Middle East And Africa Smart Medical Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.68 Billion

USD

5.73 Billion

2025

2033

USD

1.68 Billion

USD

5.73 Billion

2025

2033

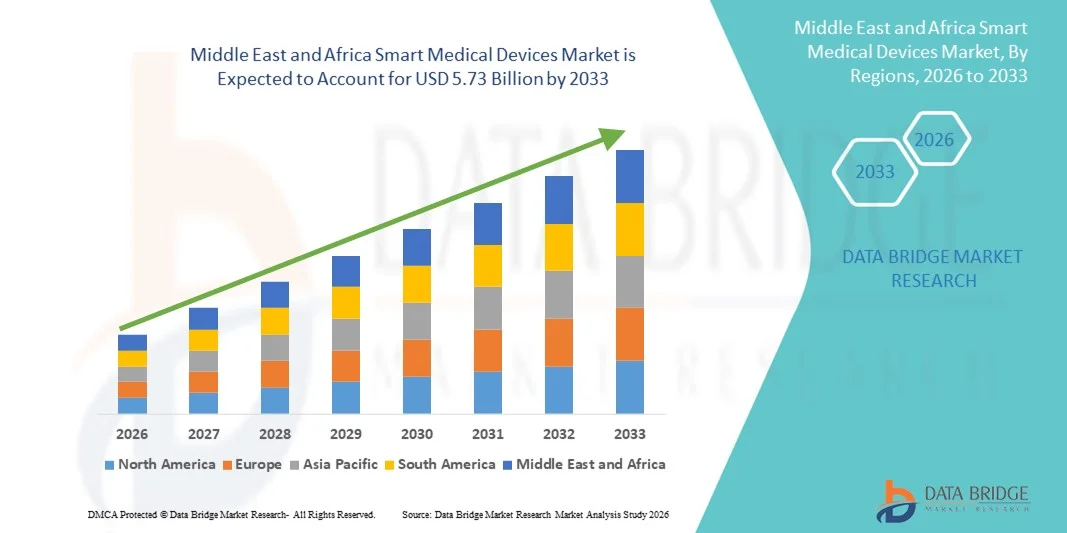

| 2026 –2033 | |

| USD 1.68 Billion | |

| USD 5.73 Billion | |

|

|

|

|

Middle East and Africa Smart Medical Devices Market Size

- The Middle East and Africa smart medical devices market size was valued at USD 1.68 billion in 2025 and is expected to reach USD 5.73 billion by 2033, at a CAGR of 16.6% during the forecast period

- The market growth is largely fueled by increasing healthcare digitization, rising prevalence of chronic diseases, and expanding integration of electronic health records (EHR) with smart devices, enabling advanced remote patient monitoring and improved clinical outcomes in both hospital and home settings

- Furthermore, government-led digital health initiatives, infrastructure enhancements and growing demand for efficient, real‑time health monitoring solutions are establishing smart medical devices as key components of modern healthcare systems. These converging factors are accelerating adoption among consumers and healthcare providers, thereby significantly boosting the industry’s growth

Middle East and Africa Smart Medical Devices Market Analysis

- Smart medical devices, including diagnostic and monitoring devices as well as therapeutic devices, are becoming essential components of modern healthcare systems in both hospitals and home care settings due to their ability to enable real-time patient monitoring, remote management, and seamless integration with electronic health records (EHR) and telemedicine platforms

- The growing demand for smart medical devices is primarily driven by rising prevalence of chronic diseases, increasing adoption of wearable and non-wearable technologies, and government-led digital health initiatives across Middle Eastern and African countries

- Saudi Arabia dominated the market with the largest revenue share of 28.4% in 2025, characterized by advanced healthcare infrastructure, early adoption of adhesive patch and handheld devices, and strong government support for smart healthcare solutions

- Nigeria is expected to be the fastest-growing country in the smart medical devices market during the forecast period due to improving healthcare infrastructure, rising awareness of wearable devices for diabetes and cardiovascular monitoring, and expanding distribution channels including pharmacies and online platforms

