Middle East And Africa Sleep Apnea Devices Market

Market Size in USD Million

CAGR :

%

USD

253.37 Million

USD

382.98 Million

2025

2033

USD

253.37 Million

USD

382.98 Million

2025

2033

| 2026 –2033 | |

| USD 253.37 Million | |

| USD 382.98 Million | |

|

|

|

|

Middle East and Africa Sleep Apnea Devices Market Size

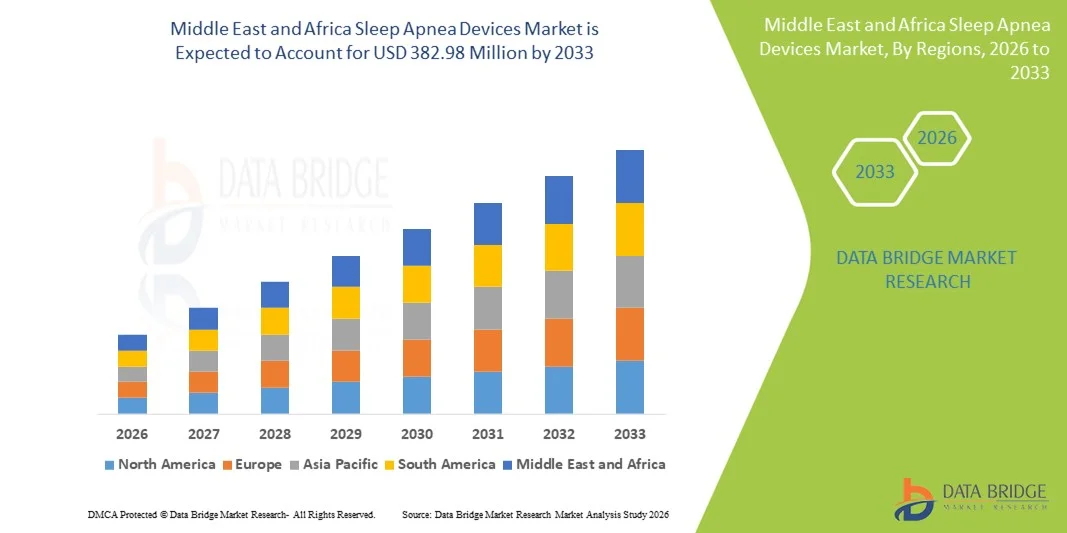

- The global Middle East and Africa sleep apnea devices market size was valued at USD 253.37 million in 2025 and is expected to reach USD 382.98 million by 2033, at a CAGR of 5.3% during the forecast period

- The market expansion in MEA is being driven by increasing prevalence of sleep apnea, rising obesity and geriatric populations, gradual improvements in healthcare infrastructure, and growing awareness of sleep‑related disorders and available diagnostic & therapeutic technologies

- The region’s growth reflects continued healthcare modernization and adoption of sleep diagnostic devices in both clinical and home settings, although uptake remains lower than in developed regions due to under‑diagnosis and limited specialty care access

Middle East and Africa Sleep Apnea Devices Market Analysis

- Sleep apnea devices and therapies, including CPAP, BiPAP, and other treatment solutions, are becoming increasingly vital in Saudi Arabia, United Arab Emirates, and South Africa, driven by rising awareness of sleep disorders, increasing prevalence of obesity, and growing healthcare infrastructure

- The escalating demand for sleep apnea solutions is primarily fueled by the high incidence of obstructive sleep apnea syndrome, rising adoption of device-based therapies, and increasing availability of both clinical and homecare treatment options for adults and geriatric patients

- Saudi Arabia dominated the MEA sleep apnea devices market with the largest revenue share of 42.5% in 2025, characterized by advanced hospital infrastructure, specialty care centers, and high healthcare spending

- United Arab Emirates is expected to be the fastest-growing country during the forecast period driven by increasing adoption of home healthcare solutions and rapid expansion of diagnostic and treatment facilities

- Device segment dominated the market with a share of 58% in 2025, driven by the effectiveness of CPAP and BiPAP systems in treating obstructive and complex sleep apnea syndromes, ease of use, and growing patient compliance with at-home therapy

