North America And Europe Endometrial Ablation Devices Market

Market Size in USD Million

CAGR :

%

USD

309.53 Million

USD

556.17 Million

2024

2032

USD

309.53 Million

USD

556.17 Million

2024

2032

| 2025 –2032 | |

| USD 309.53 Million | |

| USD 556.17 Million | |

|

|

|

|

North America and Europe Endometrial Ablation Devices Market Size

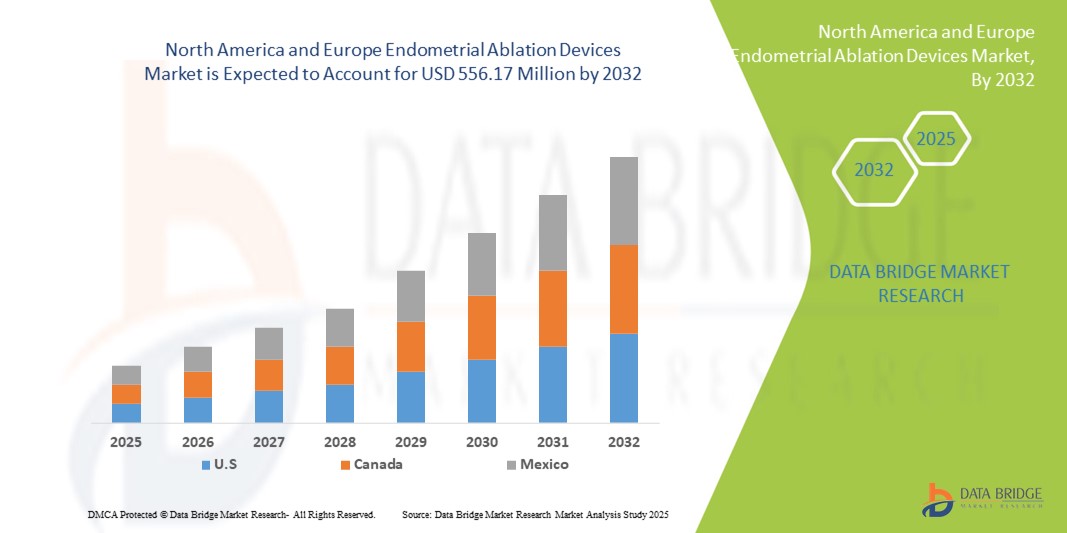

- The North America and Europe endometrial ablation devices market size was valued at USD 309.53 million in 2024 and is expected to reach USD 556.17 million by 2032, at a CAGR of 7.60% during the forecast period

- The market growth is largely fueled by technological advancements in ablation techniques, including radiofrequency and microwave energy, which enhance treatment safety and efficacy, alongside increasing adoption of minimally invasive procedures

- Furthermore, rising prevalence of gynecological disorders, such as abnormal uterine bleeding, and growing patient preference for safe, efficient, and outpatient-friendly treatment options are establishing endometrial ablation devices as a preferred solution. These converging factors are accelerating the adoption of these devices, thereby significantly boosting the industry’s growth

North America and Europe Endometrial Ablation Devices Market Analysis

- Endometrial ablation devices, providing minimally invasive treatment for abnormal uterine bleeding and other gynecological conditions, are increasingly vital components of modern gynecological care in hospitals and outpatient clinics due to their safety, efficiency, and reduced recovery times

- The escalating demand for endometrial ablation devices is primarily fueled by technological advancements in ablation techniques such as radiofrequency, microwave, and cryoablation, growing prevalence of gynecological disorders, and a rising preference among patients and healthcare providers for outpatient-friendly, minimally invasive procedures

- North America dominated the market with the largest revenue share of 42% in 2024, supported by a strong healthcare infrastructure, high adoption of advanced ablation technologies and the growing preference for uterus-preserving procedures in hospitals and ambulatory surgical centers

- Europe is expected to be the fastest-growing region during the forecast period due to rising awareness of minimally invasive procedures, supportive healthcare policies, and increasing adoption of endometrial ablation devices in hospitals and outpatient treatment centers