- Diagnostics and monitoring devices segment dominated the market with a share of 55.6% in 2025, driven by their effectiveness in oncology, diabetes, and infection disease management, ease of use in home care and hospital settings, and seamless integration with telemedicine platforms

Report Scope and Middle East and Africa Smart Medical Devices Market Segmentation

|

Attributes |

Middle East and Africa Smart Medical Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Smart Medical Devices Market Trends

Enhanced Healthcare Through AI-Enabled and Connected Devices

- A significant and accelerating trend in the Middle East and Africa smart medical devices market is the integration of artificial intelligence (AI) and IoT-enabled connectivity across diagnostic, monitoring, and therapeutic devices, significantly improving patient care, remote monitoring, and clinical decision-making

- For instance, the Omron HeartGuide wearable blood pressure monitor connects with mobile apps and AI-driven analytics, allowing users and clinicians to track cardiovascular health trends over time. Similarly, Biobeat’s wearable monitors provide continuous real-time patient monitoring integrated with AI for predictive alerts

- AI-enabled medical devices improve efficiency by analyzing patient data to detect anomalies, predict disease progression, and suggest interventions, while connected devices allow real-time reporting to healthcare providers. For instance, some Health2Sync glucose monitors utilize AI to offer personalized diabetes management insights and alert healthcare professionals if irregular glucose patterns are detected

- The seamless integration of smart medical devices with hospital EHR systems and mobile health apps facilitates centralized patient management, enabling clinicians to monitor multiple patients simultaneously and adjust treatment plans in real time

- This trend towards intelligent, connected, and patient-centric devices is reshaping expectations for healthcare delivery. Consequently, companies such as Biobeat and Health2Sync are developing AI-enabled devices with predictive analytics and cloud connectivity for hospitals and home care

- The demand for smart medical devices that integrate AI and connectivity is rapidly growing across hospitals, clinics, and home care settings, as patients and healthcare providers increasingly prioritize real-time monitoring, personalized care, and operational efficiency

- Wearable devices are increasingly preferred over traditional devices due to their portability, ease of use, and continuous monitoring capabilities, supporting long-term patient engagement and adherence to treatment plans

- Remote monitoring solutions for chronic and infectious diseases are gaining traction in countries such as Saudi Arabia and Nigeria, reducing hospital visits, optimizing healthcare resources, and enabling early interventions

Middle East and Africa Smart Medical Devices Market Dynamics

Driver

Rising Healthcare Digitization and Chronic Disease Management Needs

- The growing prevalence of chronic diseases and the increasing adoption of digital healthcare platforms across hospitals and home care settings are significant drivers of smart medical device demand

- For instance, in April 2025, Health2Sync announced an expansion of its AI-powered diabetes management platform across Saudi Arabia and UAE, aiming to integrate wearable glucose monitors with mobile health apps for real-time patient monitoring

- As healthcare providers and patients seek better outcomes and proactive management of chronic diseases, smart devices offer continuous monitoring, predictive alerts, and integration with EHR systems, providing a compelling alternative to traditional care models

- Furthermore, government-led digital health initiatives and investments in healthcare infrastructure are accelerating adoption of smart devices, particularly in advanced healthcare systems of Saudi Arabia and UAE

- The convenience of real-time monitoring, telemedicine compatibility, and personalized healthcare insights are key factors driving adoption in hospitals, clinics, and home care, while improved accessibility and patient engagement further contribute to market growth

- Partnerships between medical device companies and telemedicine platforms are driving growth by enabling integrated solutions for hospitals and home care, enhancing device adoption across Middle Eastern and African countries

- Increasing awareness and training programs for healthcare professionals on smart medical devices are promoting adoption, as clinicians recognize the value of connected and AI-enabled tools in improving patient outcomes

Restraint/Challenge

Data Security Concerns and High Initial Costs

- Concerns about data privacy, cybersecurity, and compliance with healthcare regulations pose significant challenges to broader adoption of smart medical devices in Middle Eastern and African countries

- For instance, high-profile reports of patient data breaches in IoT-enabled devices have made healthcare providers cautious about deploying connected monitoring solutions, limiting adoption in some hospitals and clinics

