Middle East And Africa Veterinary Ivf Market

Market Size in USD Million

CAGR :

%

USD

81.87 Million

USD

127.57 Million

2024

2032

USD

81.87 Million

USD

127.57 Million

2024

2032

| 2025 –2032 | |

| USD 81.87 Million | |

| USD 127.57 Million | |

|

|

|

|

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Size

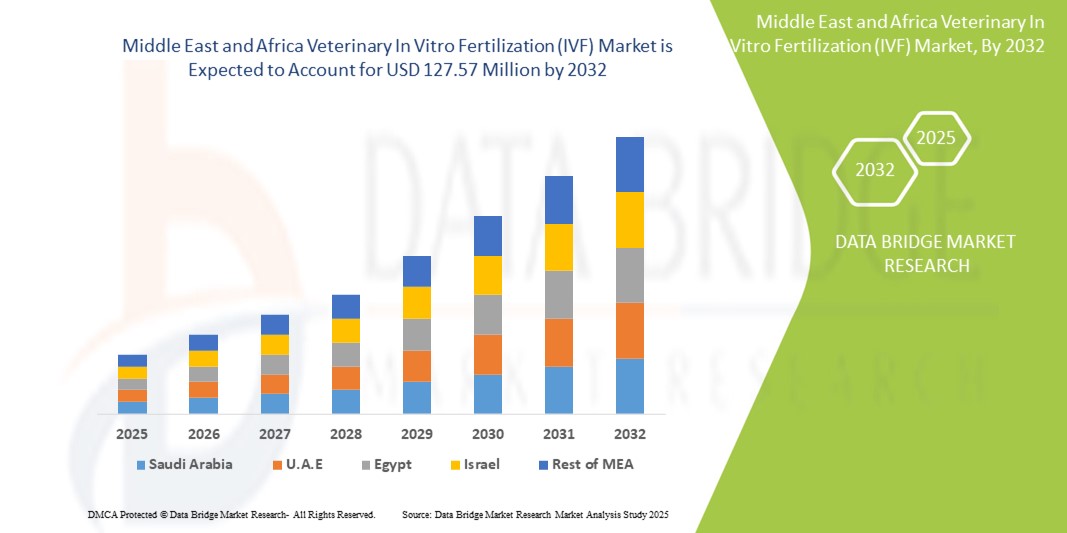

- The Middle East and Africa veterinary in vitro fertilization (IVF) market size was valued at USD 81.87 million in 2024 and is expected to reach USD 127.57 million by 2032, at a CAGR of 5.70% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within animal reproductive technologies and veterinary healthcare infrastructure across Europe, leading to increased digitalization and precision in assisted reproduction practices for livestock and companion animals

- Furthermore, rising demand for advanced, efficient, and genetics-driven breeding programs across dairy, beef, and companion animal sectors is establishing veterinary IVF as a preferred solution for reproductive management. These converging factors are accelerating the uptake of veterinary in vitro fertilization (IVF) solutions, thereby significantly boosting the industry’s growth across Europe

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Analysis

- Consumers and stakeholders in the region are increasingly investing in advanced IVF procedures to enhance breeding efficiency, particularly in cattle, sheep, goats, and camels

- This growing adoption is further supported by expanding veterinary infrastructure, rising awareness of animal reproductive health, and international collaborations aimed at improving fertility rates and livestock productivity

- Saudi Arabia dominated the Middle East and Africa veterinary in vitro fertilization (IVF) Market, with the largest revenue share of 32.4% in 2024 within the Middle East and Africa region, fueled by robust government investments in livestock development and food security. The presence of advanced veterinary clinics, trained specialists, and a strategic focus on cattle and camel breeding are key drivers of market growth

- UAE is expected to be the fastest growing region in the veterinary in vitro fertilization (IVF) market, projected to grow at a notable CAGR during the forecast period, driven by the increasing popularity of pedigree breeding, particularly in horses and companion animals. The country’s modern veterinary infrastructure and collaborations with global biotech firms are supporting broader adoption of IVF technologies

- The Reagents & Kits segment dominated the Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market with the largest revenue share of 48.6% in 2024, owing to their fundamental role in IVF cycles such as ovum pickup, sperm preparation, embryo culture, and transfer. Their widespread use in both commercial and academic veterinary labs makes them the most in-demand product category in the region

Report Scope and Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Segmentation

|

Attributes |

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Trends

“Increasing Technological Advancements and Automation in IVF Procedures”

