North America Aftermarket Combustion Engine Repairs Market

Market Size in USD Billion

CAGR :

%

USD

19.40 Billion

USD

27.99 Billion

2024

2032

USD

19.40 Billion

USD

27.99 Billion

2024

2032

| 2025 –2032 | |

| USD 19.40 Billion | |

| USD 27.99 Billion | |

|

|

|

Aftermarket Combustion Engine Repairs Market Analysis

The North America aftermarket combustion engine repairs market is a dynamic and essential industry that supports the maintenance, servicing, and repair of combustion engines across a wide range of sectors, including automotive, commercial vehicles, and industrial machinery. This market thrives on the demand for parts and services that ensure the continued performance and longevity of combustion engines after their initial sale. With growing vehicle fleets, the need for efficient, cost-effective repair solutions, and the push for environmental sustainability, the market is witnessing a rise in innovations such as improved engine parts and eco-friendly repair solutions. The market is highly influenced by technological advancements in engine diagnostics, the availability of high-quality aftermarket parts, and the increasing focus on reducing downtime and repair costs. In addition, the expansion of electric vehicles and stricter emissions regulations are shaping the future of the market, pushing for more sophisticated repair technologies and practices. The market continues to evolve with increased competition and a growing focus on providing value-added services to end users.

Aftermarket Combustion Engine Repairs Market Size

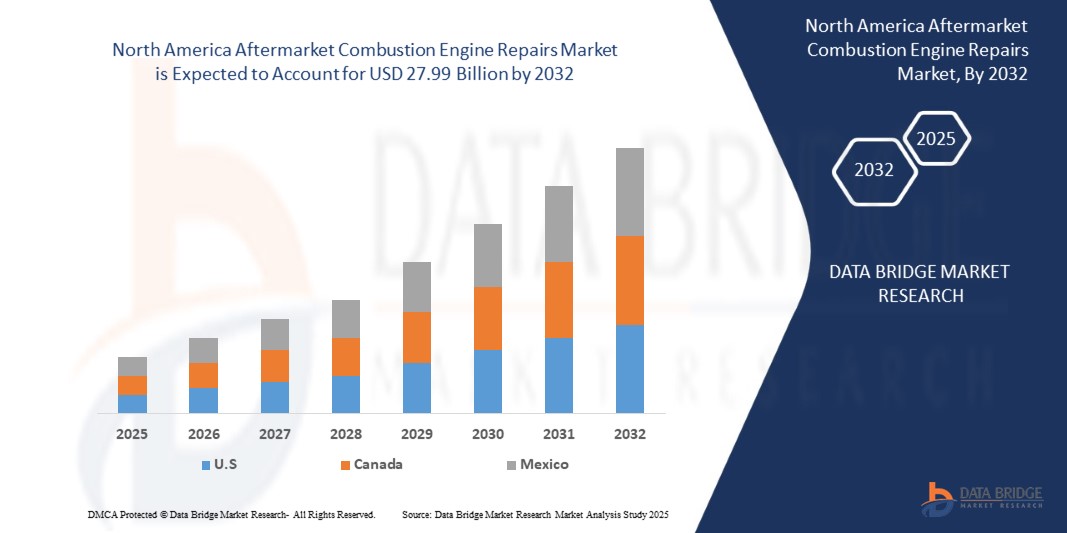

North America aftermarket combustion engine repairs market size was valued at USD 19.40 billion in 2024 and is projected to reach USD 27.99 billion by 2032, with a CAGR of 4.8% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis.

Aftermarket Combustion Engine Repairs Market Market Trends

"Rising Demand for Extended Engine Life and Sustainability Initiatives"

The increasing emphasis on sustainability and cost-efficiency has led to a rising demand for aftermarket combustion engine repairs, creating significant growth opportunities for this market. With the global focus on reducing carbon emissions and improving fuel efficiency, many industries are seeking ways to extend the lifespan of their existing combustion engines rather than replacing them. Aftermarket repairs and maintenance services, including overhauls, part replacements, and performance upgrades, are crucial in meeting these demands. Furthermore, as companies look to lower their operational costs and reduce environmental impact, the need for high-quality, reliable engine repairs is becoming more prominent. Government regulations encouraging the maintenance and retrofit of older engines to comply with stricter emission standards are also driving the growth of the aftermarket repair market. This trend is expected to continue as businesses across sectors, from transportation to industrial applications, increasingly prioritize sustainability and long-term engine performance.