- Addressing these concerns through robust encryption, secure authentication protocols, and compliance with regional regulations is crucial for building trust. Companies such as Biobeat and Omron emphasize secure cloud storage, data anonymization, and software updates in their offerings to reassure users

- In addition, the relatively high initial investment for advanced AI-enabled or connected medical devices can be a barrier, particularly for smaller clinics or price-sensitive healthcare providers in developing countries. While basic monitoring devices have become more affordable, premium devices with AI analytics, predictive alerts, and real-time connectivity often come with a higher cost

- Overcoming these challenges through enhanced cybersecurity, regulatory compliance, user education, and cost-effective device solutions will be vital for sustained growth in the Middle East and Africa smart medical devices market

- Limited local technical expertise and maintenance infrastructure in some African countries can hinder device deployment and long-term operation, especially for sophisticated AI-enabled devices

- Variations in healthcare regulations, import duties, and reimbursement policies across Middle Eastern and African countries may create adoption inconsistencies and slow market penetration for new smart medical device technologies

Middle East and Africa Smart Medical Devices Market Scope

The market is segmented on the basis of product type, device type, technology, modality, application, end user, and distribution channel

- By Product Type

On the basis of product type, the market is segmented into diagnostics and monitoring devices and therapeutic devices. The Diagnostics and Monitoring Devices segment dominated the market with the largest revenue share of 55.6% in 2025, driven by the growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and infection monitoring across hospitals and home care settings. These devices enable continuous patient monitoring, real-time data collection, and integration with hospital EHR systems, providing clinicians with actionable insights. Wearable blood pressure monitors, continuous glucose monitors, and AI-enabled cardiac monitors are witnessing high adoption due to their ease of use and clinical reliability. Hospitals and clinics in Saudi Arabia, UAE, and Qatar are prioritizing diagnostic and monitoring devices for remote patient care and telemedicine services. The segment also benefits from government-led healthcare digitization initiatives and increased investments in smart healthcare infrastructure. Furthermore, patient preference for home-based monitoring solutions is driving demand for portable and wearable diagnostic devices.

The Therapeutic Devices segment is anticipated to witness the fastest growth rate of 11.5% CAGR from 2026 to 2033, fueled by rising adoption in home care and clinical therapy applications. Therapeutic devices such as insulin pumps, wearable infusion systems, and motor-driven rehabilitation devices are gaining traction for their ability to deliver precise treatment and enhance patient compliance. The segment’s growth is also supported by increasing awareness of personalized care, advances in AI-driven therapy optimization, and expanding distribution through pharmacies and online channels. African countries, particularly Nigeria and South Africa, are adopting therapeutic devices to manage chronic and autoimmune disorders, driving faster regional growth. In addition, the integration of wearable therapeutic devices with mobile apps and cloud platforms is enhancing user engagement and monitoring capabilities.

- By Device Type

On the basis of device type, the market is segmented into on-body (adhesive patch), off-body (belt clip), and handheld. The On-Body (Adhesive Patch) segment dominated the market with a share of 38.7% in 2025, supported by widespread adoption in wearable monitoring and therapeutic applications. These patches offer continuous tracking of vital signs, glucose levels, or medication delivery, making them highly suitable for chronic disease management. Hospitals and home care providers in Saudi Arabia and UAE favor adhesive patches due to their non-intrusive design and high patient compliance. The segment also benefits from AI and cloud integration for real-time monitoring and predictive analytics. Ease of use, portability, and minimal interference with daily activities further contribute to the dominance of on-body devices. Patients prefer adhesive patches over traditional devices due to their discreet design and long-term wearability.

The Handheld segment is expected to witness the fastest CAGR of 12.3% from 2026 to 2033, driven by portability, affordability, and suitability for diagnostic use in clinics, remote areas, and home settings. Devices such as portable ultrasound scanners, handheld glucometers, and point-of-care monitors are becoming increasingly popular in African countries with limited hospital infrastructure. Handheld devices provide flexibility for mobile healthcare services and telemedicine initiatives. The growing adoption of AI-enabled handheld diagnostics also improves accuracy and reduces the need for specialist intervention. Distribution through online channels and pharmacies further facilitates rapid market penetration.