- A significant and accelerating trend in the Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market is the growing integration of automation and intelligent technologies in reproductive procedures. This technological evolution is significantly enhancing precision, efficiency, and outcomes in animal reproduction and breeding programs

- For instance, automated embryo culture systems and smart monitoring incubators, such as those offered by companies such as Esco Medical, enable real-time tracking and optimization of IVF conditions, ensuring higher embryo viability and success rates

- Advanced IVF platforms now incorporate machine learning algorithms to analyze oocyte quality and predict fertilization potential, improving the decision-making process for veterinarians and embryologists. These technologies can provide alerts and insights based on developmental patterns, ensuring timely intervention and better reproductive management

- Seamless integration of IVF tools with veterinary health record systems allows centralized control over animal reproductive health, improving traceability, record-keeping, and genetic planning. Through a unified interface, veterinary professionals can coordinate hormone treatments, semen analysis, fertilization, and embryo transfers

- This trend toward more intelligent, precise, and data-driven veterinary IVF systems is fundamentally reshaping the expectations of animal breeders and livestock owners. Consequently, companies such as Hamilton Thorne are developing specialized veterinary IVF solutions designed to improve fertilization success and reduce the manual effort involved

- The demand for veterinary IVF systems that offer enhanced automation, data analytics, and smart control capabilities is growing rapidly across Europe, particularly in the cattle, equine, and pet sectors, as breeders increasingly prioritize genetic quality, reproductive efficiency, and sustainability

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Dynamics

Driver

“Growing Need Due to Rising Infertility in Livestock and Technological Advancements”

- The increasing prevalence of infertility among livestock and companion animals, coupled with the growing demand for advanced breeding techniques, is a major driver fueling the Europe Veterinary In Vitro Fertilization (IVF) Market. The adoption of assisted reproductive technologies (ART), particularly IVF, is rising across the region as livestock producers and breeders aim to improve genetic quality, productivity, and animal health

- For instance, in April 2024, IMV Technologies (France), a key player in animal reproduction technologies, introduced advanced embryo culture solutions tailored for cattle IVF, focusing on higher yield and quality control. Such strategies by major companies are expected to propel the veterinary IVF industry growth over the forecast period

- As breeders become more aware of declining fertility rates and the economic impact of suboptimal reproduction, IVF offers a controlled, efficient method for managing animal reproduction. It enables multiple offspring from genetically superior donors and supports conservation breeding programs for endangered species

- Furthermore, the increasing emphasis on precision breeding, demand for high-performance dairy and beef cattle, and rapid technological progress in embryo transfer and oocyte retrieval procedures are making IVF a core component of modern veterinary practice across Europe

- The benefits of embryo freezing, genetic screening, and reduced disease transmission risk, along with growing veterinary expertise and improved IVF lab infrastructure, are encouraging adoption across specialty clinics, livestock farms, and research centers

Restraint/Challenge

“High Costs, Limited Access, and Skilled Personnel Shortage”

- Despite the growing demand, the high costs associated with veterinary IVF procedures remain a significant barrier to market expansion. The expenses related to lab setup, hormone therapies, skilled personnel, and post-transfer care often limit accessibility to large-scale commercial farms or elite breeding programs

- For instance, small-scale or rural breeders across Eastern Europe often face difficulty in affording advanced IVF technologies due to economic constraints and lack of government support or subsidies

- In addition, the success of IVF heavily depends on specialized expertise and technical capabilities in embryology and animal handling, which are not uniformly available across veterinary centers in the region. The shortage of skilled personnel trained in IVF protocols continues to hinder broader adoption

- Variability in success rates due to breed-specific challenges, quality of donor oocytes, or suboptimal lab conditions further discourages investment in IVF technologies by conservative or resource-constrained breeders

- To overcome these challenges, market players must focus on cost-reduction strategies, expand training programs for veterinarians, and offer mobile or centralized IVF services to improve access. Supportive regulatory policies and regional collaboration could also enhance infrastructure and uptake across underserved markets

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Scope

The market is segmented on the basis of products & services, animal type, technique, distribution channel, and end user.

• By Products & Services

On the basis of products & services, the Middle East and Africa veterinary in vitro fertilization (IVF) market is segmented into equipment, reagents & kits, and services. The reagents & kits segment dominated the largest market revenue share of 48.6% in 2024, owing to their essential role in all IVF procedures and increasing usage in embryo transfer, ovum pickup, and artificial insemination protocols. These kits are vital for successful outcomes and are widely used in both research and clinical settings.

