Middle East And Africa Swabs Collection Kits Market

Market Size in USD Million

CAGR :

%

USD

247.36 Million

USD

415.57 Million

2025

2033

USD

247.36 Million

USD

415.57 Million

2025

2033

| 2026 –2033 | |

| USD 247.36 Million | |

| USD 415.57 Million | |

|

|

|

|

Middle East and Africa Swabs Collection Kits Market Size

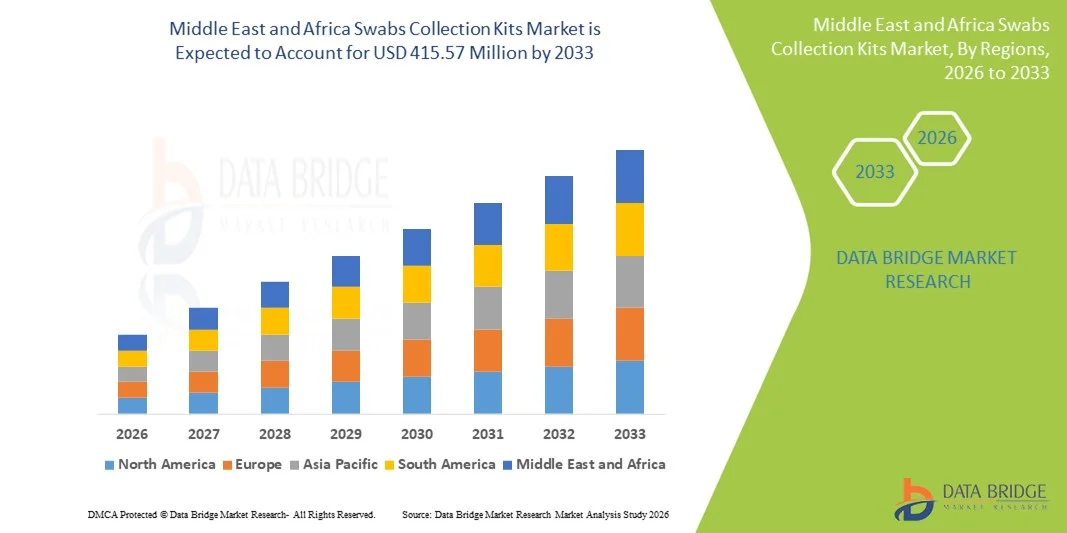

- The Middle East and Africa swabs collection kits market size was valued at USD 247.36 million in 2025 and is expected to reach USD 415.57 million by 2033, at a CAGR of 6.70% during the forecast period

- The market growth in the region is largely driven by increasing healthcare diagnostic activities, rising investment in laboratory and hospital infrastructure, and greater emphasis on infection surveillance and specimen collection systems, which are critical for molecular and microbiological testing

- Furthermore, rising demand for accurate, reliable sample‑collection solutions across clinical end users coupled with expanding government initiatives to strengthen healthcare access has positioned swab collection kits as essential tools in both routine and outbreak‑driven diagnostic workflows, significantly boosting market uptake

Middle East and Africa Swabs Collection Kits Market Analysis

- Swabs collection kits, used for the collection, transport, and preservation of clinical specimens, are increasingly vital components of modern diagnostic and laboratory workflows in both healthcare and research settings due to their accuracy, reliability, and compatibility with a wide range of testing platforms

- The escalating demand for swabs collection kits is primarily fueled by the growing prevalence of infectious diseases, expanding diagnostic testing infrastructure, and increasing awareness of early detection and disease surveillance across hospitals, clinics, and laboratories

- Saudi Arabia dominated the market with the largest revenue share of 28.5% in 2025, driven by increasing healthcare investments, government initiatives to enhance diagnostic capabilities, and rising adoption of advanced laboratory technologies, with substantial growth in diagnostic testing and specimen collection activities

- Egypt is expected to be the fastest growing country in the market during the forecast period, due to expanding healthcare infrastructure, rising government spending on public health, and growing demand for diagnostic testing across both public and private sectors

- Nasopharyngeal segment dominated the market with a market share of 42.9% in 2025, driven by their critical role in viral and bacterial diagnostics, particularly for respiratory infections, and their compatibility with standard testing protocols across diagnostic laboratories and hospitals

Report Scope and Middle East and Africa Swabs Collection Kits Market Segmentation

|

Attributes |

Middle East and Africa Swabs Collection Kits Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Middle East and Africa Swabs Collection Kits Market Trends

Growing Adoption of Diagnostic and Home-Based Testing Kits

- A significant and accelerating trend in the Middle East and Africa swabs collection kits market is the increasing adoption of home-based and point-of-care diagnostic testing kits, enhancing accessibility and convenience for patients and healthcare providers

