North America Antimicrobial Susceptibility Testing Market

Market Size in USD Billion

CAGR :

%

USD

2.02 Billion

USD

3.15 Billion

2024

2032

USD

2.02 Billion

USD

3.15 Billion

2024

2032

| 2025 –2032 | |

| USD 2.02 Billion | |

| USD 3.15 Billion | |

|

|

|

|

North America Antimicrobial Susceptibility Testing Market Size

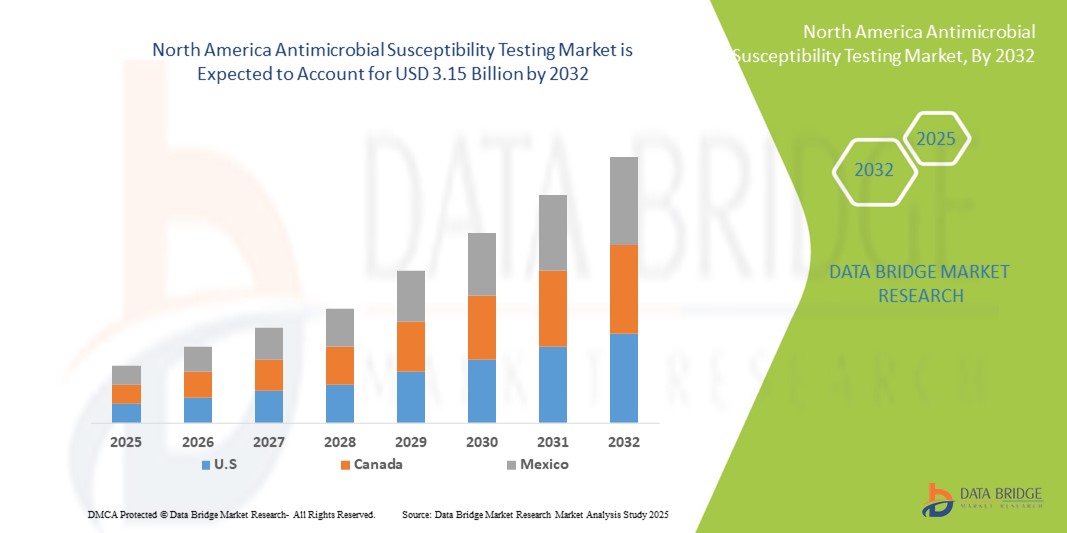

- The North America antimicrobial susceptibility testing market size was valued at USD 2.02 billion in 2024 and is expected to reach USD 3.15 billion by 2032, at a CAGR of 5.7% during the forecast period

- The market growth is largely fueled by the increasing prevalence of antibiotic-resistant infections, which require accurate and timely AST to guide effective treatment strategies

- Furthermore, rising demand for advanced diagnostic tools in clinical settings, coupled with technological advancements in testing methodologies, is establishing AST as a critical component of antimicrobial stewardship programs. These converging factors are accelerating the adoption of AST solutions, thereby significantly boosting the industry's growth

North America Antimicrobial Susceptibility Testing Market Analysis

- Antimicrobial Susceptibility Testing (AST), providing precise assessment of microbial resistance to antibiotics, is increasingly vital in modern clinical diagnostics and infection management across hospitals, diagnostic laboratories, and research institutions due to its ability to guide effective treatment strategies and improve patient outcomes

- The escalating demand for AST is primarily fueled by the rising prevalence of antibiotic-resistant infections, growing awareness of antimicrobial stewardship programs, and the increasing need for rapid and accurate diagnostic tools in clinical settings

- U.S. dominated the North America antimicrobial susceptibility testing market with the largest revenue share of 89.3% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and a strong presence of key industry players, with substantial growth in AST adoption, particularly in hospitals and reference laboratories, driven by innovations in automated testing systems and integration with clinical decision support tools

- Canada is expected to be the fastest-growing country in the North America antimicrobial susceptibility testing market during the forecast period due to increasing healthcare expenditure, stringent regulatory mandates for antimicrobial resistance monitoring, and rising investment in laboratory infrastructure

- Rapid-AST segment dominated the North America antimicrobial susceptibility testing market with a market share of 46.8% in 2024, driven by its efficiency, accuracy, and ability to provide rapid results compared to conventional manual testing methods