Report Scope and Aftermarket Combustion Engine Repairs Market Segmentation

|

Attributes |

Aftermarket Combustion Engine Repairs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada, and Mexico |

|

Key Market Players |

Denso Corporation (Japan), ZF Friedrichshafen AG (Germany), ROBERT BOSCH GMBH (Germany), MAHLE GmbH (Germany), AISIN CORPORATION (Japan), BORGWARNER INC. (U.S.), Cummins Inc. (U.S.), Continental Automotive Technologies GMBH (Subsidiary of Continental AG) (Germany), Honeywell International Inc. (U.S), JASPER ENGINES & TRANSMISSIONS (U.S), LKQ CORPORATION (U.S), MANN+HUMMEL (Germany), Niterra Co., Ltd. (Japan), PHINIA INC. (U.S.), Schaeffler AG (Germany), and Tenneco Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and PESTLE analysis. |

Aftermarket Combustion Engine Repairs Market Definition

Aftermarket combustion engine repairs market refer to the repair, maintenance, and replacement of components for combustion engine systems in vehicles and machinery that occurs after the original sale by the original equipment manufacturer (OEM). These services, typically provided by third-party service providers, include a wide range of activities such as routine maintenance, diagnostics, engine overhauls, and the replacement of essential engine parts like spark plugs, fuel injectors, filters, and other critical components. The primary objectives of aftermarket combustion engine repairs are to enhance engine performance, extend the lifespan of the engine, and ensure compliance with environmental and regulatory standards, all while offering cost-effective solutions for end-users.

Aftermarket Combustion Engine Repairs Market Dynamics

Drivers

- Growth in Commercial Vehicle Usage in Logistics And Transportation

The growth in commercia vehicle usage in logistics and transportation is a significant driver for the global aftermarket combustion engine repairs market. As industries expand and demand for goods transportation rises, the number of commercial vehicles on the road continues to increase. These vehicles require frequent maintenance and repair, particularly for their combustion engines, which are central to their performance and efficiency. This surge in vehicle usage fuels the need for aftermarket parts and repair services, creating a strong market demand for maintenance solutions to ensure optimal performance and minimize downtime.

For instance,

According to an article published by the International Organization of Motor Vehicle Manufacturers, the global commercial vehicle production showed significant fluctuations between 2019 and 2023, influenced largely by the COVID-19 pandemic. Production decreased from 27.26 million units in 2019 to 24.92 million in 2020 due to disrupted supply chains and reduced demand. It rebounded to 26.36 million in 2021 but dipped again to 24.22 million in 2022 before recovering to 27.45 million in 2023. This recovery aligns with the growth in logistics and transportation activities, driving increased usage of commercial vehicles. Consequently, the aftermarket combustion engine repairs market has witnessed growth, fueled by the need for maintenance and repairs to support the rising demand in logistics operations.

- Rising Adoption of Aftermarket Parts for Cost Savings

The rising adoption of aftermarket parts for cost savings is a key driver of growth in the aftermarket combustion engine repairs market. As businesses and vehicle owners seek more affordable alternatives to OEM parts, aftermarket parts provide a cost-effective solution without compromising on quality. With increasing awareness of the benefits, such as lower prices and competitive performance, more consumers and fleet operators are opting for aftermarket solutions to reduce maintenance expenses. This trend is expected to continue as the demand for affordable, reliable, and high-performance parts grows, further fueling the expansion of the aftermarket repair market.

For instance,

In February 2023, Reliance Industries unveiled India’s first Hydrogen Internal Combustion Engine (H2ICE) technology for heavy-duty trucks, developed in collaboration with Ashok Leyland and other partners. This indigenously developed technology aims to redefine green mobility with near-zero emissions and performance comparable to traditional diesel trucks. It also promises reduced noise and potential cost savings. As the adoption of hydrogen-powered trucks grows, the market for aftermarket parts may see a shift, as these vehicles could require specialized maintenance and parts for optimal performance, further driving demand for cost-effective aftermarket solutions.

