Middle East And Africa Wi Fi Chipset Market

Market Size in USD Million

CAGR :

%

USD

350.11 Million

USD

900.00 Million

2024

2032

USD

350.11 Million

USD

900.00 Million

2024

2032

| 2025 –2032 | |

| USD 350.11 Million | |

| USD 900.00 Million | |

|

|

|

|

Wi-Fi Chipset Market Size

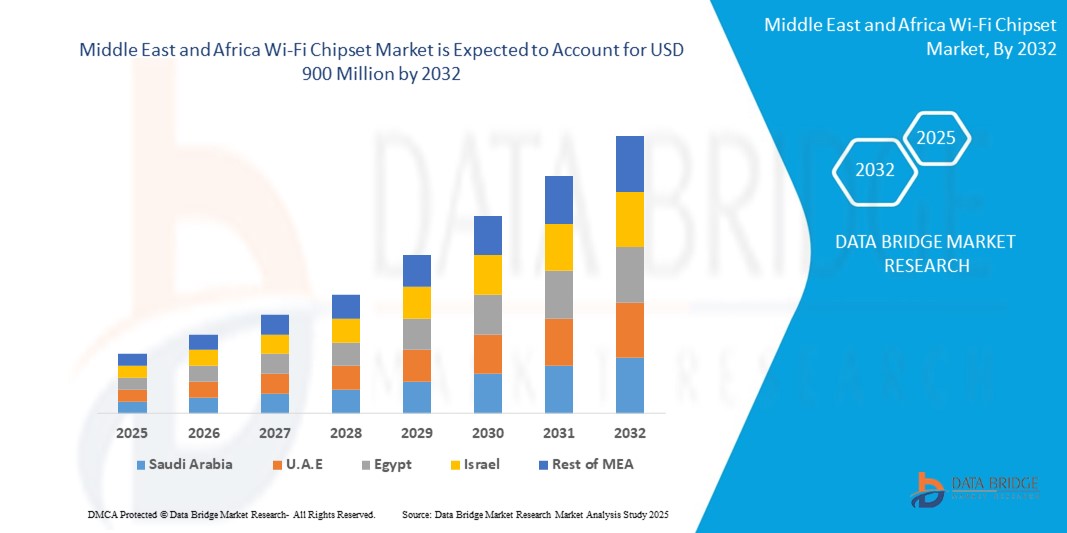

- The Middle East and Africa Wi-Fi Chipset Market Size was valued at USD 350.11 Million in 2024 and is expected to reach USD 900 Million by 2032, at a CAGR of 14.4% during the forecast period

- The growth of the Middle East and Africa Wi-Fi Chipset Market is fueled by Rising Adoption of Smart Devices, Expansion of 5G and IoT Infrastructure, and Growing Digitalization and Connectivity Initiatives.

Wi-Fi Chipset Market Analysis

- The Middle East and Africa (MEA) Wi-Fi chipset market is experiencing strong growth driven by widespread digital transformation across the region. Increasing adoption of smart devices such as smartphones, laptops, smart TVs, and wearables is fueling demand for advanced Wi-Fi chipsets that offer faster speeds and better connectivity. Governments in the MEA region, particularly in the Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia, are investing heavily in smart city projects and IoT infrastructure, which further supports market expansion. Additionally, the complementary rollout of 5G networks alongside Wi-Fi technologies is encouraging the adoption of newer chipset standards such as Wi-Fi 6 and Wi-Fi 6E, enabling improved performance and capacity.

- Consumer electronics currently represent the largest application segment, but enterprise and industrial IoT applications are expected to see rapid growth as businesses embrace digital transformation. While the GCC countries lead the market due to better-developed digital infrastructure and higher disposable incomes, African nations like South Africa, Nigeria, and Egypt present significant growth potential owing to increasing network penetration and government initiatives aimed at enhancing connectivity. The competitive landscape is dominated by global semiconductor companies such as Qualcomm, Broadcom, MediaTek, and Intel, which are actively partnering with device manufacturers and telecom operators to strengthen their market presence.