- Radiofrequency ablation segment dominated the market with a share of 38.5% in 2023, driven by its proven efficacy, patient safety profile, and ease of integration into standard gynecological treatment protocols

Report Scope and North America and Europe Endometrial Ablation Devices Market Segmentation

|

Attributes |

North America and Europe Endometrial Ablation Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America and Europe Endometrial Ablation Devices Market Trends

Minimally Invasive Treatment Preference and Technology Integration

- A significant and accelerating trend in the North American and European endometrial ablation devices market is the growing preference for minimally invasive procedures and the integration of advanced ablation technologies such as radiofrequency, microwave, and cryoablation, enhancing patient safety and treatment efficacy

- For instance, the NovaSure® system integrates controlled radiofrequency energy with real-time feedback mechanisms, allowing precise tissue ablation while minimizing complications and procedure time

- Advanced ablation technologies enable features such as improved tissue targeting, reduced post-operative recovery, and enhanced patient comfort. For instance, systems such as Minerva™ provide precise uterine cavity mapping to optimize treatment outcomes and reduce adverse events

- The integration of endometrial ablation devices with hospital digital platforms facilitates procedure monitoring, post-treatment follow-up, and streamlined patient data management, offering centralized control over treatment quality and outcomes

- This trend towards safer, more efficient, and technology-enabled treatment options is reshaping patient and physician expectations for gynecological care. Consequently, companies such as Hologic and CooperSurgical are developing devices with enhanced procedural control, automated energy delivery, and improved patient safety features

- The demand for minimally invasive, technologically advanced endometrial ablation devices is growing rapidly across hospitals and outpatient clinics, as patients and healthcare providers increasingly prioritize procedure efficiency, safety, and outpatient feasibility

North America and Europe Endometrial Ablation Devices Market Dynamics

Driver

Rising Incidence of Abnormal Uterine Bleeding and Gynecological Disorders

- The increasing prevalence of abnormal uterine bleeding and other gynecological disorders, coupled with growing awareness of minimally invasive treatment options, is a significant driver for the heightened adoption of endometrial ablation devices

- For instance, in March 2024, Hologic reported expanding utilization of NovaSure® devices in U.S. outpatient clinics, emphasizing technology-driven improvements in safety and efficacy

- As patients and healthcare providers seek effective, outpatient-friendly treatment options, endometrial ablation devices offer controlled ablation, reduced recovery times, and lower complication rates, providing a compelling alternative to traditional surgical methods

- Furthermore, government initiatives and insurance coverage supporting minimally invasive procedures are increasing accessibility, making endometrial ablation a preferred treatment across North America and Europe

- The convenience of outpatient procedures, shorter hospital stays, and improved patient satisfaction are key factors propelling the adoption of these devices in both hospitals and outpatient care centers. The trend towards procedure efficiency and patient-centric care further contributes to market growth

Restraint/Challenge

High Device Costs and Regulatory Hurdles

- Concerns regarding device costs and regulatory compliance pose significant challenges to broader adoption of endometrial ablation devices, particularly in price-sensitive clinics or smaller outpatient centers

- For instance, advanced systems such as NovaSure® and Minerva™ have relatively high initial investment costs, which can restrict adoption in certain healthcare settings despite proven efficacy

- Navigating stringent regulatory requirements across North America and Europe increases time-to-market and operational complexity, creating a barrier for new entrants and smaller device manufacturers

- For instance, companies must meet FDA and CE mark standards, including clinical trials and safety validation, before launching devices in the respective countries, delaying widespread availability

- Overcoming these challenges through cost optimization, streamlined regulatory approvals, and educational initiatives highlighting procedure benefits will be vital for sustained market growth

North America and Europe Endometrial Ablation Devices Market Scope

The market is segmented on the basis of product type, portability, procedure site, technology, technique, application, age-group, end user, and distribution channel.