The services segment is projected to witness the fastest CAGR of 9.4% from 2025 to 2032, driven by the rising demand for outsourced fertility services and specialized veterinary clinics.

• By Animal Type

On the basis of animal type, the Middle East and Africa veterinary in vitro fertilization (IVF) market is segmented into livestock animal and companion animal. The livestock animal segment accounted for the highest market revenue share of 64.1% in 2024, attributed to the high adoption of IVF techniques in cattle, sheep, and swine to enhance breeding, genetic diversity, and productivity.

The companion animal segment is expected to grow at the fastest CAGR of 8.7% during the forecast period, fueled by increasing pet ownership and rising demand for fertility solutions among high-value breeds.

• By Technique

On the basis of technique, the Middle East and Africa veterinary in vitro fertilization (IVF) market is segmented into artificial insemination, embryo transfer, ovum pickup, and in vitro maturation. The artificial insemination segment dominated with a market share of 40.2% in 2024, due to its widespread accessibility, ease of procedure, and affordability.

The in vitro maturation segment is projected to expand at the fastest CAGR of 10.1% from 2025 to 2032, supported by advancements in embryo culture technology and increasing adoption in veterinary reproductive labs.

• By Distribution Channel

On the basis of distribution channel, the Middle East and Africa veterinary in vitro fertilization (IVF) market is segmented into hospitals, dialysis centers, home care settings, and others. The hospitals segment held the largest market share of 52.8% in 2024, owing to high procedure volumes and well-established infrastructure.

The home care settings segment is anticipated to grow at a fastest CAGR of 7.9% from 2025 to 2032, supported by portable IVF tools and rising adoption of in-home fertility support.

• By End User

On the basis of end user, the Middle East and Africa veterinary in vitro fertilization (IVF) market is segmented into veterinary fertility clinics, veterinary hospitals, surgical centers, research laboratories, cryobanks, and others. The veterinary fertility clinics segment dominated with the highest revenue share of 37.4% in 2024, due to growing awareness and availability of IVF treatments in companion and livestock animals.

The cryobanks segment is anticipated to expand at the fastest CAGR of 9.8% from 2025 to 2032, supported by the increasing need for gamete and embryo preservation and the expansion of animal genetic resource banking.

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Regional Analysis

- The Middle East and Africa veterinary in vitro fertilization (IVF) market accounted for 6.8% of the global market revenue share in 2024, fueled by expanding livestock production

- Government-backed genetic improvement programs, and rising awareness of reproductive technologies for both livestock and companion animals

- Regional growth is further supported by increasing investments in veterinary infrastructure and growing demand for fertility-enhancing interventions to boost animal productivity and quality genetics

Saudi Arabia Veterinary IVF Market Insight

The Saudi Arabia veterinary in vitro fertilization (IVF) market captured 32.4% of the MEA veterinary IVF market share in 2024, driven by proactive government initiatives to enhance local livestock breeds and reduce dependence on meat imports. Advanced techniques such as artificial insemination and embryo transfer are increasingly being deployed in dairy and meat production farms, strengthening IVF adoption across the country.

U.A.E. Veterinary IVF Market Insight

The U.A.E. veterinary in vitro fertilization (IVF) market accounted for 17.3% of the regional revenue share in 2024, propelled by the country’s premium veterinary services, rising pet ownership, and the increasing demand for high-end fertility treatments. Urban veterinary clinics are seeing rising use of IVF technologies among pet owners and breeders, with a focus on exotic breeds and assisted reproduction.

South Africa Veterinary IVF Market Insight

The South Africa veterinary in vitro fertilization (IVF) market led the MEA veterinary IVF market with the largest market revenue share of 8.9% in 2024, due to its well-established veterinary services ecosystem and robust livestock breeding programs. IVF methods, including in vitro maturation (IVM) and embryo transfer (ET), are widely implemented in the country’s cattle and wildlife breeding initiatives, making it a regional leader.

Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market Share

The Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market industry is primarily led by well-established companies, including:

- Hamilton Thorne, Inc (U.S.)

- Esco Medical (Estonia)

- Zoetis Services LLC (U.S.)

- IMV Technologies (France)

- Minitube (Germany)

- Agetech Inc (U.S.)