- However, the market faces challenges including infrastructural gaps in parts of Africa, price sensitivity among consumers, and regulatory complexities related to import duties and spectrum management. Despite these hurdles, the MEA Wi-Fi chipset market is expected to sustain a double-digit compound annual growth rate (CAGR) through 2032. This growth will be propelled by continuous technological advancements, the introduction of Wi-Fi 7, and increasing demand for seamless high-speed wireless connectivity across consumer and enterprise sectors.

Report Scope and Wi-Fi Chipset Market Segmentation

|

Attributes |

Wi-Fi Chipset Market Insights |

|

Segments Covered |

|

|

Countries Covered |

Middle East and Africa

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wi-Fi Chipset Market Trends

“Innovation and Connectivity: Transforming Wireless Communication Across Devices and Industries”

- A significant and accelerating trend in the Middle East and Africa Wi-Fi chipset market is the rapid integration of advanced wireless technologies such as Wi-Fi 6, Wi-Fi 6E, and emerging Wi-Fi 7 standards. These innovations are driving performance improvements in speed, latency, and network capacity across a wide range of applications—from consumer electronics and smart homes to enterprise networks and industrial IoT. Enhanced chipset capabilities are enabling seamless streaming, immersive gaming, smart healthcare, and robust enterprise communication.

- For example, chipset manufacturers like Qualcomm, Broadcom, and MediaTek are introducing Wi-Fi platforms that support dual and tri-band connectivity, advanced MU-MIMO (multi-user, multiple input, multiple output), and beamforming. These innovations are tailored for high-density environments such as smart cities, large-scale enterprises, and public infrastructure. The convergence of AI and Wi-Fi chipsets is also emerging, with AI-driven network optimization and adaptive traffic management becoming key differentiators.

- Moreover, governments in the Gulf region and parts of Africa are prioritizing digital transformation, 5G expansion, and smart city initiatives, which require advanced Wi-Fi solutions. These trends are reshaping the design and deployment of Wi-Fi chipsets across commercial, industrial, and public sectors. The rise of e-learning, telehealth, and remote work is further amplifying the need for secure, high-speed wireless connectivity, pushing chipset manufacturers to offer reliable and scalable solutions.

Wi-Fi Chipset Market Dynamics

Driver

“Rising Demand Driven by Connectivity Expansion, IoT Adoption, and Smart Infrastructure Development”

- The increasing adoption of connected devices and expanding digital ecosystems across the Middle East and Africa are key drivers of growth in the Wi-Fi chipset market. With more consumers relying on smart devices for communication, entertainment, education, and work, the demand for high-performance Wi-Fi chipsets has surged. Countries like the UAE, Saudi Arabia, South Africa, and Nigeria are witnessing significant investments in broadband infrastructure, smart buildings, and industrial automation.

- Chipset vendors are responding by offering energy-efficient, high-speed Wi-Fi chipsets capable of supporting complex applications across multiple verticals. For instance, the widespread rollout of Wi-Fi 6 and 6E chipsets provides enhanced network performance, particularly in crowded environments. These solutions are ideal for smart homes, offices, malls, airports, and connected campuses. Additionally, the proliferation of IoT applications in agriculture, healthcare, and manufacturing is driving demand for low-latency, reliable wireless communication.

- The Middle East and Africa are also seeing a rise in telecom and internet penetration, mobile broadband adoption, and government-backed digital inclusion programs, all of which create a favorable environment for Wi-Fi chipset deployment. Furthermore, the growing popularity of e-commerce, OTT platforms, and cloud-based services is increasing network bandwidth needs, pushing for faster and more capable Wi-Fi solutions.

