North America Alkylation Market Analysis and Size

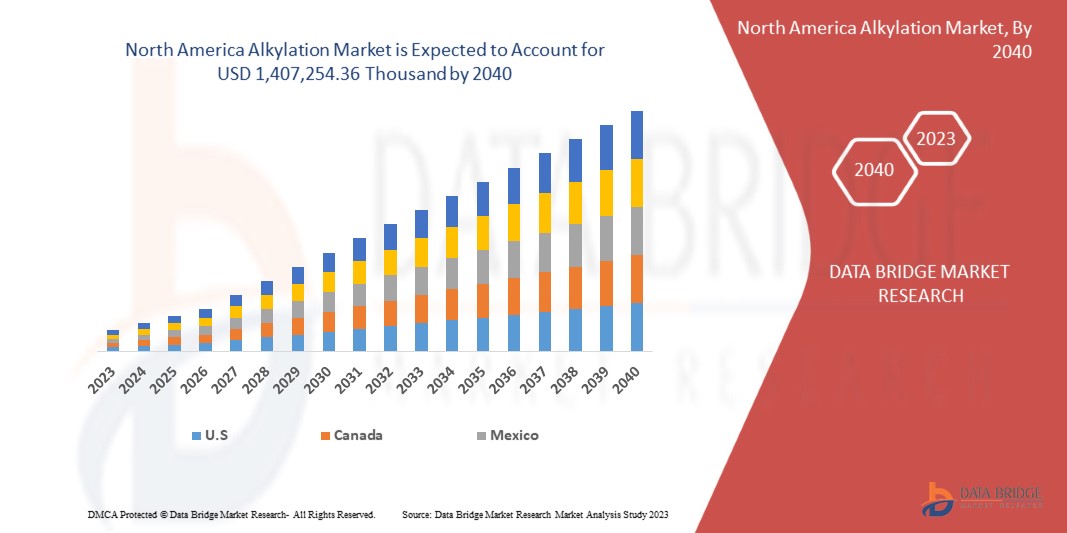

The North America alkylation market is expected to grow significantly in the forecast period of 2023 to 2040. Data Bridge Market Research analyses that the market is growing with a CAGR of 4.5% in the forecast period of 2023 to 2040 and is expected to reach USD 1,407,254.36 thousand by 2040. The major factor driving the alkylation market's growth is the demand for highly efficient gasoline.

Reacting olefins with an isoparaffin to create higher molecular weight paraffin is known as alkylation and is commonly used in the petroleum refining business. In particular, the method produces branched-chain paraffin in the gasoline boiling range by reacting propylene and butylenes with isobutane. Alkylate has high octane ratings and low sensitivity, making it a premium petrol blending stock.

The North America alkylation market report provides details of market share, new developments, and the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an analyst brief. Our team will help you create a revenue-impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2040 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

