North America Bakery Processing Equipment Market

Market Size in USD Billion

CAGR :

%

USD

4.56 Billion

USD

6.70 Billion

2024

2032

USD

4.56 Billion

USD

6.70 Billion

2024

2032

| 2025 –2032 | |

| USD 4.56 Billion | |

| USD 6.70 Billion | |

|

|

|

|

Bakery Processing Equipment Market Size

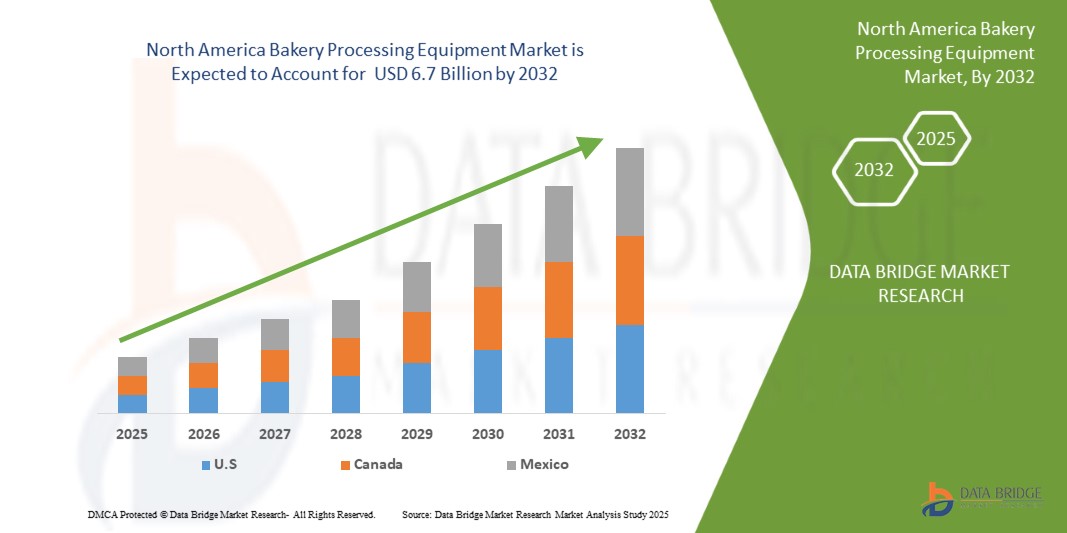

- The North America Bakery Processing Equipment Market size was valued at USD 4.56 Billion in 2024 and is expected to reach USD 6.7 Billion by 2032, at a CAGR of 5.2% during the forecast period

- The North America Bakery Processing Equipment Market is witnessing steady growth, driven by rising demand in the bakery and confectionery sectors as consumers increasingly seek convenience, variety, and quality in baked goods. Technological advancements in automation, precision baking, and energy-efficient machinery are enhancing production capabilities, reducing operational costs, and improving product consistency

- Furthermore, the growing trend of artisanal and specialty baked products, along with expanding retail and foodservice outlets, is encouraging bakery manufacturers to adopt versatile and advanced processing equipment. The focus on hygiene, safety standards, and sustainability is also pushing equipment manufacturers to innovate in terms of easy-to-clean designs and energy-saving features

Bakery Processing Equipment Market Analysis

- North America holds a prominent position in the Bakery Processing Equipment Market, driven by increasing demand for baked goods in both retail and foodservice sectors, supported by advanced manufacturing infrastructure and technological innovation. The market growth is fueled by rising consumer preference for convenience, artisanal products, and healthier baked options, pushing manufacturers to invest in versatile and efficient processing equipment.

- Increasing automation and digitalization in bakery production lines are enhancing operational efficiency, reducing labor costs, and ensuring consistent product quality. Equipment with features like precise temperature control, energy efficiency, and hygiene compliance are highly preferred to meet stringent food safety regulations and sustainability goals in the region.

- Growing consumer awareness regarding clean-label ingredients and gluten-free or organic baked goods is encouraging the adoption of specialized processing equipment tailored for niche bakery segments. The demand for on-the-go, ready-to-eat bakery products further supports the deployment of advanced packaging and processing technologies in North America.