- Orgensen Laboratories (U.S.)

- Bovine Elite LLC (U.S.)

- Kruuse (Denmark)

- Equine Fertility Centre (UK)

- Veterinary Group (U.S.)

- Stateline Veterinary Service (U.S.)

- Trans Ova Genetics (U.S.)

- Tri-Mitsu Pharmaceuticals (Japan)

Latest Developments in Middle East and Africa Veterinary In Vitro Fertilization (IVF) Market

- In June 2024, Taiwan Livestock Research Institute (TLRI) announced the successful deployment of a new IVF technique tailored for swine reproduction, aiming to boost efficiency in genetic improvement and meat production across East Asian markets. This initiative supports growing demand for advanced reproductive technologies in livestock farming

- In May 2024, GeneReach Biotechnology Corp. (Taiwan) collaborated with agricultural universities in Japan and South Korea to develop portable IVF diagnostic systems for field use. This innovation is intended to support rural veterinary services and promote faster, more accessible embryo quality testing

- In March 2024, Zenotech Laboratories (India) expanded its veterinary IVF service offerings by launching cost-effective embryo freezing solutions for cattle and buffalo breeders in India and Southeast Asia. The initiative targets the rapid growth of dairy and meat production industries in the region

- In February 2024, Anicom Holdings Inc. (Japan) partnered with local veterinary clinics to launch a pilot program using AI-powered embryo grading tools for companion animals. This move supports Japan’s emerging pet IVF segment and reflects increasing demand for specialized animal reproductive services

- In January 2024, IVF Vet Solutions (Australia) opened a new regional embryo transfer training center in Sydney, offering hands-on modules for veterinary practitioners from Australia, New Zealand, and Southeast Asia. The facility aims to build a skilled workforce to support the region’s expanding IVF animal care infrastructure