- By Technology

On the basis of technology, the market is segmented into spring-based, motor-driven, rotary pump, expanding battery, pressurized gas, and others. The Motor-Driven technology segment dominated with a revenue share of 33.5% in 2025, due to its application in wearable therapeutic devices, infusion pumps, and rehabilitation equipment. Motor-driven devices allow precise control over treatment delivery and ensure reliable patient outcomes. Hospitals in Saudi Arabia and UAE adopt motor-driven devices for chronic disease management, ICU care, and post-surgery rehabilitation. These devices are highly compatible with AI-based monitoring platforms, enabling real-time adjustments and data-driven decision-making. Regulatory approvals, clinical accuracy, and integration with telemedicine services further strengthen their market dominance. The segment also benefits from increasing patient preference for automated therapy solutions.

The Expanding Battery technology segment is expected to witness the fastest CAGR of 12.1% from 2026 to 2033, fueled by the demand for portable, long-lasting devices suitable for home care and remote monitoring. Wearable adhesive patches, handheld monitors, and portable therapeutic devices leverage expanding battery technology to ensure uninterrupted operation. This growth is particularly strong in African countries such as Nigeria and South Africa, where power reliability and mobility are critical. Expanding battery devices are also increasingly integrated with mobile apps, cloud platforms, and AI analytics, enhancing user experience and patient engagement.

- By Modality

On the basis of modality, the market is segmented into wearable and non-wearable. The Wearable segment dominated with a share of 57.2% in 2025, driven by strong adoption in chronic disease monitoring, fitness tracking, and post-operative care. Wearables such as smart patches, glucose monitors, and cardiac monitors offer real-time data collection, cloud integration, and remote monitoring capabilities. Hospitals, clinics, and home care providers in Saudi Arabia, UAE, and Qatar widely deploy wearable devices due to ease of use, patient comfort, and improved adherence. The growing awareness of preventive healthcare and fitness monitoring also fuels demand. Wearables enable personalized care plans, telemedicine support, and predictive alerts, making them the preferred modality. Integration with mobile apps and AI analytics further enhances clinical decision-making and patient engagement.

The Non-Wearable segment is expected to witness the fastest CAGR of 10.8% from 2026 to 2033, driven by the adoption of standalone diagnostic and therapeutic devices such as handheld ultrasound scanners, stationary infusion pumps, and home-use sleep disorder monitors. Non-wearable devices are widely used in clinics, hospitals, and sports therapy centers for patient assessment, rehabilitation, and treatment. African countries are witnessing rising adoption due to cost-effectiveness, clinical reliability, and ease of deployment in healthcare facilities. Increasing adoption of AI and cloud-enabled functionalities enhances the effectiveness of non-wearable devices.

- By Application

On the basis of application, the market is segmented into oncology, diabetes, auto-immune disorders, infection diseases, sports and fitness, sleep disorders, and others. The Diabetes segment dominated with a revenue share of 31.8% in 2025, owing to the rising prevalence of diabetes across Middle Eastern and African countries. Continuous glucose monitors, insulin pumps, and AI-enabled therapeutic devices are widely adopted in hospitals, clinics, and home care settings. Saudi Arabia and UAE are key markets due to early adoption of digital diabetes management programs and advanced healthcare infrastructure. Integration with mobile apps and telemedicine platforms allows real-time monitoring, predictive alerts, and improved patient compliance. The segment benefits from growing awareness, government healthcare initiatives, and availability of reimbursable devices. High patient adherence and ease of use make diabetes monitoring a dominant application segment.