Report Scope and North America Antimicrobial Susceptibility Testing Market Segmentation

|

Attributes |

North America Antimicrobial Susceptibility Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Antimicrobial Susceptibility Testing Market Trends

Rapid Diagnostic Solutions and AI-Driven Platforms

- A significant and accelerating trend in the North America AST market is the adoption of rapid diagnostic solutions integrated with artificial intelligence (AI) platforms. This combination is significantly enhancing diagnostic speed, accuracy, and decision-making in clinical settings

- For instance, the VITEK 2 Automated AST System integrates AI algorithms to provide faster identification and susceptibility results, allowing clinicians to initiate timely and targeted antibiotic therapy. Similarly, BD Phoenix AST systems leverage AI-driven analytics to improve result interpretation and workflow efficiency

- AI integration in AST enables predictive resistance pattern analysis, alerting clinicians to potential antimicrobial resistance and optimizing antibiotic selection. Some systems, such as MicroScan WalkAway, utilize AI to reduce human error in result interpretation and can flag unusual microbial resistance patterns for review. Furthermore, rapid AST platforms shorten turnaround time, allowing prompt clinical decisions and improving patient outcomes

- The seamless integration of AST systems with hospital laboratory information systems (LIS) and electronic health records (EHR) facilitates centralized data management, enabling real-time monitoring, reporting, and stewardship program compliance

- This trend toward intelligent, automated, and interconnected AST solutions is fundamentally transforming expectations for clinical diagnostics. Consequently, companies such as bioMérieux are developing AI-enabled AST platforms with features such as predictive resistance alerts and automated data reporting

- The demand for rapid, AI-integrated AST systems is growing rapidly across hospitals and reference laboratories, as healthcare providers increasingly prioritize timely, accurate, and actionable microbial susceptibility data

North America Antimicrobial Susceptibility Testing Market Dynamics

Driver

Rising Antibiotic Resistance and Demand for Rapid Diagnostics

- The increasing prevalence of multi-drug resistant infections, coupled with the rising need for rapid diagnostic results, is a significant driver for the heightened adoption of AST solutions

- For instance, in March 2024, bioMérieux launched an AI-enabled AST platform designed to reduce turnaround time and improve antimicrobial stewardship compliance in hospital settings. Such initiatives by key companies are expected to drive AST market growth in the forecast period

- As healthcare providers face the challenge of antibiotic resistance, AST systems offer advanced features such as rapid susceptibility testing, automated reporting, and integration with clinical decision support tools, providing a compelling upgrade over conventional methods

- Furthermore, the growing emphasis on antimicrobial stewardship programs and infection control protocols is making AST an essential tool in hospitals, laboratories, and research institutions

- The convenience of automated systems, faster result delivery, and integration with hospital IT infrastructures are key factors propelling AST adoption in North America. The trend toward workflow automation and increasing availability of high-throughput AST solutions further contributes to market growth

Restraint/Challenge

Regulatory Compliance and High Initial Costs

- Concerns surrounding regulatory compliance, validation requirements, and stringent FDA guidelines pose a significant challenge to broader AST market penetration. As AST systems require approval and adherence to clinical standards, this can slow adoption in some healthcare facilities

- For instance, delays in obtaining FDA clearance for new AST platforms have made some hospitals hesitant to replace existing systems, impacting market growth

- Addressing these regulatory hurdles through robust validation protocols, compliance documentation, and support for clinical adoption is crucial for building trust. Companies such as Thermo Fisher emphasize regulatory adherence and quality control in their AST product launches to reassure potential buyers. In addition, the relatively high initial cost of automated AST platforms compared to manual methods can be a barrier for smaller laboratories or budget-constrained healthcare facilities. While basic manual AST systems remain affordable, automated high-throughput platforms with AI integration often come with a higher price tag

- While costs are gradually decreasing and leasing models are emerging, the perceived premium for advanced AST technology can still hinder widespread adoption, particularly in smaller or resource-limited hospitals

- Overcoming these challenges through regulatory support, clinician training, and cost-effective AST solutions will be vital for sustained market growth

North America Antimicrobial Susceptibility Testing Market Scope

The market is segmented on the basis of product type, methods, type of testing, application, end-user, and distribution channel.