Report Scope and Middle East and Africa Sleep Apnea Devices Market Segmentation

|

Attributes |

Middle East and Africa Sleep Apnea Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Sleep Apnea Devices Market Trends

Rising Adoption of Home Healthcare and Remote Monitoring

- A significant and accelerating trend in the MEA sleep apnea devices market is the increasing adoption of home healthcare solutions and remote monitoring technologies, enabling patients to receive therapy without frequent hospital visits

- For instance, Philips DreamStation and ResMed AirSense devices allow patients in Saudi Arabia and UAE to monitor CPAP therapy compliance remotely, reducing dependency on clinical visits

- Integration with mobile applications and cloud-based platforms allows healthcare providers to track patient adherence, generate reports, and intervene when therapy issues arise, improving treatment outcomes

- The seamless integration of sleep apnea devices with telehealth and homecare platforms enhances patient convenience and compliance, offering real-time data to clinicians for proactive management

- This trend towards more connected, patient-centric, and accessible therapy solutions is reshaping expectations for sleep apnea management in MEA, encouraging device manufacturers to innovate for remote monitoring features

- The demand for sleep apnea devices with integrated homecare and remote monitoring capabilities is growing rapidly across Saudi Arabia, UAE, and South Africa as patients and providers prioritize convenience, compliance, and continuity of care

- Collaboration between device manufacturers and telehealth providers is creating integrated care solutions, enhancing real-time monitoring and patient engagement in MEA

Middle East and Africa Sleep Apnea Devices Market Dynamics

Driver

Growing Prevalence of Sleep Apnea and Awareness Initiatives

- The increasing prevalence of obstructive sleep apnea and other related disorders, combined with rising awareness campaigns, is a significant driver for the growing demand for sleep apnea devices in MEA

- For instance, government and private healthcare initiatives in UAE and Saudi Arabia are promoting early diagnosis programs in hospitals and clinics to detect sleep apnea in adults and geriatric populations

- As more patients become aware of the health risks associated with untreated sleep apnea, demand for effective therapies such as CPAP and BiPAP devices is rising

- Furthermore, the expanding adoption of device-based therapies across hospitals, diagnostic centers, and home healthcare settings is positioning sleep apnea devices as an essential healthcare solution

- Improved access to healthcare infrastructure, coupled with increasing investments in specialty care centers and home-based monitoring, is further accelerating adoption across key MEA countries

- The convenience of at-home therapy, coupled with remote monitoring and adherence tracking features, is driving higher adoption among patients and clinicians in Saudi Arabia, UAE, and South Africa

- Increasing insurance coverage for sleep apnea treatments in countries such as UAE is encouraging more patients to adopt device-based therapies

- Continuous innovations in CPAP and BiPAP technology, such as quieter operation and better humidification, are enhancing patient comfort and boosting therapy compliance

Restraint/Challenge

High Device Cost and Limited Awareness in Certain Regions

- The relatively high cost of advanced sleep apnea devices, such as CPAP and BiPAP systems, poses a significant challenge to market growth in price-sensitive regions within MEA

- For instance, some patients in South Africa and other African countries may delay or avoid therapy due to affordability concerns, despite the availability of devices in hospitals and clinics

- Limited awareness of sleep apnea symptoms and treatment options in certain countries leads to underdiagnosis and delayed adoption, restricting overall market penetration

- While initiatives in urban centers are improving awareness, rural and semi-urban regions continue to face barriers due to insufficient education and healthcare access

- Overcoming these challenges through awareness campaigns, insurance coverage expansion, and cost-effective device options is essential to unlock the full potential of the MEA market

- Healthcare providers and device manufacturers are focusing on patient education, regional outreach, and affordable device models to address adoption barriers across Saudi Arabia, UAE, and South Africa

- Challenges related to limited trained sleep specialists in certain MEA countries are affecting timely diagnosis and therapy initiation

- Inconsistent regulatory approvals and import restrictions in some African countries are delaying the introduction of advanced sleep apnea devices

Middle East and Africa Sleep Apnea Devices Market Scope

The market is segmented on the basis of disease type, device type, patient demographics, end user, and distribution channel.

