Market Analysis and Size

Industrialization and urbanization have changed the processing techniques and ways of shipment of media or fluids, which has led to the need for retort packaging in almost every industry where the fluids play a major role. Therefore, retort packaging market has been driven by the need for safer production and an adequate infrastructure.

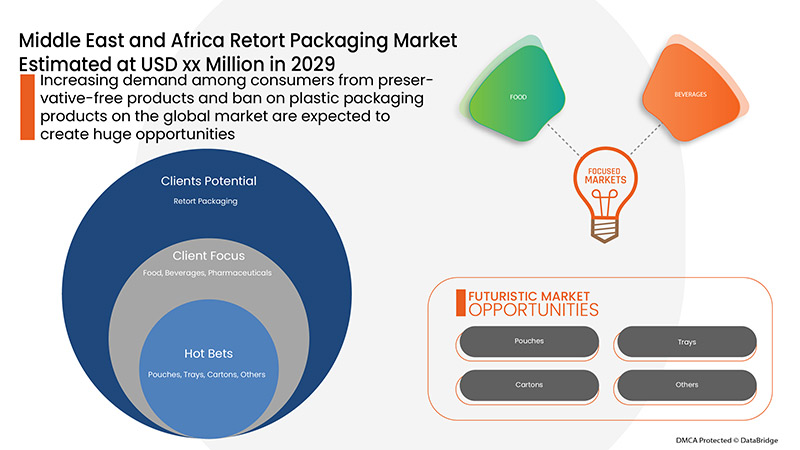

Some of the factors which are driving the market are the Increasing demand among consumers from preservative-free products, rising demand for sustainable and aesthetic packaging solutions, and the growing demand for intelligent packaging to avoid food wastage. However, high cost associated with research and development activities is the restraint hampering the growth of the market.

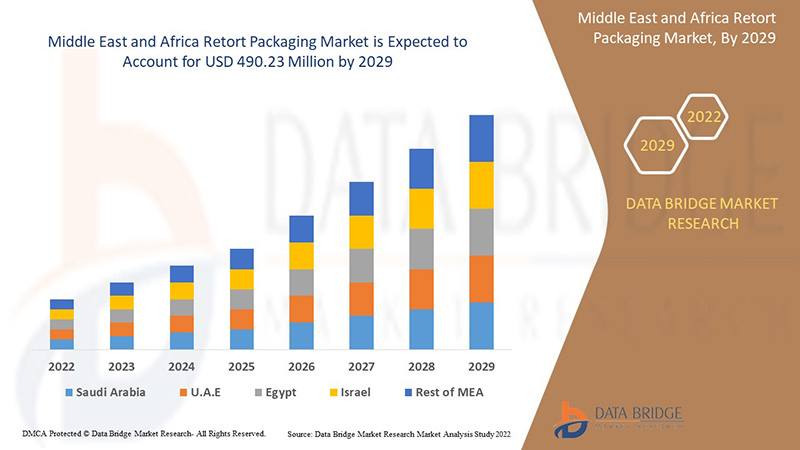

Data Bridge Market Research analyses that the Retort packaging market is expected to reach the value of USD 490.23 million by 2029, at a CAGR of 4.6% during the forecast period. “Pouches" accounts for the largest product type segment in the Retort packaging market due to changing dietary patterns and rising western influences have escalated the demand for packaged and single serve food products. The Retort packaging market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Product Type (Pouches, Trays, Cartons and Others), By Material (PET, Polypropylene, Aluminium Foil, Polyamide (PA), Paper & Paperboard, EVOH and Others), By Distribution Channel (Offline and Online), By End-Use (Food, Beverages, Pharmaceuticals and Others) |

|

Countries Covered |

South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and the rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA) |

|

Market Players Covered |

ProAmpac, Coveris, FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, among others. |

Market Definition

Retort packaging is a type of food packaging made from a laminate of flexible plastic and metal foils. It allows the sterile packaging of a wide variety of food and drink handled by aseptic processing, and is used as an alternative to traditional industrial canning methods. Packaged foods range from water to fully cooked, thermo-stabilized (heat-treated), high-caloric (1,300 kcal on average) meals like Meals, Ready-to-Eat (MREs), which can be eaten cold, warmed by submerging in hot water, or heated with a flameless ration heater, a meal component first introduced by the military in 1992. Field rations, space food, fish products, camping meals, quick noodles, and companies like Capri Sun and Tasty Bite all employ retort packaging.

