Middle East And Africa Smart Lighting Market

Market Size in USD Billion

CAGR :

%

USD

1.34 Billion

USD

5.31 Billion

2024

2032

USD

1.34 Billion

USD

5.31 Billion

2024

2032

| 2025 –2032 | |

| USD 1.34 Billion | |

| USD 5.31 Billion | |

|

|

|

|

Smart Lighting Market Size

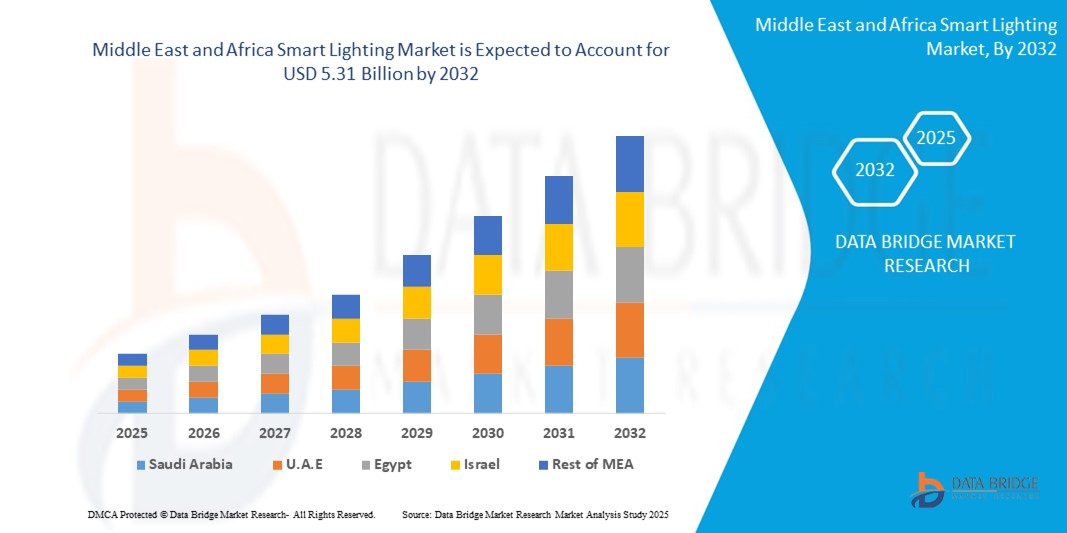

- The Middle East and Africa Smart Lighting Market size was valued at USD 1.34 billion in 2024 and is expected to reach USD 5.31 billion by 2032, at a CAGR of 18.78% during the forecast period

- This growth is driven by factors such as the rising demand for IoT integrated smart lighting solutions

Smart Lighting Market Analysis

- Smart lighting systems are transforming urban and commercial infrastructure by enabling energy efficient lighting, automated brightness adjustment, remote monitoring, and integration with smart city and home automation systems. These solutions significantly reduce electricity consumption, enhance lighting control, and support sustainability goals.

- Market growth is fueled by increasing urbanization, rising demand for energy efficient lighting solutions, and government initiatives promoting smart city projects. The adoption of IoT-enabled lighting, motion sensors, and wireless control systems is driving innovation and rapid deployment across residential, commercial, and public infrastructure.

- Saudi Arabia is expected to lead the Middle East and Africa Smart Lighting Market, driven by strong technological adoption, growing emphasis on energy efficiency, and a well established smart home ecosystem. Government mandates and incentives for replacing traditional street lighting with LED based smart systems are also contributing to regional growth.

- UAE is projected to experience the fastest growth, due to rapid urban expansion, increased investments in smart infrastructure, and favorable government policies in countries like China, India, and South Korea. Expanding smart city initiatives and industrial modernization are further accelerating market penetration.

- The Hardware segment holds the largest market share of over 57.92%, led by high demand for smart bulbs, sensors, and control systems in both residential and commercial settings. These devices are crucial for enabling real-time control, remote access, and automation in lighting applications.

