Middle East And Africa Venous Diseases Treatment Market

Market Size in USD Million

CAGR :

%

USD

386.32 Million

USD

611.10 Million

2024

2032

USD

386.32 Million

USD

611.10 Million

2024

2032

| 2025 –2032 | |

| USD 386.32 Million | |

| USD 611.10 Million | |

|

|

|

|

Middle East and Africa Venous Diseases Treatment Market Size

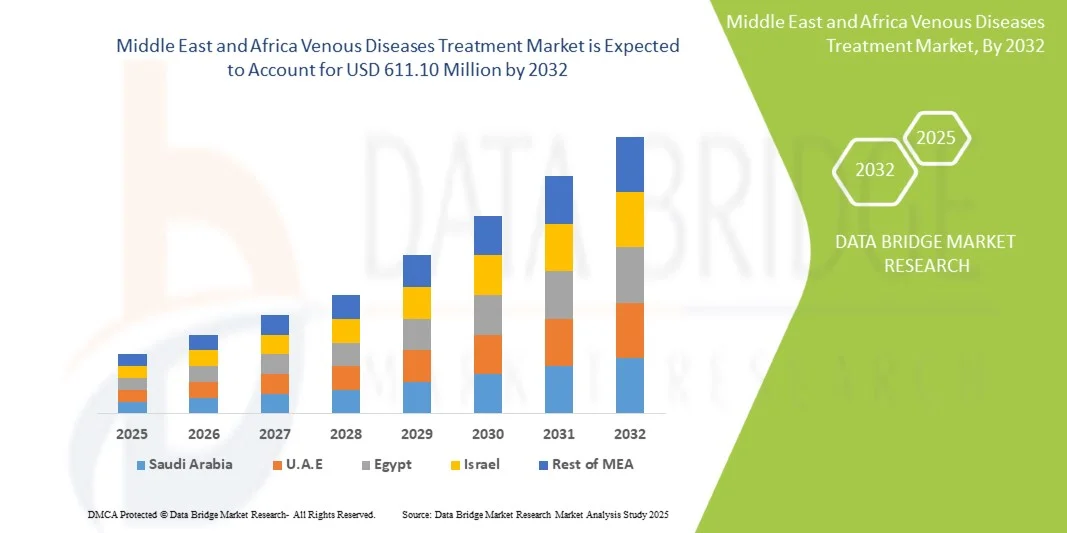

- The Middle East and Africa venous diseases treatment market size was valued at USD 386.32 million in 2024 and is expected to reach USD 611.10 million by 2032, at a CAGR of 5.9% during the forecast period

- The market growth is largely fueled by the rising prevalence of chronic venous insufficiency, varicose veins, and deep vein thrombosis, coupled with the growing geriatric population across the region that is more prone to vascular disorders

- Furthermore, increasing adoption of minimally invasive procedures, expanding healthcare infrastructure, and heightened awareness of early diagnosis are driving demand for effective venous disease therapies. These converging factors are accelerating the uptake of advanced treatment solutions, thereby significantly boosting the industry's growth

Middle East and Africa Venous Diseases Treatment Market Analysis

- Venous diseases treatment, including sclerotherapy injections, ablation devices, venous closure products, venous stents, and medications, is becoming increasingly important as key Middle Eastern and African countries experience rising cases of varicose veins, deep vein thrombosis, and chronic venous insufficiency driven by aging demographics and lifestyle-related risk factors

- The escalating demand for venous disease treatments is fueled by growing awareness of early intervention, expanding access to minimally invasive therapies, and strengthening hospital infrastructure across public and private healthcare systems

- Saudi Arabia dominated the venous diseases treatment market with the largest revenue share of 29.4% in 2024, supported by advanced healthcare facilities, strong government investments under Vision 2030, and rapid adoption of radiofrequency ablation and laser procedures in tertiary care centers

- South Africa is expected to be the fastest-growing country during the forecast period, driven by increasing obesity prevalence, vascular disease burden, and rising adoption of compression therapy and ambulatory surgical interventions

- The Sclerotherapy injection segment dominated the Middle East and Africa venous diseases treatment market with a market share of 32.6% in 2024, owing to its minimally invasive nature, cost-effectiveness, and widespread use in managing varicose veins across hospitals and specialized vascular clinics in Saudi Arabia, South Africa, the UAE, and Egypt

