Middle East And Africa Plastic Wrap Market

Market Size in USD Billion

CAGR :

%

USD

1.16 Billion

USD

1.82 Billion

2024

2032

USD

1.16 Billion

USD

1.82 Billion

2024

2032

| 2025 –2032 | |

| USD 1.16 Billion | |

| USD 1.82 Billion | |

|

|

|

|

Middle East and Africa Plastic Wrap Market Size

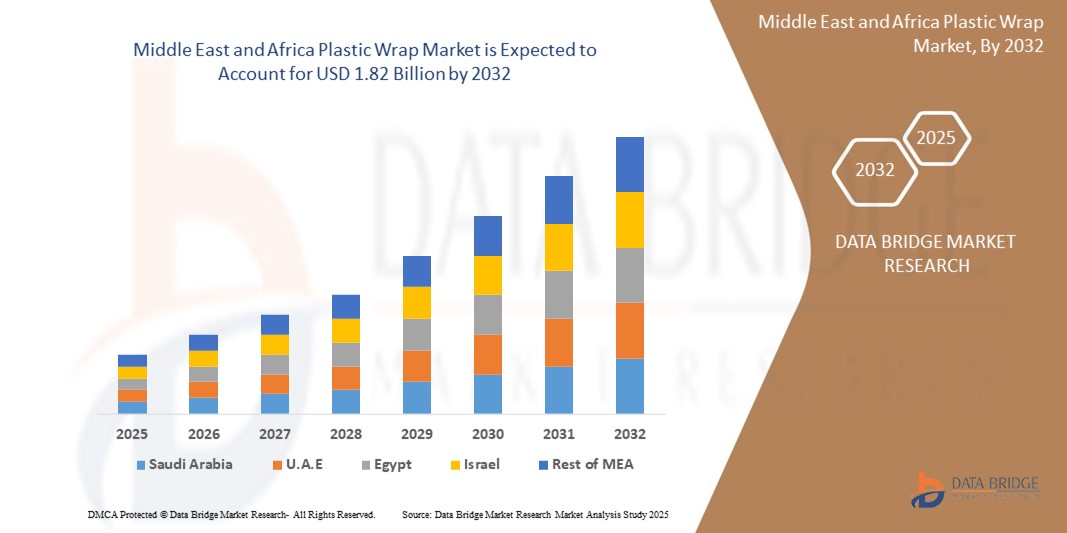

- The Middle East and Africa plastic wrap market size was valued at USD 1.16 billion in 2024 and is expected to reach USD 1.82 billion by 2032, at a CAGR of 5.80% during the forecast period

- The market growth is largely fuelled by the latest advancements in technology. Innovations such as nano-engineered materials and sustainable alternatives

- Increased demand for convenience and food preservation solutions has also driven market expansion. Companies are investing in research to develop eco-friendly options, catering to environmentally conscious consumers and addressing concerns about plastic waste

Middle East and Africa Plastic Wrap Market Analysis

- The demand for plastic wrap for food packaging is poised for growth due to its crucial role in preserving food freshness

- As consumers increasingly opt for convenience and ready-to-eat meals, plastic wrap serves as a reliable solution, offering a protective barrier against moisture, air, and contaminants

- For instance, in the busy urban lifestyle, pre-cut fruits and vegetables packaged with plastic wrap provide convenience without compromising on freshness, driving market expansion

- Africa dominated the Middle East and Africa plastic wrap market in 2024, driven by the expanding food and beverage sector, rising urban population, and increasing reliance on cost-effective food packaging solutions

- Saudi Arabia is expected to witness the highest compound annual growth rate (CAGR) in the Middle East and Africa plastic wrap market due to increasing demand for packaged food products, rapid urbanization, and a growing focus on modern retail infrastructure

- The stretch films segment dominated the plastic wrap market with the largest revenue share of 38.5% in 2024, owing to its widespread use in packaging and pallet unitization across food, beverage, and logistics sectors

