North America Balloon Catheter Market

Market Size in USD Billion

CAGR :

%

USD

1.83 Billion

USD

2.97 Billion

2024

2032

USD

1.83 Billion

USD

2.97 Billion

2024

2032

| 2025 –2032 | |

| USD 1.83 Billion | |

| USD 2.97 Billion | |

|

|

|

|

North America Balloon Catheter Market Size

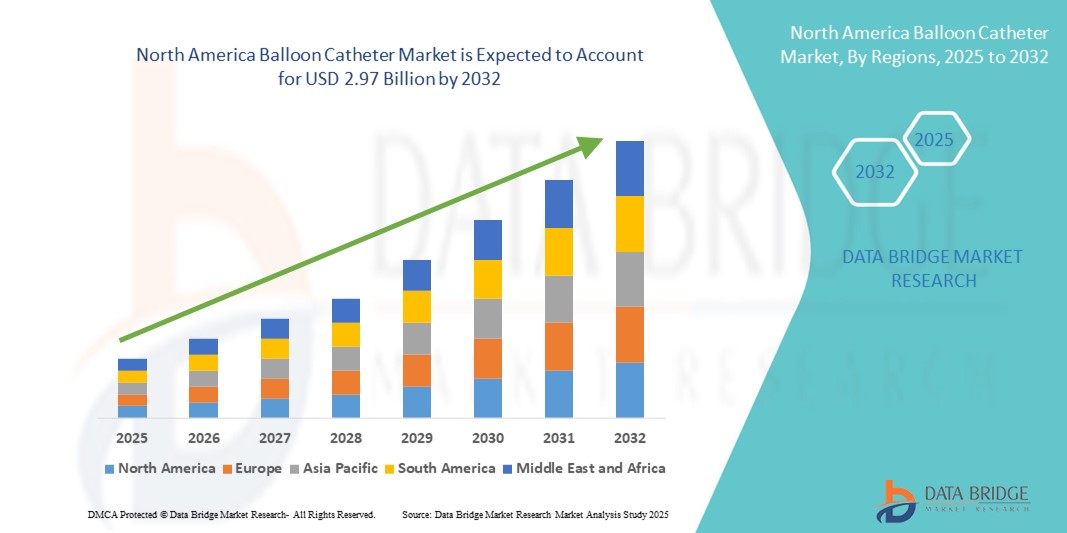

- The North America balloon catheter market size was valued at USD 1.83 billion in 2024 and is expected to reach USD 2.97 billion by 2032, at a CAGR of 6.20% during the forecast period

- The market growth is largely fueled by the increasing incidence of cardiovascular diseases, rising demand for minimally invasive procedures, and ongoing advancements in catheter technology, which are driving the widespread adoption of balloon catheters across the North America region

- Furthermore, rising healthcare expenditure, improvements in hospital infrastructure, and a growing focus on early diagnosis and interventional treatment are accelerating the uptake of North America Balloon Catheter solutions, thereby significantly boosting the industry's growth

North America Balloon Catheter Market Analysis

- Balloon catheters are increasingly vital components of the North America interventional cardiology and radiology landscape, especially across hospitals and specialty clinics, due to the growing prevalence of cardiovascular and peripheral artery diseases, advancements in minimally invasive procedures, and increased awareness about early intervention

- The escalating demand for balloon catheter-based treatments is primarily fueled by the rising burden of lifestyle-related conditions such as diabetes and hypertension, government investments in healthcare infrastructure, and increasing adoption of angioplasty procedures across emerging economies in the region

- U.S. dominated the North America balloon catheter market with the largest revenue share of 39.6% in 2024, driven by advanced healthcare infrastructure, high procedural volumes in interventional cardiology, and significant investments in R&D for minimally invasive vascular therapies

- Canada is expected to be the fastest growing country in the North America balloon catheter market during the forecast period, fueled by increasing awareness of cardiovascular health, a growing aging population, and government-led initiatives aimed at improving early diagnosis and access to endovascular procedures

- The High-Pressure Balloons segment dominated the North America Balloon Catheter market with a market share of 61.8% in 2024, favored for use in heavily calcified lesions, where enhanced radial strength and controlled inflation are critical for successful lesion dilation and stent deployment

Report Scope and North America Balloon Catheter Market Segmentation

|

Attributes |

North America Balloon Catheter Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

North America Balloon Catheter Market Trends

Technological Advancements and Seamless System Integration

- A significant and accelerating trend in the North America Balloon Catheter market is the increasing integration of advanced technologies that enhance procedural efficiency and patient outcomes. Innovations in catheter design, material science, and real-time imaging compatibility are significantly improving the precision and safety of balloon angioplasty procedures across both coronary and peripheral interventions