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 CUSTOMIZATION

6 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: REGULATIONS

6.1 REGULATORY AUTHORITIES IN THE ASIA-PACIFIC REGION

6.2 NORTH AMERICA REGULATORY SCENARIO

6.3 EUROPE REGULATORY SCENARIO

7 VALUE CHAIN ANALYSIS OF VETERINARY INTRA-VITRO FERTILIZATION (IVF)

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS

8.1.2 RISING DEMAND FOR COMPANION ANIMALS

8.1.3 INCREASE IN VETERINARY CLINICS OFFERING IVF SERVICES

8.1.4 INCREASING FOCUS ON ANIMAL WELFARE

8.2 RESTRAINTS

8.2.1 RISKS OF LOW SUCCESS RATES IN IVF

8.2.2 HIGH COST OF IN VITRO FERTILIZATION (IVF)

8.3 OPPORTUNITIES

8.3.1 INCREASE IN RESEARCH AND DEVELOPMENTAL EFFORTS

8.3.2 ADVANCEMENTS IN REPRODUCTIVE TECHNOLOGY

8.3.3 INCREASE IN PET OWNERSHIPS

8.4 CHALLENGES

8.4.1 RISK OF DISEASE TRANSMISSION DURING IVF PROCEDURES

8.4.2 LACK OF AWARENESS IN UNDERDEVELOPED MARKETS

9 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

9.1 OVERVIEW

9.2 EQUIPMENT

9.2.1 IVF AND EMBRYO CULTURE INSTRUMENTS

9.2.2 LABORATORY EQUIPMENT

9.2.3 CRYOSYSTEMS

9.2.4 MONITORING DEVICES

9.2.5 IMAGING SYSTEMS

9.2.6 OVUM PICK UP SYSTEM

9.2.7 OVUM ASPIRATION PUMPS

9.2.8 CABINETS

9.2.9 OTHERS

9.2.9.1 MICROSCOPES

9.2.9.2 CO2 INCUBATORS

9.2.9.3 EMBRYO TRANSFER CATHETERS

9.2.9.4 LASER SYSTEMS

9.2.9.5 OTHERS

9.2.9.5.1 CENTRIFUGES

9.2.9.5.2 REFRIGERATORS AND FREEZERS

9.2.9.5.3 MICROFUGE TUBES AND PLATES

9.2.9.5.4 OTHERS

9.2.9.5.4.1 ANALYZERS

9.2.9.5.4.2 PH MONITORS

9.2.9.5.4.3 OTHERS

9.2.9.5.4.4 BENCHTOP

9.2.9.5.4.5 STANDALONE

9.3 REAGENTS & KITS

9.3.1 MEDIA

9.3.2 EMBRYO ASSAY

9.3.3 KITS

9.3.3.1 EMBRYO CULTURE MEDIA

9.3.3.2 BOVINE MEDIA

9.3.3.3 SERUM FREE CULTURE MEDIA

9.3.3.4 CRYOPRESERVATION MEDIA

9.3.3.5 EQUINE MEDIA

9.3.3.5.1 DEVITRIFICATION KIT

9.3.3.5.2 VERIFICATION COOLING KIT

9.3.3.5.3 VERIFICATION WARMING KIT

9.3.3.5.4 OTHERS

9.4 SERVICES

9.4.1 OOCYTE RETRIEVAL AND COLLECTION

9.4.2 EMBRYO CULTURE AND DEVELOPMENT

9.4.3 CRYOPRESERVATION

9.4.4 GENETIC SCREENING AND SELECTION

9.4.5 OTHERS

10 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE

10.1 OVERVIEW

10.2 LIVESTOCK ANIMAL

10.2.1 CATTLES

10.2.2 SHEEP

10.2.3 GOAT

10.2.4 OTHERS

10.3 COMPANION ANIMALS

10.3.1 HORSES

10.3.2 DOGS

10.3.3 CATS

10.3.4 OTHERS

10.3.4.1 EQUIPMENT

10.3.4.2 REAGENT

10.3.4.3 SERVICES

11 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE

11.1 OVERVIEW

11.2 ARTIFICIAL INSEMINATION

11.3 EMBRYO TRANSFER

11.4 OVUM PICKUP

11.5 IN VITRO MATURATION

12 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER

12.1 OVERVIEW

12.2 VETERINARY FERTILITY CLINICS

12.3 VETERINARY HOSPITALS

12.4 SURGICAL CENTERS

12.5 RESEARCH LABORATORIES

12.6 CRYOBANKS

12.7 OTHERS

13 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDERS

13.3 RETAIL SALES

13.4 ONLINE SALES

13.5 OTHERS

14 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION

14.1 MIDDLE EAST AND AFRICA

14.1.1 SOUTH AFRICA

14.1.2 SAUDI ARABIA

14.1.3 U.A.E.

14.1.4 EGYPT

14.1.5 KUWAIT

14.1.6 ISRAEL

14.1.7 REST OF MIDDLE EAST AND AFRICA

15 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

16 SWOT ANALYSIS

17 COMPANY PROFILES

17.1 ZOETIS SERVICES LLC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 ESCO MEDICAL

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MINITÜB GMBH

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENTS

17.4 IMV TECHNOLOGIES GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENTS

17.5 HAMILTON THORNE

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT UPDATES

17.6 AGTECH, INC.

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 BOVINE ELITE

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 EQUINE FERTILITY CENTRE

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT UPDATE

17.9 JORGENSEN LABORATORIES

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT UPDATES

17.1 KRUUSE

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT UPDATE

17.11 PARAGON VETERINARY GROUP

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT UPDATE

17.12 STATELINE VETERINARY SERVICE

17.12.1 COMPANY SNAPSHOT

17.12.2 SERVICE PORTFOLIO

17.12.3 RECENT UPDATE

17.13 TRANS OVA GENETICS

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT UPDATES

17.14 TRI-MITSU PHARMACEUTICALS

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT UPDATES

18 QUESTIONNAIRE

19 RELATED REPORTS

List of Table

TABLE 1 MIDDLE EAST AND AFRICA OVERVIEW OF BOVINE IN VITRO PRODUCED (IVP) EMBRYO TRANSFER AND EXPORT TRENDS IN 2022 AND PROJECTED GROWTH FOR 2023 COUNTRY WISE

TABLE 2 BOVINE IN VIVO-DERIVED (IVD) EMBRYO COLLECTION BY REGION AND COUNTRY

TABLE 3 TRANSFER OF BOVINE IN VIVO DERIVED (IVD) EMBRYOS BY REGION AND COUNTRY

TABLE 4 VALUE CHAIN ANALYSIS

TABLE 5 DETAILS OF SELECTED COMMUNITY-BASED BREEDING PROGRAMS

TABLE 6 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 7 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 9 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 10 MIDDLE EAST AND AFRICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 11 MIDDLE EAST AND AFRICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 13 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 15 MIDDLE EAST AND AFRICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 17 MIDDLE EAST AND AFRICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 19 MIDDLE EAST AND AFRICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 20 TABLE 1 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2024-2031 (USD THOUSAND)