Restraint/Challenge

“Market Growth Hindered by High Cost, Limited Infrastructure, and Technical Barriers in Emerging Regions”

- Despite promising growth prospects, the MEA Wi-Fi chipset market faces several constraints. One major challenge is the relatively high cost of next-generation Wi-Fi chipsets, particularly those supporting Wi-Fi 6 and 6E. This can deter adoption in price-sensitive markets and among budget-conscious OEMs. Cost constraints are particularly impactful in Sub-Saharan Africa, where affordability remains a key concern for both consumers and small businesses.

- In addition, infrastructural limitations in parts of Africa—including inconsistent electricity supply, low broadband penetration, and underdeveloped telecom networks—hinder the full-scale deployment of Wi-Fi technologies. These gaps reduce the addressable market for high-end chipsets and slow down regional digital adoption.

- Technical challenges such as device interoperability, chipset integration complexities, and compatibility with legacy systems also pose hurdles, particularly for local manufacturers and system integrators. Furthermore, the market is highly dependent on imports, exposing it to supply chain disruptions, regulatory bottlenecks, and fluctuating component prices. A lack of localized manufacturing and R&D investment contributes to longer product lifecycles and reduced innovation at the regional level.

Wi-Fi Chipset Market Scope

The market is segmented on the basis of Chipset type, Wi-Fi Standard, Application and End-User Industry.

|

Segmentation |

Sub-Segmentation |

|

By Chipset Type |

|

|

By Wi-Fi Standard |

|

|

By Application |

|

|

By End-User Industry |

|

- By Chipset type

By chipset type, the market includes single-band, dual-band, and tri-band chipsets. Single-band chipsets, typically operating on the 2.4 GHz frequency, are commonly used in cost-sensitive consumer electronics such as budget smartphones and basic routers, especially in rural and lower-income areas. Dual-band chipsets, supporting both 2.4 GHz and 5 GHz frequencies, are widely used in mainstream laptops, smart TVs, and mobile devices due to their better performance and reduced interference, making them suitable for urban households and small enterprises. Tri-band chipsets, which operate on three separate frequency bands, are ideal for dense environments like smart buildings, enterprise campuses, and data centers, offering higher capacity and network efficiency.

- By Wi-Fi Standard

In terms of Wi-Fi standards, the market is segmented into Wi-Fi 4, Wi-Fi 5, Wi-Fi 6, and the emerging Wi-Fi 6E. Wi-Fi 4 remains in use in entry-level devices, particularly in underdeveloped regions of Africa, where affordability is a priority. Wi-Fi 5 has become mainstream across the region, supporting bandwidth-heavy applications such as HD video streaming and online gaming. Wi-Fi 6 is gaining popularity in both residential and enterprise segments, owing to its ability to handle multiple devices simultaneously with enhanced speed and efficiency. Wi-Fi 6E, which adds access to the 6 GHz band, is still in the early adoption phase but is expected to grow in technologically advanced markets like the UAE and South Africa as part of smart infrastructure deployments.

- By Application

Based on application, Wi-Fi chipsets are used across consumer electronics, enterprise and commercial solutions, automotive systems, and healthcare devices. Consumer electronics represent the largest segment, with chipsets embedded in smartphones, tablets, laptops, wearables, and smart home devices. In enterprise and commercial applications, Wi-Fi chipsets power routers, access points, and communication infrastructure in offices, hotels, shopping malls, and smart campuses. The automotive segment is witnessing rising demand for chipsets used in connected vehicle applications such as infotainment, telematics, and driver assistance systems, particularly as electric and autonomous vehicle trends emerge in the region. In the healthcare sector, Wi-Fi chipsets support telemedicine devices, wireless diagnostic tools, and smart monitoring systems, contributing to the digitization of healthcare services.

- By End-User Industry

By end-user industry, the telecom and IT sector dominates the market due to high demand for wireless broadband infrastructure, customer premises equipment, and network expansion efforts. The industrial and manufacturing sector is also increasingly adopting Wi-Fi chipsets for smart factory initiatives, predictive maintenance, and real-time communication across production environments. This is particularly relevant in industries such as oil & gas, mining, and logistics in the Middle East and parts of Africa. Government and public sector entities are deploying Wi-Fi-enabled technologies in smart city initiatives, public Wi-Fi networks, e-governance platforms, and defense applications, further driving demand for advanced and secure wireless communication solutions across the region.