- For instance, several companies are now offering nasopharyngeal and oropharyngeal swab kits designed for safe self-collection at home, reducing the need for hospital visits and minimizing infection exposure

- Integration with digital health platforms and mobile apps allows users to register, track, and submit samples remotely, streamlining the testing process and improving turnaround times for lab results

- The trend towards more user-friendly, pre-labeled, and standardized swab collection kits is helping laboratories and healthcare facilities maintain consistent specimen quality and reduce errors during transportation and handling

- This shift towards convenient, accurate, and connected diagnostic tools is reshaping patient expectations for healthcare delivery, prompting companies such as Copan Diagnostics and Puritan Medical to develop kits compatible with both clinical and home-testing protocols

- The demand for swab kits designed for home diagnostics, large-scale screening, and rapid infectious disease testing is growing rapidly as healthcare systems aim to improve testing coverage, early detection, and infection control

- In addition, increased awareness of pandemic preparedness and rapid outbreak response is driving governments and healthcare providers to stockpile swab kits, boosting sustained demand

Middle East and Africa Swabs Collection Kits Market Dynamics

Driver

Increasing Demand Due to Rising Infectious Disease Testing and Laboratory Expansion

- The growing prevalence of infectious diseases, along with expanding diagnostic laboratory infrastructure, is a key driver of the rising demand for swabs collection kits in the region

- For instance, in 2025, Saudi Arabia’s Ministry of Health increased funding for nationwide infectious disease surveillance, boosting procurement of nasopharyngeal and throat swabs for diagnostic testing

- Swabs collection kits provide accurate sample collection for a variety of tests, supporting early diagnosis, epidemiological monitoring, and effective treatment planning

- The expanding number of diagnostic laboratories and research facilities in countries such as Egypt, UAE, and Morocco is increasing the need for standardized and high-quality swab kits to ensure reliable test results

- Ease of use, pre-packaged kits, and compatibility with multiple testing platforms make swabs collection kits integral to both routine and large-scale testing campaigns, driving adoption across hospitals, clinics, and laboratories

- For instance, companies such as Copan Diagnostics and Puritan Medical are offering integrated solutions that cater to hospital, research, and home healthcare settings, supporting diverse testing requirements

- The rising collaborations between diagnostic kit manufacturers and government-funded testing initiatives are facilitating wider distribution of swab kits in underserved areas

- In addition, technological improvements in swab design, such as flocked tips and improved transport media, are enhancing sample integrity and expanding adoption in clinical and research applications

Restraint/Challenge

Sample Contamination Risks and Regulatory Compliance Hurdles

- Concerns over potential sample contamination, improper handling, or degradation of collected specimens pose a significant challenge to broader adoption of swab collection kits

- For instance, mishandling during transport or delayed processing can compromise diagnostic accuracy, making laboratories cautious about kit procurement and usage

- Strict regulatory requirements across different countries in the Middle East and Africa, including approvals from health ministries and compliance with ISO standards, add complexity to market entry and distribution

- For instance, kits that are not compliant with regional guidelines may face import restrictions, delaying adoption in countries with emerging healthcare markets

- High-quality, validated kits may come at a premium price, which can limit access in price-sensitive regions and smaller healthcare facilities, affecting overall market penetration

- Overcoming these challenges through robust quality assurance, adherence to regulatory standards, and training programs for proper sample collection will be critical to sustaining market growth.

- The limited awareness among end-users and healthcare staff about proper swab usage can lead to inaccurate results and lower confidence in swab-based diagnostics

- In addition, logistical challenges in rural or remote areas, including cold chain maintenance and timely sample transport, can hinder market penetration despite growing demand

Middle East and Africa Swabs Collection Kits Market Scope

The market is segmented on the basis of type, configuration, tip material, shaft, specimen, application, end user, and distribution channel.

- By Type

On the basis of type, the market is segmented into nasopharyngeal, oropharyngeal, and nares. The nasopharyngeal segment dominated the market with a largest revenue share of 42.9% in 2025, driven by its essential role in respiratory infection diagnostics, including COVID-19, influenza, and other viral/bacterial diseases. Nasopharyngeal swabs are preferred in hospitals and laboratories due to their high accuracy and standardization in PCR and molecular tests. Their wide clinical acceptance, proven reliability, and compatibility with various transport media ensure sustained demand. For instance, bulk procurement by health ministries in Saudi Arabia and UAE has strengthened the segment’s position. Major suppliers such as Copan Diagnostics and Puritan Medical provide bulk high-quality nasopharyngeal kits for public and private testing programs. The segment’s dominance is further reinforced by its usage in large-scale screening and surveillance initiatives across Middle East and Africa.

