Middle East And Africa Pathogen Detection Market

Market Size in USD Billion

CAGR :

%

USD

227.45 Billion

USD

402.65 Billion

2022

2030

USD

227.45 Billion

USD

402.65 Billion

2022

2030

| 2023 –2030 | |

| USD 227.45 Billion | |

| USD 402.65 Billion | |

|

|

|

Middle East and Africa Pathogen Detection Market Analysis and Size

Major factors driving the growth of this market are growth in the research and development activities in diagnostic industries have moved forwards and innovation towards rapid detection has led to improvement in the pathogen detection market. This testing technique is used at every stage of manufacturing to assure the safety. The market for pathogen detection is expanding as a result of the increased restrictions and safety concerns. The adoption of pathogen testing by various players in various sectors is also favoured by developments in pathogen testing techniques including polymerase chain reaction and immunomagnetic separation as well as limited detection times. Additionally, the rapid detection and accuracy in results within less time have further boosted the demand for pathogen detection in coming years.

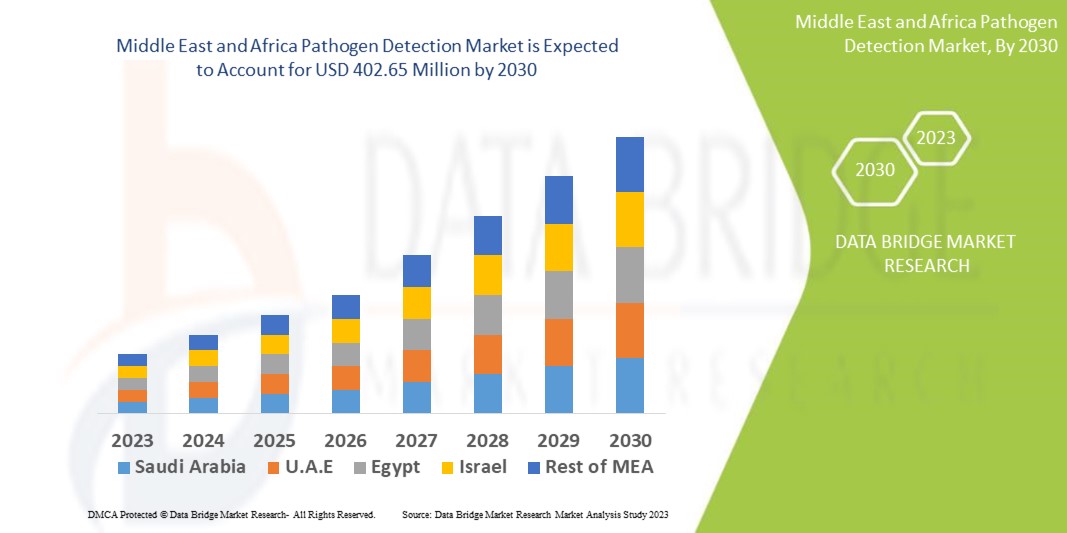

Data Bridge Market Research analyses that the pathogen detection market which is USD 227.45 million in 2022, is expected to reach USD 402.65 million by 2030, at a CAGR of 7.4% during the forecast period 2023 to 2030. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Middle East and Africa Pathogen Detection Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015 - 2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Products, Services), Consistency (Solid Media, Liquid Media), Culture Media (Chemical Composition, Synthetic Media), Contaminant Type (Salmonella, E. Coli, Listeria, Campylobacter, Clostridium Perfringens, Pseudomonas, Cronobacter, Coliforms, Legionella, Others), Total Count (Spoiling Organisms, Yeast and Moulds, Others), Technology (Rapid, Traditional, Other Molecular-Based Tests), Customer Type (Service Lab, Industry, Governmental/Non-Profit Organization), Application (Diagnostics, Pathology, Forensics, Clinical Research, Drug Discovery), End User (Pathology Laboratories, Diagnostic Centers, Hospitals, Biotechnology Companies, Pharmaceutical Companies, Culture Collection Repositories, Cooling Towers, Blood Banks, Others), Distribution Channel (Direct Tender, Retail Sales) |

|

Countries Covered |

Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

Merck KGaA (Germany), Thermo Fisher Scientific (U.S.), BIOMÉRIEUX (France), Agilent Technologies, Inc. (U.S.), BD (U.S.), biotools (U.S.), SGS Société Générale de Surveillance SA (Switzerland), Bureau Veritas (India) Private Limited (India), Intertek Group plc (U.K.), Eurofins Scientific (Luxembourg), Mérieux NutriSciences Corporation (France), ifp Institut für Produktqualität GmbH (Germany), ALS (Australia), Microbac Laboratories, Inc. (U.S.), FoodChain ID Group, Inc (U.S.), AsureQuality (New Zealand), Campden BRI (U.K.), ANGLE plc (U.K.) |

|

Market Opportunities |

|

Market Definition

Pathogen detection is essential in order to diagnose a disease. Blood, urine, saliva and stool samples are taken from individuals who show signs of a pathogenic infection and tested for pathogens using pathogenic detection assays for diagnostic purposes. Polymerase chain reaction (PCR), colony counting and immunological approaches are the most frequently used pathogen detection procedures. They involve bacterial tally, antigen-antibody interactions, and DNA analysis.