- By Disease Type

On the basis of disease type, the MEA sleep apnea devices market is segmented into obstructive sleep apnea syndrome (OSAS), central sleep apnea syndrome, and complex sleep apnea syndrome. The Obstructive Sleep Apnea Syndrome segment dominated the market with the largest revenue share of 61% in 2025, driven by its high prevalence in adults and geriatric populations across Saudi Arabia, UAE, and South Africa. Obstructive sleep apnea is widely recognized by clinicians, leading to greater diagnosis rates and higher adoption of device-based therapies such as CPAP and BiPAP. In addition, patient awareness campaigns and government initiatives to improve early diagnosis have strengthened this segment’s market presence. Hospitals and homecare providers actively recommend device-based treatments, further solidifying OSAS as the leading disease type. The effectiveness of devices in managing symptoms and preventing comorbidities such as cardiovascular disease also contributes to strong market penetration.

Central Sleep Apnea Syndrome is expected to witness the fastest growth, with a projected CAGR of 5.1% from 2026 to 2033, due to rising recognition of the condition in elderly patients with chronic cardiovascular or neurological disorders. Advances in adaptive servo-ventilation therapies and targeted clinical interventions are expanding adoption across specialty care centers and diagnostic clinics. Awareness campaigns focusing on early identification and treatment of central sleep apnea, particularly in urban centers, are also fueling growth. Increasing research and clinical trials in MEA countries are encouraging healthcare providers to adopt specific device-based solutions, enhancing the growth potential of this segment.

- By Type

On the basis of type, the MEA sleep apnea devices market is segmented into device and therapy. The Device segment dominated the market with a share of 58% in 2025, led by CPAP and BiPAP machines which are widely prescribed for obstructive sleep apnea treatment. Devices are preferred due to their proven efficacy, ease of use, and integration with telehealth and homecare monitoring systems, particularly in Saudi Arabia and UAE. Healthcare providers actively promote device use as first-line therapy, while patient compliance is supported by remote adherence monitoring. The market also benefits from continuous innovations such as portable, quiet, and energy-efficient devices, which are boosting patient adoption in both clinical and homecare settings. High awareness among adult and geriatric populations further supports the dominance of devices in the market.

The Therapy segment is anticipated to witness the fastest growth from 2026 to 2033, driven by rising demand for oral appliances, lifestyle modification programs, and complementary interventions in both pediatric and adult populations. Home healthcare expansion, combined with telemedicine integration, is enabling patients to access therapy solutions conveniently. Increasing physician recommendation for non-device therapies in mild-to-moderate cases and rising awareness of therapy benefits for geriatric patients are supporting accelerated adoption. Specialty clinics in UAE and South Africa are increasingly providing integrated therapy packages, contributing to faster growth in this segment.

- By Patient Demographics

On the basis of patient demographics, the market is segmented into pediatric, adult, and geriatric. The Adult segment dominated the market with a share of 65% in 2025, reflecting the higher prevalence of sleep apnea in the 30–60 age group. Adults represent the largest patient population seeking diagnosis and device-based treatment in Saudi Arabia, UAE, and South Africa. Awareness campaigns targeting working-age populations, combined with increasing access to diagnostic centers and home healthcare solutions, are driving adult segment dominance. The adult population also shows higher adherence to device-based therapies, supported by mobile monitoring apps and clinical follow-ups. Devices and therapies tailored to adult patients’ lifestyle needs further strengthen market share.

The Geriatric segment is expected to be the fastest-growing patient demographic with a projected CAGR of 5.4% from 2026 to 2033, fueled by rising elderly populations in MEA countries and increasing recognition of sleep apnea as a risk factor for comorbidities such as hypertension and heart disease. Adoption of adaptive CPAP and BiPAP devices, along with specialized monitoring programs in hospitals and homecare, is driving segment growth. Awareness initiatives for geriatric patients, combined with telehealth-enabled adherence tracking, are further accelerating adoption.

- By End User

On the basis of end user, the MEA sleep apnea devices market is segmented into hospitals/clinics, diagnostic centers, ambulatory care centers, specialty care centers, and home healthcare. The Hospitals/Clinics segment dominated the market with a share of 52% in 2025, driven by the high reliance on clinical diagnosis and supervised device-based therapy for adults and geriatric patients. Hospitals in Saudi Arabia, UAE, and South Africa are equipped with advanced sleep labs, offering CPAP/BiPAP titration and monitoring services. Clinicians prioritize hospital-based treatment for initial diagnosis and therapy initiation, ensuring patient adherence and better outcomes. The dominance is also supported by insurance coverage and governmental healthcare programs facilitating device access through hospitals. Furthermore, hospitals provide integrated follow-up services and telemonitoring support, enhancing treatment compliance and overall segment growth.