- For instance, modern drug-eluting balloon catheters are now being tailored for complex lesions and smaller vessel applications, enabling interventional cardiologists to deliver targeted therapy with reduced restenosis risk. Similarly, scoring and cutting balloon catheters are being optimized for calcified lesions, ensuring higher procedural success in challenging cases

- These advancements are also supported by intelligent procedural planning tools and real-time diagnostic feedback from imaging systems such as IVUS (intravascular ultrasound) and OCT (optical coherence tomography), which guide catheter deployment with increased accuracy. The adoption of such integrated interventional suites is rapidly rising in tertiary hospitals and specialized cardiac centers across the North America

- Furthermore, seamless compatibility between balloon catheters and emerging robotic-assisted intervention platforms is fostering a new standard in minimally invasive vascular care. These robotic systems allow for precise navigation of catheters through tortuous anatomy, reducing operator fatigue and radiation exposure while enhancing procedural control

- This trend toward greater interoperability, automation, and personalization is reshaping physician expectations and patient care standards in the region. Consequently, manufacturers are developing next-generation balloon catheters with features such as pressure-sensing technology, steerability, and custom inflation profiles that can adapt in real time to vessel characteristics

- The demand for such advanced, intuitive, and integrated balloon catheter solutions is growing rapidly across North American countries, driven by the rising burden of cardiovascular disease, increasing investments in cath lab modernization, and a greater emphasis on value-based outcomes in healthcare systems

North America Balloon Catheter Market Dynamics

Driver

Growing Need Due to Rising Cardiovascular Disease Burden and Technological Advancements

- The increasing prevalence of cardiovascular diseases (CVDs) across the North America, combined with an aging population and unhealthy lifestyle patterns, is significantly driving the demand for balloon catheter procedures, particularly for coronary and peripheral artery interventions

- For instance, in March 2024, the Saudi Ministry of Health launched a national cardiovascular screening initiative targeting early detection of arterial blockages in high-risk populations, thereby increasing the demand for advanced catheter-based interventions across government hospitals. Such government-led strategies are expected to drive the North America Balloon Catheter industry growth in the forecast period

- As awareness of minimally invasive treatment options grows, both patients and healthcare providers are increasingly opting for balloon catheter procedures due to their reduced recovery time, minimal surgical trauma, and high procedural success rates. This shift is particularly notable in urban healthcare facilities where catheterization labs are expanding rapidly

- Furthermore, technological advancements such as drug-eluting balloons, scoring balloons, and high-pressure balloon catheters are being integrated into interventional cardiology protocols, offering better lesion preparation and post-dilatation outcomes. These innovations enable the treatment of complex lesions with greater precision and safety

- The increasing demand for cost-effective and high-performance solutions, along with the growing number of catheterization labs across countries such as the U.S., Mexico, Canada, is propelling the adoption of balloon catheters. Favorable reimbursement policies and medical tourism initiatives are also supporting the market’s expansion

Restraint/Challenge

Limited Access to Advanced Infrastructure and High Procedural Costs

- The availability of advanced catheterization labs and skilled interventional cardiologists remains uneven across the North America, especially in low-income and rural regions, limiting access to balloon catheter procedures for a large portion of the population

- For instance, countries in Sub-Saharan Africa often face delays in importing high-tech medical devices due to regulatory bottlenecks and infrastructure challenges, which affects the timely delivery of balloon catheter interventions

- The high cost associated with drug-eluting and scoring balloon catheters also acts as a barrier to adoption for budget-constrained hospitals and public healthcare providers. Even though these technologies offer superior outcomes, their affordability and availability remain critical hurdles

- In addition, maintenance of sterile supply chains, training for device handling, and post-procedural monitoring infrastructure require substantial investment, which can deter smaller hospitals and specialty clinics from adopting such systems

- Overcoming these challenges through regional manufacturing, local distribution partnerships, investment in interventional cardiology training programs, and regulatory streamlining will be essential to ensure equitable access and long-term growth of the North America Balloon Catheter Market

North America Balloon Catheter Market Scope

The market is segmented on the basis of type, product type, delivery platform, compliance, balloon material, balloon type, application, end user, and distribution channel.

- By Type

On the basis of type, the North America balloon catheter market is segmented into PTCA Balloon Catheters, CTO Balloon Catheters, and Microcatheters. The PTCA Balloon Catheters segment dominated the market with the largest revenue share of 54.2% in 2024, attributed to their widespread use in treating coronary artery disease and the increasing number of percutaneous coronary interventions across the region.