Middle East and Africa Pathogen Detection Market Dynamics

Drivers

- Rising genetic testing technology

Genetic testing techniques can now quickly, accurately and reliably detect pathogens. Pathogens can be found using genetic testing procedures, even if they have just formed or are present in incredibly low amounts. For instance, in 2019 a biotech start-up company named LexaGena introduced LX2. This first on-site, open access pathogen detection instrumentation can be used for food safety and veterinary diagnostics, at a healthcare conference in San Francisco, California. The company is now working on the analyzer and intends to introduce it to the market place.

- Increase in R&D activities

New developments in R&D have helped to decrease the burden of infectious diseases caused by pathogens. The demand for pathogen detection in the approaching years has also increased due to the speedy detection and accuracy of results in a shorter amount of time. The region spent USD 182.3 billion on R&D operations for medical and health causes as well as the development of novel technology, according to a Research America article published in 2017. In comparison, the industrial sector contributed 67% of the total expenditure or around USD 121.8 billion, to medical and health research and development operations.

Opportunities

- Technological advancements

Other detection or screening formats may become more accessible and other sections of microbial (and viral) genomes may be targeted more regularly, recent improvements in the speed with which primary genome sequences can be gathered and examined. For instance, complex pools of microbial nucleic acid can be efficiently and in massively parallel screened for specific agents using high-density oligonucleotide or amplified DNA products. This technological platform does away with the need to clone and sequence many different microbial molecules, which is crucial when examining clinical specimens.

Restraints/Challenges

- High cost of identification tests

The most widely used methods for identifying microbial infections rely on established clinical microbiology surveillance techniques, which have a number of important disadvantages. Pathogens can be identified using conventional culture and susceptibility testing, but these procedures are time-consuming, expensive and dependent on labile natural products. More critically, virulence factors are not specifically characterized by the pathogen identification techniques that are frequently employed. All of these reasons limit market expansion.

This pathogen detection market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the pathogen detection market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Middle East and Africa Pathogen Detection Market Scope

The pathogen detection market is segmented on the basis of type, consistency, culture media, contaminant type, total count, food type, technology, customer type, application, end user and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Products

- Services

Consistency

- Solid Media

- Liquid Media

Culture Media

- Chemical Composition

- Synthetic Media

Contaminant Type

- Salmonella

- E. Coli

- Listeria

- Campylobacter

- Clostridium Perfringens

- Pseudomonas

- Cronobacter

- Coliforms

- Legionella

- Others

Total Count

- Spoiling Organisms

- Yeast and Moulds

- Others

Technology

- Rapid

- Traditional

- Other Molecular-Based Tests

Customer Type

- Service Lab

- Industry

- Governmental/Non-Profit Organization

Application

- Diagnostics

- Pathology

- Forensics

- Clinical Research

- Drug Discovery

End User

- Pathology Laboratories

- Diagnostic Centers

- Hospitals

- Biotechnology Companies

- Pharmaceutical Companies

- Culture Collection Repositories

- Cooling Towers

- Blood Banks

- Others

Distribution Channel

- Direct Tender

- Retail Sales

Pathogen Detection Market Regional Analysis/Insights

The pathogen detection market is analyzed and market size insights and trends are provided by country, type, consistency, culture media, contaminant type, total count, food type, technology, customer type, application, end user and distribution channel as referenced above.

The countries covered in the pathogen detection market report are Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

South Africa is dominating the market due to the service providers who offer testing services have taken steps to sell their goods in the Middle East region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Healthcare Infrastructure Growth Installed base and New Technology Penetration

The pathogen detection market also provides you with detailed market analysis for every country growth in healthcare expenditure for capital equipment, installed base of different kind of products for pathogen detection market, impact of technology using life line curves and changes in healthcare regulatory scenarios and their impact on the pathogen detection market. The data is available for historic period 2011-2021.

Competitive Landscape and Pathogen Detection Market Share Analysis

The pathogen detection market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to pathogen detection market.

Some of the major players operating in the pathogen detection market are:

- Merck KGaA (Germany)

- Thermo Fisher Scientific (U.S.)

- BIOMÉRIEUX (France)

- Agilent Technologies, Inc. (U.S.)

- BD (U.S.)

- biotools (U.S.)

- SGS Société Générale de Surveillance SA (Switzerland)

- Bureau Veritas (India) Private Limited (India)

- Intertek Group plc (U.K.)

- Eurofins Scientific (Luxembourg)

- Mérieux NutriSciences Corporation (France)

- ifp Institut für Produktqualität GmbH (Germany)

- ALS (Australia)

- Microbac Laboratories, Inc. (U.S.)

- FoodChain ID Group, Inc (U.S.)

- AsureQuality (New Zealand)

- Campden BRI (U.K.)

- ANGLE plc (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.