The Home Healthcare segment is expected to witness the fastest growth with a projected CAGR of 6.1% from 2026 to 2033, driven by increasing adoption of telehealth-enabled CPAP and BiPAP therapies in urban and semi-urban populations. Convenience, privacy, and continuous monitoring are motivating patients to prefer home-based therapy, especially in UAE and Saudi Arabia. Growth is further fueled by portable, battery-operated devices and cloud-based compliance tracking systems. The rise in patient education programs and remote monitoring infrastructure is encouraging adoption, particularly for adult and geriatric patients seeking therapy at home.

- By Distribution Channel

On the basis of distribution channel, the MEA sleep apnea devices market is segmented into direct tender and retail sales. The Direct Tender segment dominated the market with a share of 60% in 2025, driven by procurement through hospitals, specialty care centers, and government health programs in Saudi Arabia, UAE, and South Africa. Large hospitals and diagnostic centers often prefer direct tender agreements with manufacturers to ensure quality, cost-effectiveness, and consistent supply of CPAP, BiPAP, and other device solutions. Direct tender also enables bundled packages for installation, training, and maintenance, improving long-term adoption. Furthermore, government initiatives and hospital partnerships are promoting this channel for large-scale device deployment, particularly in urban centers.

The Retail Sales segment is expected to witness the fastest growth with a projected CAGR of 6.5% from 2026 to 2033, fueled by increasing awareness among consumers and the growing availability of CPAP and BiPAP devices through online platforms, pharmacies, and medical equipment stores. Retail sales empower patients to access devices for home therapy directly, without relying on hospital prescriptions, supporting convenience and compliance. Expansion of e-commerce channels in UAE and Saudi Arabia, along with marketing and patient education initiatives, is accelerating retail adoption. Growth is particularly strong among adult and geriatric patients preferring private, at-home treatment options.

Middle East and Africa Sleep Apnea Devices Market Regional Analysis

- Saudi Arabia dominated the MEA sleep apnea devices market with the largest revenue share of 42.5% in 2025, characterized by advanced hospital infrastructure, specialty care centers, and high healthcare spending

- Patients and healthcare providers in the region are increasingly adopting device-based therapies such as CPAP and BiPAP due to their proven effectiveness, integration with telehealth platforms, and ability to improve long-term treatment compliance

- This widespread adoption is further supported by rising awareness of sleep-related disorders, expanding specialty care centers, and growing access to home healthcare solutions, establishing sleep apnea devices as a preferred therapeutic option for both adults and geriatric patients in Saudi Arabia, UAE, and South Africa

The Saudi Arabia Sleep Apnea Devices Market Insight

The Saudi Arabia sleep apnea devices market captured the largest revenue share of 42.5% in 2025, driven by advanced healthcare infrastructure, growing prevalence of obstructive sleep apnea, and government initiatives promoting early diagnosis and treatment. Patients and healthcare providers increasingly prefer device-based therapies such as CPAP and BiPAP due to their proven efficacy and integration with telehealth platforms. Rising awareness campaigns, expanding specialty care centers, and improved access to home healthcare solutions are further propelling market growth. Hospitals and diagnostic centers are playing a key role in patient monitoring, while insurance coverage and government healthcare programs facilitate device adoption. The combination of clinical support and homecare convenience is establishing Saudi Arabia as the dominant market in MEA.

United Arab Emirates Sleep Apnea Devices Market Insight

The UAE sleep apnea devices market is expected to grow at a notable CAGR during the forecast period, driven by increasing adoption of home healthcare solutions and remote monitoring technologies. Patients are increasingly seeking at-home CPAP and BiPAP therapy to reduce hospital visits while maintaining treatment compliance. Government health initiatives and telehealth integration are facilitating early diagnosis and continuous patient monitoring. The urban population’s rising awareness of sleep-related disorders and lifestyle-driven risk factors is further driving demand. Private clinics and specialty centers in the UAE are actively offering device-based therapies, while digital platforms enhance adherence tracking. Affordability initiatives and patient education campaigns are accelerating adoption across residential and clinical settings.