Report Scope and Middle East and Africa Venous Diseases Treatment Market Segmentation

|

Attributes |

Middle East and Africa Venous Diseases Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Venous Diseases Treatment Market Trends

Rising Adoption of Minimally Invasive Therapies

- A significant and accelerating trend in the Middle East and Africa venous diseases treatment market is the growing shift towards minimally invasive procedures such as radiofrequency ablation, laser therapy, and sclerotherapy, which offer reduced recovery times, lower complication risks, and improved patient comfort compared to traditional surgeries

- For instance, major hospitals in Saudi Arabia and the UAE are increasingly offering outpatient sclerotherapy and laser treatments, reflecting patient preference for faster, less painful, and cosmetically favorable options. Similarly, private clinics in South Africa and Egypt are adopting endovenous ablation devices to meet rising patient demand

- Advancements in ablation devices and venous closure products enable more precise and targeted interventions, minimizing the need for invasive ligation or stripping procedures. Some modern devices also integrate imaging guidance for enhanced treatment accuracy.

- Growing awareness campaigns about venous diseases and the availability of advanced treatment options are encouraging earlier diagnosis and intervention, which boosts the uptake of minimally invasive therapies

- This trend toward less invasive, patient-friendly, and technologically advanced solutions is reshaping vascular care expectations across the region, with companies introducing innovative ablation devices, sclerotherapy agents, and compression systems to capture this rising demand

- The demand for safe, effective, and minimally invasive venous treatments is rapidly growing in both public and private healthcare facilities, reflecting the region’s broader push toward modernization of vascular and outpatient care

Middle East and Africa Venous Diseases Treatment Market Dynamics

Driver

Increasing Burden of Venous Disorders and Expanding Healthcare Infrastructure

- The rising prevalence of varicose veins, deep vein thrombosis (DVT), and chronic venous insufficiency, driven by aging populations, obesity, and sedentary lifestyles, is a major driver of market growth in the Middle East and Africa

- For instance, in 2024, the Saudi Ministry of Health expanded vascular care programs under Vision 2030, enabling more hospitals to integrate venous disease screening and treatment units. Similarly, South Africa’s private sector is increasing investments in vascular surgery and ambulatory care centers

- Growing awareness of venous health, combined with better access to diagnostic tools such as duplex ultrasound, is encouraging earlier detection and treatment, thereby driving demand for advanced solutions

- The availability of modern treatment options such as laser ablation, sclerotherapy injections, and venous stents within multi-specialty hospitals and clinics is further accelerating adoption

- Moreover, government-backed healthcare investments, rising disposable incomes in GCC countries, and private sector expansion across Africa are strengthening the infrastructure required to deliver advanced venous care

Restraint/Challenge

High Cost of Advanced Therapies and Unequal Access to Care

- Despite growing adoption, the relatively high cost of advanced venous treatment procedures and devices remains a significant barrier, particularly in low-income regions of Africa where public health coverage is limited. Out-of-pocket expenses often deter patients from opting for modern therapies

- For instance, while laser ablation and venous stents are readily available in Saudi Arabia and the UAE, access in countries such as Nigeria and Kenya remains constrained due to affordability issues and lack of specialized facilities

- Another challenge is the shortage of skilled vascular specialists in parts of Africa, leading to uneven distribution of advanced care and overreliance on traditional surgical approaches

- Furthermore, regulatory differences across Middle Eastern and African countries can delay the introduction of new ablation devices, venous closure products, and novel medications, slowing overall market penetration

- Overcoming these hurdles will require cost-effective treatment models, broader training programs for vascular specialists, and stronger public–private partnerships to improve accessibility and affordability of venous disease care

Middle East and Africa Venous Diseases Treatment Market Scope

The market is segmented on the basis of product type, disease type, treatment type, end user, and distribution channel.

- By Product Type

On the basis of product type, the market is segmented into sclerotherapy injection, ablation devices, venous closure products, venous stents, medication, and others. The sclerotherapy injection segment dominated the market with the largest revenue share of 32.6% in 2024, driven by its minimally invasive nature and high effectiveness in treating varicose veins and superficial venous disorders. Patients prefer sclerotherapy because it provides cosmetic benefits with minimal scarring and short recovery periods. Hospitals and outpatient clinics in Saudi Arabia, UAE, and South Africa are increasingly adopting sclerotherapy due to its efficiency and lower complication rates compared to traditional surgeries. The procedure also allows repeated sessions if needed, which makes it suitable for chronic venous conditions. Pharmaceutical partnerships supplying high-quality sclerosing agents further enhance its accessibility. In addition, strong patient awareness campaigns and growing demand for outpatient care are supporting the segment’s dominance.