Report Scope and Middle East and Africa Plastic Wrap Market Segmentation

|

Attributes |

Middle East and Africa Plastic Wrap Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Plastic Wrap Market Trends

“Sustainability and Biodegradability in Focus”

- A major trend shaping the Middle East and Africa plastic wrap market is the growing shift toward sustainable and biodegradable alternatives, driven by increasing environmental concerns and government regulations on single-use plastics. Brands and manufacturers are investing in eco-friendly wraps made from materials such as PLA, PHA, starch-based polymers, and compostable films

- For instance, in May 2025, Mars Inc.’s Kind Snacks launched a curbside-recyclable paper wrapper pilot for its Dark Chocolate Nuts & Sea Salt bars in the U.S., marking a significant move toward greener alternatives

- Companies such as TIPA Corp and Presto Products’ Fresh-Lock have expanded availability of certified home-compostable pouch zippers across Europe and the Asia-Pacific, supporting zero-waste packaging initiatives

- In addition, there is growing innovation in bio-based plastic films that replicate the flexibility, strength, and clarity of conventional wraps while offering industrial and home compostability. Regulatory support and consumer demand are accelerating this innovation

- This trend is also amplified by the rise of organic and farm-to-table retail formats, which increasingly prefer biodegradable wraps for fruits, vegetables, and deli goods to align with brand values

- As environmental awareness rises, biodegradable and recyclable plastic wraps are no longer niche major players are expected to scale production, signaling a long-term shift toward circular packaging models

Middle East and Africa Plastic Wrap Market Dynamics

Driver

“Rising Demand for Hygienic, Convenient, and Lightweight Packaging Solutions”

- Rising demand for hygienic, convenient, and lightweight packaging solutions across the food and beverage sector is a key factor driving the Middle East and Africa plastic wrap market. These wraps extend shelf life, maintain product integrity, and reduce food waste in retail and household settings

- For instance, in April 2025, DS Smith introduced its 100% recyclable GoChill Cooler, providing an innovative, fiber-based alternative to Styrofoam packaging—an instance of sustainable food containment driving growth

- The surge in ready-to-eat meals, online grocery deliveries, and frozen foods across urban markets has increased demand for stretch and shrink wraps, especially those with moisture-proof and puncture-resistant properties

- In addition, industrial applications, including bundling, warehousing, and transport, rely heavily on plastic wraps for securing goods and reducing handling losses. The rise of e-commerce and global logistics chains continues to fuel demand

- The increasing adoption of multi-layered and metallized wraps with improved barrier properties—protecting against oxygen, UV, and moisture—further strengthens the market outlook across food, pharma, and cosmetic end-users

Restraint/Challenge

“Environmental Concerns and Regulatory Restrictions on Single-Use Plastics”

- Environmental concerns and regulatory restrictions on single-use plastics pose a significant challenge to the plastic wrap market. Governments worldwide are banning or taxing plastic-based packaging to curb plastic pollution, affecting traditional plastic wrap sales

- For instance, the European Union’s single-use plastics directive and similar bans in countries such as India and Canada have mandated producers to transition toward biodegradable alternatives or face market restrictions

- Moreover, consumer pushback against petroleum-based plastics, especially among environmentally conscious demographics, is prompting retailers and manufacturers to seek alternative wrap materials, putting pressure on legacy products

- Another challenge lies in recycling complexities. Plastic wraps, especially those with multilayer or metallized components, are often not accepted by standard municipal recycling systems, leading to low recovery rates and environmental criticism

- Lastly, the cost of sustainable alternatives, such as compostable wraps or bio-based polymers, is relatively higher than conventional plastic wraps, limiting their uptake in price-sensitive markets. Infrastructure gaps in composting or recycling facilities further hinder their adoption

- To sustain growth, the industry must focus on innovation, regulatory alignment, and consumer education around disposal and end-of-life value while developing cost-effective green alternatives

Middle East and Africa Plastic Wrap Market Scope

The market is segmented on the basis of type, material, feature, processing type, transparency, hardness, thickness, distribution channel, and end-user.