The Infection Diseases segment is expected to witness the fastest CAGR of 12.5% from 2026 to 2033, fueled by increasing demand for remote diagnostic devices, wearable monitoring solutions, and point-of-care testing. Rapid screening and monitoring for infections are critical in African countries with limited hospital infrastructure. Smart devices enable timely detection, remote alerts, and integration with hospital EHRs for effective disease management. Wearable and handheld monitoring devices also facilitate epidemiological tracking and early interventions, supporting public health initiatives.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, home care, sports club, and others. The Hospitals segment dominated the market with a share of 48.3% in 2025, driven by the adoption of smart medical devices for chronic disease management, ICU monitoring, post-operative care, and telemedicine integration. Hospitals in Saudi Arabia and UAE leverage wearable and handheld devices to monitor multiple patients in real time, enhancing clinical efficiency. Integration with EHR systems, AI analytics, and predictive alerts further strengthens hospital demand. Hospitals also adopt therapeutic devices for patient rehabilitation and automated care. Government support for smart hospital initiatives and digital health infrastructure contributes to the dominance of this segment.

The Home Care segment is expected to witness the fastest CAGR of 13.1% from 2026 to 2033, fueled by rising adoption of wearable and handheld monitoring devices for diabetes, cardiovascular disorders, and infection management. Patients and caregivers increasingly prefer home-based monitoring to reduce hospital visits and enhance convenience. Countries such as Nigeria, South Africa, and Egypt are witnessing rapid adoption due to growing telemedicine initiatives, distribution via pharmacies and online platforms, and patient awareness programs. Integration of AI-driven insights and mobile app connectivity boosts the segment’s growth.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into pharmacies, online channel, and others. The Pharmacies segment dominated with a market share of 52.6% in 2025, supported by easy accessibility of smart medical devices for home care and chronic disease management. Pharmacies in Saudi Arabia, UAE, and Nigeria offer wearable monitors, handheld diagnostic tools, and therapeutic devices, often bundled with patient support services. The segment benefits from strong trust in pharmacy networks, prescription fulfillment, and on-site guidance. Pharmacies also facilitate integration with telemedicine and mobile health platforms, enhancing patient adherence. Marketing partnerships between device manufacturers and pharmacy chains further boost the dominance of this channel.

The Online Channel segment is expected to witness the fastest CAGR of 14.2% from 2026 to 2033, fueled by increasing e-commerce adoption, direct-to-consumer sales of wearable devices, and the need for convenient home delivery. Online platforms allow patients in remote African regions to access diagnostic, monitoring, and therapeutic devices easily. Integration with telehealth apps, AI-enabled device management, and virtual support services drives rapid adoption. Online channels are also cost-effective, enabling manufacturers to expand reach and provide subscription-based monitoring solutions.

Middle East and Africa Smart Medical Devices Market Regional Analysis

- Saudi Arabia dominated the market with the largest revenue share of 28.4% in 2025, characterized by advanced healthcare infrastructure, early adoption of adhesive patch and handheld devices, and strong government support for smart healthcare solutions

- Healthcare providers and patients in the region highly value real-time monitoring, AI-enabled analytics, and seamless integration of devices with hospital EHR systems and mobile health platforms, enabling improved patient outcomes, preventive care, and operational efficiency

- This widespread adoption is further supported by advanced healthcare infrastructure, government-led digital health initiatives, high patient awareness, and a growing preference for remote patient monitoring, establishing smart medical devices as essential tools for both clinical and home-based care across Saudi Arabia, UAE, and Qatar

The Saudi Arabia Smart Medical Devices Market Insight

The Saudi Arabia smart medical devices market captured the largest revenue share of 28.4% in 2025, fueled by rapid adoption of connected diagnostic, monitoring, and therapeutic devices across hospitals, clinics, and home care settings. Patients and healthcare providers increasingly prioritize real-time monitoring, AI-enabled analytics, and seamless integration with hospital EHR systems. Government initiatives promoting digital health, smart hospitals, and telemedicine platforms further propel market growth. The demand for wearable and handheld devices for chronic disease management, such as diabetes and cardiovascular disorders, continues to rise. Moreover, strong healthcare infrastructure and high patient awareness support widespread adoption across residential and clinical settings.