- Environmental regulations and sustainability initiatives are driving innovation in bakery equipment design, focusing on energy-efficient machines, waste reduction, and use of eco-friendly materials. The integration of smart sensors and IoT-enabled monitoring systems is improving production flexibility and traceability, aligning with industry 4.0 trends.

- The expansion of e-commerce platforms and food delivery services in North America is accelerating demand for high-capacity, customizable bakery processing equipment that can efficiently handle large-scale production while maintaining product freshness and quality. Continuous R&D and investments in equipment modernization are expected to sustain market growth

Report Scope and Bakery Processing Equipment Market Segmentation

|

Attributes |

Bakery Processing Equipment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Bakery Processing Equipment Market Trends

“Technological Advancements and Sustainable Innovation in Bakery Processing Equipment”

- A prominent trend in the North America Bakery Processing Equipment Market is the integration of advanced automation, robotics, and energy-efficient technologies to optimize production processes. Manufacturers are focusing on developing equipment that offers higher throughput, reduced downtime, and enhanced precision—responding to the growing demand for consistent product quality and labor cost reduction in commercial bakeries.

- Key players such as GEA Group, Bühler AG, and Middleby Corporation are investing heavily in R&D to deliver smart equipment with real-time monitoring, predictive maintenance, and data analytics capabilities. These innovations enable manufacturers to maximize operational efficiency while adhering to strict food safety and quality standards.

- The shift toward sustainable baking solutions is gaining momentum, with equipment designs increasingly incorporating eco-friendly materials, lower energy consumption features, and waste-minimizing systems. As regulatory frameworks around carbon emissions and food industry sustainability tighten, bakeries are adopting machinery that aligns with green manufacturing practices

- There is a growing demand for modular and flexible bakery processing equipment capable of producing a wide variety of products—from gluten-free to plant-based and artisanal baked goods. This adaptability allows bakeries to respond quickly to evolving consumer preferences and niche market segments without significant retooling

- The trend toward digitalization is transforming bakery operations, with the adoption of Industry 4.0 technologies such as IoT sensors, AI-driven quality control, and remote diagnostics. These advancements are enhancing traceability, reducing product recalls, and supporting compliance with regulatory standards in North America

- This convergence of sustainability, customization, and smart technology is redefining the competitive landscape. Equipment manufacturers that embrace innovation and offer integrated, future-ready solutions are best positioned to capitalize on the market’s growth across commercial, industrial, and artisanal bakery segments

Bakery Processing Equipment Market Dynamics

Driver

“Rising Demand for Automated, Energy-Efficient, and Versatile Bakery Equipment to Meet Evolving Consumer and Regulatory Expectations”

- The increasing focus on operational efficiency, food safety, and product consistency is a key driver accelerating growth in the Bakery Processing Equipment Market. As consumer demand for diverse baked goods—ranging from artisanal breads to gluten-free and ready-to-eat items—continues to rise, bakeries are turning to high-performance, automated equipment to scale production while maintaining quality and reducing labor dependency.

- For instance, in early 2025, GEA Group introduced a next-generation modular dough processing system designed with integrated energy-saving features, hygienic design, and AI-powered process optimization. This innovation addresses both sustainability targets and the need for flexible production lines capable of rapid product changeovers.

- Regulatory pressures around food safety standards, energy efficiency, and environmental impact are pushing bakery manufacturers to modernize legacy equipment. The Food Safety Modernization Act (FSMA) in the U.S. and similar frameworks in Canada are compelling producers to adopt systems with improved traceability, clean-in-place (CIP) capabilities, and contamination prevention.

- Advancements in smart technologies—such as real-time monitoring, predictive maintenance, and IoT-enabled diagnostics—are transforming bakery operations. These tools help reduce downtime, lower maintenance costs, and ensure consistent output quality, particularly in large-scale industrial production environments.