• By Type

On the basis of type, the plastic wrap market is segmented into Stretch Films, Shrink Films, Metallized Films, Twist Film, Release Film, Twist Rope, and Others. The Stretch Films segment dominated the Plastic Wrap market with the largest revenue share of 38.5% in 2024, owing to its widespread use in packaging and pallet unitization across food, beverage, and logistics sectors. Stretch films are favored for their elasticity, cost-effectiveness, and ability to tightly secure goods without adhesives or heat.

The Metallized Films segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for high-barrier packaging in snack foods and pharmaceutical applications. These films offer excellent protection against light, moisture, and oxygen, enhancing shelf life.

• By Material

On the basis of material, the plastic wrap market is segmented into Polypropylene (PP), Polyethylene (PE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), Ethylene Vinyl Alcohol Copolymer (EVOH), Ethylene-Vinyl Acetate (EVA), Nylon, and Others. The Polyethylene (PE) segment held the largest market share of 42.1% in 2024, supported by its flexibility, cost-efficiency, and widespread use in food and industrial packaging. Both LDPE and LLDPE are extensively used for stretch and shrink applications.

The EVOH segment is expected to witness the fastest growth rate from 2025 to 2032, due to its superior gas barrier properties, making it ideal for vacuum packaging and extending food shelf life.

• By Feature

On the basis of feature, the plastic wrap market is segmented into Moisture Proof and Water Soluble. The Moisture Proof segment dominated the market in 2024 with a market share of 68.9%, driven by the demand for moisture-resistant packaging in food and pharma sectors.

The Water Soluble segment is expected to witness the fastest growth rate from 2025 to 2032, with sustainability initiatives encouraging the adoption of dissolvable packaging in personal care and detergent pods.

• By Processing Type

Based on processing type, the market is segmented into Casting, Multiple Extrusion, Blow Molding, and Injection Molding. The Blow Molding segment held the largest market share in 2024, owing to its dominance in producing thin, flexible films ideal for food and consumer goods packaging.

The Multiple Extrusion segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for multilayer structures that provide superior mechanical and barrier properties.

• By Transparency

By transparency, the plastic wrap market is classified into Transparent, Translucent, and Opaque. The Transparent segment led the market in 2024 with a market share of 51.3%, favored for its clarity and use in product display packaging.

The Opaque segment is expected to witness the fastest growth rate from 2025 to 2032, especially for packaging light-sensitive pharmaceutical and cosmetic products.

• By Hardness

On the basis of hardness, the market is segmented into Soft and Rigid. The Soft segment dominated the market in 2024 with a revenue share of 59.7%, largely due to the popularity of flexible wraps in consumer and industrial packaging.

The Rigid segment is expected to witness the fastest growth rate from 2025 to 2032, in applications where structural integrity and puncture resistance are critical, such as chemical packaging.

• By Thickness

Based on thickness, the plastic wrap market is segmented into Below 8 Microns, 8 to 14 Microns, 14 to 20 Microns, and 20 Microns and Above. The 8 to 14 Microns segment held the largest market share in 2024, as it balances flexibility and durability, making it suitable for food and retail packaging.

The Below 8 Microns category is expected to witness the fastest growth rate from 2025 to 2032, due to efforts to reduce material usage and enhance film performance.

• By Distribution Channel

On the basis of distribution channel, the plastic wrap market is segmented into E-commerce, Convenience Store, Retail Stores, Supermarket/Hypermarket, and Others. The Supermarket/Hypermarket segment led the market in 2024 with a share of 34.6%, benefiting from bulk availability and consumer preference for in-store selection.

The E-commerce segment is expected to witness the fastest growth rate from 2025 to 2032, as online platforms enable access to a wide range of products and cater to small businesses and end-users directly.

• By End-User

On the basis of end-user, the market is segmented into Food and Beverages, Pharmaceuticals, Personal Care and Cosmetics, Chemical, and Others. The Food and Beverages segment dominated in 2024 with a market share of 47.8%, driven by increasing demand for perishable food preservation and ready-to-eat packaging.