- By Product Type

On the basis of product type, the antimicrobial susceptibility testing market is segmented into instruments, consumables & accessories, and services & software. The instruments segment dominated the market with the largest revenue share in 2024, driven by the increasing adoption of automated AST systems in hospitals and diagnostic laboratories. Instruments such as automated susceptibility testing platforms, incubators, and identification systems are essential for accurate and rapid results, making them a critical investment for healthcare facilities. Hospitals and reference laboratories are upgrading from manual to automated systems to reduce errors and enhance throughput. Instruments are increasingly integrated with laboratory information systems (LIS) and clinical decision support tools, improving workflow efficiency and compliance. Long-term cost-effectiveness, durability, and ability to handle high-volume testing further reinforce their dominance.

The services & software segment is anticipated to witness the fastest growth during the forecast period, fueled by AI integration, cloud-based analytics, and remote monitoring solutions. These offerings allow laboratories to optimize testing workflows, predict resistance trends, and support antimicrobial stewardship programs. AI-enabled software can flag unusual resistance patterns and provide actionable insights, reducing human error and improving clinical decision-making. Subscription-based service models are increasingly popular among hospitals and reference labs. Digital platforms also enable real-time reporting and remote access to AST results. Growing demand for analytics-driven solutions and workflow automation is accelerating adoption in North America.

- By Methods

On the basis of methods, the antimicrobial susceptibility testing market is segmented into mass spectrometry, dilution, disk diffusion, E-test, genotypic methods, and others. The dilution method dominated the market in 2024 due to its wide clinical adoption and high reproducibility. Broth microdilution and macro-dilution techniques provide highly reliable minimum inhibitory concentration (MIC) results, essential for effective treatment. Hospitals and diagnostic labs prefer dilution methods for routine and critical testing. Automated dilution platforms further enhance throughput while minimizing human intervention. The method is widely recognized by regulatory authorities, ensuring compliance and standardization. Its compatibility with both bacterial and fungal testing further strengthens market dominance.

The genotypic methods segment is expected to witness the fastest growth during the forecast period, driven by increasing demand for rapid and precise detection of antibiotic resistance genes. Genotypic techniques, including PCR and sequencing, enable early identification of resistance mechanisms, supporting timely therapy decisions. Next-generation sequencing (NGS) and molecular assays are increasingly adopted in clinical and research settings. The decreasing cost of molecular diagnostics is encouraging smaller laboratories to implement genotypic AST. Rapid turnaround times and high accuracy make this method suitable for outbreak monitoring and epidemiology studies. Rising R&D activities in hospitals and pharmaceutical companies further boost the segment’s growth.

- By Type

On the basis of type, the antimicrobial susceptibility testing market is segmented into antibacterial testing, antifungal testing, and rapid AST. The rapid AST segment dominated the market in 2024 with a market share of 46.8%, driven by the urgent clinical need for faster diagnostic results in hospitals and emergency care settings. Rapid AST platforms can deliver susceptibility results within hours instead of days, allowing clinicians to initiate targeted therapy promptly and improve patient outcomes. Hospitals and reference laboratories increasingly adopt these systems as part of antimicrobial stewardship programs to reduce treatment failures and combat antibiotic resistance. Microfluidic technologies, biosensors, and AI-driven analysis enhance both accuracy and reliability of rapid AST solutions. The segment also benefits from integration with hospital information systems (HIS) and electronic health records (EHR), enabling real-time data access and workflow efficiency. Rising awareness of the clinical and economic benefits of rapid AST further reinforces its market dominance.

The antibacterial testing segment is expected to witness the fastest growth during the forecast period, fueled by the continued prevalence of bacterial infections and rising demand for targeted antimicrobial therapy. Antibacterial AST remains essential for bloodstream infections, urinary tract infections, and hospital-acquired infections. Integration with automated instruments improves throughput and reduces errors in high-volume labs. Regulatory support, reimbursement policies, and robust clinical adoption contribute to growth. Hospitals and diagnostic labs prioritize antibacterial testing for effective patient management and infection control. Increasing R&D in novel antibiotics also supports adoption in pharmaceutical and biotechnology settings.