- By Product Type

On the basis of product type, the endometrial ablation devices market is segmented into system/equipment, consumables, and others. The System/Equipment segment dominated the market with the largest revenue share in 2024, driven by the critical role of ablation devices such as NovaSure® and Minerva™ systems in hospitals and outpatient clinics. These systems are essential for controlled, minimally invasive procedures and preferred due to proven efficacy and reliability. Hospitals prioritize high-end systems for better patient outcomes and procedural efficiency. Continuous technological improvements, including automated energy delivery and real-time monitoring, further strengthen demand. Compatibility with multiple ablation techniques solidifies the dominance of this segment.

The Consumables segment is anticipated to witness the fastest growth from 2024 to 2032, propelled by recurring need for replacement probes, catheters, and disposable components required for safe procedures. Increasing procedural volume in ambulatory centers and independent clinics is boosting consumable usage. Cost-effective and procedure-specific consumables encourage adoption among smaller clinics. Rising awareness of single-use products for infection control further enhances demand. Manufacturers are introducing innovative consumables compatible with multiple system platforms, adding to growth potential.

- By Portability

On the basis of portability, the endometrial ablation devices market is segmented into portable, standalone, and benchtop. The Standalone segment dominated in 2024 due to its widespread use in hospitals and outpatient centers for controlled ablation procedures. Standalone devices provide consistent performance, enhanced safety, and reliability in clinical settings. Their integration with hospital digital monitoring platforms makes them preferred by healthcare providers. Robust infrastructure support and procedural standardization in developed countries such as the U.S., Germany, and the UK further drive dominance. Physician familiarity and training programs also contribute to adoption.

The Portable segment is expected to witness the fastest growth from 2024 to 2032, driven by increasing adoption in smaller clinics, ambulatory surgical centers, and in-office treatment sites. Portability allows physicians to perform procedures outside traditional operating rooms, enhancing patient accessibility. Lightweight and compact designs reduce setup time. Advancements in battery technology and miniaturization are fueling adoption. Rising interest in mobile healthcare and point-of-care treatment solutions further accelerates growth.

- By Site

On the basis of procedure site, the endometrial ablation devices market is segmented into facility-based procedure site and in-office procedure site. The Facility-Based Procedure Site segment dominated in 2024, driven by high procedural volume in hospitals and specialized centers with infrastructure for ablation systems. Hospitals provide access to skilled gynecologists, sterilized environments, and advanced monitoring equipment, ensuring patient safety and higher adoption of complex devices. Strong reimbursement policies in North America and Europe favor facility-based procedures. Large hospitals invest in multiple systems to meet patient demand, supporting market dominance.

The In-Office Procedure Site segment is expected to witness the fastest growth from 2024 to 2032, fueled by adoption of minimally invasive devices enabling procedures in outpatient settings. Physicians and clinics benefit from reduced procedural costs and enhanced patient convenience. Smaller centers can offer competitive services without hospital infrastructure. Technological advancements in portable, user-friendly devices support growth. Patient preference for shorter recovery and convenience accelerates adoption.

- By Technology

On the basis of technology, the endometrial ablation devices market is segmented into radiofrequency ablation, hydrothermal ablation, thermal balloon ablation, cryoablation, microwave ablation, laser ablation, and others. The Radiofrequency Ablation segment dominated in 2024 with a market share of 38.5% due to proven efficacy, safety, and consistent clinical outcomes. Devices such as NovaSure® provide controlled tissue ablation with real-time feedback, minimizing complications and ensuring reproducibility. Hospitals and outpatient centers prefer radiofrequency systems for reliability across patient demographics. Strong clinical evidence supporting long-term outcomes consolidates dominance. Physician training and familiarity reinforce adoption.

The Cryoablation segment is anticipated to witness the fastest growth from 2024 to 2032, driven by its minimally invasive nature and reduced post-procedural pain. Cryoablation adoption is increasing in ambulatory centers and in-office settings due to lower equipment requirements. Patient preference for less discomfort and faster recovery is accelerating demand. Technological enhancements, such as precise temperature control and targeted tissue freezing, boost safety and efficacy. Awareness campaigns highlighting benefits over traditional methods further fuel growth.