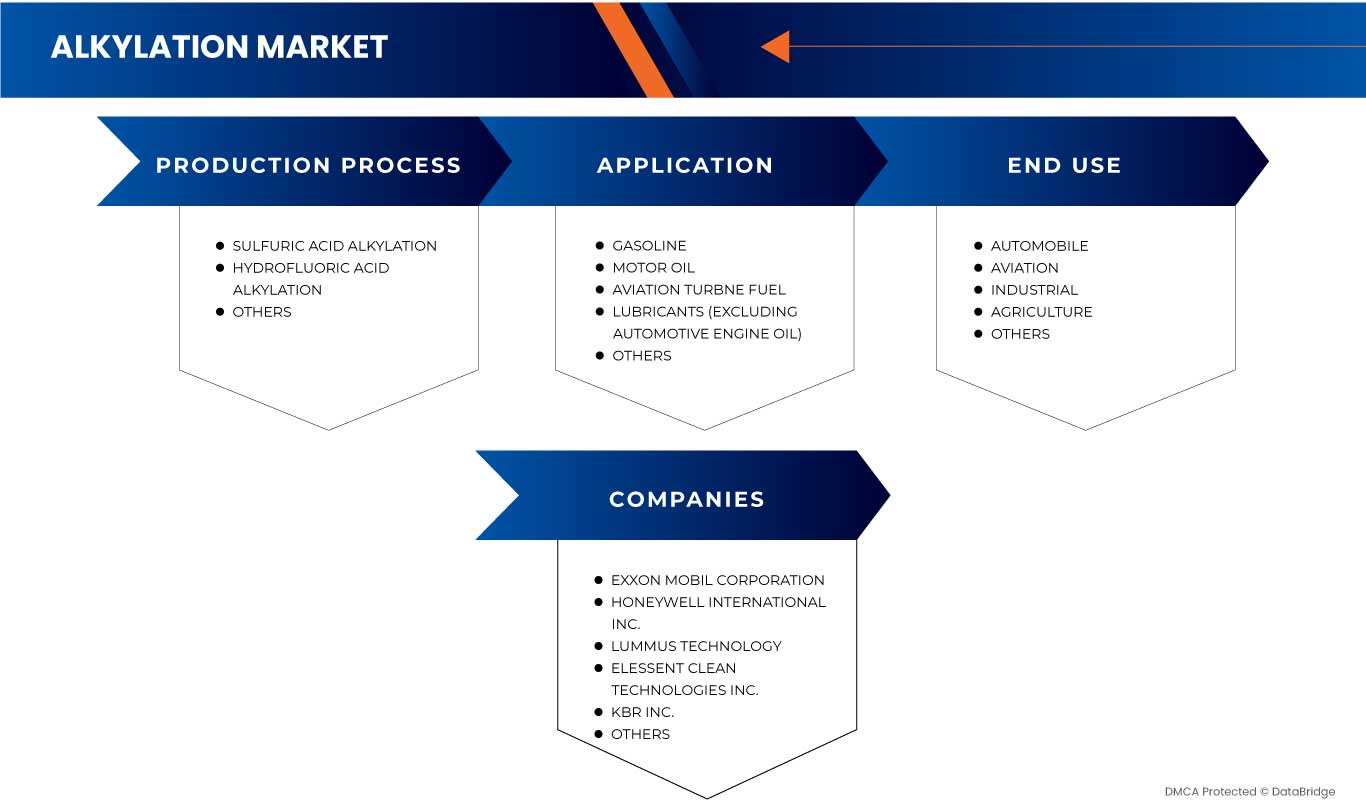

Production Process (Sulfuric Acid Alkylation, Hydrofluoric Acid Alkylation, and Others), Application (Motor Oil, Aviation Turbine Fuel, Lubricants (Excluding Automotive Engine Oil), Gasoline, and Others), End Use (Automobile, Aviation, Agriculture, Industrial, and Others) |

|

Countries Covered |

U.S., Canada, and Mexico |

|

Market Players Covered |

Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc., and Well Resources Inc. among others |

Market Definition

Alkylation produces longer-branched hydrocarbons from alkylating olefins, such as propylene, butylene, and isobutene. The high-octane hydrocarbons produced by alkylation are known as alkylates. Blending these alkylate with gasoline was introduced to improve the machinery's performance efficacy. The main factor that impacts the alkylation is using a suitable catalyst. Sulphuric acid and hydrofluoric acid are the most used alkylation catalysts.

North America Alkylation Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Rise in demand for highly efficient gasoline

The automobile sector, an important economic indicator, is on the cusp of new technology and developments. Furthermore, customers' need for distinctive and expensive features is driving the automotive sector in the present period. Today's consumers employ all-purpose vehicles on a North America scale, which is driving up automotive sales worldwide. Most automobiles are built around an internal combustion engine that only runs on diesel or gasoline. Therefore, the gasoline demand is increasing significantly, and powertrains based on combustion engines will continue to dominate for the foreseeable future.