The nares segment is expected to witness the fastest growth, with a projected CAGR of 12.1% from 2026 to 2033, driven by increasing adoption of home-based and point-of-care testing kits. Nares swabs offer a less invasive collection method, enhancing patient comfort and compliance. They are ideal for pediatric testing and self-collection kits, which are increasingly popular in both urban and rural settings. Their compatibility with rapid diagnostic tests and minimal training requirement contributes to the growing adoption. For instance, healthcare providers and diagnostic companies are innovating nares swab designs to improve accuracy and ease of use. The segment also benefits from rising awareness of infection control and prevention in home and community settings.

- By Configuration

On the basis of configuration, the market is segmented into regular swab, flocked swab, and others. The flocked swab segment dominated the market with 48% share in 2025, owing to superior sample absorption and release efficiency, which improves diagnostic accuracy. Flocked swabs are widely used in laboratories and hospitals for PCR and molecular testing, ensuring high-quality specimens. Their design allows uniform collection and easy release into transport media, reducing contamination and sample loss. For instance, government-funded screening programs in Saudi Arabia and Egypt rely heavily on flocked swabs. Leading suppliers focus on these swabs for high-throughput testing and research applications. The segment is also supported by clinical preference for consistent performance and reliability.

The regular swab segment is expected to witness the fastest growth, with a projected CAGR of 10.8% from 2026 to 2033, driven by cost-effectiveness and accessibility in low-resource settings. Regular swabs are ideal for home testing kits and routine diagnostics in smaller healthcare facilities. For instance, retail and e-commerce channels are expanding the availability of pre-sterilized regular swabs for point-of-care testing. Innovations in labeling and packaging reduce handling errors, increasing usability and adoption. The segment growth is also supported by increasing demand from community healthcare programs and home-based diagnostics.

- By Tip Material

On the basis of tip material, the market is segmented into rayon, polyester, nylon, foam, cotton, calcium alginate, and others. The nylon segment dominated the market with 37% share in 2025, due to high collection efficiency and compatibility with viral/bacterial transport media. Nylon swabs are preferred in diagnostic labs for their durability and superior sample release. For instance, laboratories in Saudi Arabia and UAE procure nylon swabs in bulk for nationwide screening programs. The segment also benefits from strong clinical adoption and standardization across testing protocols. Companies focus on providing quality-certified nylon swabs for hospitals, research facilities, and public health initiatives. The high reliability and reproducibility of results reinforce its market dominance.

The foam tip segment is expected to witness the fastest growth, with a projected CAGR of 11.5% from 2026 to 2033, due to patient comfort and suitability for delicate specimen collection. Foam tips are non-absorbent, lightweight, and compatible with microbiological and molecular tests. For instance, research institutes and specialized laboratories are increasingly adopting foam swabs for high-precision testing. The segment benefits from rising demand in home healthcare kits, ensuring ease of use. Innovations in foam swab design are contributing to faster adoption in diagnostic and research applications.

- By Shaft

On the basis of shaft, the market is segmented into plastic, aluminum, wooden, resins, and others. The plastic shaft segment dominated the market with 51% share in 2025, driven by durability, flexibility, and cost-effectiveness. Plastic shafts are preferred for nasopharyngeal and oropharyngeal swabs to ensure integrity during transport and testing. For instance, hospitals and laboratories in UAE and Saudi Arabia rely on plastic-shafted swabs for large-scale testing campaigns. Their lightweight nature reduces breakage risk and maintains sample quality. Plastic shafts also support automation in laboratories, enhancing efficiency. The segment benefits from strong supply chains and wide clinical acceptance.

The wooden shaft segment is expected to witness the fastest growth, with a projected CAGR of 10.9% from 2026 to 2033, driven by eco-friendliness and adoption in low-resource or rural healthcare settings. Wooden shafts are biodegradable and cost-effective, making them suitable for emerging economies. For instance, community clinics and home testing programs increasingly use wooden shafts for sustainability and affordability. The segment also benefits from growing awareness of eco-conscious healthcare solutions.

- By Specimen

On the basis of specimen, the market is segmented into throat, vaginal, penile meatal, rectal, and others. The throat swab segment dominated the market with 38% share in 2025, due to extensive use in respiratory infection diagnostics such as influenza and COVID-19. Throat swabs are widely used in hospitals, diagnostic labs, and research institutions. For instance, public health programs in Egypt and Saudi Arabia rely heavily on throat swabs for mass testing campaigns. The segment benefits from standardized collection protocols, proven accuracy, and reproducibility. Hospitals and labs prioritize throat swabs for epidemiological and clinical applications.