The CTO Balloon Catheters segment is anticipated to witness the fastest growth rate of 20.6% from 2025 to 2032, driven by their growing utilization in treating chronic total occlusions in complex cardiovascular cases.

- By Product Type

On the basis of product type, the market is segmented into Normal balloon catheter, drug eluting balloon catheter, cutting balloon catheter, stent graft balloon catheter, and scoring balloon catheter. The Normal Balloon Catheter segment held the largest market revenue share of 38.9% in 2024, due to its routine use in both coronary and peripheral interventions and wide accessibility.

The drug eluting balloon catheter segment is projected to grow at the fastest CAGR of 21.3% from 2025 to 2032, propelled by increased adoption in restenosis prevention and cases where stents are not suitable.

- By Delivery Platform

On the basis of delivery platform, the market is segmented into Rapid Exchange (RX)/Monorail Balloon Catheter, Over-The-Wire (OTW), and Fixed Wire (FW) Balloon Catheter. The Rapid Exchange (RX) segment dominated the market with a revenue share of 51.4% in 2024, favored for its procedural speed and single-operator use in interventional cardiology.

The Over-The-Wire (OTW) segment is expected to grow at the fastest CAGR of 18.4% from 2025 to 2032, due to its superior pushability and steerability in complex and tortuous anatomy.

- By Compliance

On the basis of compliance, the market is segmented into non-compliant, semi-compliant, and compliant balloons. The Semi-Compliant segment led with the largest market share of 46.8% in 2024, owing to their balance between flexibility and high-pressure resistance, making them ideal for a variety of lesion types.

The non-compliant segment is projected to grow at a CAGR of 17.9% from 2025 to 2032, due to their utility in post-dilation and in-stent optimization procedures.

- By Balloon Material

On the basis of balloon material, the market is segmented into Nylon, Polyethylene Terephthalate (PET), Polyethylene (PE), Silicone, Polyolefin Copolymer, and Others. The PET segment held the largest share of 42.3% in 2024, valued for its high burst pressure and non-compliant nature.

Silicone-based balloons are expected to grow at the fastest CAGR of 19.2% from 2025 to 2032, driven by their use in neurovascular and pediatric interventions.

- By Balloon Type

On the basis of balloon type, the market is segmented into high-pressure balloons and elastomeric balloons. High-pressure balloons dominated the market with 61.8% share in 2024, favored for use in heavily calcified lesions.

Elastomeric Balloons are projected to grow at a CAGR of 18.8% from 2025 to 2032, used in applications requiring lower pressure with high flexibility.

- By Application

On the basis of application, the market is segmented into coronary artery disease, peripheral artery disease, and others. The coronary artery disease (CAD) segment held the largest revenue share of 59.4% in 2024, driven by the high incidence of cardiovascular diseases and rising procedural volumes.

Peripheral Artery Disease (PAD) is projected to grow at the fastets CAGR of 20.1% from 2025 to 2032, attributed to the increasing prevalence of diabetes and smoking-related vascular conditions.

- By End User

On the basis of end user, the market is segmented into hospitals, specialty centers, ambulatory surgery centers, and others. Hospitals dominated with the largest revenue share of 64.8% in 2024, supported by advanced infrastructure and high volume of procedures.

Ambulatory Surgery Centers are expected to register the fastest CAGR of 21.6%, reflecting a shift toward minimally invasive outpatient treatments.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into Direct Tender, Third Party Distribution, and Others.The Direct Tender segment accounted for 58.1% of the market share in 2024, driven by bulk institutional purchases and centralized procurement.

Third Party Distribution is expected to witness the fastest CAGR from 2025 to 2032, supported by expanding private hospital chains and distributor networks.

North America Balloon Catheter Market Regional Analysis

- The North America balloon catheter market is experiencing robust growth driven by the increasing burden of cardiovascular diseases, rising geriatric population, and a strong shift toward minimally invasive procedures for coronary and peripheral interventions

- The region’s well-established healthcare infrastructure, favorable reimbursement environment, and early adoption of advanced interventional technologies are key drivers accelerating market expansion

- High procedural volumes in hospitals and ambulatory surgical centers, combined with the availability of cutting-edge devices such as drug-eluting, scoring, and high-pressure balloon catheters, are reinforcing the region’s leadership in the global market

U.S. Balloon Catheter Market Insight

The U.S. balloon catheter market is the largest and most mature in North America, driven by a high burden of cardiovascular diseases, advanced healthcare infrastructure, and continuous innovation in minimally invasive technologies. The presence of leading medical device manufacturers and widespread adoption of cutting-edge interventional cardiology practices are fueling the use of drug-eluting, scoring, and high-pressure balloon catheters. The U.S. dominated the North America Balloon Catheter market with the largest revenue share of 39.6% in 2024, owing to significant procedural volumes, favorable reimbursement policies, and a high concentration of cardiac care centers. Additionally, government and private sector investments in research and clinical trials continue to support market expansion, especially in treating complex coronary and peripheral artery diseases.