TABLE 21 MIDDLE EAST AND AFRICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 23 MIDDLE EAST AND AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 24 MIDDLE EAST AND AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 25 MIDDLE EAST AND AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 26 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 27 MIDDLE EAST AND AFRICA ARTIFICIAL INSEMINATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 28 MIDDLE EAST AND AFRICA EMBRYO TRANSFER IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 29 MIDDLE EAST AND AFRICA OVUM PICKUP IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 30 MIDDLE EAST AND AFRICA IN VITRO MATURATION IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 31 TABLE 1 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2024-2031 (USD THOUSAND)

TABLE 32 MIDDLE EAST AND AFRICA VETERINARY FERTILITY CLINICS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 33 MIDDLE EAST AND AFRICA VETERINARY HOSPITALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 34 MIDDLE EAST AND AFRICA SURGICAL CENTERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 35 MIDDLE EAST AND AFRICA RESEARCH LABORATORIES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 36 MIDDLE EAST AND AFRICA CRYOBANKS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 37 MIDDLE EAST AND AFRICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 38 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 39 MIDDLE EAST AND AFRICA DIRECT TENDERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 40 MIDDLE EAST AND AFRICA RETAIL SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 41 MIDDLE EAST AND AFRICA ONLINE SALES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 42 MIDDLE EAST AND AFRICA OTHERS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY REGION, 2022-2031 (USD THOUSAND)

TABLE 43 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY COUNTRY, 2022-2031 (USD THOUSAND)

TABLE 44 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 45 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 46 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 47 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 48 MIDDLE EAST AND AFRICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 49 MIDDLE EAST AND AFRICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 50 MIDDLE EAST AND AFRICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 51 MIDDLE EAST AND AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 52 MIDDLE EAST AND AFRICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 53 MIDDLE EAST AND AFRICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 54 MIDDLE EAST AND AFRICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 55 MIDDLE EAST AND AFRICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 56 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 57 MIDDLE EAST AND AFRICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 58 MIDDLE EAST AND AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 59 MIDDLE EAST AND AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 60 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 61 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 62 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 63 SOUTH AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 64 SOUTH AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 65 SOUTH AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 66 SOUTH AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 67 SOUTH AFRICA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 68 SOUTH AFRICA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 69 SOUTH AFRICA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 70 SOUTH AFRICA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 71 SOUTH AFRICA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 72 SOUTH AFRICA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 73 SOUTH AFRICA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 74 SOUTH AFRICA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 75 SOUTH AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 76 SOUTH AFRICA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 77 SOUTH AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 78 SOUTH AFRICA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 79 SOUTH AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 80 SOUTH AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 81 SOUTH AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 82 SAUDI ARABIA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 83 SAUDI ARABIA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 84 SAUDI ARABIA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 85 SAUDI ARABIA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 86 SAUDI ARABIA IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 87 SAUDI ARABIA LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 88 SAUDI ARABIA MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 89 SAUDI ARABIA EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 90 SAUDI ARABIA REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 91 SAUDI ARABIA MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 92 SAUDI ARABIA KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 93 SAUDI ARABIA SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 94 SAUDI ARABIA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 95 SAUDI ARABIA LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 96 SAUDI ARABIA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 97 SAUDI ARABIA COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 98 SAUDI ARABIA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 99 SAUDI ARABIA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 100 SAUDI ARABIA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 101 U.A.E. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 102 U.A.E. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 103 U.A.E. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 104 U.A.E. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 105 U.A.E. IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 106 U.A.E. LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 107 U.A.E. MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 108 U.A.E. EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 109 U.A.E. REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 110 U.A.E. MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 111 U.A.E. KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 112 U.A.E. SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 113 U.A.E. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 114 U.A.E. LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 115 U.A.E. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 116 U.A.E. COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 117 U.A.E. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 118 U.A.E. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 119 U.A.E. VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 120 EGYPT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 121 EGYPT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 122 EGYPT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 123 EGYPT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 124 EGYPT IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 125 EGYPT LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 126 EGYPT MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 127 EGYPT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 128 EGYPT REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 129 EGYPT MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 130 EGYPT KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 131 EGYPT SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 132 EGYPT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 133 EGYPT LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 134 EGYPT COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 135 EGYPT COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 136 EGYPT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 137 EGYPT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 138 EGYPT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 139 KUWAIT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 140 KUWAIT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 141 KUWAIT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 142 KUWAIT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 143 KUWAIT IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 144 KUWAIT LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 145 KUWAIT MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 146 KUWAIT EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 147 KUWAIT REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 148 KUWAIT MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 149 KUWAIT KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 150 KUWAIT SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 151 KUWAIT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 152 KUWAIT LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 153 KUWAIT COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 154 KUWAIT COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 155 KUWAIT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 156 KUWAIT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 157 KUWAIT VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 158 ISRAEL VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 159 ISRAEL EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 160 ISRAEL EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (VOLUME IN UNITS)