- By Technique

On the basis of technique, the endometrial ablation devices market is segmented into non-resectoscopic and resectoscopic. The Non-Resectoscopic segment dominated in 2024, driven by minimally invasive approach, reduced complications, and suitability for outpatient procedures. Non-resectoscopic methods require less specialized training, making them widely adoptable in hospitals and clinics. Procedural efficiency and patient comfort further enhance dominance. Compatibility with multiple ablation technologies increases flexibility. Physician awareness and safety outcomes strengthen adoption.

The Resectoscopic segment is expected to witness the fastest growth from 2024 to 2030, fueled by increasing adoption in specialized hospitals and centers treating complex cases such as fibroids and polyps. Resectoscopic techniques allow targeted tissue removal and are preferred for cases requiring precision. Advanced systems with integrated visualization are driving adoption. Training programs and procedural workshops enhance physician confidence and utilization. Patient demand for effective treatment of specific pathologies further boosts growth.

- By Application

On the basis of application, the endometrial ablation devices market is segmented into abnormal uterine bleeding (aub), menorrhagia, dysmenorrhea, polyps, fibroids, adenomyosis, and others. The Abnormal Uterine Bleeding (AUB) segment dominated in 2024, driven by high prevalence in peri- and pre-menopausal women. Ablation devices are widely adopted as first-line minimally invasive treatment. Hospitals and outpatient centers prioritize AUB treatment due to procedural efficacy and patient satisfaction. Strong clinical evidence and reimbursement policies support dominance. Physician familiarity and patient acceptance further strengthen the segment.

The Fibroids segment is expected to witness the fastest growth from 2024 to 2030, fueled by increasing detection rates and patient preference for minimally invasive interventions. Ablation devices targeting fibroid treatment reduce the need for hysterectomy. Technological advancements allow precise targeting and minimal complications. Patient awareness and physician adoption in specialized centers are driving growth. Insurance coverage expansion for fibroid procedures further supports adoption.

- By Age-Group

On the basis of age-group, the endometrial ablation devices market is segmented into peri-menopausal, pre-menopausal, and post-menopausal. The Peri-Menopausal segment dominated in 2024 due to high prevalence of AUB and other gynecological disorders in women aged 45–55. Minimally invasive ablation devices are preferred for symptom management and fertility preservation. Hospitals and outpatient centers prioritize treatment due to predictable outcomes and reduced complications. Clinical guidelines recommend ablation for peri-menopausal patients. Physician familiarity and patient acceptance reinforce adoption.

The Pre-Menopausal segment is expected to witness the fastest growth from 2024 to 2032, driven by rising awareness of minimally invasive procedures among women aged 35–45. Patient demand for outpatient-friendly, low-recovery treatments is increasing. Early diagnosis of fibroids, polyps, and AUB encourages ablation intervention. Technological advancements and physician recommendations support segment growth. Expanding healthcare access and awareness campaigns fuel adoption.

- By End User

On the basis of end user, the endometrial ablation devices market is segmented into hospitals, ambulatory surgical centers, independent treatment centers, diagnostic imaging centers, clinical laboratories, catheterization laboratories, and others. The Hospitals segment dominated in 2024 due to high procedural volume, infrastructure support, and availability of trained gynecologists. Hospitals provide access to advanced ablation systems, real-time monitoring, and emergency support. High adoption is further driven by insurance coverage and procedural standardization. Large hospitals invest in multiple systems to meet patient demand. Procedural reliability and positive clinical outcomes reinforce segment dominance.

The Ambulatory Surgical Centers (ASCs) segment is expected to witness the fastest growth from 2024 to 2032, fueled by increasing outpatient procedures and cost-effectiveness. ASCs provide convenient access, reduced waiting times, and shorter hospital stays. Rising adoption of portable and non-resectoscopic systems supports growth. Patient preference for in-office procedures and minimally invasive treatments accelerates demand. Expansion of ASCs in North America and Europe strengthens the segment.