UAE Smart Medical Devices Market Insight

The UAE smart medical devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by high healthcare expenditure and early adoption of digital health technologies. Hospitals and home care providers are integrating AI-enabled monitoring and therapeutic devices to enhance patient outcomes and operational efficiency. The region’s emphasis on smart city initiatives, telemedicine, and preventive healthcare is fostering adoption. Growing urbanization, rising disposable incomes, and a tech-savvy population are further contributing to market expansion. Both government hospitals and private clinics increasingly invest in connected devices to improve chronic disease management and remote patient care.

Qatar Smart Medical Devices Market Insight

The Qatar smart medical devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by rising awareness of chronic disease management and increasing home care adoption. Healthcare providers are implementing AI-enabled wearable and handheld devices to monitor patients with diabetes, cardiovascular conditions, and other chronic illnesses. Government support for digital health infrastructure and telemedicine integration continues to drive demand. Patients are increasingly preferring home-based monitoring solutions, reducing hospital visits while ensuring real-time data reporting. The country’s small population and advanced healthcare system allow for rapid deployment of smart devices in clinical and residential settings.

Nigeria Smart Medical Devices Market Insight

The Nigeria smart medical devices market is expected to expand at a considerable CAGR during the forecast period, fueled by growing awareness of telemedicine and wearable monitoring solutions. Hospitals, clinics, and home care providers are increasingly adopting AI-enabled diagnostic and therapeutic devices to manage chronic diseases and infectious conditions. The adoption of handheld devices for remote patient monitoring is rising due to limited hospital infrastructure in rural areas. Government initiatives to improve digital healthcare access, combined with increasing smartphone penetration, support market growth. Patients and caregivers are showing greater acceptance of connected devices for home-based disease management.

Middle East and Africa Smart Medical Devices Market Share

The Middle East and Africa Smart Medical Devices industry is primarily led by well-established companies, including:

- SmartHealthTec (UAE)

- Al Zahrawi Medical Supplies Est (UAE)

- Medtronic (Ireland)

- Abbott (U.S.)

- GE Healthcare (U.S.)

- Siemens Healthineers AG (Germany)

- Boston Scientific Corporation (U.S.)

- F. Hoffmann La Roche Ltd (Switzerland)

- Masimo (U.S.)

- Dexcom, Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Garmin Ltd. (Switzerland)

- Fitbit, Inc. (U.S.)

- Omron Healthcare, Inc. (Japan)

- BioTelemetry, Inc. (U.S.)

- CardiacSense Ltd (Israel)

- iHealth Labs, Inc. (U.S.)

- Polar Electro Oy (Finland)

- Bio Beat (Israel)

What are the Recent Developments in Middle East and Africa Smart Medical Devices Market?

- In November 2025, South African healthcare group Netcare partnered with Corsano Health to adopt wearable devices for continuous patient monitoring across its hospital wards, using smart wearables to track vital signs such as blood pressure, heart rate, oxygen saturation, respiratory rate, and more, marking a shift toward predictive and uninterrupted monitoring within clinical setting

- In June 2025, Royal Philips showcased its latest AI‑enabled CT and IntelliVue patient monitoring systems at Africa Health ExCon 2025 in Cairo, supporting Egypt’s healthcare transformation with solutions designed to advance diagnostic accuracy and clinical decision‑making while improving patient safety

- In March 2025, Mediclinic Middle East launched “Mediclinic at Home,” a remote patient monitoring system for chronic disease management that integrates wearable sensors, mobile phones, and other connected devices to stream patient health data to clinicians, enabling real‑time monitoring of conditions such as diabetes and hypertension and timely interventions from the comfort of patients’ homes

- In January 2025, Royal Philips unveiled AI‑driven innovations in diagnostics, patient monitoring, and treatment at Arab Health 2025 in Dubai, introducing advanced systems such as the helium‑free BlueSeal MRI with AI Smart Reading and AI‑enabled CT and ultrasound solutions that enhance diagnostic precision and clinical workflows

- In October 2023, Philips launched advanced healthcare innovations in Saudi Arabia at the Global Health Exhibition 2023, including the Zenition 10 mobile C‑arm for enhanced surgical imaging and a portable ultrasound solution, aligning with the country’s Vision 2030 goals to expand access to modern medical technology

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.