The ablation devices segment is expected to witness the fastest growth rate of 22.4% from 2025 to 2032, fueled by rising adoption of radiofrequency and laser-based minimally invasive therapies. Ablation devices enable precise, targeted treatment for both varicose veins and deep vein thrombosis, minimizing procedural complications and patient discomfort. Technological advancements, such as ultrasound-guided ablation, further improve accuracy and safety. Key hospitals and vascular specialty centers in GCC countries and South Africa are expanding their ablation therapy services, increasing accessibility. Patient preference for outpatient procedures and quicker recovery times is also driving this growth. Moreover, government support and private healthcare investments are accelerating adoption across the region.

- By Disease Type

On the basis of disease type, the market is segmented into deep vein thrombosis (DVT), chronic venous insufficiency (CVI), pulmonary embolism, superficial thrombophlebitis, varicose veins, and others. The varicose veins segment dominated the market with the largest revenue share in 2024 due to its high prevalence across both urban and aging populations in the Middle East and Africa. Varicose veins often require medical intervention for symptom relief and cosmetic improvement, prompting patients to opt for sclerotherapy, laser treatment, or ablation. Hospitals and clinics are increasingly investing in equipment and skilled personnel to manage varicose vein cases efficiently. Early diagnosis through improved imaging techniques and growing patient awareness campaigns have further boosted treatment uptake. Outpatient procedures are preferred for their minimal disruption and cost-effectiveness. In addition, the rising lifestyle-related risk factors such as obesity and sedentary habits contribute to sustained demand for varicose vein treatments.

The chronic venous insufficiency (CVI) segment is expected to witness the fastest growth during the forecast period, driven by increasing prevalence of obesity, sedentary behavior, and aging populations. CVI management often requires multiple treatment modalities including compression therapy, minimally invasive procedures, and medication, creating high adoption potential for hospitals and specialty clinics. Awareness initiatives focusing on early diagnosis and prevention are encouraging patients to seek timely intervention. The segment is gaining traction in countries such as Saudi Arabia, UAE, and South Africa due to better healthcare infrastructure and reimbursement schemes. In addition, growing investment in private vascular centers and outpatient facilities is accelerating adoption. Technological advancements in treatment devices and patient-friendly options are also supporting the fast growth of this segment.

- By Treatment Type

On the basis of treatment type, the market is segmented into sclerotherapy, radiofrequency ablation therapy, laser treatment, ambulatory phlebectomy, vein ligation and stripping, angioplasty or stenting, surgeries, compression therapy, venoactive medication, vena cava filter, and other therapies. The sclerotherapy segment dominated the market with the largest revenue share in 2024 due to its efficiency in outpatient settings and minimal invasiveness. Patients prefer it for varicose veins and superficial thrombophlebitis due to shorter recovery times and lower complication risks. Hospitals and private clinics in Saudi Arabia, UAE, and South Africa have integrated sclerotherapy into routine vascular care. The procedure’s cosmetic benefits make it popular among patients concerned with scarring. Sclerotherapy also allows for repeat sessions if necessary, making it suitable for chronic conditions. Awareness campaigns and physician recommendations further reinforce its dominant market position.

The radiofrequency ablation therapy segment is expected to witness the fastest growth rate during the forecast period, driven by technological advancements and increasing patient preference for precise, minimally invasive solutions. Adoption is growing in urban hospitals and specialty centers where trained staff and advanced devices are available. The therapy provides high treatment success rates and reduces the risk of recurrence for varicose veins and other venous disorders. Outpatient accessibility and shorter recovery periods make it attractive to both patients and healthcare providers. Awareness campaigns emphasizing early intervention and improved patient outcomes support its rapid adoption. Government healthcare investments and private sector expansion in GCC countries and South Africa are further fueling growth.

- By End User

On the basis of end user, the market is segmented into hospitals, clinics, ambulatory surgical centers, and others. The hospitals segment dominated the market in 2024 with the largest revenue share due to their ability to offer comprehensive diagnostic and therapeutic services. Hospitals provide multi-modality treatment options including sclerotherapy, ablation, and surgical procedures under one roof, ensuring better patient management and higher throughput. They also have advanced medical equipment, trained vascular specialists, and dedicated vascular departments. Government-funded hospitals in Saudi Arabia and UAE are expanding vascular services as part of national health strategies. Hospitals in South Africa are adopting advanced ablation and laser technologies to meet growing demand. Patients prefer hospitals for their credibility, safety, and access to complex procedures.