Initially, the retort packaging were developed for industrial applications and pipe-organs. Gradually the design was adapted in the bio-pharmaceutical industry for sterilizing methods by using compliant materials. And now it is being used in almost every industry for safe production and adequate infrastructure, such as food & beverage, and chemical processing among other verticals.

Retort Packaging Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints and challenges. All of this is discussed in detail as below:

- Increasing demand among consumers for preservative-free products

Retort takes place when non-sterile products are hermetically sealed, which literally means non-sterile packaging. The packaging is loaded into a retort pressure vessel and subjected to pressurized steam. The product is also exposed to high temperatures for a much longer period than in hot-filling. The additional time can significantly deteriorate the overall quality and nutritional content of the product.

The increasing demand among consumers across the globe for preservative-free products is a key driver for the Middle East and Africa retort packaging market. As consumers are getting more concerned about the harmful effects of preservatives in their beverages, the demand for preservative-free products is at its peak.

- Increase in demand for retort packaging by airlines

Recently, there is an increasing shift of consumers toward sustainable and environment friendly packaging options that has further introduced fully recyclable packaging and stand-up bags of various designs. In addition to providing environmental advantages, sustainable packaging can also help companies to increase profits and eliminate unnecessary manufacturing spare parts, thereby improving the safety of production lines, and minimizing disposal costs. The main objective of packaging is not only to protect the product from damage during transit, but to protect the warehouse and retail shops before selling the product. Different types of packaging are used for different kind of products. Also, retort packaging is used for heavy and bulky food products and also used for other products.

- Growing demand for intelligent packaging to avoid food wastage

Intelligent packaging offers various solutions to reduce food wastage as it provides different indicators to avoid food spoilage. Thus, increasing food wastage is attracting consumers to buy food with intelligent packaging.

Intelligent packaging includes indicators (time-temperature indicators; integrity or gas indicators; freshness indicators); barcodes and radiofrequency identification tags (RFID); sensors (biosensors; gas sensors; fluorescence-based oxygen sensors), among others. Hence, intelligent packaging helps food manufacturers to track the status of their food products in real-time, thus contributing to a reduction in food wastage.

Furthermore, intelligent packaging can also act as the primary tool for consumers to choose their products at the retail level as intelligent packaging concepts can enable consumers to judge the quality of the products. As a result, intelligent packaging is expected to play a major role in attracting consumers.

- High cost associated with research and development activities

Research and development expenses are associated directly with the research and development of a company's goods or services and any intellectual property generated in the process. A company generally incurs R&D expenses in the process of finding and creating new products or services.

Packaging companies rely heavily on their research and development capabilities; so they can relatively outsize R&D expenses. For instance, changing the preferences of consumers from regular packaging to intelligent and active packaging, increasing consumers' awareness about food safety, among others. Thus, companies have to invest in research & development activities to diversify their business and find new growth opportunities as technology continues to evolve.

- Ban on plastic packaging products on the Middle East and Africa market

With rise in environmental concerns in several regions, the government has taken strict steps toward banning single-use plastic products and non-biodegradable packaging products in the market. This is because plastic products take longer to decompose and is dangerous for aquatic and land animals.

For instance,

Natural Environment estimates that approximately 100,000 sea turtles and other marine animals die every year because they get strangled in bags or mistake them for food.

In North America, single-use plastic bags used for the food products and consumer goods packaging are banned. As a result, the demand for paperboard and retort packaging is increasing in the region.

Several types of packaging are used in different applications, resulting in the production of the waste and are very harmful to the environment. Plastic packaging is used for consumer goods packaging, which produces non-biodegradable plastic packaging waste, releases toxic gases in the soil, which is dangerous for animals and ground water. Hence, steps have been taken to ban plastic bag packaging as it is harmful to the environment.

- Supply chain disruption due to pandemic

The COVID-19 has disrupted the supply chain and has declined markets of retort packaging worldwide. Disruptions have led to the delayed stock of the products as well as lower access, and supplies of food and beverage products. With the persistent persistence of COVID-19, there have been restrictions on transportation, import, and export of materials. Also, with the movement restriction on workers as well, the manufacturing of retort packaging has been affected due to which the demand for consumers has not been fulfilled. Also, with restrictions on import and export, it made it difficult for the manufacturers to supply the raw materials and their end products across the countries in the world which also has impacted the prices of retort packaging. Thus, with ongoing restrictions due to COVID-19, the supply chain for retort packaging has been disrupted which is creating a major challenge for the manufacturers.