- By Application

On the basis of application, the antimicrobial susceptibility testing market is segmented into clinical diagnostics, drug discovery & development, epidemiology, and others. The clinical diagnostics segment dominated the market in 2024, as hospitals and diagnostic laboratories heavily rely on AST for patient management and infection control. Accurate susceptibility testing enables personalized therapy and reduces treatment failure. Integration with clinical decision support tools allows faster treatment decisions. Hospital adoption is high due to regulatory acceptance and reimbursement. Automated platforms improve workflow efficiency in high-volume laboratories. The segment also supports infection surveillance and outbreak management.

The drug discovery & development segment is anticipated to witness the fastest growth during the forecast period, fueled by increasing R&D activities in pharmaceutical and biotechnology companies. AST is critical in preclinical and clinical stages to evaluate efficacy and resistance patterns of new drugs. Rising focus on novel antibiotics, combination therapies, and antifungal agents is driving demand. Automated and high-throughput platforms enhance efficiency in drug development pipelines. Collaborations between diagnostic and pharmaceutical companies are expanding the use of AST solutions. Increasing investment in R&D infrastructure further accelerates adoption in North America.

- By End-User

On the basis of end-user, the antimicrobial susceptibility testing market is segmented into hospitals, pharmaceuticals & biotechnology companies, diagnostic laboratories, contract research organizations (CROs), research centers & academic institutes, and others. The hospitals segment dominated the market in 2024 due to high prevalence of infections and integration of AST with hospital IT systems. Hospitals adopt automated instruments to improve testing efficiency, enhance patient outcomes, and comply with infection control standards. Rising awareness of antimicrobial stewardship programs reinforces demand. High patient throughput requires reliable, high-capacity systems. Hospitals also benefit from rapid and automated reporting. This makes hospitals the largest revenue contributors in North America.

The diagnostic laboratories segment is expected to witness the fastest growth during the forecast period, driven by outsourcing of testing services and expansion of private and reference labs. Diagnostic labs handle high sample volumes and rely on high-throughput AST instruments. AI-driven software and subscription-based models optimize workflow and reporting. Growing partnerships with hospitals for rapid testing enhance growth. Reference laboratories increasingly adopt cloud-based platforms for centralized data management. Expansion of laboratory networks across North America accelerates the adoption of diagnostic laboratory AST services.

- By Distribution Channel

On the basis of distribution channel, the antimicrobial susceptibility testing market is segmented into direct sales, retail sales, and third-party distributors. The direct sales segment dominated the market in 2024, owing to strong manufacturer relationships with hospitals and large diagnostic laboratories. Direct sales enable customized solutions, technical support, and training, critical for high-value instruments and software. Manufacturers often provide installation, calibration, and maintenance services, strengthening customer loyalty. Long-term service contracts through direct sales channels increase adoption. Hospitals prefer direct procurement for premium instruments and complex software. This ensures reliability, compliance, and workflow integration.

The third-party distributor segment is expected to witness the fastest growth during the forecast period, driven by expansion of regional and national distribution networks. Distributors allow smaller laboratories and research institutes to access advanced instruments and consumables. E-commerce platforms and digital supply chains are facilitating adoption. Distributors provide localized support, spare parts, and training services. Subscription-based software and consumables are often delivered via distributor networks. The growing presence of third-party distributors in remote and underserved regions boosts market penetration and adoption rates.

North America Antimicrobial Susceptibility Testing Market Regional Analysis

- U.S. dominated the North America antimicrobial susceptibility testing market with the largest revenue share of 89.3% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative diagnostic technologies, and a strong presence of key industry players

- Healthcare providers in the U.S. prioritize rapid, accurate, and automated AST solutions to guide effective treatment decisions, improve patient outcomes, and support antimicrobial stewardship programs

- The widespread adoption is further supported by well-established healthcare infrastructure, high investment in clinical diagnostics, and early implementation of AI-enabled and automated testing platforms

U.S. Antimicrobial Susceptibility Testing Market Insight

The U.S. antimicrobial susceptibility testing market captured the largest revenue share of 39% in 2024 within North America, driven by the high prevalence of antibiotic-resistant infections and the adoption of advanced diagnostic technologies in hospitals and reference laboratories. Healthcare providers are increasingly prioritizing rapid, automated AST systems to support antimicrobial stewardship programs and improve patient outcomes. The growing integration of AST platforms with electronic health records (EHRs) and clinical decision support tools enhances workflow efficiency and timely clinical decision-making. In addition, rising awareness of antimicrobial resistance and government initiatives to curb it are fueling market growth. The country’s well-established healthcare infrastructure, combined with strong R&D investment, further reinforces the adoption of innovative AST solutions.