Report Scope and Smart Lighting Market Segmentation

|

Attributes |

Smart Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Smart Lighting Market Trends

“Integration of AI, IoT, and Wireless Connectivity in Smart Lighting Systems”

- A significant trend shaping the Middle East and Africa smart lighting market is the integration of Artificial Intelligence (AI), Internet of Things (IoT), and wireless technologies such as Bluetooth, Zigbee, and Wi-Fi to create adaptive and automated lighting environments.

- These intelligent systems adjust lighting based on occupancy, ambient conditions, and user preferences, resulting in energy savings and enhanced user experience.

For instance,

- In February 2025, smart city projects in Singapore implemented AI-powered lighting systems across public infrastructure. The lights used motion sensors and ambient light data to self-adjust brightness levels, which reduced energy consumption by 35%. This trend is accelerating the adoption of smart lighting in urban infrastructure and commercial buildings.

- The integration of AI and IoT also enables predictive maintenance, centralized control via cloud platforms, and improved operational efficiency, making it a key trend across residential, commercial, and industrial sectors.

Smart Lighting Market Dynamics

Driver

“Rising Demand for Energy-Efficient and Sustainable Lighting Solutions”

- The Middle East and Africa push for sustainability and carbon footprint reduction is driving the adoption of smart lighting solutions that offer significant energy savings over traditional systems.

- Governments worldwide are enforcing stringent energy efficiency regulations, promoting the replacement of conventional lighting with smart LED systems.

For Instance,

- In April 2024, the European Union updated its energy efficiency directive mandating public buildings to adopt smart lighting technologies. Countries like Germany and France accelerated large scale retrofitting of municipal lighting with smart LEDs, contributing to market growth.

- Increased consumer awareness, cost savings on electricity bills, and incentives for green buildings further strengthen this driver, especially in urban areas and smart city initiatives.

Opportunity

“Rising Demand for Filtration Solutions in Renewable Energy and EV Manufacturing”

- The growing focus on sustainability is creating new opportunities for filtration vendors in emerging sectors such as electric vehicles (EVs), battery production, and renewable energy installations (e.g., wind turbines, solar panel manufacturing).

- These applications require precise contamination control to ensure product efficiency, safety, and longevity.

For instance,

- In January 2025, a leading EV battery manufacturer in South Korea partnered with a filtration technology firm to implement ultra-fine particle control systems in its Gigafactory. The goal was to enhance battery safety, extend service life, and meet Middle East and Africa cleanroom standards.

- This expansion into clean energy sectors is opening new revenue streams for filtration system providers Middle East and Africaly.

Restraint / Challenge

“High Initial Cost and Maintenance of Advanced Filtration Systems”

- One of the key challenges in the Smart Lighting market is the high cost associated with advanced filtration systems, particularly those equipped with smart monitoring, nanofiber technology, or cleanroom compatibility.

- Small and medium sized enterprises (SMEs), especially in developing economies, may struggle to invest in such systems due to budget constraints.

For instance,

- In 2024, textile manufacturers in Southeast Asia reported delays in adopting air purification upgrades due to the upfront costs of industrial HEPA filtration units and the recurring cost of filter replacements.

- While long term operational savings and compliance benefits are evident, the initial capital burden remains a hurdle for many companies, limiting market penetration in cost-sensitive regions.

Smart Lighting Market Scope

The market is segmented on the basis, Filtration Type, Customer Type, Application

|

Segmentation |

Sub-Segmentation |

|

By Filtration Type |

|

|

By Customer Type |

|

|

By Application |

|

In 2025, Liquid Filtration are projected to dominate the market, holding the largest share within the Filtration type segment.

This dominance is driven by the growing demand across industrial processing, automotive, and water treatment sectors for effective removal of contaminants from fluids. Increasing emphasis on regulatory compliance, environmental safety, and equipment longevity is pushing industries to adopt advanced liquid filtration technologies, especially in oil & gas, chemical manufacturing, and food & beverage processing.