With the persistence of COVID-19 and restrictions on movement, there is a disruption in the supply chain which is posing a major challenge for the Middle East and Africa retort packaging market.

Post COVID-19 impact on retort packaging market

COVID-19 created a major impact on the retort packaging market as almost every country has opted for the shutdown for every production facility except the ones dealing in producing the essential goods. The government has taken some strict actions such as the shutdown of production and sale of non-essential goods, blocked international trade, and many more to prevent the spread of COVID-19. The only business which is dealing in this pandemic situation is the essential services that are allowed to open and run the processes.

Due to the outbreak of the pandemic caused by the virus, many small sectors were closed down and on the other hand some sectors decided to cut off some of the employees which resulted in a major unemployment. Retort packaging are also used in the packaging of products as well as in industries. Due to the outbreak of a pandemic, the demand for such products has gone up to an extent especially for the medical sector, healthcare, pharmaceutical, groceries, e-commerce, and various other sectors. But the unexpected demand, along with limited production capacities and supply chain interruptions is continuing to cause difficulties in all of these industries.

Manufacturers are making various strategic decisions to bounce back post-COVID-19. The players are conducting multiple research and development activities to improve the technology involved in the retort packaging. With this, the companies will bring advanced and accurate controllers to the market. In addition, the use of retort packaging by government authorities in food and beverages has led to the market's growth.

Recent Development

- In February 2021, SEE has announced the acquisition of Foxpak Flexibles Ltd. (Foxpak) under SEE Ventures, its initiative for investing in disruptive technologies and business models to accelerate growth. Foxpak has leveraged digital printing capabilities to print directly on its flexible packaging materials to empower their customers’ brands. Their solutions can be quickly scaled up or down to meet the production requirements for customers of any size. This Acquisition will help in strengthen cash flows and earnings. Further expands company’s packaging portfolio.

- In December 2021, Sonoco Acquired Ball Metalpack. Acquisition Complements Sonoco’s Largest Consumer Packaging Franchise. Ball Metalpack, a leading manufacturer of sustainable metal packaging for food and household products and the largest aerosol producer in North America. This Acquisition will help in strengthen cash flows and earnings. Further expands company’s packaging portfolio.

Middle East and Africa Retort Packaging Market Scope

The Retort packaging market is segmented on the basis of product type, material, distribution channel, and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Trays

- Pouches

- Cartons

- Others

On the basis of product type, the Middle East and Africa retort packaging market is segmented into trays, pouches, cartons and others.

Material

- PET

- Polypropylene

- Aluminium Foil

- Polyamide (PA)

- Paper & Paperboard

- EVOH

- Others

On the basis of material, the Middle East and Africa retort packaging market has been segmented into PET, polypropylene, aluminium foil, polyamide (PA), paper & paperboard, EVOH and Others.

Distribution Channel

- Offline

- Online

On the basis of distribution channel, the Middle East and Africa retort packaging market has been segmented into offline and online.

End Use

- Food

- Beverages

- Pharmaceuticals

- Others

On the basis of end-use, the Middle East and Africa retort packaging market has been segmented into food, beverages, pharmaceuticals and others.

Retort Packaging Market Regional Analysis/Insights

The retort packaging market is analysed and market size insights and trends are provided by product type, material, distribution channel, and end-use industry as referenced above.

The countries covered in the Retort packaging market report are South Africa, Saudi Arabia, U.A.E., Israel, Egypt, and the rest of the Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

South Africa dominates the Asia-Pacific retort packaging market. The demand in this region is projected to be driven by increase in demand for retort packaging by food and beverages.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Middle East and Africa brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Retort Packaging Market Share Analysis

The Retort packaging market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to retort packaging market.