- Application growth of derivatives, namely gasoline, and lubricants

There are several refinery products generated from crude oil in petroleum refining. Alkylation is a secondary refinery unit process that numerous refineries worldwide use to add high-octane hydrocarbons to motor and aviation gasoline. It is the process of adding alkyl groups to a substrate molecule and is helpful in several applications. Alkylation produces high-octane gasoline by turning isoparaffins and low-molecular-weight alkenes into alkylate. High-octane hydrocarbons are required to avoid gasoline auto-ignition (knocking) in an engine and fulfill engine octane standards.

Opportunities

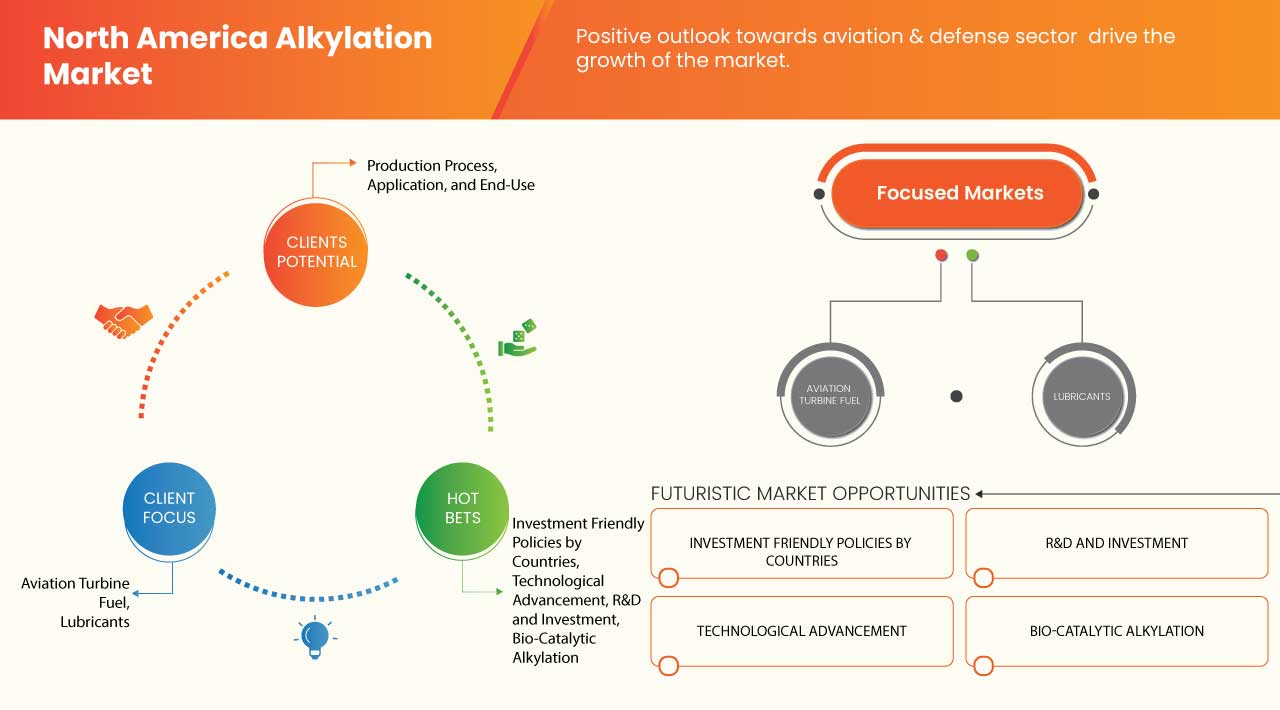

- Implementation of investment-friendly policies in countries, namely China and India

Alkylation has become an essential refinery process with the increased need for high-octane and low-vapor-pressure gasoline blending components. It will be much more important in satisfying the government's stringent laws and requirements. Commercial and regulatory pressure refiners to utilize safe and sustainable techniques to provide clean-burning, environmentally friendly fuels. Thus, established refinery firms in the alkylation market may take advantage of this opportunity to spend more on new production capacities. In contrast, new entrants can invest more in incorporating alkylation units to contribute to the industry's growth.