The Pharmaceutical segment is expected to witness the fastest growth rate from 2025 to 2032, as tamper-evident and barrier packaging gain importance in regulated healthcare markets.

Middle East and Africa Plastic Wrap Market Regional Analysis

- Africa dominated the Middle East and Africa plastic wrap market in 2024, driven by the expanding food and beverage sector, rising urban population, and increasing reliance on cost-effective food packaging solutions

- The widespread use of plastic wrap for preserving perishables in households, informal markets, and small retail outlets supports steady market demand. In addition, the region’s growing food processing and distribution networks are accelerating the uptake of plastic wraps across various applications

- Improvements in cold chain logistics and packaging infrastructure further enhance the market potential across African nations

Saudi Arabia Plastic Wrap Market Insight

The Saudi Arabia is expected to witness the fastest growth rate from 2025 to, fueled by rising demand for packaged and convenience foods, along with increased urbanization and lifestyle shifts. The country’s growing retail and hospitality sectors are contributing to higher usage of plastic wrap in food storage and presentation. In addition, national initiatives to strengthen domestic manufacturing and food security are encouraging the adoption of efficient packaging solutions. The push toward hygienic and extended shelf-life packaging is further driving market growth.

Middle East and Africa Plastic Wrap Market Share

The Middle East and Africa Plastic Wrap industry is primarily led by well-established companies, including:

- Napco National (Saudi Arabia)

- Taghleef Industries (U.A.E)

- Zubairi Plastic Bags Industry LLC (U.A.E)

- INTERPLAST Co. Ltd. (U.A.E)

- Hotpack Packaging Industries LLC (U.A.E)

- Gulf Plastic Industries Co. SAOC (Oman)

- Premier Packaging Industries LLC (U.A.E)

- Plastic Packaging Technologies (Pty) Ltd. (South Africa)

- Afroplast (South Africa)

- Flexpak (South Africa)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 SECONDARY SOURCES

2.15 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET: RESEARCH SNAPSHOT

2.16 ASSUMPTIONS

3 MARKET OVERVIEW-MIDDLE EAST AND AFRICA

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 MARKET OVERVIEW-WESTERN AFRICA (FOCUSSING GUINEA CONAKRY)

4.1 DRIVERS

4.2 RESTRAINTS

4.3 OPPORTUNITIES

4.4 CHALLENGES

5 EXECUTIVE SUMMARY

6 PREMIUM INSIGHTS

6.1 RAW MATERIAL COVERAGE

6.2 PRODUCTION CONSUMPTION ANALYSIS

6.3 IMPORT EXPORT SCENARIO

6.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

6.5 PORTER’S FIVE FORCES

6.6 VENDOR SELECTION CRITERIA

6.7 PESTEL ANALYSIS

6.8 REGULATION COVERAGE

6.8.1 PRODUCT CODES

6.8.2 CERTIFIED STANDARDS

6.8.3 SAFETY STANDARDS

6.8.3.1. MATERIAL HANDLING & STORAGE

6.8.3.2. TRANSPORT & PRECAUTIONS

6.8.3.3. HARAD IDENTIFICATION

7 PRICE INDEX

8 PRODUCTION CAPACITY OUTLOOK

9 SUPPLY CHAIN ANALYSIS

9.1 OVERVIEW

9.2 LOGISTIC COST SCENARIO

9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

10 CLIMATE CHANGE SCENARIO

10.1 ENVIRONMENTAL CONCERNS

10.2 INDUSTRY RESPONSE

10.3 GOVERNMENT’S ROLE

10.4 ANALYST RECOMMENDATIONS

11 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY TYPE, (2018-2032), (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 STRETCH FILMS