South Africa Sleep Apnea Devices Market Insight

The South Africa sleep apnea devices market is poised to grow at the fastest CAGR in MEA during the forecast period due to increasing recognition of sleep apnea in both adults and geriatric populations. Expanding urban healthcare infrastructure, rising awareness campaigns, and increasing availability of devices in diagnostic centers and homecare settings are key growth drivers. Patients are showing a strong preference for device-based therapy due to its effectiveness and ease of use. Telehealth-enabled monitoring and remote compliance tracking are boosting adoption, particularly in metropolitan areas. In addition, partnerships between healthcare providers and device manufacturers are facilitating wider market penetration. The increasing number of specialty care centers and homecare programs is expected to sustain long-term growth.

Egypt Sleep Apnea Devices Market Insight

The Egypt sleep apnea devices market is gaining momentum due to rising prevalence of obstructive sleep apnea, increasing awareness among adults and geriatric patients, and gradual expansion of healthcare infrastructure. Hospitals and diagnostic centers are playing a major role in therapy initiation and monitoring. Homecare solutions and telemonitoring platforms are increasingly available, allowing patients to manage therapy remotely. Insurance coverage and government support are also facilitating access to CPAP and BiPAP devices. Growth is further supported by urban population expansion, rising obesity rates, and lifestyle-related risk factors. The market is expected to witness steady adoption across residential, clinical, and specialty care settings.

Middle East and Africa Sleep Apnea Devices Market Share

The Middle East and Africa Sleep Apnea Devices industry is primarily led by well-established companies, including:

- ResMed Inc. (U.S.)

- Koninklijke Philips N.V. (Netherlands)

- Fisher & Paykel Healthcare Limited (New Zealand)

- BMC Medical Co., Ltd. (China)

- Apex Medical Corp. (Taiwan)

- Löwenstein Medical GmbH & Co. KG (Germany)

- Drive DeVilbiss Healthcare LLC (U.S.)

- 3B Medical, Inc. (U.S.)

- Breas Medical AB (Sweden)

- Somnetics International, Inc. (U.S.)

- SLS Medical Technology (China)

- Resvent Medical Technology Co., Ltd. (China)

- Teijin Pharma Limited (Japan)

- Koike Medical Co., Ltd. (Japan)

- Nidek Medical India Pvt. Ltd. (India)

- Medtronic (Ireland)

- Cardinal Health (U.S.)

- Smiths Medical, Inc. (U.K.)

- Fosun Pharma (China)

- Elmaslar Medikal Sistemleri (Turkey)

What are the Recent Developments in Middle East and Africa Sleep Apnea Devices Market?

- In February 2025, Nyxoah commercially launched its Genio® hypoglossal nerve stimulation therapy in the Middle East, marking the first neurostimulation OSA treatment available in the MEA region, with the first successful patient implantation performed at Saudi German Hospital in Dubai as an alternative for patients intolerant to CPAP therapy

- In February 2025, Saudi German Hospital Dubai became the first hospital in the Middle East and Africa to perform a Genio® Hypoglossal Nerve Stimulation implant surgery for sleep apnea, representing a significant clinical milestone in offering minimally invasive, advanced OSA treatment beyond traditional PAP therapy in the region

- In March 2024, Philips Respironics launched a regional training and support initiative in the UAE to enhance clinical adoption of its advanced CPAP systems (including DreamStation 2 Auto CPAP), providing healthcare professionals with latest tools and knowledge to improve sleep apnea management and therapy outcomes across the Middle East

- In February 2024, BMC Medical expanded into the Middle East through new distribution agreements in Egypt and Saudi Arabia, introducing affordable and portable CPAP solutions tailored to local needs, with integrated features such as humidifiers and mobile monitoring apps to support broader adoption of home‑based sleep apnea therapy

- In March 2021, Philips partnered with Middle East Healthcare Company (MEAHCO) to launch state‑of‑the‑art sleep disorder management services in Saudi Arabia through Saudi German Health Group, aimed at providing integrated diagnosis and therapy solutions for conditions including Obstructive Sleep Apnea (OSA), enhancing access to advanced OSA treatment in the region

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.