- By Distribution Channel

On the basis of distribution channel, the endometrial ablation devices market is segmented into direct tender, retail sales, and others. The direct tender segment dominated in 2024 due to large-scale procurement of ablation devices by hospitals, treatment centers, and government healthcare institutions. Direct tender ensures bulk procurement at negotiated prices and facilitates supplier partnerships. Strong manufacturer-hospital relationships and long-term contracts reinforce market dominance. Preference for OEM-certified systems in clinical settings drives adoption. Streamlined procurement and after-sales support further strengthen this channel.

The Retail Sales segment is expected to witness the fastest growth from 2024 to 2032, fueled by increasing availability of portable devices for outpatient clinics and smaller treatment centers. Retail distribution allows quick access to consumables and replacement components. Growing awareness of device benefits and direct-to-clinic sales models enhance adoption. Manufacturers are expanding retail channels for consumables and small systems. Convenience, accessibility, and faster procurement cycles drive growth.

North America and Europe Endometrial Ablation Devices Market Regional Analysis

- North America dominated the market with the largest revenue share of 42% in 2024, supported by a strong healthcare infrastructure, high adoption of advanced ablation technologies and the growing preference for uterus-preserving procedures in hospitals and ambulatory surgical centers

- Patients and healthcare providers in the region highly value the safety, reduced recovery time, and uterus-preserving advantages offered by endometrial ablation devices compared to traditional surgical treatments

- This widespread adoption is further supported by high healthcare spending, strong clinical awareness, and growing preference for outpatient and office-based procedures, establishing endometrial ablation devices as the preferred solution for treating abnormal uterine bleeding, fibroids, polyps, and other gynecological conditions in both hospitals and ambulatory surgical centers

U.S. Endometrial Ablation Devices Market Insight

The U.S. endometrial ablation devices market captured the largest revenue share in 2024 within North America, fueled by the high prevalence of abnormal uterine bleeding and increasing adoption of minimally invasive procedures. Patients and healthcare providers are prioritizing devices that offer safety, reduced recovery times, and outpatient-friendly treatment options. The growing preference for portable and technologically advanced ablation systems, combined with favorable insurance coverage and strong hospital infrastructure, further propels market growth. Moreover, ongoing innovations in radiofrequency, cryoablation, and thermal balloon technologies are significantly contributing to the expansion of the market.

Canada Endometrial Ablation Devices Market Insight

The Canada endometrial ablation devices market is witnessing steady growth, driven by increasing awareness of minimally invasive gynecological treatments and the rising prevalence of fibroids and polyps. Canadian patients and healthcare providers value outpatient-friendly procedures that reduce recovery time and enhance patient comfort. The availability of advanced hospital infrastructure, supportive reimbursement policies, and skilled gynecologists is further boosting market adoption. Portable and non-resectoscopic systems are increasingly utilized in outpatient centers, contributing to the overall market expansion.

Europe Endometrial Ablation Devices Market Insight

Europe endometrial ablation devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by supportive healthcare regulations, rising awareness of minimally invasive gynecological procedures, and the increasing prevalence of abnormal uterine bleeding and fibroids. Countries such as Germany, the U.K., France, and Italy are witnessing increased adoption of these devices in hospitals, ambulatory surgical centers, and outpatient treatment clinics. Technological advancements, including radiofrequency, cryoablation, and thermal balloon devices, are enhancing procedural safety, reducing recovery times, and improving patient outcomes, thereby boosting confidence among healthcare providers and patients. European healthcare providers are focusing on outpatient and office-based procedures to reduce hospital stays, lower costs, and improve patient convenience, which is further driving adoption. Additionally, growing patient preference for uterus-preserving and less invasive treatment options is encouraging the integration of endometrial ablation devices into routine gynecological care. Rising investments in healthcare infrastructure, training programs for gynecologists, and increasing collaboration with medical device manufacturers are also supporting market expansion.