Wi-Fi Chipset Market Regional Analysis

- The Middle East and Africa (MEA) Wi-Fi chipset market displays varied growth dynamics across different subregions, shaped by disparities in technological infrastructure, economic development, and government-led digitalization initiatives. In the Middle East, countries such as the United Arab Emirates (UAE), Saudi Arabia, and Qatar are leading the adoption of advanced Wi-Fi technologies. These nations benefit from high internet penetration, robust investments in smart cities, and rapid deployment of 5G and broadband infrastructure. The UAE’s focus on becoming a digital economy hub and Saudi Arabia’s Vision 2030 are driving the demand for next-generation Wi-Fi chipsets in sectors such as smart buildings, healthcare, education, and public services. Enterprise and government sectors in the Middle East are increasingly integrating Wi-Fi 6 and 6E chipsets into their networks to support dense IoT ecosystems and high-bandwidth applications.

- In contrast, the African region presents a more fragmented yet promising growth landscape. Countries such as South Africa, Kenya, and Nigeria are experiencing notable advancements in Wi-Fi deployment, driven by expanding internet access, mobile broadband usage, and the need for digital inclusion. South Africa, in particular, has emerged as a regional technology hub, with Wi-Fi chipset adoption supported by its growing telecom sector, enterprise digital transformation, and e-learning initiatives. Kenya’s focus on digital infrastructure and Nigeria’s expanding e-commerce and fintech industries are also contributing to chipset demand.

- However, much of Sub-Saharan Africa still faces infrastructural challenges such as inconsistent power supply, limited internet penetration, and high device costs, which restrict the uptake of advanced Wi-Fi solutions. Nonetheless, ongoing public-private partnerships, foreign investments in connectivity infrastructure, and regulatory efforts aimed at enhancing spectrum availability are gradually improving the regional market potential.

- Overall, the MEA Wi-Fi chipset market is poised for moderate to strong growth, with high adoption rates in digitally advanced Gulf nations and emerging opportunities in African countries as digital transformation accelerates across sectors like education, healthcare, manufacturing, and smart mobility.

Middle East Wi-Fi Chipset Market Insight

The Middle East Wi-Fi Chipset Market is witnessing significant growth, fueled by strong government-led digital transformation initiatives, increasing internet penetration, and rising demand for high-speed wireless connectivity across sectors. Countries like the United Arab Emirates (UAE), Saudi Arabia, Qatar, and Bahrain are at the forefront of this expansion, leveraging smart city projects, 5G rollouts, and cloud-based infrastructures that require advanced Wi-Fi capabilities. The adoption of Wi-Fi 6 and Wi-Fi 6E chipsets is gaining momentum in enterprise networks, commercial facilities, and public sector projects, driven by their ability to handle high device density, offer low latency, and deliver faster data throughput.

The region’s thriving telecom and IT sector is a key driver, as operators and service providers increasingly deploy Wi-Fi chipsets in routers, access points, and integrated service platforms. Additionally, the rapid growth of consumer electronics such as smart TVs, smartphones, and home automation systems has increased demand for efficient and cost-effective chipsets. In parallel, the automotive and healthcare sectors are incorporating Wi-Fi connectivity in connected vehicles and digital health monitoring solutions.

Saudi Arabia's Vision 2030 and the UAE’s smart government initiatives are accelerating investments in infrastructure that support widespread connectivity and digital inclusion. These factors, combined with rising e-commerce activity, remote working models, and digital education trends, are strengthening the market for advanced Wi-Fi chipset solutions. With growing enterprise digitalization and favorable regulatory environments, the Middle East is positioned as a key regional hub for Wi-Fi chipset innovation and deployment.