Some of the major players operating in the retort packaging market are ProAmpac, Coveris, Berry Middle East and Africa Inc., FLAIR Flexible Packaging Corporation, IMPAK CORPORATION, PORTCO PACKAGING, Constantia Flexibles, Mondi, Tetra Pak, Clifton Packaging Group Limited, DNP America, LLC., Sonoco Products Company, Amcor plc, among others

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF MIDDLE EAST & AFRICA RETORT PACKAGING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TYPE TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.1.1 OVERVIEW

4.1.2 DEVELOPMENT OF ADVANCED SMART PACKAGING PRODUCTS

4.1.3 TEMPERATURE BALANCING SMART PACKAGING

4.1.4 SMART PACKAGING TO IMPROVE CONSUMER SAFETY

4.2 REGULATIONS

4.2.1 OVERVIEW

4.2.2 FOOD AND DRUG ADMINISTRATION

4.2.3 EUROPEAN FOOD PACKAGING REGULATIONS

4.2.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

4.3 EMERGING TREND

4.4 PRICE TREND ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 IMPORT-EXPORT SCENARIO

4.7 PORTER’S FIVE FORCE ANALYSIS

4.8 SUPPLIER OVERVIEW

4.9 SUPPLY CHAIN ANALYSIS

4.9.1 OVERVIEW

4.9.2 LOGISTIC COST SCENARIO

4.9.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS

5.1.2 RISING DEMAND FOR SUSTAINABLE AND AESTHETIC PACKAGING SOLUTIONS

5.1.3 GROWING DEMAND FOR INTELLIGENT PACKAGING TO AVOID FOOD WASTAGE

5.1.4 GROWING CONSUMPTION OF PACKAGED PRODUCTS

5.2 RESTRAINTS

5.2.1 HIGH COSTS ASSOCIATED WITH RESEARCH AND DEVELOPMENT ACTIVITIES

5.2.2 AVAILABILITY OF ALTERNATIVES IN THE MARKET

5.3 OPPORTUNITIES

5.3.1 BAN ON PLASTIC PACKAGING PRODUCTS IN THE MIDDLE EAST & AFRICA MARKET

5.3.2 RECENT INNOVATION AND NEW PRODUCT LAUNCHES

5.3.3 INCREASING CASES OF FOOD CONTAMINATION

5.4 CHALLENGE

5.4.1 SUPPLY CHAIN DISRUPTION DUE TO PANDEMIC

6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 POUCHES

6.2.1 STAND-UP-POUCHES

6.2.2 GUSSETED POUCHES

6.2.3 BACK-SEAL QUAD

6.2.4 SPOUTED POUCHES

6.3 TRAYS

6.4 CARTONS

6.5 OTHERS

7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL

7.1 OVERVIEW

7.2 PET

7.3 POLYPROPYLENE

7.4 ALUMINIUM FOIL

7.5 POLYAMIDE (PA)

7.6 PAPER & PAPERBOARD

7.7 EVOH

7.8 OTHERS

8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 OFFLINE

8.3 ONLINE

9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE

9.1 OVERVIEW

9.2 FOOD

9.2.1 READY TO EAT MEALS

9.2.2 MEAT, POULTRY, & SEA FOOD

9.2.3 PET FOOD

9.2.4 BABY FOOD

9.2.5 SOUPS & SAUCES

9.2.6 SPICES & CONDIMENTS

9.2.7 OTHERS

9.3 BEVERAGES

9.3.1 NON-ALCOHOLIC

9.3.2 ALCOHOLIC

9.4 PHARMACEUTICALS

9.5 OTHERS

10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY REGION

10.1 MIDDLE EAST AND AFRICA

10.1.1 SOUTH AFRICA

10.1.2 SAUDI ARABIA

10.1.3 EGYPT

10.1.4 U.A.E.

10.1.5 ISRAEL

10.1.6 REST OF MIDDLE EAST AND AFRICA

11 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: MIDDLE EAST & AFRICA

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 TETRA PAK

13.1.1 COMPANY SNAPSHOT

13.1.2 COMPANY SHARE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENT

13.2 SEALED AIR

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENT

13.3 SONOCO PRODUCTS COMPANY

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 PROAMPAC

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 AMCOR PLC

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 BERRY MIDDLE EAST & AFRICA INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 COMPANY SNAPSHOT

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENT

13.7 CLIFTON PACKAGING GROUP LIMITED

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENT

13.8 CONSTANTIA FLEXIBLES

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENT

13.9 COVERIS

13.9.1 COMPANY SNAPSHOT

13.9.2 RODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 DNP AMERICA, LLC.

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENT

13.11 FLAIR FLEXIBLE PACKAGING CORPORATION

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 FLOETER INDIA RETORT POUCHES (P) LTD

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 HUHTAMAKI

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 IMPAK CORPORATION

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 LD PACKAGING CO .,LTD

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 MONDI

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PAHARPUR 3P

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 PORTCO PACKAGING

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 PRINTPACK

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 WINPAK LTD.