- Expansion of E-Commerce Platforms for Aftermarket Product Availability

The expansion of e-commerce platforms for aftermarket product availability is a key driver of growth in the aftermarket market. With the increasing shift toward online shopping, consumers and businesses can now easily access a wide range of aftermarket parts and accessories from the comfort of their homes or offices. E-commerce platforms offer convenience, competitive pricing, and faster delivery options, making it easier for fleet operators, repair shops, and individual vehicle owners to find and purchase the necessary components. This growing digital marketplace not only enhances the availability of products but also drives cost savings, further accelerating the adoption of aftermarket solutions.

For instance,

Alibaba offers a wide range of engine spare parts through its e-commerce platform, including items such as the Overflow Pipe 02232342 and Diesel Engine Spare Parts such as the Fuel Return Pipe for FL912 engines. These products are available directly from suppliers such as Hebei Keluo Construction Machinery Co., Ltd., with options for easy returns and warranty guarantees. The platform enables businesses to access high-quality, genuine aftermarket parts at competitive prices, enhancing the availability and convenience of sourcing engine repair components for various industries. This expansion of e-commerce platforms significantly boosts the accessibility of aftermarket products North Americaly.

Opportunities

- Integration of AI and IoT in Aftermarket Repair Systems

The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) presents a transformative opportunity for the aftermarket combustion engine repairs market. Advanced AI-powered diagnostics enable precise fault detection, predictive maintenance, and efficient repair processes, reducing downtime and improving vehicle reliability. IoT-connected systems facilitate real-time monitoring of engine performance, allowing service providers to proactively address issues before they escalate. These technologies not only enhance repair accuracy and efficiency but also create value-added services, positioning businesses at the forefront of innovation in a competitive market.

For instance,

According to the SPIE RODIAS GmbH, Verusen implemented its AI-driven solution for Spare Parts Criticality, designed to optimize inventory management by assessing the importance of spare parts and operational risks. This tool evaluates factors such as asset usage, supply chain conditions, and risks, allowing businesses to prioritize critical components, leading to significant cost savings and increased operational efficiency. The solution promises up to a 45% reduction in inventory spending. The integration of AI and IoT in aftermarket repair systems presents a major opportunity for the aftermarket combustion engine repairs market. This technology can enhance spare part management, reduce inventory costs, and improve repair system operations, enabling businesses to meet rising customer demands for faster and more reliable repair services.

- Expanding Applications in Marine and Industrial Combustion Engines

The expanding applications of combustion engines in marine and industrial sectors present a significant opportunity for the aftermarket combustion engine repairs market. As industries such as shipping, power generation, and manufacturing continue to rely on high-performance combustion engines, the demand for specialized aftermarket repair services is expected to grow. Advancements in engine technology, coupled with the need for efficient maintenance, create a fertile ground for innovative repair solutions. This growth in industrial and marine engine applications offers repair providers the chance to offer tailored services, boost operational efficiency, and support the longevity of critical machinery across various sectors.

For instance,

VOcean Ship Spares company offers a wide range of high-quality marine engine spare parts, catering to various types of marine engines for efficient maintenance and repairs. Their products include essential parts such as cylinder heads, camshafts, crankshafts, connecting rods, and engine valves, ensuring vessels are equipped with durable and reliable components. By partnering with VOcean, businesses in the aftermarket combustion engine repairs market can benefit from access to premium parts, boosting performance and extending engine lifespans. This collaboration offers the opportunity to enhance operational efficiency and reduce downtime in both marine and industrial sectors

- Innovations in Diagnostic Tools Boosting Repair Efficiency

Innovations in diagnostic tools are significantly boosting repair efficiency in the aftermarket combustion engine repairs market. With the introduction of advanced diagnostic systems, repair shops can quickly identify the root causes of engine issues, reducing downtime and ensuring accurate repairs. These tools enable faster diagnostics, optimized workflows, and more precise maintenance, ultimately enhancing operational efficiency and reducing repair costs for businesses. As these innovations gain wider adoption, they offer a valuable opportunity for companies to improve service quality, increase customer satisfaction, and maintain a competitive edge in the evolving aftermarket repair industry.