- Technological advancement to improvise alkylation processes

Long-term North America demand for high-quality gasoline is driven by macro factors such as a continually rising customer base and the advent of high-compression engines requiring low vapor pressure. Simultaneously, stricter fuel and emissions criteria, such as low-sulfur or ultra-low-sulfur content demands, increase dependence on octane-boosting blending stocks, like alkylate. Refineries utilize several technologies to create alkylate, and all refineries must use an innovative, safe, and sustainable alkylation technique.

Restraints/Challenges

- Safety concerns related to the use of alkylation technology

The acid-based alkylation technology converts mixed olefin feedstock into high-octane alkylates for gasoline blending using hydrogen fluoride or sulfuric acid as the catalyst. However, the highly corrosive nature of the strong acid catalysts makes both the hydrogen fluoride and sulfuric acid alkylation reactions dangerous. The refiners using acid-based alkylation technology use various metals for equipment for alkylation technology and also require high-cost safety systems to protect refinery employees, infrastructure, and the outer environment. The operators and owners are highly concerned about the safety of the alkylation process and regularly monitor their units' safety. However, as every industrial process has risks, the alkylation process will likely face potential safety concerns.

- Environmental issues associated with alkylation technology

Alkylate is produced through alkylation technology from light olefins and isobutene in the presence of chemical-based catalysts. It is essential for producing gasoline, so various environmental issues are associated with alkylation technology. Alkylate manufacturing requires the utilization of liquid acid-catalyzed processes, for example, hydrofluoric acid or sulfuric acid chemical catalysts. The catalysts are unsafe, corrosive, and toxic in nature. The temperature rises, and the air vapor volume increases when hydrofluoric acid comes into contact with water. Spilled hydrofluoric acid evaporates quickly, but some remain in the soil environment and can severely impact the soil quality and groundwater.

Recent Development

- In June 2021, Sinopec successfully launched two more STRATCO alkylation specialized units from Elessent Clean Technologies Inc. The company is expanding its alkylation capacity by adding a fifth and sixth STRATCO alkylation unit to its refining network.

- In March 2023, ExxonMobil announced the successful start-up of its Beaumont refinery expansion project, which will increase the capacity of one of the biggest petrochemical and refining complexes on the American Gulf Coast by 250,000 barrels per day. The greatest refinery expansion in more than ten years is supported by the company's rising crude production in the Permian Basin, which will assist in meeting the rising need for affordable and dependable energy. The Beaumont refinery, where the company produces finished products including diesel, petrol, and jet fuel through the Permian crude oil

North America Alkylation Market Scope

The North America alkylation market is categorized based on production process, application, and end use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Production Process

- Sulfuric Acid Alkylation

- Hydrofluoric Acid Alkylation

- Others

On the basis of production process, the North America alkylation market is classified into sulfuric acid alkylation, hydrofluoric acid alkylation, others.

Application

- Motor Oil

- Aviation Turbine Fuel

- Lubricants (Excluding Automotive Engine Oil)

- Gasoline

- Others

On the basis of application, the North America alkylation market is classified into motor oil, aviation turbine fuel, lubricants (excluding automotive engine oil), gasoline, and others.

End Use

- Automobile

- Aviation

- Agriculture

- Industrial

- Others

On the basis of end use, the North America alkylation market is classified into automobile, aviation, agriculture, industrial, and others.

North America Alkylation Market Regional Analysis/Insights

The North America alkylation market is segmented on the basis of production process, application, and end use.

The countries in the North America alkylation market are the U.S., Canada, and Mexico. The U.S. is dominating the North America alkylation market in terms of share and revenue due to the due to positive outlook towards the aviation and defense sector in this region.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Alkylation Market Share Analysis

The North America alkylation market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the North America Alkylation market.