11.2.1 STRETCH FILMS, BY TYPE

11.2.1.1. MACHINE STRETCH FILM

11.2.1.2. HAND STRETCH FILM

11.2.1.3. MINI STRETCH FILM

11.2.1.4. PRE STRETCH FILM

11.2.1.5. PRINTED STRETCH FILM

11.2.1.6. OXO-BIODEGRADABLE STRETCH FILM

11.2.1.7. UVI STRETCH FILM

11.2.1.8. VCI STRETCH FILM

11.2.1.9. COLOR TINTED STRETCH FILM

11.3 SHRINK FILMS

11.3.1 SHRINK FILMS, BY MATERIAL

11.3.1.1. POLYOLEFIN SHRINK FILM

11.3.1.2. PVC SHRINK FILM

11.3.1.3. LDPE SHRINK FILM

11.4 AGRICULTURAL FILMS

11.5 BUBBLE WRAP

11.6 VCI FILMS

11.7 SURFACE PROTECTION FILMS

11.8 AIR CUSHION PACKAGING FILMS

11.9 METALIZED FILMS

11.1 TWIST FILM

11.11 RELEASE FILM

11.12 TWIST ROPE

11.13 OTHERS

12 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY MATERIAL, (2018-2032), (USD MILLION)

12.1 OVERVIEW

12.2 POLYPROPYLENE (PP)

12.3 POLYETHYLENE (PE)

12.3.1 LDPE

12.3.2 HDPE

12.3.3 OTHERS

12.4 POLYVINYL CHLORIDE (PVC)

12.5 POLYETHYLENE TEREPHTHALATE (PET)

12.6 VINYL ALCOHOL COPOLYMER (EVOH)

12.7 ETHYLENE-VINYL ACETATE (EVA)

12.8 NYLON

12.9 OTHERS

13 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY FEATURE, (2018-2032), (USD MILLION)

13.1 OVERVIEW

13.2 MOISTURE PROOF

13.3 WATER SOLUBLE

14 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY PROCESSING TYPE, (2018-2032), (USD MILLION)

14.1 OVERVIEW

14.2 CASTING

14.3 MULTIPLE EXTRUSION

14.4 BLOW MOLDING

14.5 INJECTION MOLDING

15 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY TRANSPARENCY, (2018-2032), (USD MILLION)

15.1 OVERVIEW

15.2 TRANSPARENT

15.3 TRANSLUCENT

15.4 OPAQUE

16 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY HARDNESS, (2018-2032), (USD MILLION)

16.1 OVERVIEW

16.2 SOFT/FLEXIBLE

16.3 RIGID

17 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY THICKNESS, (2018-2032), (USD MILLION)

17.1 OVERVIEW

17.2 LESS THAN 20 MICRONS

17.3 21-30 MICRONS

17.4 31-40 MICRONS

17.5 41-50 MICRONS

17.6 MORE THAN 50 MICRONS

18 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY END USER, (2018-2032), (USD MILLION)

18.1 OVERVIEW

18.2 HOUSEHOLD

18.3 CATERING

18.4 PACKAGING

18.5 FOOD & BEVERAGES

18.5.1 FOOD & BEVERAGES, BY TYPE

18.5.1.1. MEAT

18.5.1.2. FISH

18.5.1.3. POULTRY

18.5.1.4. DAIRY PRODUCTS

18.5.1.5. OTHERS

18.6 PHARMACEUTICALS

18.7 PERSONAL CARE & COSMETICS

18.8 OTHERS

19 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, BY REGION, (2018-2032), (USD MILLION)

MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

19.1 MIDDLE EAST AND AFRICA

19.1.1 MIDDLE EAST

19.1.1.1. BAHRAIN

19.1.1.2. UNITED ARAB EMIRATES

19.1.1.3. KUWAIT

19.1.1.4. OMAN

19.1.1.5. QATAR

19.1.1.6. SAUDI ARABIA

19.1.1.7. REST OF MIDDLE EAST

19.1.2 AFRICA

19.1.2.1. NORTHERN AFRICA

19.1.2.1.1. EGYPT

19.1.2.1.2. LIBYA

19.1.2.1.3. TUNISIA

19.1.2.1.4. ALGERIA

19.1.2.1.5. MOROCCO

19.1.2.1.6. MAURITANIA

19.1.2.2. EASTERN AFRICA

19.1.2.2.1. KENYA

19.1.2.2.2. TANZANIA

19.1.2.2.3. ETHIOPIA

19.1.2.2.4. UGANDA

19.1.2.2.5. RWANDA

19.1.2.2.6. BURUNDI

19.1.2.2.7. DJIBOUTI

19.1.2.2.8. ERITREA

19.1.2.2.9. SOMALIA

19.1.2.3. WESTERN AFRICA

19.1.2.3.1. GUINEA (CONAKRY)

19.1.2.3.2. GHANA

19.1.2.3.3. NIGERIA

19.1.2.3.4. SENEGAL

19.1.2.3.5. CÔTE D’IVOIRE

19.1.2.3.6. BURKINA FASO

19.1.2.3.7. MALI

19.1.2.3.8. SIERRA LEONE

19.1.2.3.9. LIBERIA

19.1.2.3.10. TOGO

19.1.2.3.11. BENIN

19.1.2.3.12. NIGER

19.1.2.3.13. CAPE VERDE

19.1.2.3.14. THE GAMBIA

19.1.2.4. CENTRAL AFRICA

19.1.2.4.1. DEMOCRATIC REPUBLIC OF CONGO (DRC)

19.1.2.4.2. CAMEROON

19.1.2.4.3. ANGOLA

19.1.2.4.4. GABON

19.1.2.4.5. REPUBLIC OF CONGO (CONGO-BRAZZAVILLE)

19.1.2.4.6. CHAD

19.1.2.4.7. CENTRAL AFRICAN REPUBLIC (CAR)

19.1.2.4.8. EQUATORIAL GUINEA

19.1.2.4.9. SÃO TOMÉ AND PRÍNCIPE

19.1.2.5. SOUTHERN AFRICA

19.1.2.5.1. SOUTH AFRICA

19.1.2.5.2. BOTSWANA

19.1.2.5.3. NAMIBIA

19.1.2.5.4. ZIMBABWE

19.1.2.5.5. ZAMBIA

19.1.2.5.6. LESOTHO

19.1.2.5.7. ESWATINI (SWAZILAND)

19.1.2.5.8. MOZAMBIQUE

19.1.2.5.9. MALAWI

19.1.2.5.10. ANGOLA

20 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET, COMPANY LANDSCAPE

20.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

20.2 COMPANY SHARE ANALYSIS: WESTERN AFRICA

20.3 COMPANY SHARE ANALYSIS: GUINEA (CONAKRY)

20.4 MERGERS AND ACQUISITIONS

20.5 NEW PRODUCT DEVELOPMENT AND APPROVALS

20.6 EXPANSIONS

20.7 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

21 MIDDLE EAST AND AFRICA PLASTIC WRAP MARKET - COMPANY PROFILES

21.1 SIGMA STRETCH FILM

21.1.1 COMPANY SNAPSHOT

21.1.2 PRODUCT PORTFOLIO

21.1.3 SWOT ANALYSIS

21.1.4 REVENUE ANALYSIS

21.1.5 RECENT UPDATES

21.2 NATIONAL PLASTIC FACTORY (NPF)

21.2.1 COMPANY SNAPSHOT

21.2.2 PRODUCT PORTFOLIO

21.2.3 SWOT ANALYSIS

21.2.4 REVENUE ANALYSIS

21.2.5 RECENT UPDATES

21.3 ORIENT PLAST

21.3.1 COMPANY SNAPSHOT

21.3.2 PRODUCT PORTFOLIO

21.3.3 SWOT ANALYSIS

21.3.4 REVENUE ANALYSIS

21.3.5 RECENT UPDATES

21.4 ASPCO