- The growing preference for sustainable production is also shaping the market. Equipment that minimizes energy and water consumption, reduces material waste, and supports cleaner manufacturing practices is gaining traction among bakeries aiming to align with corporate social responsibility (CSR) goals and carbon-reduction targets.

- This combination of regulatory compliance, sustainability imperatives, and consumer-driven innovation is propelling the Bakery Processing Equipment Market forward. Companies that offer scalable, efficient, and environmentally responsible equipment solutions are well-positioned to capitalize on industry transformation and long-term growth

Restraint/Challenge

“High Capital Investment, Maintenance Costs, and Regulatory Compliance Challenges Restraining Market Growth”

- The high initial capital investment required for purchasing and installing advanced bakery processing equipment is a major restraint, particularly for small and medium-sized bakeries. Automation systems, precision ovens, and modular dough handling lines often involve substantial upfront costs, making it difficult for smaller players to compete with large-scale industrial bakeries.

- For example, transitioning from manual to automated production systems often requires not only new machinery but also plant retrofitting, workforce retraining, and infrastructure upgrades—factors that significantly elevate the total cost of ownership and prolong return on investment timelines.

- Strict food safety and hygiene regulations enforced by agencies such as the U.S. Food and Drug Administration (FDA), the Canadian Food Inspection Agency (CFIA), and industry-specific standards like Hazard Analysis and Critical Control Points (HACCP) impose stringent requirements on equipment design, cleaning protocols, and material traceability. These mandates can complicate equipment selection and increase compliance-related costs for manufacturers.

- The complexity of maintaining high-tech bakery machinery—particularly those with digital interfaces, robotic components, or AI-based control systems—can lead to elevated maintenance costs and require skilled technicians. A shortage of trained personnel can result in production delays and costly downtimes.

- Volatility in the prices of raw materials such as stainless steel, electronics, and energy inputs further constrains manufacturers' ability to maintain stable pricing, especially in periods of economic uncertainty or supply chain disruptions.

- In developing regions or rural markets, limited access to technical support, infrastructure, and financing solutions for modern bakery equipment hinders broader market penetration. Many bakeries in these areas continue to rely on outdated or improvised machinery that doesn't meet international standards.

- To overcome these restraints, industry stakeholders will need to invest in modular and scalable equipment solutions, expand leasing and financing options for smaller bakeries, and provide training programs to bridge the skills gap—ensuring wider adoption and more inclusive market growth across different segments

Bakery Processing Equipment Market Scope

- By Type

On the basis of type, the Bakery Processing Equipment Market is segmented into Mixers, Proofers and Retarders, Sheeters, Dough Feeding Systems, Ovens, Slicers and Dividers, Depanners, Piston Filling Injectors, Handling Systems, Moulders, Pan Greasers and Depositors, Freezers and Coolers, Denester, and Others.

The Ovens segment holds the largest revenue share in 2024, driven by its critical role in baking operations across commercial and industrial bakeries. Ovens are essential for achieving desired product texture, taste, and shelf stability, and ongoing innovations in energy efficiency, temperature control, and multi-zone baking are enhancing their performance

- By Application

On the basis of coating, the Bakery Processing Equipment Market is segmented into Plastic Barrier Coated, Aluminum Barrier Coated, and Others

The Plastic Barrier Coated segment dominates the market with the largest revenue share in 2024, driven by its widespread application in food and beverage packaging that requires effective moisture and oxygen resistance

- By End User

On the basis of end user, the Bakery Processing Equipment Market is segmented into Bakery Processing Industry, Artesian Bakery, and Food Service Industry.

The Bakery Processing Industry segment dominates the market with the largest revenue share in 2024, driven by the demand for large-scale, automated production systems capable of meeting high-volume output requirements. Industrial bakeries rely heavily on continuous and efficient processing lines—including mixers, ovens, and handling systems—to produce a wide range of standardized bakery products

- By Mode of Operation

On the basis of mode of operation, the Bakery Processing Equipment Market is segmented into Semi-Automatic and Automatic.