For instance,

In December 2024, VDIAGTOOL introduced the VD70S, an advanced diagnostic tool priced under USD 400, catering to over 10,000 vehicle models and featuring Wi-Fi and USB connectivity. This tool supports key maintenance functions such as DPF regeneration and ABS bleeding, while real-time live data analysis improves diagnostic precision and efficiency. By enabling faster and more accurate repairs at a lower cost, this innovation aligns with the growing demand for advanced diagnostic solutions in the aftermarket sector. It highlights the shift toward technology-driven services, enhancing repair businesses' competitiveness and addressing evolving market needs.

Restraints/Challenges

- Declining Market Growth Accelerating the Shift Towards EV Adoption

The declining market in regions which favoring electric vehicle (EV) adoption poses a significant restraint to the aftermarket combustion engine repairs market. As EVs become more popular due to their environmental benefits and lower maintenance requirements, the demand for traditional combustion engine repairs is expected to decrease. This shift towards EVs reduces the need for spare parts and repair services associated with internal combustion engines, thereby limiting growth opportunities for companies in the combustion engine aftermarket sector. As a result, the market must adapt to this transition, focusing on emerging trends in EV-related parts and services to sustain long-term growth

For instance,

In 2024, electric car sales saw significant growth, with China accounting for the majority of the additional 3 million sales compared to 2023. Despite the phase-out of NEV purchase subsidies, sales in China grew by nearly 25%, reaching around 10 million units, making up 45% of total car sales. The United States also saw a 20% increase, with electric car sales rising by almost half a million units, while Europe experienced more modest growth of less than 10%. Other regions, such as Southeast Asia and India, also contributed to the rise in EV sales, with a 40% increase outside of the major markets. This strong growth in EV adoption presents a restraint to the aftermarket combustion engine repairs market, as the shift towards electric vehicles reduces the demand for traditional combustion engine parts and repair services, slowing down the growth market in the combustion engine aftermarket sector.

- High Costs Associated with Advanced Repair Technologies

High costs associated with advanced repair technologies pose a significant restraint to the aftermarket combustion engine repairs Market. As the automotive industry increasingly adopts complex systems and sophisticated diagnostic tools for engine repairs, the expenses related to acquiring and maintaining these advanced technologies can be prohibitive for smaller repair shops. This financial burden will limit the accessibility and affordability of specialized repair services, especially in emerging markets, hindering the growth of the aftermarket sector. Consequently, the high cost of repair technologies may restrict the ability of service providers to meet rising demands efficiently, affecting overall market expansion.

For instance,

Laptops mentioned the Universal Diesel Truck Diagnostic Tool & Scanner Kit as a comprehensive solution for diesel diagnostics, designed to connect with various vehicles and equipment types. However, its high cost of USD 2,895, coupled with the specialized software and advanced technology it includes, underscores the financial barrier faced by repair service providers. Such expensive tools and equipment required for modern diagnostics act as a restraint to the aftermarket combustion engine repairs market, as smaller shops and independent service providers may struggle to afford these technologies, limiting their ability to compete and meet repair demands effectively.

- Maintaining Quality and Reliability in Low-Cost Aftermarket Parts

Maintaing quality and reliability in low-cost aftermarket parts presents a significant challenge to the aftermarket combustion engine repairs market. While affordability drives demand for these components, inconsistent quality, lack of adherence to OEM standards, and shorter lifespans can lead to frequent replacements and compromised engine performance. This creates hurdles for repair businesses to balance cost-effectiveness with customer satisfaction, making it essential to implement stricter quality control measures and foster trust in aftermarket solutions.