African Wi-fi Chipset Market Insight

The Africa Wi-Fi Chipset Market is undergoing gradual but promising growth, driven by increasing internet penetration, the rapid expansion of mobile broadband, and efforts to bridge the digital divide across the continent. Countries such as South Africa, Kenya, Nigeria, Egypt, and Morocco are emerging as key contributors to market expansion, supported by rising investments in telecom infrastructure, digital education initiatives, and growing demand for connected consumer devices. In South Africa, the most advanced market in the region, robust developments in the enterprise IT sector, smart city projects, and the proliferation of public Wi-Fi networks are creating sustained demand for advanced chipsets—especially those based on Wi-Fi 5 and Wi-Fi 6 technologies.

In Kenya and Nigeria, the increasing affordability of smartphones and laptops, combined with strong e-commerce and fintech growth, is boosting the uptake of Wi-Fi-enabled devices. These trends are driving chipset consumption in both urban and semi-urban areas. Moreover, educational institutions across several African nations are adopting digital learning platforms, increasing the need for reliable and cost-effective Wi-Fi infrastructure.

However, widespread adoption of higher-end chipsets such as Wi-Fi 6E remains limited due to infrastructure challenges, high equipment costs, and inconsistent power supply in many parts of Sub-Saharan Africa. The market also faces constraints related to limited spectrum availability and low digital literacy in remote regions. Nevertheless, ongoing public-private partnerships, international funding for broadband expansion, and regulatory support for spectrum allocation are expected to unlock further opportunities in the coming years.

Wi-Fi Chipset Market Share

The Wi-Fi Chipset industry is primarily led by well-established companies, including:

- Qualcomm Technologies Inc.

- Broadcom Inc.

- MediaTek Inc.

- Intel Corporation

- Marvell Technology Group

- Texas Instruments Inc.

- NXP Semiconductors

- Infineon Technologies (Cypress Semiconductor)

Latest Developments in Wi-Fi Chipset Market

- In early 2024, regional telecom operators invested in integrated connectivity services, combining 5G and Wi-Fi with chipset solutions optimized for seamless network management and handover. The automotive sector embraced Wi-Fi chipset technology for connected car platforms focusing on telematics and infotainment. Meanwhile, government digital initiatives in cities like Riyadh and Dubai scaled up public Wi-Fi projects, boosting demand for chipsets with enhanced security and management features.

- In late 2024 and beyond, the market is expected to see broader adoption of Wi-Fi 6E and early introductions of Wi-Fi 7 technologies as spectrum regulations evolve. Chipset manufacturers are anticipated to integrate AI and machine learning capabilities for smarter network optimization and predictive maintenance, particularly for enterprise and smart city deployments. Additionally, expanding telecom infrastructure investments in African countries such as South Africa, Kenya, and Nigeria will drive growth in Wi-Fi chipset adoption, focusing on bridging connectivity gaps in urban and semi-urban regions.

- In 2023, Wi-Fi 6E chipsets were introduced in select Middle Eastern markets, taking advantage of the newly available 6 GHz spectrum for enhanced wireless performance. The consumer market witnessed a surge in demand for smart home and IoT devices, driving the adoption of low-power Wi-Fi chipsets optimized for such applications. Enterprise sectors also saw expanded deployment of tri-band Wi-Fi chipsets in offices and commercial spaces, supporting remote work and dense device environments.

- In 2022, the Middle East saw accelerated adoption of Wi-Fi 6 technology, with major telecom operators like Etisalat and STC deploying Wi-Fi 6-enabled infrastructure to meet the rising demand for higher bandwidth in urban areas. That year also marked strategic partnerships between global chipset vendors such as Qualcomm and Broadcom and regional ISPs and network equipment providers, facilitating advanced Wi-Fi solutions deployment. Governments in the UAE and Saudi Arabia initiated smart city projects embedding Wi-Fi 6 chipsets to enable IoT connectivity and public Wi-Fi services.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Middle East And Africa Wi Fi Chipset Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Middle East And Africa Wi Fi Chipset Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Middle East And Africa Wi Fi Chipset Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.