The Automatic segment dominates the market with the largest revenue share in 2024, driven by the growing need for high-speed, efficient, and labor-saving production processes in commercial and industrial bakeries. Automatic bakery equipment offers enhanced precision, consistency, and throughput, making it ideal for large-scale operations producing bread, pastries, and snack items

- By Function

On the basis of function, the Bakery Processing Equipment Market is segmented into Ingredient Handling, Mixing, Extrusion, Weighing and Packing, Baking, Enrobing, Moulding, Cooling, and Others.

The Baking segment dominates the market with the largest revenue share in 2024, driven by its critical role in transforming dough and batter into finished bakery products with desired texture, flavor, and shelf life. High demand for efficient and uniform baking solutions in commercial and industrial bakeries is fueling investment in advanced ovens and baking systems

Bakery Processing Equipment Market Regional Analysis

- North America dominates the Bakery Processing Equipment Market with the largest revenue share of 39.01% in 2024, driven by strong demand across food & beverage, pharmaceutical, and personal care industries. The region benefits from well-established recycling infrastructure, stringent environmental regulations, and rising consumer preference for sustainable packaging solutions. Innovation in bio-based coatings and high-barrier technologies further propels market growth.

- Leading manufacturers in North America are focusing on developing eco-friendly, lightweight packaging boards that enhance product shelf life while reducing environmental impact, particularly in the dairy and beverage sectors

U.S. Bakery Processing Equipment Market Insight

The U.S. captured the largest revenue share of 81% within North America in 2024, supported by stringent FDA regulations, increasing demand for aseptic packaging, and incentives promoting recyclable packaging materials. Growing e-commerce and retail packaging needs are accelerating adoption in personal care and pharmaceutical liquid packaging

Bakery Processing Equipment Market Share

The smart lock industry is primarily led by well-established companies, including:

- GEA Group AG (Germany)

- Bühler AG (Switzerland)

- John Bean Technologies Corporation (U.S.)

- Ali Group S.r.l. (Italy)

- Middleby Corporation (U.S.)

- Heat and Control, Inc. (U.S.)

- Bakery Concepts International, LLC (U.S.)

- Rademaker BV (Netherlands)

- MIWE Michael Wenz GmbH (Germany)

- Rheon Automatic Machinery Co., Ltd. (Japan)

- Koenig Maschinen GmbH (Austria)

- ANKO Food Machine Co., Ltd. (Taiwan)

- Markel Food Group (U.S.)

- Sinmag Equipment Corporation (Taiwan)

- AMF Bakery Systems (U.S.)

Latest Developments in North America Bakery Processing Equipment Market

- In April 2025, SIG Combibloc introduced a next-generation bakery processing equipment line featuring automated mixers and high-efficiency ovens designed to reduce energy consumption while enhancing production capacity. This innovation aligns with growing demand for sustainable and cost-effective solutions in commercial bakeries across North America

- In March 2025, Tetra Pak launched a smart bakery processing system integrating IoT-enabled monitoring and precision control technologies to optimize dough handling and proofing processes. The system aims to improve product consistency, reduce waste, and support real-time production adjustments in industrial bakery setups

- In February 2025, WestRock expanded its North American manufacturing facilities by inaugurating a state-of-the-art bakery equipment assembly plant focused on producing eco-friendly, semi-automatic to fully automatic processing machinery. The expansion addresses increasing demand for advanced, energy-efficient bakery solutions across the foodservice and retail sectors

- In January 2025, Stora Enso partnered with leading bakery chains to co-develop customizable equipment solutions, including modular sheeters and depositor units, designed to enhance flexibility in artisanal and large-scale bakery production. This collaboration supports the rising consumer trend toward specialty and craft baked goods

- In January 2025, Mondi Group unveiled a new line of sustainable packaging-integrated bakery processing equipment that combines advanced dough feeding and automated slicing with packaging readiness features. This innovation reduces handling time and improves operational efficiency, catering to fast-growing ready-to-eat bakery product markets in North America

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

North America Bakery Processing Equipment Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its North America Bakery Processing Equipment Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as North America Bakery Processing Equipment Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.