The rectal swab segment is expected to witness the fastest growth, with a projected CAGR of 12% from 2026 to 2033, due to increasing applications in microbiome research, STI screening, and advanced clinical diagnostics. Rectal swabs provide high-quality microbial samples, attracting research institutes and specialized laboratories. For instance, academic and clinical research programs in UAE and Egypt are adopting rectal swabs for precise microbial analysis. The segment benefits from growing focus on gut health research and infectious disease monitoring.

- By Application

On the basis of application, the market is segmented into pharmaceutical, microbiological, laboratory, and disinfection. The laboratory segment dominated the market with 44% share in 2025, driven by high demand for accurate sample collection in diagnostics and research. Laboratories require standardized, high-precision swabs for reproducible results. For instance, diagnostic labs in Saudi Arabia and UAE use swabs for infectious disease surveillance and pharmaceutical testing. The segment benefits from government-funded testing initiatives, widespread adoption of molecular diagnostics, and large-scale screening programs.

The pharmaceutical segment is expected to witness the fastest growth, with a projected CAGR of 11.3% from 2026 to 2033, driven by increasing demand for swabs in drug trials, vaccine development, and clinical research studies. Pharmaceutical companies procure specialized swabs for precise sample collection. For instance, clinical research programs in Egypt and UAE are using swabs in R&D applications. The segment benefits from increasing focus on regulatory compliance, quality assurance, and sample integrity in pharmaceutical testing.

- By End User

On the basis of end user, the market is segmented into diagnostic laboratories, hospitals & clinics, research & academic institutes, home healthcare, and others. The diagnostic laboratories segment dominated the market with 46% share in 2025, due to large-scale testing, epidemiological studies, and routine diagnostic procedures. Diagnostic labs require high-quality swabs for standardized testing protocols. For instance, national laboratories in Egypt and Saudi Arabia procure swabs in bulk to support continuous disease surveillance. The segment benefits from strong government funding, consistent workflow requirements, and established clinical protocols.

The home healthcare segment is expected to witness the fastest growth, with a projected CAGR of 12.5% from 2026 to 2033, fueled by rising adoption of self-testing and home-based diagnostics. Home kits include user-friendly swabs for nasal, throat, or nares collection. For instance, home healthcare programs in UAE and Egypt are promoting home testing for respiratory infections. The segment benefits from increasing patient awareness, convenience, and the need to reduce hospital visits.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with 55% share in 2025, driven by government procurement for national testing programs and bulk hospital/lab purchases. Direct tenders ensure standardized quality, timely delivery, and large-volume availability. For instance, Saudi Arabia and UAE governments regularly issue tenders for swab kits to support nationwide diagnostics. The segment benefits from institutional trust, procurement efficiency, and reliable supply chains.

The retail sales segment is expected to witness the fastest growth, with a projected CAGR of 13% from 2026 to 2033, fueled by the increasing availability of home testing kits and point-of-care solutions via pharmacies, e-commerce, and healthcare retailers. For instance, home diagnostic programs in Egypt and UAE are distributing swabs through the retail channels to increase accessibility. The retail channels expand reach, enhance convenience, and support the decentralized testing initiatives.

Middle East and Africa Swabs Collection Kits Market Regional Analysis

- Saudi Arabia dominated the market with the largest revenue share of 28.5% in 2025, driven by increasing healthcare investments, government initiatives to enhance diagnostic capabilities, and rising adoption of advanced laboratory technologies, with substantial growth in diagnostic testing and specimen collection activities

- Healthcare providers and diagnostic laboratories in the country prioritize high-quality swabs for accurate sample collection, particularly for nasopharyngeal and throat specimens, which are essential for viral and bacterial testing in both routine and outbreak situations

- This widespread adoption is further supported by strong government initiatives, availability of advanced laboratory facilities, high awareness of early disease detection, and bulk procurement programs, establishing swab collection kits as essential tools for clinical diagnostics and public health screening

The Saudi Arabia Swabs Collection Kits Market Insight

The Saudi Arabia swabs collection kits market captured the largest revenue share of 28.5% in 2025, fueled by extensive government investments in healthcare infrastructure, large-scale infectious disease surveillance, and the expansion of diagnostic laboratories. Hospitals and laboratories in the country prioritize high-quality nasopharyngeal and throat swabs for accurate diagnostics and outbreak response. The growing focus on early detection and preventive healthcare, combined with the increasing adoption of standardized testing protocols, is driving strong demand. Moreover, government-funded bulk procurement programs and national screening initiatives are significantly contributing to market expansion. Increasing awareness of home-based testing and the integration of swab kits into modern laboratory workflows further strengthen market growth.