Canada Balloon Catheter Market Insight

The Canada balloon catheter market is anticipated to be the fastest growing in North America during the forecast period, supported by an aging population, rising prevalence of cardiovascular risk factors, and expanding interventional cardiology capabilities across provinces. Increased funding for public healthcare, along with strategic procurement of advanced balloon catheter systems by hospitals, is driving adoption. Canada's focus on early diagnosis and minimally invasive therapies, particularly within its universal healthcare framework, is leading to greater usage of compliant, non-compliant, and drug-coated balloon catheter products. Partnerships between academic institutions and device manufacturers are further accelerating innovation and deployment of next-generation catheter solutions across cardiac and vascular specialties.

Mexico Balloon Catheter Market Insight

The Mexico balloon catheter market is gaining momentum due to improving access to specialized cardiac care, growth in private healthcare investments, and rising awareness of interventional treatment options for heart and vascular diseases. Urbanization and increased prevalence of obesity, diabetes, and hypertension are elevating the demand for minimally invasive cardiovascular procedures. Hospitals in major cities such as Mexico City, Guadalajara, and Monterrey are increasingly adopting balloon catheters for coronary and peripheral artery disease management. Moreover, Mexico’s proximity to the U.S. facilitates the import of advanced medical technologies, supporting the availability of diverse balloon catheter types, including PTCA, scoring, and drug-eluting variants.

North America Balloon Catheter Market Share

The North America balloon catheter industry is primarily led by well-established companies, including:

- Boston Scientific Corporation (U.S.)

- Medtronic (Ireland)

- Abbott (U.S.)

- Terumo Corporation (Japan)

- BD (U.S.)

- B. Braun SE (Germany)

- Koninklijke Philips N.V. (Netherlands)

- Teleflex Incorporated (U.S.)

- Cook (U.S.)

- Lepu Medical Technology (Beijing) Co., Ltd. (China)

- KANEKA CORPORATION (Japan)

- MicroPort Scientific Corporation (China)

- Acrostak Int. Distr. Sàrl (Switzerland)

- Biotronik (Germany)

- Alvimedica (Turkey)

- SMT (India)

- BALTON (Poland)

- APR Medtech Ltd (England)

- Advin Health Care (India)

Latest Developments in North America Balloon Catheter Market

- In June 2025, the 8th World Congress on Targeting Phage Therapy took place in Berlin, convening over 75 experts from 27 countries. The event emphasized translating phage research into clinical practice, covering topics such as engineered phages, regulatory frameworks, GMP production, and clinical case studies for MDR infections

- In July 2025, Cellexus (UK) highlighted the real-world impact of phage therapy, noting its promise in reducing healthcare costs and improving outcomes in Europe. The article outlined how phage treatments support antimicrobial resistance (AMR) efforts at scale

- In November 2023, Boston Scientific concluded its acquisition of Relevant Medsystems, adding the Intracept Intraosseous Nerve Ablation System to its chronic pain portfolio. The acquisition, costing USD 850 million upfront plus contingent payments, expands access to vertebrogenic pain treatment through national coverage, benefiting over 150 million lives

- In April 2023, Abbott completed its acquisition of Cardiovascular Systems, Inc., a company known for its innovative atherectomy system used in treating vascular disease. CSI's system, which prepares vessels for angioplasty or stenting, became part of Abbott’s vascular portfolio. CSI shares ceased trading on Nasdaq that day

- In August 2022, Boston Scientific announced the acquisition of Obsidio, Inc., a company behind the GEM technology for embolization in peripheral vasculature. The semi-solid GEM material, recently FDA-cleared, simplifies embolization procedures with its unique gel-like properties. The transaction was not expected to affect Boston Scientific's 2022 earnings materially

- In February 2022, Medtronic received FDA approval for its Freezor and Freezor Xtra catheters to treat pediatric atrioventricular nodal reentrant tachycardia (AVRNT). This cryoablation therapy, is effective for over 140,000 patients worldwide, targets abnormal heart rhythms in children, helping to prevent life-threatening complications and support normal heart function

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.