The ambulatory surgical centers segment is expected to witness the fastest growth during the forecast period, fueled by the rising preference for outpatient and minimally invasive treatments. Patients favor ambulatory centers for lower costs, faster procedures, and shorter recovery times. Private specialty clinics in South Africa, UAE, and Egypt are increasingly investing in ablation devices, laser equipment, and sclerotherapy infrastructure. These centers provide convenient access for follow-up care and repeated sessions if necessary. Rising awareness about outpatient treatments and patient education initiatives further support rapid adoption. The segment’s flexibility and patient-centric approach make it an attractive choice for both consumers and healthcare providers.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into direct tender, retail sales, and others. The direct tender segment dominated the market with the largest revenue share in 2024, driven by bulk procurement by hospitals and government healthcare programs. Direct tenders allow institutions to acquire advanced ablation devices, venous stents, and sclerotherapy products at competitive prices. Partnerships between manufacturers and hospital procurement departments in GCC countries strengthen this channel’s dominance. Large-scale government tenders ensure consistent supply across public hospitals and specialty centers. This channel also enables easier training and maintenance support from manufacturers. Hospitals and clinics benefit from streamlined procurement and reliable product availability.

The retail sales segment is expected to witness the fastest growth during the forecast period, supported by increasing availability of over-the-counter compression therapy, venoactive medications, and home-use venous care devices. Growth is fueled by rising patient awareness and the expansion of pharmacy networks in South Africa, UAE, and Egypt. E-commerce platforms and online pharmacies are further enhancing access to venous care products. Retail channels allow patients to manage minor conditions at home while complementing hospital treatments. Convenience, affordability, and increasing consumer health consciousness contribute to rapid adoption. Manufacturers are also launching patient-friendly packaging and educational campaigns to boost retail sales.

Middle East and Africa Venous Diseases Treatment Market Regional Analysis

- Saudi Arabia dominated the venous diseases treatment market with the largest revenue share of 29.4% in 2024, supported by advanced healthcare facilities, strong government investments under Vision 2030, and rapid adoption of radiofrequency ablation and laser procedures in tertiary care centers

- Patients and healthcare providers in the country increasingly prefer minimally invasive therapies such as sclerotherapy, radiofrequency ablation, and laser treatment due to shorter recovery times, reduced complications, and improved cosmetic outcomes. Hospitals and specialty vascular centers are expanding services to meet this demand, enhancing accessibility and patient convenience

- The widespread adoption is further supported by high healthcare expenditure, availability of trained vascular specialists, and increasing awareness of venous disease management. Public–private partnerships and advanced medical equipment procurement also strengthen the delivery of effective venous treatments

The Saudi Arabia Venous Diseases Treatment Market Insight

The Saudi Arabia venous diseases treatment market captured the largest revenue share of 29.4% in 2024 within the Middle East and Africa region, fueled by rising prevalence of varicose veins, chronic venous insufficiency (CVI), and deep vein thrombosis (DVT). Increasing patient awareness, coupled with government healthcare initiatives under Vision 2030, is driving the adoption of minimally invasive therapies such as sclerotherapy, radiofrequency ablation, and laser treatment. Hospitals and specialty vascular centers are expanding capacity, providing advanced diagnostics and treatment options. The growing preference for outpatient procedures and faster recovery times further propels market growth. In addition, the integration of advanced devices with hospital information systems ensures effective monitoring and patient management.

South Africa Venous Diseases Treatment Market Insight

The South Africa market is projected to grow at the fastest CAGR during the forecast period. This growth is driven by increasing prevalence of obesity, sedentary lifestyles, and age-related venous disorders. Private hospitals and ambulatory surgical centers are investing in ablation devices, sclerotherapy equipment, and laser systems to meet rising demand. Patient preference for minimally invasive outpatient procedures and improved recovery outcomes is encouraging adoption. Government awareness campaigns and private healthcare investments are strengthening infrastructure for venous disease management. Furthermore, South African consumers are increasingly seeking treatment in specialized centers for faster, safer, and cosmetically favorable procedures.