Egypt Swabs Collection Kits Market Insight

The Egypt swabs collection kits market is expected to grow at a noteworthy CAGR of 11.2% during the forecast period, driven by the expanding healthcare infrastructure and rising adoption of home-based and point-of-care diagnostic kits. Diagnostic laboratories, hospitals, and clinics are increasingly procuring standardized swab kits for accurate testing of infectious diseases, including respiratory and gastrointestinal infections. The region’s growing focus on public health initiatives, government-led screening programs, and laboratory modernization is supporting adoption. Furthermore, rising awareness of infection prevention and self-testing among consumers is propelling market growth. Retail and e-commerce channels are enhancing accessibility, making swab kits more available to both medical institutions and home users.

United Arab Emirates (UAE) Swabs Collection Kits Market Insight

The UAE swabs collection kits market is gaining momentum due to rapid urbanization, high healthcare spending, and a growing network of modern diagnostic laboratories. The country places strong emphasis on quality and standardized specimen collection, driving demand for high-performance swabs such as nasopharyngeal and flocked types. Government initiatives for pandemic preparedness and routine screening programs are accelerating adoption in hospitals and clinics. For instance, national healthcare programs frequently procure swab kits in bulk for preventive testing campaigns. In addition, the growing use of home-based testing and point-of-care diagnostics is fueling market expansion. Rising collaborations between local distributors and international swab kit manufacturers further support availability and technological adoption.

South Africa Swabs Collection Kits Market Insight

The South Africa swabs collection kits market is expected to grow steadily due to the country’s increasing healthcare investment and expansion of diagnostic services across hospitals and research centers. Swab kits are increasingly used for infectious disease testing, microbiology studies, and epidemiological monitoring. The rising prevalence of respiratory infections and sexually transmitted diseases is driving demand for high-quality swabs. For instance, private and public diagnostic laboratories are focusing on nasopharyngeal, throat, and rectal specimens for accurate results. Government health programs and NGOs are also distributing kits for large-scale testing initiatives. In addition, awareness campaigns promoting early detection and home-based diagnostics contribute to market growth.

Middle East and Africa Swabs Collection Kits Market Share

The Middle East and Africa Swabs Collection Kits industry is primarily led by well-established companies, including:

- Puritan Medical Products (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- BD (U.S.)

- HiMedia Laboratories (India)

- Copan Diagnostics Inc. (Italy)

- Medline Industries, Inc. (U.S.)

- DiaSorin S.p.A. (Italy)

- BTNX, Inc. (Canada)

- Norgen Biotek Corp. (Canada)

- VIRCELL S.L. (Spain)

- Quidel Corporation (U.S.)

- Quest Diagnostics Incorporated (U.S.)

- Abbott (U.S.)

- QIAGEN (Netherlands)

- Hologic, Inc. (U.S.)

- Labcorp. (U.S.)

- Lynn Peavey Company (U.S.)

- Formlabs, Inc. (U.S.)

- Medical Wire & Equipment (U.K.)

- Titan Biotech Ltd (India)

What are the Recent Developments in Middle East and Africa Swabs Collection Kits Market?

- In August 2025, Becton, Dickinson and Company (BD) reported submission of an FDA application for an at‑home HPV assay that includes a self‑collection fiber swab, reflecting a broader trend toward self‑collection kits that is relevant to expansion of similar products in Middle East and Africa diagnostics markets

- In June 2025, the Africa CDC and European Commission launched a major initiative to strengthen diagnostic testing capacity, including swab‑based testing and sequencing for mpox and other priority pathogens across Africa, aiming to scale up testing, build local laboratory capacity, and promote validation of locally developed diagnostic kits

- In August 2024, the Africa Centres for Disease Control and Prevention (Africa CDC) declared the ongoing mpox outbreak across Africa a continental public health emergency, prompting expanded laboratory testing, surveillance, and response activities that significantly increased demand for swab‑based molecular diagnostic testing across the region

- In January 2024, Isohelix launched its SaliFix saliva swab DNA collection kit, highlighting continued innovation in swab and sample collection technologies that supports broader diagnostic testing infrastructure; while global, this development influences markets including Middle East and Africa seeking easier, non‑invasive collection methods

- In October 2022, Reme‑D, a biotech startup focused on affordable diagnostics, expanded its operations across Egypt and other Middle Eastern/African markets by providing locally produced COVID‑19 tests and sample collection kits to over 92 hospitals and labs, selling in Iraq, Sudan, and Kenya, marking a notable regional move toward home‑grown diagnostics capacity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.