For instance,

In April 2024, according to the blog published by the PDM highlighted the challenges of maintaining quality and reliability in low-cost aftermarket parts for the aftermarket combustion engine repairs market. Despite the growing demand for such parts due to aging vehicles, ensuring adherence to certifications such as ISO 9001, CAPA, and NSF remained critical. The blog emphasized that inconsistent quality, safety concerns, and lack of compliance with industry standards hindered trust and long-term performance. Manufacturers faced pressure to balance affordability with stringent quality assurance to sustain market competitiveness.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Aftermarket Combustion Engine Repairs Market Scope

The market is segmented into five notable segments based on the service type, type, fuel type, engine type, and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Service Type

- Routine Maintenance

- Oil change

- Filter replacements

- Oil

- Air

- Fuel

- Spark plug replacement

- Others

- Repairs

- Pistons

- Valves

- Timing Valves

- Others

- Diagnosis

- Engine Overhaul or Rebuilding

- Other Services

Type

- Normal Engine

- Sports Engine

- Vintage Engine

- Others

Fuel Type

- Petrol

- Diesel

Engine Type

- Car engines

- Commercial Vehicle Engines

- Motor Cycles engines

- Other Engines

Aftermarket Combustion Engine Repairs Market Regional Analysis

The market is segmented into five notable segments based on the country, service type, type, fuel type, engine type, and end-user as referenced above.

The countries covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate the North America aftermarket combustion engine repairs market due to its large and diverse automotive and industrial sectors, which rely heavily on combustion engines. The country’s extensive vehicle fleet and high demand for repair services further fuel market growth. Additionally, regulatory standards and a focus on extending engine lifespans drive the need for aftermarket repairs across various industries.

U.S. is the fastest growing country in the North America aftermarket combustion engine repairs market due to its large vehicle fleet and high demand for maintenance and repair services. The continuous growth of both traditional combustion engine and hybrid vehicles boosts the need for aftermarket parts and repairs.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Aftermarket Combustion Engine Repairs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Aftermarket Combustion Engine Repairs Market Leaders Operating in the Market Are:

- Denso Corporation (Japan)

- ZF Friedrichshafen AG (Germany)

- ROBERT BOSCH GMBH (Germany)

- MAHLE GmbH (Germany)

- AISIN CORPORATION (Japan)

- BORGWARNER INC. (U.S.)

- Cummins Inc. (U.S.)

- Continental Automotive Technologies GMBH (Subsidiary of Continental AG) (Germany)

- Honeywell International Inc. (U.S)

- JASPER ENGINES & TRANSMISSIONS (U.S)

- LKQ CORPORATION (U.S)

- MANN+HUMMEL (Germany)

- Niterra Co., Ltd. (Japan)

- PHINIA INC. (U.S.)

- Schaeffler AG (Germany)

- Tenneco Inc. (U.S.)

Latest Developments in Aftermarket Combustion Engine Repairs Market

- In September 2024, DENSO announced plans to build a new plant at its Zenmyo Plant in Nishio City, Aichi Prefecture, with construction starting in FY2025 and production set to begin in FY2028. The new facility, with an investment of 69 billion yen, will focus on manufacturing large-scale integrated ECUs for electrification and ADAS products. It will incorporate digital infrastructure, automation, and 24-hour unmanned operation, improving production efficiency. The plant will also aim to be carbon-neutral, utilizing solar power and hydrogen. DENSO benefits by enhancing manufacturing flexibility, automation, and sustainability, reinforcing its position as a leading supplier in the mobility industry

- In August 2024, ZF Aftermarket has introduced 25 Electric Axle Drive Repair Kits for cars and SUVs in the U.S. and Canada, streamlining electric axle drive repairs by eliminating the need for component removal. This launch expands ZF’s portfolio for electric and hybrid vehicles, bolstering its aftermarket presence and enhancing its ability to support both electric and combustion engine repairs with a diverse product range

- In January 2024, Robert Bosch GmbH announced they will launch hydrogen combustion engine. Bosch aims to become a major supplier to automotive and truck manufacturers as the heavy trucking industry shifts from diesel engines to zero-emission hydrogen-based propulsion. The company is also applying its technology to the stationary hydrogen sector and plans to invest $2.6 billion in hydrogen initiatives between 2021 and 2026

- In November 2024, AISIN announced the launch of AISIN Aftermarket & Service of America, Inc., formed by merging AWTEC and AISIN World Corp. of America’s aftermarket division. The company plans to expand its product range and become a comprehensive parts and service provider. This development strengthens AISIN’s position in the aftermarket combustion engine repair market by broadening its offerings and enhancing regional reach