TABLE 161 ISRAEL EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (ASP)

TABLE 162 ISRAEL IVF AND EMBRYO CULTURE INSTRUMENTS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 163 ISRAEL LABORATORY EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 164 ISRAEL MONITORING DEVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 165 ISRAEL EQUIPMENT IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY MODALITY, 2022-2031 (USD THOUSAND)

TABLE 166 ISRAEL REAGENTS & KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 167 ISRAEL MEDIA IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 168 ISRAEL KITS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 169 ISRAEL SERVICES IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 170 ISRAEL VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY ANIMAL TYPE, 2022-2031 (USD THOUSAND)

TABLE 171 ISRAEL LIVESTOCK ANIMAL IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 172 ISRAEL COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TYPE, 2022-2031 (USD THOUSAND)

TABLE 173 ISRAEL COMPANION ANIMALS IN VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCT & SERVICES, 2022-2031 (USD THOUSAND)

TABLE 174 ISRAEL VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY TECHNIQUE, 2022-2031 (USD THOUSAND)

TABLE 175 ISRAEL VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY DISTRIBUTION CHANNEL, 2022-2031 (USD THOUSAND)

TABLE 176 ISRAEL VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY END USER, 2022-2031 (USD THOUSAND)

TABLE 177 REST OF MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES, 2022-2031 (USD THOUSAND)

List of Figure

FIGURE 1 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 2 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DATA TRIANGULATION

FIGURE 3 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DROC ANALYSIS

FIGURE 4 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: MIDDLE EAST AND AFRICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: DBMR MARKET POSITION GRID

FIGURE 9 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SEGMENTATION

FIGURE 11 THREE SEGMENTS COMPRISE THE MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET, BY PRODUCTS & SERVICES

FIGURE 12 EXECUTIVE SUMMARY

FIGURE 13 STRATEGIC DECISIONS

FIGURE 14 INCREASING LIVESTOCK PRODUCTION & BREEDING PROGRAMS IS DRIVING THE GROWTH OF THE MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET FROM 2024 TO 2031

FIGURE 15 THE PRODUCTS & SERVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET IN 2024 AND 2031

FIGURE 16 DROC ANALYSIS

FIGURE 17 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, 2023

FIGURE 18 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES 2024-2031 (USD THOUSAND)

FIGURE 19 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY PRODUCTS & SERVICES, CAGR (2024-2031)

FIGURE 20 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 21 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, 2023

FIGURE 22 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE 2024-2031 (USD THOUSAND)

FIGURE 23 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, CAGR (2024-2031)

FIGURE 24 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY ANIMAL TYPE, LIFELINE CURVE

FIGURE 25 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, 2023

FIGURE 26 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE 2024-2031 (USD THOUSAND)

FIGURE 27 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, CAGR (2024-2031)

FIGURE 28 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TECHNIQUE, LIFELINE CURVE

FIGURE 29 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, 2023

FIGURE 30 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER 2024-2031 (USD THOUSAND)

FIGURE 31 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY END USER, CAGR (2024-2031)

FIGURE 32 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY TYPE, LIFELINE CURVE

FIGURE 33 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, 2023

FIGURE 34 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL 2024-2031 (USD THOUSAND)

FIGURE 35 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, CAGR (2024-2031)

FIGURE 36 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 37 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION (IVF) MARKET: SNAPSHOT (2023)

FIGURE 38 MIDDLE EAST AND AFRICA VETERINARY IN VITRO FERTILIZATION MARKET: COMPANY SHARE 2023 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.