enhance stability, bioavailability, and palatability, particularly in vitamins, minerals, and protein-based products

- This strong adoption is further supported by growing health awareness, an expanding middle-class population, and the availability of diverse retail and e-commerce distribution channels, positioning South Africa as a leading hub for nutraceutical excipient demand in the region

The South Africa Nutraceutical Excipients Market Insight

The South Africa nutraceutical excipients market captured the largest revenue share of 32.9% in 2024 within the region, driven by the country’s advanced pharmaceutical and nutraceutical production capacity. Consumers are increasingly focused on preventive healthcare and functional supplements, fueling demand for excipients that enhance stability, bioavailability, and sensory appeal. The rising middle-class population and expanding retail and e-commerce distribution channels further boost market growth. Moreover, regulatory support for quality and safety standards is strengthening confidence in nutraceutical products, establishing South Africa as a key regional hub.

Saudi Arabia Nutraceutical Excipients Market Insight

The Saudi Arabia nutraceutical excipients market is projected to expand at a substantial CAGR throughout the forecast period, primarily fueled by government-led health awareness initiatives under Vision 2030 and rising demand for functional foods and dietary supplements. Increasing lifestyle-related health concerns such as obesity and diabetes are encouraging greater consumption of nutraceuticals. The growing pharmaceutical sector, combined with rising disposable incomes and urbanization, is also fostering the adoption of advanced excipient technologies across supplements and fortified food products.

UAE Nutraceutical Excipients Market Insight

The UAE nutraceutical excipients market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by its strong position as a regional trade and distribution hub. Rising health consciousness among residents, coupled with high purchasing power, is driving greater adoption of premium nutraceutical products. Moreover, the UAE’s robust retail infrastructure and rapidly expanding e-commerce sector are enabling wider access to dietary supplements, vitamins, and functional foods formulated with advanced excipients

Nigeria Nutraceutical Excipients Market Insight

The Nigeria nutraceutical excipients market is gaining momentum due to rapid population growth, rising prevalence of nutritional deficiencies, and increasing consumer interest in preventive healthcare. The market is seeing expanding demand for affordable dietary supplements, particularly in vitamins, minerals, and protein categories. Moreover, the growth of local nutraceutical manufacturing and government-backed nutrition programs are expected to spur further adoption of excipients, ensuring product stability, safety, and affordability for the mass population.

Middle East and Africa Nutraceutical Excipients Market Share

The Middle East and Africa Nutraceutical Excipients industry is primarily led by well-established companies, including:

- Roquette Frères (France)

- Ingredion (U.S.)

- Cargill, Incorporated (U.S.)

- Kerry Group plc (Ireland)

- BASF (Germany)

- Ashland. (U.S.)

- Evonik Industries AG (Germany)

- JRS PHARMA (Germany)

- Colorcon, Inc. (U.S.)

- GELITA AG (Germany)

- Croda International Plc (U.K.)

- Tate & Lyle (U.K.)

- Archer Daniels Midland Company (U.S.)

- DFE Pharma (Germany)

- MEGGLE GmbH & Co. KG (Germany)

- Lubrizol (U.S.)

- CP Kelco (U.S.)

- Sensient Technologies Corporation (U.S.)

- dsm-firmenich (Netherlands)

What are the Recent Developments in Middle East and Africa Nutraceutical Excipients Market?

- In November 2024, FutureCeuticals and Global Calcium entered a global distribution and manufacturing partnership for Asia, the Middle East, and Africa, initially focusing on the patented mineral complex FruiteX-B calcium fructoborate

- In April 2024, Roquette announced the latest addition to its LYCAGEL plant-based softgel excipient range, highlighting pea-starch based softgel excipient technology aimed at vegetarian/vegan softgels and improved functionality — an advancement that broadens plant-based excipient options for formulators targeting clean-label and halal/vegetarian segments across MEA

- In May 2023, Roquette launched PEARLITOL ProTec, a plant-based co-processed mannitol-maize starch excipient designed to protect moisture-sensitive actives (notably probiotics), extend shelf life, and improve handling in nutraceutical formats a product innovation that directly addresses stability challenges common in hot/humid markets such as parts of the Middle East and Africa

- In April 2023, Ingredion announced expansions in its pharmaceutical & nutraceutical business including acquisitions/portfolio growth in India strengthening its excipient supply and formulation services for nutraceutical makers; moves such as this by major ingredient suppliers help improve regional sourcing and tailored excipient support for MEA manufacturers

- In February 2021, International Flavors & Fragrances (IFF) completed the acquisition/merger of DuPont’s Nutrition & Biosciences business (N&B), creating a substantially larger ingredients platform that consolidated many excipient and formulation capabilities used across nutraceuticals globally a major industry reshuffle that impacts excipient supply, formulation expertise, and global distribution channels relevant to MEA manufacturers and suppliers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.