U.K. Endometrial Ablation Devices Market Insight

The U.K. endometrial ablation devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing demand for minimally invasive treatments and enhanced patient convenience. Concerns regarding surgical complications and longer recovery periods are encouraging both patients and healthcare providers to adopt ablation devices. In addition, the U.K.’s well-developed healthcare system and robust hospital and outpatient infrastructure are expected to continue stimulating market growth. The adoption of portable and non-resectoscopic systems is further enhancing market expansion.

Germany Endometrial Ablation Devices Market Insight

The Germany endometrial ablation devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of gynecological disorders and the preference for minimally invasive procedures. Germany’s advanced healthcare infrastructure and focus on innovation promote adoption of ablation systems in hospitals and specialized clinics. The integration of devices with hospital digital monitoring and procedure tracking systems is increasingly prevalent, with a strong preference for safe, patient-friendly solutions aligning with local clinical practices.

France Endometrial Ablation Devices Market Insight

The France endometrial ablation devices market is witnessing steady growth due to rising awareness of abnormal uterine bleeding and growing preference for outpatient-friendly minimally invasive treatments. Hospitals and ambulatory centers are increasingly investing in portable and advanced ablation systems to improve procedural efficiency and patient comfort. Favorable reimbursement policies, skilled gynecologists, and increased adoption of non-resectoscopic techniques are contributing to market expansion. Patient preference for less invasive procedures is further driving growth.

North America and Europe Endometrial Ablation Devices Market Share

The North America and Europe endometrial ablation devices industry is primarily led by well-established companies, including:

- Hologic, Inc. (U.S.)

- Medtronic (Ireland)

- Boston Scientific Corporation (U.S.)

- CooperSurgical, Inc. (U.S.)

- Ethicon, Inc. (U.S.)

- Olympus Corporation (Japan)

- KARL STORZ SE & Co. KG (Germany)

- Richard Wolf GmbH (Germany)

- MedGyn Products, Inc. (U.S.)

- ConMed Corporation (U.S.)

- Smith & Nephew (U.K.)

- Stryker (U.S.)

- Zimmer Biomet. (U.S.)

- B. Braun SE (Germany)

- Fertility Focus Ltd. (U.K.)

- Lumenis Ltd. (Israel)

- Biolitec Holding GmbH & Co KG (Germany)

- AngioDynamics (U.S.)

What are the Recent Developments in North America and Europe Endometrial Ablation Devices Market?

- In March 2025, the FDA extended the review period for its De Novo marketing authorization request for the ProSense cryoablation system, a device designed for early-stage breast cancer treatment. While not directly related to endometrial ablation, this extension indicates ongoing developments in cryoablation technologies

- In September 2023, the American College of Obstetricians and Gynecologists (ACOG) updated its guidelines, advising against the use of endometrial ablation for treating endometrial intraepithelial neoplasia (EIN) or atypical endometrial hyperplasia (AEH) due to high persistence and recurrence rates. This clinical update reflects evolving standards in patient care

- In February 2023, the NovaSure V5 Global Endometrial Ablation (GEA) device from Hologic, Inc. received regulatory approval for use in Canada and Europe. This expansion followed its successful launch in the US in late 2021, making the updated radiofrequency ablation technology available to a wider market and further solidifying Hologic's presence in international women's healthcare

- In October 2022, Channel Medsystems announced the first endometrial ablation procedures in Europe using its Cerene Cryotherapy Device. This marked the company's initial assessment of the European market after the device received a CE Mark. The Cerene device offers an in-office, minimally-anesthetic treatment for heavy menstrual bleeding, utilizing cryoablation technology

- In February 2021, CooperSurgical, Inc. acquired AEGEA Medical, a medical device company with the FDA-approved Mara Water Vapor Ablation System. This acquisition expanded CooperSurgical's portfolio in women's health with a system that uses water vapor to treat heavy menstrual bleeding in a two-minute office-based procedure. This development highlighted a trend towards less invasive, convenient, and efficient treatments for abnormal uterine bleeding

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.