United Arab Emirates (UAE) Venous Diseases Treatment Market Insight

The UAE market is witnessing steady growth, driven by rising healthcare expenditure, urbanization, and lifestyle-related venous disorders. Hospitals and clinics in major cities such as Dubai and Abu Dhabi are increasingly offering advanced sclerotherapy and ablation therapies. Patient awareness campaigns and medical tourism initiatives are boosting adoption among both residents and international patients. The availability of trained vascular specialists and modern treatment facilities is a key factor supporting market expansion. In addition, government investment in healthcare innovation encourages private sector participation, further driving growth. The UAE’s focus on advanced, minimally invasive care aligns with patient preference for quick, effective, and aesthetically favorable treatments.

Egypt Venous Diseases Treatment Market Insight

The Egypt market is growing steadily due to increased recognition of venous health issues and expanding access to modern treatment options in urban centers. Hospitals and clinics are adopting radiofrequency ablation, laser therapies, and compression devices to address varicose veins and CVI. Rising patient awareness about early intervention and minimally invasive procedures is accelerating market adoption. In addition, government health initiatives and private sector expansion are improving infrastructure for venous care. The increasing number of outpatient facilities and specialist clinics enhances accessibility. Consumer demand for affordable and effective treatment solutions continues to drive market development.

Nigeria Venous Diseases Treatment Market Insight

The Nigeria venous diseases treatment market is emerging, supported by growing awareness of chronic venous insufficiency and varicose vein management. Urban hospitals and private clinics are gradually introducing sclerotherapy and compression therapy, though adoption is still limited by affordability and access to specialized equipment. The government is encouraging public–private partnerships to expand vascular care services. Patient preference for minimally invasive, outpatient solutions is growing, particularly in metropolitan areas. In addition, local training programs for vascular specialists are improving service availability. The expanding middle class and rising health consciousness are expected to drive further market growth in the coming years.

Middle East and Africa Venous Diseases Treatment Market Share

The Middle East and Africa Venous Diseases Treatment industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- AngioDynamics, (U.S.)

- biolitec Holding GmbH & Co KG (Austria)

- Lumenis Be Ltd. (Israel)

- Dornier MedTech (Germany)

- Energist Group (U.K.)

- Eufoton s.r.l. (Italy)

- Vascular Solutions, Inc. (U.S.)

- Quanta System S.p.A. (Italy)

- Sciton (U.S.)

- Fotona (Slovenia)

- BTG plc (U.K.)

- Merz Pharma (U.S.)

- iVein Clinic (Egypt)

- Vein Centres of South Africa (South Africa)

- Burjeel Hospital. (UAE)

- Mediclinic Group (UAE)

What are the Recent Developments in Middle East and Africa Venous Diseases Treatment Market?

- In May 2025, RHEACELL, a leader in cell therapy, and AOP Health, a global pharmaceutical company, announced a strategic partnership aimed at delivering innovative therapies for chronic venous ulcers and epidermolysis bullosa ("butterfly disease"). This collaboration focuses on advancing somatic cell therapeutics to address high unmet medical needs in these areas. The partnership underscores a commitment to providing patients with access to cutting-edge treatments for chronic venous conditions

- In February 2025, MediWound, a biopharmaceutical company, launched a Phase III clinical trial for its novel treatment targeting venous leg ulcers. The trial aims to evaluate the efficacy and safety of EscharEx, a proteolytic enzyme-based therapy, in promoting wound healing. To support the trial, MediWound has established research collaborations with Solventum, Mölnlycke, and MIMEDX, which will provide advanced wound care products to ensure consistent management across all study sites

- In February 2025, during the EVES 2024 Summit, the Women in Vascular Forum established a dedicated society for female vascular surgeons in the Middle East. This initiative aims to foster collaboration, advocate for policy changes, and promote research, laying the foundation for improved vascular health for women and greater representation of women in vascular surgery in the region

- In September 2024, experts from the Middle East gathered to discuss best practices for managing deep venous disease during the v-WINdonesia World Congress. Dr. AlQedrah from the UAE presented insights on deep venous disease management, contributing to the international exchange of knowledge and practices in treating venous conditions

- In June 2024, Philips announced the launch of its Duo Venous Stent System, an implantable medical device designed to treat symptomatic venous outflow obstruction in patients with chronic venous insufficiency (CVI). The system received premarket approval from the U.S. Food and Drug Administration (FDA), marking a significant advancement in the treatment of venous diseases

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.