- In January 2020, MAHLE Aftermarket has joined forces with Grant Brothers Sales Ltd. to broaden its product presence in key Canadian markets, utilizing Grant Brothers' extensive network and expertise. This collaboration enhances MAHLE GmbH's position in the aftermarket combustion engine repair market by expanding its reach, improving distribution processes, and offering in-depth support with technical training and a holistic service approach in industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 SERVICE TYPE TIMELINE CURVE

2.1 MARKET END USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

4.3 VALUE CHAIN ANALYSIS

4.4 REGULATORY STANDARDS

4.5 COMPANY COMPARATIVE ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWTH IN COMMERCIAL VEHICLE USAGE IN LOGISTICS AND TRANSPORTATION

5.1.2 RISING ADOPTION OF AFTERMARKET PARTS FOR COST SAVINGS

5.1.3 EXPANSION OF E-COMMERCE PLATFORMS FOR AFTERMARKET PRODUCT AVAILABILITY

5.1.4 AVAILABILITY OF AUTOMOTIVE REPAIR NETWORKS IN RURAL AREAS

5.2 RESTRAINT

5.2.1 DECLINING MARKET GROWTH ACCELERATING THE SHIFT TOWARDS EV ADOPTION

5.2.2 HIGH COSTS ASSOCIATED WITH ADVANCED REPAIR TECHNOLOGIES

5.3 OPPORTUNITIES

5.3.1 INTEGRATION OF AI AND IOT IN AFTERMARKET REPAIR SYSTEMS

5.3.2 EXPANDING APPLICATIONS IN MARINE AND INDUSTRIAL COMBUSTION ENGINES

5.3.3 INNOVATIONS IN DIAGNOSTIC TOOLS BOOSTING REPAIR EFFICIENCY

5.4 CHALLENGES

5.4.1 MAINTAINING QUALITY AND RELIABILITY IN LOW-COST AFTERMARKET PARTS

5.4.2 COMPETITION FROM ORIGINAL EQUIPMENT MANUFACTURER-AUTHORIZED SERVICE PROVIDERS

6 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE

6.1 OVERVIEW

6.2 ROUTINE MAINTENANCE

6.2.1 OIL CHANGE

6.2.2 FILTER REPLACEMENTS

6.2.2.1 OIL

6.2.2.2 AIR

6.2.2.3 FUEL

6.2.3 SPARK PLUG REPLACEMENT

6.2.4 OTHERS

6.3 REPAIRS

6.3.1 PISTONS

6.3.2 VALVES

6.3.3 TIMING VALVES

6.3.4 OTHERS

6.4 DIAGNOSIS

6.5 ENGINE OVERHAUL OR REBUILDING

6.6 OTHER SERVICES

7 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE

7.1 OVERVIEW

7.2 CAR ENGINES

7.3 COMMERCIAL VEHICLE ENGINES

7.4 MOTOR CYCLES ENGINES

7.5 OTHER ENGINES

8 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE

8.1 OVERVIEW

8.2 NORMAL ENGINE

8.3 SPORTS ENGINE

8.4 VINTAGE ENGINE

8.5 OTHERS

9 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE

9.1 OVERVIEW

9.2 PETROL

9.3 DIESEL

10 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END USER

10.1 OVERVIEW

10.2 INDIVIDUAL VEHICLE OWNER

10.2.1 ROUTINE MAINTENANCE

10.2.1.1 OIL CHANGE

10.2.1.2 FILTER REPLACEMENTS

10.2.1.2.1 OIL

10.2.1.2.2 AIR

10.2.1.2.3 FUEL

10.2.1.3 SPARK PLUG REPLACEMENT

10.2.1.4 OTHERS

10.2.2 REPAIRS

10.2.2.1 PISTONS

10.2.2.2 VALVES

10.2.2.3 TIMING VALVES

10.2.2.4 OTHERS

10.2.3 DIAGNOSIS

10.2.4 ENGINE OVERHAUL OR REBUILDING

10.2.5 OTHER SERVICES

10.3 FLEET OPERATORS

10.3.1 ROUTINE MAINTENANCE

10.3.1.1 OIL CHANGE

10.3.1.2 FILTER REPLACEMENTS

10.3.1.2.1 OIL

10.3.1.2.2 AIR

10.3.1.2.3 FUEL

10.3.1.3 SPARK PLUG REPLACEMENT

10.3.1.4 OTHERS

10.3.2 REPAIRS

10.3.2.1 PISTONS

10.3.2.2 VALVES

10.3.2.3 TIMING VALVES

10.3.2.4 OTHERS

10.3.3 DIAGNOSIS

10.3.4 ENGINE OVERHAUL OR REBUILDING

10.3.5 OTHER SERVICES

10.4 OEMS AND AUTO MANUFACTURERS

10.4.1 ROUTINE MAINTENANCE

10.4.1.1 OIL CHANGE

10.4.1.2 FILTER REPLACEMENTS

10.4.1.2.1 OIL

10.4.1.2.2 AIR

10.4.1.2.3 FUEL

10.4.1.3 SPARK PLUG REPLACEMENT

10.4.1.4 OTHERS

10.4.2 REPAIRS

10.4.2.1 PISTONS

10.4.2.2 VALVES

10.4.2.3 TIMING VALVES

10.4.2.4 OTHERS