The OEM is expected to account for the largest share in the customer type segment during the forecast period.

the OEM segment is anticipated to dominate the customer type category, fueled by the rising integration of filtration systems in newly manufactured industrial and automotive equipment. As industries shift towards sustainability and efficiency, OEMs are embedding high-performance filtration components during production to meet regulatory standards, reduce lifecycle costs, and improve system reliability.

Smart Lighting Market Regional Analysis

“Saudi Arabia Holds the Largest Share in the Smart Lighting Market”

- Saudi Arabia is expected to dominate the Middle East and Africa Smart Lighting market, driven by its highly developed industrial base, stringent environmental regulations, and significant investments in advanced manufacturing technologies.

- Saudi Arabia is a major contributor due to ongoing infrastructure upgrades, technological innovation in filter media, and emphasis on sustainable industrial practices.

“UAE is Projected to Register the Highest CAGR in the Smart Lighting Market”

- UAE is poised to witness the fastest growth in the Middle East and Africa Smart Lighting market during the forecast period. This surge is attributed to rapid industrialization, expanding automotive and manufacturing sectors, and increasing environmental concerns

- With rising infrastructure investments, urban development, and regulatory alignment with international standards, UAE is becoming a strategic focus for Middle East and Africa filtration system providers seeking to tap into high-growth, emerging markets.

Smart Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Middle East and Africa presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Signify Holding (Netherlands)

- ACUITY BRANDS LIGHTING, INC. (U.S.)

- Häfele (Germany)

- Honeywell International Inc. (U.S.)

- Cree Lighting (U.S.)

- Digital Lumens, Inc. (U.S.)

- OSRAM GmbH (Germany)

- General Electric (U.S.)

- Lutron Electronics Co., Inc. (U.S.)

- Hubbell (U.S.)

- Itron Inc. (U.S.)

- Legrand Group (France)

- Seiko Epson Corporation (Japan)

- Encelium Technologies (Canada)

- Virtual Extension (Israel)

- Zumtobel Group AG (Austria)

- Wipro Consumer Care & Lighting (India)

- Schneider Electric (France)

- Eaton (Ireland)

- Leviton Manufacturing Co., Inc. (U.S.)

- Syska (India)

Latest Developments in Middle East and Africa Smart Lighting Market

- In March 2025, Donaldson Company unveiled its latest industrial filtration system designed to enhance efficiency in manufacturing processes. This new system incorporates advanced nanofiber technology, offering superior contaminant capture and extended filter life. The launch aims to address the growing demand for high performance filtration solutions in sectors such as automotive, aerospace, and pharmaceuticals.

- In February 2025, Cummins Filtration announced a strategic partnership with a leading Middle East and Africa automotive manufacturer to co develop next-generation engine filtration systems. This collaboration focuses on creating filters that meet stricter emission standards and improve fuel efficiency. By leveraging Cummins expertise in filtration and the manufacturer's automotive innovation, the partnership aims to deliver sustainable solutions for the evolving automotive industry.

- In January 2025, 3M introduced its smart air filtration technology equipped with IoT capabilities for real time monitoring and maintenance alerts. This innovation allows facilities to track air quality metrics and filter performance remotely, ensuring optimal indoor air conditions. The smart filters are particularly beneficial for hospitals, laboratories, and cleanrooms where air purity is critical.

- In December 2024, a major Middle East and Africa industrial firm completed the acquisition of Filtration Group, aiming to expand its portfolio in the Smart Lighting market. This acquisition enhances the firm's capabilities in providing comprehensive filtration solutions across various industries, including healthcare, food and beverage, and industrial manufacturing. The move is expected to strengthen the firm's market position and drive innovation in filtration technologies.

- In November 2024, Pentair launched a new line of eco friendly water filtration systems designed for residential and commercial use. These systems utilize sustainable materials and energy efficient processes to deliver clean water while minimizing environmental impact. The product line addresses the increasing consumer demand for sustainable and efficient water purification solutions.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Smart Lighting Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Smart Lighting Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Smart Lighting Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.