21.4.1 COMPANY SNAPSHOT

21.4.2 PRODUCT PORTFOLIO

21.4.3 SWOT ANALYSIS

21.4.4 REVENUE ANALYSIS

21.4.5 RECENT UPDATES

21.5 ROWAD

21.5.1 COMPANY SNAPSHOT

21.5.2 PRODUCT PORTFOLIO

21.5.3 SWOT ANALYSIS

21.5.4 REVENUE ANALYSIS

21.5.5 RECENT UPDATES

21.6 CHEMCO

21.6.1 COMPANY SNAPSHOT

21.6.2 PRODUCT PORTFOLIO

21.6.3 SWOT ANALYSIS

21.6.4 REVENUE ANALYSIS

21.6.5 RECENT UPDATES

21.7 ADVANCED FLEXIBLE PACKAGING CO

21.7.1 COMPANY SNAPSHOT

21.7.2 PRODUCT PORTFOLIO

21.7.3 SWOT ANALYSIS

21.7.4 REVENUE ANALYSIS

21.7.5 RECENT UPDATES

21.8 THE GLAD PRODUCTS COMPANY

21.8.1 COMPANY SNAPSHOT

21.8.2 PRODUCT PORTFOLIO

21.8.3 SWOT ANALYSIS

21.8.4 REVENUE ANALYSIS

21.8.5 RECENT UPDATES

21.9 LAKELAND

21.9.1 COMPANY SNAPSHOT

21.9.2 PRODUCT PORTFOLIO

21.9.3 SWOT ANALYSIS

21.9.4 REVENUE ANALYSIS

21.9.5 RECENT UPDATES

21.1 THERMO FISHER SCIENTIFIC INC.

21.10.1 COMPANY SNAPSHOT

21.10.2 PRODUCT PORTFOLIO

21.10.3 SWOT ANALYSIS

21.10.4 REVENUE ANALYSIS

21.10.5 RECENT UPDATES

21.11 SPECIALTY POLYFILMS PVT. LTD.

21.11.1 COMPANY SNAPSHOT

21.11.2 PRODUCT PORTFOLIO

21.11.3 SWOT ANALYSIS

21.11.4 REVENUE ANALYSIS

21.11.5 RECENT UPDATES

21.12 JINDAL POLYWRAP PVT. LTD.

21.12.1 COMPANY SNAPSHOT

21.12.2 PRODUCT PORTFOLIO

21.12.3 SWOT ANALYSIS

21.12.4 REVENUE ANALYSIS

21.12.5 RECENT UPDATES

21.13 COVERIS

21.13.1 COMPANY SNAPSHOT

21.13.2 PRODUCT PORTFOLIO

21.13.3 SWOT ANALYSIS

21.13.4 REVENUE ANALYSIS

21.13.5 RECENT UPDATES

21.14 CHICWRAP

21.14.1 COMPANY SNAPSHOT

21.14.2 PRODUCT PORTFOLIO

21.14.3 SWOT ANALYSIS

21.14.4 REVENUE ANALYSIS

21.14.5 RECENT UPDATES

21.15 REYNOLDS CONSUMER PRODUCTS

21.15.1 COMPANY SNAPSHOT

21.15.2 PRODUCT PORTFOLIO

21.15.3 SWOT ANALYSIS

21.15.4 REVENUE ANALYSIS

21.15.5 RECENT UPDATES

21.16 BERRY GLOBAL INC

21.16.1 COMPANY SNAPSHOT

21.16.2 PRODUCT PORTFOLIO

21.16.3 SWOT ANALYSIS

21.16.4 REVENUE ANALYSIS

21.16.5 RECENT UPDATES

21.17 KOROPLAST TEMIZLIK AMBALAJ ÜRÜNLERI SAN. VE DIŞ TIC. A.Ş.

21.17.1 COMPANY SNAPSHOT

21.17.2 PRODUCT PORTFOLIO

21.17.3 SWOT ANALYSIS

21.17.4 REVENUE ANALYSIS

21.17.5 RECENT UPDATES

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

22 RELATED REPORTS

23 QUESTIONNAIRE

24 CONCLUSION

25 ABOUT DATA BRIDGE MARKET RESEARCH

Middle East And Africa Plastic Wrap Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Plastic Wrap Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Plastic Wrap Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.