10.4.3 DIAGNOSIS

10.4.4 ENGINE OVERHAUL OR REBUILDING

10.4.5 OTHER SERVICES

10.5 SHIPPING AND MARINE COMPANIES

10.5.1 ROUTINE MAINTENANCE

10.5.1.1 OIL CHANGE

10.5.1.2 FILTER REPLACEMENTS

10.5.1.2.1 OIL

10.5.1.2.2 AIR

10.5.1.2.3 FUEL

10.5.1.3 SPARK PLUG REPLACEMENT

10.5.1.4 OTHERS

10.5.2 REPAIRS

10.5.2.1 PISTONS

10.5.2.2 VALVES

10.5.2.3 TIMING VALVES

10.5.2.4 OTHERS

10.5.3 DIAGNOSIS

10.5.4 ENGINE OVERHAUL OR REBUILDING

10.5.5 OTHERS SERVICES

10.6 OTHERS

11 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILES

14.1 DENSO CORPORATION

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 ZF FRIEDRICHSHAFEN AG

14.2.1 COMPANY SNAPSHOT

14.2.2 COMPANY SHARE ANALYSIS

14.2.3 PRODUCT PORTFOLIO

14.2.4 RECENT DEVELOPMENT

14.3 ROBERT BOSCH GMBH

14.3.1 COMPANY SNAPSHOT

14.3.2 COMPANY SHARE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENT

14.4 MAHLE GMBH

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 AISIN CORPORATION

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 BORGWARNER INC.

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.4 RECENT DEVELOPMENT

14.7 CUMMINS INC.

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENT

14.8 CONTINENTAL AUTOMOTIVE TECHNOLOGIES GMBH (SUBSIDIARY OF CONTINENTAL AG)

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 PRODUCT PORTFOLIO

14.8.4 RECENT DEVELOPMENT

14.9 HONEYWELL INTERNATIONAL INC.

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENT

14.1 JASPER ENGINES & TRANSMISSIONS

14.10.1 COMPANY SNAPSHOT

14.10.2 PRODUCT PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 LKQ CORPORATION

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 MANN+HUMMEL

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENT

14.13 NITERRA CO., LTD.

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 PRODUCT PORTFOLIO

14.13.4 RECENT DEVELOPMENT

14.14 PHINIA INC.

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 PRODUCT PORTFOLIO

14.14.4 RECENT DEVELOPMENT

14.15 SCHAEFFLER AG

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 PRODUCT PORTFOLIO

14.15.4 RECENT DEVELOPMENT

14.16 TENNECO INC.

14.16.1 COMPANY SNAPSHOT

14.16.2 SERVICE PORTFOLIO

14.16.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

List of Table

TABLE 1 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET

TABLE 2 COMPANY COMPARATIVE ANALYSIS

TABLE 3 HIGH COST OF DIAGNOSTIC TOOLS FOR ENGINE REPAIRS

TABLE 4 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA DIAGNOSIS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA ENGINE OVERHAUL OR REBUILDING IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHER SERVICES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA CAR ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 15 NORTH AMERICA COMMERCIAL VEHICLE ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 16 NORTH AMERICA MOTOR CYCLES ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA OTHER ENGINES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 18 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA NORMAL ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA SPORTS ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 21 NORTH AMERICA VINTAGE ENGINE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA OTHERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA PETROL IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA DIESEL IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032, (USD THOUSAND)