Canada Antimicrobial Susceptibility Testing Market Insight

The Canada antimicrobial susceptibility testing market is expected to grow at a substantial CAGR during the forecast period, driven by increasing government support for antimicrobial resistance monitoring and rising healthcare expenditure. Hospitals and diagnostic laboratories are increasingly adopting automated and rapid AST solutions to improve diagnostic accuracy and patient outcomes. Growing awareness among clinicians and healthcare policymakers about the importance of early resistance detection is accelerating the adoption of advanced AST systems. The expansion of public and private laboratory infrastructure, coupled with collaborations with technology providers, supports market development. Increasing focus on antimicrobial stewardship programs and infection prevention initiatives further contributes to the growth trajectory.

Mexico Antimicrobial Susceptibility Testing Market Insight

The Mexico antimicrobial susceptibility testing market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising investments in healthcare infrastructure and the increasing prevalence of infectious diseases. Diagnostic laboratories and hospitals are adopting automated and high-throughput AST systems to enhance testing efficiency and accuracy. Government initiatives to improve healthcare access and antimicrobial resistance monitoring are also driving demand. The expansion of private and regional laboratories provides opportunities for market players to deploy advanced AST technologies. In addition, growing awareness about antimicrobial resistance among healthcare professionals supports market adoption. Strategic partnerships between international AST providers and local healthcare institutions are further propelling growth.

North America Antimicrobial Susceptibility Testing Market Share

The North America antimicrobial susceptibility testing industry is primarily led by well-established companies, including:

- BIOMÉRIEUX (France)

- BD (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Danaher Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Bruker Corporation (U.S.)

- Roche Diagnostics (U.K.)

- Siemens Healthineers AG (Germany)

- Accelerate Diagnostics, Inc. (U.S.)

- Himedia Laboratories Pvt. Ltd. (India)

- Liofilchem S.r.l. (Italy)

- Alifax S.r.l. (Italy)

- Creative Diagnostics (U.S.)

- Synbiosis (U.K.)

- Genefluidics, Inc. (U.S.)

- ERBA Mannheim (Germany)

- Alifax S.r.l. (Italy)

What are the Recent Developments in North America Antimicrobial Susceptibility Testing Market?

- In March 2025, Accelerate Diagnostics submitted its WAVE System and gram-negative test kit to the U.S. Food and Drug Administration (FDA) for 510(k) clearance. Designed to deliver antimicrobial susceptibility results in just 4.5 hours, the WAVE System aims to address the global sepsis crisis affecting millions annually. If approved, the WAVE System could significantly improve patient outcomes by enabling same-shift targeted antimicrobial therapy

- In June 2024, bioMérieux collaborated with AdventHealth Orlando to pioneer the use of the VITEK REVEAL AST System in the United States. This partnership aims to accelerate the treatment of bloodstream infections by providing fast and accurate antibiotic susceptibility testing results. The integration of the VITEK REVEAL system into AdventHealth Orlando's blood culture workflow is expected to enhance antimicrobial stewardship efforts and improve patient outcomes by enabling timely and targeted therapy

- In May 2024, the U.S. Committee on Antimicrobial Susceptibility Testing (USCAST) finalized updates to its in vitro susceptibility test interpretive criteria (STIC). The updated guidelines, which include revised breakpoints for antibiotics such as ceftriaxone and azithromycin, aim to improve the accuracy and consistency of AST results across clinical laboratories in the U.S.

- In February 2024, Avails Medical announced that its eQUANT system received 510(k) clearance from the U.S. Food and Drug Administration (FDA). This innovative system enables rapid, fully electrical antibiotic susceptibility testing directly from positive blood cultures. The eQUANT system aims to reduce the time to actionable results by up to 24 hours, facilitating quicker and more accurate treatment decisions

- In February 2024, Selux Diagnostics received FDA 510(k) clearance for its eQUANT System, a rapid, fully electrical antibiotic susceptibility testing platform. The eQUANT System enables standardized inoculum preparation directly from positive blood cultures, reducing routine AST turnaround times by up to one day while maintaining over 95% correlation to standard-of-care methods. This advancement aims to enhance the efficiency and accuracy of AST in clinical settings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.