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 3 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 5 MIDDLE EAST & AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 MIDDLE EAST & AFRICA TRAYS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 8 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 MIDDLE EAST & AFRICA CARTONS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 10 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 12 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 13 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 14 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 MIDDLE EAST & AFRICA PET IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 16 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 MIDDLE EAST & AFRICA POLYPROPYLENE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 18 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 MIDDLE EAST & AFRICA ALUMINUM FOIL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 20 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 MIDDLE EAST & AFRICA POLYAMIDE (PA) IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 22 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 MIDDLE EAST & AFRICA PAPER & PAPERBOARD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 24 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 MIDDLE EAST & AFRICA EVOH IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 26 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 28 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 29 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 30 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 MIDDLE EAST & AFRICA OFFLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 32 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 MIDDLE EAST & AFRICA ONLINE IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 34 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 35 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 36 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 38 MIDDLE EAST & AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 39 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 41 MIDDLE EAST & AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 42 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 MIDDLE EAST & AFRICA PHARMACEUTICAL IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 44 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 MIDDLE EAST & AFRICA OTHERS IN RETORT PACKAGING MARKET, BY REGION, 2020-2029 (MILLION UNITS)

TABLE 46 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 47 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY COUNTRY, 2020-2029 (MILLION UNITS)

TABLE 48 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 50 MIDDLE EAST AND AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 52 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 53 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 55 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 56 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 57 MIDDLE EAST AND AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 58 MIDDLE EAST AND AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 59 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 61 SOUTH AFRICA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 63 SOUTH AFRICA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 64 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 65 SOUTH AFRICA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 66 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH AFRICA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 68 SOUTH AFRICA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 69 SOUTH AFRICA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 70 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 SAUDI ARABIA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 72 SAUDI ARABIA POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 74 SAUDI ARABIA RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 75 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 76 SAUDI ARABIA RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 77 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 78 SAUDI ARABIA RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 79 SAUDI ARABIA FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 80 SAUDI ARABIA BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 81 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 EGYPT RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 83 EGYPT POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 85 EGYPT RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 86 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 87 EGYPT RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 88 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 89 EGYPT RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 90 EGYPT FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 91 EGYPT BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.A.E. RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 94 U.A.E. POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 96 U.A.E. RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 97 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 U.A.E. RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 99 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 100 U.A.E. RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 101 U.A.E. FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 102 U.A.E. BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 103 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ISRAEL RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

TABLE 105 ISRAEL POUCHES IN RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 107 ISRAEL RETORT PACKAGING MARKET, BY MATERIAL, 2020-2029 (MILLION UNITS)

TABLE 108 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 109 ISRAEL RETORT PACKAGING MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (MILLION UNITS)

TABLE 110 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 111 ISRAEL RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (MILLION UNITS)

TABLE 112 ISRAEL FOOD IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 113 ISRAEL BEVERAGES IN RETORT PACKAGING MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 114 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 REST OF MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET, BY PRODUCT TYPE, 2020-2029 (MILLION UNITS)

List of Figure

FIGURE 1 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: MIDDLE EAST & AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: END-USE COVERAGE GRID

FIGURE 10 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: SEGMENTATION

FIGURE 11 INCREASING DEMAND AMONG CONSUMERS FOR PRESERVATIVE-FREE PRODUCTS IS EXPECTED TO DRIVE THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 POUCHES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST-GROWING REGION IN THE MIDDLE EAST & AFRICA RETORT PACKAGING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF MIDDLE EAST & AFRICA RETROT PACKAGING MARKET

FIGURE 15 THE BELOW PIE CHART SHOWS THE RESULT OF FOODBORNE OUTBREAKS IN 2018

FIGURE 16 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE, 2021

FIGURE 17 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 18 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 19 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: BY END-USE, 2021

FIGURE 20 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 21 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 22 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 MIDDLE EAST AND AFRICA RETORT PACKAGING MARKET: BY PRODUCT TYPE (2022 & 2029)

FIGURE 25 MIDDLE EAST & AFRICA RETORT PACKAGING MARKET: COMPANY SHARE 2021 (%)

Middle East And Africa Retort Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Retort Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Retort Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.