TABLE 26 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY MODE OF OPERATIONS, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA REPAIR IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA OTHERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 51 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 52 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 57 NORTH AMERICA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 NORTH AMERICA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 65 NORTH AMERICA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 66 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 67 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 NORTH AMERICA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 NORTH AMERICA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 NORTH AMERICA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 NORTH AMERICA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 U.S. AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 U.S. ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 U.S. FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 U.S. REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 U.S. AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 U.S. AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 U.S. AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 80 U.S. AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 81 U.S. INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 82 U.S. ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 U.S. FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 U.S. REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 U.S. FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 U.S. ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 U.S. FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 U.S. REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 U.S. OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 U.S. ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 U.S. FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 U.S. REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 U.S. SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 U.S. ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 95 U.S. FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 96 U.S. REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 97 CANADA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 CANADA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 CANADA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 CANADA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 CANADA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 CANADA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 CANADA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 CANADA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 105 CANADA INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 CANADA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 CANADA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 CANADA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 CANADA FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 110 CANADA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 111 CANADA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 112 CANADA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 CANADA OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 CANADA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 CANADA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 CANADA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 CANADA SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 CANADA ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 CANADA FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 CANADA REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 MEXICO AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 MEXICO ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 MEXICO FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 MEXICO REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 125 MEXICO AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 126 MEXICO AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY FUEL TYPE, 2018-2032 (USD THOUSAND)

TABLE 127 MEXICO AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY ENGINE TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 MEXICO AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY END-USER, 2018-2032 (USD THOUSAND)

TABLE 129 MEXICO INDIVIDUAL VEHICLE OWNER IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 MEXICO ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 MEXICO FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 MEXICO REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 MEXICO FLEET OPERATORS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 MEXICO ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 MEXICO FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 MEXICO REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 MEXICO OEMS AND AUTO MANUFACTURERS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 MEXICO ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 MEXICO FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 140 MEXICO REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 141 MEXICO SHIPPING AND MARINE COMPANIES IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE, 2018-2032 (USD THOUSAND)

TABLE 142 MEXICO ROUTINE MAINTENANCE IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 MEXICO FILTER REPLACEMENTS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 MEXICO REPAIRS IN AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: SERVICE TYPE TIMELINE CURVE

FIGURE 11 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: END USER COVERAGE GRID

FIGURE 12 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: SEGMENTATION

FIGURE 13 FIVE SEGMENTS COMPRISE THE NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET, BY SERVICE TYPE (2024)

FIGURE 14 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: EXECUTIVE SUMMARY

FIGURE 15 STRATEGIC DECISIONS

FIGURE 16 GROWTH IN COMMERCIAL VEHICLE USAGE IN LOGISTICS AND TRANSPORTATION IS EXPECTED TO DRIVE THE NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET DURING THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 17 SERVICE TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET IN 2025 & 2032

FIGURE 18 DROC ANALYSIS

FIGURE 19 NORTH AMERICA COMMERICAL VEHICLE 2019-2023

FIGURE 20 ROAD FREIGHT TRANSPORT BY AGE OF VEHICLE IN EUROPE (2019-2023)

FIGURE 21 U.S. VECHICLES BY TRANSPORTAION MODE

FIGURE 22 NORTH AMERICA ELECTRIC CAR SALES, 2023 AND 2024 (IN MILLION)

FIGURE 23 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: BY SERVICE TYPE, 2024

FIGURE 24 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: BY ENGINE TYPE, 2024

FIGURE 25 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: BY TYPE, 2024

FIGURE 26 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: BY FUEL TYPE, 2024

FIGURE 27 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: BY END USER, 2024

FIGURE 28 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: SNAPSHOT (2024)

FIGURE 29 NORTH AMERICA AFTERMARKET COMBUSTION ENGINE REPAIRS MARKET: COMPANY SHARE 2024 (%)

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.