Some of the prominent participants operating in the North America alkylation market are Exxon Mobil Corporation, Honeywell International Inc., Lummus Technology, Elessent Clean Technologies Inc., Sulzer Ltd, KBR Inc., and Well Resources Inc. among others.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 APPLICATION LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THE THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 LIST OF FEW ALKYLATION SERVICE PROVIDERS

4.4 CLIMATE CHANGE SCENARIO

4.4.1 ENVIRONMENTAL CONCERNS

4.4.2 INDUSTRY RESPONSE

4.4.3 GOVERNMENT’S ROLE

4.4.4 ANALYST RECOMMENDATION

4.5 SUPPLY CHAIN ANALYSIS

4.5.1 OVERVIEW

4.5.2 LOGISTIC COST SCENARIO

4.5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.6 VENDOR SELECTION CRITERIA

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE

6.1.2 APPLICATION GROWTH OF DERIVATIVES, NAMELY GASOLINE, AND LUBRICANTS

6.1.3 POSITIVE OUTLOOK TOWARDS AVIATION AND DEFENSE SECTOR

6.1.4 GROWING IMPORTANCE OF IMPROVING REFINING MARGINS

6.2 RESTRAINTS

6.2.1 SAFETY CONCERNS RELATED TO THE USE OF ALKYLATION TECHNOLOGY

6.2.2 CREDIBLE THREAT FROM ALTERNATIVE FUEL SOURCES

6.3 OPPORTUNITIES

6.3.1 IMPLEMENTATION OF INVESTMENT-FRIENDLY POLICIES IN COUNTRIES, NAMELY CHINA AND INDIA

6.3.2 TECHNOLOGICAL ADVANCEMENT TO IMPROVISE ALKYLATION PROCESSES

6.4 CHALLENGES

6.4.1 ENVIRONMENTAL ISSUES ASSOCIATED WITH ALKYLATION TECHNOLOGY

6.4.2 STRINGENT RULES AND REGULATIONS

6.4.3 VOLATILITY IN RAW MATERIAL PRICES

7 NORTH AMERICA ALKYLATION MARKET, BY PRODUCTION PROCESS

7.1 OVERVIEW

7.2 SULFURIC ACID ALKYLATION

7.3 HYDROFLUORIC ACID ALKYLATION

7.4 OTHERS

8 NORTH AMERICA ALKYLATION MARKET, BY END-USE

8.1 OVERVIEW

8.2 AUTOMOBILE

8.3 AVIATION

8.4 AGRICULTURE

8.5 INDUSTRIAL

8.6 OTHERS

9 NORTH AMERICA ALKYLATION MARKET BY APPLICATION

9.1 OVERVIEW

9.2 MOTOR OIL

9.3 AVIATION TURBINE FUEL

9.4 GASOLINE

9.5 OTHERS

10 NORTH AMERICA ALKYLATION MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA ALKYLATION MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.2 EXPANSION

11.3 NEW PROJECT

11.4 COLLABORATION

11.5 NEW UNIT

12 COMPANY PROFILES

12.1 EXXON MOBIL CORPORATION

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 SWOT ANALYSIS

12.1.5 PRODUCT PORTFOLIO

12.1.6 RECENT DEVELOPMENT

12.2 HONEYWELL INTERNATIONAL INC.

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 SWOT ANALYSIS

12.2.5 PRODUCT PORTFOLIO

12.2.6 RECENT DEVELOPMENTS

12.3 LUMMUS TECHNOLOGY

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 SWOT ANALYSIS

12.3.4 PRODUCT PORTFOLIO

12.3.5 RECENT DEVELOPMENTS

12.4 KBR INC.

12.4.1 COMPANY SNAPSHOT

12.4.2 REVENUE ANALYSIS

12.4.3 COMPANY SHARE ANALYSIS

12.4.4 PRODUCT PORTFOLIO

12.4.5 SWOT ANALYSIS

12.4.6 RECENT DEVELOPMENT

12.5 ELESSENT CLEAN TECHNOLOGIES INC.

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 SWOT ANALYSIS

12.5.5 RECENT DEVELOPMENTS

12.6 SULZER LTD

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 SWOT ANALYSIS

12.6.5 RECENT DEVELOPMENT

12.7 WELL RESOURCES INC.

12.7.1 COMPANY SNAPSHOT

12.7.2 SWOT ANALYSIS

12.7.3 PRODUCT PORTFOLIO

12.7.4 RECENT DEVELOPMENTS

13 QUESTIONNAIRE

14 RELATED REPORTS

List of Table

TABLE 1 REGULATORY COVERAGE

TABLE 2 NORTH AMERICA ALKYLATION MARKET, BY COUNTRY, 2021-2040 (USD THOUSAND)

TABLE 3 NORTH AMERICA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 4 NORTH AMERICA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 5 NORTH AMERICA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 6 NORTH AMERICA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 7 NORTH AMERICA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 8 NORTH AMERICA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 9 U.S. ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 10 U.S. ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 11 U.S. ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 12 U.S. AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 13 U.S. AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 14 U.S. AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 15 CANADA ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 16 CANADA ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 17 CANADA ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 18 CANADA AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 19 CANADA AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 20 CANADA AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 21 MEXICO ALKYLATION MARKET, BY PRODUCTION PROCESS, 2021-2040 (USD THOUSAND)

TABLE 22 MEXICO ALKYLATION MARKET, BY APPLICATION, 2021-2040 (USD THOUSAND)

TABLE 23 MEXICO ALKYLATION MARKET, BY END USE, 2021-2040 (USD THOUSAND)

TABLE 24 MEXICO AUTOMOBILE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 25 MEXICO AVIATION IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

TABLE 26 MEXICO AGRICULTURE IN ALKYLATION MARKET, BY TYPE, 2021-2040 (USD THOUSAND)

List of Figure

FIGURE 1 NORTH AMERICA ALKYLATION MARKET

FIGURE 2 NORTH AMERICA ALKYLATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA ALKYLATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA ALKYLATION MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA ALKYLATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA ALKYLATION MARKET: THE APPLICATION LIFE LINE CURVE

FIGURE 7 NORTH AMERICA ALKYLATION MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA ALKYLATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA ALKYLATION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA ALKYLATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA ALKYLATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA ALKYLATION MARKET: SEGMENTATION

FIGURE 13 RISE IN DEMAND FOR HIGHLY EFFICIENT GASOLINE IS EXPECTED TO DRIVE THE NORTH AMERICA ALKYLATION MARKET IN THE FORECAST PERIOD

FIGURE 14 THE SULFURIC ACID ALKYLATION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA ALKYLATION MARKET IN 2023 AND 2040

FIGURE 15 VENDOR SELECTION CRITERIA

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA ALKYLATION MARKET

FIGURE 17 NUMBER OF CAR SALES IN U.S. 2018 TO 2022 (IN MILLION)

FIGURE 18 CONSUMPTION OF REFINERY PRODUCTS FROM 2018 TO 2021 IN INDIA (IN ‘000 METRIC TONS)

FIGURE 19 U.S. JET FUEL CONSUMPTION 2017 TO 2021 (IN THOUSAND BARRELS PER DAY)

FIGURE 20 NORTH AMERICA ALKYLATION MARKET: BY PRODUCTION PROCESS, 2022

FIGURE 21 NORTH AMERICA ALKYLATION MARKET: BY END-USE, 2022

FIGURE 22 NORTH AMERICA ALKYLATION MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA ALKYLATION MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA ALKYLATION MARKET: BY COUNTRY (2022)

FIGURE 25 NORTH AMERICA ALKYLATION MARKET: BY COUNTRY (2023 & 2040)

FIGURE 26 NORTH AMERICA ALKYLATION MARKET: BY COUNTRY (2022 & 2040)

FIGURE 27 NORTH AMERICA ALKYLATION MARKET: BY PRODUCTION PROCESS (2023 - 2040)

FIGURE 28 NORTH AMERICA ALKYLATION MARKET: COMPANY SHARE 2022 (%)

North America Alkylation Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Alkylation Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Alkylation Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.